FT5

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

The discounted payback period method uses discounted cash-flow techniques.

Which of the following statements about the "discounted payback period method" is true?

decisions are based on cash flows, not accounting income

One of the basic principles of capital budgeting is that…

Systematic risk

The relevant risk for the fair market pricing of financial securities is the….

A portfolio half invested in the market portfolio and half invested in stocks with betas = 1.50.

Which of the following would likely have the greatest amount of systematic risk?

If a stock's dividend is expected to grow at a constant rate, then the growth rate of its price (price appreciation or capital gain) is exactly the same as the growth rate of its dividends

Which of the following statements is true?

Both time interest earned (TIE) ratio and cash coverage ratio

Which of the following ratios could capture a firm's ability to service its loans?

decrease of net cash flow.

An increase of $100,000 in inventory would result in a(n)…

A share of IBM common stock

Which of the following would most likely be considered the most liquid asset?

Selling stock of the company

Which of the following items would not be included in cash flow from investing?

The SML will shift up and have a steeper slope

-Assume that the Security Market Line (SML) is based on a risk=free rate of 5% and a market return of 11%. What will happen to the SML if the risk-free rate is expected to increase and investors become more risk averse?

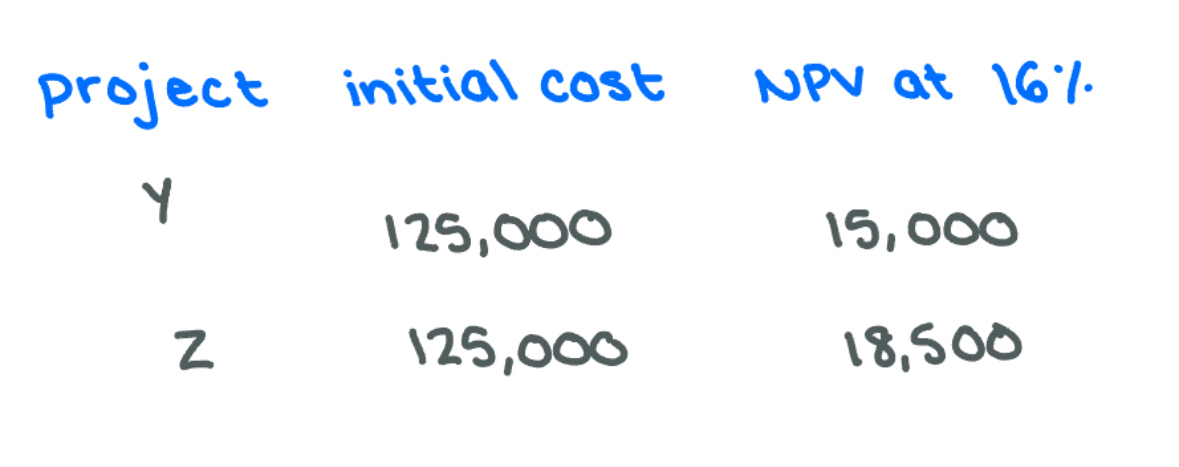

Both projects' IRRs are higher than 16%.

The Sunnyside corporation has calculated the following information for the projects Y and Z…

Both projects have conventional cash flow patterns. Which of the following must be true?

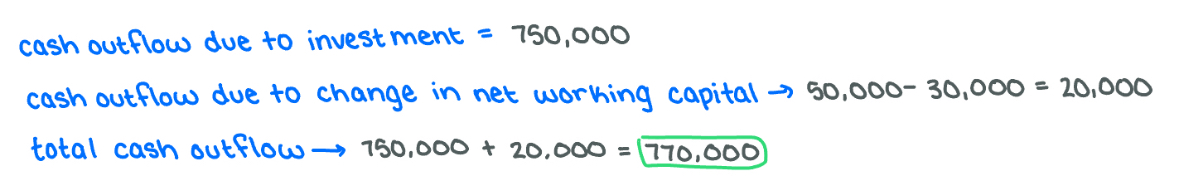

$770,000 cash outflow

Your company is considering an expansion into a new product area. The company has collected the following information about the proposed product. (Note: You may or may not need to use all of this information, use only the information that is relevant.)

The project has an anticipated economic life of 5 years.

The company will have to purchase a new machine to produce the product. The machine has an up-front cost (T = 0) of $750,000. The machine will be depreciated on a straight-line basis over 5 years (that is,

the company's depreciation expense will be $150,000 in each of the first five years (T = 1, 2, 3, 4, and 5).If the company goes ahead with the project, it will have an effect on the company's net working capital. At the outset, T = 0, inventory will increase by $50,000 and accounts payable will increase by $30,000. At T = 5, the net working capital will be recovered after the project is completed.

The project is expected to produce EBIT of $200,000 the first year (T = 1), $300,000 the second and third years (T = 2 and 3), $200,000 the fourth year (T = 4), and $150,000 the final year (T = 5). These values already include operating costs that are expected to equal 50 percent of sales revenue and depreciation expense.

The company's tax rate is 40 percent.

What is the total cash flow in year 0 (T=0)?

