Revenue, profit and objectives

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

What is the formula for TR?

Quantity x price

What is the formula for AR?.

TR/Q, AR = P

What is the formula for marginal revenue?

The change in total revenue as a result of selling one more unit,

Change in TR/Change in Q

What is meant by price taker?

This is when the firm is too small to influence market price, it must face a lot of competition in the market.

What is meant by price maker?

The firm has a large market share and can therefore influence the market price- it could be a monopoly.

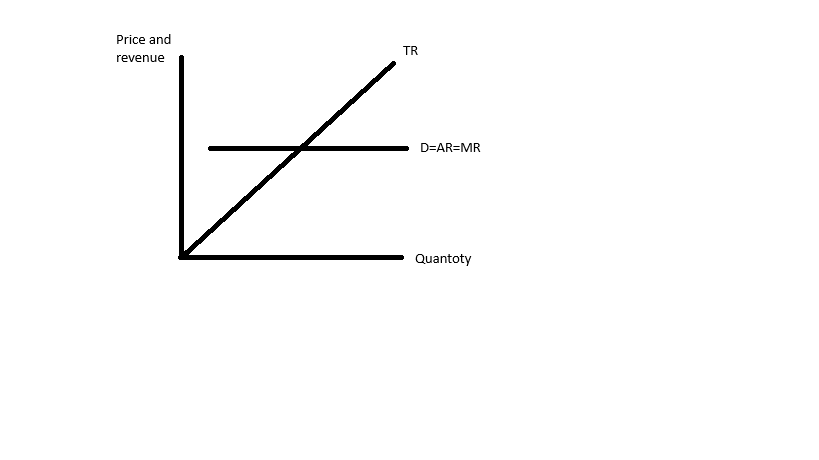

Graph of price taker

The AR curve is horizontal because the price received for the good is constant, demand is also perfectly elastic due to their being perfect substitutes.

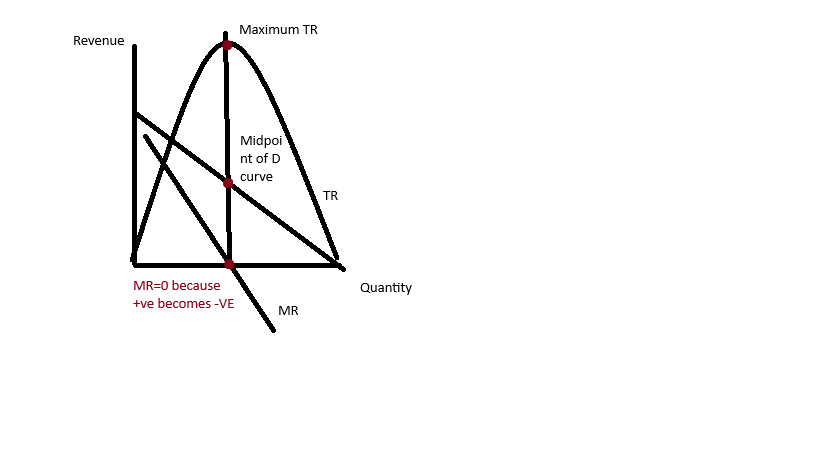

Graph of price maker

Firms must lower price to increase revenue shown by the downward sloping D curve.

What is the formula for profit?

TR-TC

What are the two types of profit?

Normal

Supernormal

What is normal profit?

The minimum amount of profit required by the entrepreneur to keep them in the industry, sometimes seen as the wage.

What is supernormal profit?

Any profit earned over and above normal profit.

When does supernormal profit occur?

When TR is higher than TC.

What is an objective/aim?

A statement of intent, a target that the firm wants to achieve.

What objective do economists assume all firms have?

Profit maximisation

What is profit maximisation?

The profit made when there is the greatest possible positive difference between TR and TC.

What is the profit maximisation rule?

Profit is maximised at the level of output where MC=MR and MC are rising.

