Paper 1: Theme 3 - Business behaviour and the labour market

1/62

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

63 Terms

A firm

A firm is a production unit that transforms resources into goods and services

Reasons why some firms tend to grow:

Increase market share

Benefit from greater profits

Increase economies of scale

Gain power to prevent potential takedowns by larger businesses

What is the principal-agent problem

The principal is the shareholder/owner of the business, while the person in charge of the day-to-day runnings is the agent.

A private-sector firm

Those that are not owned by the government

A public sector firm

A firm that is owned by the government, either because they could not survive without significant state funding or the government wishes to determine the direction the business takes.

Organic/internal growth

Achieved by investment within the firm by the firm, expanding the scale of operations and gaining market share

Advantages/Disadvantages of organic growth

Lowest-risk form of growth

Control of the firm remains unchanged

Good for worker’s morale as there will be more job opportunities within the firm

Tends to be slow

Building on the existing knowledge of current employees = people might be unaware of or unwilling to take on new innovations

Inorganic growth

Through the horizontal/vertical integration of firms

Horizontal integration

Merger of two firms at the same stage of production

Advantages/Disadvantages of horizontal integration:

Increased market share

Reduced competition

Economies of scale

Risks - too many eggs in one basket

Weakening/ ‘dilution’ of brand name

unknown costs

Diseconomies of scale

Conglomerate integration

Merger between firms in unrelated industries

Constraints on business growth

Regulation: licenses and patents

Marketing barriers: imposed by businesses currently operating in the market. failed marketing investment is sunk costs

Pricing barriers: limit and predatory pricing

Technical barriers: some firms have such large economies of scale that no small firm can have a competitive price. to compete, the new firm would have to operate on the same scale - but then there’d be so much supply that profit would be eroded

Size of the market: niche market won’t support expansion

Lack of resources: growth may be beyond the owner’s knowledge, expertise or funds