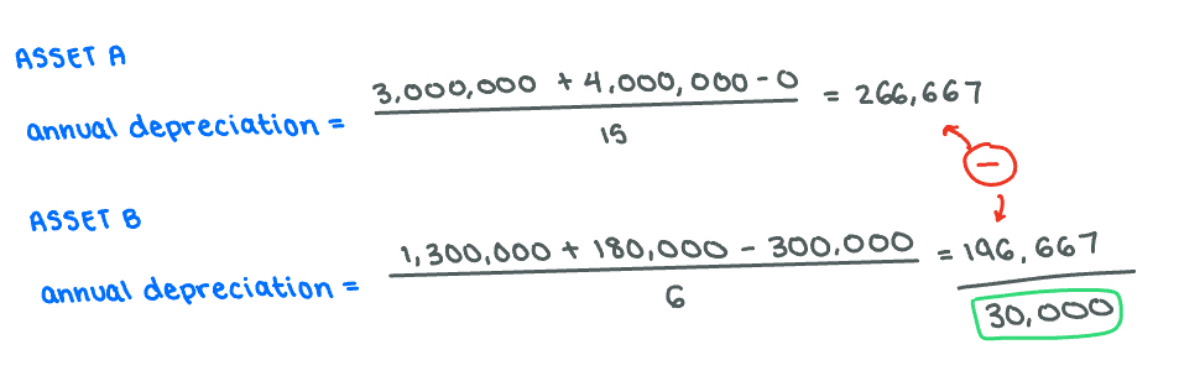

Asset A has $30,000 more in depreciation per year

A firm is considering purchasing two assets.

Asset A will have a useful life of fifteen years and cost $3 million. It will have installation costs of $400,000, but no salvage or residual value.

Asset B will have a useful life of six years and cost $1.3 million. It will have installation costs of $180,000 and a salvage or residual value of $300,000.

Which asset will have a greater annual straight-line depreciation?

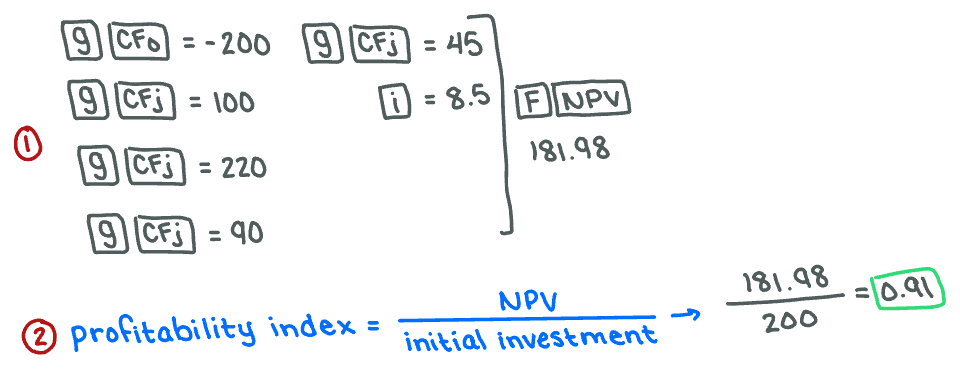

Yes because PI equals 0.91.

An investment has expected cash flows of -$200, $100, $220, $90 and $45 at the end of years 0 through 4, respectively. The required return is 8.5%. Estimate the investment's profitability index, and is this expected to create shareholder value (yes or no)?

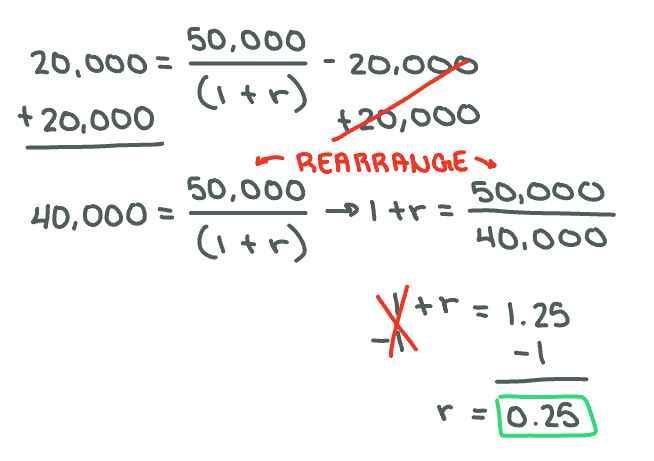

The cost of capital is 25%.

Your colleague has just resigned and left you the following information about a one-year investment project. Your boss would like to know what cost of capital your colleague has used in the project evaluation. Your answer to your boss is:

Profitability Index = 1

Initial Investment = $20,000

Cash inflow in Year 1 = $50,000

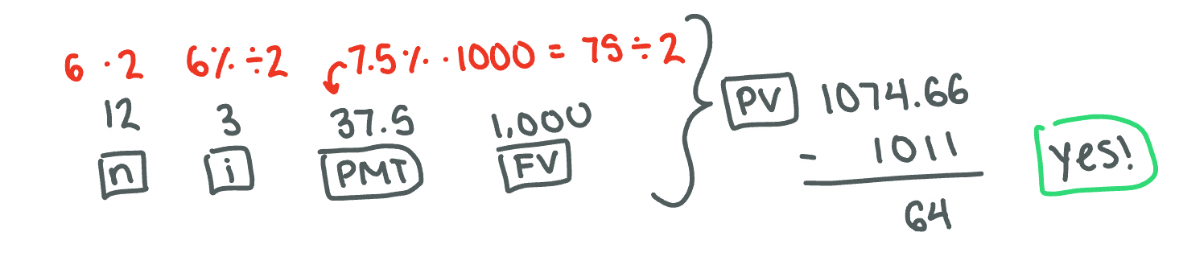

Yes, the bond is undervalued by about $64

Consider a 6-year $1,000 par bond priced at $1,011. The coupon rate is 7.5% paid semiannually. Six-year bonds with comparable credit quality have a yield to maturity (YTM) of 6%. Should an investor purchase this bond?

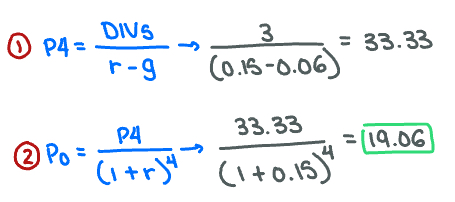

$19.06

Suppose that sales and profits of Oly Enterprises are growing at a rate of 30% per year. At the end of four years, the growth rate will drop to a steady 6%. At the end of year 5, Oly will issue its first dividend in the amount of $3 per share. If the required return is 15%, what is the value of a share of stock? Assume dividends grow at the same rate as earnings after year 4.

