The External Environment and Its Relationship to Strategy

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

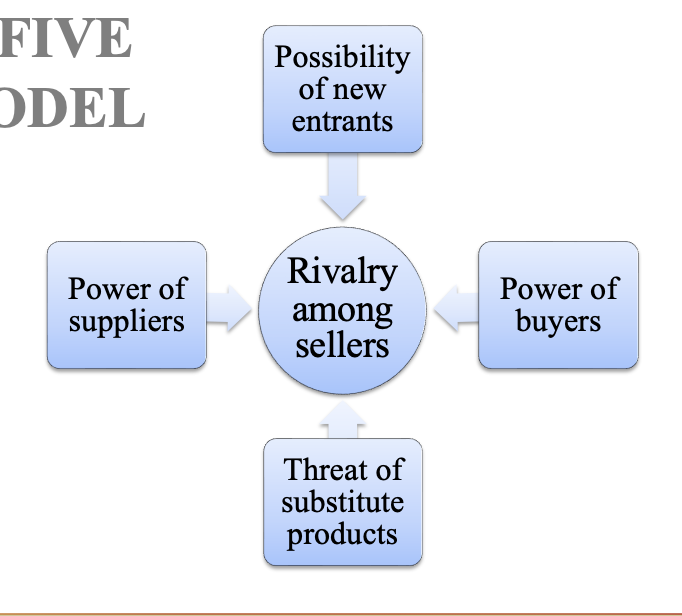

Porter’s Five Forces

possibility of new entrants: the risk and increased competition associated with the threat of new entrants

threat of substitute products: increased competitiveness due to the availability or possible availability of substitutes for buyers’ needs

power of suppliers: the degree of suppliers’ bargaining power and supplier-seller collaboration

power of buyers: the degree of buyers’ bargaining power and seller-buyer collaboration

rivalry among competing sellers: the level of competitive pressures associated with market conditions and actions among rival sellers in an industry

threat of new entrants

new capacity

new capabilities

changes existing market relationships

greater competition over price and quality

possible loss of market share

barriers to entry

economies of scale

cost disadvantages not related to scale

product differentiation

nonrecoverable capital investments

switching costs

access to distribution channels

government policy

economies of scale

new entrants will not have the large volumes incumbents have and thus would risk having a cost per unit disadvantage

cost disadvantages not related to scale

existing organizations often enjoy advantages conferred by their experience or position; these factors can become strong deterrents to new entries

product differentiation

customers’ loyalty to established products may require new entrants to spend heavily to change customers’ perceptions and convince them to switch to new products

nonrecoverable capital investments

large financial investments are required to successfully enter a market; these investments cannot be recovered or would be difficult to recover if the venture fails

switching costs

real or perceived costs are associated with changing to another product, brand, marketplace, or supplier

access to distribution channels

the best products will not sell unless consumers have access to them through a distribution channel; the more exclusive distribution channels are to existing companies, the more dofficult it is to enter a market

government policy

governments can complicate or even block entry into a market; legislative barriers include licensure, permits, and regulatory rules

evaluating the strength of barriers to entry

do you have a unique process or product that is protected by patent?

are customers loyal to your brand and product?

does your type of business require high start-up costs?

are the assets needed to operate your type of business unique and hard to obtain?

are your business’ processes and procedures difficult to learn?

would a new rival have difficulty purchasing key inputs?

would a new competitor have difficulty finding customers?

would it be difficult for a new entrant to attract enough customers and resources to operate efficiently?

threat of substitute products

closely related industries almost always produce products that can be substituted for each other by differ with respect to quality, cost, and features

contact lenses and glasses vs laser surgery

prescription drugs vs alternative medicine

substitutes increase price competition

evaluating the threat of substitues

does your product offer more benefits than its substitutes do?

if so, why are the benefits of your product valued by consumers? are the benefits sustainable?

is the price for your product the same or less than the price for comparable substitutes?

is it difficult for your customers to switch to another product?

are customers loyal to your existing products and brands?

power of suppliers

powerful suppliers can extract concessions from their buyers

suppliers consist of a wide array of organizations, ranging from unions, intermediaries like HMOs and insurance companies, and retail outlets to wholesalers and manufacturers of raw materials

evaluating suppliers’ relative bargaining power in a market

is there a large number of potential suppliers for your critical inputs?

are there potential substitutes for your critical inputs?

do your purchases from certain suppliers represent a small portion of your business?

would it be difficult for your supplier to enter your business and sell directly to your customers?

are you well informed about your supplier’s product and market?

