Year 12 ATAR Economics - Updated

1/261

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

262 Terms

Economic growth.

Unemployment.

Inflation.

The aggregate demand and supply model allows us to analyse

The total demand for goods and services in an economy amounting to the total spending in the economy

Aggregate demand

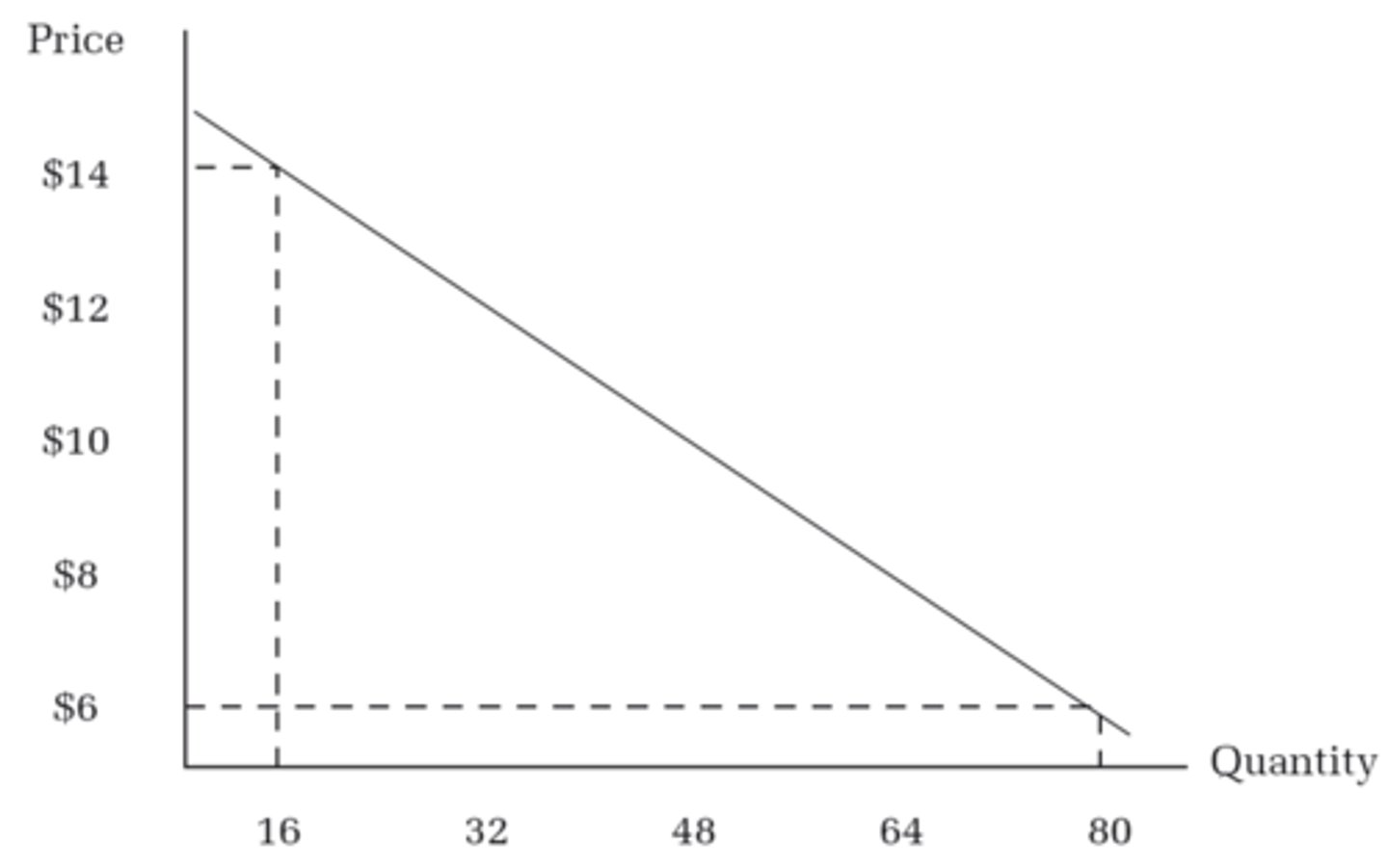

The demand curve

What is this

The income and wealth effect.

The interest rate effect.

The open economy effect.

Three reasons why the demand curve has a negative relationship

The price level and quality of real GDP

The aggregate demand (AD) curve shows a relationship between

A rise in the price level reduces the purchasing power of household income or wealth.

The income or wealth effect

The real value of household wealth declines, and so will consumption.

As price level increases

The real value of household wealth increases, and so will consumption.

As price level decreases

A rise in the general price level means that households and firms will demand more funds to finance their transactions

Interest rate effect

If the domestic price level rises relative to other countries, domestic goods and services become less competitive in those countries, leading to a decrease in exports.

