FT7

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

a series of consecutive payments of equal amounts.

An annuity may best be defined as…

Her fund will last forever and never run out of money

Lisa is 58 years old and would like to retire at the age of 63. Based on her retirement plan, she assumes she will have $1.5 million in her 401(k) account at that time, which will earn interest at a rate of 6% annually. To supplement her monthly pension and social security checks, she plans to withdraw $7,000 every month from her 401(k) plan. How long will her 401(k) last from the date of her retirement, if her assumptions are all correct?

(Round to the nearest year)

decreases.

As the time period until receipt of a cash flow increases, the present value of the cash flow…

The NPV is greater than zero.

For a project with conventional cash flows, if PI (profitability index) is greater than 1, then…

If an asset to be used by a potential project is already owned by the firm, and if that asset could be leased to another firm if the new project were not undertaken, then the net rent that could be obtained should be charged as a cost to the project under consideration.

Which of the following statements is most correct?

both PI and NPV

The ______ indicate(s) whether value is expected to be created for shareholders.

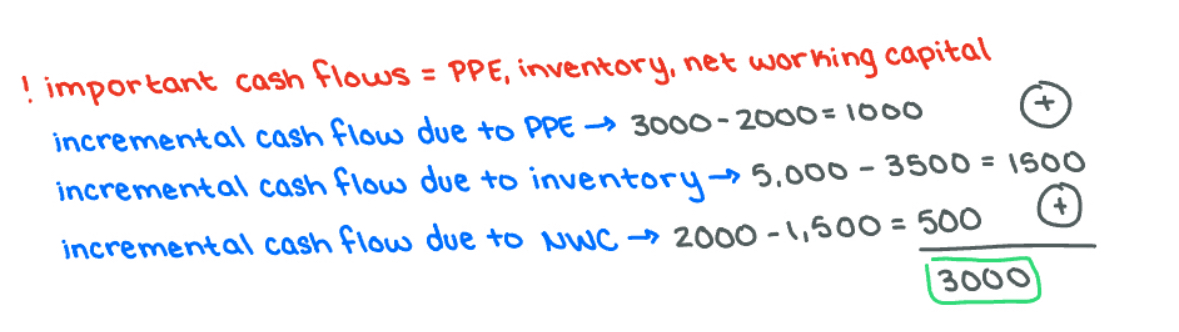

Any opportunity costs associated with the project.

A company is considering a new project. The company s CFO plans to calculate the project's NPV by discounting the relevant cash flows (which include the initial investment, the operating cash flows, and the salvage values) at the company's cost of capital. Which of the following costs/expenses should the CFO include when estimating the relevant cash flows?

Net Working Capital increases by $1,000

You are given the following information from the financial statements: | |||

Year 2022 | Year 2023 | Year 2024 | |

Revenues | $10,000 | $12,000 | $14,000 |

Net Income | $7,500 | $7,000 | $8,000 |

Cash | $1,500 | $1,750 | $2,000 |

Inventory | $2,000 | $750 | $1,250 |

Accounts Payable | $3,000 | $2,500 | $1,500 |

Retained Earnings | $5,000 | $4,500 | $4,000 |

Accounts Receivable | $5,000 | $3,250 | $2,500 |

Patents | $2,500 | $3,500 | $4,500 |

What is the change in net working capital from year 2023 to 2024?

Statement of Cash Flow: cash outflow in financing activities.

Roboton Inc. paid $512 million in cash dividends. What impact would this have on the financial statements?

Cash down $100; current liability down $100

Which accounts are affected and will the transaction increase or decrease the account? Pay $100 owed on a short-term bank note

earns significantly more than its interest obligations

A times interest earned ratio of 5.0 indicates that the firm…

can still have a positive net income.

Which of the following statements is correct for a firm in which depreciation expense exceeds EBIT? The firm…

annual sales for every dollar of total assets

The total asset turnover ratio indicates…

stock is publicly traded.

Corporations are referred to as public companies when their…

The stock with the higher dividend yield will have a lower dividend growth rate.

If two constant growth stocks have the same required rate of return and the same price, which of the following statements is most correct?

an inverse relation

The price and yield to maturity on a bond have…

Bonds X and Y have the same current yield because they have the same annual payments and prices.

A $900 bond (Bond X) with a 10-year maturity has a coupon rate of 10%. Bond X makes coupon payments annually. Another $900 bond (Bond Y) has 12 years to maturity and a coupon rate of 10%. However, bond Y pays coupons on a semiannual basis. Which of the following statements regarding the current yields of the two bonds is true?

Like bonds, common stocks always make regular and fixed payments in the form of dividends to the owners

Which of the following is not a characteristic of common stock?

cannot be determined.

A stock has been held for one year, during which time its dividend yield was greater than its capital gains yield. For this stock, the percentage return…

undervalued and expected return is higher than the required return.