power of buyers

the power of buyers is almost the mirror image of the power of suppliers

buyers can have little or extensive market power, depending on their size, their number, and the nature of the market

buyers enjoy more power when they are large relative to sellers and purchase a large part of a business’ output

buyer power increases if switching costs are low, the number of buyers is small relative to the number of sellers, the demand for the product is marginal, buyers have a good understanding of the purchase, buyers can acquire sellers fairly easily, and the products sellers offer are not critical to the buyers’ business

evaluating the strength of buyers’ power

do you have enough customers that the loss of one will not significantly damage your business?

does your product account for a relatively small expense for your buyers?

is it difficult to understand your market, and are buyers poorly informed?

is your product unique and differentiated in the minds of your buyers?

would it be difficult for your buyers to purchase one of your competitors and/or the products you offer?

would it be difficult for customers to switch from your products to those of your competitors?

rivalry

rivals may invoke different competitive tactics to gain better market positions, greater sales and market share, and other competitive advantages; these tactics include

lowering prices

adding new or different features to their products

emphasizing their brand image

offering a wider selection of products and services

expanding their distribution network

offering low-interest financing

increasing their advertising

providing longer warranties

improving customer service

organizational and product-related factors affecting rivalry

equality of organizations’ strengths

degree of product differentiation

height of exit barriers

different ownership types

rate of demand growth

degree of product differentiation and market rivalry

lack of brand loyalty increases competition and enables rivals to more easily convince buyers to switch products

negotiations for managed care contracts between insurance companies and hospitals often are centered on pricing, enabling insurance companies to extract cost concessions

many perceive brand-name prescription drugs to be different from their generic equivalents; as a result, there is little direct competition between manufacturers of brand-name and generic drugs

exit barriers

costs to an organization to exit a business

greater unrecoverable costs lead to greater competition

special assets increase exit barriers

may be non-asset factors

emotional ties

governmental and social restrictions

different ownership types

market competition is greater among rivals of different ownership types

corporate-owned and freestanding organizations in the same industry often engage in greater competition than do organizations of the same ownership type

greater variation brings distrust and uncertainty of actions

distinct cultures and norms

corporate vs freestanding

for vs non-profit

rivalry and demand

rivalry is greater in industries in which consumer demand is low of decelerating

when consumer demand is high, producers have growth opportunities and strategies often focus on attracting new customers

when demand slows or declines, organizations grow primarily by drawing existing customers away from rivals

organizations commonly predict future demand on the basis of past increases in demand

when the rate of demand slows unexpectedly, organizations may be left with unneeded facilities and capacity; those in this situation may seek to undercut their competitors through price competition and fierce sales tactics

evaluating the favorability of market conditions

is the number of competitors small?

does one organization clearly lead the market?

is the market growing?

does your organization have low fixed costs?

can your product be stored and sold at a later time?

are competitors pursuing a low-growth strategy and making few investments to develop their products?

is your product unique and different from other available products?

would it be easy for your competitors to exit the industry?

is it difficult for your customers to switch from your product to another?

strategic groups

strategic groups are clusters of organizations that use the same of similar strategies in an industry

by segmenting industry competitors, analysts refine their view of organizations’ market positions and gain a better understanding of how the organizations interact and compete

the factor or factors used to form strategic groups depend on which best capture essential strategic differences among the organizations in an industry

mobility barriers

intra-industry obstacles that impeded organizations in a strategic group from joining and competing in another group

may include advertising, research and development expenditures, distribution channels, breadth of product line, patents, and objectives that might be difficult to achieve without large expenditures of time and money

industry driving forces

major factors causing change in an industry

common driving forces in healthcare

changes in consumer demand

technological changes

workforce availablity

political changes

PEST analysis

PEST is an analytical method for deriving driving forces (political, economic, social, and technological)

conducted much like a SWOT process, PEST guides participants to examine each driving force sequentially to provide a more detailed environmental analysis

force field analysis

determines whether the identified forces support or undermine an organization’s plans

forces that promote achievement of the organization’s goals should be leveraged, while those that hinder it should be mitigated

identifying driving forces

what factors account for our present situation?

what factors are keeping us from accomplishing our goals?

what factors are helping us achieve our goals?

scenario analysis

sensitizes leaders to different possible environments in ways that traditional graphs and written plans do not

helps organizations prepare the knowledge and means they will need to deal with different futures

use of scenario planning

appropriate when significant future uncertainties exist as a result of

rapidly advancing technologies

potential shifts in customers’ preferences

major market power shifts by consolidation of distribution channels, suppliers, or buyers

changes in government regulations

steps in scenario analysis

examination of key factors in the external environment

identification of key uncertainties and driving forces

creation of scenarios

integration of scenarios into strategic planning