FT9

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

cash outflow for investment activities

A firm's purchase of plant and equipment would be considered a…

Drysdale has a higher profit margin and a lower debt ratio than Commerce.

Drysdale Financial Company and Commerce Financial Company have the same total assets, the same total assets turnover, and the same return on equity. However, Drysdale has a higher return on assets than Commerce.

Which of the following can explain these ratios?

increasing the long-term value of the firm is emphasized.

Maximization of shareholder wealth is a concept in which…

Project C

The financial manager at Johnson & Smith estimates that its required rate of return is 11%. Which of the following independent projects should Johnson & Smith accept?

Project A requires an up-front expenditure of $1,000,000 and generates an NPV of -$4,600.

Project B requires an up-front expenditure of $800,000 and generates a positive IRR of 10.5%.

Project C requires an up-front expenditure of $600,000 and generates a positive internal rate of return of 12.0%.

Statement 1 is correct and statement 2 is incorrect.

Ashlyn Lutz makes the following statements to her supervisor, Paul Ulring, regarding the basic principles of capital budgeting:

Statement 1: The timing of expected cash flows is crucial for determining the profitability of a capital budgeting project.

Statement 2: Capital budgeting decisions should be based on the after-tax net income produced by the capital project. Which of the following regarding Lutz's statements is most accurate?

accept the project with the higher net present value.

When a company is evaluating two mutually exclusive projects that both have positive NPV but have conflicting NPV and IRR project rankings, the company should…

a perpetuity

A stream of equal cash payments lasting forever is termed…

decrease; decrease

After a bond is issued (or sold to investors), the going rate of interest (or bond yield to maturity) increases. This will have the effect of the present value of remaining coupon payments, and the present value of the face value to be received at maturity.

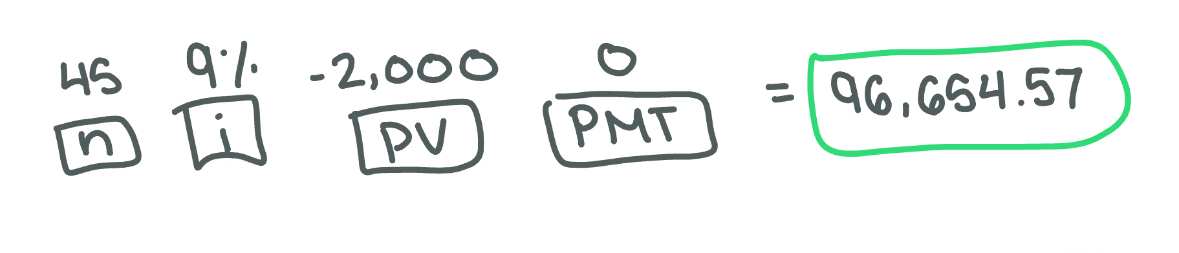

96,654.57

You have just made your first $2,000 contribution to your individual retirement account. Assuming you earn a 9% rate of return and make no additional contributions, what will your account be worth when you retire in 45 years? Round your answer to the nearest dollar. (NOTE: do NOT include the dollar sign in your answer.)

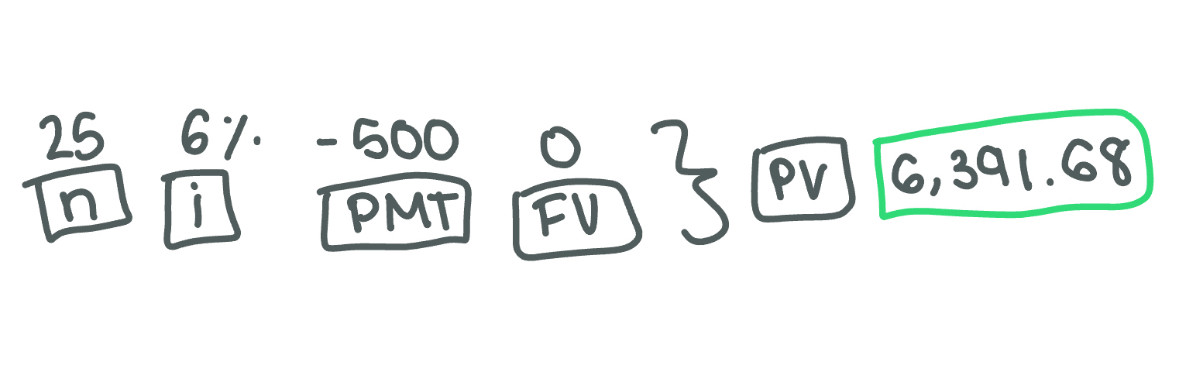

6,391.68

County Ranch Insurance Company wants to offer a guaranteed annuity in units of $500, payable at the end of each year for twenty-five years. The company has a strong investment record and can consistently earn 7% on its investments after taxes. If the company wants to make 1% on this contract, what price should it set on it? Use 6% as the discount rate. Assume it is an ordinary annuity and the price is the same as present value. Round your answer to the nearest dollar. (NOTE, do NOT include the dollar sign in your answer.)

