Lesson 4 - Trends

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

______ is the securities market is the sole objective

Profit

trend-following trading strategy

Identify a trend early with minimal error.

Trade in the direction of the trend (buy in an uptrend, sell/short in a downtrend).

Exit when the trend ends to secure profits and avoid reversals

Basis of Trend Analysis - Dow Theory

This is true of all free, liquid markets. The key is to focus on your timeframe.

1. Trends are Fractal ,

2. Trends Tend to Continue

3. Trends are Influenced by the Next Larger and Smaller Trend

4. The minor trend reverses first, followed by the intermediate trend, followed by the primary trend.

How is the Trend Determined

1.Uptrend - higher highs and higher lows

2. Downtrend - lower highs and lower lows

3. Range - equal highs and low

Determining a Trading Range

This usually represents a pause after a large move in the direction of the prevailing trend.

Resistance

when prices have been rising and then reverse down

and the level where price struggles to go higher

Support

when buyers overwhelm sellers with demand, preventing the price from falling lower.

How Are Important Reversal Points Determined?Percentage Method

any time price declines by x%, makes a low and then rallies by x%,

an important trough has been established. The larger the % used, the more important

the low.

How Are Important Reversal Points Determined?High Volume Method

look for higher than average volume to signal a tuning point. This creates an

important reversal level that can now be support or resistance. Can happen over one or two days.

Range Trading - Not a Great Idea

Difficult to recognize that prices are in a range at an early enough time to take

advantage of.

2. Support and resistance is usually a zone, making it hard to know where to enter and exit the trade.

3. Finally, you are eventually going to be wrong on the last trade.

A range is a battleground between the buyers and the sellers...let them fight!

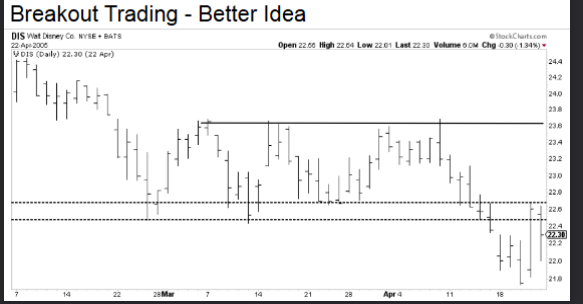

Breakout Trading - Better Idea

Breakout Trade - Take a position when the stock moves from the range. Long in the case

of a breakout, short in the case of a breakdown. We now have information about who has won the war.

Not just used for trading ranges. Richard Donchain created a method that was fine-tuned by Richard Dennis where traders buy when the stock breaches N-day highs and sell when it breached N-day lows.

How is an Uptrend Spotted?

Regression Line: Line of best fit; slope is up

Moving Averages - a dynamic measure of the price trend

Trend Lines - connect a series of higher lows

Retracements

A pullback to a prior breakout level. Usually a high-probability entry point.

What happens during a resistance?

Sellers have equal power to buyers and when they become more aggressive, price moves lower.

Why does are sellers equally as powerful as buyers during resistance

Sellers overwhelm buyers with supply

When the price hits a certain point, sellers step in, wanting to take profits, causing an increase in supply.

At this point, the buying pressure is matched by the selling pressure, leading to a balance.

Trends are Fractal

trends in one time-frame are the same as trends in a different time frame. Primary, Intermediate and Minor. Most people focus on the first two because the last one is considered noise. Technology is changing this.

. Trends are Influenced by the Next Larger and Smaller Trend

you must be aware of the other trends in the market. In an uptrend, rallies will be larger than declines. In a downtrend, the reverse is true.