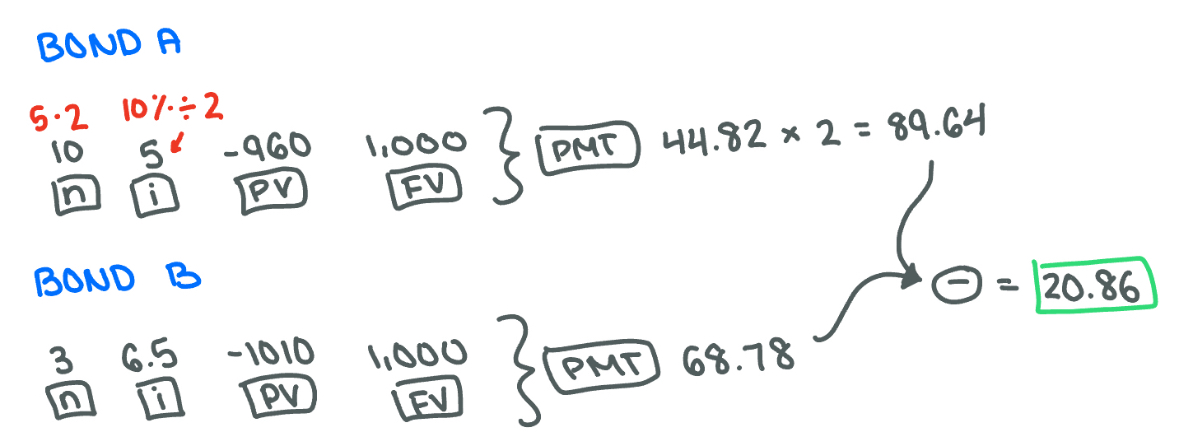

Bond A by $20.86

Bond A has a market price of $960, a yield to maturity of 10%, and a maturity of 5 years. Bond A pays coupon semi-annually. Bond B has a current price of $1010, a yield to maturity of 6.5%, and 3 years to maturity. Bond B makes coupon payments annually. Which bond has higher annual coupon payments and by how much? (please chose the closest answer).

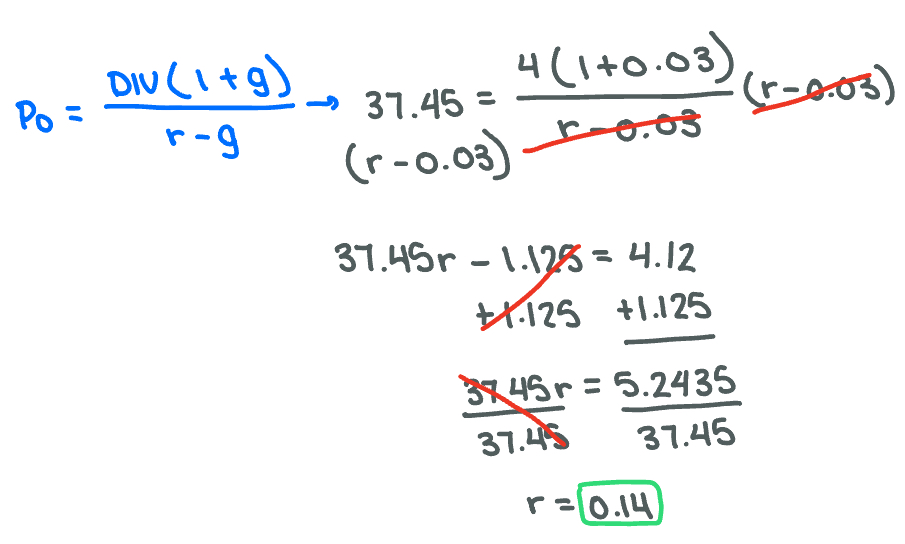

14%

A stock has a current value of $37.45 and just paid $4 in dividends, which are growing at a constant rate of 3%. Given that the ROE is 6%, what rate of return do investors require for this stock? (round to the nearest percentage)

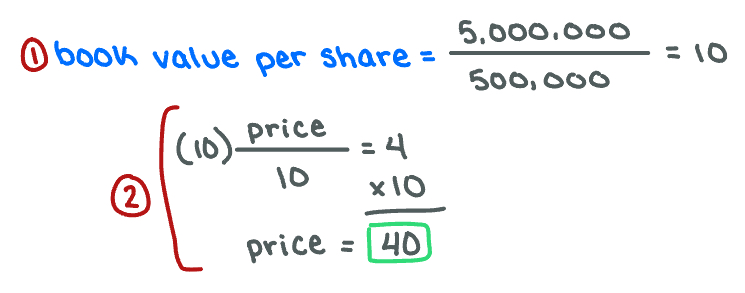

$40.00

What is the current price of a share of stock for a firm with $5 million in balance-sheet equity, 500,000 shares of stock outstanding, and a price/book value ratio of 4?

