ALL INFO Torts Negligence Cases (Area of Law, Facts and Law)

5.0(10)

5.0(10)

Card Sorting

1/66

Earn XP

Description and Tags

ALL INFO Area of Law, Facts and Law from Torts Negligence Cases

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

1

New cards

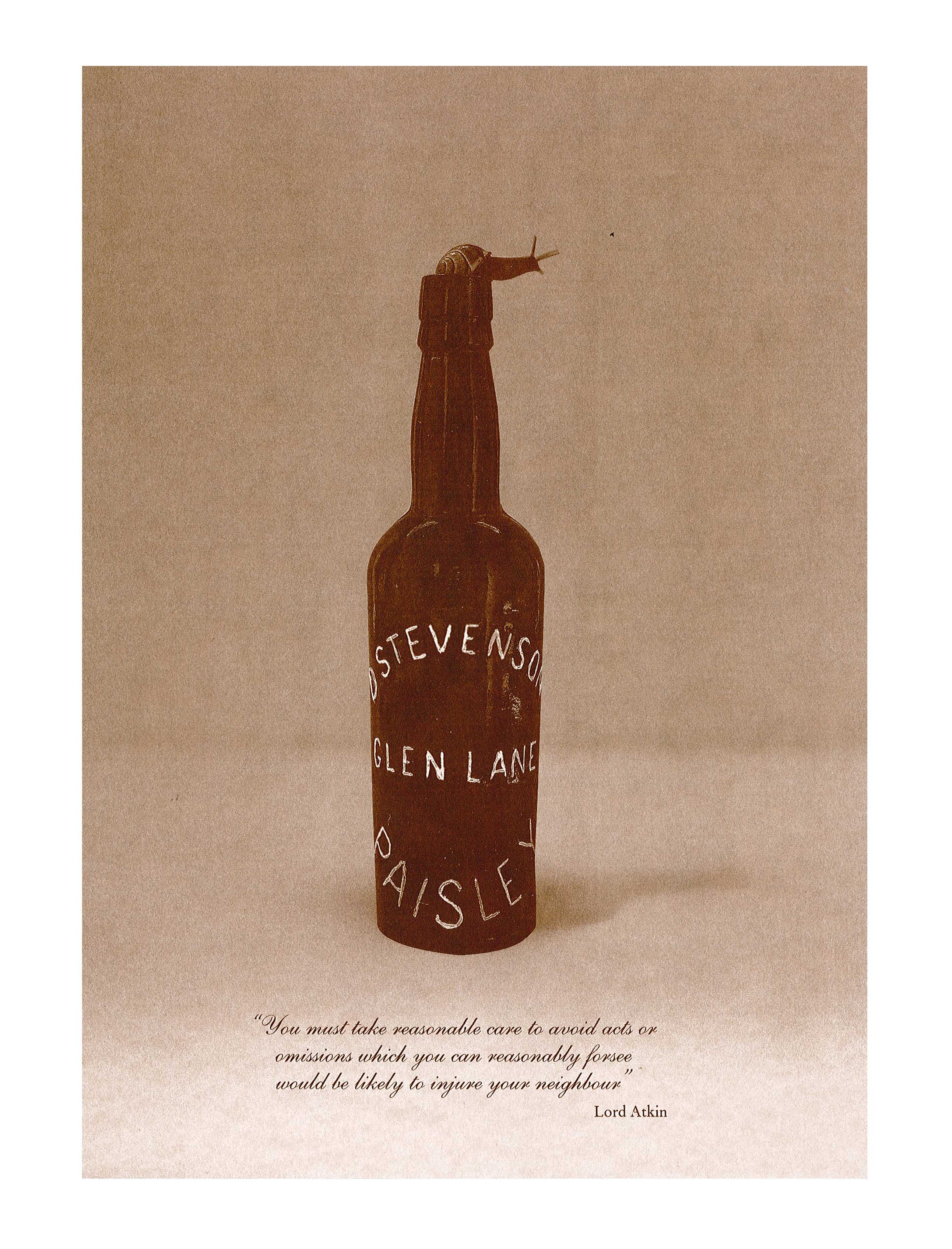

*Donoghue v Stephenson* \[1932\] AC 562 (HL)

**Duty of Care**

__Facts__: Appellant drank a bottle of ginger beer and became sick (shock and gastro-entinitis). The bottle allegedly contained the remains of a snail which could not be discovered until most of the contents had been consumed.

__Issue__: Does the manufacturer owe a duty of care to consumers?

__Law__:

* Lord Atkin finds that there should be a duty of care

* “...persons who are so closely and directly affected by my act that I ought reasonably to have them in contemplation as being so affected…”

* Does the defendant have a duty of care to the plaintiff when harm is caused due to a breach of this duty of care?

* Third party principle/neighbourhood principle - people are our neighbours where a reasonable person in the position of the defendant would foresee that if they were careless somebody in the position of the plaintiff would be injured.

* Opacity of the bottle is arguably material because Mrs Donoghue didn’t have the opportunity to guard herself from the harm because the bottle was opaque.

__Facts__: Appellant drank a bottle of ginger beer and became sick (shock and gastro-entinitis). The bottle allegedly contained the remains of a snail which could not be discovered until most of the contents had been consumed.

__Issue__: Does the manufacturer owe a duty of care to consumers?

__Law__:

* Lord Atkin finds that there should be a duty of care

* “...persons who are so closely and directly affected by my act that I ought reasonably to have them in contemplation as being so affected…”

* Does the defendant have a duty of care to the plaintiff when harm is caused due to a breach of this duty of care?

* Third party principle/neighbourhood principle - people are our neighbours where a reasonable person in the position of the defendant would foresee that if they were careless somebody in the position of the plaintiff would be injured.

* Opacity of the bottle is arguably material because Mrs Donoghue didn’t have the opportunity to guard herself from the harm because the bottle was opaque.

2

New cards

*Smith v Fonterra* \[2021\] NZCA 552

**Duty of Care** - Novel Duty

__Facts__: Smith alleges that the defendants’ contributions to climate change constitute a public nuisance, negligence, and a breach of a duty cognizable at law to cease contributing to climate change.

__Issue__: Does the defendant have a duty of care to cease contributing to climate change?

__Law__:

* Held: Smith’s negligence claim must fail because he has not shown the defendants owed him a duty of care, concluding the damage claimed was not reasonably foreseeable or proximately caused by their actions.

* The court concluded that Smith could not demonstrate public nuisance because the damage claimed was neither particular to him, nor the direct consequence of the defendant’s actions.

__Facts__: Smith alleges that the defendants’ contributions to climate change constitute a public nuisance, negligence, and a breach of a duty cognizable at law to cease contributing to climate change.

__Issue__: Does the defendant have a duty of care to cease contributing to climate change?

__Law__:

* Held: Smith’s negligence claim must fail because he has not shown the defendants owed him a duty of care, concluding the damage claimed was not reasonably foreseeable or proximately caused by their actions.

* The court concluded that Smith could not demonstrate public nuisance because the damage claimed was neither particular to him, nor the direct consequence of the defendant’s actions.

3

New cards

*McLoughlin v O’Brian* \[1983\] 1 AC 410 (HL)

**Nervous Shock**

__Facts__: Mrs McLoughlin suffered shock as a result of seeing her husband and children in a hospital two hours after a car accident in 1973. It was there she found out her youngest daughter had been killed. In 1976 she alleged the shock led to depression and a personality change, affecting her abilities as a wife and mother. Mrs McLoughlin’s appeal was allowed

__Issue__: Can you make a negligence claim for psychiatric harm suffered as a result of an accident in which one’s family was involved?

__Law__:

* Lord Wilderforce sets out 5 existing principles:

* A claim for damages for ‘nervous shock’ caused by damages can be made without showing direct impact or fear of immediate personal injuries for oneself

* Damages may be recovered for ‘nervous shock’ brought on by an injury caused to a near relative or the fear of such injury

* There has been no English case in which a plaintiff has been able to recover nervous shock damages where the injury to the near relative occurred out of sight and earshot of the plaintiff

* An exception to the previous has been made where the plaintiff does not see or hear the incident but comes upon its immediate aftermath

* A remedy on account of nervous shock has been given to a man who came upon a serious accident involving numerous people immediately thereafter and acted as a rescuer of those involved

* Lord Wilberforce sets out three elements inherent in any claim for ‘nervous shock’;

* (1) the class of the persons whose claims should be recognised (family ties/closeness);

* (2) the proximity of such persons to the accident (closeness in both time and space);

* (3) and the means by which shock is caused

__Facts__: Mrs McLoughlin suffered shock as a result of seeing her husband and children in a hospital two hours after a car accident in 1973. It was there she found out her youngest daughter had been killed. In 1976 she alleged the shock led to depression and a personality change, affecting her abilities as a wife and mother. Mrs McLoughlin’s appeal was allowed

__Issue__: Can you make a negligence claim for psychiatric harm suffered as a result of an accident in which one’s family was involved?

