Lesson 9 Offshoring Model

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Suppose there are two countries in the economy:

1. Assume the Foreign country has lower wages for both types of labor: w∗L < wL and w∗H < w∗L

2. Assume that the relative wage of low-skilled labor is lower in Foreign than at Home: w∗L/w∗H< wL/wH

If we rank the economic activities by their skill levels, the Home country will start offshore its activities to the Foreign starting from the right as follows:

Now, suppose the Home firm finds it profitable to offshore more activities to Foreign:

What happened to the relative demand for high-skilled labor over low-skilled labor in both Home and Foreign?

I) decrease; decrease

II) increase; decrease

III) decrease; increase

IV) increase; increase

IV) increase; increase

Based on the offshoring model we've studied in the lecture, what could explain the simultaneous increase in the non-production/production relative wage in the U.S. and Mexico?

I) Mexico started to offshore its economic activities to the U.S. starting in around 1984.

II) There are more migrants flowing in both countries.

III) There's a global macroeconomic shock affecting the U.S. and Mexico at the same time.

IV) The U.S. started to offshore its economic activities to Mexico starting in around 1984.

IV) The U.S. started to offshore its economic activities to Mexico starting in around 1984.

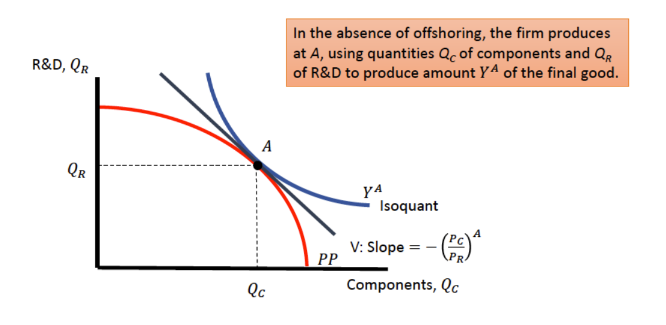

What does the (absolute value of) slope of an isoquant that represents combinations of components (on the x-axis) and R&D (on the y-axis) that give the firm the same amount of final good? (Think about the similarity between the isoquant curve and indifference curve).

I) The units of R&D a firm needs to give in exchange for using one additional unit of component to produce the same amount of final good.

II) The relative price P_R/P_C

III) The units of component a firm needs to give in exchange for using one additional unit of R&D to produce the same amount of final good.

IV) The relative price P_C/P_R

I) The units of R&D a firm needs to give in exchange for using one additional unit of component to produce the same amount of final good.

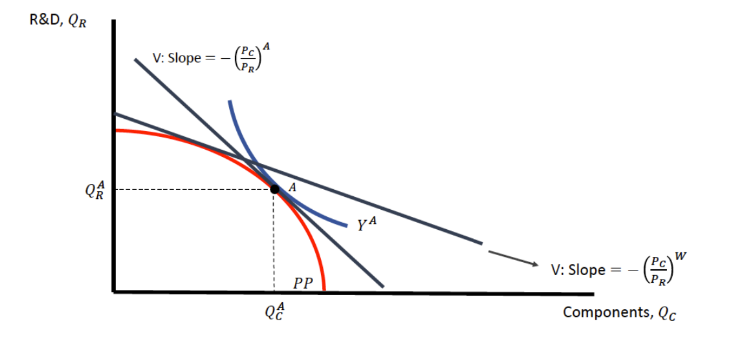

Suppose the firm in the Home country originally produces the R&D and components at point A. Now it's open to trade and finds that the world price of PC/PR (components/R&D) is lower than its autarky price as shown in the graph. In this case, what would the firm do to achieve a higher isoquant curve of the final good?

I) Produce more R&D than A and export the R&D in exchange for more components.

II) Stay at A because the world relative price doesn't matter.

III) No matter how the firm changes the production, it cannot achieve a higher isoquant curve.

IV) Produce more components than point A and export the component in exchange for more R&D.

I) Produce more R&D than A and export the R&D in exchange for more components.

Which of the following statements correctly describes the types of Foreign Direct Investment (FDI)?

I) Brownfield and Greenfield can be used as the same term interchangeably.

II) Greenfield FDI is when a company builds a new production facility abroad.

III) Greenfield FDI is when a domestic firm buys a controlling stake in a foreign firm.