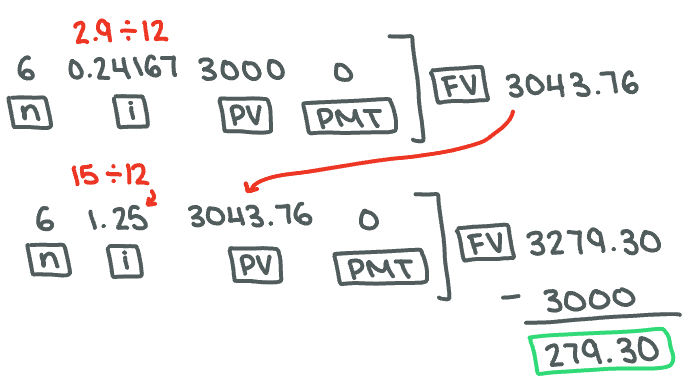

$ 279.30

You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 2.90 percent per year, compounded monthly for the first six months, increasing thereafter to 15 percent compounded monthly. Assuming you transfer the $3,000 balance from our existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? (round to the nearest cent)

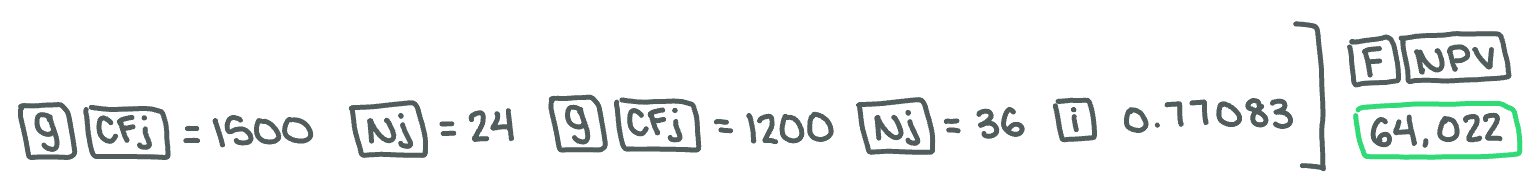

$64,022

What is the present value of $1,500 received for 24 months, followed by $1,200 received for 36 months, if the annual discount rate is 9.25%?

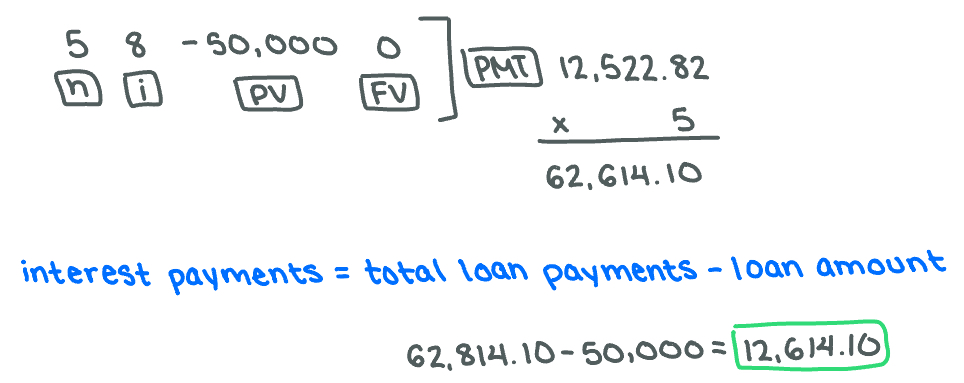

$12,614

The Corner Bar & Grill is in the process of taking a five-year loan of $50,000 at an annual interest rate of 8% with First Community Bank. The loan requires 5 equal payments at the end of each year inclusive of interest and part of the principal. Find the total interest payments over the life of the loan. (Round your answer to the nearest dollar)

$3,604.78

How much must be invested today in order to generate a 5-year annuity of $1,000 per year, with the first payment 1 year from today, at an interest rate of 12%? (Round to the nearest cent)

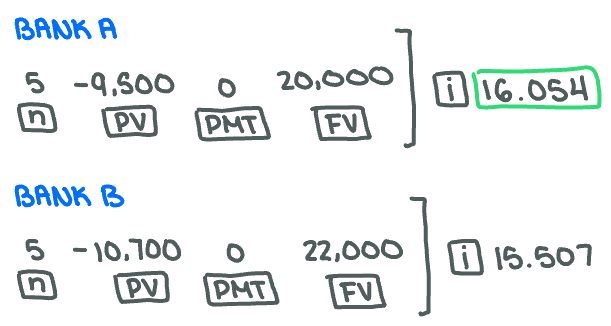

Bank A

Bank A offers to pay you a lump sum of $20,000 after 5 years if you deposit $9,500 with them today. Bank B, on the other hand, says that they will pay you a lump sum of $22,000 after 5 years if you deposit $10,700 with them today. Which offer should you accept?

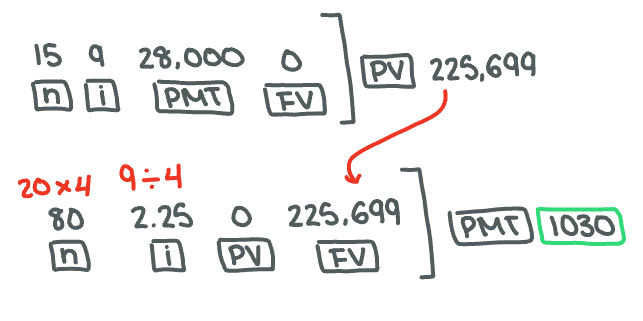

$1,030

MacAfee Company will make contributions to a pension plan for 20 years, and then payout $28,000 per year (at the end of each year) for the next 15 years. Assuming money always earns 9% per year, what quarterly contributions must be made (at the end of each quarter) for the next 20 years to meet their obligation?

