Unit 3 - Debt Securities

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Par value

the amount paid to the investor as principal at maturity

most debt securities have a par value of $1,000

principal or face value

Maturities

the date the investor receives the loan principal back

term bonds: principal of the whole issue matures at once

issuers may establish a sinking fund (cash reserve) to accumulate money to retire the bonds at maturity

serial bonds: schedule for portions of the principal to mature at intervals over a period of years until the entire balance has been paid

balloon bonds: hybrid - repays part of the bond’s principal before the final maturity date but pays off the major portion of the bond at final maturity

Coupon rates

the interest rate the bond issuers has agreed to pay the investor

fixed percentage of par value

can be stated yield or nominal yield

Accrued Interest

used to determine the interest earned to date for when the bond trades between coupon payments

the buyer (new owner) must pay the sell (old owner) the amount of interest earned to date at the time of settlement

the new owner get paid the full coupon from the issuer in the next payment cycle

interest is paid on a semiannual basis

Bond Pricing

can trade at par, at a discount to par, or premium to par

bond pricing is measured in points

multiply the quoted price by 10 to get the dollar amount

Market Forces affecting bond prices

the interest rate is the cost of borrowing money (for the issuer) and the reward for lending money (for the investor)

bond prices will rise and fall as interest rates in the market fluctuate

P ↑ r ↓

P ↓ r ↑

inverse relationship

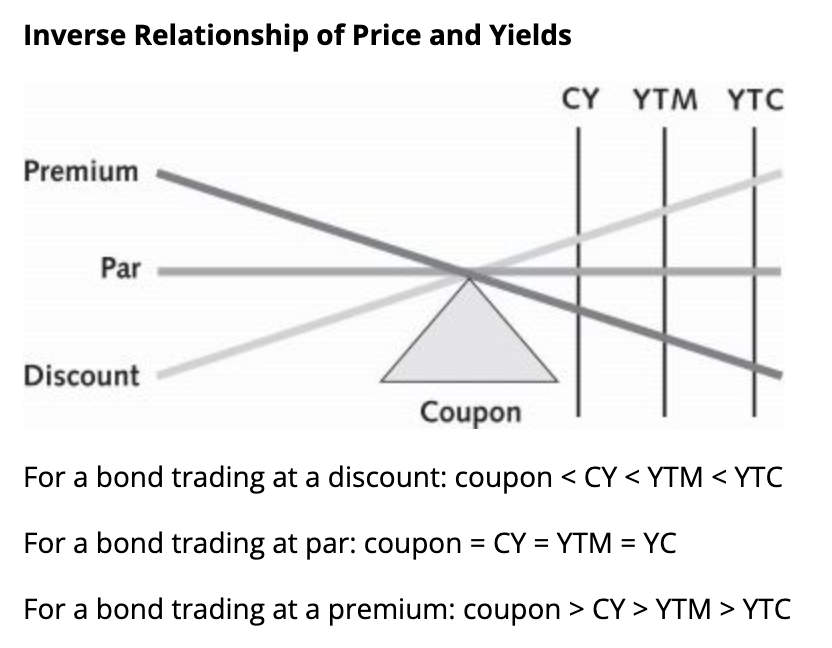

Yields

a measure of a bond’s interest payments in relation to the bond’s value

nominal yield (coupon or stated yield): set at the time of issue and is a fixed percentage of the bond’s par value

current yield = annual coupon payment / market price

Q15 on practice for this chapter

YTM: the annualized return of the bond if held to maturity

takes difference between the price that was paid for a bond and par value received when the bond matures

sometimes called a bond’s basis (“trading on a basis of”)

purchased at discount → investor makes money at maturity

purchased at premium → investor loses money at maturity

YTC: bond w/ a call feature can be redeemed by the issuer before maturity

when a bond is called in by the issuer, the investor receives the principal back sooner than anticipated

reflect the early redemption date and the acceleration of the discount gained or the premium lost