__Law__:

* Lord Wilderforce sets out 5 existing principles:

* A claim for damages for ‘nervous shock’ caused by damages can be made without showing direct impact or fear of immediate personal injuries for oneself

* Damages may be recovered for ‘nervous shock’ brought on by an injury caused to a near relative or the fear of such injury

* There has been no English case in which a plaintiff has been able to recover nervous shock damages where the injury to the near relative occurred out of sight and earshot of the plaintiff

* An exception to the previous has been made where the plaintiff does not see or hear the incident but comes upon its immediate aftermath

* A remedy on account of nervous shock has been given to a man who came upon a serious accident involving numerous people immediately thereafter and acted as a rescuer of those involved

* Lord Wilberforce sets out three elements inherent in any claim for ‘nervous shock’;

* (1) the class of the persons whose claims should be recognised (family ties/closeness);

* (2) the proximity of such persons to the accident (closeness in both time and space);

* (3) and the means by which shock is caused

4

New cards

*Alcock v Chief Constable of South Yorkshire Police* \[1992\] 1 AC 310 (HL)

**Nervous Shock**

__Facts__: 95 people were killed and more than 400 received injuries from being crushed at Hillsborough Stadium. The plaintiffs are claiming damages to compensate them for their psychiatric illnesses. They allege it was the defendant’s negligence (breach of duty of care) which caused them to suffer their illnesses. Appeals dismissed.

__Issue__: When can a secondary victim be compensated for psychiatric damage in a negligence case?

__Law__:

* Lord Ackner uses the three elements from *McLoughlin*

* (1) the class of persons whose claim should be recognised

* (2) the proximity of the plaintiff to the accident

* Established there was not sufficient proximity in time and space to the accident

* (3) the means by which the shock is caused

* In this case the TV broadcast cannot be equated with the ‘sight or hearing of the event or its immediate aftermath’

__Facts__: 95 people were killed and more than 400 received injuries from being crushed at Hillsborough Stadium. The plaintiffs are claiming damages to compensate them for their psychiatric illnesses. They allege it was the defendant’s negligence (breach of duty of care) which caused them to suffer their illnesses. Appeals dismissed.

__Issue__: When can a secondary victim be compensated for psychiatric damage in a negligence case?

__Law__:

* Lord Ackner uses the three elements from *McLoughlin*

* (1) the class of persons whose claim should be recognised

* (2) the proximity of the plaintiff to the accident

* Established there was not sufficient proximity in time and space to the accident

* (3) the means by which the shock is caused

* In this case the TV broadcast cannot be equated with the ‘sight or hearing of the event or its immediate aftermath’

5

New cards

*Page v Smith* \[1996\] AC 155 (HL)

**Nervous Shock**

__Facts__: C was involved in a car collision caused by D’s negligence which caused no physical injury. As a result of the accident, C suffered chronic fatigue syndrome which affected him on and off for 25 years but has now become permanent. D argued that it is not foreseeable that a person of normal fortitude would suffer psychiatric illness.

__Law__:

* For secondary victims, foreseeability of psychiatric injury is a crucial ingredient since they are almost always outside the area of physical impact and hence range of foreseeable physical injury

* For primary victims, D is under a duty of care not to cause foreseeable physical injury, it is unnecessary to ask whether he was under a separate duty not to cause psychiatric injury

* The criteria for liability applicable to secondary victims is inapplicable to primary victims

* Proximity of relationship cannot arise and proximity in time and space goes without saying

* C’s claim succeeded, it did not matter that C’s psychiatric injury was not reasonably foreseeable as the risk of C’s physical injury was reasonably foreseeable, even though C did not suffer any physical injury.

* (Leading case on the distinction between primary and secondary victims)

__Facts__: C was involved in a car collision caused by D’s negligence which caused no physical injury. As a result of the accident, C suffered chronic fatigue syndrome which affected him on and off for 25 years but has now become permanent. D argued that it is not foreseeable that a person of normal fortitude would suffer psychiatric illness.

__Law__:

* For secondary victims, foreseeability of psychiatric injury is a crucial ingredient since they are almost always outside the area of physical impact and hence range of foreseeable physical injury

* For primary victims, D is under a duty of care not to cause foreseeable physical injury, it is unnecessary to ask whether he was under a separate duty not to cause psychiatric injury

* The criteria for liability applicable to secondary victims is inapplicable to primary victims

* Proximity of relationship cannot arise and proximity in time and space goes without saying

* C’s claim succeeded, it did not matter that C’s psychiatric injury was not reasonably foreseeable as the risk of C’s physical injury was reasonably foreseeable, even though C did not suffer any physical injury.

* (Leading case on the distinction between primary and secondary victims)

6

New cards

*Van Soest v Residual Health Management Unit* \[2000\] 1 NZLR 179 (CA)

**Nervous Shock**

__Facts__: The relatives of a number of patients at Christchurch Public Hospital who had died, allegedly as the result of the negligence of the defendant’s surgeon, Keith Ramstead, sued the management.

__Issue__: Can there be recovery for ‘abnormal grief’?

__Law__:

* Relaxes the relational and physical proximity requirements in *McLoughlin* and changes the requirements for ‘nervous shock’. (Aligns with ACC legislation? Also aims to ensure new understandings of psychiatric illness do not go unrecognised in the future due to the wording of the law)

* There has to be a recognisable psychiatric injury

__Facts__: The relatives of a number of patients at Christchurch Public Hospital who had died, allegedly as the result of the negligence of the defendant’s surgeon, Keith Ramstead, sued the management.

__Issue__: Can there be recovery for ‘abnormal grief’?

__Law__:

* Relaxes the relational and physical proximity requirements in *McLoughlin* and changes the requirements for ‘nervous shock’. (Aligns with ACC legislation? Also aims to ensure new understandings of psychiatric illness do not go unrecognised in the future due to the wording of the law)

* There has to be a recognisable psychiatric injury

7

New cards

*Blyth v The Company of Proprietors of the Birmingham Waterworks* (1865) 11 Ex 781, 156 ER 1047 (Exch)

**Breach of Duty**

__Facts__: An unprecedented frost caused the fire plug in the defendant’s water pipe to come out. As a result, a large amount of water flooded into the plaintiff’s house.

__Issue__: Were the defendant’s negligent because they failed to anticipate and take precautions against an unprecedented frost?

__Law__:

* “Negligence is the omission to do something which a reasonable \[person\] guided upon those considerations which ordinarily regulate the conduct of human affairs, would do, or doing something which a prudent and reasonable \[person\] would not do.”

* An accident that is not occasioned by the taking of or failure to take an action does not qualify as negligence

Illustrates that negligence is not *strict* liability.

__Facts__: An unprecedented frost caused the fire plug in the defendant’s water pipe to come out. As a result, a large amount of water flooded into the plaintiff’s house.

__Issue__: Were the defendant’s negligent because they failed to anticipate and take precautions against an unprecedented frost?

__Law__:

* “Negligence is the omission to do something which a reasonable \[person\] guided upon those considerations which ordinarily regulate the conduct of human affairs, would do, or doing something which a prudent and reasonable \[person\] would not do.”

* An accident that is not occasioned by the taking of or failure to take an action does not qualify as negligence

Illustrates that negligence is not *strict* liability.

![**Breach of Duty**

__Facts__: An unprecedented frost caused the fire plug in the defendant’s water pipe to come out. As a result, a large amount of water flooded into the plaintiff’s house.

__Issue__: Were the defendant’s negligent because they failed to anticipate and take precautions against an unprecedented frost?

__Law__:

* “Negligence is the omission to do something which a reasonable \[person\] guided upon those considerations which ordinarily regulate the conduct of human affairs, would do, or doing something which a prudent and reasonable \[person\] would not do.”

* An accident that is not occasioned by the taking of or failure to take an action does not qualify as negligence

Illustrates that negligence is not *strict* liability.](https://knowt-user-attachments.s3.amazonaws.com/0c63e222513a41879448f4a620e6e018.jpeg)

8

New cards

*Bolton v Stone* \[1951\] AC 850 (HL)

**Breach of Duty**

__Facts__: A cricket ball was hit out onto a public road where it subsequently hit and injured a pedestrian.

__Issue__: What factors are relevant to determine how a reasonable person would behave, and therefore when is the defendant in breach of their duty of care?

