Chapter 3: The Income Statement

Objective 3.1: Describe common operating transactions and select appropriate income statement account titles.

Operating Activities

- Operating activities occur routinely and are necessary for running a business. They often have a shorter duration of effect.

- Operating activities ^^produce expenses and revenues^^ for a company.

- Examples include:

- Selling a good or service

- Buying a good or service

- Cash payments

- Receiving cash

- The transactions between a company and a customer when selling goods or services is called the operating cycle.

- ^^The order of the operating cycle is^^:

- Buying goods and services

- Paying cash to suppliers and/or employees

- Selling goods and services

- Receiving money from customers

- The journal entries for this cycle would be structured like:

- Buying goods and services

| Account Name 1 | Account Name 2 | Debit | Credit |

|---|---|---|---|

| Supplies | $ | ||

| Accounts Payable | $ |

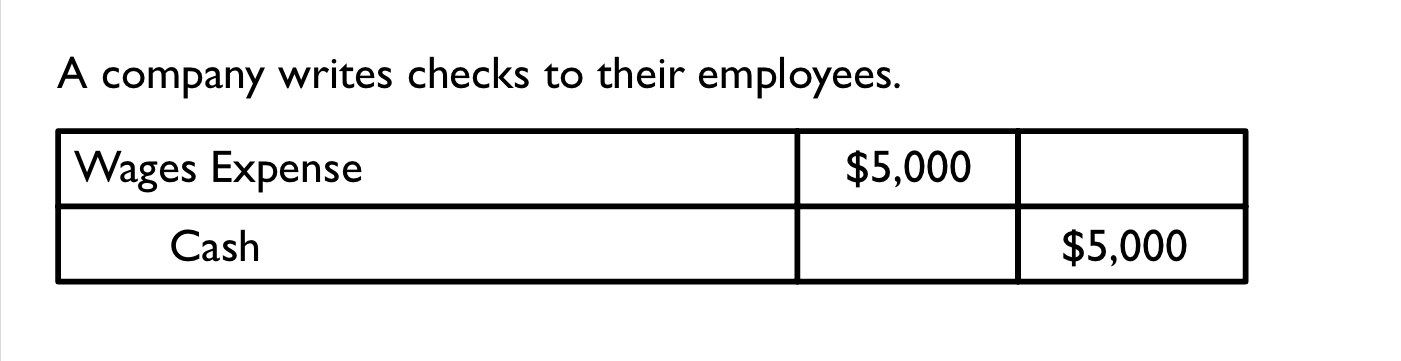

- Paying suppliers and/or employees

| Account Name 1 | Account Name 2 | Debit | Credit |

|---|---|---|---|

| Liability | $ | ||

| Cash | $ |

- Selling goods and services

| Account Name 1 | Account Name 2 | Debit | Credit |

|---|---|---|---|

| Account Receivable | $ | ||

| Revenue | $ |

- Receiving cash from customers

| Account Name 1 | Account Name 2 | Debit | Credit |

|---|---|---|---|

| Cash | $ | ||

| Accounts Receivable | $ |

The Income Statement

- The Income Statement vs the Balance Sheet

- Income Statements show the activities over a period of time (month ended, year ended)

- The accounts under an Income Statement are ^^temporary^^.

- Balance Sheets records assets, liabilities, and stockholders’ equity at specific point in time (like a snapshot)

- Accounts under the Balance Sheet are ^^permanent^^.

- Under the Income Statement, you will find:

- Revenues

- Expenses

- Net Income or Loss

- Revenues are the amount of ^^money generated^^ from selling goods or services. They are recorded when earned (doing the sale or service). Just because they are reported, does not mean they have gotten paid yet.

- Expenses are ^^costs incurred^^ from business operations. They are reported when resources are used, like supplies, land, buildings, etc.

- Net Income or Loss measures the company’s success

- To have Net Income, revenues must be greater than expenses.

- Net Income INCREASES stockholders’ equity.

- To get Net Loss, expenses are higher than revenues.

- Net Loss DECREASES stockholders’ equity.