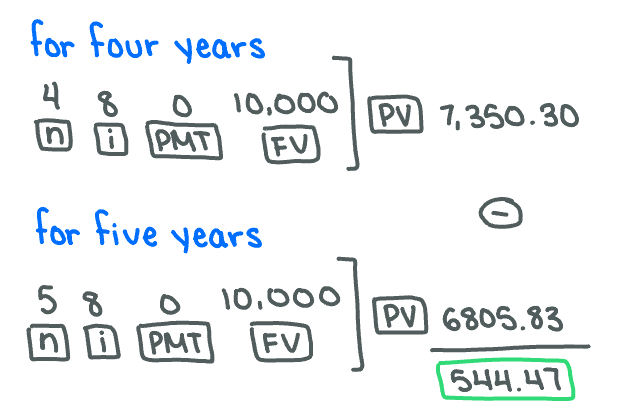

$544.47

How much more would you be willing to pay today for an investment offering $10,000 in 4 years rather than the normally advertised 5-year period? Your discount rate is 8%. (Round to the nearest cent).

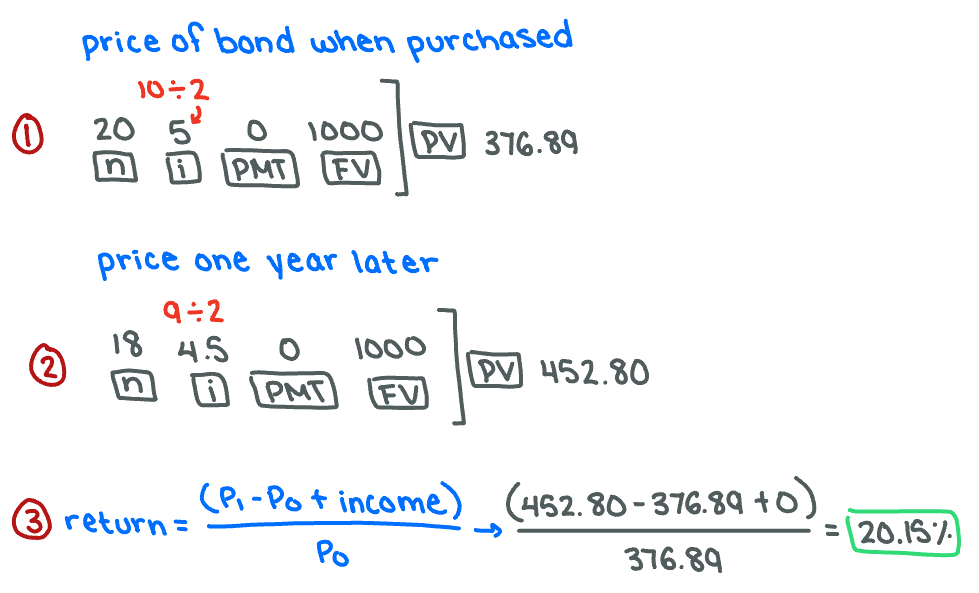

20.15%

An investor purchased a 10-year zero-coupon bond with a yield to maturity of 10% and a par value of $1,000. What would her rate of return be at the end of the year if she sells the bond? Assume the yield to maturity on the bond is 9% at the time it is sold and semi-annual compounding periods are used.

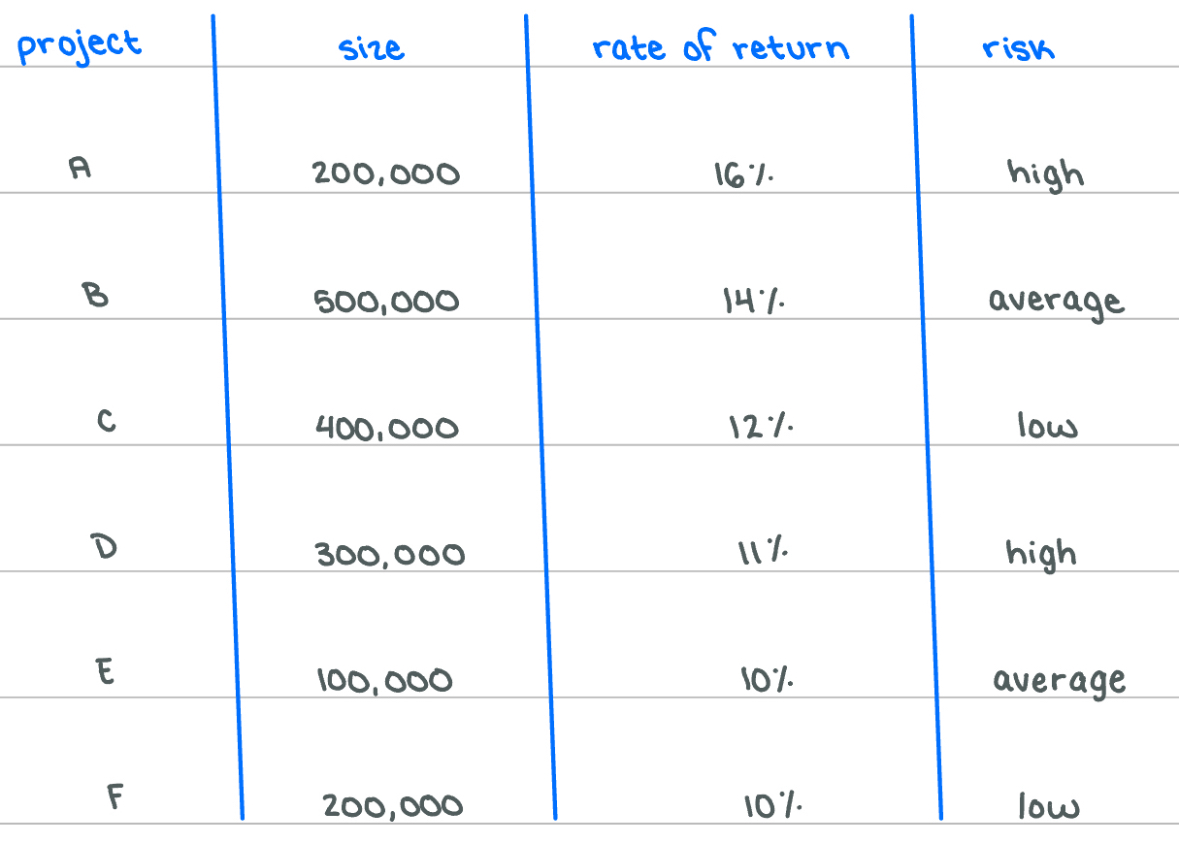

A, B, C, F

The managers of Kenforest Grocers are trying to determine the company's optimal capital budget for the upcoming year. Kenforest is considering the following projects…

The company estimates that its WACC is 11 percent. All projects are independent. The company adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low-risk projects. Which of the projects will the company accept?

