Principles of Economics

1/110

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

111 Terms

What is microeconomics?

Analysis of individual choices and their interaction on markets

What is macroeconomics?

Analysis of economy as a whole

How do scarce resources appear and what is their cause?

human wants exceed the resources available to satisfy them → trade-offs

Trade-off: opportunity cost of a choice → best forgone alternative → need to weigh costs and benefits

What is the general goal of optimization?

rational individuals make rational choices

maximize utility (satisfaction) from a given set of resources → objective function

minimize resource use to obtain a given utility level

these opposing goals create a dual problem

What is an equilibrium?

no agent has an incentive to change their behavior

agents are compatible with each other, and thus feasible → market equilibrium

all choices are realizable

market supply quantity is at a given price (market demand quantity = market supply quantity)

What is the Pareto principle?

allocation of resources so that they are Pareto efficient

Pareto improvement: reallocation that makes at least one agent better off without making any other agent worse off

What is production?

transformation of inputs into outputs

time + other resources → production → alleviate scarcity

efficient production → trade-off → producing more of one good implies producing less of another good

What is trade?

voluntary exchange of goods between agents

voluntariness → Pareto improvement

direct exchange (barter, goods-for-goods) → double coincidence of wants

indirect exchange → simple coincidence of wants

uses a medium of exchange (money)

dividable

widely accepted

non-perishable

terms of trade must be between the opportunity costs of two agents

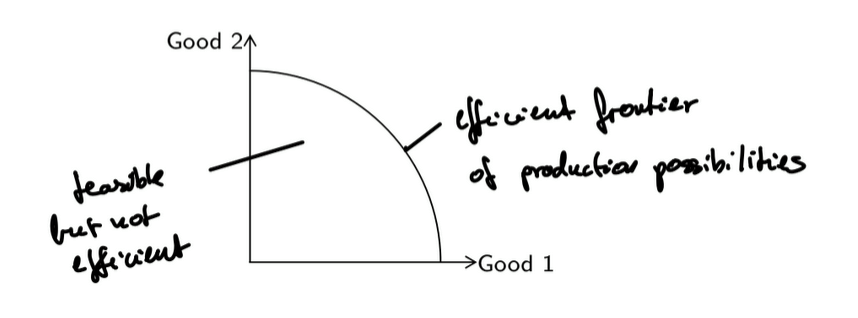

What is a transformation curve?

graphical representation of a production trade-off

all combinations of goods on and below the transformation curve are feasible

efficient combinations on the curve

slope → opportunity cost = marginal cost of producing one good expressed in units of another

What is an absolute advantage?

An agent’s ability to produce a certain good using less resources than other agents

What is a comparative advantage?

An agent’s ability to produce a certain good at a lower opportunity cost than other agents

not relevant when one party has an absolute advantage for all produces

What is the principle of comparative advantage?

Specialization according to comparative advantages → mutual gains from trade

true whether one trading partner has an absolute advantage in every good

terms of trade must be between the opportunity costs of the trading partners

What are the three main characteristics of a representative consumer?

derives utility from the consumption of two goods (q1, q2) available to the individual

price taker; considers the prices (p1, p2) as given

the individual’s budget (initial endowment) y= p1q1 + p2q2 is given

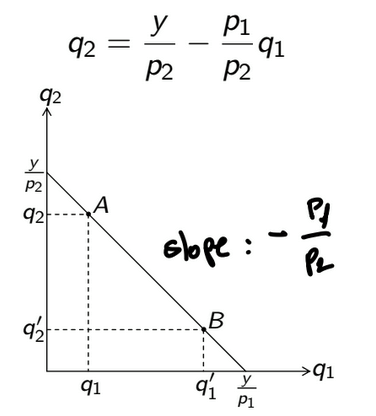

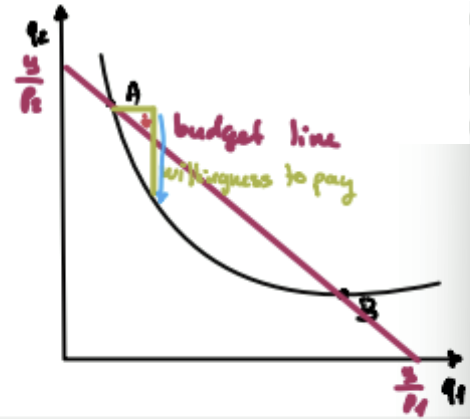

What is the budget line?

Locus of all consumption bundles (q1, q2) that an individual can obtain is she spends her entire budget

What is the price ratio?

Rate at which the individual can substitute one good for another at constant expenses (price of one good in the unit of another good)

What does the utility function for demand U(q1, q2) represent?

the individual’s preference order with respect to all consumption bundles (q1, q2)

utility is an ordinal concept, not cardinal

there are infinite preference combinations

increasing, strictly concave function

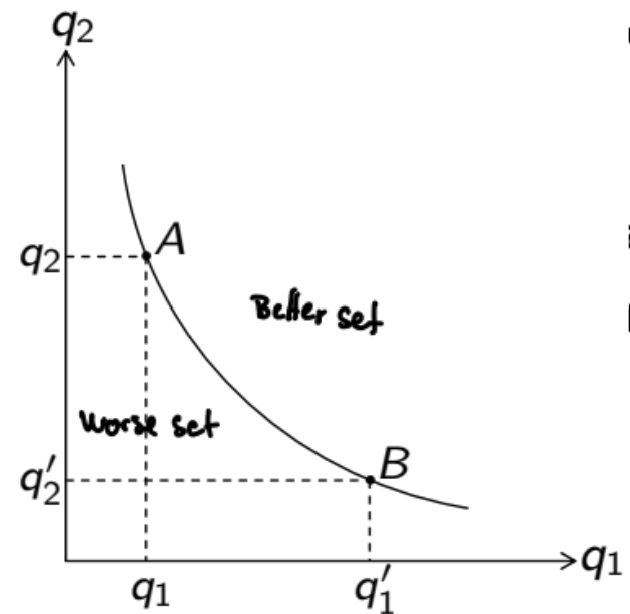

What is the indifference curve of consumption?

Locus of all consumption bundles (q1, q2) that have the same rank in the individual’s preference order → yield the same utility level U(q1, q2)

What is marginal utility?

By how much does utility increase when the consumer increases the consumption of one of the goods

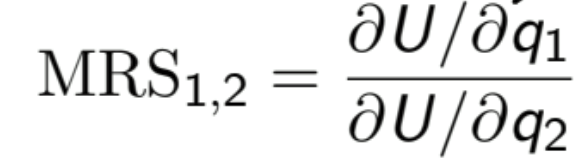

What is the marginal rate of substitution?

Rate at which the individual can substitute one good for another at constant utility

individual’s willingness to pay for an additional unit of q1 measured in units of q2

slope of indifference curve: -MRS

What are the four assumption of preferences?

completeness

transitivity

monotonicity

convexity

What is completeness?

The individual can compare any two consumption bundles A and B

every consumption bundle is located on an indifference curve

What is transitivity?

