RE 1

0.0(0)

0.0(0)

Card Sorting

1/146

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

147 Terms

1

New cards

Ch 17

sources of commercial debt and equity capital

2

New cards

2018 value of CRE in the US

$12.6T, 50% of the value of the stock of owner-occupied houses ($25.9T), 70% of the value of outstanding US treasury securities ($17.8T) and 30% of the value of corporate equities ($4.29T)

3

New cards

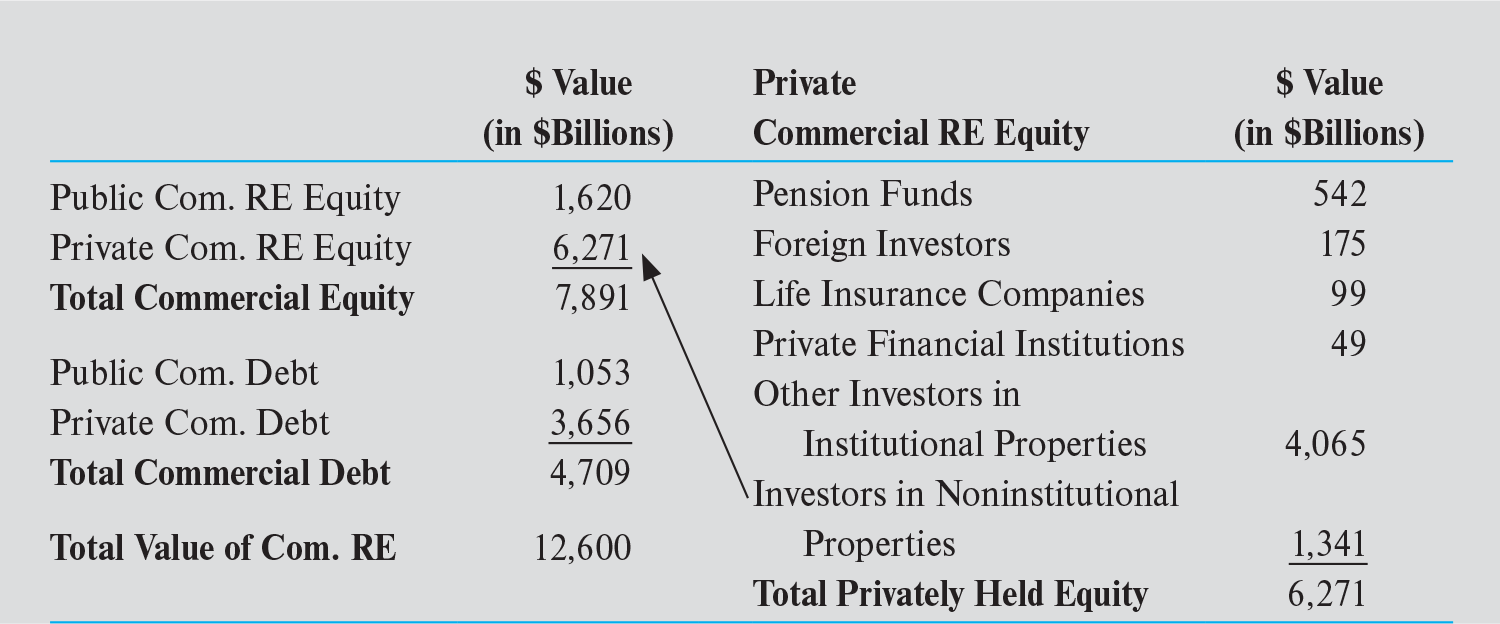

$12.6T market value of commercial real estate can be broken down into 4 groups

- $1.6T public equity capital

- $6.3T privately held equity

- $1T in publicly traded mortgage debt

- $3.7 T in privately held mortgage debt

- $6.3T privately held equity

- $1T in publicly traded mortgage debt

- $3.7 T in privately held mortgage debt

4

New cards

debt accounts for apprx 37% of market value of CRE...

low bc large organizations like pension funds typically purchase CRE with 100% equity

5

New cards

advantages of pooling equity; allows investors to...

