FFS - 4.Stocks

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

What is common stock?

An equity claim representing ownership in a corporation. It gives rights to dividends and residual claims

What forms can dividends take?

Cash dividends and stock dividends (stock splits)

Why are payments to stockholders uncertain?

because both the amount and the timing of dividends depend on firm performance and board decisions

What are the three main characteristics of common stock?

residual claim

limited liability

voting rights

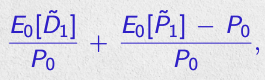

What is the formula for a stock’s expected return?

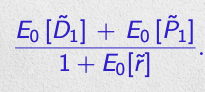

What is the rearranged formula for stock price (one-year horizon)?

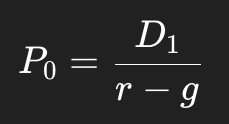

What is the Gordon Growth Model?

When can the Gordon Model be used?

When dividends grow at a constant rate g forever and r > g

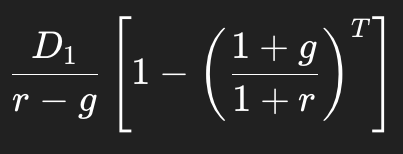

How do you value a stock with multiple growth phases?

Value high-growth dividends as a growing annuity

Compute the continuing value using Gordon

Discount everything to today

What is the value formula for a growing annuity?

What is the payout ratio?

DPS/EPS

What is the plowback ratio (retention ratio)?

1 - p

What is ROE (Return on Equity)?

= Earnings/Book Value

What is the formula for dividend growth?

ROE x b

How do you express next year’s dividend?

EPS x p

What is PVGO (PV of growth opportunities) ?

extra value coming from future investments

How is the stock price decomposed into components?

EPS/r + PVGO

When is PVGO positive?

When ROE > required return r, meaning the firm earns more than its cost of capital

Relation between P/E ratio and growth?

1/r + PVGO/EPS

What does a stock’s expected return consist of?

Dividend yield + capital gains yield

What makes a stock a “growth stock”?

high PVGO and high P/E ratio

What is the no-growth stock price formula?

EPS/r