Between three consumption bundles of A, B, and C, if the individual prefers A to B and B to C, then she also prefers A to C. Similarly, if she is indifferent between A and B, as well as B and C, then she is indifferent between A and C.

homo economicus → rational decision maker

if preferences are transitive, indifference curves do not cross

What is monotonicity?

If consumption bundle A contains more of each good than consumption bundle B, then A is better than B. If consumption bundle A contains more of at least one good and not less of another, then A is at least as good as B. If A is always better than B, then preferences are strictly monotonous.

“more is better than less”

if preferences are strictly monotonous, indifference curves are negatively sloped

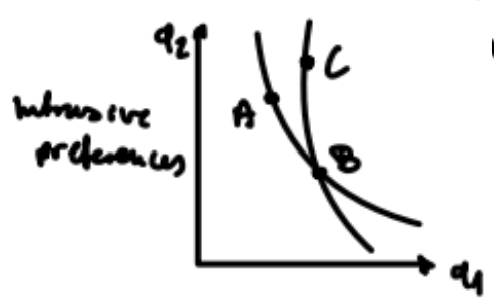

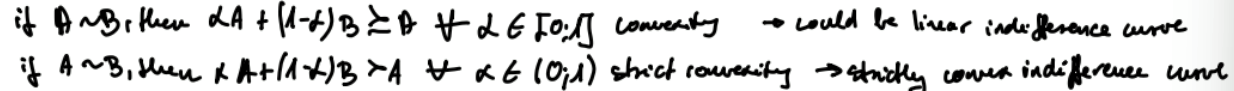

What is convexity?

If the individual is indifferent between two consumption bundles A and B, then any convex combination of A and B is at least as good as A or B. If any strictly convex combination of A and B is better than A or B, then preferences are strictly convex.

strictly convex preferences → strictly convex indifference curves

What are perfect substitutes for consumption?

Two goods the individual is willing to substitute for one another at a constant rate → linear indifference curves (not strictly convex !)

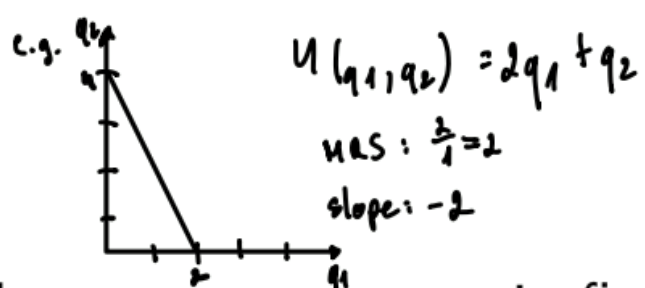

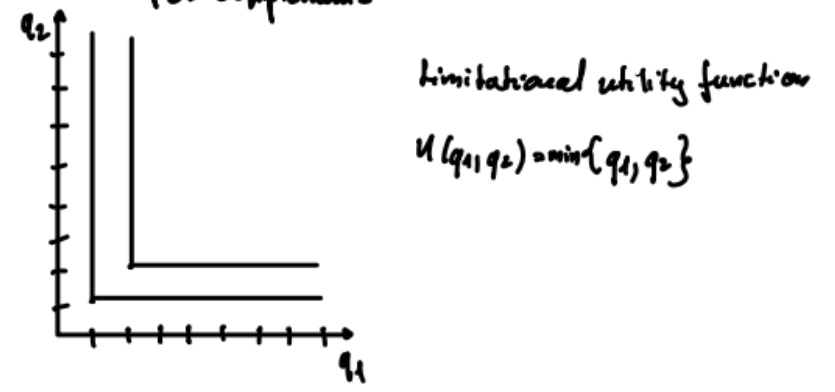

What are perfect complements for consumption?

Two goods the individual wants to consume in fixed proportions → orthogonal indifference curves

e.g. left and right shoes

What is Grossen’s 2nd law?

MRS should be equal to the price ratio

What are the 3 assumption of a budget maximization problem? What is an interior solution?

the entire budget must be spent

the consumption bundle is on the budget line

MRS = price ratio

If slope of indifference curve = slope of budget line → interior solution → exchange rate at constant utility = exchange rate at constant expenses

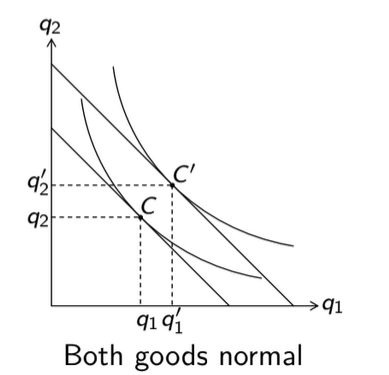

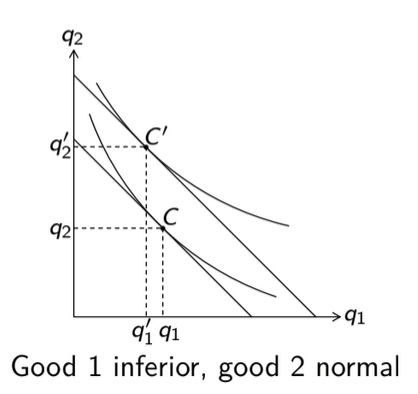

What is a normal good?

A good for which an increase in income causes an increase in consumption

dqi/dy > 0

What is an inferior good?

A good for which an increase in income causes a decrease in consumption

dqi/dy < 0

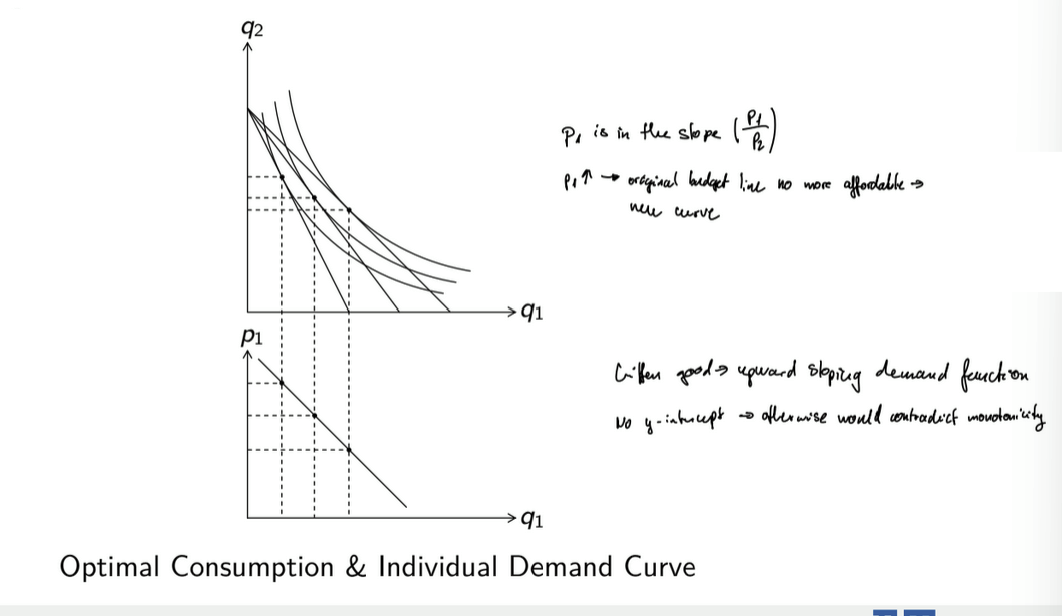

What is the substitution effect?