Inverse Relationship of Price and Yields

Call Feature

allows an issuer to redeem a bond before maturity

issuers will exercise the call when interest rates are falling

this feature benefits the issuer

bonds w/ this will need to have a slightly higher coupon rate than a similar bond that doesn’t have this

to make the bond attractive to new investors

assume the call is at par

some have a call set at a premium

Put Feature

allows the investor to force the issuer to pay off the bond before it matures

when interest rates are rising

benefits the bondholder

have a lower coupon rate than similar bonds w/o the feature

feature will compensate for the lower return

Convertible Feature

allows the investor to convert the bond into shares of the issuer’s common stock

gives the investor ownership rights → benefit for the investor

when the value of a convertible bond equals the value of the shares an investor would receive if the conversion feature were exercised → bond is said to be at parity

pay lower coupon rate b/c feature will compensate for the lower return

Zero Coupon Bonds (zeros)

don’t make regular interest payments

issued at a deep discount to their face value and mature at par

the difference between the discounted purchase price and the face value at maturity is the interest the investor receives

b/c coupon rate is 0 → these are more volatile than other bonds w/ similar maturities

owners will pay taxes on the interest annually

“phantom income” → total interest payment / the years remaining to maturity

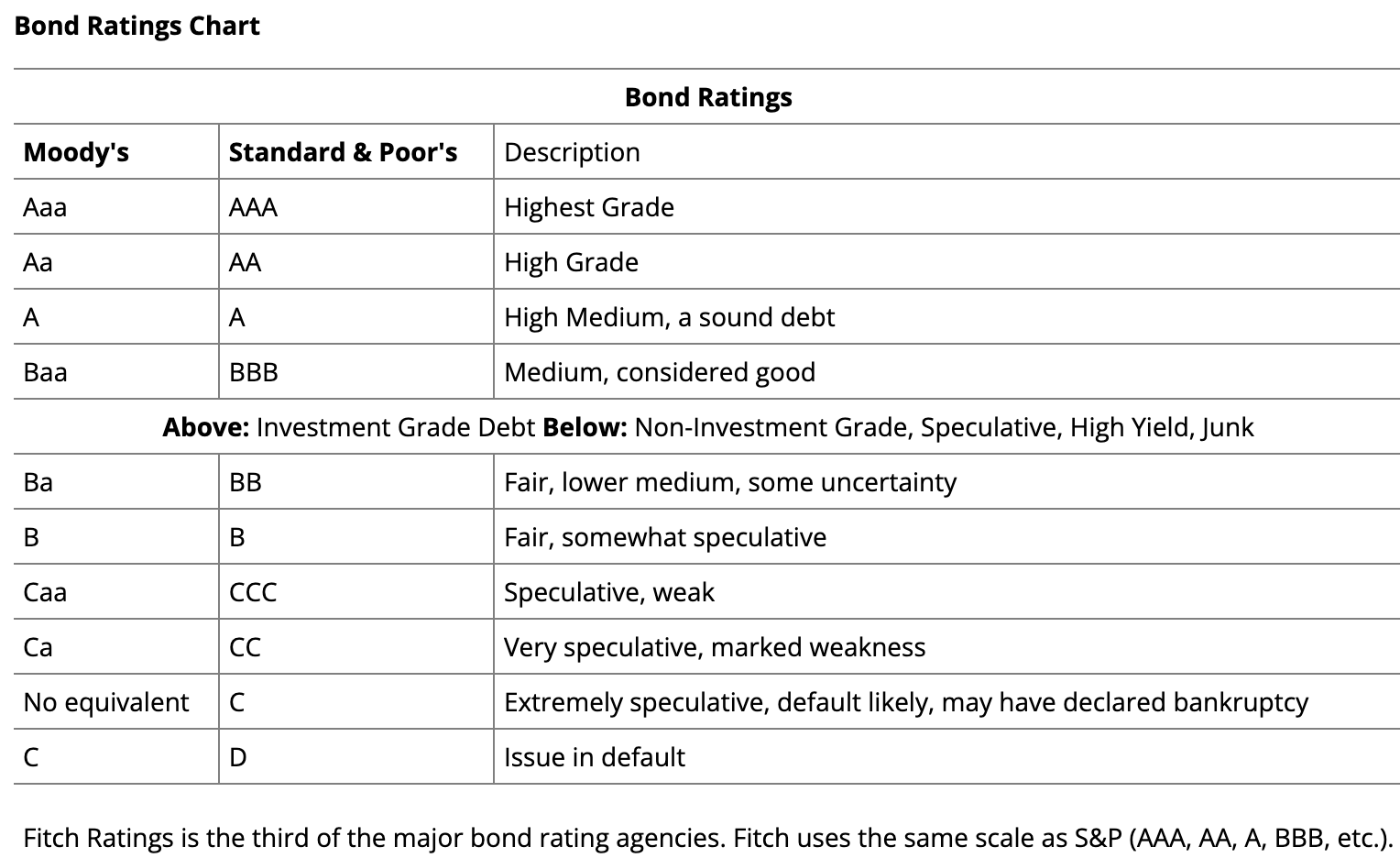

Bond Ratings

the purchase of a debt security is only as safe as the strength of the borrower

strength can be enhanced if the loan has collateral

investors consult rating services before buying bonds → rate the strength of borrowers

