Micro Economics Edexcel A level

1/138

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

139 Terms

What are the four assumptions of micro economics?

Rational Consumers, perfectly competitive market, average consumer, ceteris paribus

What is a positive statement?

a statement that can be tested and validated

What is a normative statement?

an opinion, a value judgement

What is the economic problem?

Resources are scarce, however wants are unlimited. There are finite resources so goods/services need to be allocated efficiently.

What is opportunity cost?

Cost of the next best alternative foregone

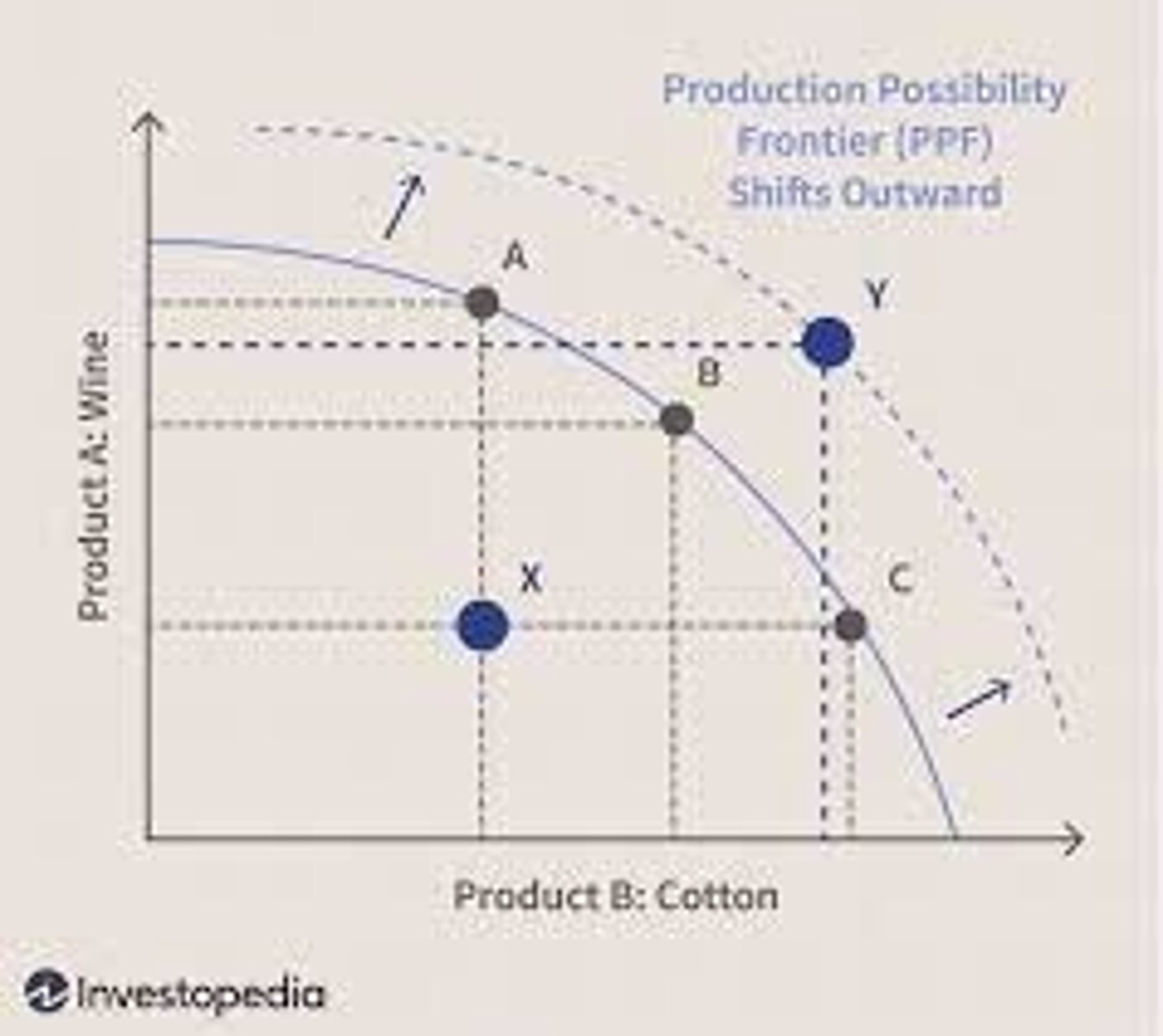

What is the PPF?

production possibilities frontier is a graph showing the combinations of output that the economy can possibly produce given the current production and technology

What do points x, b and y show?

X - underutilisation - at this point the opportunity cost is zero as you can increase one good without decreasing the other.

B - Efficient

C - unattainable

Difference between capital and consumer goods?

Capital goods are used to make consumer goods, consumer goods are goods to meet needs and wants when consumed

What are the economic agents?

Producers - decide what to make and how much they are willing to sell for

Consumers - decide what they want to buy and how much they are willing to sell for

Governments - decide how much to intervene in the way producers and consumers act

What is specialisation?

when a country decides to focus on making a particular good/service

What is division of labour?

production process of a good which is broken down in various small tasks

What are the advantages and disadvantages of specialisation and division of labour?

Advantages

- Greater output - focus on one means they will become better

- Less wastage - less mistakes more efficient

- Lower unit costs - EOS gained cause unit costs to decrease

- Greater variety - more countries producing different goods

Disadvantages

- Boredom - same thing every day

- Structural unemployment - people wont have skills to find other jobs

- Over-reliance - on trading partners

What are the functions of money?

medium of exchange, unit of account, store of value, deferred payment

What is a free market economy?

Economic system based on supply and demand

What is a command economy?

An economic system in which the government makes decisions to allocate resources

What is a mixed economy?

a combination of a free market and command economy

Advantages and disadvantages of free market economy

+ Choice - if enough demand firms will produce

+ Competition - Free market economies allow firms to compete against each other. This entails many benefits, the main two being lower prices and greater quality.

+ Efficiencies - efficiency gains which high levels of competition can result in

- Profit maximisation - consumers may have to pay high prices and suffer from low quality goods

- Missing markets - no provision of public goods

- Monopolies - lack of competition

Advantages and disadvantages of command economy

+ More equal society – state allocates in society’s best interest, maximising social welfare rather than businesses which aim to maximise profit.

+ Provision of public goods

+ Prevention of monopolies - state allocates resources so less risk of monopolies

- Inefficient allocation of resources

- Lack of innovation

- Lack of information

Define Demand

Demand refers to the amount of consumers that are willing and able to buy a certain good at a given price in a given period of time

What are factors that cause a shift in demand?

PIRATES

P- Population. The larger the population, the higher the demand.

I- Income. If consumers have more disposable income, they are able to afford more goods, so demand increases.

R- Related goods. Related goods are substitutes or complements. A substitute can replace another good

A- Advertising. This will increase consumer loyalty to the good and increase demand.

T- Tastes and fashions. The demand curve will also shift if consumer tastes change.

E- Expectations. This is of future price changes.

S- Seasons. Demand changes according to the season.

Why is the demand curve downward sloping?

The law of diminishing marginal utility-as more of a product is consumed, the marginal benefit to the consumer falls, hence the consumer is prepared to pay less

The income effect-As prices rise, the amount of disposable income falls

The substitution effect-As prices rise, consumers will start to evaluate alternatives

What is quantity demanded?

the quantity of a good that people are willing to buy at a particular price at a given time

What is the law of demand?

there is an inverse relationship between price and quantity demanded

Define PED, XED and YED

Price elasticity of demand - responsiveness of quantity demanded to a change in price

Income elasticity of demand - responsiveness of quantity demanded to a change in income

Cross elasticity of demand - responsiveness of quantity demanded for good A to the change in the price of good B

What is the PED, XED, YED formula?

%change in Q / %change in price/income/good B

What are the values of PED?

ped > 1 then price elastic

ped < 1 price inelastic

ped = 1 unitary elastic

ped = 0 perfectly inelastic

ped is infinity then perfectly elastic

What are the factors affected in PED?

DANSPP

1) Necessity: A necessary good, such as bread or electricity, will have a relatively inelastic demand.

