corporations and financial analysis accounting

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

sole proprietorship

1 owner: 1 capital, 1 drawings account

partnership

2 or more owners: each partner has a capital and drawings account

corporation

separate legal entity owned by shareholders/stockholders

characteristics of corporations

unlimited lifespan (can change owners, business doesn’t stop if an owner dies)

corp. can own property, sue others, enter into legal contracts just like people

pay separate income taxes (usually lower than most income taxes)

corporation: type of ownership

limited liability (if a business has debts, the owner can’t be personally responsible for paying them)

shareholders can only lose up to the amount theyve invested

requirements for owning a corporation

must have 50% of investments + 1 of the shares

typical common shareholders’ rights

allowed one vote per share for board of directors

may receive dividends (part of company’s income)

may receive assets during liquidation (owners only get paid after liabilities)

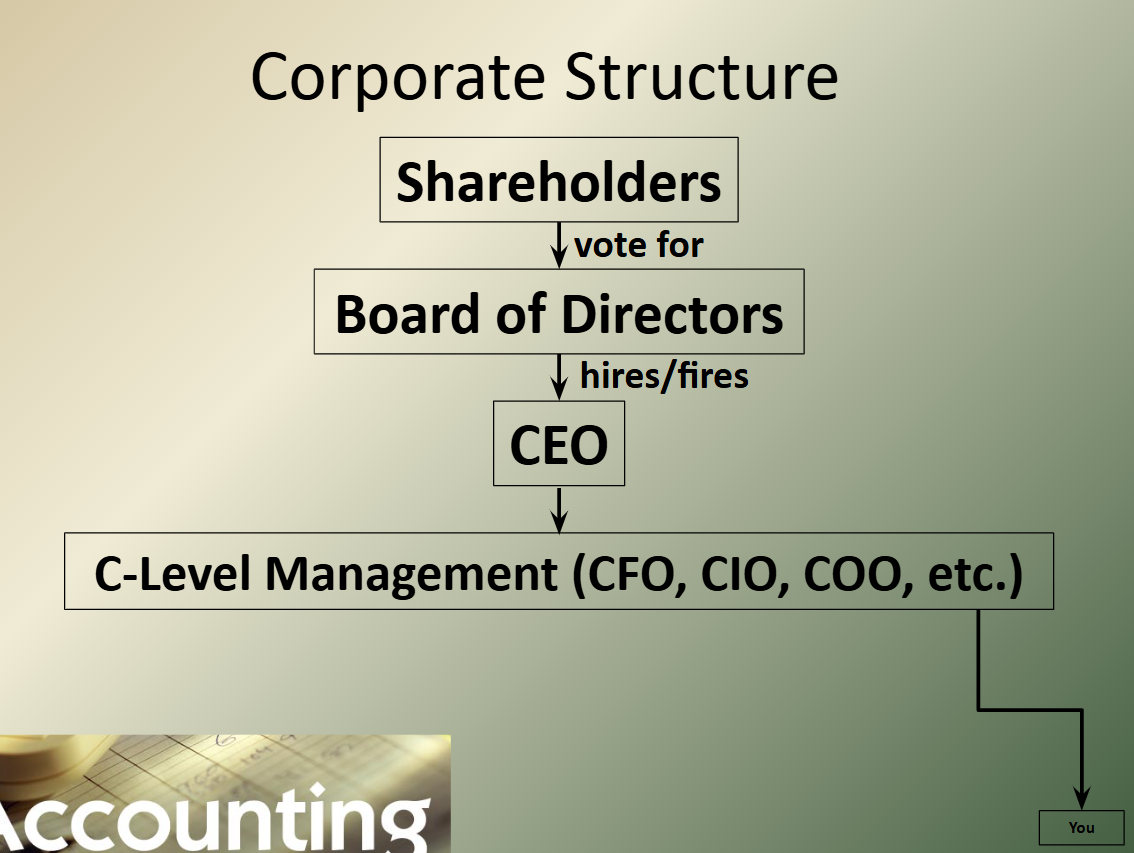

board of directors

small group of advisors who meet 4x per year to discuss business. chairman of board is usually the CEO, the directors can be past CEOs, founders, or not related to business at all

meant to represent shareholders’ interests

corporate structure (img)

private corporation

has shares that are controlled (cant simply be bought/sold)

typically formed to take advantage of limited liability and is a small/medium business

public corporation

has shares that are freely traded on public stock exchanges

typically are public to get a large increase in cash from selling shares

only public corps are required by law to publish financial statements

limited liability

legal status in which a persons liability is limited to a fixed sum (the value of someones investment)

diff. between director and company officer/executive?

a director oversees the broader strategic direction and governance, while company officers (like a CEO or CFO) handle the day-to-day operational management

corporation equity

NO CAPITAL OR DRAWINGS ACCOUNTS!

share capital: money obtained through initial sale of stock

retained earnings: all income and losses since incorporation, minus dividends (in other words: all the earnings a company has RETAINED after paying off dividends)

selling new shares (journal entry)