__Law__:

* Factors:

* (1) The likelihood of harm;

* (2) What precautions were practical for a defendant to take in terms of cost and effort;

* (3) Whether the defendant provides a socially useful service

* Held that the risk was so small that a reasonable person would have been justified in disregarding it and taking no steps to eliminate it.

* “...I think it would be right to take into account not only how remote is the chance that a person might be struck but also how serious the consequences are likely to be if a person is struck…”

* “...what is the nature and extent of the duty of a person who promotes on his land operations which may cause damage to persons on an adjoining highway?”

__Facts__: A cricket ball was hit out onto a public road where it subsequently hit and injured a pedestrian.

__Issue__: What factors are relevant to determine how a reasonable person would behave, and therefore when is the defendant in breach of their duty of care?

__Law__:

* Factors:

* (1) The likelihood of harm;

* (2) What precautions were practical for a defendant to take in terms of cost and effort;

* (3) Whether the defendant provides a socially useful service

* Held that the risk was so small that a reasonable person would have been justified in disregarding it and taking no steps to eliminate it.

* “...I think it would be right to take into account not only how remote is the chance that a person might be struck but also how serious the consequences are likely to be if a person is struck…”

* “...what is the nature and extent of the duty of a person who promotes on his land operations which may cause damage to persons on an adjoining highway?”

9

New cards

*Overseas Tankship (UK) Ltd v The Miller Steamship Co Pty (The Wagon Mound No 2))* \[1967\] 1 AC 617 (PC)

**Breach of Duty**

__Facts__: On Oct 30th *The Wagon Mound* engineers were taking in bunkering oil. Due to carelessness a large quantity of oil overflowed onto the surface of the water. The oil drifted and accumulated around Sheerlegs Wharf and the respondents’ vessels. On November 1st the oil was set alight and the fire spread rapidly, causing extensive damage to the wharf and the respondents’ vessels.

__Issue__: Whether the fire, which was found to be reasonably foreseeable to the reasonable man, was reasonably foreseeable to the extent liability attaches?

__Law__:

* If a party did nothing to prevent the injury, he is liable for the foreseeable consequences of his actions, even if the consequences are remote

__Facts__: On Oct 30th *The Wagon Mound* engineers were taking in bunkering oil. Due to carelessness a large quantity of oil overflowed onto the surface of the water. The oil drifted and accumulated around Sheerlegs Wharf and the respondents’ vessels. On November 1st the oil was set alight and the fire spread rapidly, causing extensive damage to the wharf and the respondents’ vessels.

__Issue__: Whether the fire, which was found to be reasonably foreseeable to the reasonable man, was reasonably foreseeable to the extent liability attaches?

__Law__:

* If a party did nothing to prevent the injury, he is liable for the foreseeable consequences of his actions, even if the consequences are remote

10

New cards

*Watt v Hertfordshire County Council* \[1954\] 1 WLR 835 (CA)

**Breach of Duty**

__Facts__: A firefighter employed by the defendants, was on duty when an emergency call was received that a woman was trapped under a heavy vehicle 200 or 300 yards away. The plaintiff’s team were instructed to transport a very heavy jack on an unequipped vehicle. The plaintiff was harmed by the jack when the driver had to apply the brake suddenly. It was rare for the heavy jack to be required, and in the normal course, if the appropriate vehicle to carry the jack was unavailable, another station would be notified and answer the call.

__Issue__: Was the social utility of the activity being undertaken by the HCC a relevant consideration in determining whether the HCC had breached its duty of care to Watt?

__Law__:

* Social utility of the action

* “...you must balance the risk against the end to be achieved.”

* If the defendant is engaged in an activity that serves a socially useful purpose then they may be justified in taking greater risks.

* The standard of care owed to the plaintiff is to be assessed on the basis of that which is reasonably required in the circumstances.

__Facts__: A firefighter employed by the defendants, was on duty when an emergency call was received that a woman was trapped under a heavy vehicle 200 or 300 yards away. The plaintiff’s team were instructed to transport a very heavy jack on an unequipped vehicle. The plaintiff was harmed by the jack when the driver had to apply the brake suddenly. It was rare for the heavy jack to be required, and in the normal course, if the appropriate vehicle to carry the jack was unavailable, another station would be notified and answer the call.

__Issue__: Was the social utility of the activity being undertaken by the HCC a relevant consideration in determining whether the HCC had breached its duty of care to Watt?

__Law__:

* Social utility of the action

* “...you must balance the risk against the end to be achieved.”

* If the defendant is engaged in an activity that serves a socially useful purpose then they may be justified in taking greater risks.

* The standard of care owed to the plaintiff is to be assessed on the basis of that which is reasonably required in the circumstances.

11

New cards

*Tomlinson (FC) v Congleton Borough Council* \[2003\] UKHL 47, \[2004\] 1 AC 46

**Breach of Duty**

__Facts__: Tomlinson suffered a terrible neck injury as a result of diving into a mere (lake). The Council had made plans to make the mere less attractive and more difficult to dive into. Tomlinson sought to sue the Council for not preventing him from diving.

__Law__:

* The burden of the risk needs to take into account the effects on other people

* “...the question of what amounts to ‘such care as in all the circumstances of the case reasonable’ depends upon assessing, as in the case of common law negligence, not only the likelihood that someone may be injured and the seriousness of the injury which may occur, but also the social value of the activity which gives rise to the risk and cost of preventative measures.”

* There is no duty to protect against obvious risks

* A balance should be struck between the magnitude and gravity of risk with the social and financial cost of preventative measures when assessing whether reasonable care was taken

__Facts__: Tomlinson suffered a terrible neck injury as a result of diving into a mere (lake). The Council had made plans to make the mere less attractive and more difficult to dive into. Tomlinson sought to sue the Council for not preventing him from diving.

__Law__:

* The burden of the risk needs to take into account the effects on other people

* “...the question of what amounts to ‘such care as in all the circumstances of the case reasonable’ depends upon assessing, as in the case of common law negligence, not only the likelihood that someone may be injured and the seriousness of the injury which may occur, but also the social value of the activity which gives rise to the risk and cost of preventative measures.”

* There is no duty to protect against obvious risks

* A balance should be struck between the magnitude and gravity of risk with the social and financial cost of preventative measures when assessing whether reasonable care was taken

12

New cards

*Goldman v Hargrave* \[1967\] 1 AC 645 (PC)

**Breach of Duty**

__Facts__: On Feb 25th lightning in an electrical storm struck a tall redgum on the appellant’s property, catching it on fire. The appellant called the district fire control officer and asked for a tree feller to be sent. Pending his arrival, the appellant cleared combustible material away from the tree and sprayed the surrounding area with water. The tree feller arrived on Feb 26th at midday and cut down the tree. It was accepted that if the appellant had taken reasonable care, he could have put out the fire with the use of water that evening or the next morning. The appellant instead decided to let the fire burn itself out and on March 1st, the fire revived and spread onto the respondents’ properties.

__Law__:

* A person can be liable in negligence for an omission where he fails to remove a source of danger that he knew or ought to know of and could foresee the harm of not doing so.

* Takes into account the free will of victims

__Facts__: On Feb 25th lightning in an electrical storm struck a tall redgum on the appellant’s property, catching it on fire. The appellant called the district fire control officer and asked for a tree feller to be sent. Pending his arrival, the appellant cleared combustible material away from the tree and sprayed the surrounding area with water. The tree feller arrived on Feb 26th at midday and cut down the tree. It was accepted that if the appellant had taken reasonable care, he could have put out the fire with the use of water that evening or the next morning. The appellant instead decided to let the fire burn itself out and on March 1st, the fire revived and spread onto the respondents’ properties.

__Law__:

* A person can be liable in negligence for an omission where he fails to remove a source of danger that he knew or ought to know of and could foresee the harm of not doing so.

* Takes into account the free will of victims

13

New cards

*ACC v Ambros* \[2007\] NZCA 304

**Causation** - Sufficient Causal Link

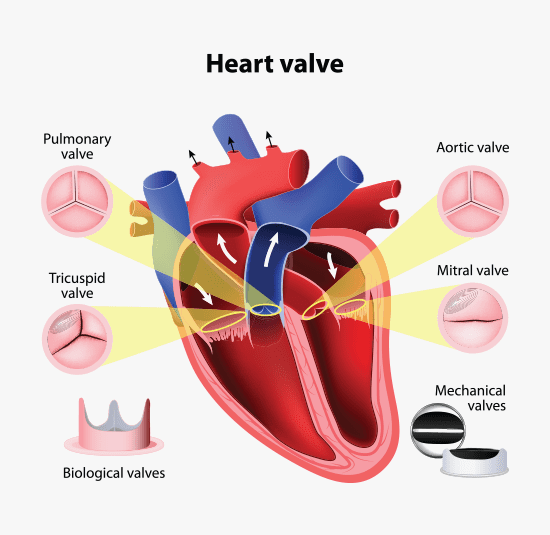

__Facts__: Mrs Ambros had an underlying condition (SCAD) giving rise to a risk of death. She had a heart attack (myocardial infarction) as a result of the underlying condition. She was admitted to hospital with chest pain. Mr Ambros’ consultant, Dr Hart, failed to observe reasonable skill, including failing to take a number of critical steps in the face of evidence of the heart attack.