2) Substitutes: If the good has several substitutes, such as Android phones instead of iPhones, then the demand is more price elastic.

3) Addictiveness or habitual consumption: The demand for goods such as cigarettes is not sensitive to a change in price because consumers become addicted to them

4) Proportion of income spent on the good: If the good only takes up a small proportion of income, such as a magazine which increases in price from £1.50 to £2, demand is likely to be relatively price inelastic.

5) Durability of the good: A good which lasts a long time, such a washing machine, has a more elastic demand because consumers wait to buy another one.

6) Peak and off-peak demand: During peak times, such as 9am and 5pm for trains, the demand for tickets is more price inelastic.

What are the values of YED?

if

YED < 0 inferior good - demand decreases when income increases

YED > 0 normal good - demand increases as income increases

YED > 1 luxury good - increase in income causes bigger increase in demand

What are the values of XED?

XED < 0 complements - if ones expensive both fall in demand

XED > 0 substitutes - can replace goods so increase in demand

XED = 0 unrelated goods

What is the importance of PES, PED, YED and XED?

PES - can help know level of stock

PED - government can use for externalities and firms can use for general use

YED - depending on recession or general income of country

XED - if a substitute has an impact on my good or complements have an impact

Define supply

Supply is the goods and services that firms are willing and able to provide to customers at given time period.

Factors that can shift supply

PINTSWC

P- Productivity. Higher productivity causes an outward shift in supply, because average costs for the firm fall. o I- Indirect taxes. Inward shift in supply.

N- Number of firms. The more firms there are, the larger the supply.

T- Technology. More advanced the technology causes an outward shift in supply.

S- Subsidies. Subsidies cause an outward shift in supply.

W- Weather. This is particularly for agricultural produce. Favourable conditions will increase supply.

C- Costs of production. If costs of production fall, the firm can afford to supply more. If costs rise, such as with higher wages, there will be an inward shift in supply

Define PES

responsiveness of quantity supplied to a change in price

Factors affecting PES

TSBLH

1)Time scale: In the short run, supply is more price inelastic, because producers cannot quickly increase supply. In the long run, supply becomes more price elastic.

2) Spare capacity: If the firm is operating at full capacity, there is no space left to increase supply. If there are spare resources, for example in a recession there are lots of spare and unemployed resources, supply can be increased quickly.

3) Level of stocks: If goods can be stored, such as CDs, firms can stock them and increase market supply easily. If the goods are perishable, such as apples, firms cannot stock them for long so supply is more inelastic. 4) How substitutable factors are: If labour and capital are mobile, supply is more price elastic because resources can be allocated to where extra supply is needed. For example, if workers have transferable skills, they can be reallocated to produce a different good and increase the supply of it.

5) Barriers to entry to the market: Higher barriers to entry means supply is more price inelastic, because it is difficult for new firms to enter and supply the market.

Values of PES

PES > 1 - elastic

PES < 1 - inelastic

PES = 0 supply fixed

PES infinity - Supply is perfectly elastic

Define Equilibrium price and quantity

The equilibrium price is determined by the forces of supply and demand.

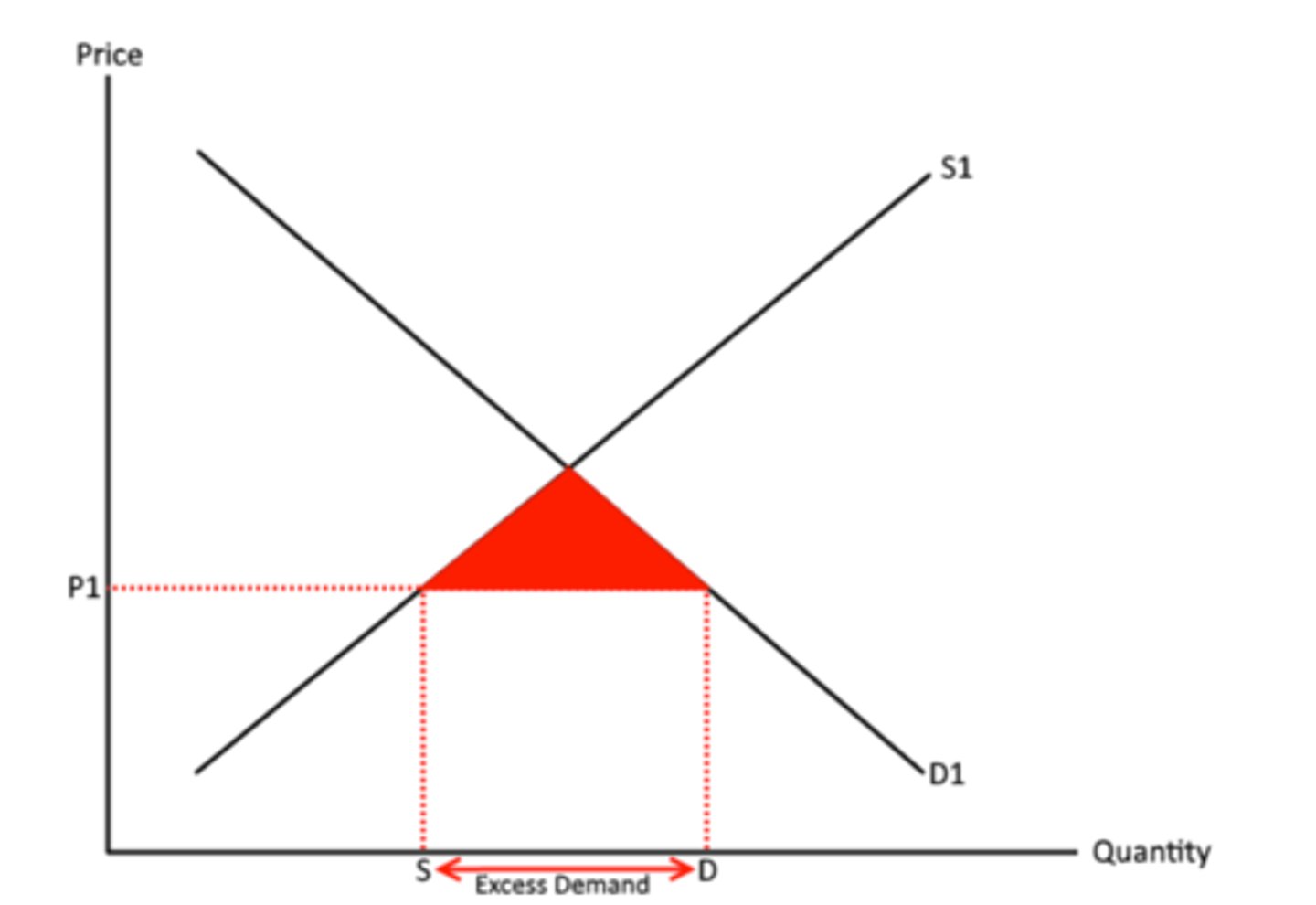

Draw Excess demand, and what does this mean to firms

If there is excess demand, market forces will result in an extension in supply and a contraction in demand. This is because firms will spot this excess demand and recognise that they will have to increase prices in order to ration demand. This means there can be market equilibrium.