- @@Equation to calculate net income or loss:@@

- Revenues - Expenses = Net Income or Loss

- The Income Statement uses the Time Period Assumption - Dividing the company’s long life into shorter chunks of time such as months, quarters, and years.

Cash Basis Accounting

- Cash basis accounting records revenues when cash is received and expenses when cash is paid.

- ^^Cash may not be received when something is paid “on account” or by credit^^.

- When cash is paid but not received, expenses are recorded and it creates an inaccurate representation of the company.

- When cash is received but not paid, revenues are recorded and it looks good for the company.

Objective 3.2: Explain and apply the revenue and expense recognition principles.

Accrual Basis Accounting

- In Accrual Basis Accounting, revenues are recorded when earned and expenses are recorded in the same period as correlated revenues (regardless of cash received or payment)

- Accounting standards:

- GAAP - Generally Accepted Accounting Principles

- IFRS - International Financial Reporting Standard

- Both GAAP and IFRS use accrual accounting for external reporting of income.

- The two basic accounting principles associated with accrual accounting are the revenue recognition principle and the expense cognition principle.

Revenue Recognition Principle

The Revenue Recognition Principle says that revenues are acknowledged when the good or service is provided to the customer and not when cash is received.

^^Three scenarios can apply to revenues^^.

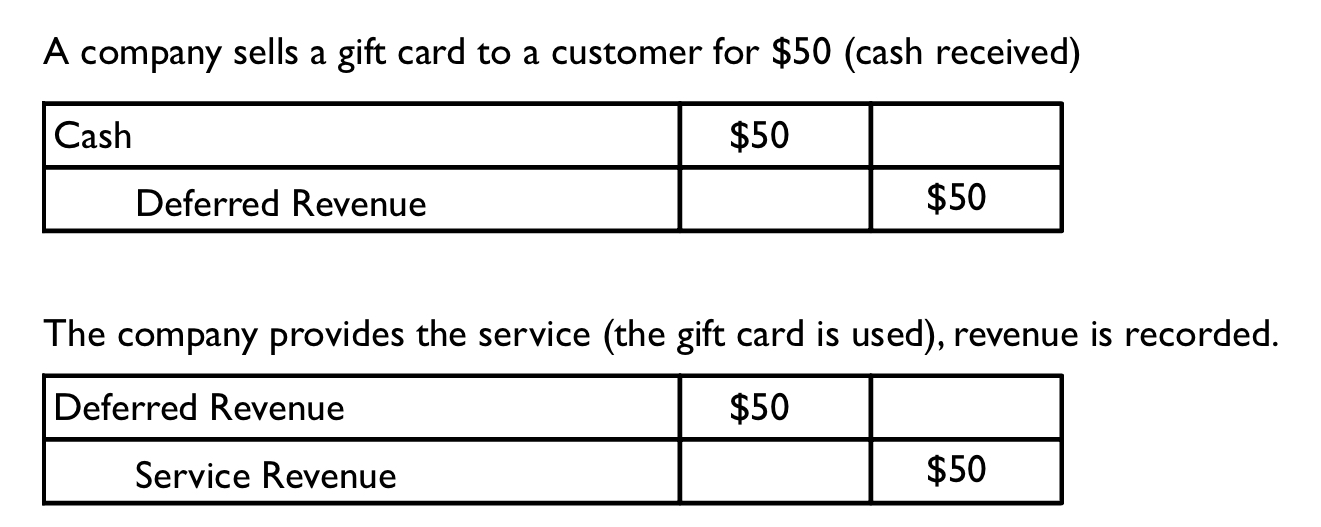

Scenario 1: Cash is received before a sale or service.