__Issue__: Whether, for the purposes of the ACC Act, Mrs Ambros suffered “treatment injury”? (Was medical negligence the cause of death? Would she have died “but for” the negligence?)

__Law__:

* There may be a shifting evidential burden of proof

* (1) Statistical evidence suggested that Mrs Ambros had at least a 51% chance of survival;

* (2) Temporal proximity between the negligence and the death;

* (3) Treatment was available had her condition been diagnosed properly

* __Courts can reasonably infer causation in circumstances where experts cannot through these three factors__

* In the light of the above, the *tactical burden to disprove* causation should shift to ACC

* Evidence is to be weighed according to the proof which it was in the power of one side to have produced and the power of the other side to have contradicted.

* Treatment injury was suffered

__Facts__: Mrs Ambros had an underlying condition (SCAD) giving rise to a risk of death. She had a heart attack (myocardial infarction) as a result of the underlying condition. She was admitted to hospital with chest pain. Mr Ambros’ consultant, Dr Hart, failed to observe reasonable skill, including failing to take a number of critical steps in the face of evidence of the heart attack.

__Issue__: Whether, for the purposes of the ACC Act, Mrs Ambros suffered “treatment injury”? (Was medical negligence the cause of death? Would she have died “but for” the negligence?)

__Law__:

* There may be a shifting evidential burden of proof

* (1) Statistical evidence suggested that Mrs Ambros had at least a 51% chance of survival;

* (2) Temporal proximity between the negligence and the death;

* (3) Treatment was available had her condition been diagnosed properly

* __Courts can reasonably infer causation in circumstances where experts cannot through these three factors__

* In the light of the above, the *tactical burden to disprove* causation should shift to ACC

* Evidence is to be weighed according to the proof which it was in the power of one side to have produced and the power of the other side to have contradicted.

* Treatment injury was suffered

14

New cards

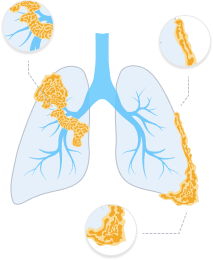

*Fairchild v Glenhaven Funeral Services Ltd* \[2002\] UKHL 22, \[2003\] 1 AC 32

**Causation** - No Causal Link to Harm

__Facts__: A man who had worked for two different companies handling asbestos developed mesothelioma. The man wanted to make a claim against both companies A and B. It was not clear if he was entitled to claim compensation from either because the exposure could have taken place during either term of employment.

__Issue__: From which employer, if any, were the claimants entitled to claim compensation from their tortious negligence in exposing their employees to asbestos.

__Law__:

* The claimant could claim total compensation from both A and B

* Where the ‘but for’ test cannot be reasonably or fairly applied, the ‘materially increased risk’ of harm test may be used

* The materially increased risk of exposure to asbestos by both A and B caused mesothelioma in the plaintiff.

__Facts__: A man who had worked for two different companies handling asbestos developed mesothelioma. The man wanted to make a claim against both companies A and B. It was not clear if he was entitled to claim compensation from either because the exposure could have taken place during either term of employment.

__Issue__: From which employer, if any, were the claimants entitled to claim compensation from their tortious negligence in exposing their employees to asbestos.

__Law__:

* The claimant could claim total compensation from both A and B

* Where the ‘but for’ test cannot be reasonably or fairly applied, the ‘materially increased risk’ of harm test may be used

* The materially increased risk of exposure to asbestos by both A and B caused mesothelioma in the plaintiff.

15

New cards

*Barnett v Chelsea & Kensington Hospitals* (1969)

**Causation** - No Causal Link to Harm

__Facts__: A man was poisoned and sought medical attention. He was sent home by a nurse and died five hours later. He would have died regardless of the doctor seeing him or not, however, because there was nothing that could have been done to save him.

__Law__:

* The defendant’s were not liable because their failure to examine him did not cause his death

* But for the doctor not seeing him, he still would have died regardless as the poison had already taken effect

* The nurse sending him home was not negligent

__Facts__: A man was poisoned and sought medical attention. He was sent home by a nurse and died five hours later. He would have died regardless of the doctor seeing him or not, however, because there was nothing that could have been done to save him.

__Law__:

* The defendant’s were not liable because their failure to examine him did not cause his death

* But for the doctor not seeing him, he still would have died regardless as the poison had already taken effect

* The nurse sending him home was not negligent

16

New cards

*Henry v Auckland City Council* \[2015\] NZHC 435

**Causation** - No Causal Link to Harm

__Facts__: The plaintiffs property overlooking the Hauraki Gulf, very close to a cliff, was subject to a great slip into the ocean. The plaintiffs brought a claim against the council over issues with the LIM report.

__Law__:

* The defendant (Auckland Council) was successful in this case

* The plaintiffs did not ask a lawyer to read the LIM and read it themselves

* Could not be established that if provided more information in the LIM report, the plaintiffs would have acted differently (?)

* The Court held the couple was going to buy the house with or without the report

__Facts__: The plaintiffs property overlooking the Hauraki Gulf, very close to a cliff, was subject to a great slip into the ocean. The plaintiffs brought a claim against the council over issues with the LIM report.

__Law__:

* The defendant (Auckland Council) was successful in this case

* The plaintiffs did not ask a lawyer to read the LIM and read it themselves

* Could not be established that if provided more information in the LIM report, the plaintiffs would have acted differently (?)

* The Court held the couple was going to buy the house with or without the report

17

New cards

*Re Polemis and Furness Withy & Co Ltd* \[1921\] 3 KB 560 (CA)

**Remoteness of Harm**

__Facts__: From a crane loading cargo onto a ship a plank of wood fell, causing a spark igniting a fire destroying the ship.

__Issue__: Whether a defendant can be held liable for the outcome of events entirely caused by their actions, but which could not have been foreseen by either the party in question or any other reasonable party?

__Law__:

* Defendant held liable for all direct consequences resulting from their negligent actions

* Overruled in *Wagon Mound No. 1* where it was held that the actual injury caused by the defendant’s negligence **must be reasonably foreseeable to be claimed as damages**

* Liable for direct consequences of carelessness

__Facts__: From a crane loading cargo onto a ship a plank of wood fell, causing a spark igniting a fire destroying the ship.

__Issue__: Whether a defendant can be held liable for the outcome of events entirely caused by their actions, but which could not have been foreseen by either the party in question or any other reasonable party?

__Law__:

* Defendant held liable for all direct consequences resulting from their negligent actions

* Overruled in *Wagon Mound No. 1* where it was held that the actual injury caused by the defendant’s negligence **must be reasonably foreseeable to be claimed as damages**

* Liable for direct consequences of carelessness

18

New cards

*Overseas Tankship (UK) Ltd v Morts Dock & Engineering Co Ltd (The Wagon Mound ((No 1))* \[1961\] AC 388 (PC)

**Remoteness of Harm**

__Facts__: Overrules *Re Polemis*. Bunkering oil spilled due to negligence, causing the appellants to seriously damage the respondents’ nearby wharf.

__Issue__: Whether the fire that destroyed the respondent’s wharf was a foreseeable consequence of the appellant’s negligence?

__Law__:

* The injury to property, although a direct result of the appellant’s negligence, was an unforeseeable consequences and therefore they are not liable

* The type of harm needs to be reasonably foreseeable

__Facts__: Overrules *Re Polemis*. Bunkering oil spilled due to negligence, causing the appellants to seriously damage the respondents’ nearby wharf.

__Issue__: Whether the fire that destroyed the respondent’s wharf was a foreseeable consequence of the appellant’s negligence?

__Law__:

* The injury to property, although a direct result of the appellant’s negligence, was an unforeseeable consequences and therefore they are not liable

* The type of harm needs to be reasonably foreseeable

19

New cards

*Hughes v Lord Advocate* \[1963\] AC 837 (HL)

**Remoteness of Harm**

__Facts__: A paraffin lamp was left next to an open manhole. Children playing on the street on a Sunday took the lamp into the hole ultimately creating an explosion resulting in extensive burns.

__Issue__: Whether a party can be found liable for injuries that could not have been specifically foreseen as resulting from their actions, even where the kind of injury was a foreseeable consequence?