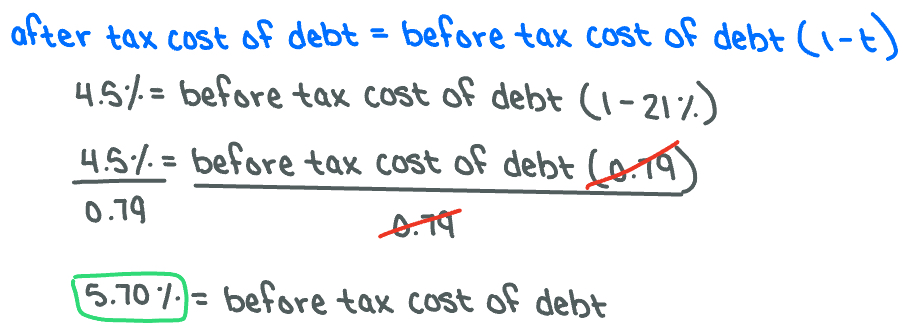

5.70%

Lewis, Schultz, and Nobel Development Corp. has an after-tax cost of debt of 4.5%. With a tax rate of 21%, what is the yield to maturity on the debt? (Round your answer to the nearest hundredth percentage).

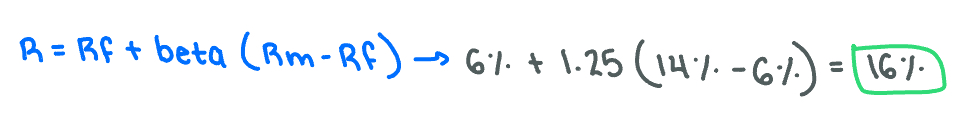

16.0%

What rate of return should an investor expect for a stock that has a beta of 1.25 when the market is expected to yield 14% and Treasury bills offer 6%?