measure the bond’s default risk

Investment-Grade Debt

bonds rated in the top 4 categories (BBB or Baa and higher)

the only quality eligible for purchase by institutions and fiduciaries

have greater liquidity than lower-grade instruments

the higher the rating, the lower the yield

High-Yield bonds

lower-grade bonds/junk bonds

lower ratings (BB or Ba or lower) and additional risk of default

see large price drops during slow economic times

volatility is usually higher than investment-grade bonds

have higher interest rates b/c the borrower is less creditworthy and there is more risk for the lender

Volatility in bond prices

the more time left to maturity, the more volatile a bond’s price will be given a change in interest rates

the lower a bond’s coupon rate, the more volatile it is

a higher duration → a more volatile price

lower duration → less price volatility

Benefits of debt instruments

bonds are the best way to produce current income for an investor

Q: a customer is seeking income

A: look for income producing debt instruments

if a corporation fails, bonds are higher in priority than equity securities

Risks of debt instruments

DEFAULT: the issuer will fail to pay interest or principal when due

default, financial, or credit risk

treasury-backed securities are the safest for US investors

INTEREST RATE RISK: price of debt securities fluctuate inversely to changes in interest rates

PURCHASING POWER RISK (inflation): as the fixed payment stays the same while prices are rising, the amount of goods the payment will buy decreases

Corporate bonds

trades settle the next business day

accrued interest is calculated using 30 days a month/360 days a year

Secured debt

debt that has collateral → an asset of the corporation is pledged to secure the loan

if the corporation fails the asset can be sold to pay back the bond

the value of the collateral will exceed the face amount of the bond at the time the bond is issued

mortgage bonds: backed by real estate owned by the corporation

equipment trust certificate: secured by equipment the corporation uses in its operations

“rolling stock” for vehicles

collateral trust bonds: backed by a portfolio of securities held in trust to secure the loan

held in a separate account and can’t be touched except for this purpose

securities must be liquid and exceed the loan amount

treasury issues often used as collateral

the securities must have maturities as long as the bond or longer

Unsecured debt

not backed by collateral

based on the financial strength of the issuer

“full faith and credit”

have more risk than a secured bond

debentures: most senior (highest priority) of the unsecured debt obligations

'“senior debt”

guaranteed bonds: are the responsibility of the issuer but are further backed by a third party should the issuer default

most common third party is a parent company

no collateral

income bonds: only make interest payments when the company has enough income and the board authorizes the payments

adjustment bonds

don’t provide reliable income

subordinated debt: carry a higher coupon rate b/c of the additional risk

below debentures - “junior debt”

lowest level of unsecured debt

Order of Liquidation in Corporate Dissolutions

all assets are sold off and those who are owed money line up to be paid

DEBT HAS PRIORITY OVER EQUITY

- administrative claimants help w/ liquidation

Secured debtholders → paid from proceeds of the sale of assets that secured the debt

Unsecured debt (debentures) and general creditors → those the company owes money to as part of its operations (ex. vendors/suppliers)

where wages and taxes are paid out

Subordinated debtholders → higher coupon rate for them b/c of the increased risk for these investors

Preferred stockholders → equity holding and will come after all creditors have been paid out