The open economy effect

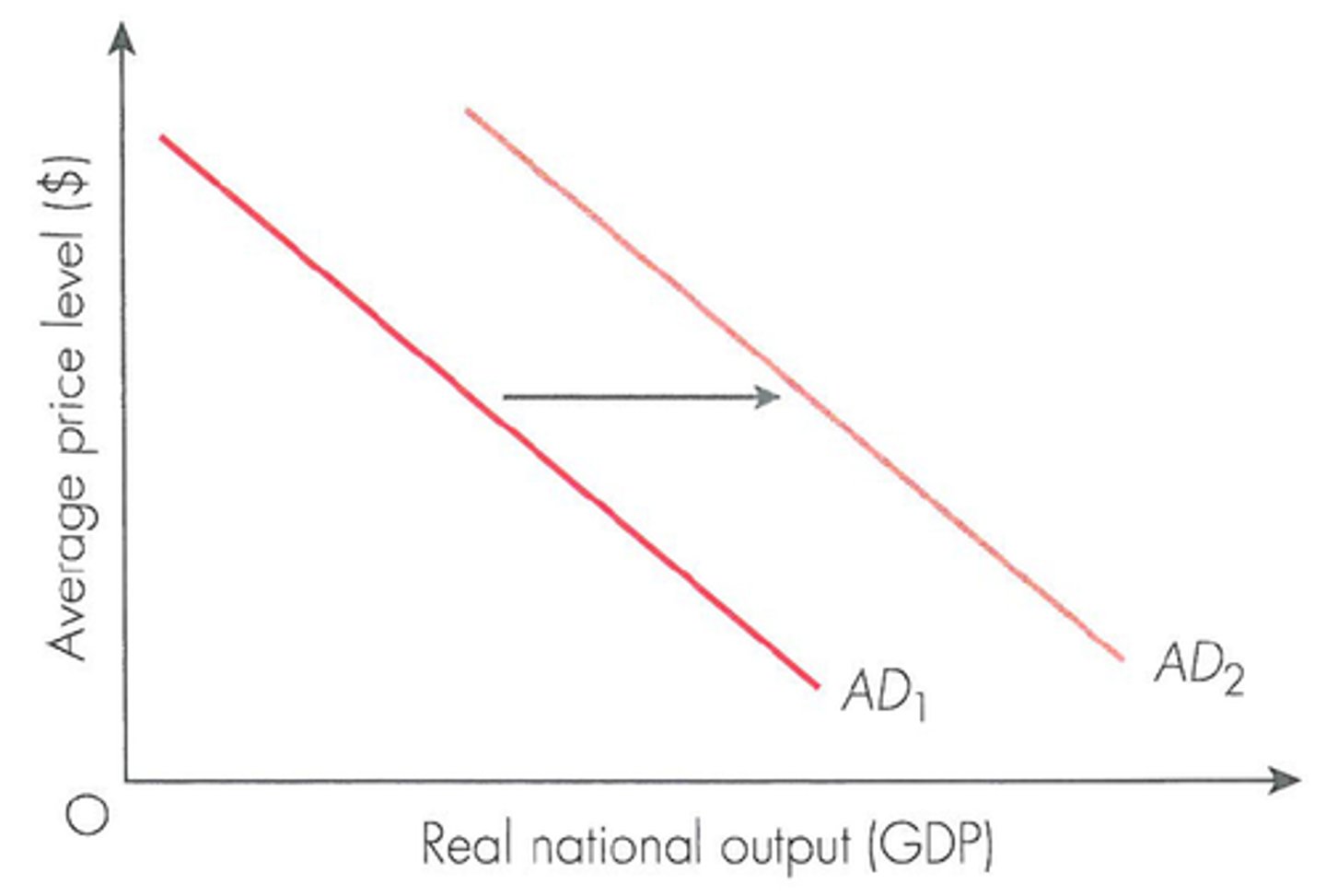

An increase in Aggregate Demand (AD)

A shift to the right of a curve represents

Increased consumption spending due to reduced income tax.

Increased investment spending due to increased business confidence.

Increased consumption spending due to fall in interest

rates.

An increase in government spending.

Increased exports to China.

Some factors that might cause an increase in AD include:

A decrease in government spending.

A fall in business confidence leading to reduced investment

spending.

The strengthening of the $A, which would reduce exports.

Some factors that might cause a decrease in AD include:

There is a change in the price level.

A movement along the curve will occur if

Something other than a change in the price level affects the components of Aggregate Demands

A shift in the curve will occur if

total supply of goods and services that firms in a national economy plan on selling during a specific time period.

What is is aggregate supply

The relationship between the total production of goods and services and the general price level.

