FT1

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

For mutually exclusive projects, if the NPV rankings and the IRR rankings give conflicting signals, you should select the project with the higher IRR

Which of the following statements about the internal rate of return (IRR) and net present value (NPV) is least accurate?

24%

An investment with a cost of $5,000 is expected to have cash inflows of $3,000 in year 1, and $4,000 in year 2. The internal rate of return (IRR) for this investment is closest to…

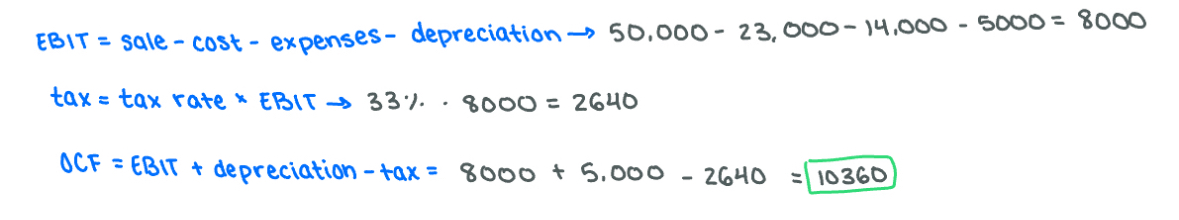

$10,360

A firm has revenue of $50,000, the cost of goods sold is $23,000, other expenses (selling and administration) are $14,000 and depreciation is $5,000. The firm's tax rate is 33%. What is the operating cash flow?

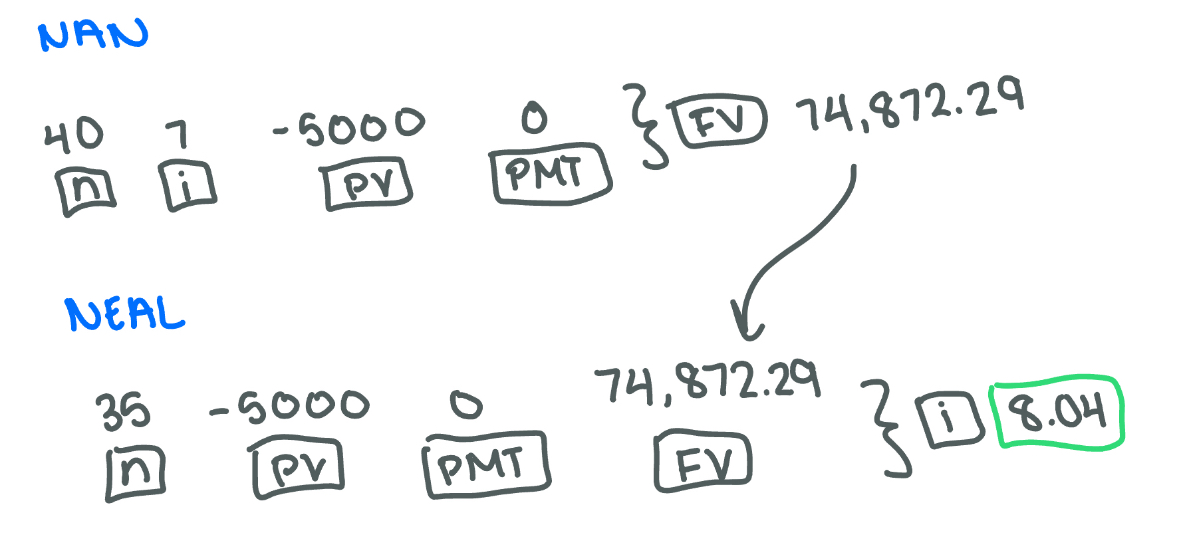

8.04%

Nan and Neal are twins. Nan invests $5,000 at age 25 while Neal invests the same amount at age 30. Nan chooses a relatively safe investment product that offers an annual interest rate of 7%. Both twins plan to retire at age 65 and neither adds nor withdraws funds prior to retirement. If Neal would like to have the same amount of money as Nan by their retirements, what annual interest rate must his investment earn?

Investment in working capital, unlike investment in plant and equipment, represents a positive cash flow.

Which of the following statements regarding investment in working capital is incorrect?