Already operating at Minimum Efficient Scale

Owner objectives: not worth the lost leisure time or risk of investing money

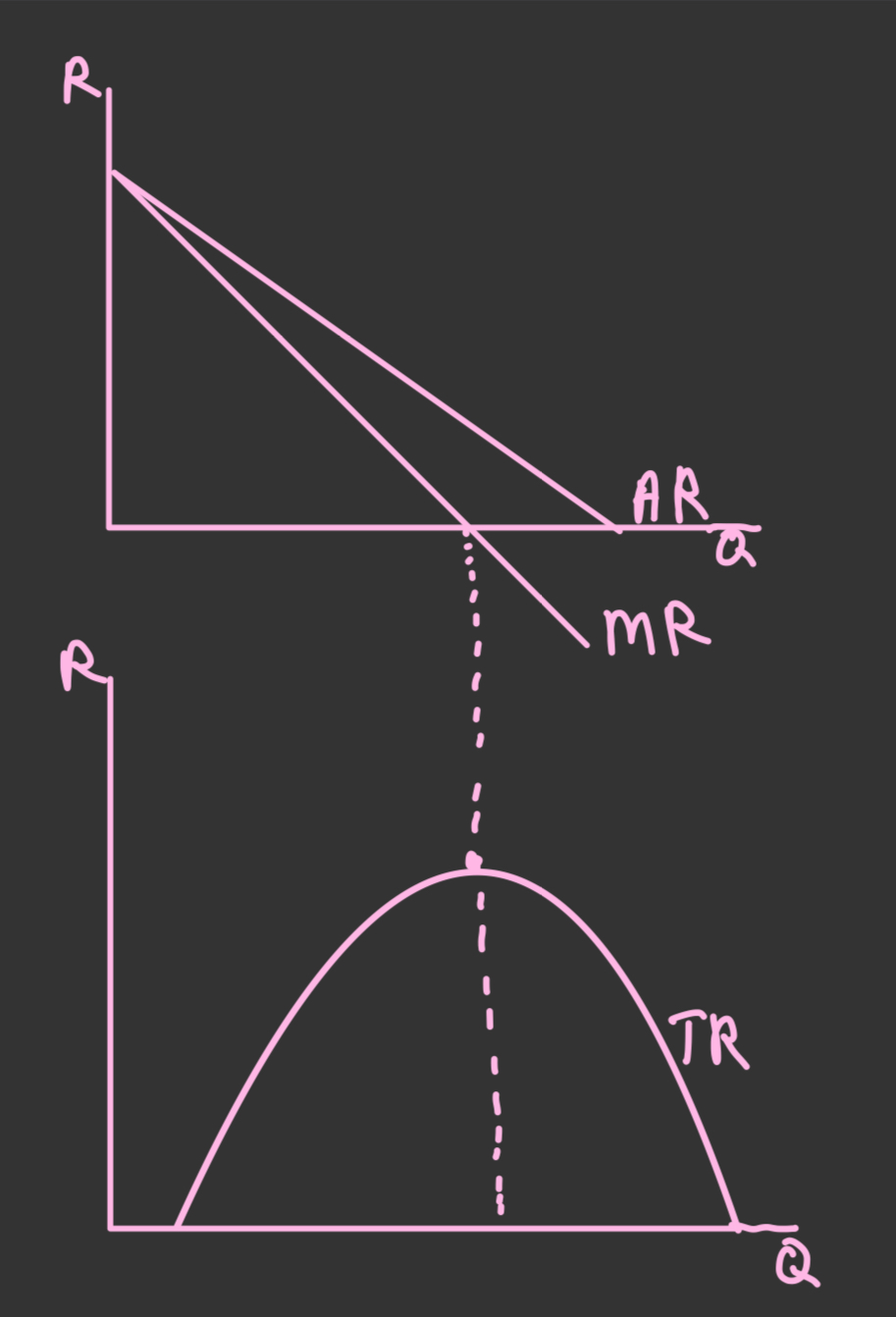

Total revenue

The amount the firm recieves from all its sales over a certain period

TR = price x quantity

Average revenue

How much people pay per unit (price) and also the demand curve

Total revenue

——————- = AR

Quantity

Marginal revenue

The revenue associated with each additional unit sold, i.e. the change in total revenue from selling one more unit/

Is the gradient of the total revenue curve

PED

% change in QD

———————- = PED

% change in P

Calculate percentage change

New value - Old value

—————————— = % change

Old value

Short run

The time period in which at least one factor of production is fixed

Fixed costs

Costs that do not vary with output

These can occur in the short run only

Total cost

All the rewards to the factors of production: wages, rent, interest, normal profit

Average cost

Average cost per unit of output

Marginal cost

The change in total cost when one additional unit of output is produced.

change in total cost / change in quantity

Economies of scale

A fall in long-run average costs as output increases

Internal v.s. External economies of scale

Internal: Occur when an individual firm expands

External: Have an impact on the entire industry, lowering the Long Run Average Cost curve

Types of internal economies of scale:

Financial economies: as a firm grows, it’s more able to access loans at a low cost

Risk-bearing economies: wider customer base and range of products minimise risk

Marketing economies: as a firm expands its product range, it is able to use any central brand marketing to advertise the range

Relationship between short-run and long-run average cost curves

The LRAC is made up of many SRACs joined together at their lowest points

Profit maximisation

Occurs where MC = MR, and MC is rising

It is where the firm maximises profits or minimises losses

Revenue maximisation

When MR = 0

Occurs when a firm seeks to make as much revenue as possible

Sales maximisation

AR = AC

When a firm maximises sales of its output while still achieving normal profit

Allocative efficiency / welfare maximisation

Producing where P = MC, maximising producer and consumer surplus

When goods are produced in a way that maximises overall societal welfare and utility

Productive efficiency

Occurs at the lowest point on the AC curve

Producing goods and services at the lowest possible cost

Dynamic efficiency

The ability of a firm to innovate and adapt to new technologies and techniques over time

X-inefficiency

Occurs when the average cost is higher than the lowest possible average cost - the firm is operating above the AC curve

Satisficing

When a firm aims to make a minimum accepted level of profit and then pursues other aims

Predatory pricing

Pricing below costs to drive out other firms.