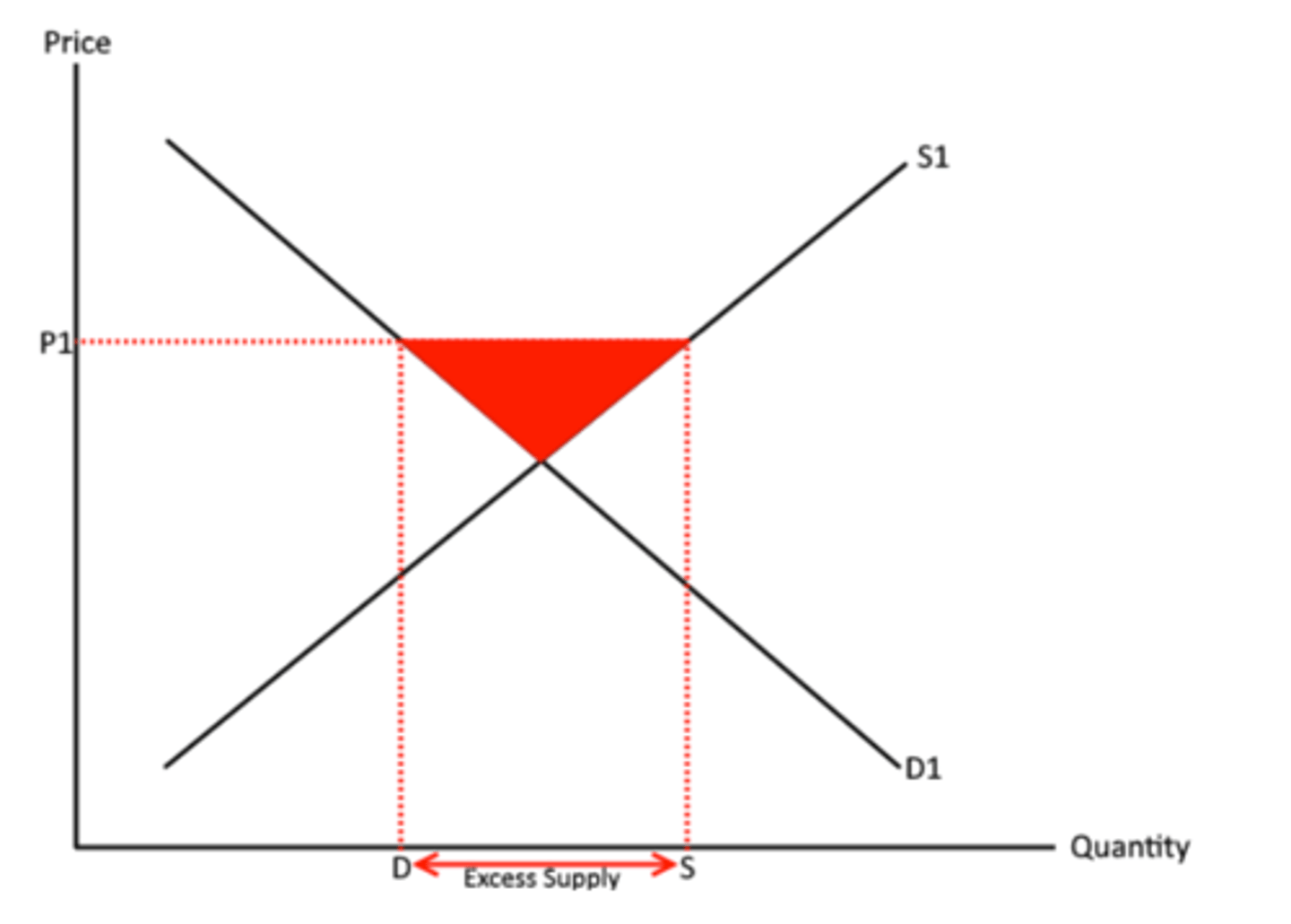

Draw excess supply, and what does this mean to firms

If there is excess supply, market forces will result in a contraction in supply and an extension in demand, causing a fall in price to its market clearing level. This shortage in demand will result in a decrease in the price of the good as firms will realise that they have to lower their prices if they are to sell all their goods.