Common stockholders → extremely rare for them to get anything at liquidation

downside of being the investor that make the most when the company is successful

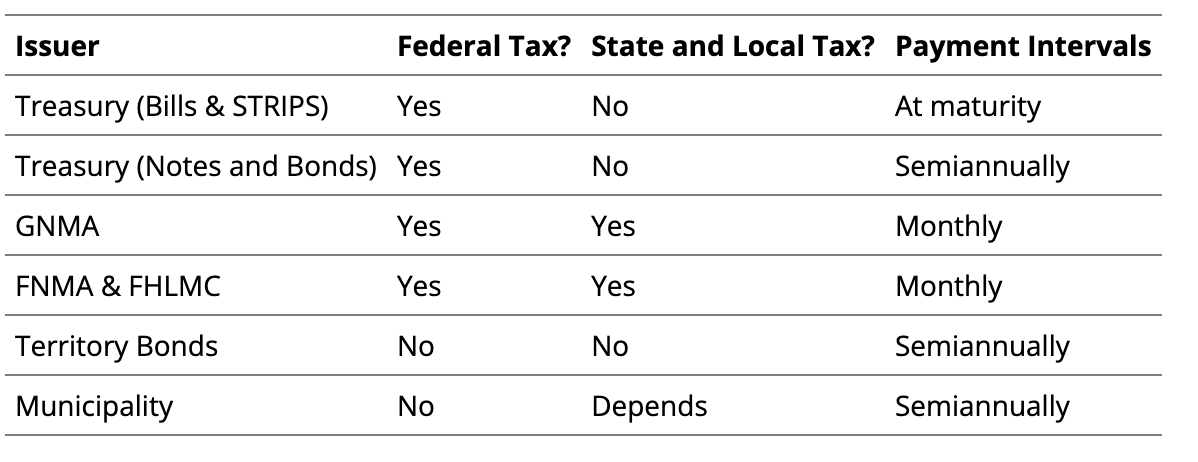

Treasury securities

only debt issued directly by the US Treasury is backed by the full faith and credit of the US

backed by the govt’s right to impose and collect taxes

US Treasury determines the quantity and types of gov’t securities it must issue to meet federal budget needs

the marketplace determines their interest rates

securities issued by the US gov’t are considered among the highest quality in safety of principal

issued in book-entry form and they have a T+1 settlement cycle

very marketable, liquid, and easy to buy and sell

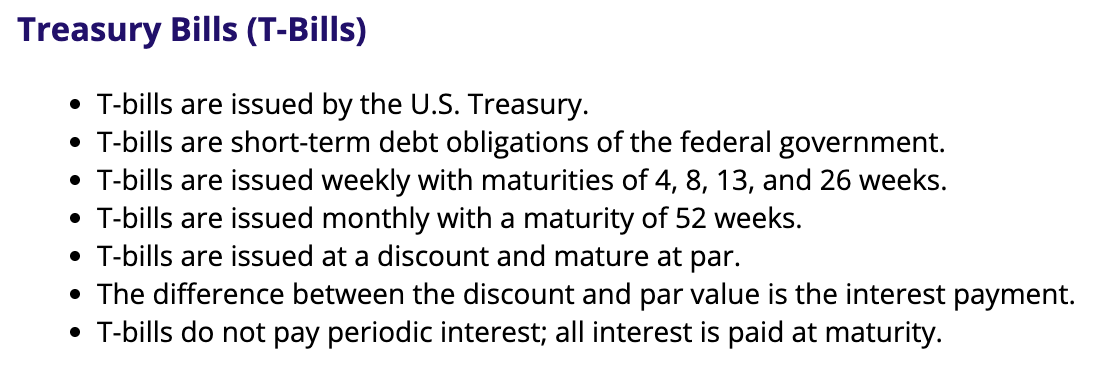

T-Bills

these and STRIPS are the only ones issued at a discount and w/o a stated interest rate

highly liquid

used in market analysis as the standard for a risk free rate of return

also a money market security b/c its short-term

once t-notes and t-bonds have only a year left to maturity, they are considered money market instruments

T-Notes

T-notes are issued by the Treasury,

T-notes have maturities from as short as two years to a maximum of 10 years,

T-notes pay interest every six months (semi-annually), and

at maturity, the investor receives the final semi-annual interest payment and the par value.

intermediate-term

issued at par and pay periodic interest

T-Bonds

long-term

issued at par and pay periodic interest

T-bonds are issued by the Treasury,

T-bonds have maturities greater than 10 years and up to 30 years,

T-bonds pay interest every six months (semi-annually),

at maturity, the investor receives the final semi-annual interest payment and the par value.