- acquire more expensive properties than they could otherwise afford

- diversity their portfolios

- take advantage of economies of scale

- access debt at lower interest rates to achieve greater returns

- to pool their capital and allow someone else to manage it and take advantage of the skills of the sponsor/syndicator

- diversity their portfolios

- take advantage of economies of scale

- access debt at lower interest rates to achieve greater returns

- to pool their capital and allow someone else to manage it and take advantage of the skills of the sponsor/syndicator

6

New cards

disadvantages of pooling equity

- investors usually have to cede their right to manage and control the property to the active sponsor

- sponsor has to be compensated either with fees, a salary, or a disproportionately large share of equity cash flows

- sponsor has to be compensated either with fees, a salary, or a disproportionately large share of equity cash flows

7

New cards

two considerations that determine the choice of ownership for pooled equity investments

tax issues (avoid double taxation)

limited liability (want to avoid unlimited liability)

management control issues

ability to access additional equity capital

ability to reduce return volatility and share risk

ability of investors to dispose of their interests in org

ability to distribute cash flows to investors base on perfcentages

limited liability (want to avoid unlimited liability)

management control issues

ability to access additional equity capital

ability to reduce return volatility and share risk

ability of investors to dispose of their interests in org

ability to distribute cash flows to investors base on perfcentages

8

New cards

general partnership

simplest form of pooled ownership; most important benefit of a general partnership is that it features pass-through taxation

treated as conduits for tax purposes (taxable income and losses flow through to the individual partners who pay the tax)

treated as conduits for tax purposes (taxable income and losses flow through to the individual partners who pay the tax)

9

New cards

disadvantage of general partnership

have unlimited liability; liable for all debts of the partnership (personal assets are subject to the claims of partnership's creditors)

10

New cards

limited partnership

A partnership in which one party (the general partner) assumes unlimited liability in exchange for control of all material decision making. The limited partners enjoy liability that is limited to the extent of their equity contributions to the entity. All parties involved benefit from flow-through income and taxation; that is, the partnership is not taxed.

general partners can be entities rather than individuals

general partners can be entities rather than individuals

11

New cards

advantages and disadvantages of limited partnership

pro: allows the limited partners to cap their personal liability to an amount equal to their total equity investment in the partnership; pass-through tax treatment

con: in exchange for limited personal liability, the limited partners give up day-to-day control of the partnership and are prohibited from participating in management or policy making (principal-agent relationship)

con: in exchange for limited personal liability, the limited partners give up day-to-day control of the partnership and are prohibited from participating in management or policy making (principal-agent relationship)

12

New cards

C corporation

Corporate ownership structure that provides limited liability, but suffers from double taxation and does not enable losses to flow through to investors for current use.

advantage: shareholders enjoy limited liability

disadvantage: shareholders subject to double taxation

advantage: shareholders enjoy limited liability

disadvantage: shareholders subject to double taxation

13

New cards

subchapter S corporation

Corporate ownership structure that is a federal tax election made with the unanimous consent of the shareholders. An S corporation possesses the same limited liability benefits for its shareholders as do C corporations but it is not a separate taxable entity.

14

New cards

limited liability company (LLC)

A hybrid form of ownership that combines the corporate characteristics of limited liability with the tax characteristics of a partnership.

15

New cards

intermediaries

In real estate investment, third party specialists who use their expertise and knowledge to invest and manage funds on behalf of clients.

popular bc supply better expertise, improve liquidity, and allow the investor to diversity and share risk

popular bc supply better expertise, improve liquidity, and allow the investor to diversity and share risk

16

New cards

direct investment in CRE

most commonly used by large institutional investors and high-net-worth private investors

includes: pension funds, life insurance companies, etc.

includes: pension funds, life insurance companies, etc.

17

New cards

pension funds

Retirement savings accounts that now represent a major source of equity capital in commercial real estate markets.

$542B, less than 7% of CRE equity

$542B, less than 7% of CRE equity

18

New cards

life insurance companies

involves the payment of premiums by the insured in exchange for benefits to be paid upon the death of the insured

19

New cards

value of US CRE Equity

20

New cards

securitized investments

Investment instruments that pool investment assets, enabling investors to purchase a share in the pool of assets.

21

New cards

syndicate

A group of persons or legal entities who come together to carry out a particular investment activity.

can be formed by institutional or non institutional investors, typically organized as limited partnerships or LLCs

can be formed by institutional or non institutional investors, typically organized as limited partnerships or LLCs

22

New cards

pooled equity investment alternatives

- separate accounts

- commingled real estate funds (CREFs)

- closed-end real estate private equity funds

- full platform operating company

- commingled real estate funds (CREFs)

- closed-end real estate private equity funds

- full platform operating company

23

New cards

separate accounts

An investment manager acting on behalf of multiple clients holds each client’s assets in a separate account rather than as part of a commingled fund to permit customized investments for each client.

