ECONOMIC GROWTH NEW SYLLABUS

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

Economic Growth

RGDP of a country increase overtime

Indicator Economic Growth

RGDP because economic growth is quantitative concept

Real GDP

Is total output produce in an economy

Real GDP per capita

Output per person

It’s the better indicator of the amount of standard of living.

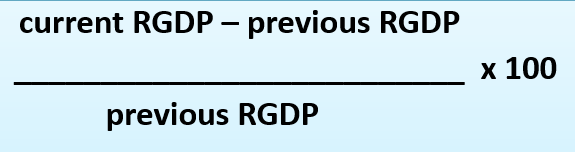

Formula for EG

Relationship between RGDP and RGDP per capita

% change in RGDP per capita = % change in RGDP - % change in population

Benefits of economic growth

Increase real GDP

Increase national income

Increase standard of living

Increase government revenue

Short term Economic Growth

caused mainly by increases in AD and increases in SRAS correspond to expansion of real GDP in the business cycle diagram.

Long term Economic Growth

Caused by rightward shift New classical LRAS or Keynesian AS curves that show increases in potential output corresponds to the long-term growth trend in the business cycle diagram.

PPC and Economic Growth

The movement from point A to B if there is an increase in AD and SRAS

It is showing an actual economic growth

Shows a limited amount of output produce

It shows a reduction of unemployment and inefficiency

Impact of EG on living standard

Increase EG → Increase income → Increase income per capita → increase consumption → increase living standard.

However to increase income per capita does not guarantee the income is distributed equally. Therefore, increase income per capita does not reflect an increase the living standard.

Increase EG leads to increase living standard

Greater income go to poorer household to improve living standard.

There is greater spending of household for education and healt care

Government allocated more budget on education, health care, infrastructure, provide clean water, and sanitation.

Impact of EG on the environment

Urban pollution

Soil degradation

Water logging

Over grazing

Threat to biodiversity

Deforestation

Impact of EG on income distribution

In many countries around the world, inequality have been widening over the past three decades.

Factors behind the widening income distribution: the use of market-oriented supply side policy which require a minimizing government intervention in the economy.

Impact of EG on income distribution (Privatization)

Tend to be more capital intensive

Low level government investment

Most service and infrastructure investment is more to urban area and ignoring rural area.

Living standard

EG can be expected to impact living standard, but increase living standard measured as improvement in human capital and decrease income inequality are major factor of contributing economic growth.

Environment

EG that ignoring the effect on environment leads to unsustainability. But unsustainability leads to lower economic growth.

Income distribution

EG can make income distribution more or less equal (equitable). BUT more equal income distribution has positive effect on economic growth.

Solution to improve economic growth

Expansionary Demand Side Policy (DSP): Expansionary Monetary Policy, and Expansionary Fiscal Policy.

Expansionary Monetary Policy

By decreasing interest rate, C and I will increase, increase AD, and increase output (RGDP), increase EG.

Expansionary Fiscal Policy

Decreasing taxes and/ or increasing govt. Spending: C, I & G will increase, AD increase, increase output (RGDP), increase EG.

Evaluation of Expansionary Demand Side Policy (DSP)

Expansionary Monetary Policy: (decreasing interest rate)—increase AD, increase RGDP, decrease UE, increase national income, increase SOL, increase ED, decrease the number of people who live in poverty, increase equality dist. Of income. However inflation increase, increase price of export, decrease price of import, decrease in net export, and increase deficit in trade balance in the BOP.

Evaluation of Expansionary DSP (Expansionary Fiscal Policy)

Expansionary Fiscal Policy: increase taxes and/ or decrease govt spending: Increase AD, increase RGDP, decrease UE, increase national income, increase SOL, increased ED, decrease the number of people who live in poverty, increase equity dist. of income. However, inflation increase, increase price of export, decrease price of import, decrease in net export, and increase deficit in trade balance in the BOP.

Evaluation of Expansionary DSP (Expansionary Fiscal Policy: increase taxes and/ decrease govt spending)

Government will run budget deficit, increase government debt to overseas.

Crowding out, is when the intention of government to increase AD leads to increase interest rate, decrease investment, decrease AD and doesn’t change the UE rate.

Opportunity cost: demand pull inflation, loose of export competitiveness.

Market Oriented Supply Side Policy (Labour Market Reform)

Abolishment of minimum wage: decrease COP, increase SRAS, and increase output, increase EG

Reduction trade union power: decrease COP, increase SRAS, and increase output, increase EG.

Reduction of UE benefit: Increase ASL in labour market, decrease wage, decrease COP, increase SRAS, increase output, and increase EG.

Deregulation: Decrease COP, increase SRAS, and increase output increase EG.

Privatization: Increase efficiency, decrease COP, increase SRAS, increase output, and increase EG.

Reduction corporate tax: Decrease COP, increase SRAS, increase output, and increase EG.

Reduction personal income tax: Increase disposable income, increase incentive to work, increase productivity, decrease COP, increase SRAS, increase output, increase EG.

Evaluation of Market oriented Supply Side Policy

Labour market reform

Deregulation

Privatization

Reduction corporate tax

Reduction income tax

Interventionist Supply Side Policy

Investment in human capital/ resources

R&D

Provision and maintenance of infrastructire

Subsidy

Evaluation of Interventionist Supply Side Policy

Increase government spending, is expensive scheme

Government may run budget deficit

Increase government debt

The result can be seen in the long run

There is opportunity cost, due to cancelling spending on the other sector

Increase government spending in the short run will increase AD, so inflation problem may be even worse

Exchange Rate Control

Depreciation of currency: Decrease price of export, increase price of import, increase net export, and increase AD, increase output, increase EG.

Evaluation of Depreciation of currency

Create cost push inflation, due to price import become more expensive.

Reasons why an increase in real gdp per capita may not lead to an improvement in living standards

The distribution of income may become uneven, so that the benefits of increasing real GDP may not be enjoyed by some.

Due to structural changes, employment opportunities decrease for some groups who will not benefit from higher real GDP

More accurate recording of self-provided goods may account for the increase in real GDP without a corresponding increase in output/ income.