Cash and cash equivalent and Bank Reconciliation

1/4

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

5 Terms

Definition and classifications

Cash includes both currency and demand deposits with banks and or other financial institutions.

Cash equivalent include short term, highly liquid investments that are both:

a. Readily convertible to Cash; and

b. Have an original maturity of 90 days or less from date of purchase when acquired by the entity.

Examples of cash and cash equivalent:

a. Coin and currency on hand (including petty cash) parentheses

b. Checking and savings accounts.

c. Money market funds.

d. Deposits held as compensating balances against borrowing arrangements with a lending institution that are not legally restricted.

e. Negotiable paper.

A. Bank checks, money, orders, travelers, checks, bank, drafts, and cashiers checks.

B. Commercial paper and treasury bills.

C. Certificates of deposit (having original maturities of 90 days or less)

Components of a simple reconciliation

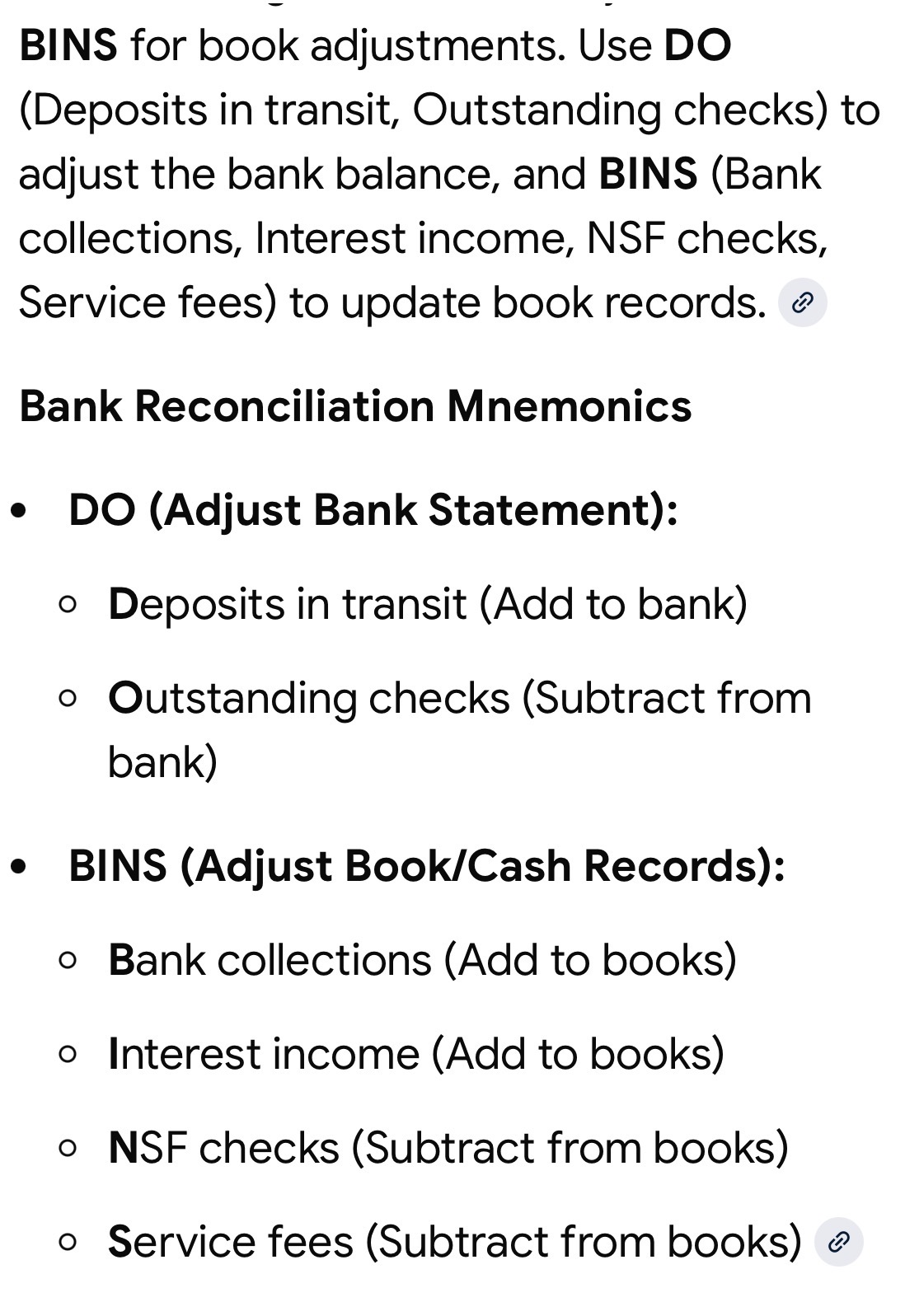

Bank Adjustments: DO

D: Deposit in Transit +

O: Outstanding Checks -

(adjusted Bank balance = true balance.)

Book/ledger Adjustments: BINS

B: Bank Collections +

I: Interest Income +

N: NSF -

S: Service Charge -

(adjusted book balance = true balance.)

Reconciliation of cash, receipts, and disbursements

Commonly referred to as the four column reconciliation or proof of cash.

Serves as a proof of the proper recording of cash transactions.

The objective of the four column is to reconcile any differences between:

a. The amount of depositor has recorded as cash receipts;

b. The amount the bank has recorded as deposits.

Accounting for bank balances at separate banks

Although the balances in the various accounts within the same bank can be netted, balance totals for different banks must be accounted for separately on the balance sheet when one has a negative position.