24

New cards

commingled real estate funds (CREFs)

A collection of investment capital from various pension funds that are pooled by an investment advisor/fund manager to purchase commercial real estate properties.

offered by major banks, life insurance companies, investment banks, etc.

allow for better diversification for a management fee

min about $1M-$10M

front-end fee for acquiring properties and back-end fee upon disposition (1.5%)

closed-end (finite life; offer no liquidity until the funds begin to sell properties at end of life) or open-end (infinite life; allows investors to redeem interests periodically)

offered by major banks, life insurance companies, investment banks, etc.

allow for better diversification for a management fee

min about $1M-$10M

front-end fee for acquiring properties and back-end fee upon disposition (1.5%)

closed-end (finite life; offer no liquidity until the funds begin to sell properties at end of life) or open-end (infinite life; allows investors to redeem interests periodically)

25

New cards

closed-end real estate private equity funds

These funds have a finite life, typically 7–10 years, with an option for the fund manager or sponsor to extend the life by an additional year or two. Because of this finite life, the fund manager is forced to eventually dispose of the assets and return the investors’ capital. These funds typically have meaningful side-by-side investment by the fund sponsor/manager, aligning the manager’s economic outcomes with those of the investors. The fee structures are also usually richer and more complex, allowing more features that further align interests.

limited partners earn a preferred return before general partner

carried interest/founder's equity: general partner receives a percentage of the rest of the profits

limited partners earn a preferred return before general partner

carried interest/founder's equity: general partner receives a percentage of the rest of the profits

26

New cards

core funds

least risky and offer the lowest returns (primarily invest in high-quality properties with strong leases in large metro areas)

27

New cards

value-added funds

have intermediate level of risk and offer an intermediate level of returno

28

New cards

opportunistic funds

highest risk and highest returns

29

New cards

full platform operating companies

This is an investment strategy that involves starting or acquiring and then operating a real estate company. The company may then acquire real estate investments, develop properties, and/or act as a general partner in a variety of investments funds. High net-worth families have been common investors in full-platform companies, while more conservative pension funds have gravitated toward safer, more passive forms of investment.

30

New cards

institutional investors vs non-institutional investors

institutional investors (78%) account for 4.93T of the 6.27T in real estate private CRE equity in 2018

non institutional investors (22%) account for 1.34T in private CRE equity; typically high net worth individuals and family offices

non institutional investors (22%) account for 1.34T in private CRE equity; typically high net worth individuals and family offices

31

New cards

Real estate investment trust (REITs)

A corporation or trust that uses the pooled capital of many investors to purchase and manage income property (equity REIT) and/or mortgage loans (mortgage REIT). special type of corp. and creature of the US tax code

design allows investors to enjoy the same limited liability as c corps but also enjoy pass-through taxation unlike c corps

design allows investors to enjoy the same limited liability as c corps but also enjoy pass-through taxation unlike c corps

32

New cards

equity REITs

real estate investment trusts that invest in and operate income-producing properties

33

New cards

mortgage REITs

REITs that purchase mortgage obligations and effectively become real estate lenders

34

New cards

sources of CRE Debt

78% of the 4.7T in outstanding mortgage debt is privately held by institutional and individual investors; commercial banks and saving associations hold 61%

remaining 22% is publicly traded as commercial mortgage-backed securities or REIT unsecured debt; dominated by commercial mortgage-backed securities (CMBs)

remaining 22% is publicly traded as commercial mortgage-backed securities or REIT unsecured debt; dominated by commercial mortgage-backed securities (CMBs)

35

New cards

development and construction lending

development and construction of commercial properties achieved by short-term development and construction loans; risky bc likelihood that the project will not be successfully completed on time and on budget

commercial banks typically lend (also savings institutions, credit agencies, and private equity lenders)

commercial banks typically lend (also savings institutions, credit agencies, and private equity lenders)

36

New cards

How much of a person's financial portfolio should be in real estate?

10% to 15%

37

New cards

Private Commercial Real Estate Investment Markets

- local LLCs

- private equity commercial real estate funds

- private REITs (about 750 in existence)

- public commercial real estate markets

- private equity commercial real estate funds

- private REITs (about 750 in existence)

- public commercial real estate markets

38

New cards

National Association of Real Estate Investment Trusts (NAREIT)

has website and good info about publicly traded REITs

39

New cards

real estate investment trust (REITs)

a company that owns, develops, operates, manages, or finances income-producing properties; corporations that have a special tax designation that allows them to forego the potential double-taxation of dividends

40

New cards

equity REITs

own and manage real estate properties and derive most of their revenues from rent (164 publicly traded, 96% of the market cap of publicly traded REITs)

41

New cards

mortgage REITs

hold or trade mortgages and mortgage-backed securities; most revenue derived from interest payments (44 publicly traded, 4% market cap)

42

New cards

key benefit of REITs

qualified reits can deduct dividends paid from corporate taxable income; avoid taxation of corporate income if it distributes all of its taxable income as dividends

43

New cards

five or fewer rule

the entity can have no more than half its shares held by five or fewer individuals

44

New cards

REIT entities must pay dividends equal to at least...