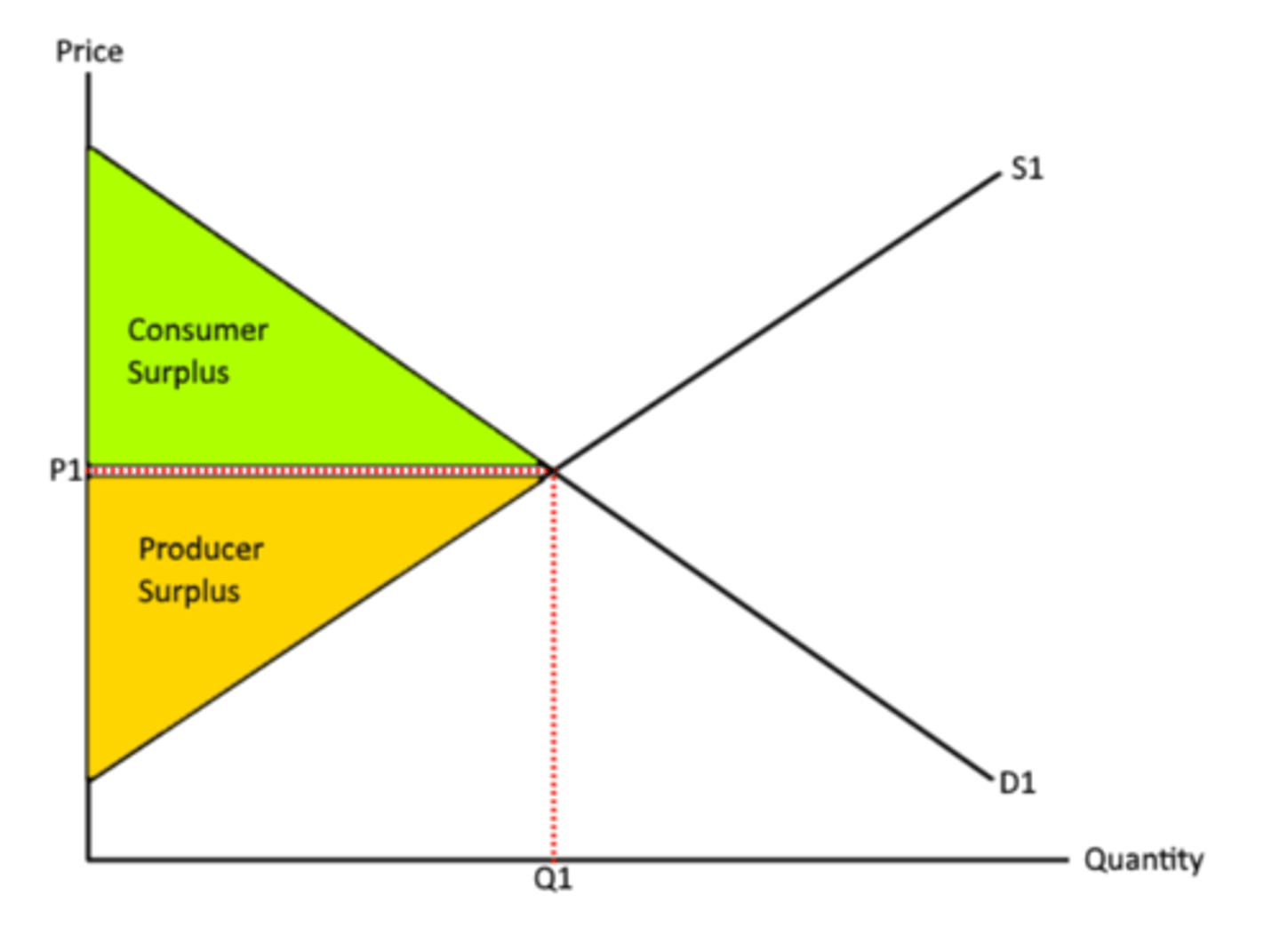

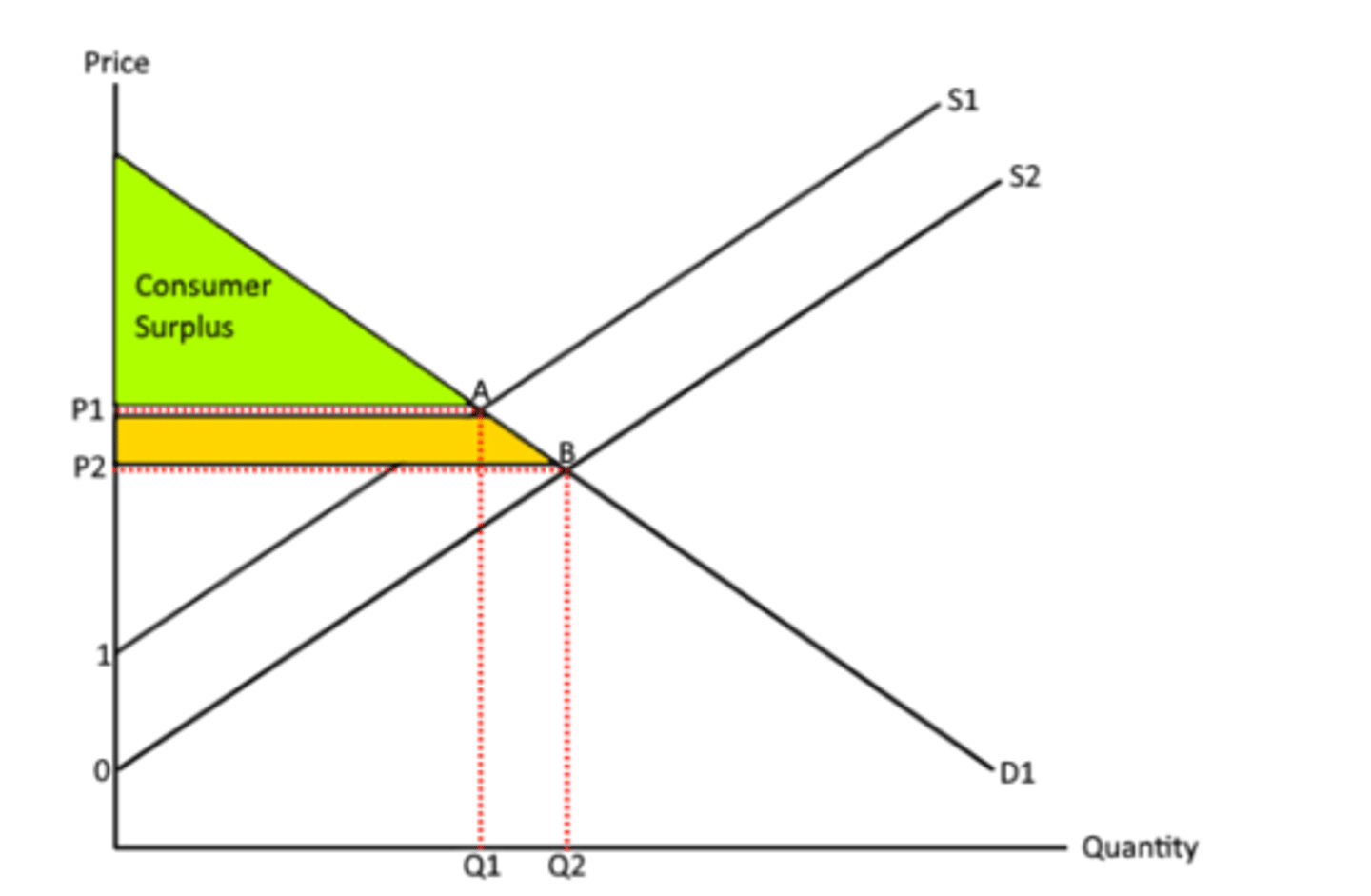

Define consumer surplus

the difference between what the consumers are willing and able to pay for a good/service and what they're actually paying for the good/service.

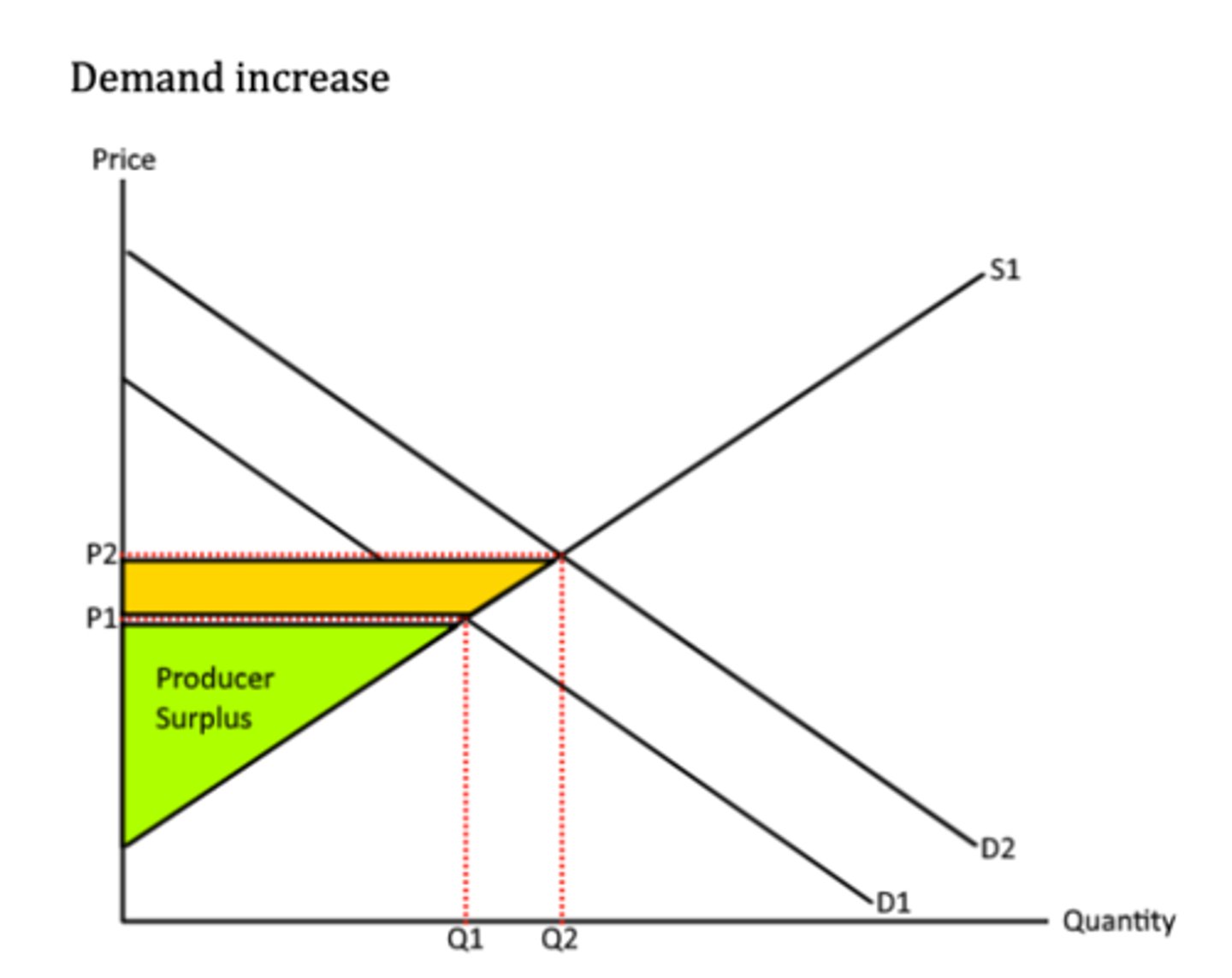

Define producer surplus

the difference between what the producers are willing and able to sell a good/service for and what they're actually paying for the good/service.