A company's stock plots above the security market line. This means the company is…

Assets with returns that are totally uncorrelated, if included in an investment portfolio, provide some risk reduction.

Which of the following statements is true?

The IRR is about 28.89%

Flynn, Inc. is considering a four-year project that has an initial after-tax outlay or after-tax cost of $80,000. The future after-tax cash inflows from its project for years one, two, three, and four are $40,000, $40,000, $30,000, and $30,000, respectively. Flynn uses the internal rate of return method to evaluate projects. What is the approximate IRR for this project?

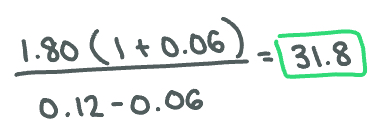

$31.80

The most recent paid dividend (DivO) is $1.80, the growth rate (g) is 6%, and the required rate of return (r) is 12%. What is the stock price according to the constant growth dividend model?

11,557.5

A smooth used-car salesman who smiles considerably is offering you a great deal on a "preowned" car. He says, "For only six annual payments of $2,500, this beautiful 2008 Honda Civic can be yours." If you can borrow money at 8%, what is the price of this car? Round your answer to the nearest dollar. (NOTE, do NOT include the dollar sign in your answer.).

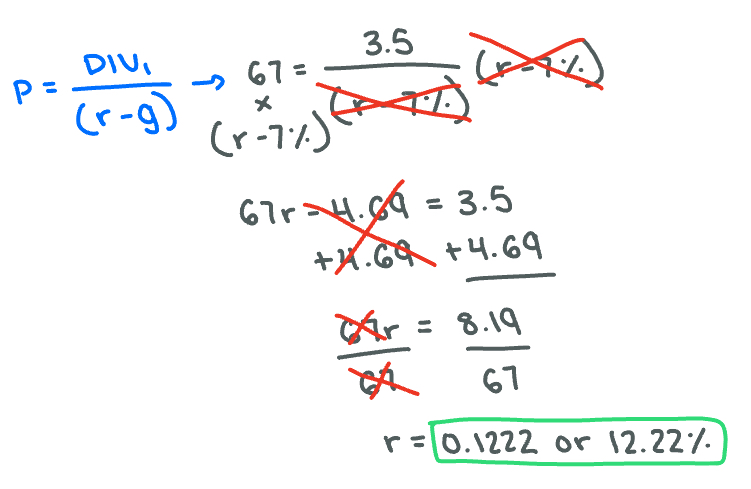

12.22%

A firm is expected to pay a dividend of $3.50 per share in one year. This dividend, along with the firm's earnings, is expected to grow at a rate of 7% forever. If the current market price for a share is $67, what is the cost of equity?

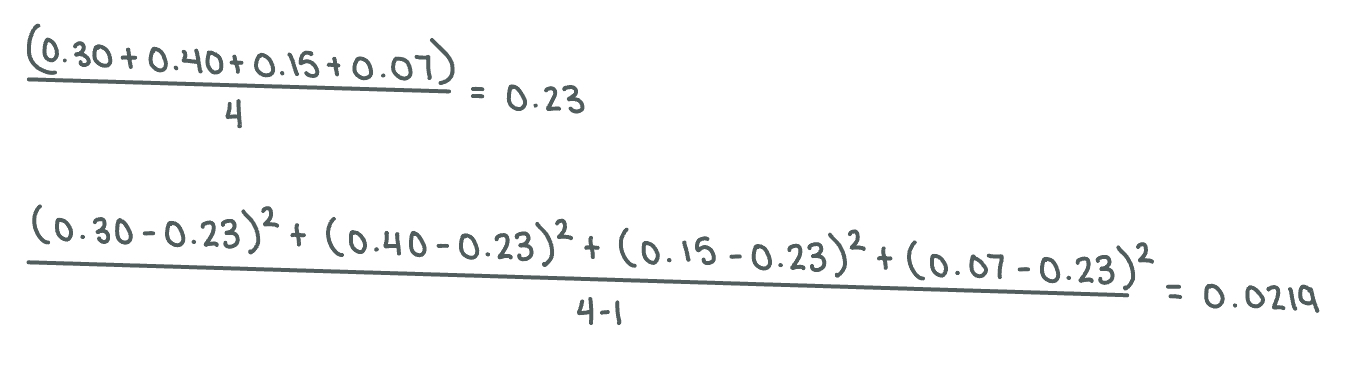

None of these are correct

An investment earned the following returns for the returns 1998 through 2001: 30%, 40%, 15%, and 7%. What is the variance of returns for this investment?