Treasury Receipts

broker-dealers (BDs) can create this type of bond from US T-notes and T-bonds

they buy Treasury securities, place them in trust at a bank, and sell separate receipts against the principal and coupon payments

creates new securities and different maturities to choose from

the separating process (stripping) yields more profit for the BD

the receipts themselves aren’t backed by the full faith and credit of the US gov’t

Treasury STRIPS

treasury department’s own version of receipts

banks and BDs perform the actual separation

zero-coupon bonds

issues of the US Treasury and are backed by the full faith and credit of the US gov’t

**not suitable for an investor seeking income

Treasury Inflation-Protected Securities (TIPS)

maturities of 5, 10, or 20 years

fixed coupon rate and pay interest semiannually

the principal value of the bond is adjusted every six months based on the inflation rate

the final principal payment will never be less than $1,000 par

Farm Credit System (FCS)

National network of lending institutions that provides agricultural financing and credit.

Privately owned, government-sponsored enterprise

Raises funds through the sale of Farm Credit Debt Securities to investors.

Funds are made available to farmers through banks and Farm Credit lending institutions.

The FCA, a government agency, oversees the system

Government National Mortgage Association (GNMA or Ginnie Mae)

Government-owned corporation.

Supports the Department of Housing and Urban Development.

GNMA certificates are the only agency securities backed by the full faith and credit of the federal government.

GNMA certificates have a stated 30-year life.

When sold, GNMA maturities are based on an average life expectancy of the mortgages in the portfolio.

GNMAs are based on a portfolio of mortgages.

When mortgages are paid off early, GNMA investors will receive back all outstanding principal of that loan at par.

Creates prepayment risk (covered in the unit on Risk).

GNMA certificates pay a monthly payment that is part principal, part interest (pass-through security).

Federal Home Loan Mortgage Corporation (FHLMC or Freddic Mac)

The FHLMC is a public corporation.

Created to promote the development of a nationwide secondary market in mortgages

Buys residential mortgages from financial institutions

Packages mortgages into mortgage-backed securities for sale to investors.

Freddie Mac certificates pay principal and interest monthly. Note that FHLMC also issues bonds that pay semi-annual interest.

Securities it issues are backed by FHLMC's general credit, not by the U.S. Treasury.

corporation thats owned by investors

their stock trades in the secondary market

Federal National Mortgage Association (FNMA or Fannie Mae)

FNMA is a publicly held corporation that provides mortgage capital.

FNMA purchases conventional and insured mortgages from agencies such as the Federal Housing Administration (FHA) and the Veterans Administration (VA).

FNMA packages them into mortgage-backed securities for sale to investors.

Fannie Mae certificates pay principal and interest monthly. Note that Fannie Mae also issues bonds that pay semi-annual interest.

Securities it issues are backed by FNMA's general credit, not by the U.S. treasury.

corporation thats owned by investors

their stock trades in the secondary market

Municipal Bonds (munis)

issued by state or local govt’s, US territories, or other local authorites

investors are lending money to the issuers to raise funds for public works and construction projects

second in safety after US gov’t securities

safety is based on the issuer’s financial strength and taxing authority

interest is tax exempt at the federal level

capital gains is still taxable

settle T+1 and pay accrued interest

General Obligation (GO) Munis

issued to generate capital for infrastructure or property improvements that benefit the community

capital improvements

don’t produce revenues so principal and interest paid from taxes

GO bonds are known as full faith and credit bonds because they are backed by the municipality's taxing power.

requires a vote

Bonds issued by states are backed by income taxes, license fees, and sales taxes.

Bonds issued by towns, cities, and counties are backed by

property taxes, also called "ad valorem" or real estate taxes,

license fees,

other sources of direct income to the municipality.

School, road, and park districts may also issue municipal bonds backed by property taxes.

GO bonds represent a debt of the municipality and often require voter approval.

A debt limit is the amount of debt that a municipal government may incur as set by state or local law.

Debt limits make a bond safer for investors.

The lower the debt limit, the less risk of excessive borrowing.

The law must be changed to issue GO bonds that exceed a municipality's debt limit.

Revenue Bonds

used to finance a municipal facility that generates sufficient income to pay the bond

interest payments are made from revenues

projects funded by these → utilities, housing, transportation, education, health, industrial, sports

not subject to statutory debt limits

don’t require voter approval

issued by authorities (quasi-governmental entities)

interest from bonds issued by the US is tax free to US taxapayers

Tax-equivalent yield

the higher the tax bracket, the greater the tax exemption’s value

municipal bond investment’s tax benefit, find the tax-equivalent yield

tax-free yield / (100% - investor’s tax bracket/rate)

municipal yield will always be less than corporate yield

after-tax yield of a taxable bond = corporate yield * (100% - tax bracket)

Taxation on Bond Interest

Muni notes (short-term municipal debt)

generated funds for a municipality that expects other revenues soon and are repaid when the muni receives the anticipated funds

Tax anticipation notes (TANs) finance current operations in anticipation of future tax receipts. This helps municipalities to even out cash flow between tax collection periods.

