Income statement part 2

1/40

Earn XP

Description and Tags

lecture 5

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

What does depreciation show

a way of showing how non-current assets lose value over time

why do we need to know about depreciation

most non-current assets have a finite life because they get used to generate wealth for the business

what does depreciation attempt to do?

measure the proportion of non-current asset used to generate the revenue for the current period

is depreciation cash or not?

it is a non-cash expense

how often is depreciation recorded in the income statement

annually

what do we need to know to calculate the annual depreciation expense? (4)

the purchase cost of the asset

the useful life of the asset

the residual life of the asset

the depreciation method to be used

what are the two most common methods to measure depreciation?

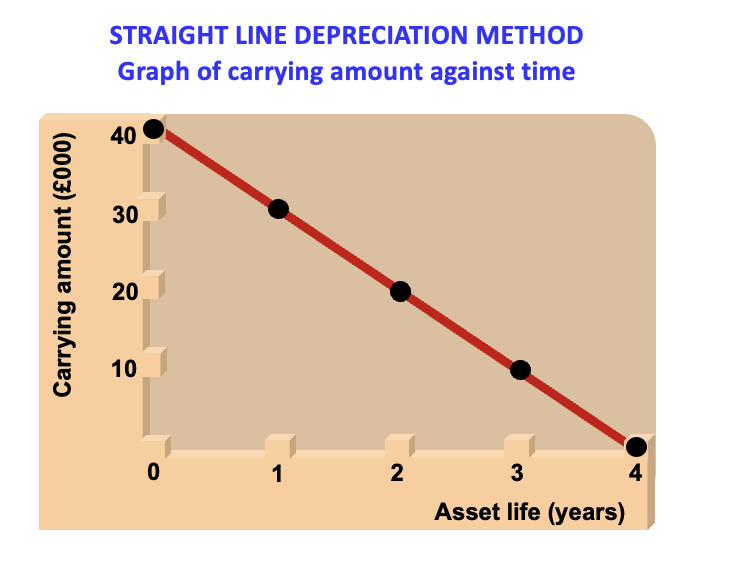

straight line method

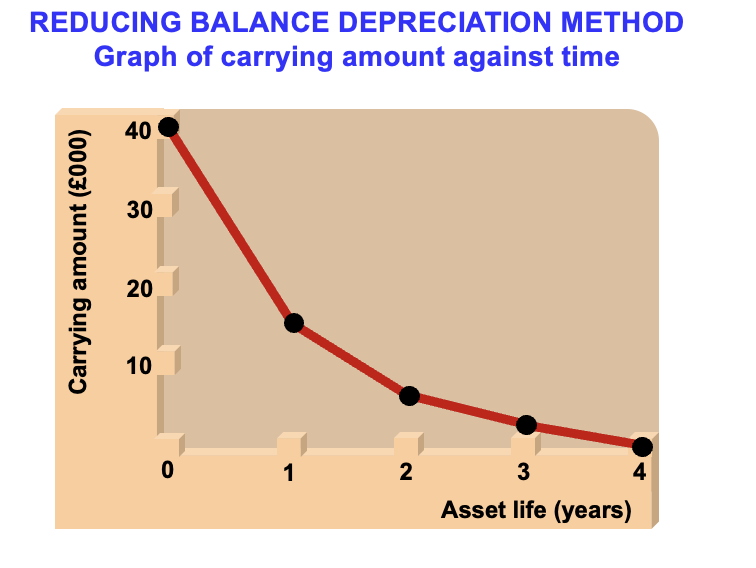

reducing balance method

how do we do the straight line method and van example?