__Law__:

* The explosion was not reasonably foreseeable, however, it was reasonably foreseeable that someone may burn themselves on an unattended paraffin lamp

* So long as the injury is of a type that is reasonably foreseeable there exists liability

* It did not matter if one of the effects in the chain of causation was unexpected

* Emphasis on the foreseeability of the *kind* of damage (rather than specific actual damage \[an unexpected explosion\])

* Does not overrule *Wagon Mound* - the fire must be reasonably foreseeable but how the fire begins does not need to be reasonably foreseeable

__Facts__: A paraffin lamp was left next to an open manhole. Children playing on the street on a Sunday took the lamp into the hole ultimately creating an explosion resulting in extensive burns.

__Issue__: Whether a party can be found liable for injuries that could not have been specifically foreseen as resulting from their actions, even where the kind of injury was a foreseeable consequence?

__Law__:

* The explosion was not reasonably foreseeable, however, it was reasonably foreseeable that someone may burn themselves on an unattended paraffin lamp

* So long as the injury is of a type that is reasonably foreseeable there exists liability

* It did not matter if one of the effects in the chain of causation was unexpected

* Emphasis on the foreseeability of the *kind* of damage (rather than specific actual damage \[an unexpected explosion\])

* Does not overrule *Wagon Mound* - the fire must be reasonably foreseeable but how the fire begins does not need to be reasonably foreseeable

![**Remoteness of Harm**

__Facts__: A paraffin lamp was left next to an open manhole. Children playing on the street on a Sunday took the lamp into the hole ultimately creating an explosion resulting in extensive burns.

__Issue__: Whether a party can be found liable for injuries that could not have been specifically foreseen as resulting from their actions, even where the kind of injury was a foreseeable consequence?

__Law__:

* The explosion was not reasonably foreseeable, however, it was reasonably foreseeable that someone may burn themselves on an unattended paraffin lamp

* So long as the injury is of a type that is reasonably foreseeable there exists liability

* It did not matter if one of the effects in the chain of causation was unexpected

* Emphasis on the foreseeability of the *kind* of damage (rather than specific actual damage \[an unexpected explosion\])

* Does not overrule *Wagon Mound* - the fire must be reasonably foreseeable but how the fire begins does not need to be reasonably foreseeable](https://knowt-user-attachments.s3.amazonaws.com/156211e37fd1443390940caf159b8644.jpeg)

20

New cards

*Stephenson v Waite Tileman Ltd* \[1973\] 1 NZLR 152 (CA)

**Remoteness of Harm**

__Facts__: The plaintiff cut his hand on a rusty wire rope while working, contracting an unknown virus which infected the cut leading to brain damage. He was scarcely able to look after himself after this and sued the defendant for negligence.

__Issue__: Whether a person is responsible for the injuries of another person if the injuries are very remote from their cause?

__Law__:

* But for the defendant’s negligent actions, the plaintiff would not have suffered the harm caused (brain damage)

* The defendant was found to be negligent

* Successful in causation - passed the ‘but for’ test

* Eggshell skull rule - not a reasonably foreseeable type of harm BUT a plaintiff’s peculiar susceptibility needs to be protected (freedoms, rights and duty still need to be owed)

__Facts__: The plaintiff cut his hand on a rusty wire rope while working, contracting an unknown virus which infected the cut leading to brain damage. He was scarcely able to look after himself after this and sued the defendant for negligence.

__Issue__: Whether a person is responsible for the injuries of another person if the injuries are very remote from their cause?

__Law__:

* But for the defendant’s negligent actions, the plaintiff would not have suffered the harm caused (brain damage)

* The defendant was found to be negligent

* Successful in causation - passed the ‘but for’ test

* Eggshell skull rule - not a reasonably foreseeable type of harm BUT a plaintiff’s peculiar susceptibility needs to be protected (freedoms, rights and duty still need to be owed)

21

New cards

*Mustapha v Culligan of Canada Ltd* 2008 SCC 27, \[2008\] 2 SCR 114

**Remoteness of Harm**

__Facts__: The plaintiff witnessed dead flies in a bottle of water supplied by the defendant. The plaintiff suffered serious psychiatric injury as a result.

__Law__:

* You must consider if the breach would result in psychiatric harm to a reasonable person

* If yes, eggshell skull rule applies

* The unexpected frailty of the injured person is not a valid defence to the seriousness of any injury caused to them

* But damage will be seen as too remote if the breach would not have resulted in the psychiatric harm of a reasonable person

* If the defendant knew that the plaintiff had a particular vulnerability to psychiatric harm before the breach, then psychiatric harm is reasonably foreseeable

__Facts__: The plaintiff witnessed dead flies in a bottle of water supplied by the defendant. The plaintiff suffered serious psychiatric injury as a result.

__Law__:

* You must consider if the breach would result in psychiatric harm to a reasonable person

* If yes, eggshell skull rule applies

* The unexpected frailty of the injured person is not a valid defence to the seriousness of any injury caused to them

* But damage will be seen as too remote if the breach would not have resulted in the psychiatric harm of a reasonable person

* If the defendant knew that the plaintiff had a particular vulnerability to psychiatric harm before the breach, then psychiatric harm is reasonably foreseeable

22

New cards

*White v Chief Constable of South Yorkshire Police (alt cit: Frost)* \[1992\] 2 AC 455 (HL)

**Remoteness of Harm**

__Facts__: A number of police officers who worked during the Hillsborough disaster sued their employer, alleging they suffered post-traumatic stress disorder due to their roles in the disaster. CA majority distinguished police officers from other ‘secondary’ victims (who were not entitled to recovery) on two bases. Some had been involved as rescuers; all were owed a duty to be kept safe, including from psychological harm, as police employees.

__Issue__: Whether an employer owes a duty of care to protect their employees from psychiatric injuries they may incur in the course of their employment? (and: Are the claimants ‘primary’ victims and should they be permitted to succeed with an ordinary claim in negligence?)

__Law__:

* Claim failed as they were neither primary nor secondary rescuers.

* The claimants' status as rescuers did not give them an exception to the limitations in *Alcock*. (Think back to *Chadwick* and the rescuer who successfully claimed ‘shock’)

* Reasonable fortitude

__Facts__: A number of police officers who worked during the Hillsborough disaster sued their employer, alleging they suffered post-traumatic stress disorder due to their roles in the disaster. CA majority distinguished police officers from other ‘secondary’ victims (who were not entitled to recovery) on two bases. Some had been involved as rescuers; all were owed a duty to be kept safe, including from psychological harm, as police employees.

__Issue__: Whether an employer owes a duty of care to protect their employees from psychiatric injuries they may incur in the course of their employment? (and: Are the claimants ‘primary’ victims and should they be permitted to succeed with an ordinary claim in negligence?)

__Law__:

* Claim failed as they were neither primary nor secondary rescuers.

* The claimants' status as rescuers did not give them an exception to the limitations in *Alcock*. (Think back to *Chadwick* and the rescuer who successfully claimed ‘shock’)

* Reasonable fortitude

23

New cards

*Bazley v Curry* \[1999\] 2 SCR 534

**Vicarious Liability**

__Facts__: The Children’s Foundation is a non-profit organisation operating residential facilities for troubled young children. The Foundation authorised its employees to act as parent figures for the children. Mr Curry, a paedophile, was unknowingly hired by the Foundation. Curry, who has since died, was convicted on 19 counts of sexual abuse. The Court held the Foundation vicariously liable.

__Issue__: Whether a non-profit organisation may be held vicariously liable in tort law for sexual misconduct by one of its employees?

__Law__:

* The Court held that a non-profit organisation may be held vicariously liable in tort law for sexual misconduct by one of its employees.

* Test

* (1) Is the tortfeasor somebody whose actions the defendant (employer) must take responsibility?

* (2) Was the tort sufficiently connected to the work of the defendant? OR

* (3) Was the alleged wrongdoing a tort?

__Facts__: The Children’s Foundation is a non-profit organisation operating residential facilities for troubled young children. The Foundation authorised its employees to act as parent figures for the children. Mr Curry, a paedophile, was unknowingly hired by the Foundation. Curry, who has since died, was convicted on 19 counts of sexual abuse. The Court held the Foundation vicariously liable.

__Issue__: Whether a non-profit organisation may be held vicariously liable in tort law for sexual misconduct by one of its employees?

__Law__:

* The Court held that a non-profit organisation may be held vicariously liable in tort law for sexual misconduct by one of its employees.

* Test

* (1) Is the tortfeasor somebody whose actions the defendant (employer) must take responsibility?

* (2) Was the tort sufficiently connected to the work of the defendant? OR

* (3) Was the alleged wrongdoing a tort?