Revenue anticipation notes (RANs) are offered periodically to finance current operations in anticipation of future revenues from revenue-producing projects or facilities.

Tax and revenue anticipation notes (TRANs) are a combination of the characteristics of both TANs and RANs.

Bond anticipation notes (BANs) are sold as interim financing that will eventually be converted to long-term funding through a sale of bonds.

Tax-exempt commercial paper is often used in place of BANs and TANs for up to 270 days; maturities are most often 30, 60, or 90 days.

Grant anticipation notes (GANs) are issued with the expectation of receiving grant money, usually from the federal government.

Construction loan notes (CLNs) are issued to provide interim financing for the construction of housing projects.

Variable-rate demand notes have a fluctuating interest rate and are usually issued with a put option. This means that the investor could periodically (e.g., weekly, monthly) return the security to the issuer for its stated value.

Money market instruments

focused on short-term debt securities for short-term needs

=<1 year left until maturity

high-quality debt (safer)

very liquid and there is an active market

most issued at a discount and mature at par

their rate of return is low so they’re not suitable for long-term investors

Jumbo Certificate of Deposit (CD)

Banks issue and guarantee jumbo certificates of deposit (CDs) with fixed interest rates

Jumbo CDs have minimum face values of $100,000, although face values of $1 million or more are common.

Most mature in one year or less.

Some jumbo CDs that can be traded in the secondary market are known as negotiable CDs.

Negotiable CDs are considered to be money market instruments.

If a jumbo CD is not negotiable, it is not liquid and is not considered a money market security

Jumbo CDs are issued at face value, not at a discount, and pay interest at maturity.

Longer maturities will pay interest every six months.

A negotiable CD is a bank's promise to pay principal and interest and is secured by no physical asset and is backed only by the bank's good faith and credit.

Bankers’ Acceptances (BAs)

used in the import-export business as a short-term time draft

postdated check or line of credit

issued at a discount

finance international trade

pays for goods and services in a foreign country

bill of exchange or letter of credit

Commercial Paper (Promissory Notes)

short-term, unsecured debt

sell them to raise cash to finance accounts receivable

Repurchase Agreements (Repos)

raises cash by temporarily selling some of the assets it holds, with an agreement to buy back the assets at a specific future date (the maturity date), and at a slightly higher price

investor makes a profit on the difference b/t what they paid at the asset sale and what they receive at repurchase

in a reverse repo, a dealer agrees to buy securities from an investor and sell them back later at a higher price

Federal Funds Loans

any excess reserves from the Fed can be loaned from one member bank to another for the purpose of meeting the reserve requirement

Asset-backed securities

value and income payments are derived from a specific pool of underlying assets

the pool of assets include different types of loans

Pooling the assets into securities allows them to be sold to general investors more easily than selling them individually

securitization

allows the risk of investing to be diversified b/c each security will now representing only a fraction of the total value of the pool

created and issued by investment banks

Collateralized Mortgage Obligations (CMOs)

CMOs pool a large number of mortgages.

They often contain mortgage-backed securities like FNMA and FHLMC certificates.

The pool of mortgages is structured into maturity classes called tranches.

Pay monthly principal and interest payments.

Repays principal to only one tranche at a time, highest tranche to lowest

Investors in higher (short-term) tranche receive all their principal before the next tranche begins to receive principal repayments.

Changes in interest rates affect the rate of mortgage prepayments (refinancing), which affects the flow of interest payment and principal repayment to the CMO investor.

Collateralized Debt Obligations (CDOs)

CDOs are complex asset-backed securities.

CDOs do not specialize in any single type of debt; usually their portfolios consist of

non-mortgage loans, bonds, auto loans, leases, credit card debt, a company's receivables, or even products that derive their value from an underlying asset of any of the assets listed (derivative products).

Like CMOs, CDOs represent different types of debt and credit risk.

The different types of debt and risk categories are often called tranches or slices.

Each tranche has a different maturity and risk associated with it.

The higher the risk, the more the CDO pays.

Investors choose a tranche with a suitable risk profile.

CDOs are like CMOs in that illiquid debt can be made liquid through securitization.