25

Most of the beneficial effects of diversification will have been received by the time a portfolio of common stocks contains ___ stocks.

None of the statements above is correct

Stock A and B have the same required rate of return and the same expected year-end dividend (D1). Stock A’s dividend is expected to grow at a constant rate of 10 percent per year, while Stock B’a dividend is expected to grow at a constant rate of 5 percent per year. Which of the following statements is most accurate?

All the future values are greater than $100

Which of the following will result in a future value of greater than $100?

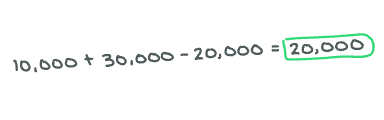

$20,000 increase in NWC

What is the net effect on a firm's net working capital if a new project requires $30,000 increase in inventory, $10,000 increase in accounts receivable, $35,000 increase in machinery, and a $20,000 increase in accounts payable?

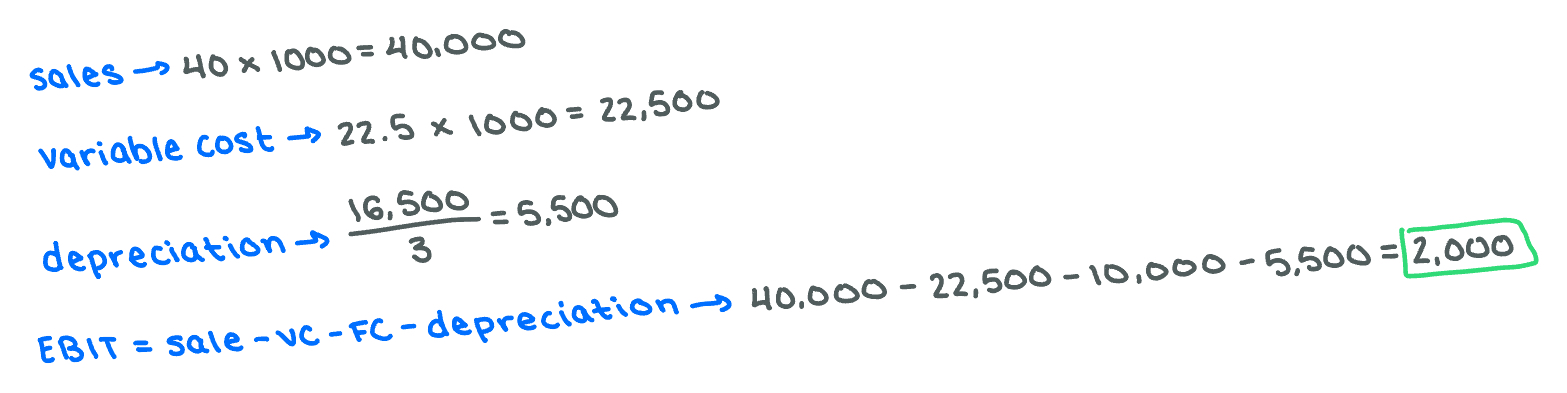

$2,000

Company XYZ is evaluating a project and here is some information for the project. The unit sales price is projected to be $40 and sales volume to be 1,000 units in year 1, 1,250 units in year 2, and 1,325 units in year 3. The project has a 3 year life. Variable costs amount to $22.5 per unit and fixed costs are $10,000 per year. The project requires an initial investment of $16,500, which is depreciated straight-line to zero over the 3 year project life.

The actual market value of the initial investment at the end of year 3 is $3,500. Initial net working capital investment of $7,500 and NWC will maintain a level equal to 20% of sales each year thereafter. The tax rate is 34% and the required return on the project is 10%.

What is EBIT for the project in the first year?

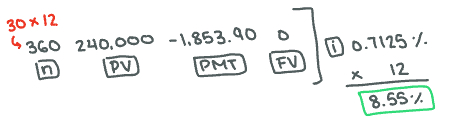

8.55%

Assume that you have taken out a 30-year mortgage of $240,000 and that your monthly payments are $1,853.90. What is your annual interest rate on the mortgage loan? (find the closest answer)

$16,198.60

You are going to withdraw $5,000 at the end of each year for the next four years from an account that pays interest at a rate of 9% compounded annually. How much must there be in the account today in order for the account to reduce to a balance of zero after the last withdrawal? (round to the nearest cent)

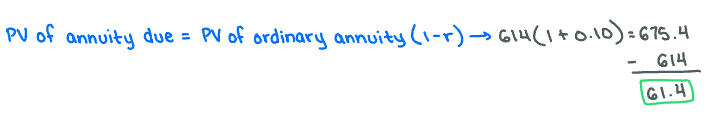

An increase of $61

The present value of an annuity stream of $100 per year is $614 when valued at a 10% rate. By approximately how much would the value change if these were annuities due? (Round to the nearest dollar).