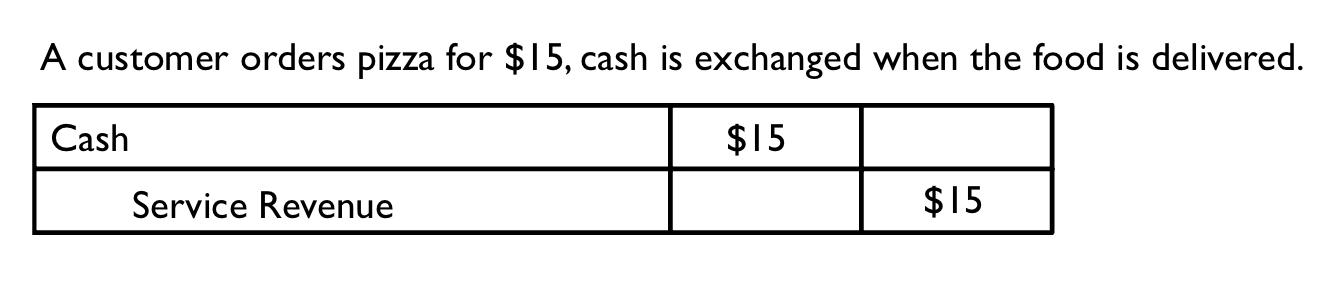

Scenario 2: Cash comes in with the sale or service.

- The cash and revenue are reported at the same time.

- ONE journal entry: An asset is debited (cash) and revenue is credited at the same time.

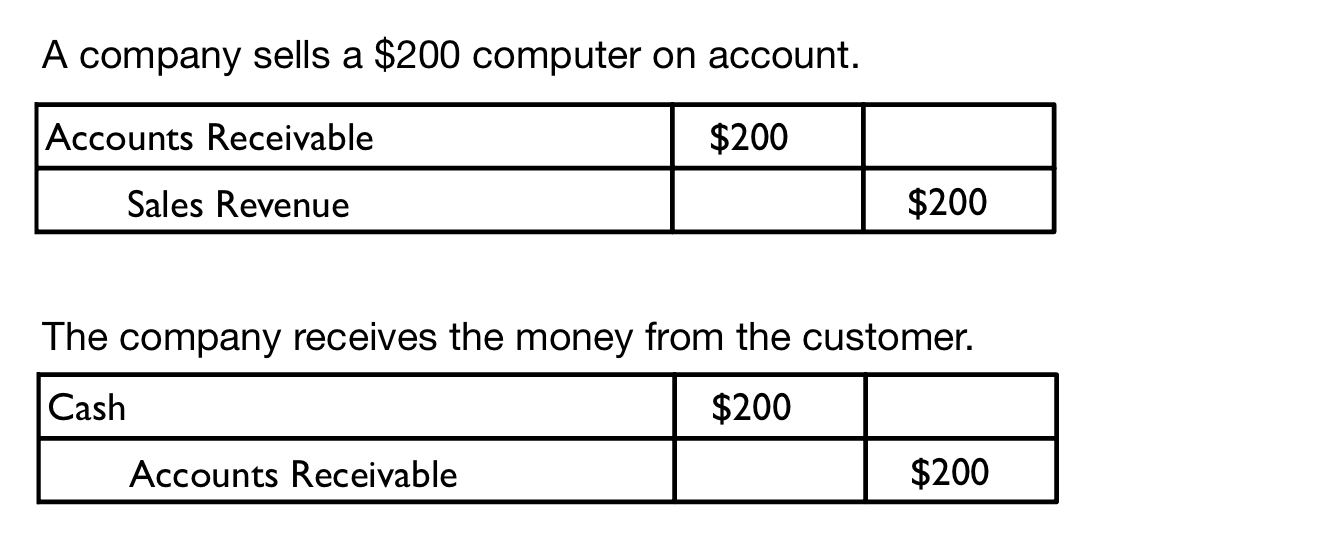

Scenario 3: The sale or service happens first and cash comes after.

- Sale/service is provided, so an asset is debited (accounts receivable) and revenue is credited.

- Cash is received, so an asset is debited (cash) and an asset is credited (accounts receivable).

Deferred Revenue is a liability on the Balance Sheet. It means you ^^promise to provide a sale or service^^.

The term “on account” means you bought a good or service without cash and ^^will owe cash to the company in the future^^.

Accounts Receivable is the right to collect cash from a customer who paid “on account”. It is an asset on the Balance Sheet.

