IGS 8a L16-18 (Exchange Rates)

1/35

Earn XP

Description and Tags

IGS 8a Final Exam Study Deck

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

How do we buy things abroad?

Exchange our currency for the local currency via exchange rates

What is the exchange rate?

price at which we exchange one currency for another

exchange rate for home currency is its price in other currencies

Spot Rate

the price you must pay in order to get other currencies at that point in time

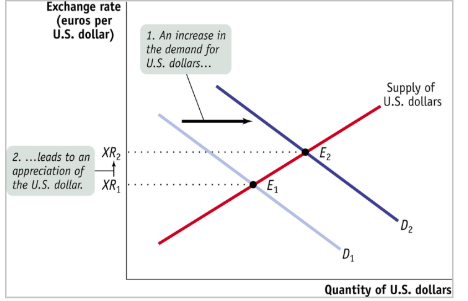

currency appreciation

when a currency becomes more valuable in terms of other currencies

currency depreciation

when a currency becomes less valuable in terms of other currencies.

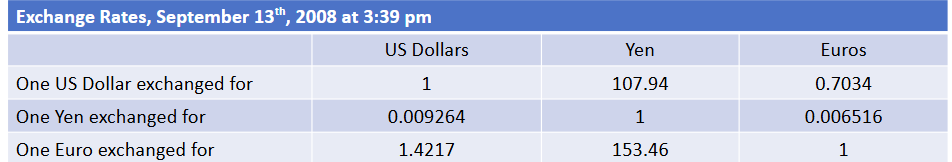

Movements in Exchange Rates EURO example

2008: .70 Euro per USD —> 2025: .93 Euro per USD

Euro depreciated. Used to by 1.42 USD now buys 1.07 USD

Impact of Exchange Rate Movements

When our currency appreciates, the price, in our home currency, of foreign goods, service, and assets goes down

when our currency depreciates, the price, in our home country, of foreign goods, services, and assets goes up

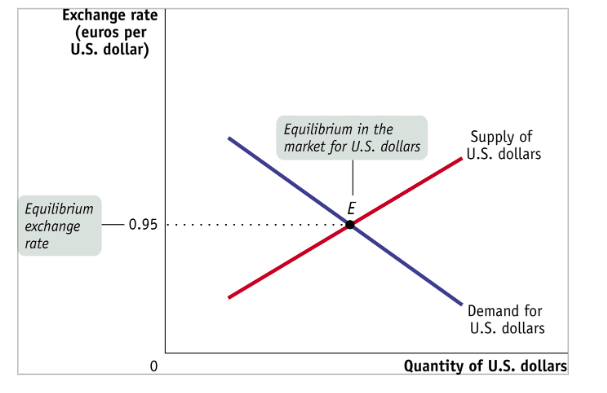

Forex market

Participants are transacting currencies

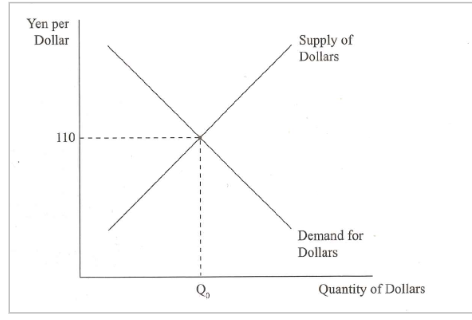

S and D of USD

D for USD comes from foreigners who want to by USD so they can buy US goods/services/assets

S for USD comes from US citizens who want to buy foreign goods/services/assets

BofP and Supply and Demand for currency

BofP debits create supply in forex markets → push up exchange rate

BofP credits create demand in forex markets —> lowers exchange rate

BofP & ER: Sample

USD appreciated, Americans want more foreign goods (CA). foreigners want more assets (FA)

Effective Exchange rate

average of all the exchange rates that a country has with its trading partners

weights of different individual exchange rates given by trade shares

Real exchange rate

for USD vs Peso → Peso/$1 x Price US/Price Mexico

What shifts supply and demand for forex

Changes in relative income growth

price increases at home or abroad

changes in consumer preferences

changes in attractiveness of assets at home and abroad

changes in national confidence and outlook

3 Core Influences on ER

Prices

Monetary police and interest rates

Speculation

Prices (core influence on ER)

PPP hypothesis → nominal ER will adjust so that each currency has the same purchasing power everywhere

ER will offset change in prices

Real ER numerical meaning

If less than 1 → currency depreciation in real terms

if more than 1 → currency appreciation in real terms

real appreciation

your currency can buy more of another currency’s goods

akak how much stuff you can buy in another country

PPP decline

decline in Real ER for US means USD has depreciated in real terms

USD is now under-valued

PPP increase

increase in Real ER for Mexico means Peso has appreciated in real terms

Peso now over-valued

how to offset CA deficit

real appreciation of currency

Depreciation and CA deficit

Depreciation of a currency can lead to a worsening of the current account (CA) deficit, as it may increase the cost of imported goods, thereby affecting trade balances negatively.

J curve response in current account

A theory that illustrates how a country's current account balance initially worsens following a depreciation of its currency before improving over time as exports become more competitive.

monetary policy (core influence on ER)

Refers to actions by a central bank to control the money supply, interest rates, and inflation, which can significantly impact exchange rates (ER) and affect trade balances.

affects Financial Account

Speculation (core influences on ER)

Currencies are traded instantly and their value responds quickly to changes in sentiment/beliefs on how an economy will perform in the future

Exchange Rate regime

rule governing policy toward exchange rate

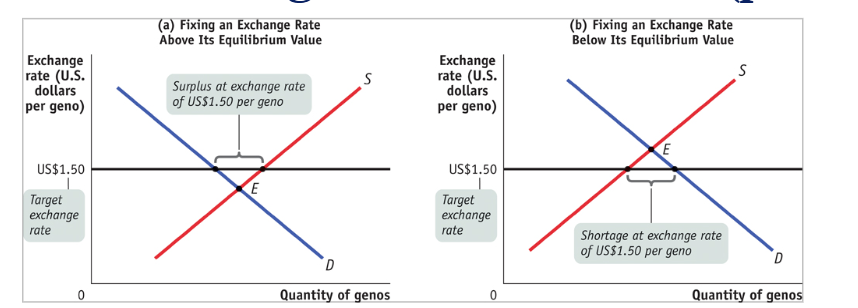

Fixed exchange rate

when government keeps exchange rate against some other currency at or near a particular target

floating or flexibly exchange rate

government lets exchange rate go wherever market takes it

exchange market intervention

government purchases or sales of its own currency in forex markets

benefit of fixing currency

stability and reduces currency risk

lowers transaction costs of trade

fixing currency and inflation expectations

must have lower inflation than other country to make sure their prices don’t go up faster than partner country

attempt to reduce inflation by fixing against USD

Fixed ER example

under-valued exchange rate (fixed)

government intervention by selling its own currency and acquiring USD to add stock to its foreign reserves

government can use monetary policy by lowering interest rate

government can impose foreign exchange controls to make it harder to buy their currency

over-valued exchange rate (fixed)

government can buy up surplus of currency

raise interest rates

limit citizens ability to exchange their currency for USD using foreign exchange controls

devaluation

reduction in value of currency that is set under a fixed exchange rate

revaluation

increase in value of currency that is set under a fixed exchange rate