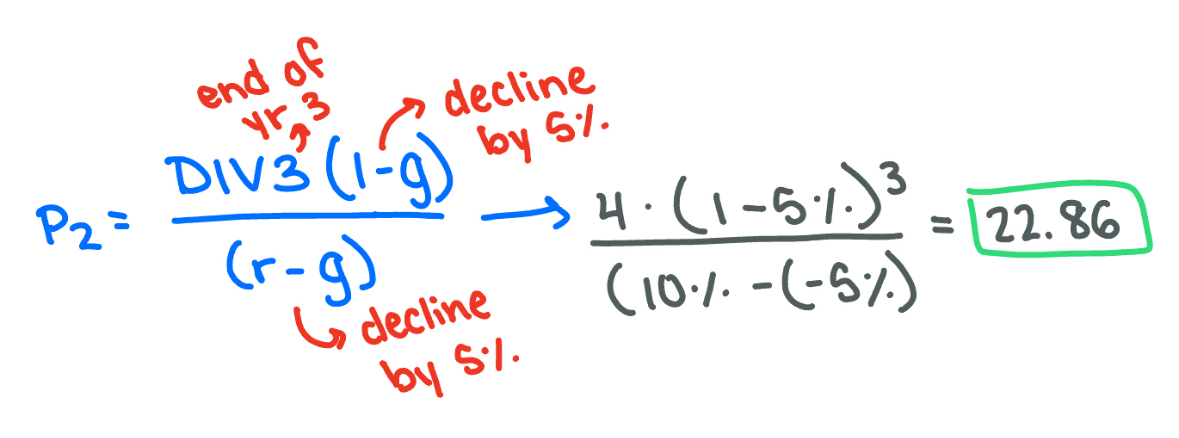

$22.86

Boomer Products, Inc. manufactures "no-inhale" cigarettes. As their target customers age and pass on, sales of the product are expected to decline. Thus, demographics suggest that earnings and dividends will decline at a rate of 5% annually forever. The firm just paid-a dividend of $4; given a required rate of return is 10%, the price of the stock in 2 years will be...

Protective covenants

Restrictions on asset sales and borrowing in bond indenture are often known as?

Gone down

If a company's stock price (Po) goes up, and nothing else changes, the required rate of return must have…

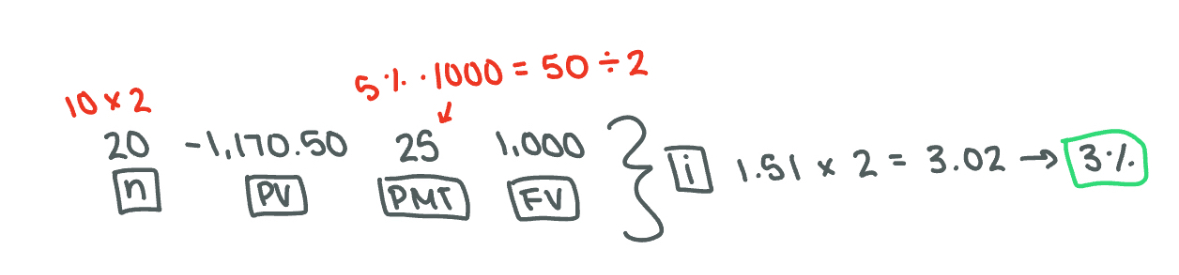

3%

Market Enterprises would like to issue bonds at a par value of $1,000 per unit and needs to determine the approximate coupon rate it would need to pay investors. A firm with similar risk recently issued bonds, which currently have the following features: a 5% coupon rate, 10 years until maturity, and a current price of $1,170.50. At what coupon rate would Market Enterprises expect to issue bonds, assuming annual interest payments? Please round to the closest answer.

If the required rate of return increases, the price decreases

Which of the following regarding preferred stock is true?

premium; gain

A bond with an annual coupon of $100 originally sold at par for $1,000. The current market interest rate (or yield to maturity) on this bond is 9%. Assuming no change in risk, this bond will sell at a _______ and present the seller (who bought the bond at initial issuance) of the bond today with a capital _______

Common equity: no effect; preferred equity: no effect; debt: decrease

Which of the following choices best describes the role of taxes on the after-tax cost of capital in the U.S. from the different capital sources?