90% of its taxable income every year (not cash flow)

45

New cards

REIT entities must be in the real estate business

75% of its assets have to be invested in real estate, government securities, or cash, and 75% of its gross income must come from real estate

46

New cards

REIT trends

1960s, 1990s became popular (increase from $13B to $438B in 2006), 2007-2008 housing collapse decreased market cap by 50%, now growing again

47

New cards

umbrella partnership REITs (UPREITs)

an organizational structure in which a publicly traded REIT owns a fractional interest in an operating partnership that owns all or part of individual property partnerships

more than 80% reits structured like this

more than 80% reits structured like this

48

New cards

One way to invest in commercial real estate is to buy a commercial property, hold the title to it, and exercise complete control over it. This is an example of...

direct investment in private commercial real estate equity (bc investor owns the underlying property, not the debt)

49

New cards

Double taxation is a negative characteristic of which entity type?

C Corporation

50

New cards

syndicate

a group of individuals or legal entities that come together to carry out a particular activity

51

New cards

Tenancy in Common (TIC

form of direct ownership in which multiple investors have undivided ownership interests in the property, evidenced by a separate deed

52

New cards

which of the following holds the largest share of private CRE debt in the US?

banks and savings associations (hold 61% of all private CRE debt, and 47% of overall cre debt)

53

New cards

what percentage of real estate private equity in the us is held by investors in institutional-quality properties?

78%, res held by investors in non-institutional properties

54

New cards

What percentage of debt that finances private commercial real estate is privately held?

78% of the $4.7T in outstanding mortgage debt is privately held by institutional and individual investors, and the remaining 22% is publicly traded as commercial mortgage-backed securities or REIT unsecured debt

55

New cards

Which was the fastest-growing source of long-term commercial mortgage funds until their market collapsed in 2008?

commercial mortgage-backed securities

56

New cards

in the US, the largest and most common holders of cre are

LLCs

57

New cards

Which pooled ownership structure is most commonly used by private funds that attempt to attract capital from high-net worth individuals and institutional investors?

limited partnerships

58

New cards

Price-FFO Multiple

(Price/share) / (FFO/share)

59

New cards

Net Asset Value in relation to REIT's

if REIT price < price/share NAV = discount

if REIT price > price/share NAV = premium

if REIT price > price/share NAV = premium

60

New cards

For a REIT to maintain its special tax status under US tax law, what is the min. amount of investors and how much of its taxable income must be distributed in the form of dividends?

at least 100 investors; 90%

61

New cards

the FTSE NAREIT ALL REIT index

a market capitalization-weighted index that includes all tax-qualified REITs that are listed on the NY stock exchange, NASDAQ, and the American Stock Exchange. It is an index for public, listed REITs

62

New cards

What was the significance of the development of the UPREIT in the early 1990s?

it is now easier to convert private ownership of real estate to reits (IRS no longer treats as a normal sale, so the owners do not accrue tax liability like capital gains and depreciation recapture tax, which are disincentives)

63

New cards

REIT status is a voluntary election under the

internal revenue code

64

New cards

according to the "five or fewer" rule...

a qualified REIT can have no more than half of its shares held by five or fewer individuals

65

New cards

two kinds of reits

equity reits (invest in and operate commercial properties)

mortgage reits (buy mortgage obligations and are effectively real estate lenders)

majority of all reits are equity reits

mortgage reits (buy mortgage obligations and are effectively real estate lenders)

majority of all reits are equity reits

66

New cards

advantages of investing in REITs

- higher-than-average expected returns

- strong corporate governance

- possibility for diversification

- increased liquidity

- strong corporate governance

- possibility for diversification

- increased liquidity

67

New cards

one major downside of investing in public non-listed REITs is that...

they typically have high fees associated with them (10%-15%)

68

New cards

Over the past 20 years, returns on the REIT index fund have been ____ than those of other index funds. Investing in REITs helps diversify a person's portfolio because they are _____ correlated with other investments (such as stocks and bonds)

greater (annualized returns of more than 12%); not highly (useful for portfolio diversification)

69

New cards

Funds From Operations (FFO)

adds depreciation and other amortization expenses to net income

= NI + Depr + amortization of leasing expenses + amortization of improvements made to tenants' space - gains from infrequent and unusual events

= NI + Depr + amortization of leasing expenses + amortization of improvements made to tenants' space - gains from infrequent and unusual events

70

New cards

Conditions that REITs must satisfy to maintain special tax status

- must be at least 100 investors

- no five investors can own more than half of the shares

- 75% or more of the REIT's assets must consist of real estate assets, cash, or government-backed securities

- REIT has to distribute at least 90% of its taxable income as dividends to shareholders

- no five investors can own more than half of the shares

- 75% or more of the REIT's assets must consist of real estate assets, cash, or government-backed securities

- REIT has to distribute at least 90% of its taxable income as dividends to shareholders

71

New cards

What is true about investment value?