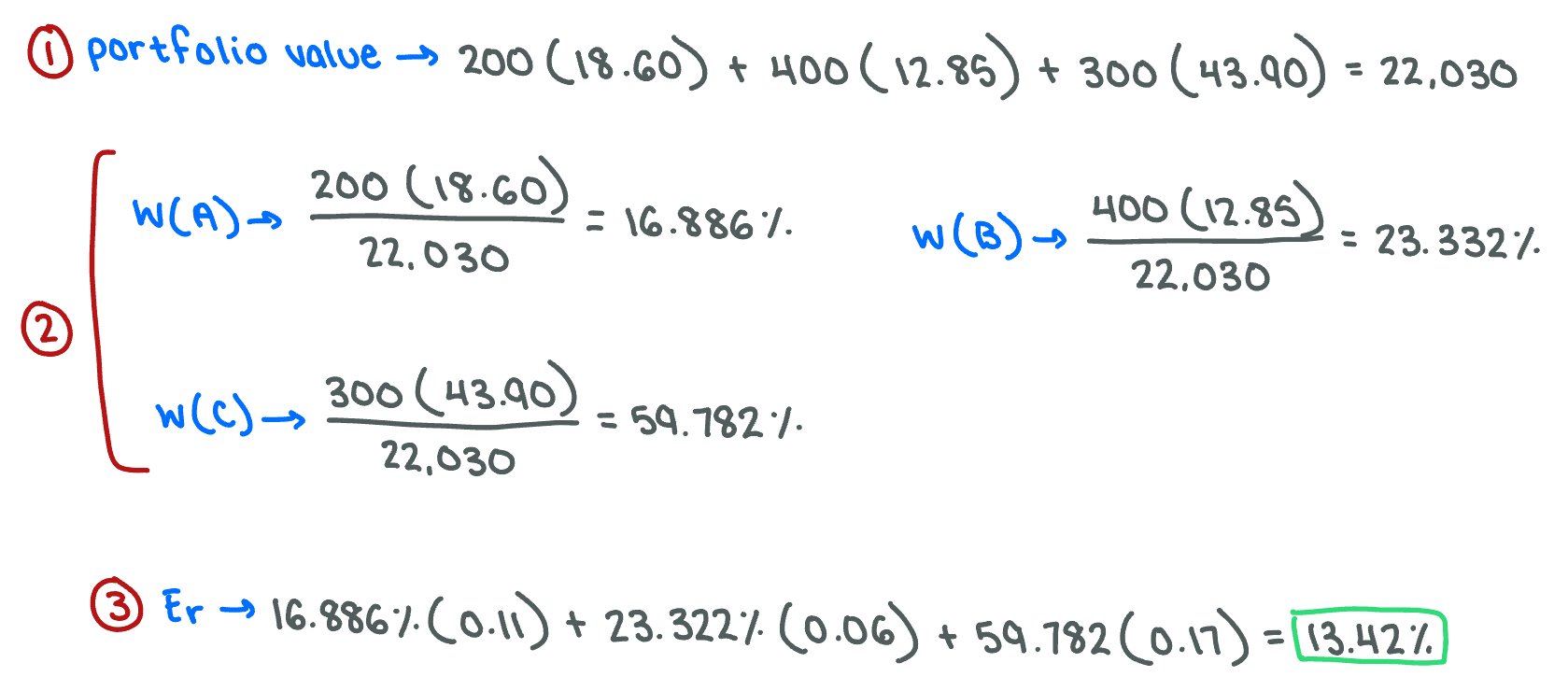

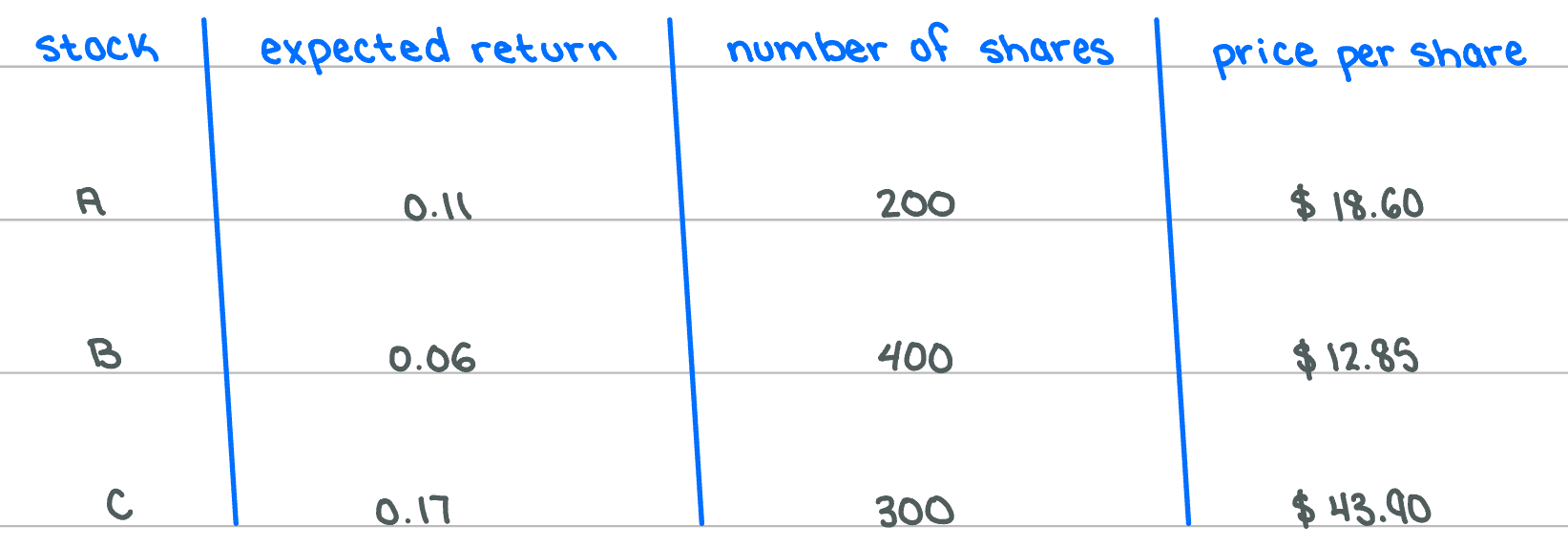

13.42%

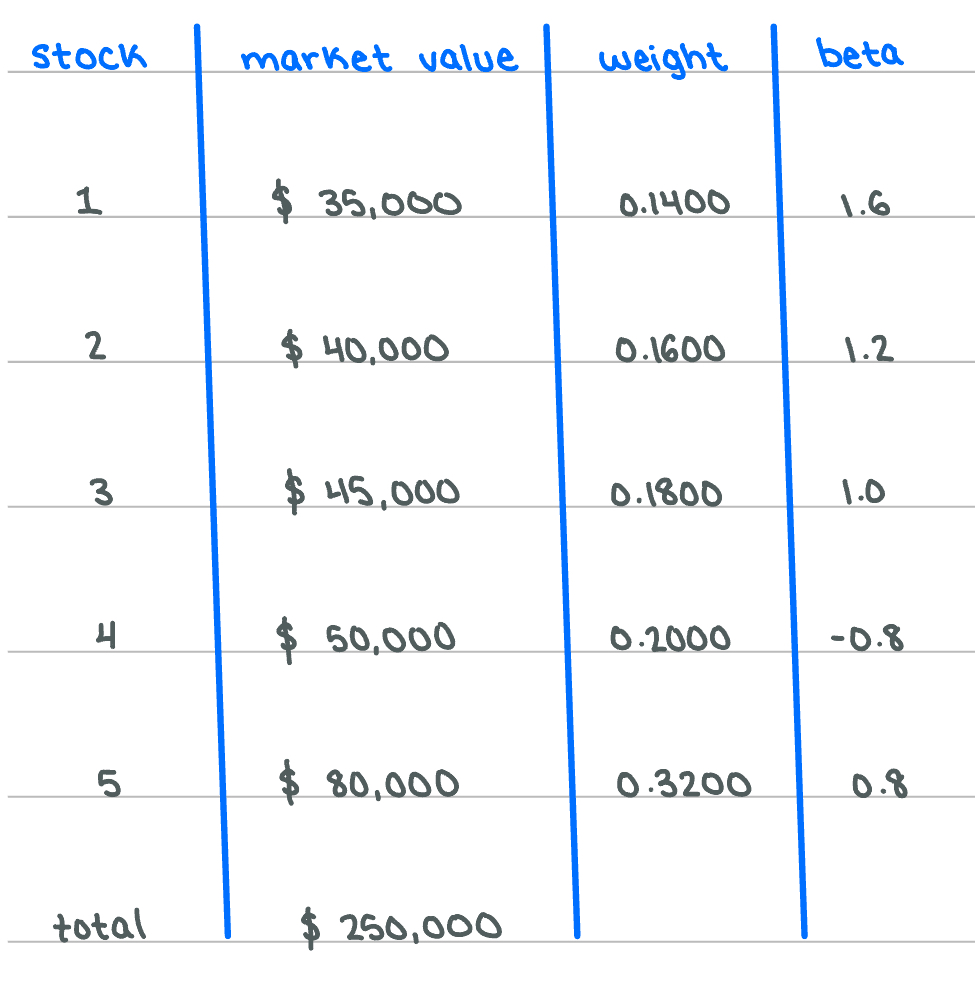

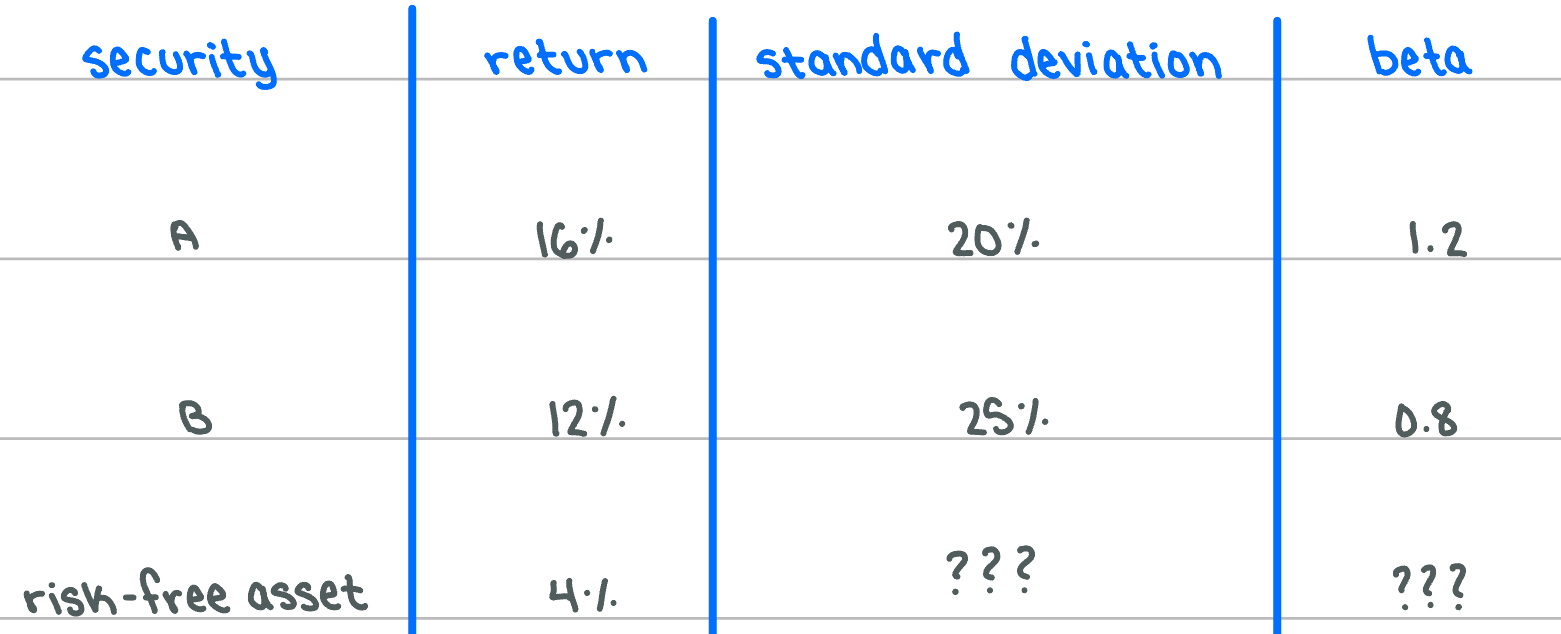

What is the expected return on this portfolio? (Choose the closest answer)

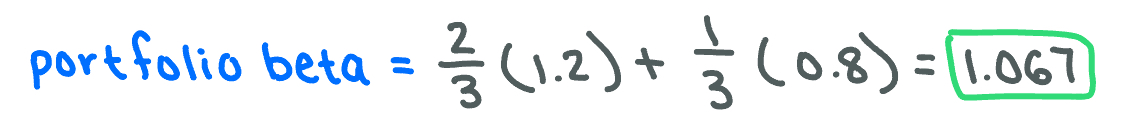

1.067

What is the value of systematic risk (as measured by beta) for a portfolio with 2/3 of the funds invested in A and 1/3 of the funds invested in B?

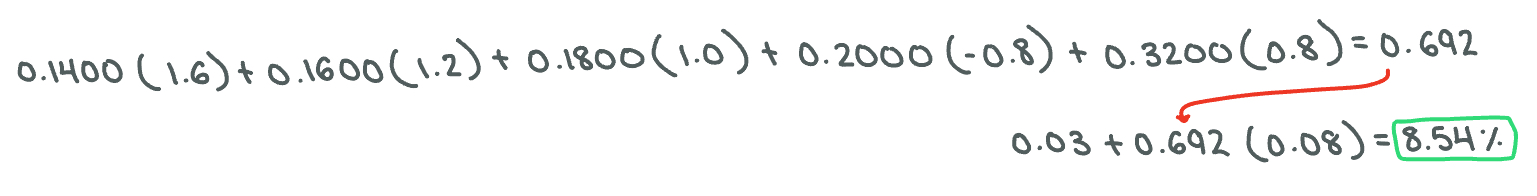

8.54%

Annie would like to know her portfolio's expected rate of return based on CAPM. After doing some research she figures out the market values and betas of each of her 5 stocks (see the table below) and is told by her consultant that the risk-free rate is 3% and the market risk premium is 8%. What is the expected rate of return of Annie's portfolio?