Expense Recognition Principle

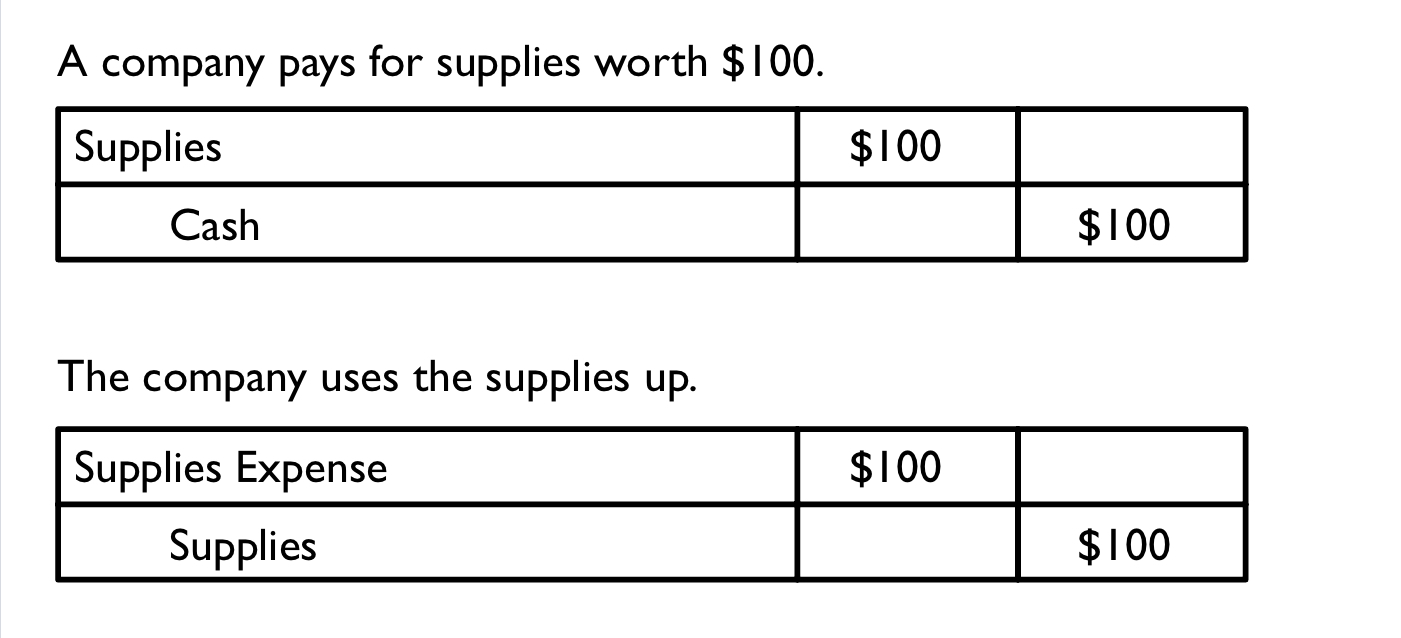

- The Expense Recognition Principle (aka “matching”) means expenses are recorded in the same period as revenues.

- An expense is recorded when an asset is used.

- ^^Three scenarios can apply to expenses^^.

- When paying for supplies, an asset is debited and an asset is credited.

- When the supplies are used up, an expense is credited and an asset is credited.

- This can apply to supplies, equipment, prepaid rent, etc.

Scenario 1: Cash is paid before the expense

Scenario 1: Cash is paid and expense is reported in the same period

- ^^Only one journal entry^^: An expense is debited and an asset is credited.