Firm makes a loss in the short run, but as the other firms leave the prices are raised higher as theres less competition.

This is an anti-competitive practice and can lead to fines by competition authorities

Limit pricing

Pricing at a level low enough to discourage entry of new firms

Exploits economies of scale that an incumbent firm has, and is not necessarily illegal in the UK

Cost-plus pricing

Making a fixed percentage mark-up on average costs

Methods of non-price competition:

Advertising

Branding - loyalty cards

Customer service

Packaging - free gifts

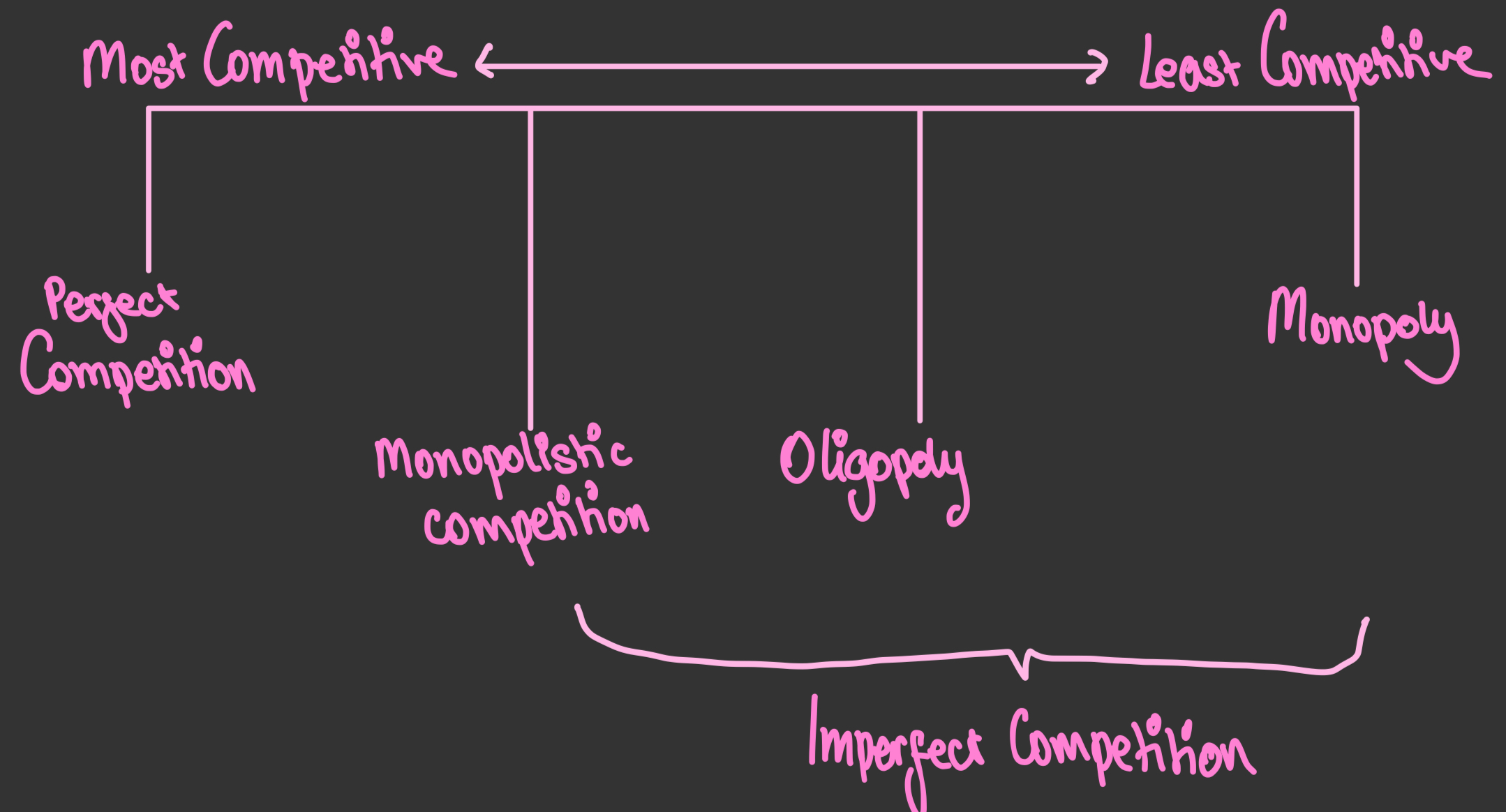

What are the four models of market sellers?