The aggregate supply curve

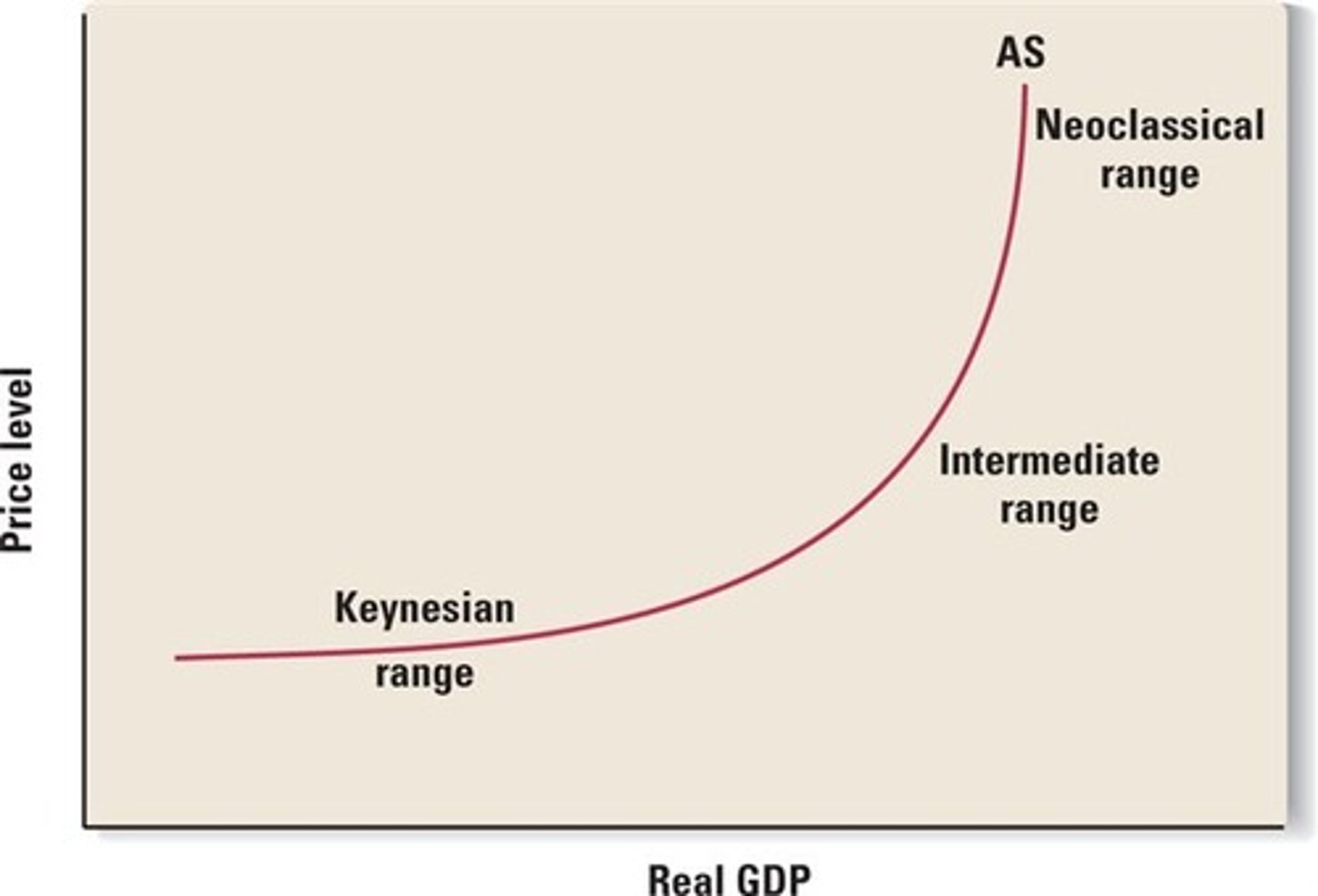