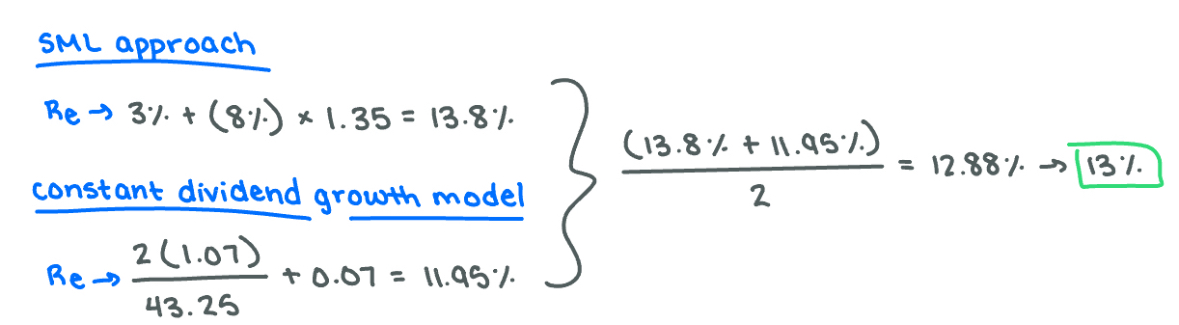

About 13%

R.K. Boats Inc. is in the process of making some major investments for growth and is interested in calculating its cost of equity to correctly estimate its adjusted WACC.

The firm's common stock is currently trading for $43.25. Its annual dividend, which was paid last year, was $2 and should continue to grow at 7% per year.

Moreover, the company's beta is 1.35, the risk-free rate is 3%, and the market risk premium is 8%. Which of the following is a reasonable estimation of the firm's cost of equity?

Have realized returns close to expected returns

Investments with low return variances usually….

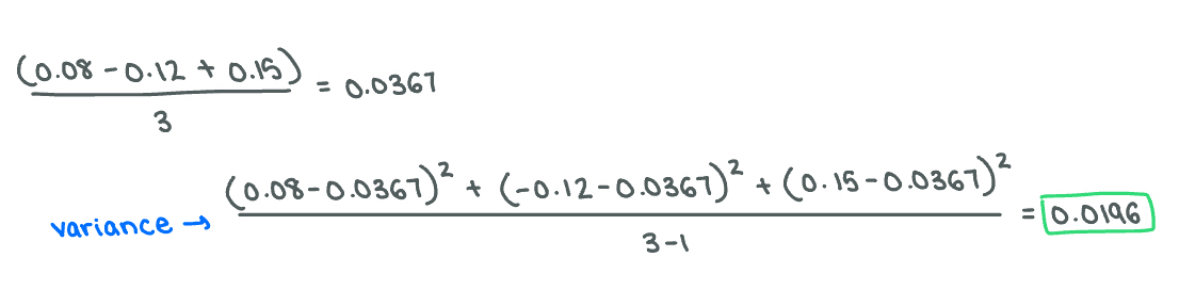

0.0196

What is the approximate variance of returns if over the past 3 years an investment returned 8.0%, -12.0%, and 15.0%?

Steel prices

Which of the following risks would be classified as a non-systematic risk for an auto manufacturer?

beta measures the risk of an individual stock relative to a market index.

Within the capital asset pricing model…

sole proprietorship

Which of the following does NOT offer the protection of limited liability?

Decrease net income

An increase in depreciation expenses will (other things equal):

Five of these items

How many of the following items are found on the balance sheet, rather than the income statement?

Accounts receivable

Addition to retained earnings

Income tax expense

Notes payable

Cash

Selling and administrative expenses

Plant and equipment

Operating expense

Marketable securities

Interest expense

4.00%

Assume that a share of stock, priced at $52.5 per share, just paid a dividend of $2. The dividend is expected to grow at a long-run constant rate. The required rate of return is 4% higher than the dividend growth rate (or R - g = 4%). Given this information, determine the dividend yield of the stock.