Change in price ratio → substitution of the good that has become relatively more expensive with the good that has become relatively less expensive

What is the income effect?

Increase in prices decreases the individual’s purchasing power → decrease in purchasing power induces the individual to consume less of normal and more of inferior goods

What is an ordinary good?

A good for which an increase in its own price causes a decrease in consumption

dqi/dpi < 0

the ordinary good is normal → substitution and income effect work in the same direction

the ordinary good is inferior → substitution and income effects work in opposite direction

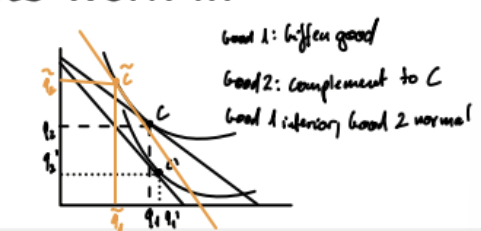

What is a Giffen good?

A good for which an increase in its own price causes an increase in consumption

dqi/dpi > 0

must be inferior → substitution and income effects work in opposite direction

income effect outweighs substitution effect

e.g. price of bread

What is a substitute?

A good is a substitute if an increase in the price of the latter causes an increase in the consumption of the former

dqj/dpi > 0

the substitute good is normal → substitution and income effects work in the opposite direction

substitute good is inferior → substitution and income effects work in the same direction

e.g. potato & rice

What are complements?

A good is a complement to another if an increase in the price of the latter causes a decrease in the consumption of the former

dqj/dpi < 0

must be normal → substitution and income effects work in opposite directions

e.g. printers and cartridges

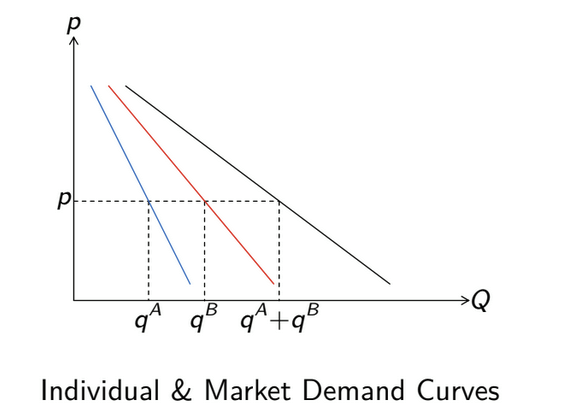

What is market demand?

Sum of individual demand quantities of a good → Q = sum of q

What is the law of demand?

The market demand for a good decreases as its price increases

dQ/dp < 0

What assumptions are made for production and supply?

The firm produces q units of a good (output) by employing two factors of production (inputs); L denotes the quantity of labor, while K denotes the quantity of capital.

the firm is a price taker → output price p, labor w, and capital r are given

input cost: c = wL + rK

revenue: R(q) = pq

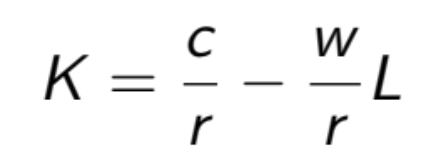

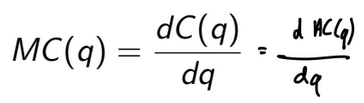

What is an isocost line?

Locus of all input bundles (L, K) that lead to the same level of input costs

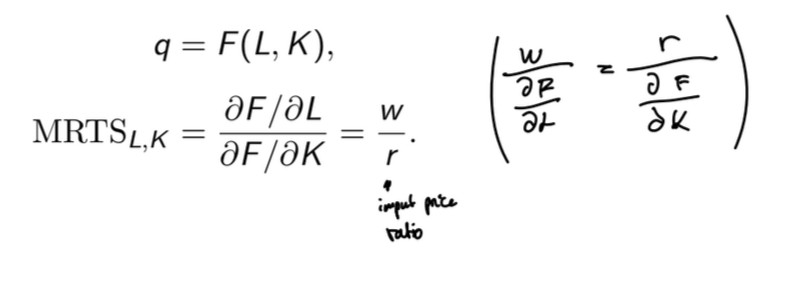

What is the input price ratio?

Rate at which the firm can substitute one input for another at constant input costs

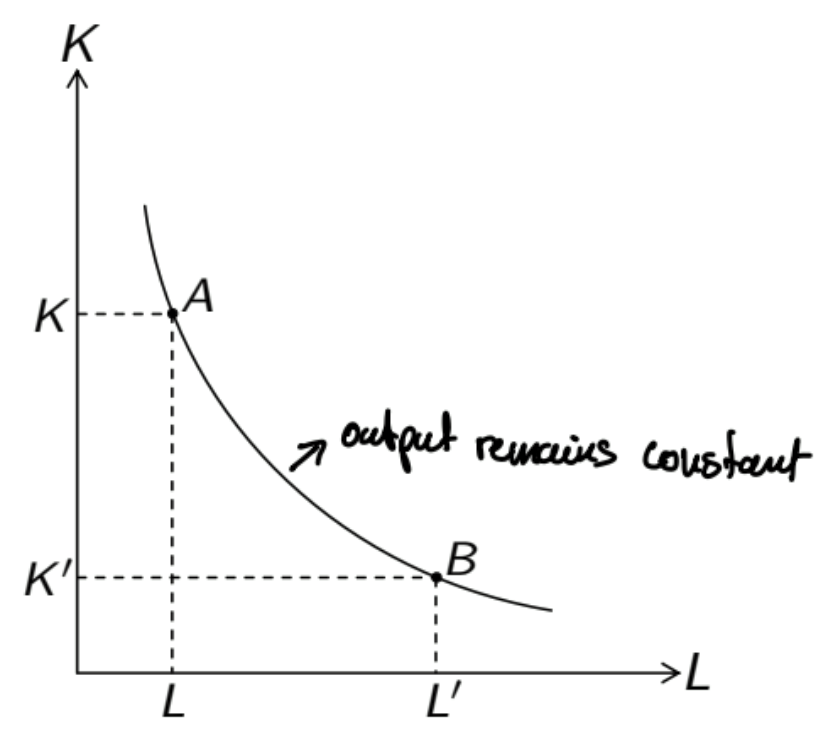

What is an isoquant?

Locus of all input bundles (L, K) that yield the same level of output q = F(L,K)

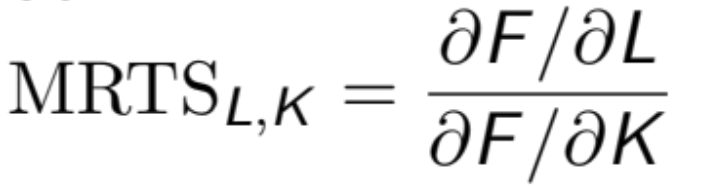

What is the marginal rate of technical substitution?