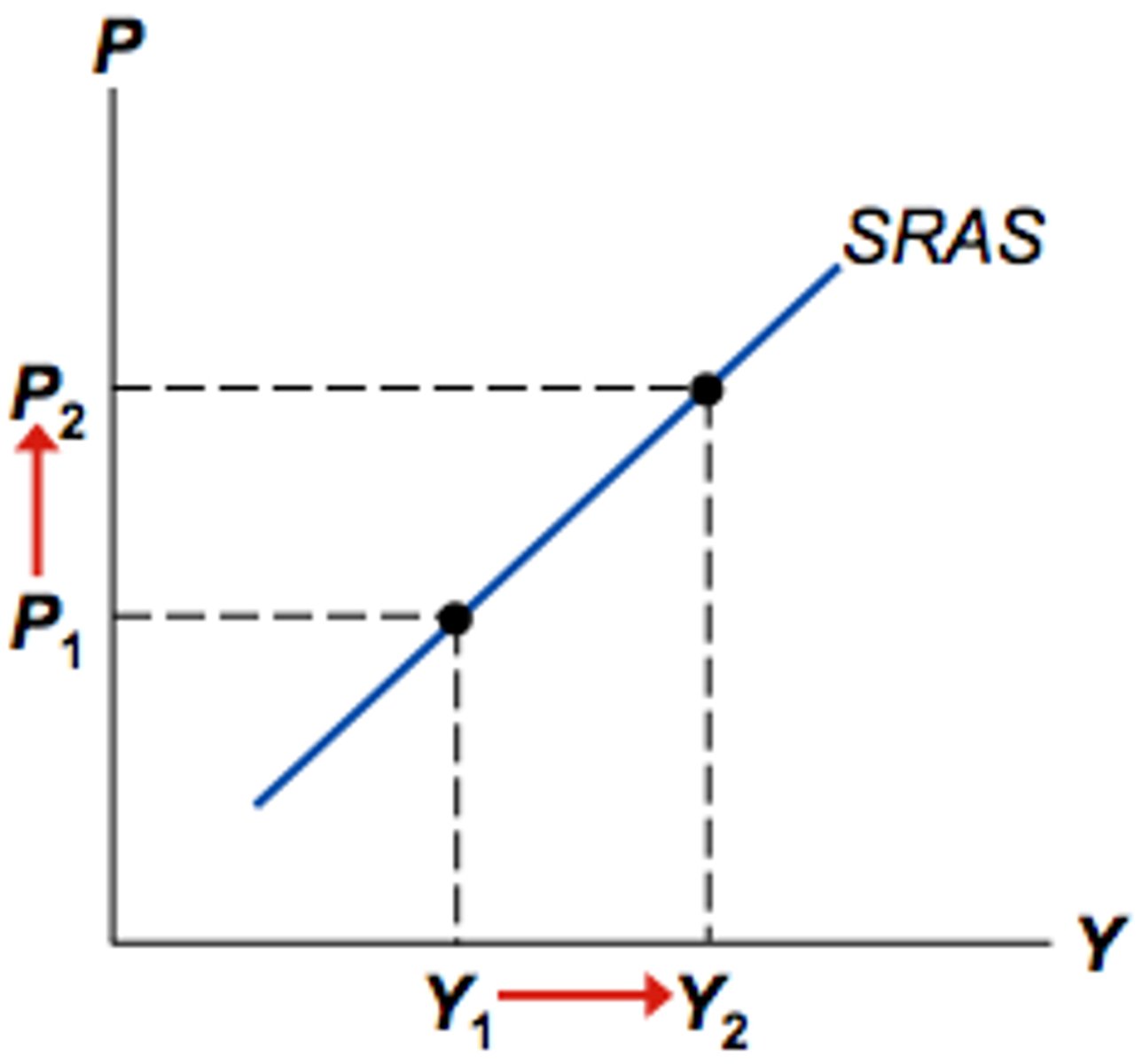

The supply curve.