24

New cards

*Lister v Hesley Hall* \[2002\] 1 AC 215

**Vicarious Liability**

__Facts__: Mr and Mrs Grain were employed as warden and housekeeper at Axeholme House for children with emotional and behavioural difficulties. On most days, the Grains were the only staff on the premises. Unbeknownst to the employers, Mr Grain systematically sexually abused the children. In the early 1990s Mr Grain was charged for sexual abuse, receiving seven years imprisonment upon conviction. In 1997 some of Mr Grain’s victims brought claims for personal injury against Mr Grain’s employers.

__Issue__: Whether the warden’s torts were so closely connected with his employment that it would be fair and just to hold the employers vicariously liable?

__Law__:

* The House of Lords held that vicarious liability can arise for unauthorised, intentional wrongdoings committed by an employee for his own benefit

* Yes. The sexual abuse was interwoven with carrying out by the warden of his duties in the home.

__Facts__: Mr and Mrs Grain were employed as warden and housekeeper at Axeholme House for children with emotional and behavioural difficulties. On most days, the Grains were the only staff on the premises. Unbeknownst to the employers, Mr Grain systematically sexually abused the children. In the early 1990s Mr Grain was charged for sexual abuse, receiving seven years imprisonment upon conviction. In 1997 some of Mr Grain’s victims brought claims for personal injury against Mr Grain’s employers.

__Issue__: Whether the warden’s torts were so closely connected with his employment that it would be fair and just to hold the employers vicariously liable?

__Law__:

* The House of Lords held that vicarious liability can arise for unauthorised, intentional wrongdoings committed by an employee for his own benefit

* Yes. The sexual abuse was interwoven with carrying out by the warden of his duties in the home.

25

New cards

*S v Attorney-General* \[2003\] 3 NZLR 450

**Vicarious Liability**

__Facts__: BS was abused by his foster parents while in the care of the Department of Social Welfare.

__Issue__: Whether the department of Social Welfare should be held vicariously liable for abuse committed by foster parents?

__Law__:

* NZCA recognises vicarious liability can apply in the kind of “agency” relationship involved in a child fostering situation.

* The state is responsible for these children - but the foster “parents” were performing those responsibilities.

__Facts__: BS was abused by his foster parents while in the care of the Department of Social Welfare.

__Issue__: Whether the department of Social Welfare should be held vicariously liable for abuse committed by foster parents?

__Law__:

* NZCA recognises vicarious liability can apply in the kind of “agency” relationship involved in a child fostering situation.

* The state is responsible for these children - but the foster “parents” were performing those responsibilities.

26

New cards

*Christian Bros* \[2013\] 2 AC 1

**Vicarious Liability**

__Facts__: Priests were abusing children in a parish home in a Catholic boys’ home. They were absolutely integrated into the work of the order and so would have been employees if it were not for the idiosyncratic structure of religious organisations like these.

__Issue__: Whether the Christian Bros was responsible for the sexual and physical abuse of children (who were in need of care and protection) committed by its brothers at one of its institutes?

__Law__:

* The Supreme Court held in favour of the claimants.

* The relationship between the Institute and the brothers could give rise to vicarious liability: it was ‘akin to contract’. The torts were sufficiently connected to that relationship.

* (1) What was the nature of the relationship between the defendant and the wrongdoer?

* (2) What was the connection between the wrongdoing and the work of the boys’ home?

__Facts__: Priests were abusing children in a parish home in a Catholic boys’ home. They were absolutely integrated into the work of the order and so would have been employees if it were not for the idiosyncratic structure of religious organisations like these.

__Issue__: Whether the Christian Bros was responsible for the sexual and physical abuse of children (who were in need of care and protection) committed by its brothers at one of its institutes?

__Law__:

* The Supreme Court held in favour of the claimants.

* The relationship between the Institute and the brothers could give rise to vicarious liability: it was ‘akin to contract’. The torts were sufficiently connected to that relationship.

* (1) What was the nature of the relationship between the defendant and the wrongdoer?

* (2) What was the connection between the wrongdoing and the work of the boys’ home?

27

New cards

*Reeves v Commissioner of Police of the Metropolis* \[2001\] 1 AC 360 (HL)

**Contributory Negligence**

__Facts__: The police failed to close a door hatch, enabling a prisoner, Mr Lynch, to commit suicide. The prisoner was a known suicide risk. The police admitted they had failed to take normal precautions.

__Issue__: Whether the deliberate self-harm of the plaintiff gives rise to claims that the police were negligent in their supervision of the plaintiff, allowing the plaintiff to kill himself?

__Law__:

* The court can reduce the damage available, having regard to the claimants share in responsibility that they see reasonable.

* Police are 50% responsible and the plaintiff was 50% responsible.

__Facts__: The police failed to close a door hatch, enabling a prisoner, Mr Lynch, to commit suicide. The prisoner was a known suicide risk. The police admitted they had failed to take normal precautions.

__Issue__: Whether the deliberate self-harm of the plaintiff gives rise to claims that the police were negligent in their supervision of the plaintiff, allowing the plaintiff to kill himself?

__Law__:

* The court can reduce the damage available, having regard to the claimants share in responsibility that they see reasonable.

* Police are 50% responsible and the plaintiff was 50% responsible.

28

New cards

*Hotchin v NZ Guardian Trust Co Ltd* \[2016\] NZSC 24, \[2016\] 1 NZLR 906

**Contribution Between Tortfeasors**

__Facts__: This was a strike out decision. (1) The promoters of an investment were alleged to have made untrue statements in a prospectus. (2) Trustees of the trust deed were alleged to have negligently monitored the fund. Because of (1) investors were caused to invest in a fund that did not have a sufficient asset backing. Because (2) the company was allowed to trade for too long, deteriorating the asset position of the company.

__Law__:

* One tortfeasor who has been held liable can seek “contribution” to the liability from another tortfeasor - but only if that tortfeasor would have been liable for the same damage.

* “...any tortfeasor liable in respect of that damage may recover contribution from any other tortfeasor who is, or would if sued in time have been, liable in respect of the same damage, whether as a joint tortfeasor or otherwise.”

* Both parties were responsible for the investors losing

* The Supreme Court held that the allegedly misleading promoter of the investment could join the trustees even though the wrongs were quite different on these facts

__Facts__: This was a strike out decision. (1) The promoters of an investment were alleged to have made untrue statements in a prospectus. (2) Trustees of the trust deed were alleged to have negligently monitored the fund. Because of (1) investors were caused to invest in a fund that did not have a sufficient asset backing. Because (2) the company was allowed to trade for too long, deteriorating the asset position of the company.

__Law__:

* One tortfeasor who has been held liable can seek “contribution” to the liability from another tortfeasor - but only if that tortfeasor would have been liable for the same damage.

* “...any tortfeasor liable in respect of that damage may recover contribution from any other tortfeasor who is, or would if sued in time have been, liable in respect of the same damage, whether as a joint tortfeasor or otherwise.”

* Both parties were responsible for the investors losing

* The Supreme Court held that the allegedly misleading promoter of the investment could join the trustees even though the wrongs were quite different on these facts

29

New cards

*Home Office v Dorset Yacht Co Ltd* \[1970\] AC 1004 (HL)

**Advanced Duty: Third Party Interventions/Wrongdoing**

__Facts__: Borstal trainees were working on an island under supervision. Three borstal officers had control over the trainees. The borstal officers were under the control of the Home Office (DoC). The Borstal trainees escaped and boarded a yacht one night. They set the yacht in motion and caused extensive damage. The respondents sued the Home Office (DoC) for damages.

__Issue__: Whether the Home Office or \[the\] Borstal officers owed any duty of care to the respondents?

__Law__:

* Mere foreseeability is not sufficient - damage to the plaintiff must be very likely to follow from their carelessness

* If the damage is very likely the defendant will be liable when what occurred was the most obvious of events (depending on the facts). Once you create the danger, you have a duty to prevent the harm arising from it.

* The damage was highly probable (heightened reasonable foreseeability standard)

* Exception to the general rule that there is no duty of care for omissions

* Policy: Once the boys are in a criminal justice system, there is a public law set of obligations in the rehabilitation of the boys. Therefore, there is a large amount of discretion for the officers.

__Facts__: Borstal trainees were working on an island under supervision. Three borstal officers had control over the trainees. The borstal officers were under the control of the Home Office (DoC). The Borstal trainees escaped and boarded a yacht one night. They set the yacht in motion and caused extensive damage. The respondents sued the Home Office (DoC) for damages.

__Issue__: Whether the Home Office or \[the\] Borstal officers owed any duty of care to the respondents?

__Law__:

* Mere foreseeability is not sufficient - damage to the plaintiff must be very likely to follow from their carelessness

* If the damage is very likely the defendant will be liable when what occurred was the most obvious of events (depending on the facts). Once you create the danger, you have a duty to prevent the harm arising from it.

