Looks like no one added any tags here yet for you.

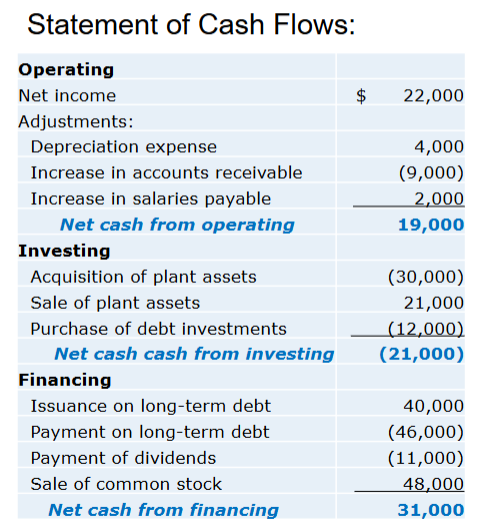

Statement of Cash Flows:

Explains change in cash over period of time

Provides information about cash inflows and outflows

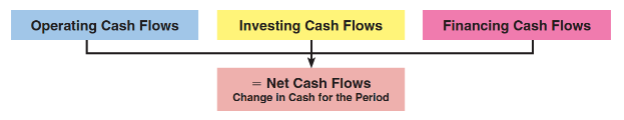

Classifies cash flows into three types:

Usefulness of the Statement of Cash Flows

Information provided in a statement of cash flows, if used with related disclosures and information in the other financial statements, should help investors, creditors, and others (including donors) to do all of the following:

Assess the entity’s ability to generate positive future net cash flows

Assess the entity’s ability to meet its obligations, its ability to pay dividends, and its needs for external financing

Assess the reasons for differences between net income and associated cash receipts and payments

Assess the effects on an entity’s financial position of both its cash and noncash investing and financing transactions during the period.

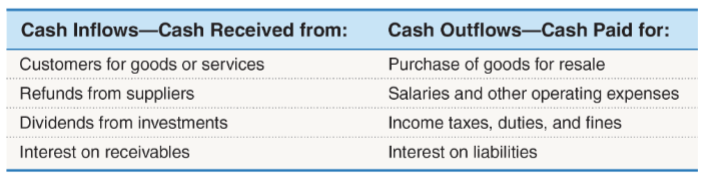

Cash Flows from Operating Activities Section

Includes all cash flows not defined as investing and financing

Relates to activities that generate net income

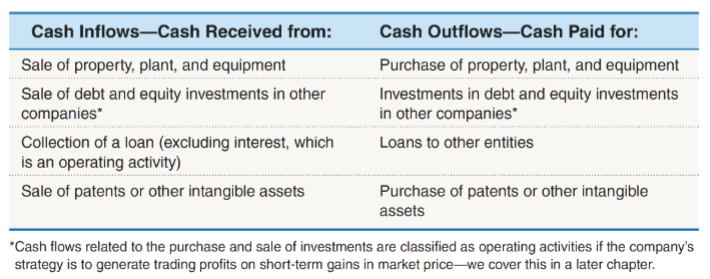

Cash Flows from Investing Activities Section

Includes cash flows related to disposing/acquiring fixed assets and investments and making/collecting loans

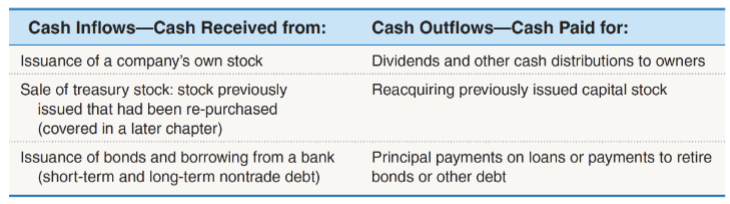

Cash Flows from Financing Activities Section

Includes cash flows related to issuance of debt and equity securities

Cash Flow Classification

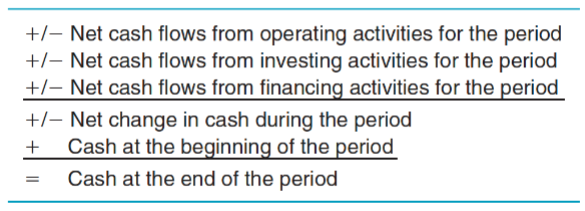

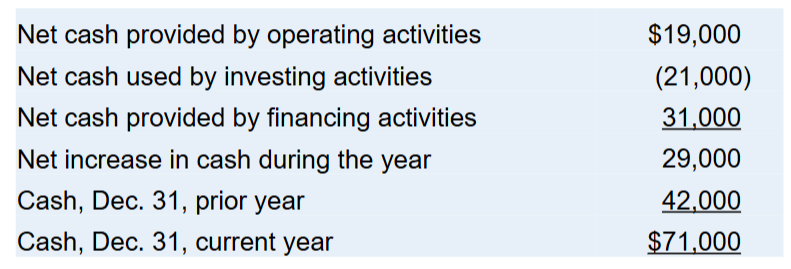

Reconciling Cash

Beginning to End of Period

Reconciliation of Cash, Cash Equivalents, and Restricted Cash

A statement of cash flows for a period shall report net cash provided or used by operating, investing, and financing activities and the net effect of those flows on the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents during the period.