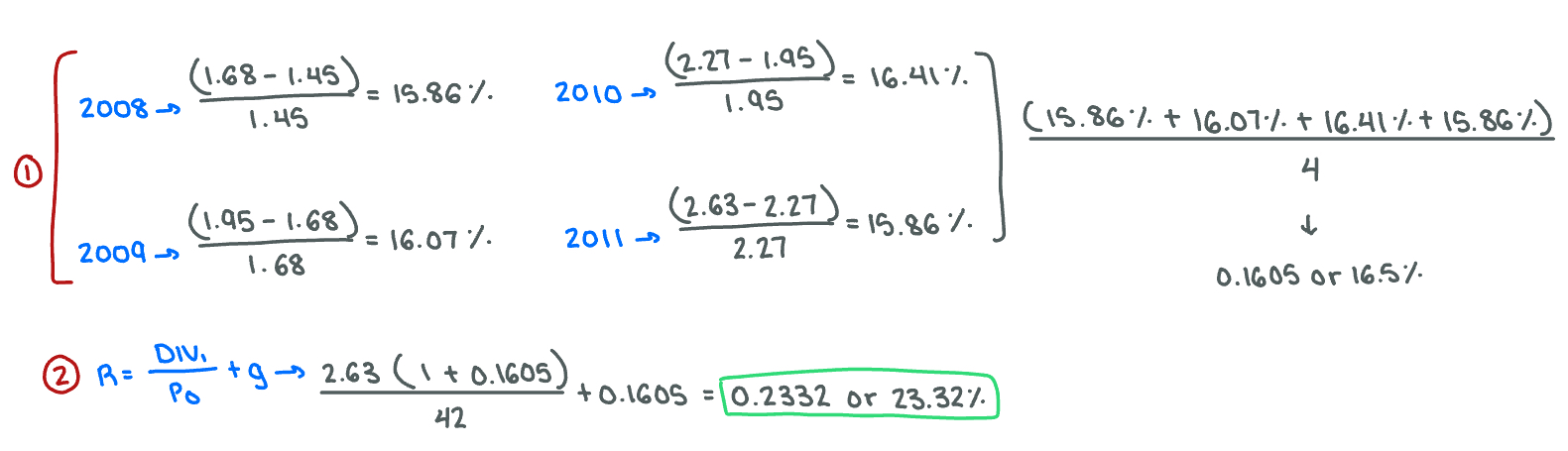

About 23%

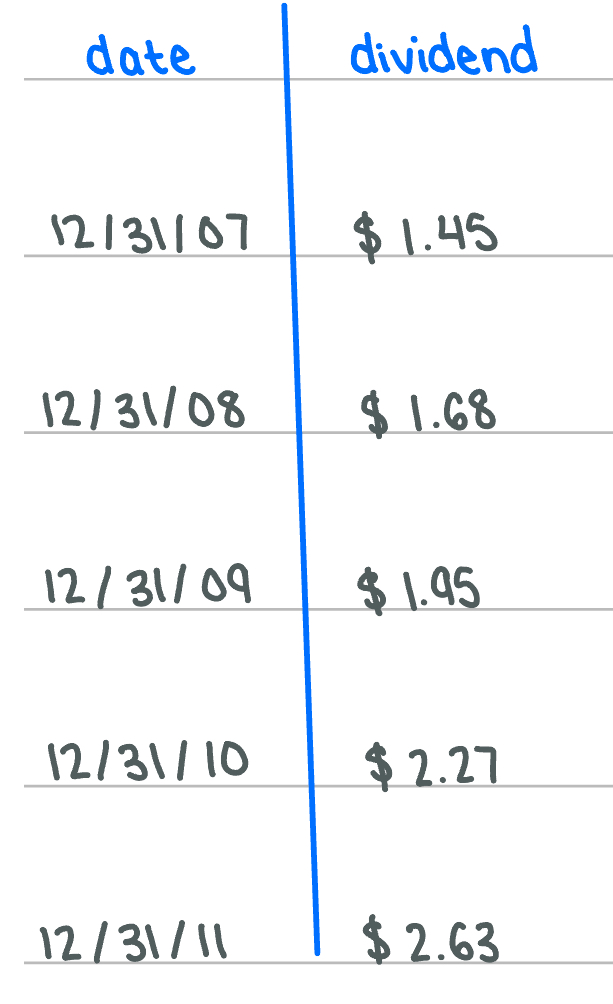

Given the following information, what is your best estimate for the firm's cost of equity on January 2,2012, if the stock sells for $42 on that day?

17%

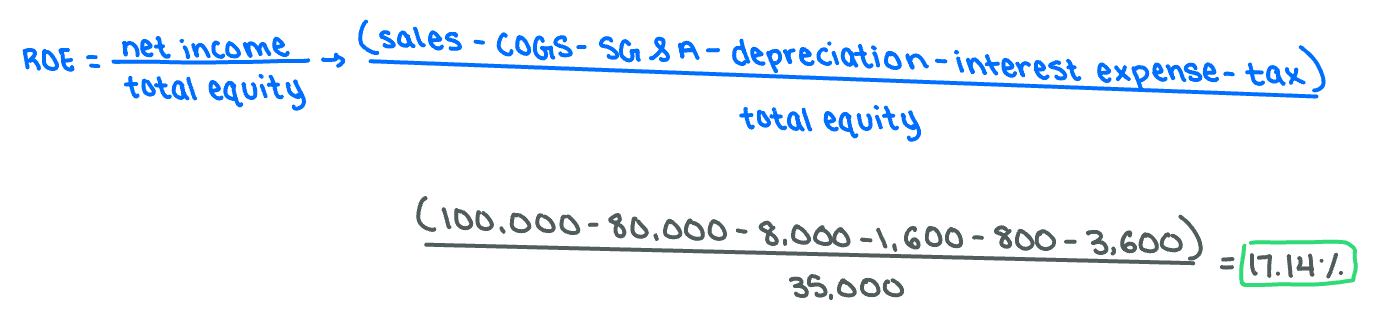

Below are items in company ABC's annual income statement. There is no other income or expense….