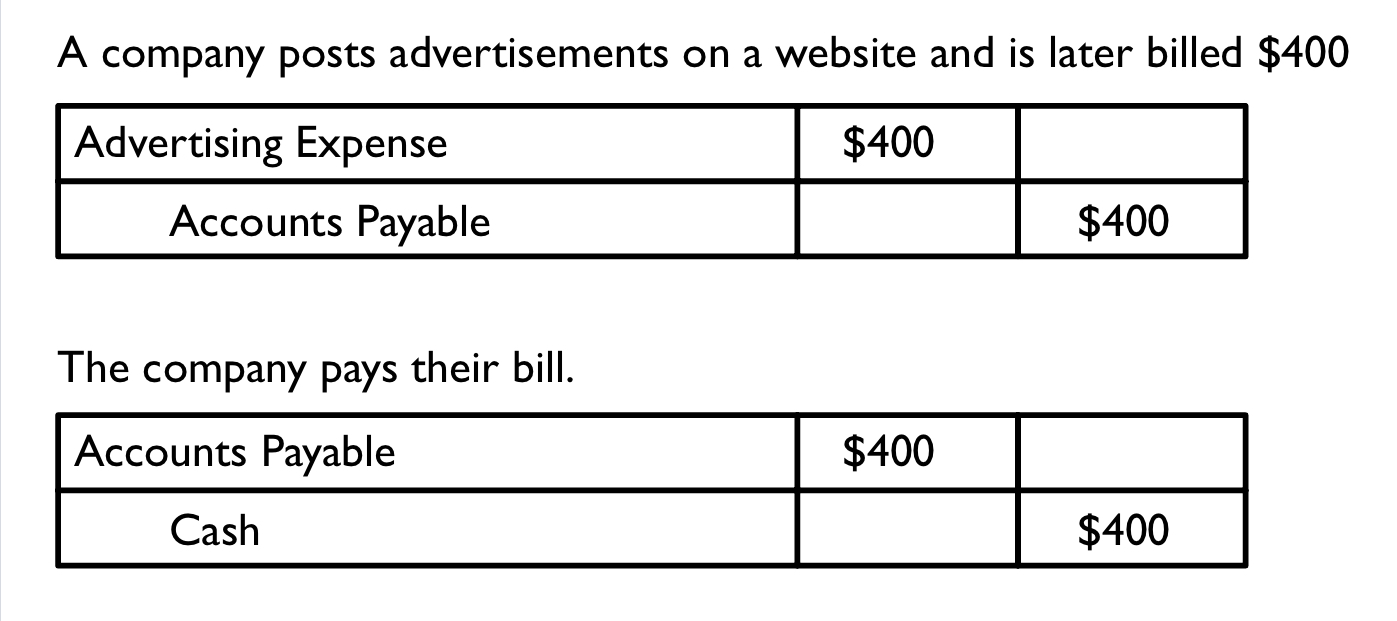

Scenario 3: Cash comes after the expense is reported

- When services are used up, an expense is debited and a liability is credited (Accounts Payable).

- When you pay cash for the service used up, the liability is debited (Accounts Payable) and the asset is credited (cash)

- Accounts Payable - A promise to pay in the future.

Objective 3.3: Analyze, record, and summarize the effects of operating transactions using the accounting equation, journal entries, and T-accounts.

The Expanded Accounting Equation

- Basic accounting equation: Assets = Liabilities + Stockholders’ Equity.

- The Expanded Accounting Equation breaks down the contents of Stockholders’ Equity.

- Stockholders’ Equity consists of Common Stock and Retained Earnings.

- ^^Retained Earnings has two subcategories^^:

- Revenues

- They have a normal credit balance (right side of T-account).

- Increases Net Income.

- Increases Retained Earnings.

- Expenses

- Expenses have a normal debit balance (left side of T-account).

- Decreases Net Income.

- Decreases Retained Earnings.