What is this

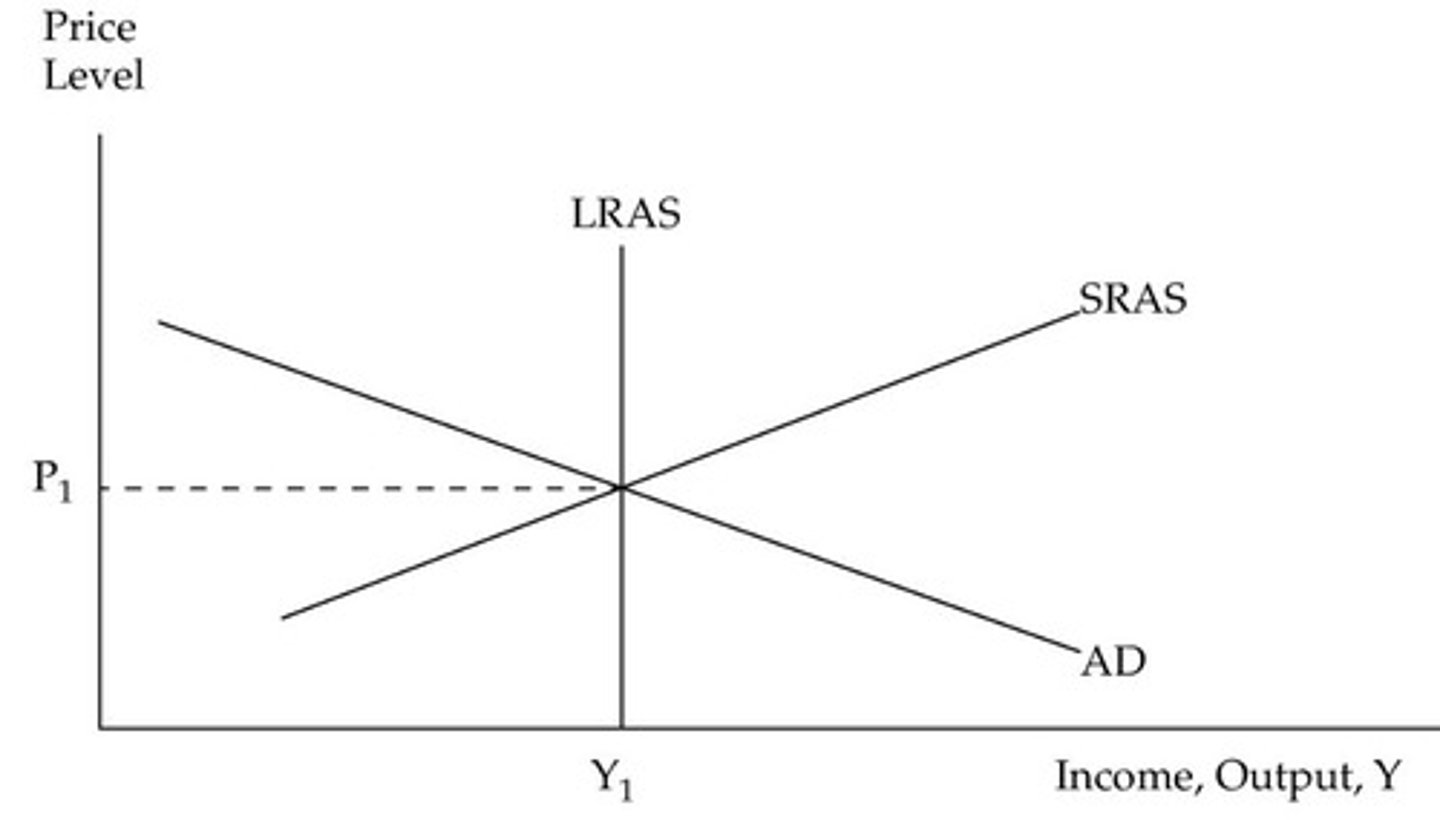

1. The short-run aggregate supply curve (SRAS)

2. The long-run aggregate supply curve (LRAS)

What are the two types of aggregate supply curves

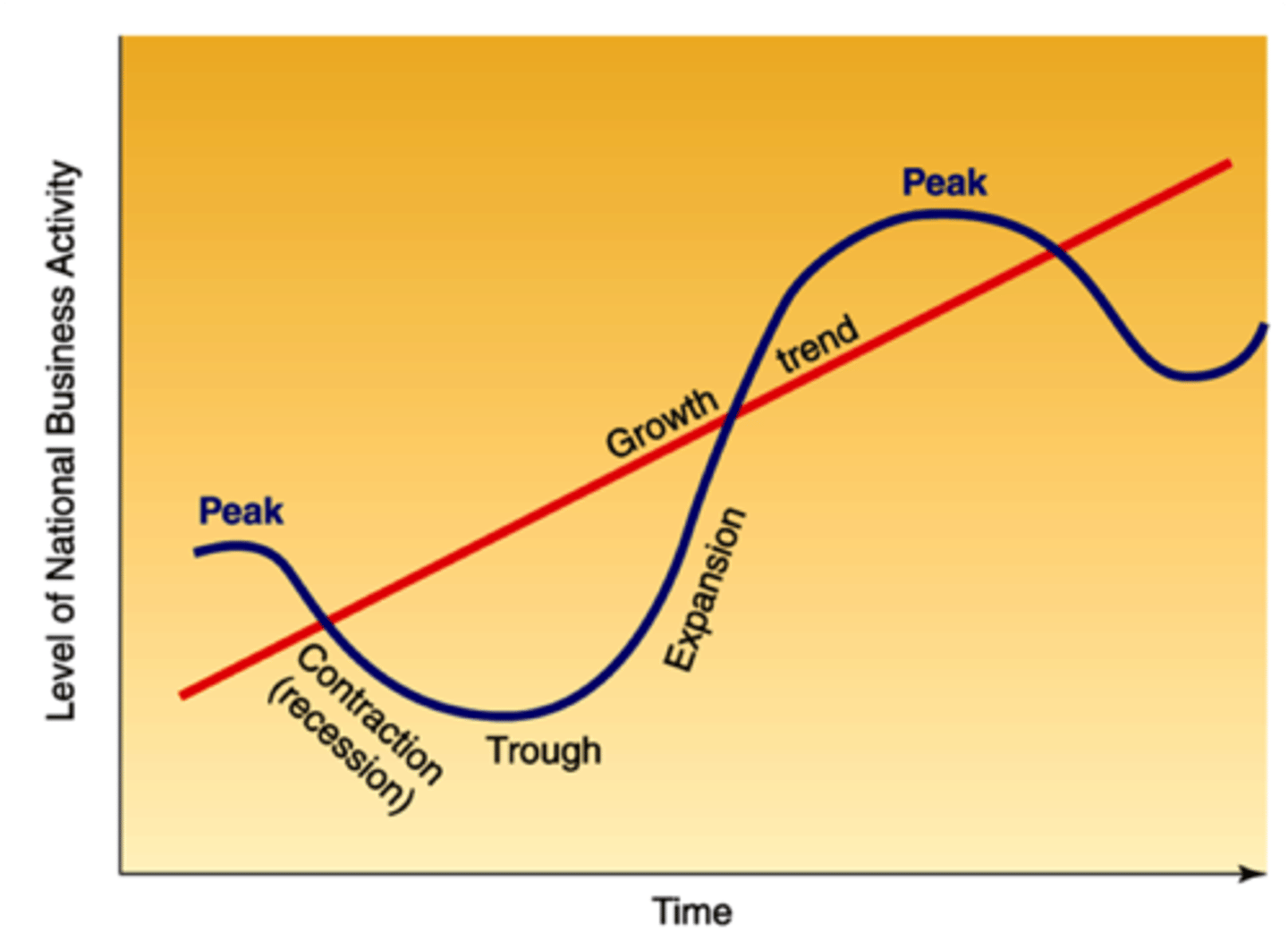

A pattern of expansion, contraction and recovery in the economy through fluctuations in its level of income, output and expenditure

What is the business cycle

Upswing (recovery)

Boom

Downturn (contraction)

Trough (recession)

4 phases of the business cycle

Rising employment rates

Increased economic growth

Rising inflation

Output gap decreases

Upswing

Occurs when the economy is operating above or at its full employment levels

-High economic growth

-Imports are higher than exports

-High Inflation rates

-Very little unemployment (natural rate of unemployment)

-High consumer consumption

Boom

Occurs when the growth rate declines

-Unemployment Increases

-Output gap increases

-Decling business and consumer confidence

-Lower consumption spending

-Delining inflation rates

Downturn

Refers to two consecutive quarters of negative growth

-High unemployment

-Low inflation rates

-Decline in business and consumer confidence

-Budget deficit rising

Trough

-Exogenous shocks

-Endogenous shocks

Two types of economic shocks

Unrelated to changes in aggregate demand and impact upon spending in the economy

For example:

-Growth in the rest of the world

-Changes in the Terms of Trade

-Natural disasters

-Changes in exchange rates

Exogenous shocks

Internal shocks that come from the economies own working

Endogenous shocks

1. Multiplier effect - The multiplier effect refers to the increase in the final income arising from any new injection of spending

2. Accelerator effect - The accelerator effect states that investment levels are related to the rate of change of GDP

Two types of cumulative processes

BRuSH the floor

-Basic survival consumption

-Replacement spending

-Social security net

-Habit

Economic Floors

AIMS for the ceiling

-A negative output gap develops

-Inflation

-ME (monetary) policy response

-Supply-side constraints

Economic ceilings

The sum of the expenditures undertaken in the economy by the factors during a specific time period