Draw consumer surplus and producer surplus when market is in equilibrium

draw - check notes

Draw consumer surplus and producer surplus when supply shifts left/right

draw

Draw consumer surplus and producer surplus when demand shifts left/right

draw

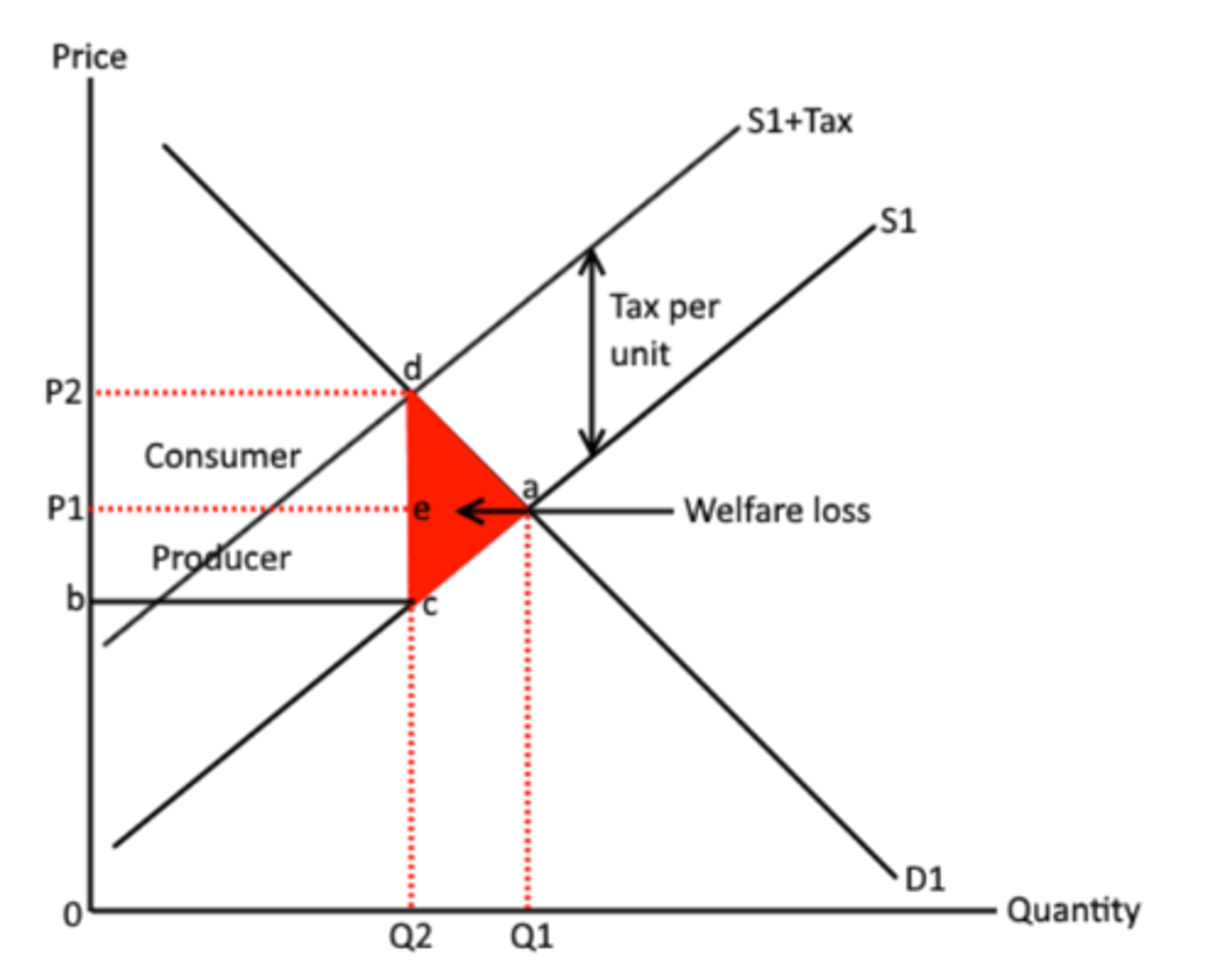

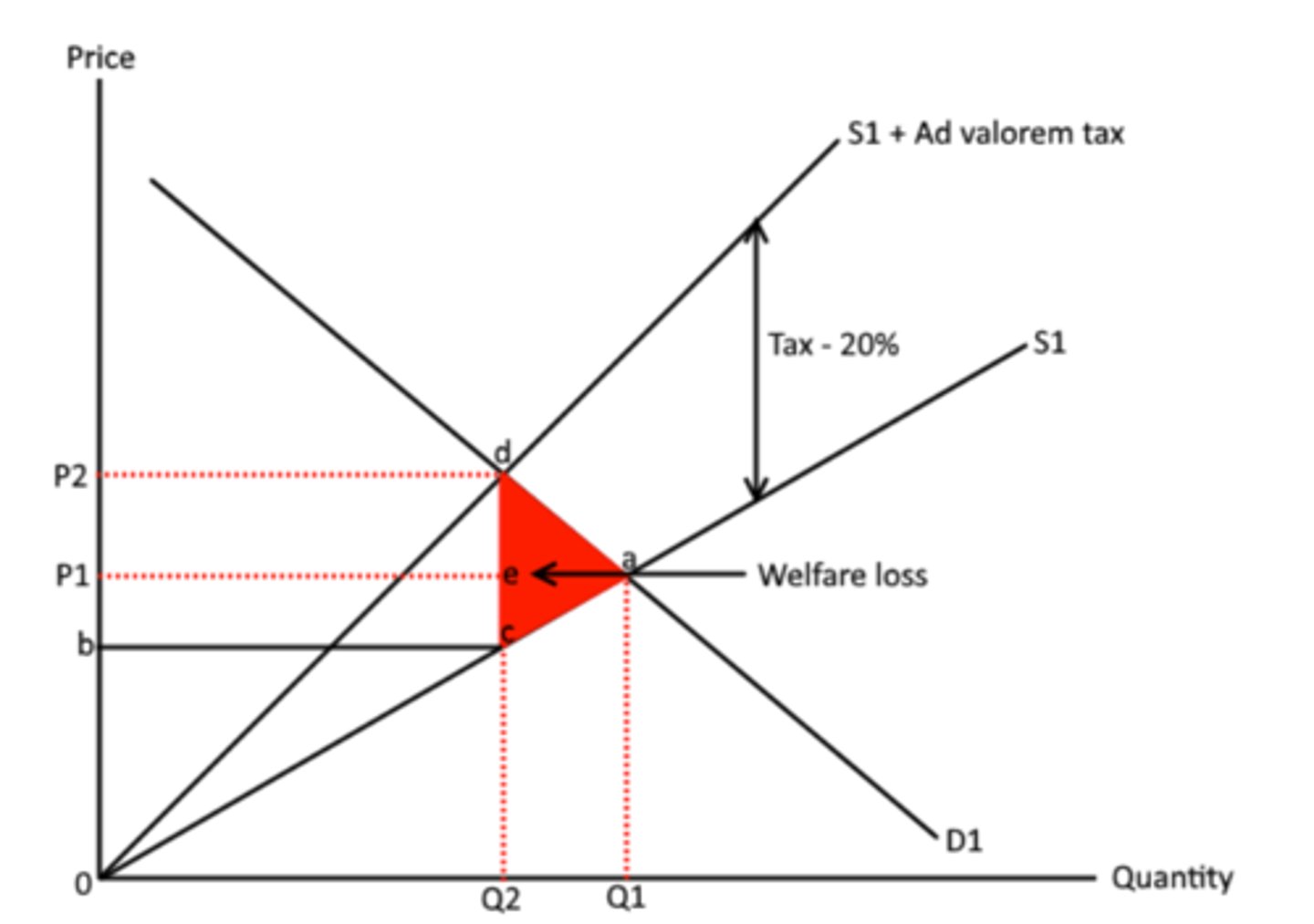

Define the two indirect taxes

Ad valorem - percentage tax e.g. vat

specific - fixed amount of tax e.g. road tax

Draw ad valorem and specific tax

always 2 to 1 and consumer is above

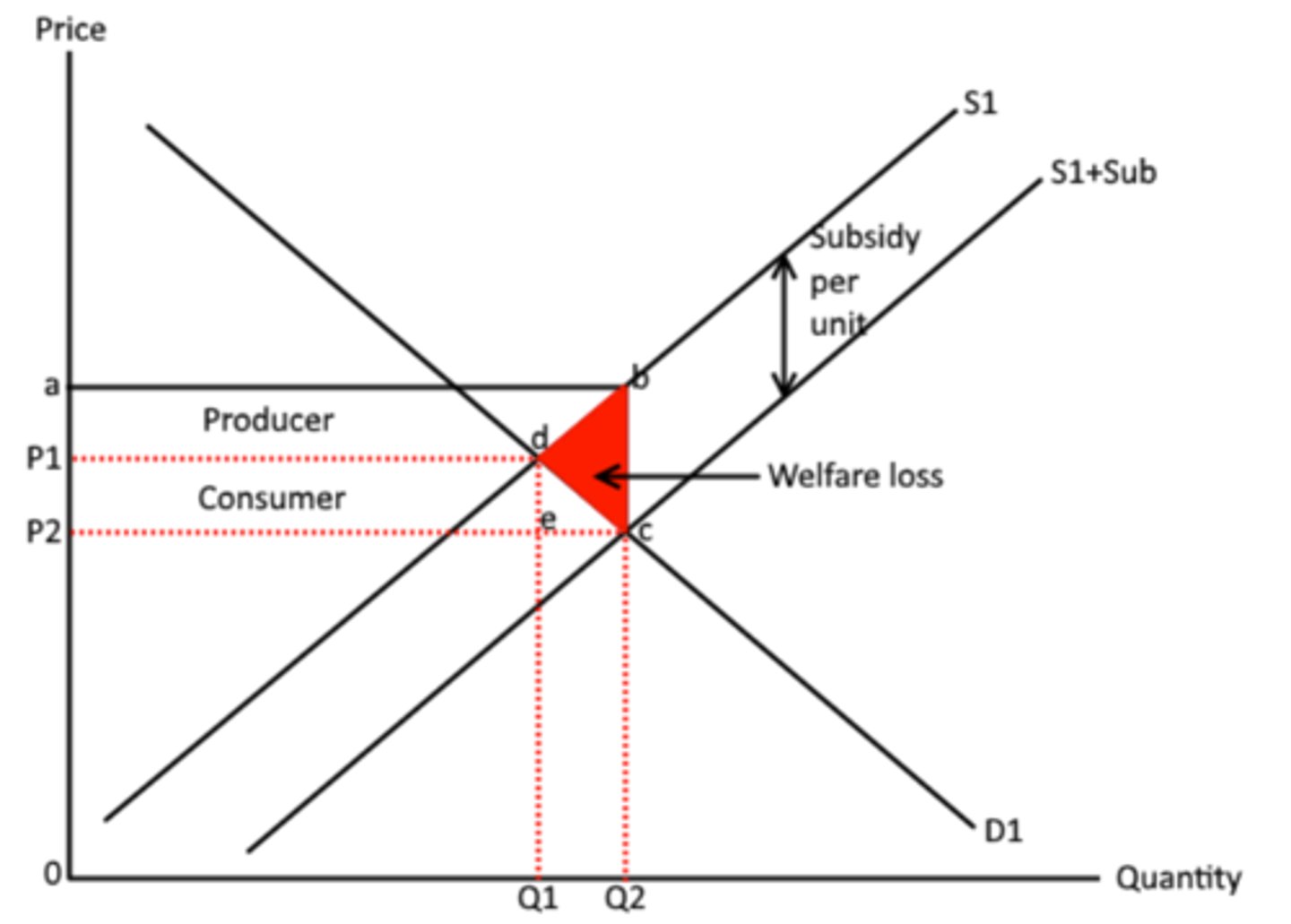

Define subsidy

A subsidy is a certain amount of money given to a firm by the government in order to try and increase production or consumption of a good/service.

Draw subsidy graph

always 2 to 1 and producer is above

Define market failure

Market failure occurs when the free market fails to allocate resources at the socially optimum level, leading to inefficient outcomes and therefore a net welfare loss to society.

Types of market failure

- Externalities

- Overconsumption

- Underconsumption

- Overproduction

- Underproduction

- Under provision of public goods

- Asymmetric information

Define externality

the effect on the third party who were not involved directly in the economic transaction

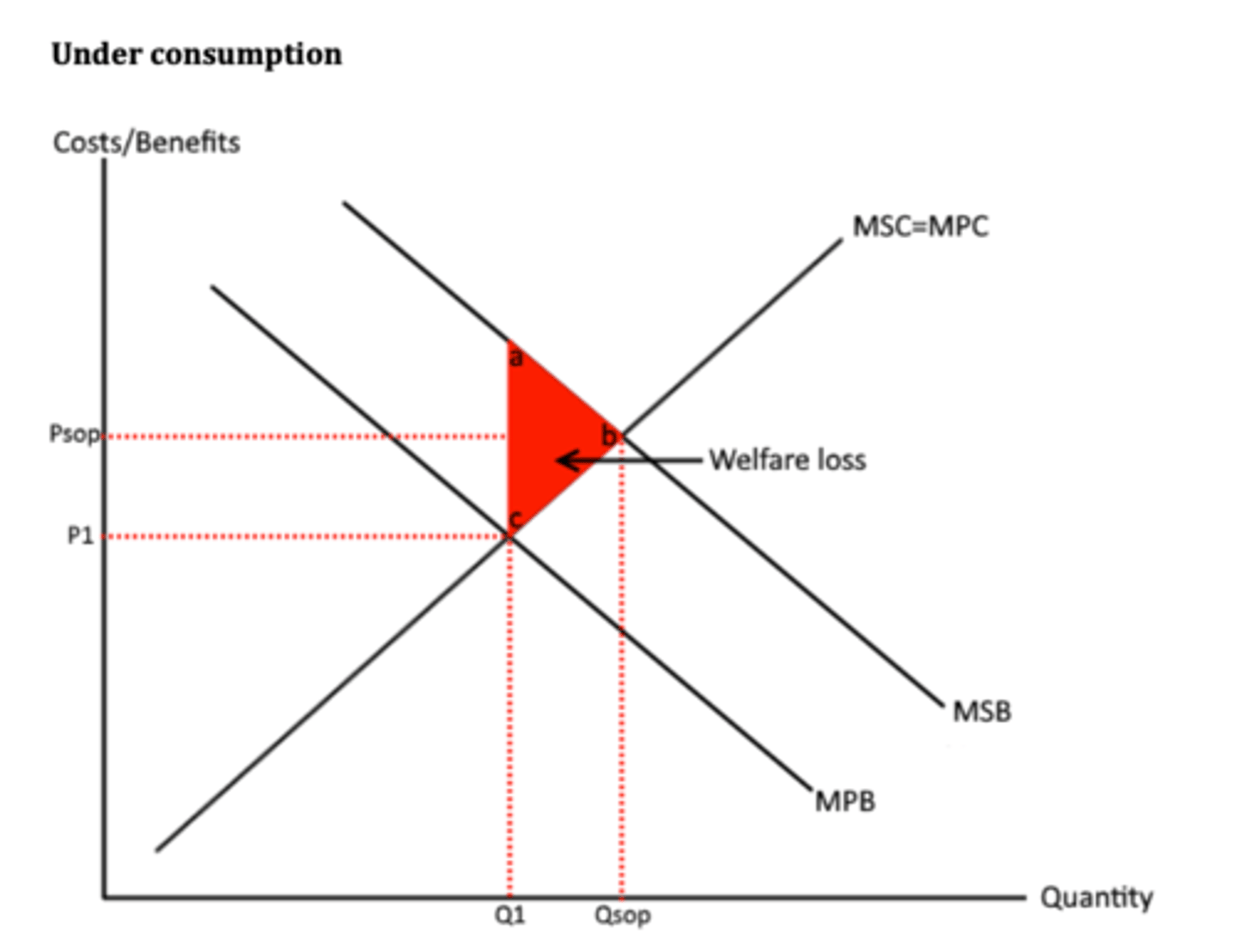

Draw Externality diagrams, for overproduction and underconsumption

always 1 to 2 for welfare loss

Define MPB, MPC, MSC, MSB

Private benefits - The benefit received from those involved directly in the economic transaction

Social benefits - The benefit to society as a result of the economic transaction made. Social benefits = private benefits + external benefits.

Costs are just opposite

What are the characteristics of a public good?

non-excludable and non-rival in consumption

- consumption of good does not reduce the amount of benefit derived from that good/service to other people

- benefit derived from good/service is unable to be excluded from certain individuals

What is asymmetric information?

Asymmetric information occurs when the consumer and producer have different levels of information available to them. The best example of this is in the insurance market

How does a lack of information lead to a misallocation of resources?

A lack of information can often lead to irrational decisions being made by both consumers and producers. This can be linked into the topic of externalities. For example, consumers often make irrational decisions such as the consuming cigarettes due to a lack of information.

Define government intervention

Government intervention occurs when the government interferes with decision making by firms and individuals through regulatory action in an attempt to overcome market failure.