If shareholders' equity is $35,000 and total liability is $15,000, return on equity is about ________

$350 is cash provided by financing activities

How much cash is provided by, or used by financing activities, given the following. $200 is raised in long-term debt. A $100 cash dividend is paid. $300 worth of shares are sold. $50 in stock is repurchased.

return on equity

Which of the following profitability ratios are shareholders of a company most interested in?

The $200,000 today.

Sharon Smith will receive $1 million in 20 years. The discount rate is 10%. As an alternative, she can receive $200,000 today. Which option should she choose?

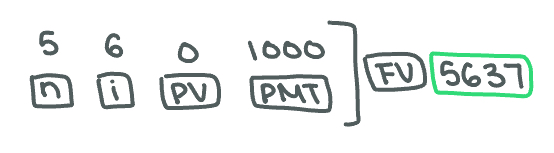

$5,637

Mr. Blochirt is creating a college investment fund for his daughter. He will put in $1,000 per year for the next 5 years starting one year from now and expects to earn a 6% annual rate of return. How much money will his daughter have when she starts college by the end of the fifth year?

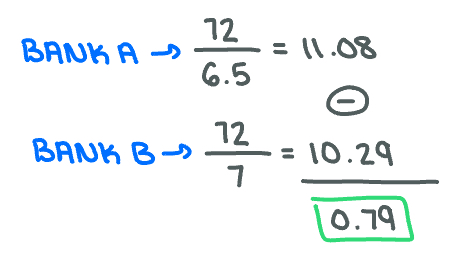

It would take longer with Bank A by less than 1 year.

Tristan wants to analyze and compare different investment options to see how long it would take him to double his money. Bank A offers an interest rate of 6.5% while bank B offers an interest rate of 7%. Based on the rule of 72, which option would take longer, and by how much?

The future value of a perpetuity.

Which of the following CANNOT be calculated?

$380,649

Your firm intends to finance the purchase of a new construction crane. The cost is $1,500,000. The loan has an annual interest rate of 8.5% and requires annual installment payment. If the loan is to be completely paid off by the end of year five, what should be the annual payment? (round to the nearest dollar)

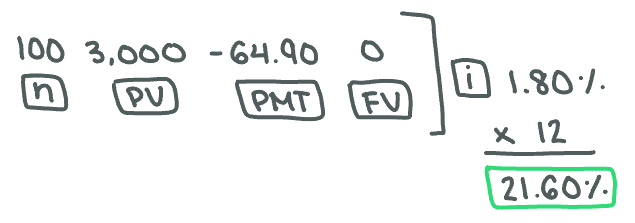

21.60%

Your credit card has a balance of $3,000. The bank requires a minimum monthly payment of $64.90 and states that it will take 100 months to pay off the balance if you only make minimum payment every month and do NOT make additional charges on the card. What is the annual interest rate charged by your credit card?

Il only

Which of the following statements is true?

I. The dividend growth model only holds if, at some point in time, the dividend growth rate exceeds the stock's required return.

Il. An increase in the dividend growth rate will increase a stock's market value, all else the same.

Ill. An increase in the required return on a stock will increase its market value, all else the same.

Likely will see its WACC rise over time.