Aggregate expenditure definition

Determines the total amount that firms and households plan to spend on goods and services at each level of income

What does Aggregate Expenditure determine

Consumption (C)

Investment (I)

Government spending (G)

Net exports (X - M)

Components of Aggregate Expenditure

AE = C + I + G + (X - M)

Aggregate expenditure equation

Consumption expenditure is the purchase of goods and services for use by households

Consumption makes up about 55% of aggregate expenditure and is a relatively stable component

What is consumption expenditure

Non-durable goods

Durable goods

Services

The three areas of consumption

Goods that are consumed quickly after purchase

Non-durable goods

Expected to last or provide utility for three or more years

Durable goods

Non-commodity items, education, health and recreation

Services

Some consumption expenditure is necessary to satisfy basic needs. This is known as survival consumption and is not direclty related to the level of income

Autonomous Consumption

Discretionary spending is on luxuries that can be put off or postponed. It satifies a consumer's higher order needs.

Discretionary Consumption

The more after-tax income household's have, the more consumption spending

Disposable income

The higher the interest rate the more households are encouraged to save and the less they will be prepared to borrow.

Interest rates

-Disposable income

-Interest rates

-Inflation

-Expectations and consumer confidence

-Wealth and debt

Factors affecting discretionary consumption

The higher the rate of inflation, the more expensive it is to delay purchases as household purchasing power declines

Inflation

The higher the level of consumer expectations or confidence the higher the level of consumption

Expectations and consumer confidence

Consumption is directly related to changes in net wealth. The wealthier people are or feel, the higher the level of consumption

Wealth and debt

C = a +bY

C = Consumption

a = autonomous spending

b = MPC (marginal propensity to consume)

The consumption function

S = -a + (1-b)Y

Saving function

Short-run economic fluctuations will impact price level and real GDP

At higher prices, producers are willing to supply more.