What are the types of government intervention?

Taxation, Subsidies, Maximum and minimum prices, price regulation, privatisation, regulation and deregulation

How does the government use taxation to fix market failure? Draw diagrams. State advantages and disadvantages.

Indirect taxes can be passed onto consumers therefore can be an effective policy when trying to reduce consumption through higher prices. Allows the government to deal with negative externalities.

Advantages - cost of negative externalities are internalised in the price of good, this will reduce demand.

If demand is not reduced, there is still benefit that the revenue gained from the tax can be used to offset the externalities.

Disadvantages - where demand is price inelastic, the demand is not reduced by the extra cost of the tax

Firms may choose to relocate and sell their goods abroad to avoid taxation.

How does the government use subsidies to fix market failure? Draw diagram. State advantages and disadvantages.

Market failure is also caused by through the under consumption and underproduction of merit goods. In order to fix this market failure, government can intervene in the market and implement a subsidy.

Advantages - benefit of goods with positive externalities is internalised. So the price of the goods is reduced from what it would be in the absence of the subsidy.

- Subsidies create positive externalities, e.g. subsidy to wind farms will reduce pollution levels

- Subsides can also help support a domestic industry until is gets to the point where is can exploit EOS and become internationally competitive.

Disadvantages - subsidies have an opportunity cost, the money spend on it might be better spent on something else.

- Subsidies can make producers inefficient and reliant on subsidies

- The effectiveness of a subsidy depends on the elasticity of demand

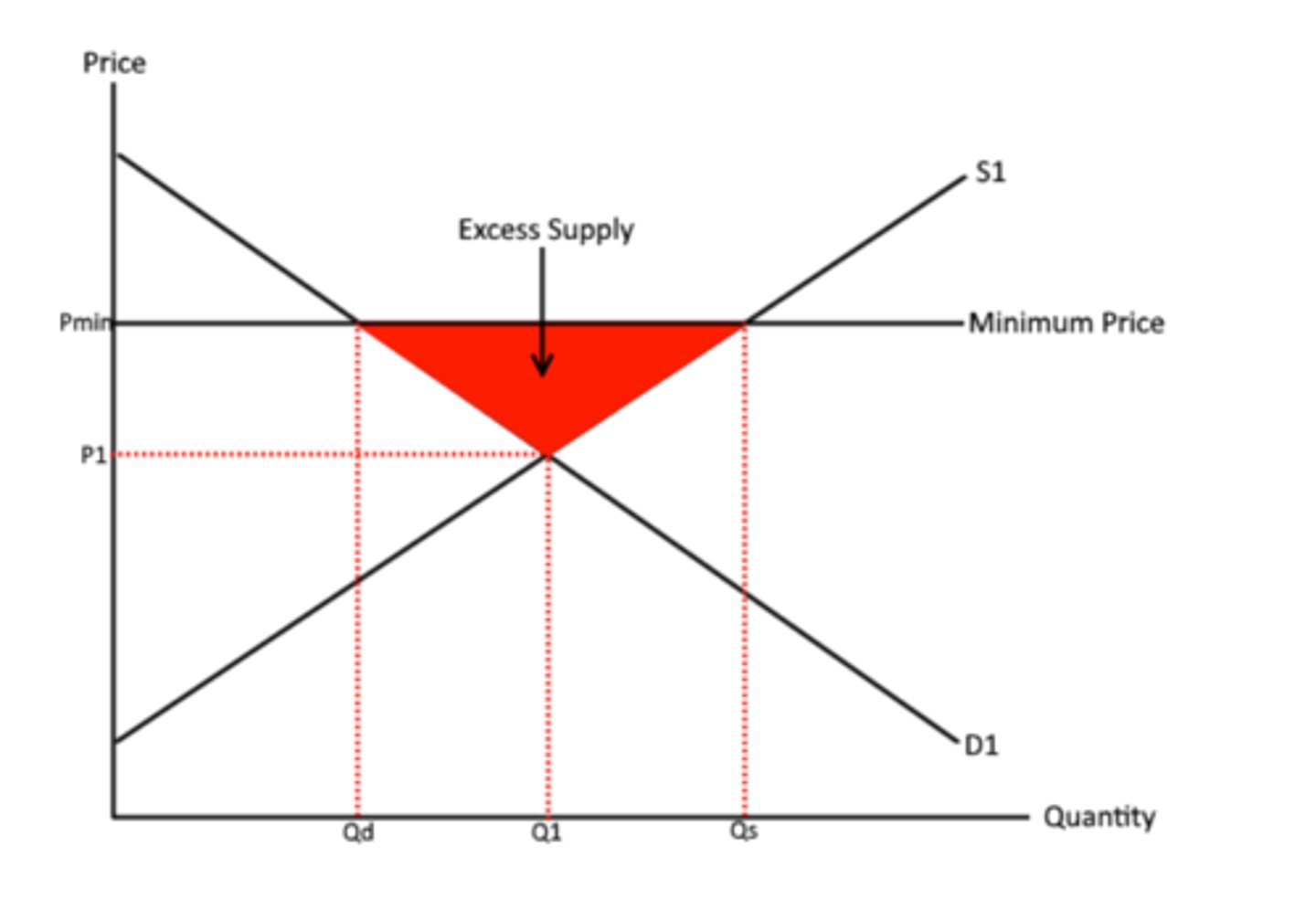

How does the government use price controls to fix market failure? Draw diagram. State advantages and disadvantages.

Maximum prices are set in order to try and increase the consumption of a good/service that is being under consumed. Minimum prices can be set to reduce the consumption of a good/service which causes negative externalities. The minimum price reduces the demand for the good/service as consumers now have to pay a higher price.

Maximum advantages and disadvantages

+ Max prices help increase fairness, by allowing more people to buy the g/s

+ Can be used to prevent monopolies from exploiting consumers

- Demand is high, so excess demand can lead to creation of black market for the good

Minimum advantages and disadvantages

+ Produces guaranteed minimum income, encourages investment

+Stockpiles can be used when supply is reduced

- Consumers are paying a higher price

- goods may have to be destroyed which is a waste of resources

- resources used to produce excess supply could be used elsewhere, inefficient allocation of resources

How does the government use price regulation to fix market failure? State advantages and disadvantages.

The government (CMA) may use regulation to prevent a firm from getting monopoly power. They do this by introducing price caps.

- One price cap is RPI-X. the X represents a certain percentage, and the government uses this to restrict price increases by a lower percentage that of the RPI.

Advantages - Implementing this encourages firms to be efficient, so the firm will still make a substantial profit.

Disadvantages - If firms cannot make normal profit within the RPI then the firm may have to leave the market.

How does the government use privatisation to fix market failure? State advantages and disadvantages.

Publicly owned firms tend to be inefficient because they lack competition and this can cause market failure. Privatisation is the transfer of ownership of a firm from the public sector to the private sector

Advantages - Increased competition improves efficiency and reduces x-inefficiency.

Improves resource allocation as firms react to market signals

Government gains revenue from selling firms

Disadvantages - a public monopoly becomes a private monopoly

Privatised firms have less focus on safety and quality as they have more focus on reducing costs and increasing profits

How does the government use deregulation to fix market failure? State advantages and disadvantages.

Deregulation means removing or reducing regulations.

Advantages - improves resources allocation, markets become more contestable so prices fall

Can be used alongside privatisation of a public monopoly to prevent firm from becoming a private monopoly

Improves efficiency by reducing amount of red tape

Disadvantages - difficult to deregulate some natural monopolies, e.g. water industry

Deregulation cannot fix other market failures such as negative externalities, consumer inertia

Means less safety and protection for consumers

How does the government use regulation to fix market failure? State advantages and disadvantages.

Regulations are rules enforced by and authority and are used to control activities of producers and consumers to try change their behaviour. Can be used to reduce demerit goods and services, used to reduce power of monopolies.

Advantages - increases costs of production, this causes supply to decrease.

Disadvantages - regulatory capture, when people are appointed, they may have worked in the industry previously and the firms may be able to break the rules of regulation

Define government failure

inefficient allocation of resources caused by government intervention in the economy

What are the causes of government failure?

