4 The Accounting Cycle (Theory)

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

Elements of the End-of-Period Spreadsheet

(1) unadjusted trial balance

(2) adjustments

(3) adjusted trial balance

Permanent Accounts or Real Accounts

(1) accounts found on the balance sheet: assets, liabilities, equity

Ex

Cash, accounts payable, capital

Temporary Accounts or Nominal Accounts

(1) accounts found on the income statement: revenues, expenses + accounts found in the statement of owner’s equity: drawings and capital

What does it mean when you close the accounts?

(1) you close the temporary accounts: revenues, expenses, owner’s equity, and drawing accounts

(2) the temporary account balances are transferred to permanent accounts at the end of the accounting period

Why are accounts closed at the end of the period?

(1) temporary accounts are not carried forward because they only relate to one period

(2) temporary accounts should have zero balances at the beginning of the next period

2 Parts of the Closing Process

(1) revenue and expense account balances are transferred to the owner’s capital account

(2) the balance of the owner’s drawing account is transferred to the owner’s capital account

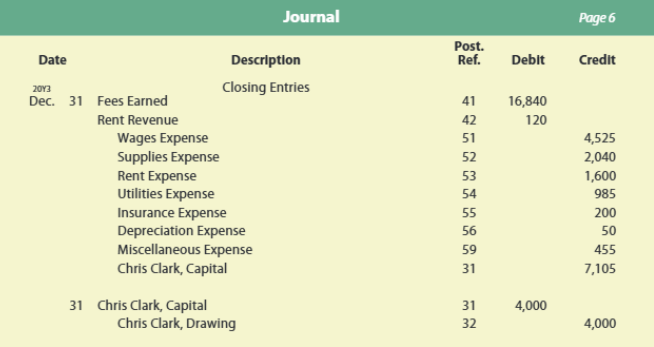

Rules to Journalizing Closing Entries

(1) dated last day of accounting period

(2) recorded immediately following the adjusting entries

(3) caption “closing entries”

Journalizing Closing Entries

Balances taken from the adjusted trial balance

1) Revenues | Debited | ||||

2) Capital (Net Loss) | Debited | ||||

3) Expenses | Credited | ||||

2) Capital (Net Income) | Credited | ||||

4) Capital | Value of Drawing Acc - Debited | ||||

5) Drawings | Value of Drawing Acc - Credited |

Posting Closing Entries

(1) posting all the closing revenue, expense, drawing balances in the ledger will result in zeroed out accounts

Post-Closing Trial Balance

(1) listing all the ledger accounts that have not zeroed out

(2) the revenue and expense accounts

Owner’s Capital for Post Closing Trial Balance Formula

Return

11 Steps to the Accounting Cycle

A. Transactions

(1) Journalize transaction entries

(2) Post journal transactions to ledger

(3) Unadjusted trial balance

B. Adjustments

(4) End-of-period spreadsheet

(5) Journalize adjusting entries

(6) Post adjusting entries to ledger

(7) Adjusted trial balance

C. Financial Statements

(8) Financial statements

D. Closing

(9) Journalize closing entries

(10) Post closing entries to ledger

(11) Post-closing trial balance

4 Stages to the Accounting Cycle

(1) Transactions

(2) Adjustments

(3) Financial Statements

(4) Closing