The statement of cash flows shall report that information in a manner that reconciles beginning and ending totals of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents.

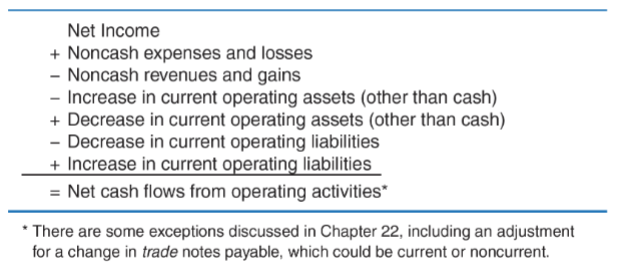

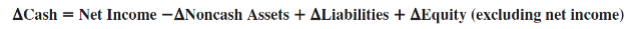

Cash Flow from Operating Activities Indirect Method

Report Noncash Investing and Financing Activities

Involve an exchange of value other than cash

Report in separate schedule at bottom of statement of cash flows or disclose in notes

Examples include:

Purchase of equipment through a note

Conversion of debt to equity securities

Issuance of stock for equipment purchase

Exchange of noncurrent assets

Cash Flow Disclosures

If the indirect method is used, amounts of interest paid (net of amounts capitalized)...and income taxes paid during the period shall be disclosed.

An entity shall disclose information about the nature of restrictions on its cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents.

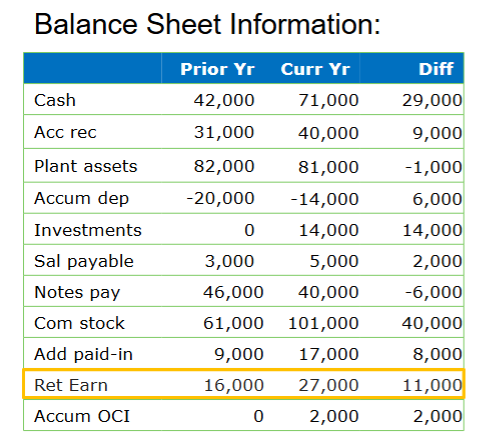

Balance Sheet

Balance sheet displays assets, liabilities, and net assets (equity) at a point in time.

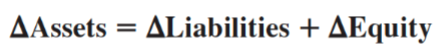

Balance sheet is based on the balance sheet equation:

Assets = Liabilities + Equity (Net Assets)

Interrelations among financial statements derive from this balance sheet equation.

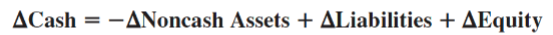

Statement of stockholders’ equity shows

changes in equity resulting from transactions with owners and changes not resulting from transactions with owners

Transactions with owners include stock issuances, stock repurchases, and dividends

Changes not resulting from transactions with owners include net income and other comprehensive income

The total of stockholders’ equity accounts equals total

equity on the balance sheet

Statement of comprehensive income shows

the components of net income and other comprehensive income (OCI)

Net income and OCI adjust stockholders’ equity on the statement of stockholders’ equity

