3. Accounting and Finance

1/161

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

162 Terms

the balance sheet, the income statement, and the statement of cash flows

The most (BLANK) assets are at the top of the balance sheet with the least at the bottom

Shows in detail how much of the firm's earnings has been retained in the business rather than paid out as dividends and how much money has been raised by issuing new shares or spent by repurchasing stock

statement of shareholders' equity

The difference between current assets and current liabilities

net current assets or net working capital

net current assets or net working capital

Shareholders' equity is equal to which is equal to

Suppose that Target borrows $500 million by issuing new long-term bonds. It places $100 million of the proceeds in the bank and uses $400 million to buy new machinery. What items of the balance sheet would change? Would shareholders’ equity change?

Cash and equivalents would increase by $100 million. Property, plant, and equipment would increase by $400 million. Long-term debt would increase by $500 million. Shareholders' equity would not change.

All items in the balance sheet are expressed as a percentage of total assets

common-size balance sheet

retained earnings is not a pile of (BLANK) that a company has built up form its past operations

cash

U.S. procedures for preparing financial statements

generally accepted accounting principles (GAAP)

net worth of the firm according to the balance sheet

book value

GAAP states that assets must be shown in the balance sheet at their

historical cost adjusted for depreciation

based on the past cost of the asset, not its current market price or value to the firm

book value

In the case of cash the difference between book value and market value is

zero

Usually the market value of fixed assets is much (BLANK) than the book value

higher

In the case of liabilities, the accountant simply records the amount of money that you have (BLANK) to pay

promised

For short-term liabilities the recorded value is generally (BLANK) to the market value of the promise

close

If interest rates rise after you have issued the debt, lenders may (BLANK) prepared to pay (BLANK) as your total debt

not be, as much

If interest rates fall after you have issued the debt, lenders may (BLANK) prepared to pay (BLANK) your total debt

be, more than

Market values of assets and liabilities do not generally (BLANK) their book values

equal

Market values measure (BLANK) values of assets and liabilities

current

The difference between book value and market value is likely to be greatest for

shareholders’ equity

Shareholders are concerned with the (BLANK) value of their shares

market

Balance sheet showing market rather than book values of assets, liabilities, and stockholders’ equity.

market-value balance sheet

market value of assets - market value of liabilities =

market value of the shareholders’ equity claim

stock price =

market value of shareholders’ equity/number of outstanding shares

It has invested $10 billion in building its new auto plant. To finance the investment, Jupiter borrowed $4 billion and raised the remaining funds by selling new shares of stock in the firm. There are currently 100 million shares of stock outstanding. Make the book-value balance sheet (in billions) if these are the Jupiter’s only assets.

Assets:

Auto plant 10

Liabilities and shareholders’ equity:

Debt 4

Shareholders’ equity 6

Investors are placing a market value on Jupiter’s equity of $7.5 billion ($75 per share times 100 million shares). We assume that the debt outstanding is worth $4 billion. Make the market-value balance sheet (in billions) if these are the Jupiter’s only assets.

Assets:

Auto plant 11.5

Liabilities:

Debt 4

Shareholders’ equity 7.5

the market value of the assets must be equal to the market value of the (BLANK) plus the market value of the

liabilities, shareholders’ equity

Thus, in contrast to the balance sheet shown in the company’s books, the market-value balance sheet is (BLANK). It depends on the profits that investors (BLANK) the assets to provide

forward-looking, expect

Financial statement that shows the revenues, expenses, and net income of a firm over a period of time

income statement

Earnings before interest and taxes (EBIT) =

total revenues - costs - depreciation

All items on the income statement are expressed as a percentage of revenues

common-size income statement

Cash payments are dividend into two groups which are (BLANK) which include wages and (BLANK) which include the purchase of new machinery

current expenditures, capital expenditures

Current expenditures are (BLANK) from current profits

deducted

when calculating profits, the accountant does not deduct the (BLANK) on new equipment that year, even though cash is paid out. However, the accountant does deduct (BLANK) on assets previously purchased, even though no cash is currently paid out.