* The damage was highly probable (heightened reasonable foreseeability standard)

* Exception to the general rule that there is no duty of care for omissions

* Policy: Once the boys are in a criminal justice system, there is a public law set of obligations in the rehabilitation of the boys. Therefore, there is a large amount of discretion for the officers.

![**Advanced Duty: Third Party Interventions/Wrongdoing**

__Facts__: Borstal trainees were working on an island under supervision. Three borstal officers had control over the trainees. The borstal officers were under the control of the Home Office (DoC). The Borstal trainees escaped and boarded a yacht one night. They set the yacht in motion and caused extensive damage. The respondents sued the Home Office (DoC) for damages.

__Issue__: Whether the Home Office or \[the\] Borstal officers owed any duty of care to the respondents?

__Law__:

* Mere foreseeability is not sufficient - damage to the plaintiff must be very likely to follow from their carelessness

* If the damage is very likely the defendant will be liable when what occurred was the most obvious of events (depending on the facts). Once you create the danger, you have a duty to prevent the harm arising from it.

* The damage was highly probable (heightened reasonable foreseeability standard)

* Exception to the general rule that there is no duty of care for omissions

* Policy: Once the boys are in a criminal justice system, there is a public law set of obligations in the rehabilitation of the boys. Therefore, there is a large amount of discretion for the officers.](https://knowt-user-attachments.s3.amazonaws.com/b6557a6623d942e0a906461358fcd7b8.jpeg)

30

New cards

*Smith v Littlewoods Organisation Ltd* \[1987\] AC 241 (HL)

**Advanced Duty: Third Party Interventions/Wrongdoing**

__Facts__: Youths set fire to an abandoned cinema, causing extensive damage to the surrounding buildings. Plaintiffs argued the defendant failed to protect the neighbours.

__Issue__: Whether the owner of the cinema owed a duty of care to protect the plaintiffs?

__Law__:

* Lord Mackay: Heightened reasonable foreseeability

* A duty is owed when the type of harm was highly likely and the facts make the hazard a virtual certainty

* Lord Goff: A duty will be imposed where the defendant created the harm

* Where the defendant negligently causes or allows to be caused a source of danger which is reasonably foreseeable for a third party to interfere and cause the danger

* Where the defendant knew or ought to have known of a danger and failed to take reasonable steps to prevent that danger harming his neighbour

* Supports *Dorset*

* Duty will be imposed where the defendant created harm

__Facts__: Youths set fire to an abandoned cinema, causing extensive damage to the surrounding buildings. Plaintiffs argued the defendant failed to protect the neighbours.

__Issue__: Whether the owner of the cinema owed a duty of care to protect the plaintiffs?

__Law__:

* Lord Mackay: Heightened reasonable foreseeability

* A duty is owed when the type of harm was highly likely and the facts make the hazard a virtual certainty

* Lord Goff: A duty will be imposed where the defendant created the harm

* Where the defendant negligently causes or allows to be caused a source of danger which is reasonably foreseeable for a third party to interfere and cause the danger

* Where the defendant knew or ought to have known of a danger and failed to take reasonable steps to prevent that danger harming his neighbour

* Supports *Dorset*

* Duty will be imposed where the defendant created harm

31

New cards

*Couch v Attorney General (No 1)* \[2008\] NZSC 45, \[2008\] 3 NZLR 724

**Advanced Duty: Third Party Interventions/Wrongdoing**

__Facts__: Mr Bell was on parole and was known to have issues with alcohol abuse and had a violent background. Mr Bell was allowed to work in the RSA around cash and alcohol. Mr Bell violently robbed the RSA killing other victims and seriously injuring Ms Couch. Ms Couch seeks exemplary damages.

__Issue__: Whether the DoC were negligent in administering Mr Bell’s parole conditions and whether this negligence caused the injuries suffered by Ms Couch?

__Law__:

* Is the defendant in a specific and delineated class which is a special risk?

* Majority: If the plaintiff was in an identifiable and delineated class of people, a duty would be imposed.

* Plaintiff might be able to establish that she was at a *specific and obvious risk*, that put her in an identifiable class.

* “The more specific and obvious the risk is, the stronger will be the case for holding that the defendant had a duty of care to the plaintiff, fulfilment of which required the reasonable exercise of that power and ability.”

* Facts that could help establish a specific and obvious risk:

* (1) Defendant had an opportunity to *control* the (primary) wrongdoer

* (2) There was a high risk that Bell would reoffend

* (3) There had been a past episode of random violence accompanying property crime (service station episode)

* (4) Bell had been in constant need of money

* (5) There was cash on the premises

* (6) The premises were a predictable target for a robbery

* (7) Bell had been able to find out about the security system

__Facts__: Mr Bell was on parole and was known to have issues with alcohol abuse and had a violent background. Mr Bell was allowed to work in the RSA around cash and alcohol. Mr Bell violently robbed the RSA killing other victims and seriously injuring Ms Couch. Ms Couch seeks exemplary damages.

__Issue__: Whether the DoC were negligent in administering Mr Bell’s parole conditions and whether this negligence caused the injuries suffered by Ms Couch?

__Law__:

* Is the defendant in a specific and delineated class which is a special risk?

* Majority: If the plaintiff was in an identifiable and delineated class of people, a duty would be imposed.

* Plaintiff might be able to establish that she was at a *specific and obvious risk*, that put her in an identifiable class.

* “The more specific and obvious the risk is, the stronger will be the case for holding that the defendant had a duty of care to the plaintiff, fulfilment of which required the reasonable exercise of that power and ability.”

* Facts that could help establish a specific and obvious risk:

* (1) Defendant had an opportunity to *control* the (primary) wrongdoer

* (2) There was a high risk that Bell would reoffend

* (3) There had been a past episode of random violence accompanying property crime (service station episode)

* (4) Bell had been in constant need of money

* (5) There was cash on the premises

* (6) The premises were a predictable target for a robbery

* (7) Bell had been able to find out about the security system

32

New cards

*Hedley Byrne v Heller & Partners Ltd* \[1964\] AC 465

**Advanced Duty: Negligent Misstatements**

__Facts__: Hedley Byrne and co were advertising agents liable for orders made by a company. Hedley Byrnes asked D whether the company was stable. D gave favourable credit references, which were misleading, and Hedley Byrne lost 17,000 pounds.

__Issue__: Whether the appellants can recover damages from the respondent on the basis that the references were negligently provided and in breach of the respondents’ duty of care to the appellants?

__Law__:

* Duty of care for negligent misstatement arises where there is an assumption of responsibility, and loss is recoverable despite being pure economic loss

* A general duty of care in cases involving statements was not recognised until *Hedley Byrne*

* Statements can be obscured and stretched

* Statements can be casual

* Lord Reid: Even professionals can speak freely and carelessly so it might not be just to hold them liable

* The loss in negligent misstatements cases is economic, so it is quite a high standard this also can undermine law of contracts

* Problem with statement: floodgate of widespread control of misinterpretation of words

__Facts__: Hedley Byrne and co were advertising agents liable for orders made by a company. Hedley Byrnes asked D whether the company was stable. D gave favourable credit references, which were misleading, and Hedley Byrne lost 17,000 pounds.

__Issue__: Whether the appellants can recover damages from the respondent on the basis that the references were negligently provided and in breach of the respondents’ duty of care to the appellants?

__Law__:

* Duty of care for negligent misstatement arises where there is an assumption of responsibility, and loss is recoverable despite being pure economic loss

* A general duty of care in cases involving statements was not recognised until *Hedley Byrne*

* Statements can be obscured and stretched

* Statements can be casual

* Lord Reid: Even professionals can speak freely and carelessly so it might not be just to hold them liable

* The loss in negligent misstatements cases is economic, so it is quite a high standard this also can undermine law of contracts

* Problem with statement: floodgate of widespread control of misinterpretation of words

33

New cards

*Caparo Industries Plc v Dickman* \[1990\] UKHL 2

**Advanced Duty: Negligent Misstatements**

__Facts__: Caparo owned shares in Fidelity. C started buying more shares in F shortly before the publication of F’s audited accounts for the financial year. C continued to buy shares after the accounts were published, and in doing so made a successful takeover of F. The accounts showed a 1.2M pound pre-tax profit, the true position was .4M loss. Accordingly C had overpaid for its new shares in F.