deduct the same amount each year

e.g. cost of van is £12,000, useful life is 5 years, residual value is £2000

depreciation charge = 12,000-2000 = 10,000/5 = 2000 each year

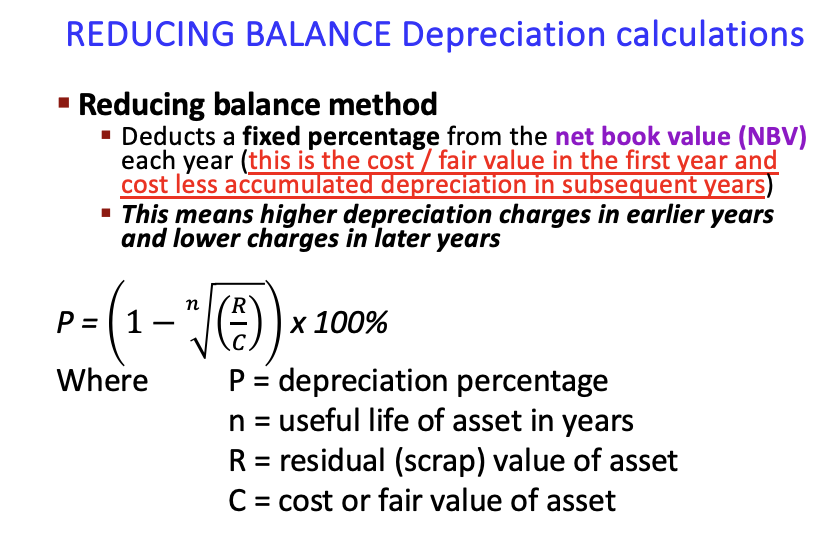

how do we do the reducing balance method?

deduct same % every year, but you deduct from a reducing amount each year e.g. in year 1 you deduct 30% of 10,000 but in year 2 you deduct 30% of 7000

straight line method graph

reducing balance method graph

formula for straight line method?

cost - residual value/number of expected years’ life

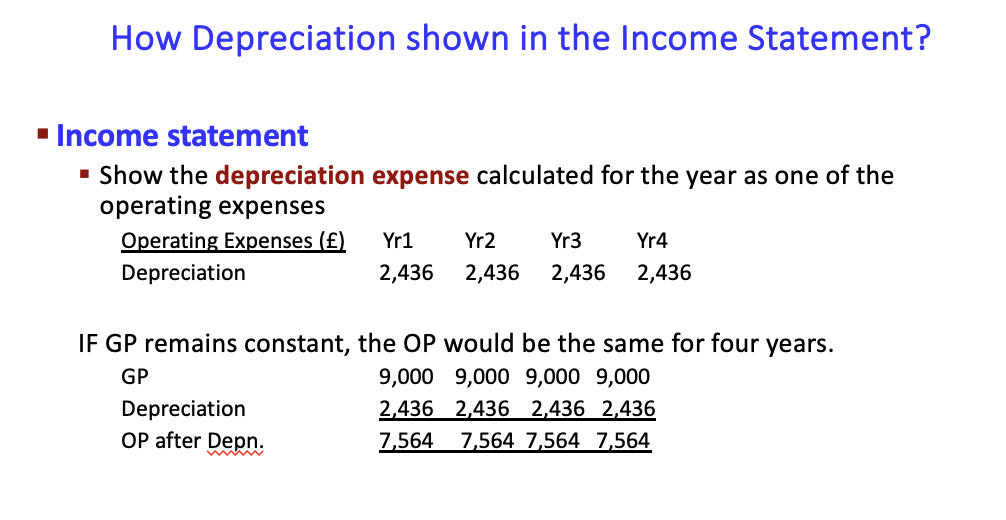

what is GP?

gross profit

what is OP?

operating profit

what list does depreciation come under?

operating expenses

how is it shown in the income statement?