expenditure, depreciation

matches revenues with expenses so that goods paid for are treated as an investment and when the goods are taken out of inventory they are reduced from inventory

accrual accounting

In the United States, firms may maintain two sets of accounts, one for (BLANK) and one for (BLANKS)

reporting, taxes

Cash outflow =

cost of goods sold + change in inventories

Cash inflow =

sales shown in the income statement - change in uncollected bills

cash outflow in each period =

is equal to the cost of goods sold that is shown in

the income statement + change in inventories

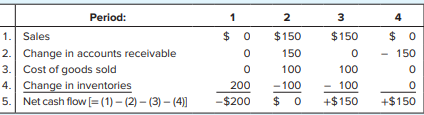

Consider a firm that spends $200 to produce goods in period 1. In period 2, it

sells half of those goods for $150, but it doesn’t collect payment until one period

later. In period 3, it sells the other half of the goods for $150, and it collects

payment on these sales in period 4. Calculate the profits and the cash flows for

this firm in periods 1 to 4.

y

Financial statement that shows the firm’s cash receipts and cash payments over a period of time

statement of cash flows

cash generated from ormal business activities

cash flow from operations

cash that has been invested in plant and equipment or in the acquisition of new

businesses.

cash flows from investments

cash flows such as the sale of new debt or stock

cash flows from financing activities

The three sections of the statement of cash flows are

1. Cash provided by operations

2. Cash flows from investments

3. Cash provided for (used by) financing activities

Any additions to current assets (other than cash itself) need to be (BLANK) from (BLANK) because these absorb cash but do not show up in the income statement

subtracted, net income

Any additions to current liabilities need to be (BLANK) to (BLANK) because these release cash

added, net income

interest is usually included in statement of cash flows in the

cash flow from operations

When there are discrepancies between statements to understand movements in cash, you will want to focus on the company’s

statement of cash flows

Would the following activities increase or decrease the firm’s cash balance?

a. Inventories are increased.

b. The firm reduces its accounts payable.

c. The firm issues additional common stock.

d. The firm buys new equipment

a. decrease

b. decrease

c. increase

d. decrease

Cash flow available for distribution to investors after firm pays for new investments or additions to working capital

free cash flow (FCF)

Free cash flow =

interest payments to debt investors + shareholders’ operating cash flow - capital expenditures

Security analysts forecast

earnings per share

U.S. accounting rules, GAAP, are spelled out by the

Financial Accounting Standards Board (FASB)

Companies that investors worry about the fact that seem particularly prone to inflate their earnings by playing fast and loose with accounting practice are referred to as having

low quality earnings

Some examples of ambiguities in accounting rules that have been used by companies to conceal unflattering information:

1. Revenue recognition

2. Cookie-jar reserves

3. Off-balance sheet assets and liabilities

When you tell your cusomters that the price of your product may rise in the new year and suggest that they place an extra order. This increases this year’s sales at the expense of next year’s sales. This practice is known as

channel stuffing

Many companies have been thought to use channel stuffing to overstate their

earnings, but very blatant instances are liable to attract the

SEC

refer to an accounting practice where companies create artificial reserves during profitable periods to offset potential losses or smooth out earnings in less profitable periods

Cookie-jar reserves

When Enron created and placed paper firms—so-called special-purpose entities (SPEs)—in the middle of its transactions to exclude liabilities from its financial statements.

off-balance sheet assets and liabilities

The International Financial Reporting Standards (IFRS), are set by the London-based

International Accounting Standards Board (IASB)

For some years, the SEC has worked to bring U.S. accounting standards more in line with

international rules

IFRS tend to be “(BLANK),” By contrast, in the United States, GAAP are accompanied by thousands of pages of prescriptive regulatory guidance and interpretations from auditors and accounting groups.

principles-based

In response to these scandals, Congress passed the (BLANK), widely known as SOX.