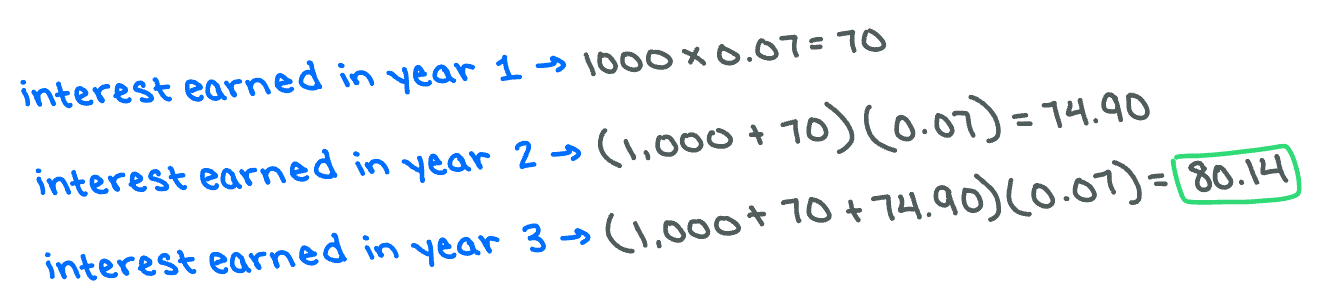

$80.14

How much interest is earned in just the third year on a $1,000 deposit that earns 7% interest compounded annually?

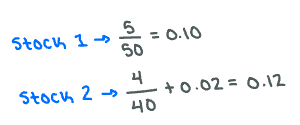

Stock 2

You would like to maximize the required rate of return of your investment. Stock 1 has a current price of $50 and a constant dividend of $5 (i.e., the dividend will not increase or decrease in the future). Stock 2 has a current price of $40 and will pay a dividend of $4 in one year. In addition, the dividend of stock 2 is expected to grow at a constant rate of 2% forever. Which option should you choose to maximize your required rate of return?

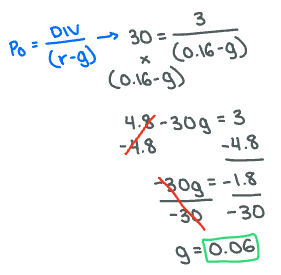

6.00%

Albright Motors is expected to pay a year-end dividend of $3.00 a share (DIV1 = $3.00). The stock currently sells for $30 a share. The required (and expected) rate of return on the stock is 16 percent. If the dividend is expected to grow at a constant rate, g, what is g?

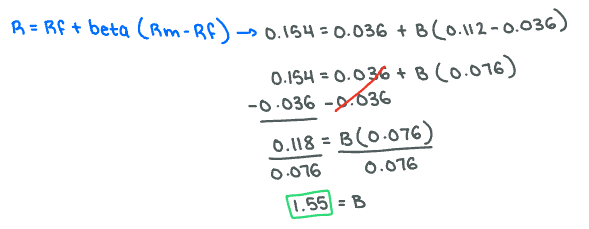

1.55

The common stock of Jensen Shipping has an expected return of 15.4 percent. The return on the market is 11.2 percent, the inflation rate is 3.1 percent, and the risk-free rate of return is 3.6 percent. What is the beta of this stock?

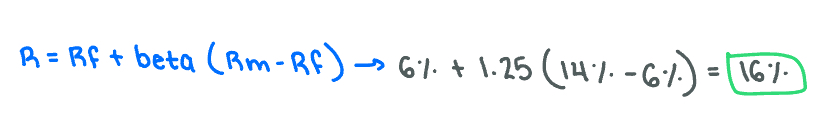

16.0%

What rate of return should an investor expect for a stock that has a beta of 1.25 when the market is expected to yield 14% and Treasury bills offer 6%?