Net income adjusts retained earnings

OCI adjusts accumulated OCI

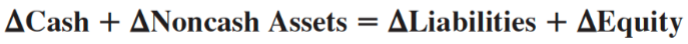

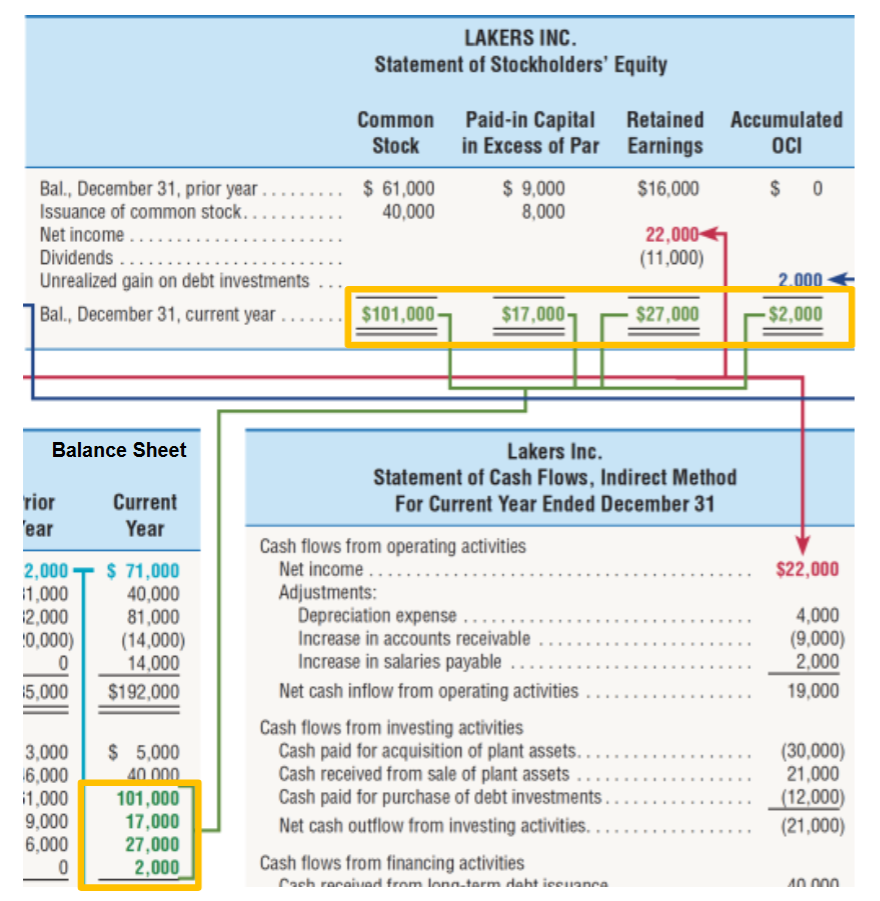

Because the balance sheet equation is true, the change in assets must equal the change in liabilities plus the change in equity.

The change in assets equals the change in cash plus the change in assets other than cash.

Subtracting the change in noncash assets from both sides shows that the change in cash is equal to the change in liabilities and equity minus the change in noncash assets.

Breaking out the change in equity into net income and other changes in equity shows that net income is an important source of the total change in cash. The change in cash is made up of the items on the right of the equation, classified as operating, investing, and financing activities.

Ending equity balances from the balance sheet tie to ending balances in the statement of stockholders’ equity.

Net income and other comprehensive income on the statement of stockholders’ equity are detailed in the

statement of comprehensive income.

Statement of cash flows explains the change in cash.

The operating section begins with

net income and adjusts for noncash revenue and expense items and changes in current operating assets and current operating liabilities