Sarbanes-Oxley Act

SOX created the (BLANK) to oversee the auditing of public companies; it banned accounting firms from offering (BLANK) to companies whose accounts they audit; it prohibited any individual from heading a firm’s (BLANK) for more than (BLANK) years; and it required that the board’s audit committee consist of directors who are (BLANK). Sarbanes–Oxley also required that (BLANK) certify that the financial statements present a fair view of the firm’s financial position and demonstrate that the firm has adequate controls and procedures for financial reporting.

PCAOB, other services, audit, five, independent of the company’s management, management

Managers and investors worry that the costs of SOX and the burden of meeting detailed, inflexible regulations are pushing some corporations to return from public to

private ownership

Some blame SOX and onerous regulation in the United States for the fact that an increasing number of foreign companies have chosen to list their shares (BLANK) rather than New York

overseas

The United States follows a (BLANK) approach, with detailed rules governing virtually every circumstance that possibly can be anticipated. In contrast, the European Union takes a (BLANK) approach to accounting.

rules-based, principles-based

Europe and the United States have been engaged for years in attempts to (BLANK) their systems, and many in the United States have lobbied for the greater simplicity that principles-based accounting standards might offer. These efforts in recent years have effectively (BLANK)

coordinate, stalled

passed in December 2017, reduced the corporate tax rate

The U.S. Tax Cuts and Jobs Act

When firms calculate taxable income, they are allowed to deduct (BLANK). These (BLANK) include an allowance for (BLANK)

expenses, expenses, depreciation

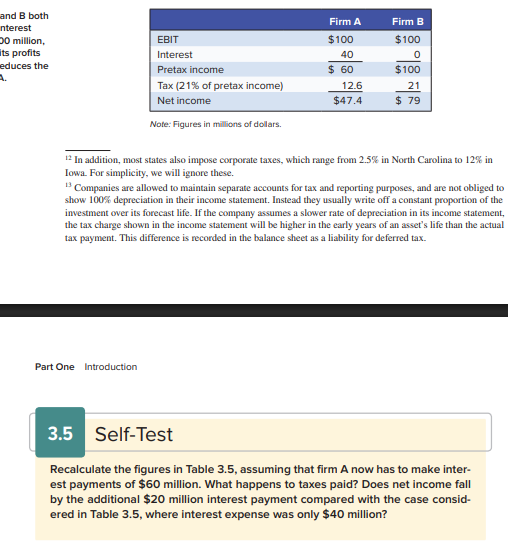

The company is also allowed to deduct (BLANK) paid to debtholders when calculating its taxable income, but (BLANK) paid to shareholders are not deductible

interest, dividends

Dividends are paid out of

after-tax income

Interest payments (BLANK) corporate taxes

reduce

Calculate

Pretax income: $60, $100

Tax: $12.6, $21

Net income: $47.4, $79

The bad news about taxes is that each extra dollar of (BLANK) increases taxable income by $1 and results in 21 cents of extra taxes. The good news is that each extra dollar of (BLANK) reduces taxable income by $1 and therefore reduces taxes by 21 cents

revenue, expense

Most states also impose

corporate taxes

Companies are not obliged to show 100% depreciation in their income statement. Instead they usually write off a (BLANK) of the investment over its forecast life

constant proportion

If the company assumes a slower rate of depreciation in its income statement, the tax charge shown in the income statement will be (BLANK) in the (BLANK) years of an asset’s life than the actual tax payment. This difference is recorded in the balance sheet as a (BLANK) for (BLANK).

higher, early, liability, deferred tax

Taxes owed by firm A fall from $12.6 million (when debt was $40 million) to $8.4 million. The reduction in taxes is 21% of the extra $20 million of interest expense. Net income does not fall by the full $20 million of extra interest expense. It instead falls by interest expense less the reduction in taxes, or $20 million − $4.2 million = $15.8 million.