A firm that uses its WACC as a cutoff without consideration of project risk…

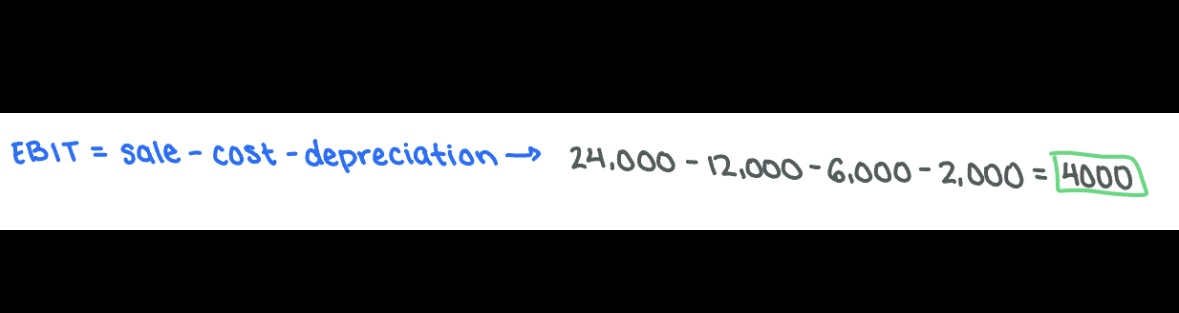

$4,000

The revenue is $24,000, the cost of goods sold is $12,000, other expenses (from selling and administration) are $6,000, and depreciation is $2,000. What is the EBIT?

all of the options.

Companies that have higher risk than a competitor in the same industry will generally have…

-$62,000

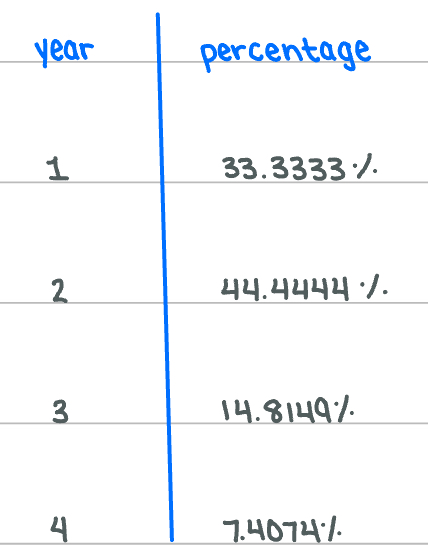

You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck. The truck's basic price is $50,000, and it will cost another $10,000 to modify it for special use by your firm. The truck falls in the MACRS 3-year class, and it will be sold after three years for $20,000. Use of the truck will require an increase in net operating working capital (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40 percent.

The three-year MACRS schedule is as follows:

What is the cash flow at year 0?

Investment in working capital, unlike investment in plant and equipment, represents a positive cash flow.

Which of the following statements regarding investment in working capital is incorrect?

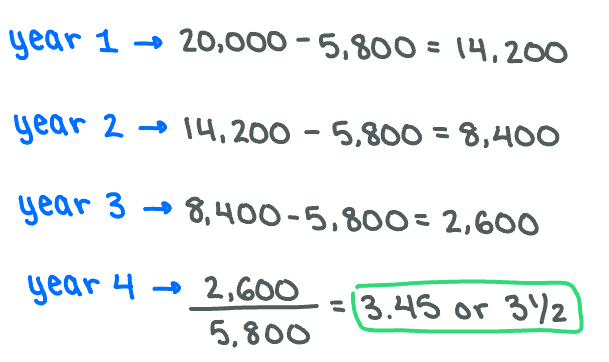

Its payback period is roughly 3 1/2 years.

Which of the following statements is true for a project with $20,000 initial cost, cash inflows of $5,800 per year for 6 years, and a discount rate of 15%?