Rate at which the firm can substitute one input for another at constant output

Out of the four assumption which do not apply for production and supply?

completeness and transitivity → naturally satisfied in a cardinal context

What are perfect substitutes for production?

Two inputs that can be substituted for one another at a constant rate while output remains constant → linear isoquants

e.g. driver vs. autonomous driving

What are perfect complements for production?

Two inputs that should be employed in fixed proportions → orthogonal isoquants

e.g. truck and truck driver

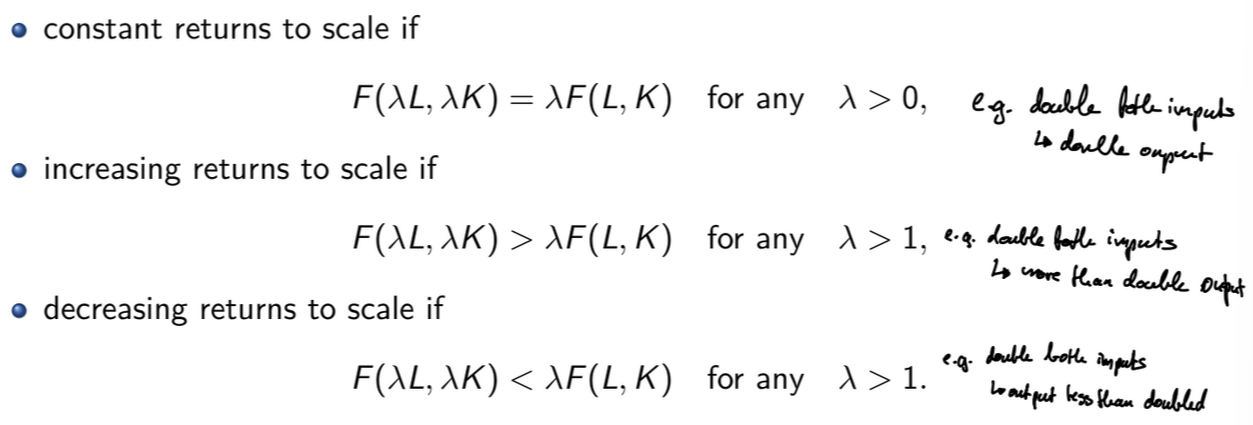

What are returns to scale?

All inputs are multiplied by a constant λ → change in output can be proportional, more than proportional, or less than proportional

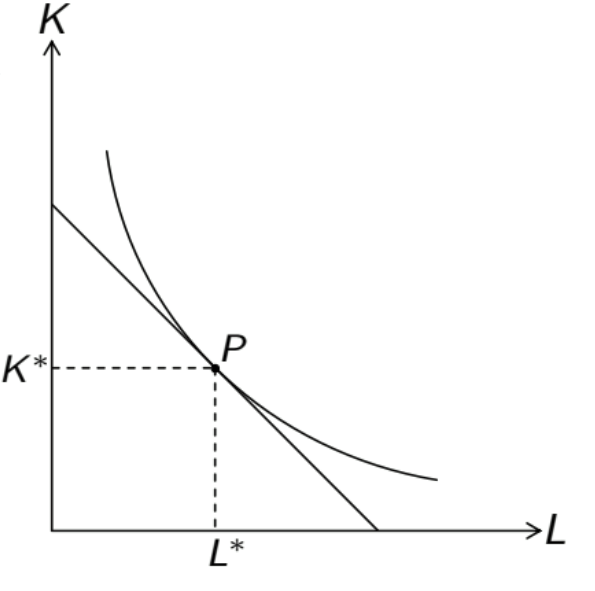

For a cost minimization problem, which conditions must be satisfied?

What is the interior solution for cost minimization?

substitution of labor for capital at constant output = substitution of labor for capital at constant input costs

optimality: slope of isoquant = slope of isocost line

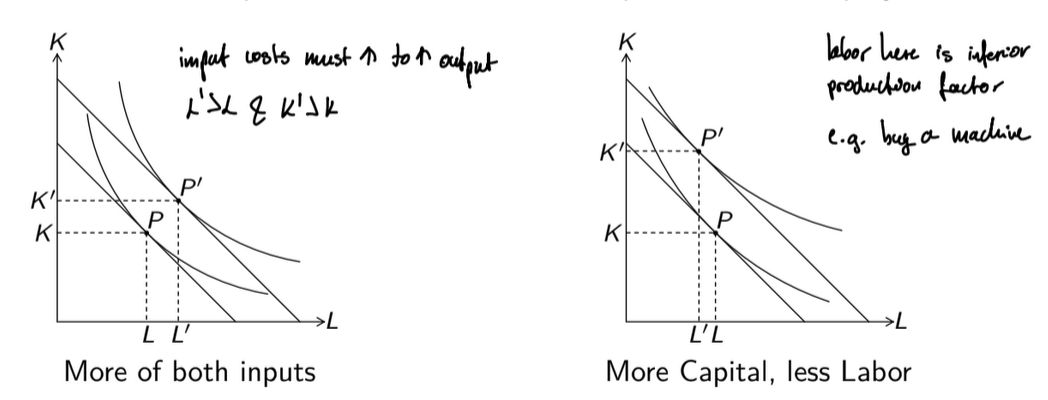

How does the change in output influence input costs?

increase in output → higher input costs

to increase output, more of at least one input must be employed

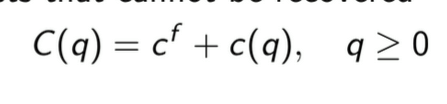

What are total costs of production?

Sum of fixed and variable costs

fixed cost cf : independent of output

variable cost c(q): represent minimum input costs as a function of output

C(q) = cf + c(q)

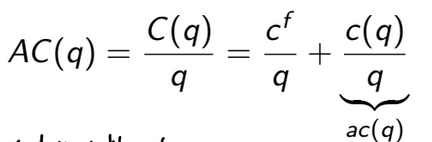

What are average costs of production?

Cost per unit of output

AC(q): average total cost

ac(q): average variable costs

What are marginal cost of production?

Change in total costs resulting from a marginal increase in output

positive → costs monotonously increasing

What does the variable cost curve show?

Variable cost increases → output increases

function of minimum input costs

price of capital is normalized to r = 1

dc(q)/dq > 0

What are short-run total costs?

In the short run, fixed costs are sunk costs.

Sunk costs: incurred costs that cannot be recovered

What are long-run total costs?

In the long run, non-variable costs must be quasi-fixed costs.