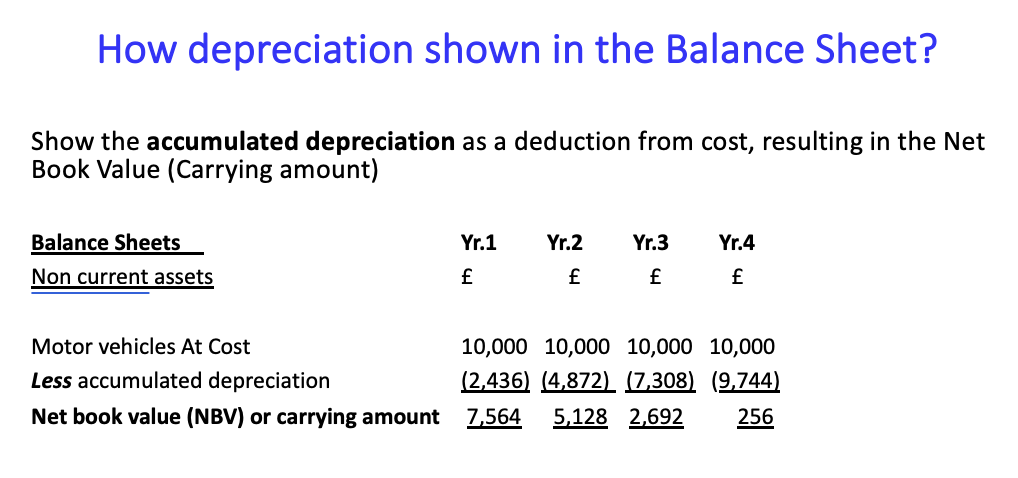

how is it shown in the balance sheet?

formula for reducing balance method

what happens when a non-current asset is sold?

the sale value is unlikely to be the same as the net book value of that asset, we need ton calculate a profit or loss on disposal

how do we calculate profit or loss on a disposal of an NCA? (4)

Determine NBV of asset at date of the sale and compare with selling price to see profit/loss

record profit/loss as a non-operating income/expense in IS

remove the asset and its accumulated depreciation from the BS

depending on how sale is paid for record cash or payable receivables

what are the two things the business need to determine in relation to inventories at the end of each accounting period? (valuing inventories)

the cost of the inventories sold or used up during the period

the cost of the inventories remaining at the end of the period

how do you determine the two things?

the business must make an assumption about how inventories are physically handled e.g. which inventories should the business assume sells first?

what are the 3 methods to value inventories?

FIFO (First in, first out)

LIFO (Last in, first out)

AVCO (Weighted average cost)

What is FIFO? (First in, first out)

the earliest inventories bought are the first to be sold

what is LIFO (last in, first out)

the latest inventories to be bought are first to be sold, not allowed in UK

what is AVCO (Weighted average cost)

the average purchase cost weighted by the volume of inventory purchased at different times is used as the cost of inventories

How is FIFO unique? (how does choosing this affect profit and closing inventory value on B/S)

will give highest profit and highest closing inventory value

How is LIFO unique? (how does choosing this affect profit and closing inventory value on B/S)

will give lowest profit and lowest closing value

how is AVCO unique? (how does choosing this affect profit and closing inventory value on B/S)

will give a value in-between

what are problems with trade receivables? (2)

bad debts and doubtful debts

how to bad debts arise?

sales made on credit, occur when the customer is unable to pay

how are bad debts treated in accounting e.g. the company who owes has gone bankrupt (4)

decrease trade receivables by the bad debt amount in BS

Increase expenses ‘bad debt written off’

we do not cancel original sale

what is a doubtful debt

company doesn’t know whether they will pay yet

what comes about on the B/S due to doubtful debts

allowance for trade receivables

how are doubtful debts treated in accounting (2)

decrease trade receivables on the B/S by required allowance

increase expenses on the I/S as ‘allowance for trade receivables’ by the same amount

what can businesses choose?

depreciation and inventory valuation methods

what does the business choice affect

profit and asset values, can make comparisons between firms difficult

what judgement does a business need to make about non-current assets

the useful life and residual value

what judgement is needed in terms of inventories

whether they should be valued at cost value or net realisable value, if NRV then an estimate must be made

what judgement is needed when considering the amount of doubtful debts to fill in allowance for trade receivables

the proportion of trade receivables that are deemed doubtful