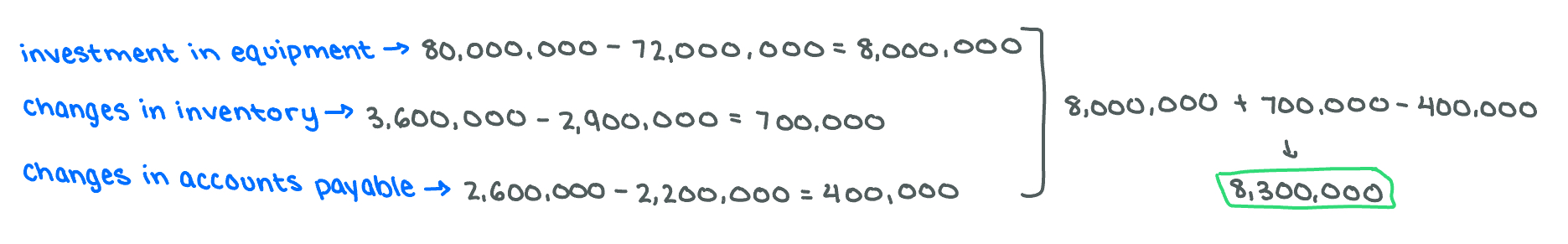

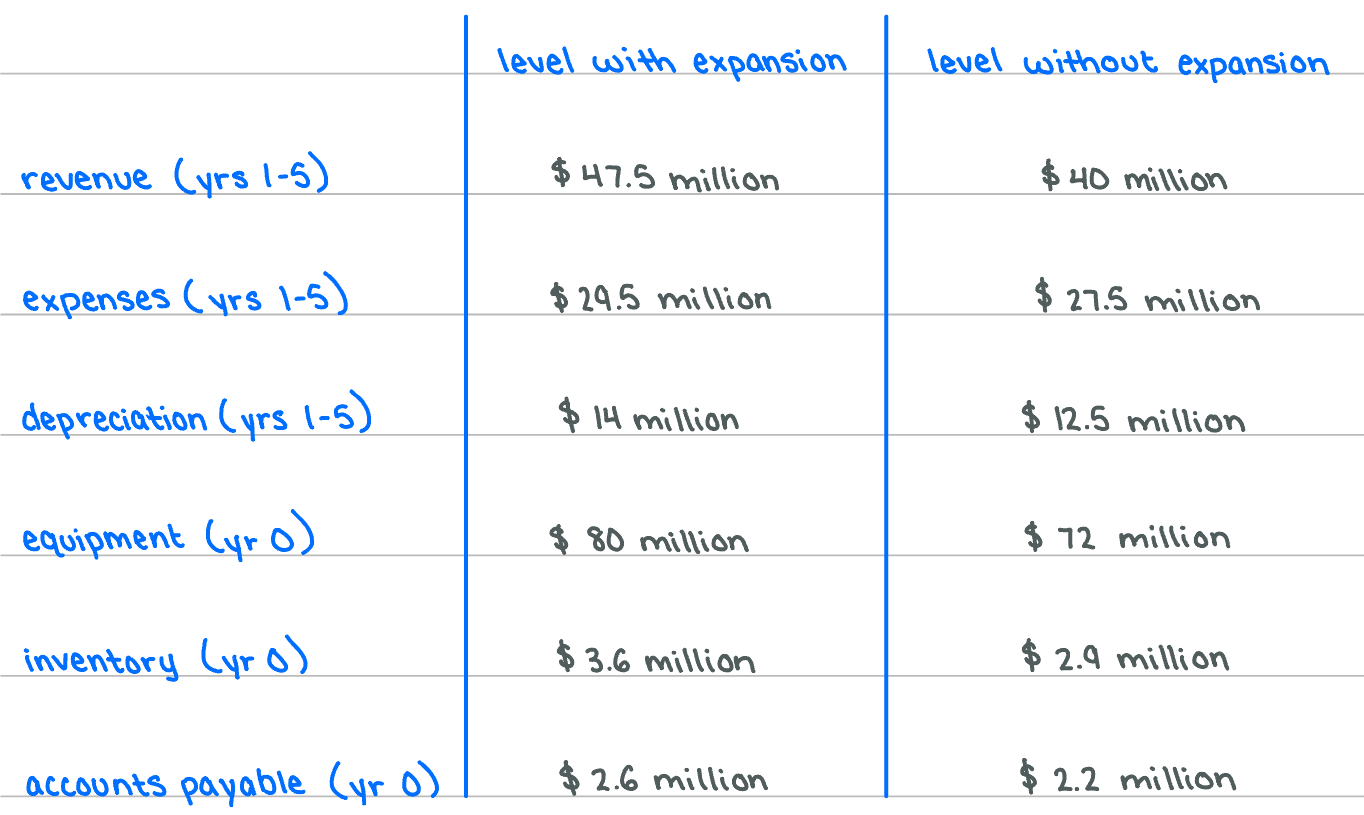

8.3 million

The BBM Corp. is considering the expansion into the production of Wuk, a revolutionary new product. The firm has forecasted the following information with the expansion and without. The firm is in the 35% marginal tax bracket.

The net cash outflow in year 0 from the production of Wuk is…

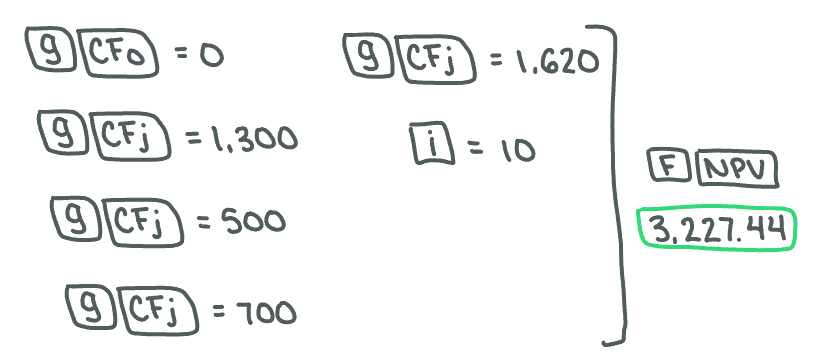

3,227.44

Mercer Shaved Ice Co. has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows?