Quasi-fixed cost: costs that arise if a firm starts production, but do not vary as output increases.

there are always short-run costs as long as a company is active in the market

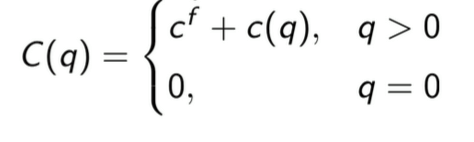

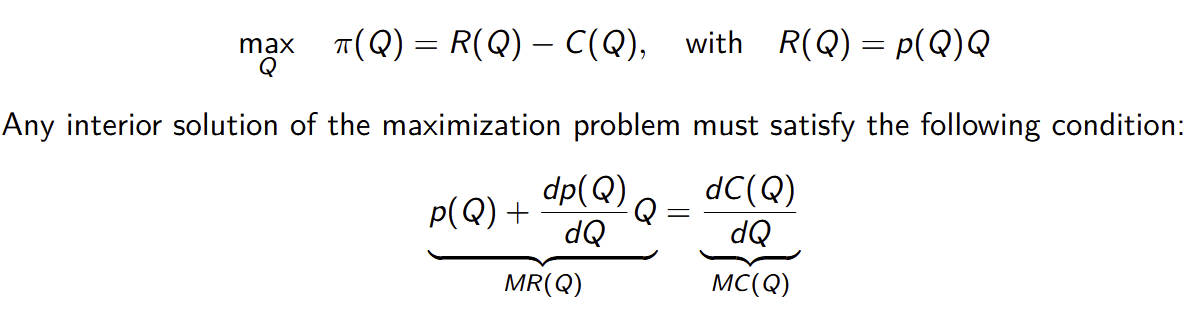

What are the correlations in a profit-maximization problem?

profit: revenue - total cost

marginal revenue = marginal cost → MR + MC = 0

MR: change in revenue resulting from a marginal increase in output

price-taking firm → MR = output price

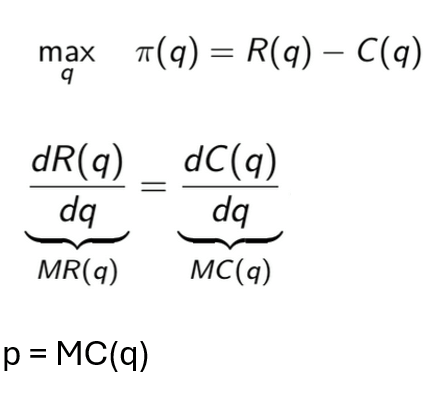

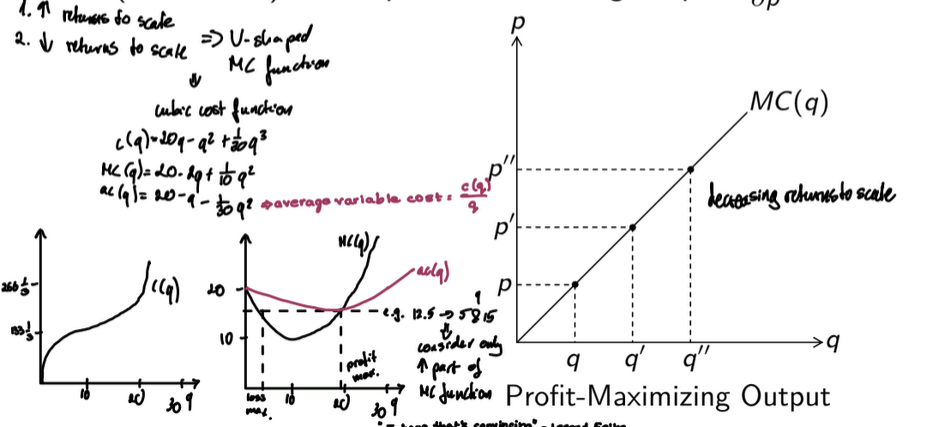

What does a marginal cost curve show?

costs are strictly convex → MC increase as output increases → dMC(q)/dq > 0

increase in the output price → increase in profit-maximizing output ωq/ωp > 0

increasing MC function → convex → decreasing returns to scale

flat MC function → linear

decreasing MC function → concave → increasing returns to scale

What are the conditions of optimal production?

q > 0 → p=MC(q) or q = 0

short run: R(q)≥c(q); p≥ac(q) if p>0

production should only continue if revenue at least covers variable costs → fixed costs are already sunk

long run: R(q)≥C(q); p≥AC(q) if q>0

at least break even

What does the individual supply curve correspond to short- & long-term?

short-run: the individual supply curve corresponds to the segment of the MC curve that runs above the average variable cost curve

long-run: the individual supply curve corresponds to the segment of the MC curve that runs above the average total cost curve

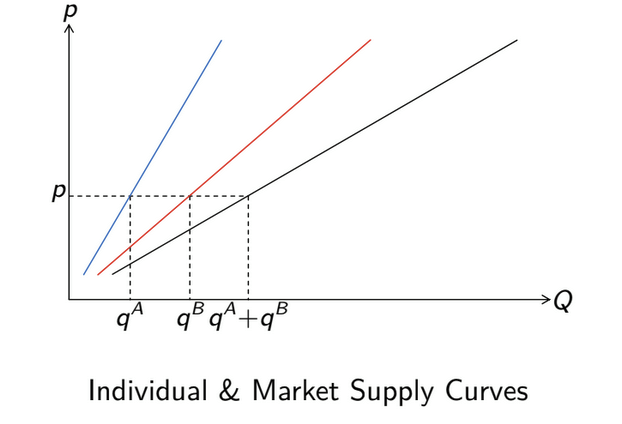

What is market supply?

Sum of individual supply quantities of a good; Q = ∑ q

What is the law of supply?

The market supply of a good increases as its price increases

When is a market perfectly competitive?

If all producers and all consumers are price takers

What are the assumptions made in case of perfect competition?

an ordinary good is supplied by identical profit-maximizing firms

production at increasing marginal costs

no barriers to enter or exit market

consumers consider every unit of good identical → products of different firms are perfect substitutes

uniform prices

consumption doesn’t affect market price

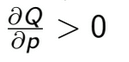

When is a market in equilibrium?

if for a given price p, market demand QD equals market supply QS so that the market is cleared

p* → equilibrium price (market clearing price)

Q* → equilibrium quantity (market clearing quantity)

agent’s choices are optimal (no change) & compatible with each other

stable situation

stable choices

every agent is optimized → no reason to change behavior

individual choices add up → feasibility

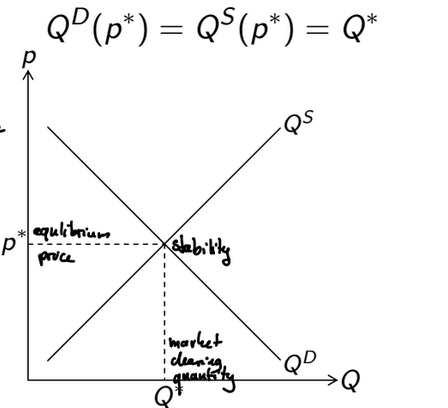

When is a market imbalanced?

if for a given price p, market demand QD differs from market supply QS so that the market is not cleared

excess demand: p’ < p* → QD > QS; Q’ < Q*

market price is too low to clear the market → price will increase until equilibrium

unmet demand

customers signal they are willing to pay more

excess supply: p’’ > p* → QD < QS; Q’’ < Q*

price too high → can’t sell supply

firms signal they are willing to sell at a lower price

QD = QS → market clearing price

How does the number of firms differ short & long run?