Concentration ratio

The market share controlled by the ‘n’ largest firms - e.g. four firm concentration ratio

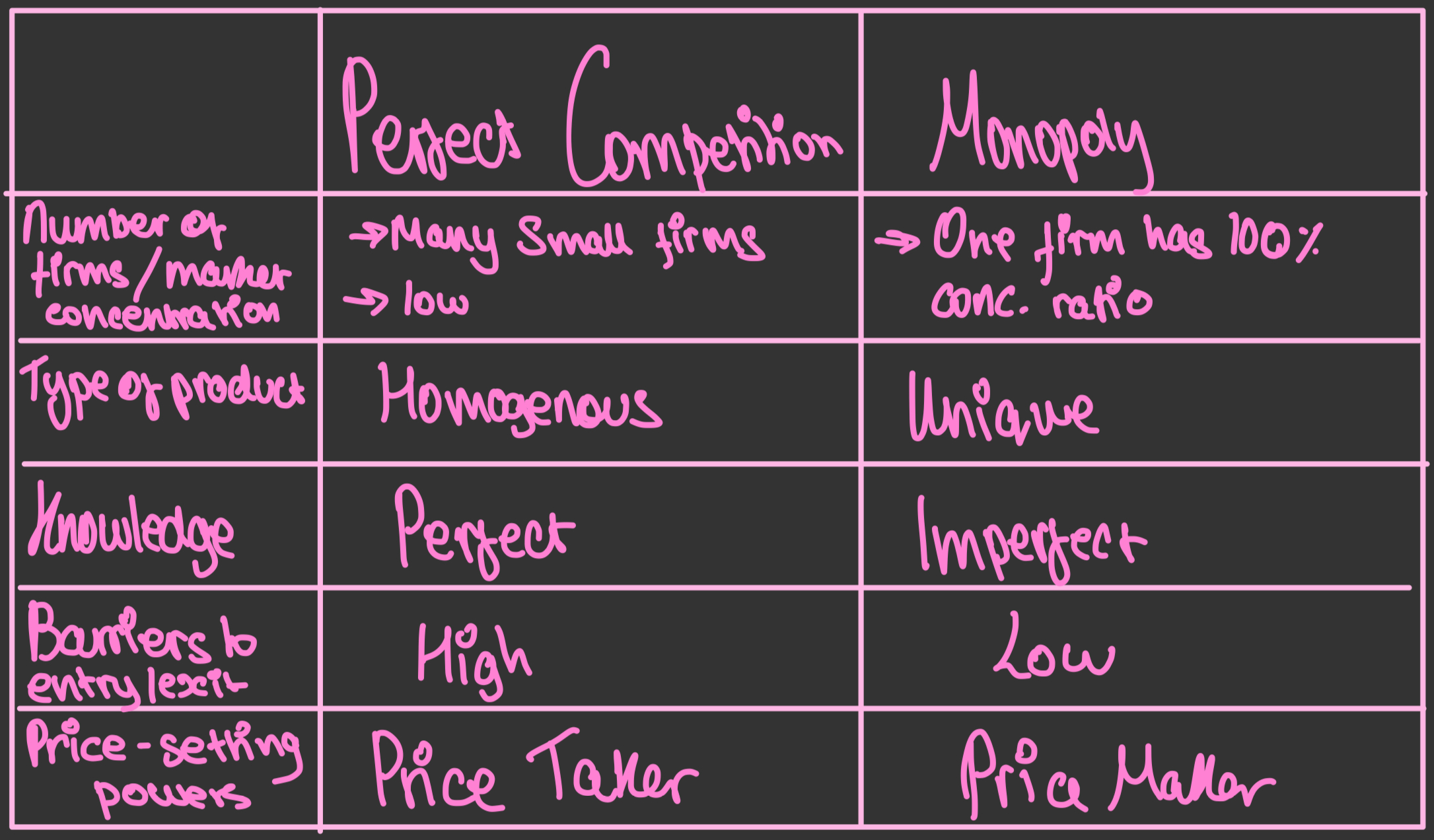

Perfect competition VS Monopoly

When does the shutdown point of a firm occur

When the firm is no longer covering Average Variable Costs

Monopolistic Competition

A market with many small firms that supply goods that are slightly differentiated, allowing them some price-setting powers

Oligopoly

A market dominated by a few large firms - often associated with interdependence and collusion

Interdependence

The actions of one firm in an industry will impact on the other firms in the industry

Why is there low price competition in oligopolies?

If one firm were to lower prices, the others would follow, and they would lose revenue from the price war that would ensue

Collusion

An agreement between two or more firms to limit competition and work together to fix prices and avoid price wars

Overt collusion VS tacit collusion

Overt collusion: when firms openly fix prices, output, marketing, or the sharing of customers

Tacit collusion: implicit collusion with maybe no spoken agreement

Price fixing

Firms coming together to ensure that prices remain stable, thus avoiding price competition

Advantages of monopoly power:

Supernormal profit means:

finance for investment and Research and Development

Firms can create savings to overcome difficulties = job stability for employees

Monopoly power means firms will have the financial power to match large overseas competitiors

May be able to take the best advantage of economies of scale

Disadvantages of monopoly power:

Supernormal profit means less incentive to be efficient and innovative

More ability to raise barriers to entry, e.g. exerting pressure on suppliers that rely on the monopoly

Higher prices and lower output

May waste resources by undertaking cross-subsidisation, using profits from one sector to finance losses in another

Price discrimination

The sale of the same good to two different markets at different prices

Under what conditions will price discrimination be successful?

There are high barriers to entry and a degree of monopoly power

There are at least two seperate markets with differing price elasticities of demand