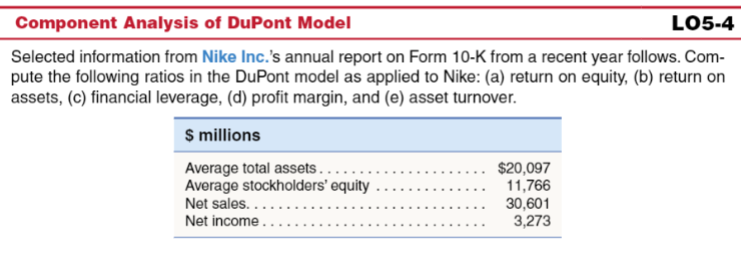

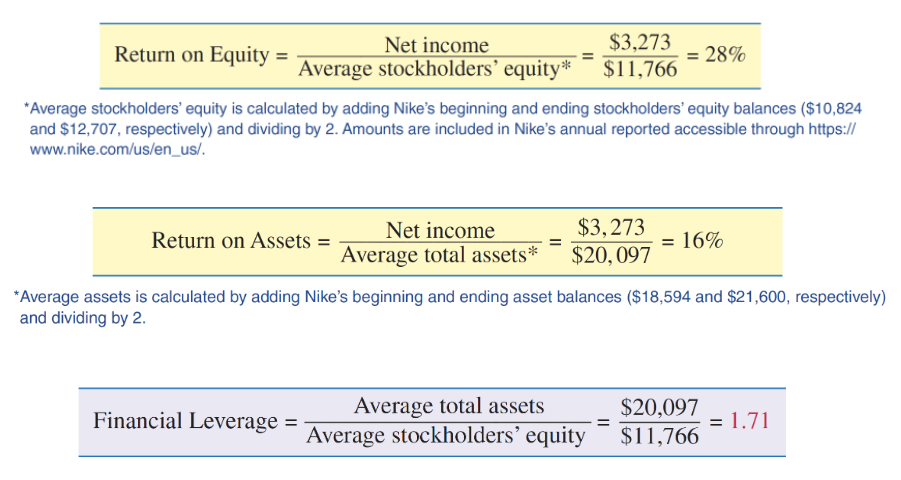

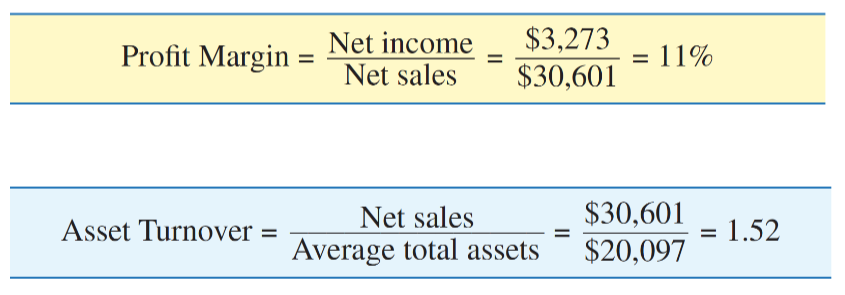

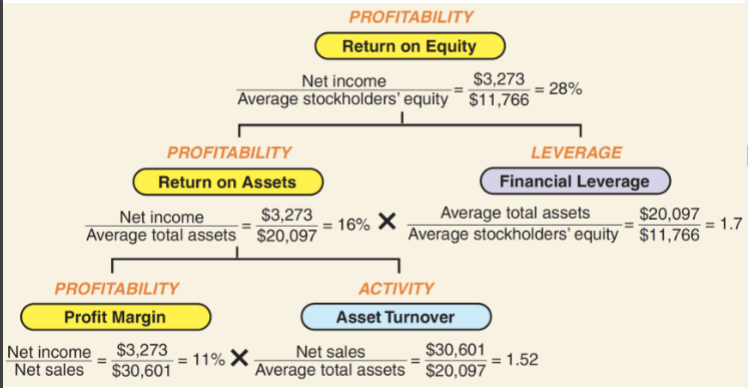

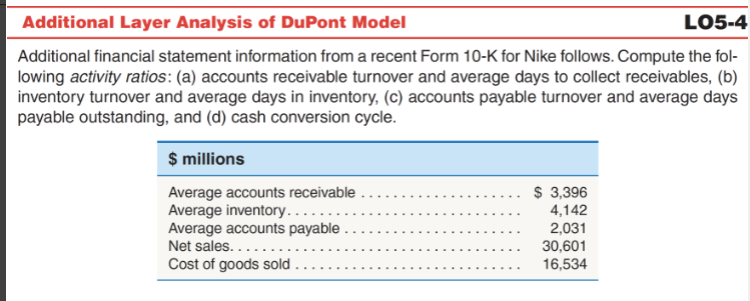

DuPont Model

DuPont Model Ratios

Gross Profit Ratio =

Gross Profit/ Net Sales

Operating-Expenses-to Sales =

Operating Expenses/ Net Sales

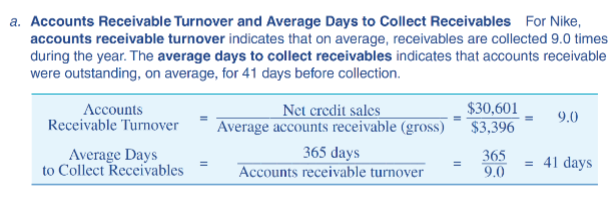

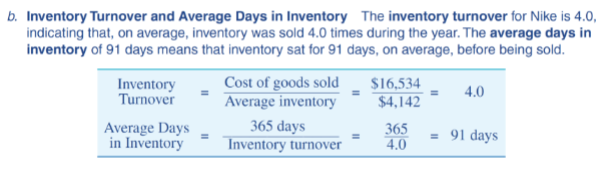

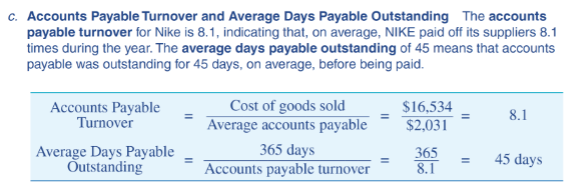

Receivables ratios

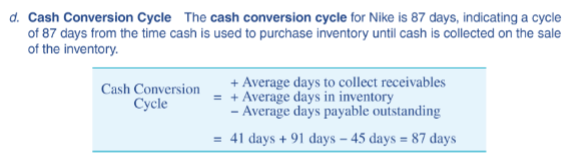

Cash Conversion Cycle ratio