short run: number of firms in the market is fixed

long run: number of firms may change because of entry & exit of firms

additional firms enter the market if this yields non-negative profits

incumbent firms exit the market if they make losses

equilibrium: number of firms in the market is the maximum number of firms that can make non-negative profits

more firms → additive individual supply functions become flatter → intersection with demand function at a lower p value → more competition = selling products for less → more difficult to break even

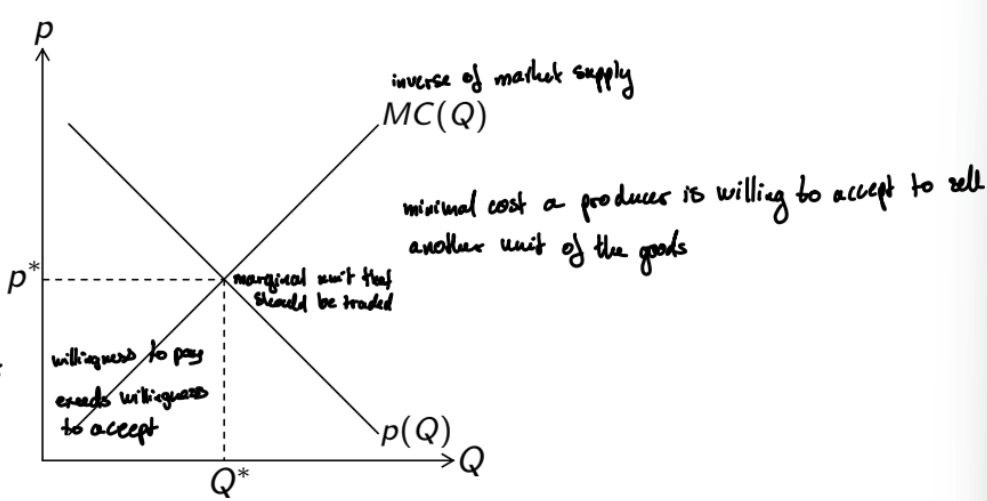

What is the marginal willingness to pay?

At any quantity Q, inverse market demand p(Q) measures the maximum price that consumers are willing to pay for an additional marginal unit of the good.

utility maximization implies that consumers buy a quantity for which inverse market demand equals market price → p(Q) = p

What is the marginal willingness to accept?

At any quantity Q, marginal costs MC(Q) measure the minimum price that producers are willing to accept for an additional marginal unit of the good.

profit maximization implies that firms produce a quantity for which marginal costs equal the market price → MC(Q) = p

What is competitive equilibrium?

If consumers and producers face the same market price, then inverse market demand equals marginal costs in equilibrium, i.e. at the market clearing quantity Q*.

p(Q*) = MC(Q*) = p*

marginal monetary valuation of market demand

first unit is worth the most → with more units the willingness to pay is decreasing

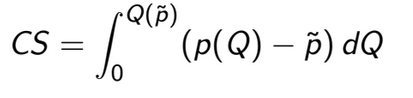

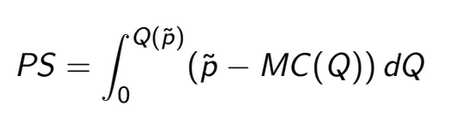

What is consumer surplus?

Aggregated differences between inverse market demand and the market price

What is producer surplus?

Aggregated differences between the market price and marginal costs

PS = revenue - variable cost vs. profit = revenue - cost

What is total surplus?

Sum of consumer and producer surplus

When is welfare maximum achieved?

traded quantity inverse market demand = marginal cost

Q* → all potential gains from trade are realized

When does welfare loss happen?

traded quantity inverse market demand > marginal cost → not all potential gains are realized

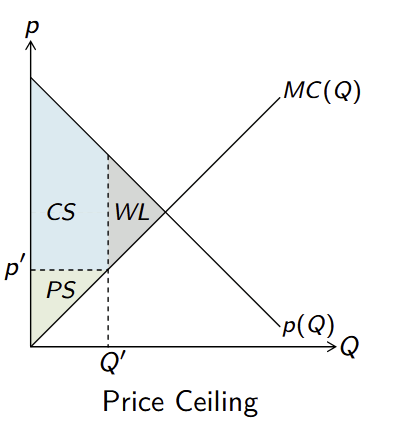

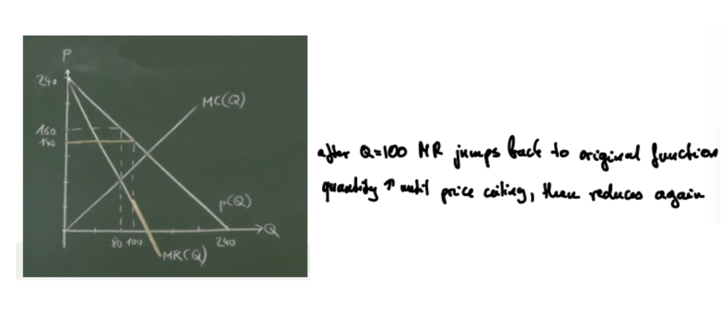

What is the effect of introducing a price ceiling?

p’ < p*; Q’ < Q*; p(Q’) > MC(Q’)

lower cost → less product is sold → welfare loss

makes sense only below market clearing price

producers lost 2 areas → strictly detrimental

consumers gain 1 area & lose 1 area → ambiguous

total surplus is smaller

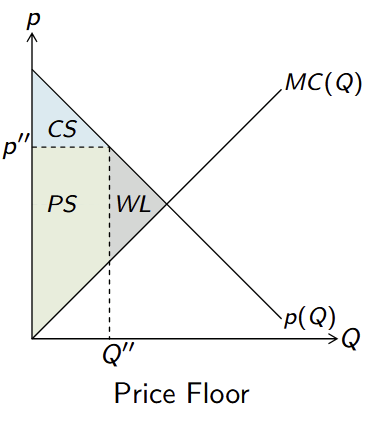

What is the effect of introducing a price floor?

p’’ > p*; Q’’ < Q*; p(Q’’) > MC(Q’’)

consumers lose welfare

producer surplus increases

willingness to pay exceeds willingness to accept

increased price and limited quantity → loss of welfare for maximum price

e.g. to protect producers of agricultural goods, pharmaceuticals, renting, labor market

similar: cartel, monopolistic market

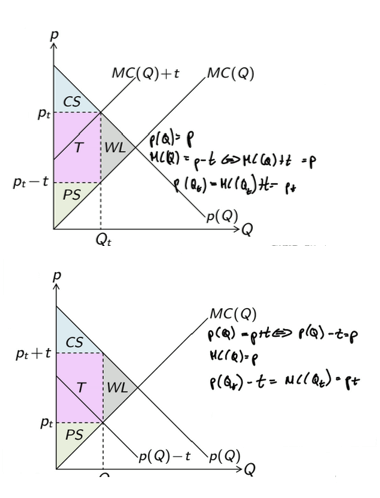

What is the effect of taxation on welfare?