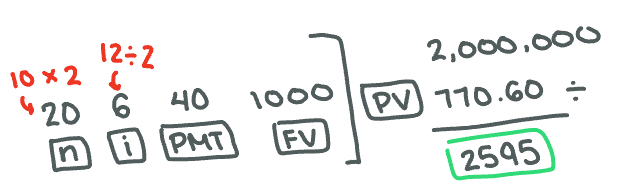

2595

Your company recently issued 10-year bonds at a market price of $1,000 (that is, they were issued at face value). These bonds pay an annual coupon of $120 ($60 each six months). Due to additional financing needs, the firm wishes to issue new bonds which would have a maturity of 10 years and which would pay $40 in interest every 6 months. Assume that both bonds are of the same risk class (that is, they have the same yield or required rate of return). How many bonds, to the nearest whole number, should the firm issue to raise $2,000,000 in cash?

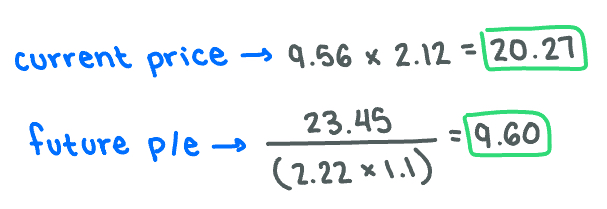

Current price = $20.27; Future P/E = 9.60

Lasten Company will release earnings soon. Current earnings per shares (EPS) is $2.12 and the P/E ratio is 9.56. Analysts expect EPS to be $2.22 for this quarter. Lasten Company's management is confident that it can beat analysts' EPS expectations by 10% and stock price will increase to $23.45. What is its current price (before earnings release) and what will its P/E ratio be if Lasten Company's management is right with the predictions?

The P/E ratio of company A is about 30% higher than that of company B.

Companies A and B are very similar in many respects. Both companies have an earnings per share (EPS) of $2 and a payout ratio of 0.5 (what is, they pay out half of the EPS to shareholders as dividend per share). Both companies are expected to maintain the same payout ratio (0.5) well into the future. The required rate of return is 10% for both stocks. However, investors expect company A can grow its EPS at a rate of 4% per year, while the growth rate of company's EPS is expected to be 2% per year forever. Which of the following is true about price-to-earnings ratios (P/E) of the two companies?

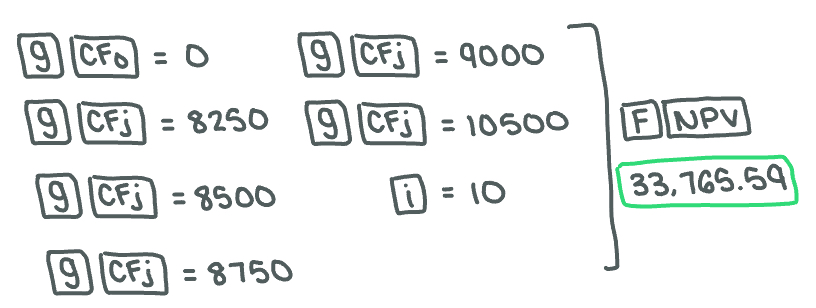

$33,766

Jane Bryant has just purchased some equipment for her beauty salon, financed by the equipment maker. To pay off the equipment loan, Jane must make the following payments at the end of the next five years: $8,250, $8,500, $8,750, $9,000, and $10,500. If the loan interest rate is 10 percent, what is the cost of the equipment that she purchased today? (round your answer to the nearest dollar).

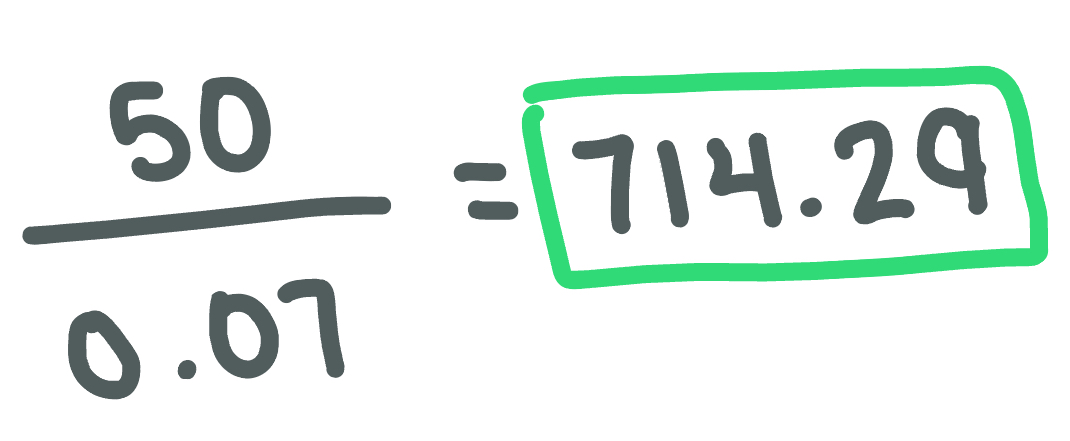

$ 714.29

You own a bond issued by the Canadian Pacific railroad that promises to pay the holder $50 annually forever. You plan to sell the bond 10 years from now. If similar investments yield 7% at that time, how much will the bond be worth in year 10 when you try to sell it?