- it includes the impact of the cash flow from the ultimate sale of the property

- it is calculated via the application of a discount rate to future cash flows

- it is a function of estimated cash flows from operations

- based on the value that a PARTICULAR investor places on the property

- it is calculated via the application of a discount rate to future cash flows

- it is a function of estimated cash flows from operations

- based on the value that a PARTICULAR investor places on the property

72

New cards

market value considers...

most probable selling price under "normal" sale conditions, so it is based on the expectations of the average (typical) investor

73

New cards

Effective Gross Income Multiplier

EGIM = (Acquisition Price/ EGI)

74

New cards

going-in cap rate

RO = NOI/Acquisition Price

75

New cards

Net operating income is a ____ cash flow and before-tax cash flow is a ____ cash flow

noi is unlevered bc it does not account for the use of financial leverage (does not deduct debt service, mortgage pmt.)

BTCF is levered bc it deducts debt service

BTCF is levered bc it deducts debt service

76

New cards

Financial risk ratios

measures the ability of the property to produce income that meets its operating and financial obligations

77

New cards

minimum acceptable debt yield ratio and debt coverage ratio

DYR = at least 10%

DCR = at least 1.2

DCR = at least 1.2

78

New cards

Equity dividend rate (EDR)

represents the residual cash flow return to equity investment, after subtracting the debt service from NOI.

aka "cash-on-cash" return (used for smaller investments)

aka "cash-on-cash" return (used for smaller investments)

79

New cards

Before-tax cash flows are considered...

levered cash flows because they subtract the mortgage payment from NOI

80

New cards

Before-Tax Equity Revision

BTER = Net Sale Proceeds - RMB

81

New cards

The use of leverage increases both the project's NPV and its IRR when...

the unlevered IRR > effective borrowing cost

82

New cards

The use of leverage will increase the levered IRR as long as the unlevered IRR is...

unlevered IRR > effective borrowing cost of the mortgage (income taxes reduce the going-in IRR)

83

New cards

The NPV of a project ____ as the investor's required rate of return increases, which makes it ____ likely the investor will take the project

decreases (bc PV of future cash flows gets smaller); less

84

New cards

What is captured by the calculation of effective rent?

The effective rent (equivalent level rent) is the fixed monthly payment that has the same present value as the actual lease payments after concessions and operating expenses. Takes the time value of money into account (NOT interlease risk, re-leasing costs, or need for flexibility)

85

New cards

Expansion option

obligates the property owner to provide space for the tenant to expand the size of their leased space

86

New cards

right of first refusal

allows the tenant to lease adjacent space if it becomes available

87

New cards

gross lease

the owner pays for all of the operating expenses, including property taxes

88

New cards

Graduated rent clause (escalation clause)

step-ups; authorizes pre-specified increases in the rental rate over the course of the lease

89

New cards

allows a mortgage lender to terminate a tenant's lease when the property owner defaults

90

New cards

rent for commercial properties is typically quoted in terms of...

dollars per square foot per year

91

New cards

concession

a lease clause that reduces the cost of the lease to the tenant and thus provides an incentive to lease space from the owner

(ex: offering free rent for x months)

(ex: offering free rent for x months)

92

New cards

triple net lease

tenant responsible for paying all operating expenses

93

New cards

what is a key downside of long-term leases?

loss of flexibility

94

New cards

tenant improvement allowance

the landlord agrees to pay a certain amount to rebuild out or refurbish space so that it is adequate for the tenant's use

95

New cards

Double taxation of the income produced by the underlying properties is most likely to occur if the commercial properties are held in the form of a

C Corporation

96

New cards

With regard to double taxation, distribution, and the treatment of the losses, general partnership are most like

limited partnerships

97

New cards

Special allocations of income or loss are available if the form of ownership is a

LLC

98

New cards

Small to medium sized real estate syndicates that develop or acquire property in a local market are most typically organized as

LLCs

99

New cards

Which of the following forms of ownership involve both limited and unlimited liability?

limited partnerships

100

New cards

General partnerships

not a taxable entity