Year | Cash Flow |

1 | $1,300 |

2 | 500 |

3 | 700 |

4 | 1,620 |

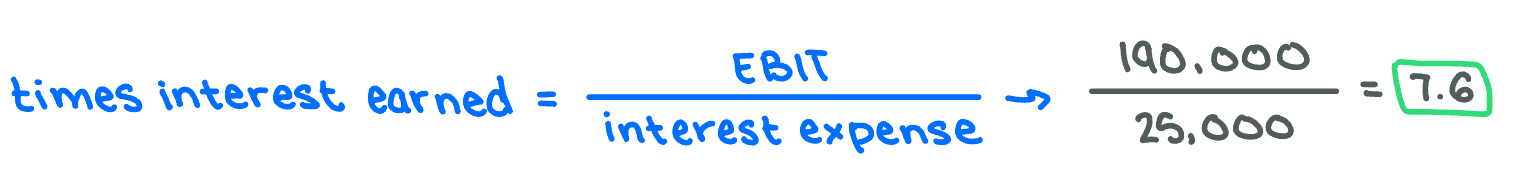

7.6

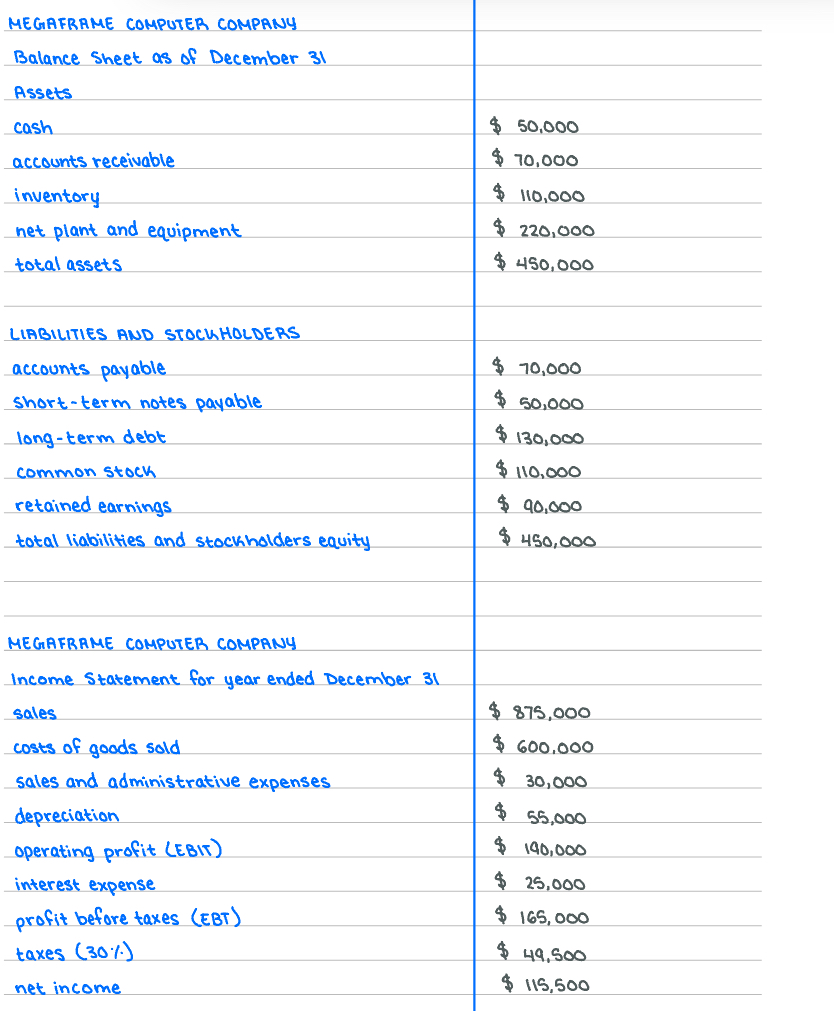

Refer to the tables above. Times interest earned for Megaframe Computer is…. (round your answer to the nearest tenth).