IV) Brownfield FDI is when a company builds a new production facility abroad.

II) Greenfield FDI is when a company builds a new production facility abroad.

Which of the following statements best describes the types of Foreign Direct Investment (FDI) and related business strategies?

I) Vertical FDI is when the affiliate replicates the production process that the parent firm undertakes in its domestic facilities elsewhere in the world.

II) Horizontal FDI is when the affiliate replicates the production process that the parent firm undertakes in its domestic facilities elsewhere in the world, and Vertical FDI is when the production chain is broken up, transferring parts of the processes to the affiliate location.

III) Offshoring refers to a firm's decision to transfer part or all of its production processes to another country without necessarily establishing any foreign direct investment.

IV) Horizontal FDI is when the production chain is broken up and parts of the production processes are transferred to the affiliate location.

II) Horizontal FDI is when the affiliate replicates the production process that the parent firm undertakes in its domestic facilities elsewhere in the world, and Vertical FDI is when the production chain is broken up, transferring parts of the processes to the affiliate location.

What are the main motives behind the two types (horizontal and vertical) of FDI?

I) Both are driven by driven by production cost differences between countries.

II) The main drive for vertical FDI is to locate production near a firm’s large customer bases while horizontal FDI is mainly driven by production cost differences between countries.

III) Both are driven by the incentive to locate production near a firm’s large customer bases.

IV) The main drive for horizontal FDI is to locate production near a firm’s large customer bases while vertical FDI is mainly driven by production cost differences between countries.

IV) The main drive for horizontal FDI is to locate production near a firm’s large customer bases while vertical FDI is mainly driven by production cost differences between countries.

In the context of the horizontal FDI decision, which of the following statements accurately describes the relationship between per-unit export cost t, the fixed cost F of setting up an additional production facility, and the quantity Q sold abroad?

I) When t x Q < F the firm chooses horizontal FDI because trade costs are higher than the fixed costs of building a plant abroad.

II) When Q>F/t, exporting becomes the more affordable option for the firm compared to FDI.

III) If foreign sales Q are substantial enough such that Q>F/t, then FDI becomes the profit-maximizing choice for the firm over exporting.

IV) A firm always prefers exporting over FDI regardless of the size of Q.

III) If foreign sales Q are substantial enough such that Q>F/t, then FDI becomes the profit-maximizing choice for the firm over exporting.

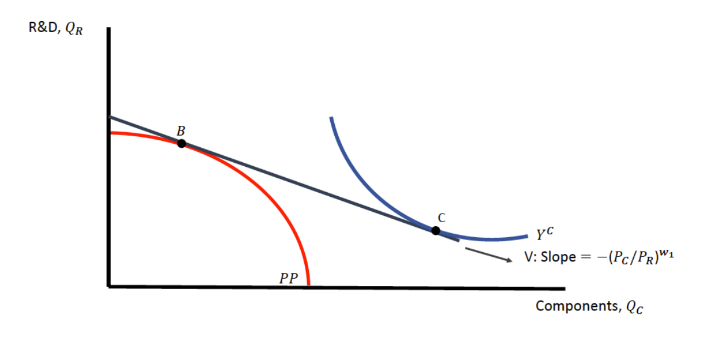

Suppose the firm in the Home country exports the R&D and imports components at point B. Now the world goes through a technological improvement in R&D that the world price of PC/PR (components/R&D) is higher than the relative price at B shown in the graph (assuming PC/PR is still lower than the autarky price.

In this case, is open to trade still beneficial to the Home country?

I) No, because now the firm in Home country should export components.

II) Yes, because the world relative price of PC/PR is still lower than the autarky price, and therefore the firm can export R&D in exchange for more components.

III) No, because a decrease in terms of trade hurts the firm.

IV) Yes, because it's always beneficial for the firm in Home country to export R&D regardless of what the world relative price is.

II) Yes, because the world relative price of PC/PR is still lower than the autarky price, and therefore the firm can export R&D in exchange for more components.

In the following scenario of components and R&D production:

1. Which line represents the supply for R&D and components, which line represents the demand for them?

2. Who are the supplier and demander of the R&D and components?

I) isoquant, PPF; labor and firm.

II) PPF, isoquant; firm and labor.

III) PPF, isoquant; firm and firm itself.

IV) isoquant, PPF; firm and firm itself.

III) PPF, isoquant; firm and firm itself.