The SRAS Curve

The Intermediate range

The Keynesian range

The Classical range

The Three stages of the AS curve

Where the economy usually is

The Intermediate range

Applies when the economy is in recession and there are many underutilised resources

The Keynesian range

Applies when the economy is booming and there is pressure on resources

The Classical range

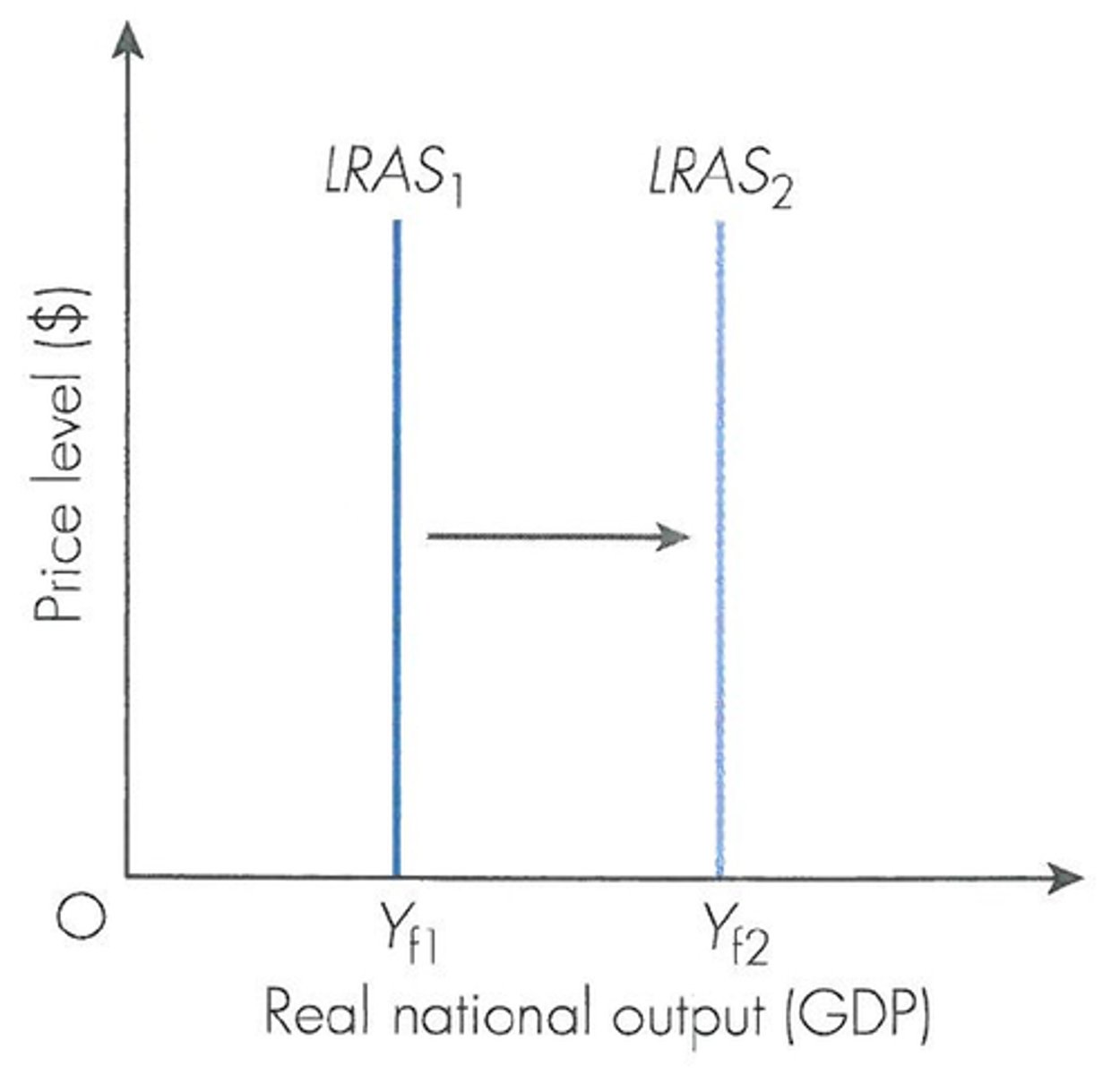

Shows the economy's the potential level of real GDP when all resources are fully employed

The position on the LRAS curve is determined by the quantity of resources and the technology available

The LRAS Curve

The Australian government and the RBA deliberately regulate various aspects of our market economy as to improve its performance.

What does the Reserve Bank of Australia (RBA) and the government do?

Sustainable economic growth

Price stability (low inflation)

Full employment (low unemployment)

Main economic objectives

More equitable distribution of income

Efficient allocation of resources

Other economic objectives

Involves the overall pace or speed at which national production is growing

The level of economic activity

Usually very unstable, and sometimes experience violent ups and downs in national production involving booms and recessions

Unregulated market economies

3.2% - 3.5%

The target range for economic growth

3.2%

The long term average rate of growth in Australia is

not sustainable due to resource depletion, production bottlenecks and inflationary pressure.