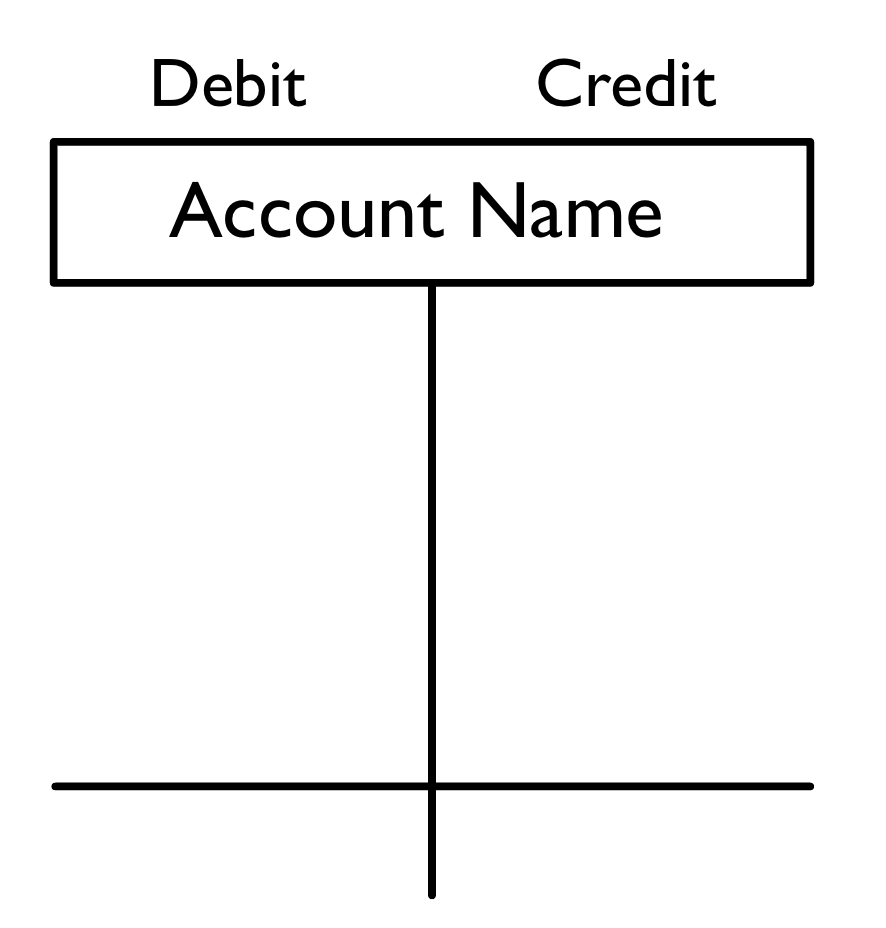

Totaling T-Accounts

Each individual T-account must have an ending balance.

T-accounts for assets, liabilities, and stockholders’ equity are totaled.

Objective 3.4: Prepare an unadjusted trial balance.

Unadjusted Trial Balance

- An adjusted trial balance makes sure debits equal credits after finding the ending balances for each account. Adjustments are made if needed.

- The totals for accounts with normal debit balances are found in the left column and the totals for accounts with a normal credit balance are found in the right column.

Objective 3.5: Evaluate net profit margin, but beware of Income Statement limitations.

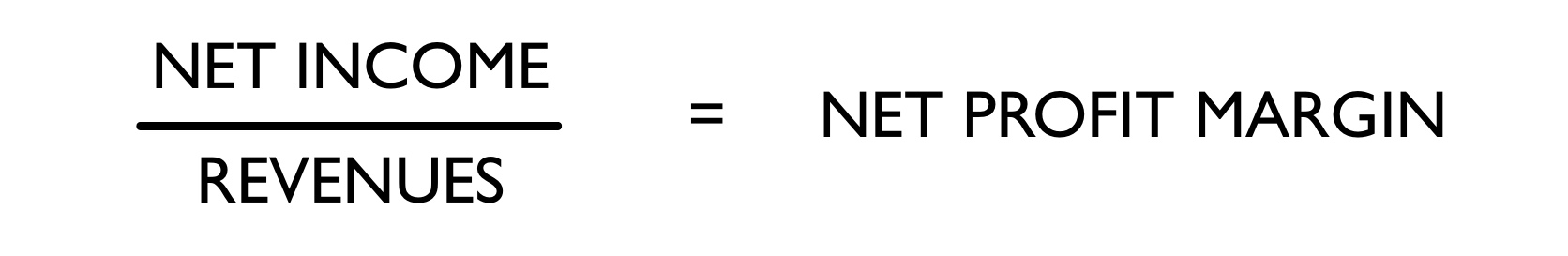

Net Profit Margin

The Net Profit Margin is the profit made from revenues.

@@Equation to calculate net profit:@@

Income Statement Limitations

- ^^Three misconceptions about the Income Statement^^:

- Net Income is NOT the cash generated by the business.

- Net Income does NOT report the change in the company’s value during the period. When assets increase and decrease during a period of time, this is not reflected in Net Income.

- Net Income is NOT exact, it is an estimate.