-Distortion of price signals

-unintended consequences

-excessive administrative costs

-information gaps

How does distortion of price signals lead to government failure?

This can occur when the government gives out subsidies to firms. Information gaps can often lead to the government giving out subsidies to firms that are inefficient. This causes firms to become reliant on government subsidies rather than trying to cut down waste in order to become more competitive in the market. If it was left to the free market, inefficient firms wouldn't survive in the market.

How does unintended consequences lead to government failure?

Another example can often be seen when setting levels of regulation. The aim of this is too reduce the negative externalities that occur through overproduction. However, governments can often set regulation levels too high. This can cause a massive increase in the costs of production for firms.

How does excessive administrative costs lead to government failure?

A good example of this is when the government intervenes in a market where there is excessive pollution, implementing a trade pollution permit scheme. The cost of policing the pollution levels of firms involved can be extremely high. Therefore, in order for the intervention to be successful, the benefits have to be even higher than this.

How does information gaps lead to government failure?

Governments can often intervene in markets without having a perfect level of information about that market. Just like firms and consumers can have information gaps, so can the government. This leads them to making irrational decisions. For example, when implementing regulations to fix a market failure, if the government does not have perfect information then they are more likely to set regulations at a level different from the socially optimal level. Either too much regulation can be set, forcing firms out of the market, or too little regulation can be set, having minimal impact and therefore not solving the market failure.

Why do firms grow?

- Profits - As businesses grow they are able to generate more sales revenue and therefore have a greater chance of achieving high levels profit. This can then be reinvested back into the business in order to expand further.

- Economies of scale - There are certain benefits that only large businesses are able to experience. For example, when borrowing money from a bank, the amount of money that large businesses want to borrow is much greater than that of smaller firms. As a result of this, banks will offer larger businesses a lower rate of interest. This reduces the cost of borrowing for larger businesses and is one of the many benefits of being big business.

- Increased market share – As businesses grow they’re are likely to experience increased sales revenue and therefore their market share will increase (the sales revenue they make as a percentage of the total sales revenue within the market). With this comes increased market setting powers, allowing them to generate a larger profit margin.

- Diversification – Increased growth gives businesses the opportunity to enter into new markets as they have more money to expand. This allows them to diversify their product portfolio, helping to spread risk across multiple markets and products. Therefore, if one product fails then it has a reduced impact on the firm, thus increasing chances of survival.

- Managerial motives - It may be the owner’s ambition to own a large business or to receive the benefits that come with owning a large business.

Why do firms remain small?

- Avoid diseconomies of scale – Rapid growth can have some negative impacts on a business and therefore growth may not be an objective of certain business owners. For example, as a business grows, communication is likely to suffer due to an increase in the business hierarchy structure and the span of control.

- Operate in niche markets – Some businesses may operate in a niche market and therefore don’t have sufficient demand for the goods/services that they sell in order for their business to grow.

- Barriers to entry – This may make it difficult for firms to expand in to different markets and therefore grow. For example, some markets may be dominated by large businesses that have much lower operating costs than their business. As a result of this, they would not be able to offer a competitive price if they were to enter in that market.

What is the principle agent problem?

As a business grows, the shareholders (principals) often appoint managers (agents) to run the business from day to day e.g. financial managers, sales managers etc. However, the managers/agents may have different objectives from the shareholders/principals. For example, the shareholders often want to maximise the dividends that they are paid and therefore want the business to profit maximise. In contrast to this, the managers may have objectives such as revenue maximisation, which is different to the shareholders objective of profit maximisation.

What is organic growth?

Organic growth can exist through a number of different ways such as increased output, expanding into international markets, launching new products etc.

What is forward back vertical integration?

This occurs when a business merges or takes over another business that is in a different stage of production from them.

What is horizontal integration?

A business may decide to takeover/merge with a business that is in the same industry and at the same stage in the production process as them

What is conglomerate integration?

Business's may also decide to expand through merging or taking over a business in another industry to what they're in.

What are the advantages and disadvantages of organic growth?

- Reduced risk – The main advantage of growing organically is the reduced risk of enduring any of the detrimental effects that may occur during mergers and takeovers e.g. a clash of business cultures. This is one of the many reasons why takeovers and mergers often fail.

- Helps to avoid diseconomies of scale – By growing organically it allows the business to grow at a more sustainable pace. As a result of this, there is less chance of the business experiencing increased costs as a result of diseconomies of scale.

Slow growth – The reduction in the rate of growth can also be a disadvantage. By growing organically it will take longer for the business to increase its market share, by which point their competitor that has grown through a merger/takeover may be dominating the market.

Advantages and disadvantages of vertical integration

Guarantees source of raw materials or outlet for product.

Greater control over supply chain

Better access to raw materials

However,

Diseconomies of scale

clash of business culture

Advantages and disadvantages of horizontal integration

Reducing competition, increased market share

Reduction in costs

However,

Diseconomies of scale

clash of business culture

Advantages and disadvantages of conglomerate integration

reduced risk

but, lack of knowledge

Define demerger

A demerger occurs when a business sells one or more of the businesses it currently owns resulting in the business turning into a separate company.

Why do demergers take place?

Cultural differences - Differences within the two businesses cultures can cause demergers to occur.

Reducing the risk of diseconomies of scale - By demerging it can reduce the risk of becoming too big too fast and therefore the negative aspects that are associated with this.

Increased focus - Mergers can often result in the business losing focus of its key aims and objectives

Remove loss making parts - A business may decide to demerge if some areas of the business are making much more profit than another part of the business which may be loss making.

Raising money from asset sales - By demerging the business is able to raise money from asset sales. This can then be given to the shareholders or used to increase investment in their core business

What is the impact of demergers on businesses?

Increased efficiency - The demerger can lead to increase efficiency within the business by getting rid of some of the problems caused by diseconomies of scale.

Increased profit - By demerging the business may be able to remove loss making parts of the business and therefore increase their overall level of profit.

Reduction in market share - If the business is demerging with another business that is in the same industry then they are likely to lose some of their market share.

What is the impact of demergers on workers?

Increased job security - if loss making parts of the business are demerged it is likely to increase the stability of the business as profit levels increase.

Reduced conflict between cultures - If a business experiences cultural differences between the two merged businesses then they may decide to demerge.

Increased focus on the business - By demerging it allows workers to focus on the core business and therefore increases the chances of the business becoming a dominant force in the market they operate in.

What is the impact of demergers on consumers?

Lower prices - In some cases a business's market share may become too high and therefore they are forced to demerge by the competition and markets authority.

Better meet consumer needs - Demerging can result in increased focus on the core business. This allows them to better spot changing consumer tastes and trends, thus allowing them to better meet customer needs.

What is profit maximisation and why do firms choose to profit max?

Profit maximisation (MC=MR)

- By increasing the profit that the firm makes it allows room for an increase in the dividends paid out to shareholders.

- Another reason why a firm may want to profit maximise is to use some of the profit in order to reinvest into the business

What is revenue maximisation and why do firms choose to revenue max?

Revenue maximisation (MR=0)

- drive out competition

- to experience economies of scale.

What is sales maximisation and why do firms choose to sales max?

Sales maximisation (AC=AR)

- to experience economies of scale through increasing the size of the firm

- it allows them to maximise their utility

What is profit satisficing?

In order to keep all stakeholders happy, a firm may decide to choose a price point where profit satisfying takes place. They are encouraged to do this due to the conflicting interests of all stakeholders.

What is the formula for total revenue?

Price x Quantity

What is the formula for average revenue?

total revenue/quantity

What is the formula for marginal revenue?

change in total revenue / change in quantity

What is the formula for total cost?

total fixed cost + total variable cost

What is the formula for variable cost?

variable cost x quantity

What is the average cost?

Total cost / quantity

What is the formula for average fixed cost?

Total fixed cost / quantity

What is the formula for average variable cost?

total variable cost / quantity

What is the formula for marginal cost?

change in total cost / change in quantity

What is the law of diminishing marginal productivity?

As labour increases there is a certain point at which productivity can no longer increase so it begins to decrease after that.