Economic growth above 4% is

Is determined by the increase in the labour force and growth of productivity.

The rate of increase in Real GDP

Higher living standards and creates demand for labour which could increase employment opportunities.

Economic growth leads to

Occurs when there is little increase in the general price level - low rates of inflation.

Price stability

2 - 3% inflation

Inflation rate target

Persistent increase in the price level

What is inflation

Maintains the value of money

Protects savings

Helps keep interest rates low

Promotes international competitiveness

Reduces uncertainty for decision makers

Protects the living standards of low income earners

Benefits of low inflation

Through its various policies, the Australian Government seeks to create more jobs, achieve the goal of full employment and raise Australian living standards.

Full employment

5%

Unemployment target range

It is impossible to achieve a zero rate of unemployment.

This is because of the existence of frictional (1.5-2.5%) and structural (2-3%) unemployment.

Dynamic structure of developed economies

The natural rate is the lowest rate of unemployment we can achieve without inflationary pressure.

The natural rate of unemployment

A households wealth is determined by the difference between the value of its assets and the value of debts

The wealth effect

the real value of household wealth declines (purchasing power), and so will consumption

As price level (PL) increases

the real value of household wealth increases (purchasing power), and so will consumption

As price level (PL) decreases

Higher prices normally lead to higher nominal interest rates to reward or compensate savers for the effect inflation has on the real value of bank deposits and loans.

The interest rate effect

households and firms need more funds to finance buying and selling

As interest rate effect PL increases

A rise in the price level (ceteris paribus) reduces the international competitiveness of Australia's products

International Trade effect

A shift in the AD curve

What is this

-Prices in resource markets, particularly labour markets, adjust when there are shortages or surpluses in markets

-A change in the cost of resources will cause producers to adjust their willingness to supply (SRAS)

-The long-run capacity of the economy is independent of the economy's price level

Neo-classical aggregate supply assumptions

The short run is defined as the time period in which prices of factors of production are inflexible (wage levels)

SRAS - Short-run aggregate supply

The Short-run aggregate supply curve shows the relationship between the price level and real GDP

SRAS shows

The LRAS curve shows the relationship in the long-run between the price level and the quantity of real GDP supplied

LRAS - Long-run aggregate supply

-Population - rate of growth in the working age population

-Participation - changes in labour force participation

-Productivity - growth in output over and above growth in labour hours

In the long-run, the level of real GDP or the potential level of output is determined by the 3 P's

Greater level of investment. (purchase of capital goods)

Technological change and integration. (better equipment, increased knowledge capital and more efficient production processes)

More education and better health. (human capital)

Increases in entrepreneurial activity. (investment in human capital)

An increase in resources such as migrant workers or mineral discoveries.

An increase in the quantity and quality of machinery and equipment used in production.

Factors/ shocks that cause shifts

The autonomous change in a competent o

Neo-classical equilibrium

Expansion

Short run

-Allocative role - The government direct allocates resources to provide public and merit goods and services

-Regulatory role - The government regulates business activity and markets eg. to control monopoly power or prevent negative externalities

-Redistributive role - The government provides a social security safety net, where needed through a system of taxation and transfers

-Demand management role - The government manages the level of aggregate demand to achieve its economic growth

The economic role of the Australian Government

Reduced unemployment.

Improved public services.

A rise in material living standards.

Avoids relative decline.

Advantages to sustained economic growth

Externalities.

Increased inequality.

Demand-Pull inflation.

MPM.

Skill shortages.

Disadvantages to sustained economic growth

Promotes international competitiveness.

Fosters a low interest rate environment.

Protects real incomes in the economy.

Confidence.

Advantages to price stability

A danger of deflation.

Fall in aggregate demand.

Allows debts to fall in real terms over time.

Disadvantages to price stability

Avoids economic costs.

Avoids costs to the government.

Avoids social costs.

Avoids personal/individual costs.

Advantages to full employment

Wage-push inflation.

Moral hazard.

Natural unemployment.

Disadvantages to full employment

Higher marginal propensity to consume.

Access to minimum living standards.

More people have the ability and power to spend.

More Harmonious.

Advantages to equitable income distribution

Expense of economic efficiency.

Remaining competitive.

Lack of reward and incentive.

Disadvantages to equitable income distribution

Competitive in overseas markets.

Greater levels of exports.

Comparative advantage.

Economies of Scale.

Reduces CAD.

Fosters a dynamic business climate

Advantages to Improving trade performance

Only some sectors are developed.

Dumping.

Crowd out domestic firms

Disadvantages to Improving trade performance

Add more to...

previous chapter