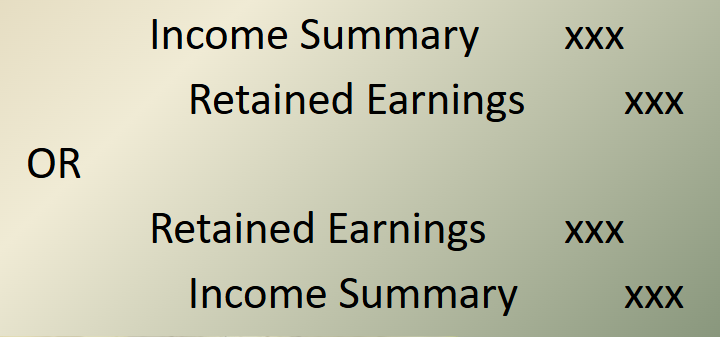

net income/loss

recorded in closing entries to income summary, then to retained earnings

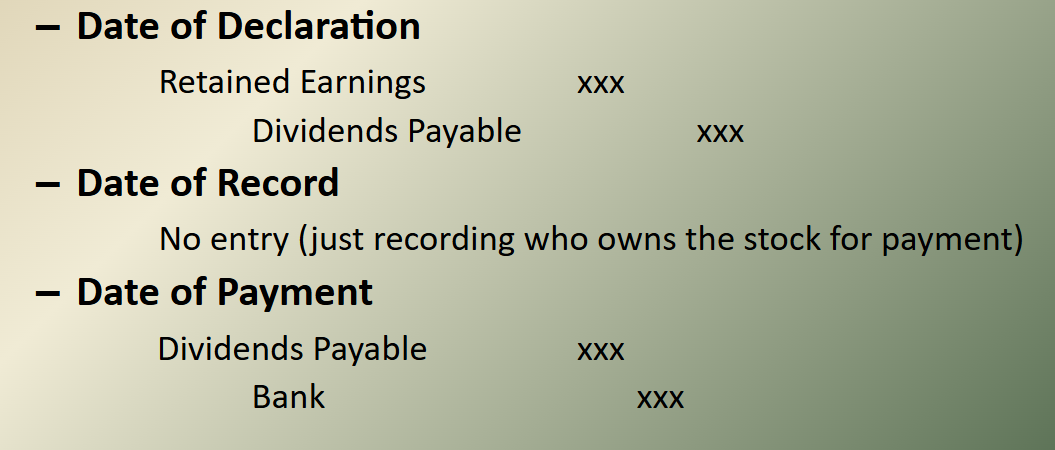

what happens when a board elects to pay dividends? (3 dates involved)

date of declaration: board “declares” (commits) to the dividend payment

date of record: company will pay dividend to whoever owns shares on this date

date of payment: company pays the dividend

journal entries for dividend payments

preferred vs common shares

may issue multiple types of common shares/preferred shares to raise additional money

preferred shares do not have voting rights, but are guaranteed a dividend before common shareholders

retained earnings formula

RE at end of year = previous RE + profit/loss - dividends

cash flow

the total amount of money being transferred into and out of a business. cash flow =/= profit

cash flow statement

shows inflows (positive) and outflows (negative) of cash (cash flow). helpful for investors to see how the company handles money/earning profit

cash flow statement sections

operating activities, investing activities, financing activities

operating activities

related to normal, daily operations (selling goods/services and paying expenses)

investing activities

related to long-term assets (buying and selling plants, land, etc) can be related to investing in other companies’ stocks and bonds as well

financing activities

related to borrowing and paying loans, or selling stocks or bonds (for corporations)

cash flow analysis

removes certain “paper” expenses or events (like depreciation)

looks at the 3 main sections to determine if the business is able to pay its bills on its own, if it’s expanding, if it has a lot of debt, etc.

operating activities: pos or neg?

should be positive (business is bringing in more cash through sales than is spending. higher number = better)

investing activities: pos or neg?

negative suggests growth (buying more assets to invest in success) but positive may be good or bad (could be selling old assets, securities)

financing activities: pos or neg?

only concerning if results suggest this is primary inflow for cash (which would mean company is relying on loans/not generating enough money on its own)

3 primary types of financial analysis

horizontal (comparative), vertical (common size), ratio

need other company’s data / industry averages to tell if company is doing well or not, especially for ratios

horizontal (comparative) + formula

allows us to see how each account has changed in the past year

Can compare growth in one line to another (i.e. Gross Profit vs Net Income before Taxes)

Used to compare company’s growth to other companies

formula: (Year 2 – Year 1) / Year 1 x 100%

vertical (common size) + formula

allows us to compare companies to each other (eg. coke to apple)

base number for balance sheet is total assets, for income statement its net sales

Shows where the company spends / invests money – critical assets/ largest expenses/etc.

Used to compare a company’s allocation of money to other companies

formula: (Line Item) / (Base Number) x 100%

ratio (in financial analysis)

gives very specific information about a company

2 primary types: liquidity (how easily company can pay debts) and profitability (how capable company is of earning profit)

Often used to compare companies to industry averages

liquidity ratios: current ratio

(Total Current Assets) / (Total Current Liabilities)

compares current assets with immediate debt (how easily can we pay debt through normal operations?)

measures company’s ability to pay off short-term liabilities

what do too low (<1) and too high (>3) liquidity ratios mean?

too low: difficulties in meeting short-term obligations (not enough assets)

too high: inefficient use of assets (like holding too much idle cash/inventory)

liquidity ratios: debt ratio

(Total Liabilities) ÷ (Total Assets) x 100%.

shows % of company’s assets that are financed by debt (how much of the business is “owed” to outsiders)

<50% preferred

liquidity ratios: equity ratio

(Total Equity) ÷ (Total Assets) x 100%

% of assets financed by owners (shareholders) rather than borrowed. >50% preferred

reflects financial independence + sustainability of the company

profitability ratio: return on net sales/net profit margin

(Net Income) ÷ (Net Sales) X 100%

tells you what % of revenue being generated that the company keeps as profit after covering all expenses

It shows how efficient and profitable a company is.

It allows comparisons across companies or time periods.

It helps investors and analysts assess cost control and pricing strategy.