__Law__:

* The takeover bid should have been foreseen; or

1. D should have anticipating that C would have relied on the accounts to make decisions as to how many shares in F it should hold

* Caparo test (*Special relationship is necessary between the advisor and advisee*) The relationship between adviser and advisee may typically be held to exist where:

* (1) The advice is required for a purpose, whether particularly specified or generally described, which is made known, either actually of inferentially, to the adviser at the time when the advice is given;

* (2) The adviser knows, either actually or inferentially, that his advice will be communicated to the advisee, either specifically or as a member of an ascertainable class, in order that it should be used by the advisee for that purpose;

* (3) It is known either actually of inferentially, that the advice so communicated is likely to be acted upon by the advisee for the purpose without independent inquiry, and

* (4) It is so acted upon by the advisee to his detriment

__Facts__: Caparo owned shares in Fidelity. C started buying more shares in F shortly before the publication of F’s audited accounts for the financial year. C continued to buy shares after the accounts were published, and in doing so made a successful takeover of F. The accounts showed a 1.2M pound pre-tax profit, the true position was .4M loss. Accordingly C had overpaid for its new shares in F.

__Law__:

* The takeover bid should have been foreseen; or

1. D should have anticipating that C would have relied on the accounts to make decisions as to how many shares in F it should hold

* Caparo test (*Special relationship is necessary between the advisor and advisee*) The relationship between adviser and advisee may typically be held to exist where:

* (1) The advice is required for a purpose, whether particularly specified or generally described, which is made known, either actually of inferentially, to the adviser at the time when the advice is given;

* (2) The adviser knows, either actually or inferentially, that his advice will be communicated to the advisee, either specifically or as a member of an ascertainable class, in order that it should be used by the advisee for that purpose;

* (3) It is known either actually of inferentially, that the advice so communicated is likely to be acted upon by the advisee for the purpose without independent inquiry, and

* (4) It is so acted upon by the advisee to his detriment

34

New cards

*Scott Group v McFarlane and Others* \[1978\] 1 NZLR 553

**Advanced Duty: Negligent Misstatements**

__Facts__: The audited accounts of a company indicated that it was ripe for takeover. The shares had a large asset backing, but the profits were low. Scott Group Ltd relied on the 1970 accounts of John Duthie Holdings Ltd for the purposes of a successful takeover bid. There was an error in the accounts audited by the defendants which suggested the capital position was much stronger than it actually was.

__Law__:

* Established that a duty of care is owed by auditors who could reasonably foresee persons will rely on the audited financial statements for a particular type of investment decision. The *Hedley Byrne* principle of knowledge or reliance was extended to a test of reasonable foreseeability

* Woodhouse J: Proximity analysis -

* (1) The auditors are professionals

* (2) Though the *immediate* purpose was to provide information to the shareholders, auditors know that others dealing with the company will rely on the audited accounts

* (3) No opportunity for intermediate examination

* (4) No obligation to the general public - but persons who are “sufficiently concerned” will be in a different category

* Cooke J: There needs to be a close and direct relationship between the parties (“proximity”)

* The relationship would be sufficiently proximate *where there was a high likelihood of reliance* - such as would exist when a company is ripe for takeover

* Richmond P: A duty of care in cases like this requires the provider of the information to be aware that a particular person or class of person is likely to rely on the information

* Mere foreseeability is not enough

__Facts__: The audited accounts of a company indicated that it was ripe for takeover. The shares had a large asset backing, but the profits were low. Scott Group Ltd relied on the 1970 accounts of John Duthie Holdings Ltd for the purposes of a successful takeover bid. There was an error in the accounts audited by the defendants which suggested the capital position was much stronger than it actually was.

__Law__:

* Established that a duty of care is owed by auditors who could reasonably foresee persons will rely on the audited financial statements for a particular type of investment decision. The *Hedley Byrne* principle of knowledge or reliance was extended to a test of reasonable foreseeability

* Woodhouse J: Proximity analysis -

* (1) The auditors are professionals

* (2) Though the *immediate* purpose was to provide information to the shareholders, auditors know that others dealing with the company will rely on the audited accounts

* (3) No opportunity for intermediate examination

* (4) No obligation to the general public - but persons who are “sufficiently concerned” will be in a different category

* Cooke J: There needs to be a close and direct relationship between the parties (“proximity”)

* The relationship would be sufficiently proximate *where there was a high likelihood of reliance* - such as would exist when a company is ripe for takeover

* Richmond P: A duty of care in cases like this requires the provider of the information to be aware that a particular person or class of person is likely to rely on the information

* Mere foreseeability is not enough

35

New cards

*Boyd Knight v Purdue & Matthew* \[1999\] 2 NZLR 278 (CA)

**Advanced Duty: Negligent Misstatements**

__Facts__: D were auditors of accounts of a finance company. The Securities Act 1978 required the report be incorporated into the prospectus. The auditors had failed to detect fraud by one of the finance company’s principals. The company collapsed, and investigators sought to recover from the auditors. The CA held “in the light of the 1978 Act” a sufficiently proximate relationship existed.

__Law__:

* The CA held “in the light of the 1978 Act” a sufficiently proximate relationship existed.

* Emphasises the purpose of the information provided.

* Blanchard J:

* “I have no doubt that these factors give rise to the necessary closeness of relationship between the auditor and those who invest on the strength of the prospectus, so that the auditor owes them a duty to be careful…”

* For there to be liability for negligent misstatements you must show the plaintiff actually relied on the audited accounts

* That wasn’t the case on these facts

__Facts__: D were auditors of accounts of a finance company. The Securities Act 1978 required the report be incorporated into the prospectus. The auditors had failed to detect fraud by one of the finance company’s principals. The company collapsed, and investigators sought to recover from the auditors. The CA held “in the light of the 1978 Act” a sufficiently proximate relationship existed.

__Law__:

* The CA held “in the light of the 1978 Act” a sufficiently proximate relationship existed.

* Emphasises the purpose of the information provided.

* Blanchard J:

* “I have no doubt that these factors give rise to the necessary closeness of relationship between the auditor and those who invest on the strength of the prospectus, so that the auditor owes them a duty to be careful…”

* For there to be liability for negligent misstatements you must show the plaintiff actually relied on the audited accounts

* That wasn’t the case on these facts

36

New cards

*Malborough District Council v Altimarlock Joint Venture Ltd* \[2012\] 2 NZLR 726 (SC)

**Advanced Duty: Negligent Building/Inspection (Pure Economic Loss)**

__Facts__: Altimarloch Joint Venture Ltd agreed to purchase a farm for viticulture. It was represented that the vendors would be able to transfer resource consent to extract water from a passing stream, providing necessary irrigation. The representations were false. Altimarloch brought an action against the Council for negligent misstatement.

__Law__:

* NZSC confirmed a duty of care is owed in relation to incorrect information provided in a LIM regardless of the fact that they did not specifically provide the information to the plaintiff for the purpose of buying land. (The Council owed a duty to the potential purchaser to be careful in preparation of a LIM.)

* “The information supplied in a LIM is likely to be crucial to those who seek it. They will obviously rely on the accuracy of the LIM when deciding how to proceed.”

* This is because the statutory scheme indicated that the public should be able to rely on the information.

__Facts__: Altimarloch Joint Venture Ltd agreed to purchase a farm for viticulture. It was represented that the vendors would be able to transfer resource consent to extract water from a passing stream, providing necessary irrigation. The representations were false. Altimarloch brought an action against the Council for negligent misstatement.

__Law__:

* NZSC confirmed a duty of care is owed in relation to incorrect information provided in a LIM regardless of the fact that they did not specifically provide the information to the plaintiff for the purpose of buying land. (The Council owed a duty to the potential purchaser to be careful in preparation of a LIM.)

* “The information supplied in a LIM is likely to be crucial to those who seek it. They will obviously rely on the accuracy of the LIM when deciding how to proceed.”

* This is because the statutory scheme indicated that the public should be able to rely on the information.

37

New cards

*Anns v Merton London Borough Council* \[1977\] UKHL 4, \[1978\] AC 728

**Advanced Duty: Negligent Building/Inspection (Pure Economic Loss)**

__Facts__: The local authority approved building plans for a block of flats. In 1970 a structural movement began to occur causing cracking to the walls and other damage. The property became dangerous and the tenants began proceedings in negligence against the council for failing to properly inspect the building walls to ensure the foundations were laid to the correct depth.

__Issue__: (1) Whether the council owed a duty of care to the claimants in respect of the incorrect depth of foundations laid by the third-party builder. (2) Whether the claim was statute barred.

__Law__:

* Held: A local authority owed a duty to owners of occupiers who might suffer injury to health caused by defective foundations to act carefully in the inspection of foundation.

* Recognition of a duty of care imposed on local authorities in the building inspection context

* (1) Whether, as between the alleged wrongdoer and the person who has suffered damage there is a sufficient relationship of proximity or neighbourhood such that in reasonable contemplation of the former carelessness on his part may be likely to cause damage to the latter