Creditor Analysis

Creditors supply capital to business

In return, creditors expect repayment plus interest

Fewer opportunities for gains beyond debt contract

Thus, more attention focused on liquidity and solvency ratios

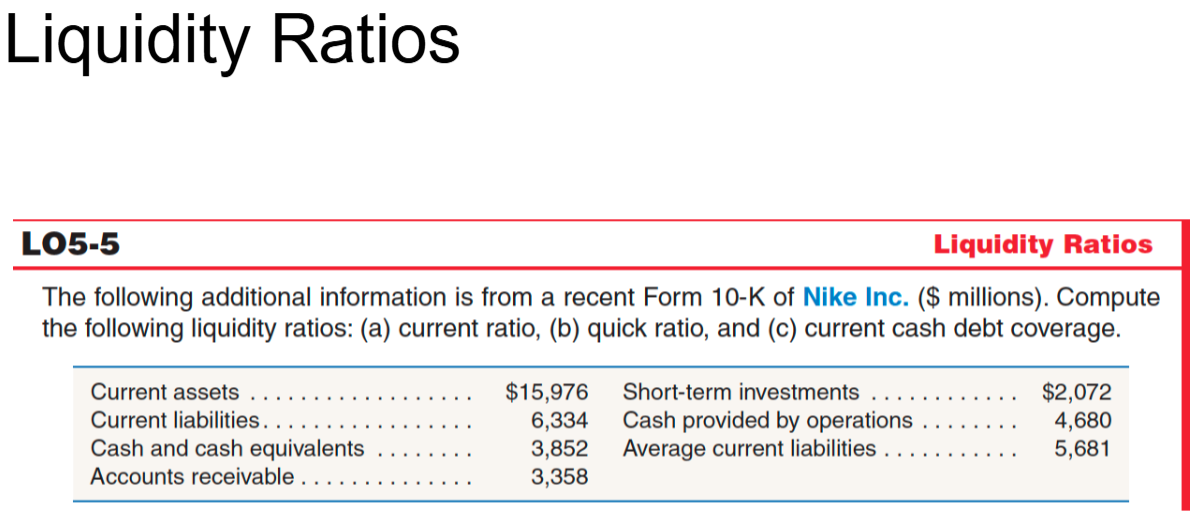

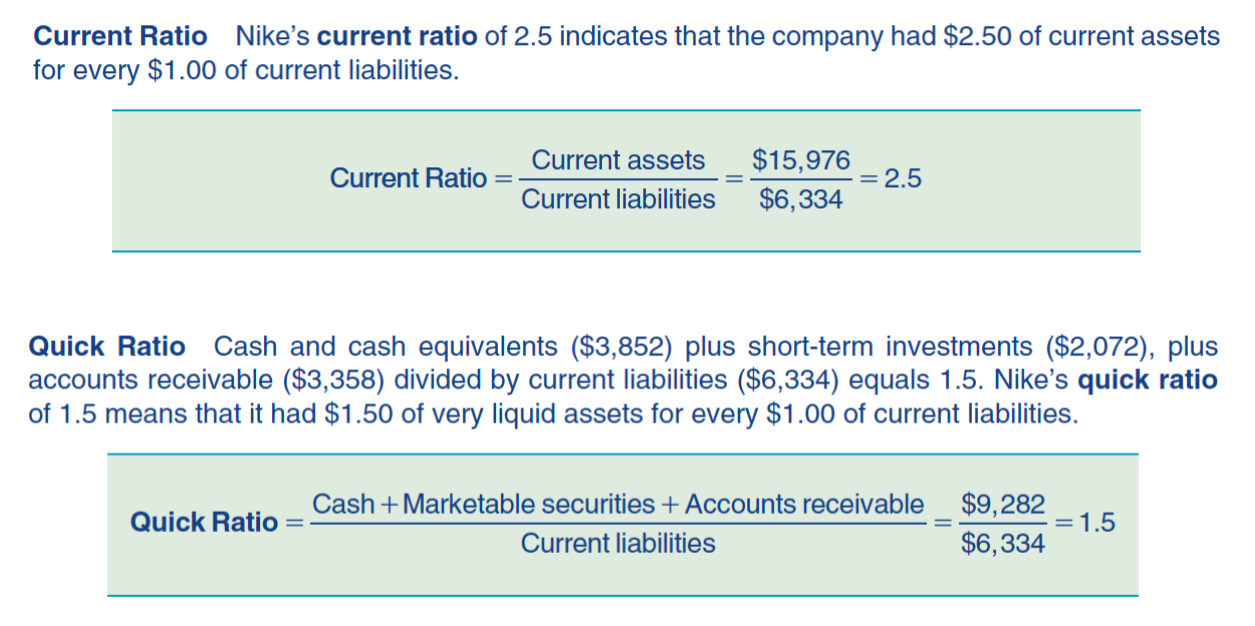

Liquidity Ratios

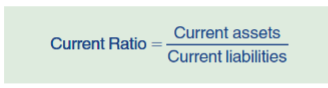

Current ratio

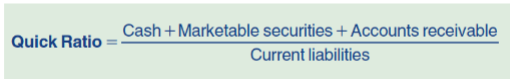

Quick ratio

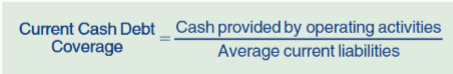

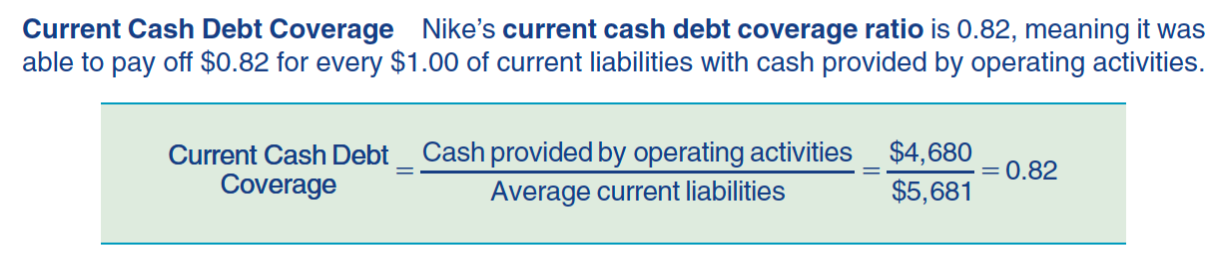

Current cash debt coverage