tax rate t > 0; T = tQ tax revenue

the welfare effects of the tax are independent of whether it is levied on producers (e.g. per unit tax on gasoline or electricity) or consumers (e.g. sales tax)

tax drives a wedge between inverse market demand and MC in equilibrium → t = p(Qt) - MC(Qt)

equilibrium price: MC(p) + t

tax → higher equilibrium price → burden on consumers

willingness to pay is adjusted according to tax

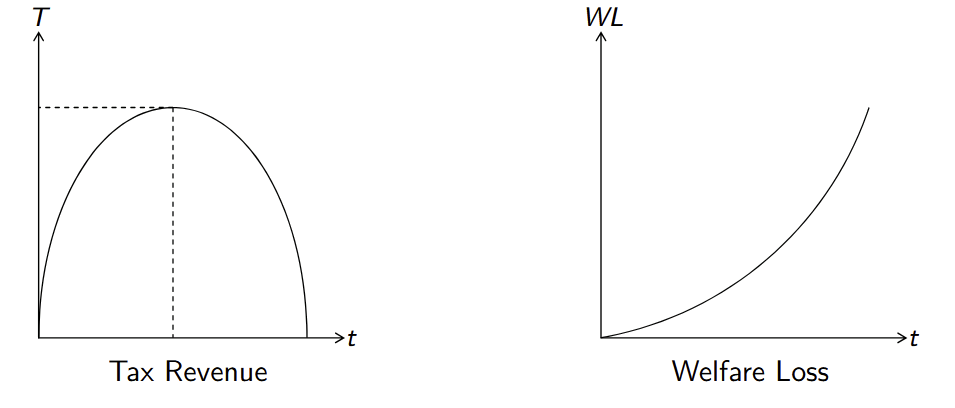

How does the change in tax rate influence welfare?

increase in tax rate → decrease in traded quantity → increase in tax revenue if the tax rate is sufficiently large

higher welfare loss of taxation

When does market failure occur?

When individual optimization of consumer and firms leads to an outcome that is not optimal from a societal (collective) perspective → justifies government intervention

What are properties of a monopoly market?

all consumers are price takers → negligible influence on market price

the monopolist is a price setter

the monopolist’s output choice determines market price

monopolist has market power

the monopolist is informed about market demand but cannot identify individual demands

knows how much consumers are willing to pay given the quantity produced

no price discrimination → charge the same price for everyone

1st degree: personalized pricing → perfect price discrimination

2nd degree: different prices based on quantity

3rd degree: group pricing (e.g. children, seniors)

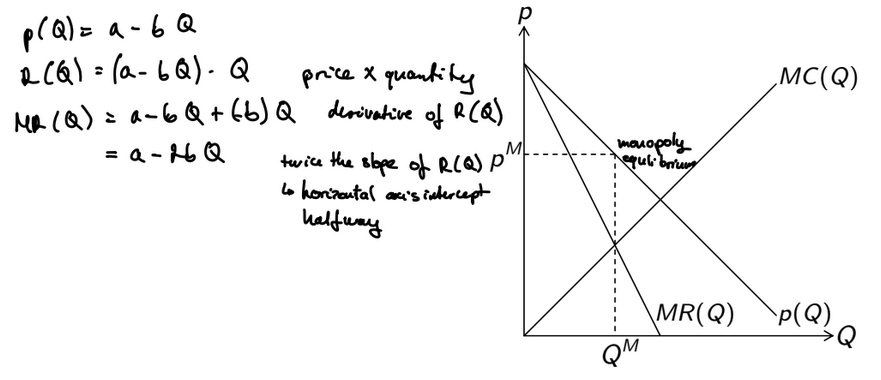

What are the conditions of monopoly profit maximization?

maximize with respect to output given market demand and total costs

if MR>MC → increase production quantity

MR: market price + price reduction of intramarginal units

When is market equilibrium reached in a monopoly market?

QM = profit-maximizing quantity; pM = corresponding price

monopoly quantity equals market demand: QM = QD(pM)

monopoly price equals inverse market demand: pM = p(QM)

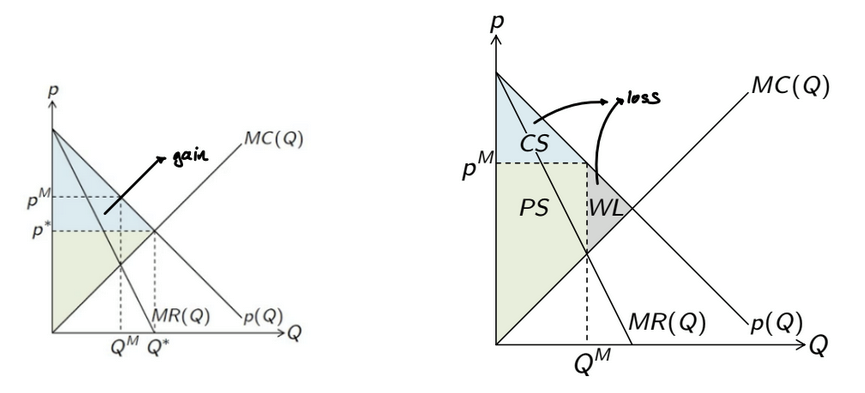

When does welfare loss happen in a monopoly market?

profit-maximizing quantity does not maximize total surplus

not all potential gains are realized

choosing profit-maximizing quantity → price above MC

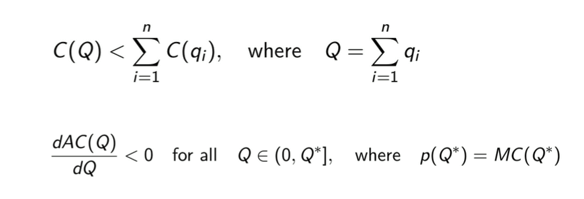

What is a natural monopoly?

A market where total costs are subadditive in the relevant output range → desired quantity can be produced less costly by a single firm than by two or more firms

e.g. rail network, electricity/gas/water

when fixed costs are very high/demand very small

average total costs of the monopolist are decreasing at any positive output smaller or equal to the quantity where inverse market demand is equal to marginal costs

Why is patent protection necessary?

prevents others from utilizing the invention

if fixed costs are higher for the inventor than for potential imitators → protect inventor from making negative profits

results in welfare loss

e.g. upfront costs of R&D

trade-off between prospective welfare and present welfare

Why is price control used to regulate monopolies?

price ceiling that induces the monopolist to increase output → increase welfare (since change in MR is not linear with output increase)

welfare-maximizing price ceiling → produce Q* where p(Q*) = MC(Q*)

natural monopoly: welfare-maximizing price ceiling → losses for monopolist → subsidization/nationalization → soft budget constraint

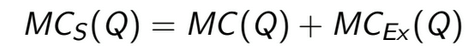

When do external effects occur?

Occurs if a choice has an effect on a third-party which is not taken into account by a decision maker because there is no compensation for it

What are external costs?