The markets can be kept separate at a cost that is lower than the gain in profits.

This is to prevent resale between the markets

Natural monopoly

One that exists when an industry can only support one firm

When an industry has high sunk costs and requires very large levels of output to exploit economies of scale

Sunk costs

Costs that a firm cannot recover, e.g. advertising

Monopsony

Where there is a sole buyer of a good. Firms can use these powers to exploit their suppliers and drive down prices

Advantages and disadvantages of monopsony

Lower prices are passed on to consumers

Quality may be better than perfect competition - buyers can be extremely picky

Monopsony power may balance out monopoly power - monopoly charges a high price, monopsony forces them to drive the price back down

Contestable market

A market with low sunk costs and therefore low barriers to entry and exit.

Nationalisation

Refers to the process by which the government takes ownership of a private company or industry

Advantages of nationalisation:

Public interest: essential services such as healthcare and education operated for public interest instead of private profit

Social equality: when certain industries owned and operated by the state, the benefits generated can be more evenly distributed among the population

Service quality: less focus on profits = more focus on quality

Job security: people argue that private companies prioritise profits over job security

Disadvantages of nationalisation:

Inefficiency and bureaucracy: State-owned enterprises lack the incentives for innovation and cost-effectiveness

Risk aversion: due to the lack of direct compeitition and guarantee of government support. This can hinder entreprenaurial spirit and potential rewards

Misallocation of resources: without the price mechanism

Competitive tendering

The process by which a number of private sector firms compete to win the right to perform a task on behalf of the government. They will charge the government for the particular task and seek to make a profit.

What are two types of market failure from labour:

Geographical immobility: Occurs when people cannot relocate to another part of the country to take up job opportunities

Occupational immobility: When workers are unable to change jobs due to a lack of skills or training