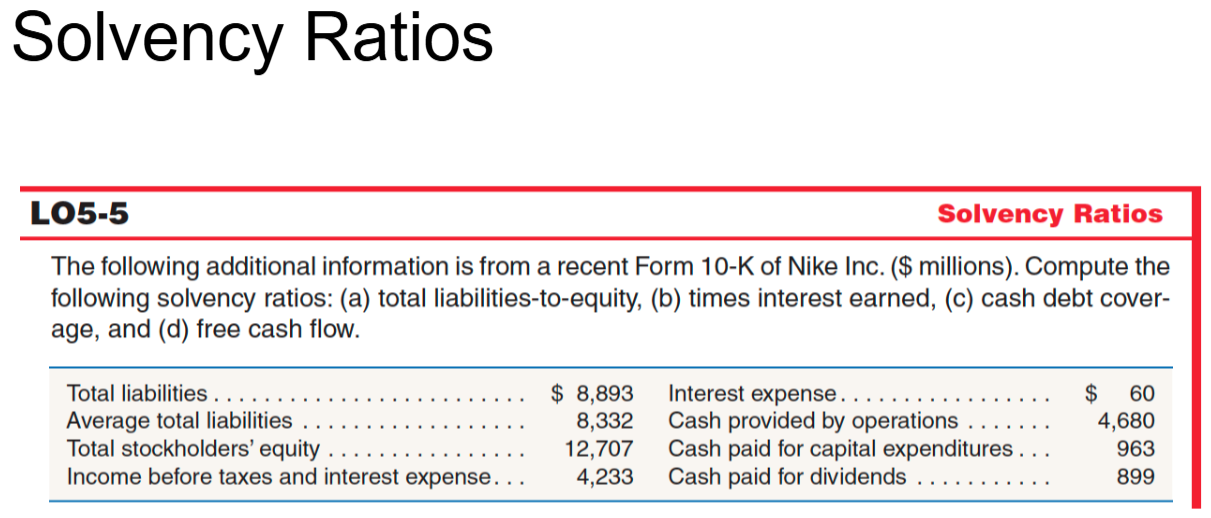

Solvency Ratios

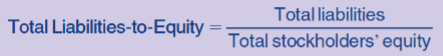

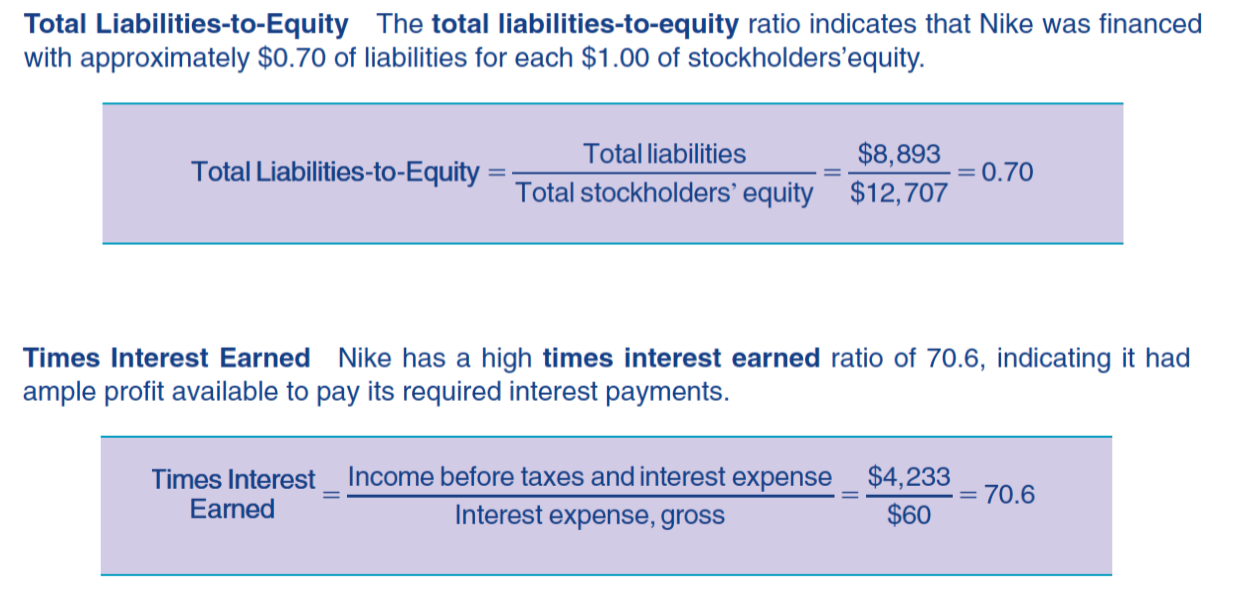

Total liabilities-to-equity

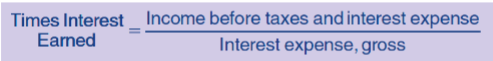

Times interest earned

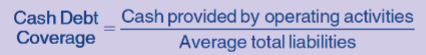

Cash debt coverage

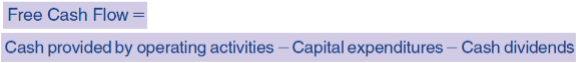

Free cash flow

Current ratio

Quick ratio

Current cash debt coverage

Total liabilities-to-equity

Times interest earned

Cash debt coverage

Free cash flow

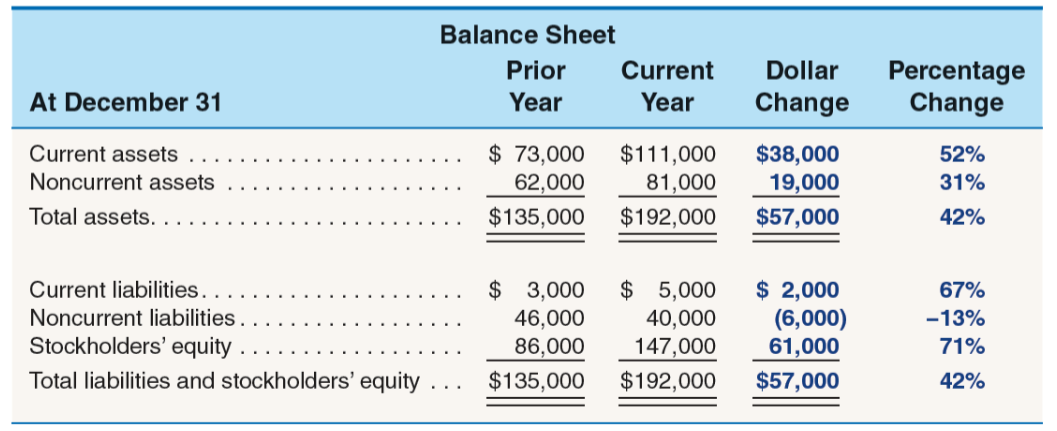