Uncompensated costs resulting from production or consumption choices that affect third parties.

negative externality

social marginal costs are the sum of private and external marginal costs

private marginal costs: marginal willingness to accept of the firms active in the market → inverse market supply

e.g. waste water disposal, health costs of second-hand smoking

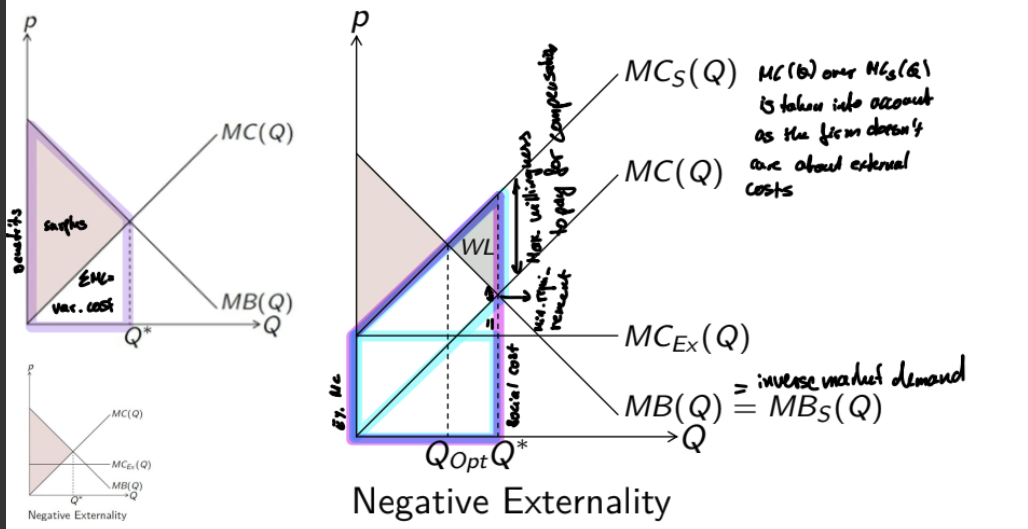

What are external benefits?

Uncompensated benefits resulting from production or consumption choices that affect third parties.

positive externality

social marginal benefits are the sum of private and external marginal benefits

private marginal benefits: marginal willingness to pay of the consumers active in the market → inverse market demand

e.g. honey production → pollination of farm crops, education

What welfare loss occurs in case of negative externalities?

QOpt < Q*

What welfare loss occurs in case of positive externalities?

QOpt > Q*

What is quantity regulation?

decision makers can be forced to choose the welfare-maximizing quantity

requires information on social marginal costs and social marginal benefits

What is corrective taxation?

Pigouvian tax or subsidy

induces decision makers to choose the welfare-maximizing quantity

requires information on external marginal costs and external marginal benefits

e.g. tax for water pollution

What is the purpose of bargaining?

only if property rights of the resource are well-defined

between those affected by the externality and those causing it

choose the welfare-maximizing quantity irrespective of the division of property rights

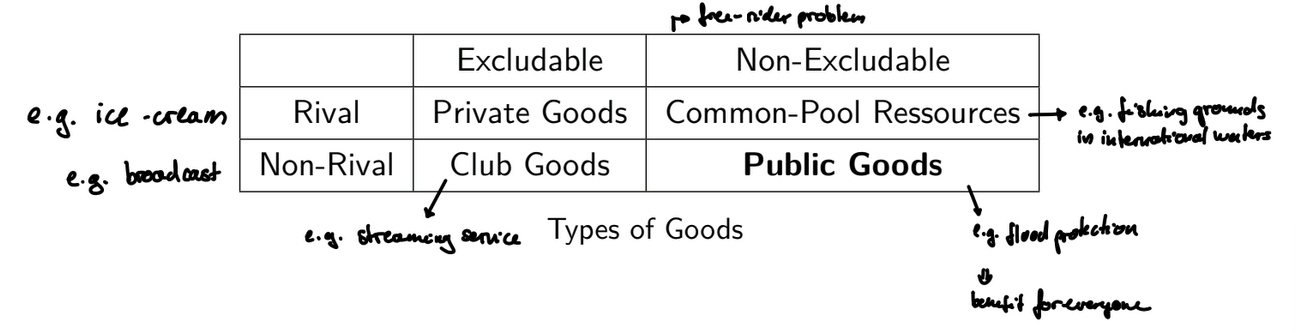

What is a public good?

neither rival nor excludable

rival: consumption by one individual diminishes the consumption possibilities of other individuals

excludable: individuals can be prevented from consuming the good → can charge for it

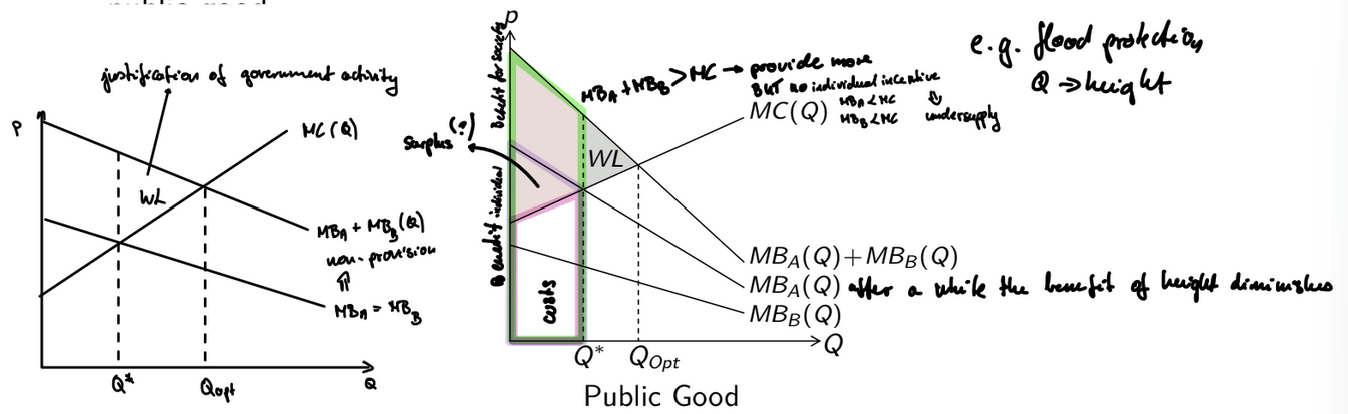

When does welfare loss occur for public goods?

private provision of public good → undersupply ← benefits are not taken into account

Q* < QOpt

Free-rider problem: consumers have an incentive to rely on others to provide the public good

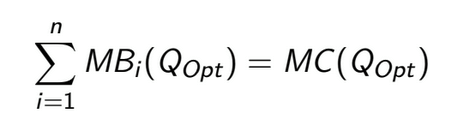

What is the Samuelson condition?

welfare-maximizing public-good provision

welfare-maximizing quantity → sum of marginal benefits is equal to marginal costs

public provision of a public good requires information on marginal benefits of all consumers and marginal costs

leads to increased supply and reduced welfare loss

tax → enforce individuals to contribute

What is gross domestic product?

Measure of domestic economic activity in a given period of time that equivalently captures output, income, and expenditures.

Output method: GDP is the market value of domestic production

import → value-added from domestic step → subtract foreign component values

count final product at its respective market price (includes value of intermediate products) - net of intermediate goods produced abroad/intermediate goods produced in previous periods

Income method: GDP is the sum of incomes from domestic production

Expenditure method: GDP is the sum of expenditures on domestic production

What is net domestic product?

GDP - depreciation