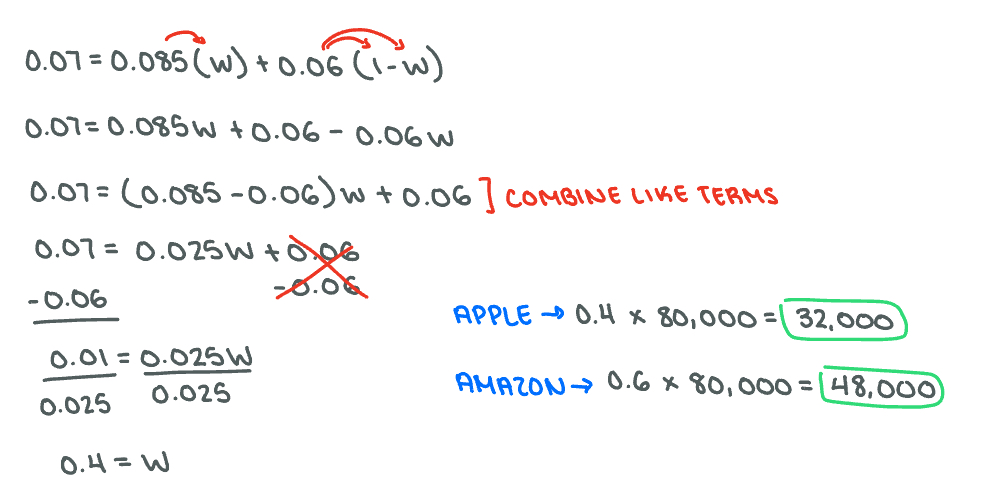

Apple = $32,000; Amazon = $48,000

You have an $80,000 investment portfolio of Apple and Amazon stocks with an expected return of 8.5% and 6%, respectively. The portfolio expected return is 7%. What is the dollar value of each stock in the portfolio?

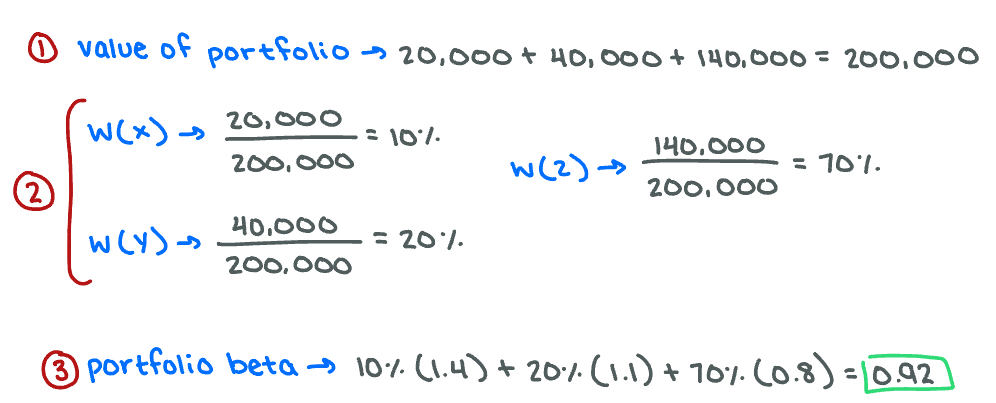

0.92

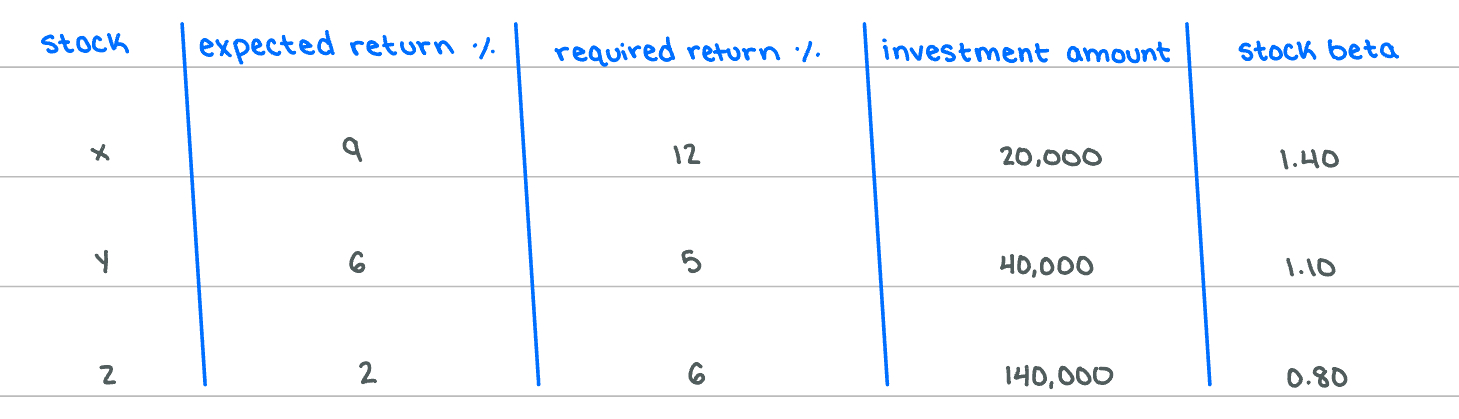

Assume a portfolio is made up of the following three stocks:

Selecting the closet answer, the beta for the portfolio is…