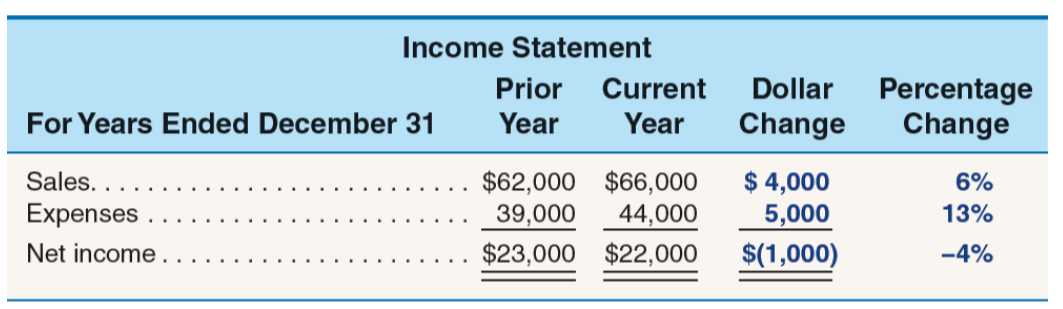

Horizontal/Trend Analysis

Analysis of financial statements across time

Expresses the change between two periods as a percentage

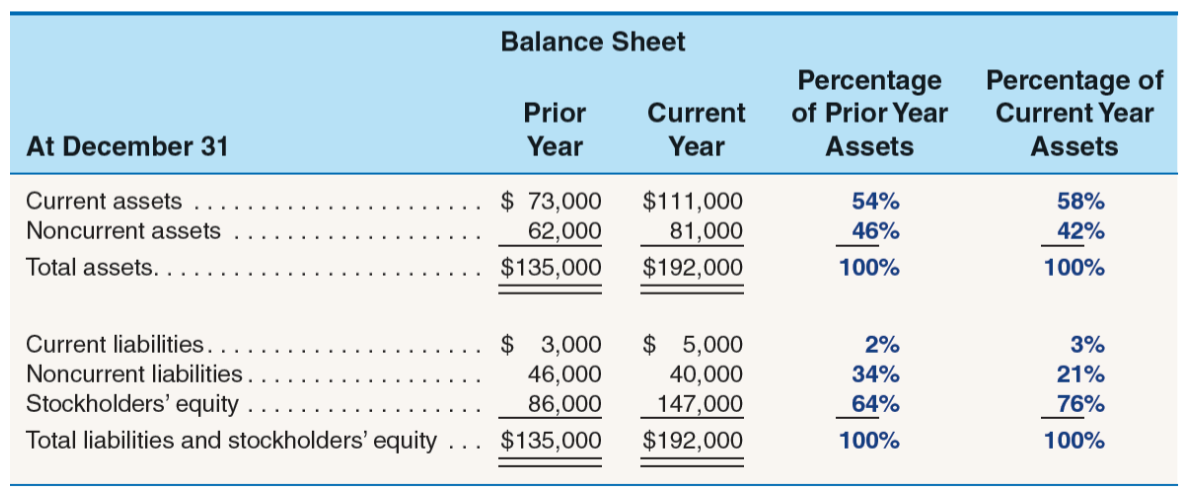

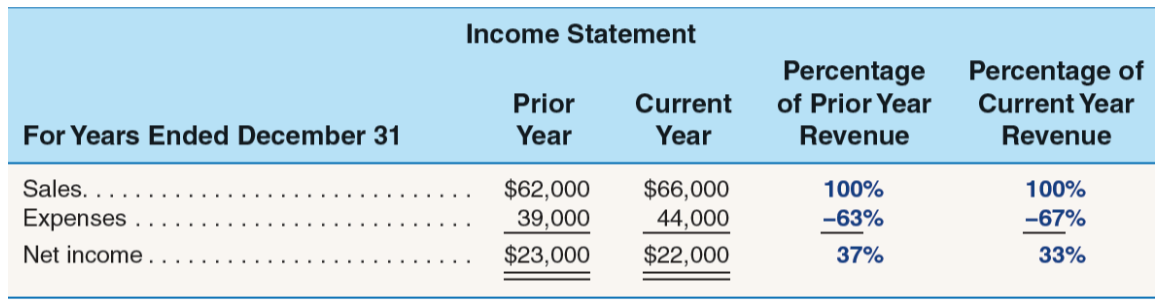

Vertical/Common Size Analysis

Analyze financial statement item relative to base

Base for income statement: Total revenues

Base for balance sheet: Total assets

Non-GAAP Financial Measures

Measure not calculated or presented in accordance with GAAP

Has no defined meaning or uniform characteristics

Examples include:

Gap Inc. reported free cash flow

American Eagle Outfitters Inc. reported non-GAAP earnings per share

Walgreens Boots Alliance Inc. reported adjusted operating income

SEC requires its registrants to provide a reconciliation between:

Non-GAAP measure reported and

Most directly comparable GAAP measure S-K Section 229.10 (i) A reconciliation...of the differences between the non-GAAP financial measure disclosed or released with the most directly comparable financial measure or measures calculated and presented in accordance with GAAP.