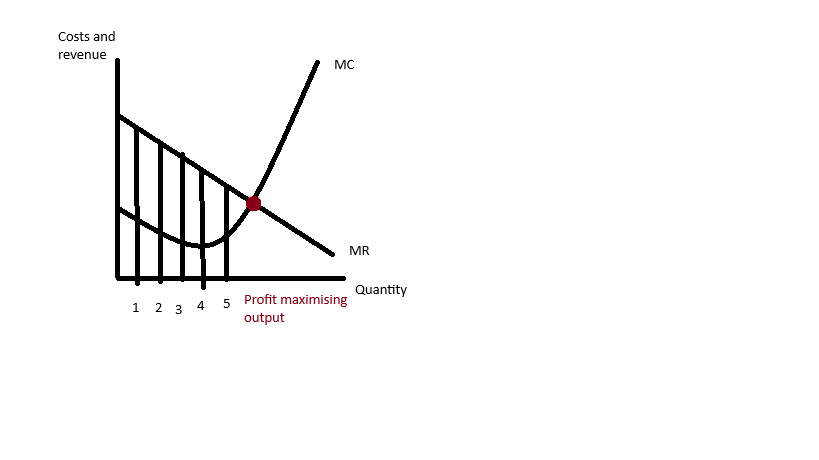

Costs and revenue graph for price maker

If the firm produces at maximum profit output the total profits is equal to the area between the MR and MC curves, every unit after this a marginal loss is made.

What are the advantages of profit maximisation?

enables firms to reward workers with greater wages and bonuses, may motivate the workforce which will reduce costs in the long run

enables firms to reward their shareholders with higher dividends, prevents take-over

retained profit can act as a buffer during potential economic crises

What are the disadvantages of profit maximisation?

In practice it is difficult to know the exact marginal revenue and cost

firms may have other objectives

profit satisficing, occurs when there is a separation of ownership and control and managers do enough to keep owners happy

Objective: Growth/Expansion

Increasing the capacity of the firm, growth brings economies of scale which allows firms to charge lower prices.

What two ways can market share be measured by?

Sales volume or sales value

What is sales value?

The value of sales is known as revenue, market share by sales revenue is the firm’s sales revenue as a proportion of total market sales revenue.

What is the formula for sales value?

Firm’s total revenue/Total market sales revenue x 100

What is sales volume?

The volume of sales is the number of units of output that are sold, market share by sales volume is the firm’s total output as a proportion of total market output.

What is the formula for sales volume?

Firm’s total output/Total market output x 100

Objective: Profit satisficing

This occurs due to:

owners of small firms, being a larger firm involves more workers, more time, more decisions etc.

Lack of information, difficult to identify where the profit maximizing position is

Other aims, may look into maximizing long run profit

Objective: Survival

Early stages of training, risky to be successful in a new business

trading becomes difficult, during a recession or falling demand

Threat of take-over

Objective: Sales revenue maximisation

This was identified by William Baumol in the 50’s, this will be favoured by those whose salaries are linked to sales or price taker firms.

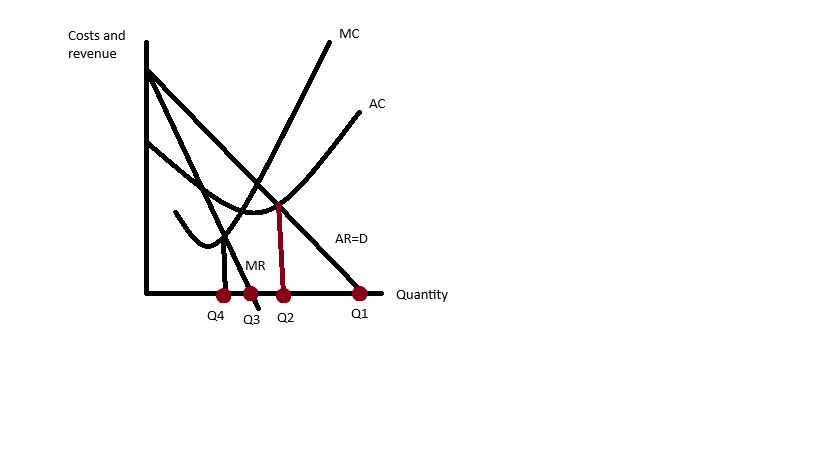

Graph for sales vs profit maximisation

Q1, sales volume maximisation (the most aa firm can sell), will occur when P is 0 but 0 revenue.

Q2, sales volume maximisation with a profit constraint, normal profit occurs where AC=AR

Q3, sales revenue maximisation, mid point of D curve and where MR=0

Q4, profit maximisation, using the profit maximisation rule

Objective: Image and social responsibility

Firms have become concerned over their ‘corporate image’ as it can affect sales, firms that have environmental credentials may achieve greater sales

Objective: Improving service/providing a public service

Some firms may be run on a ‘not for profit’ basis and aim to provide the best possible service to taxpayers at the lowest cost.

Objective: Managerial objectives

Their must be some divorce of ownership form control, happens when there are a large number of owners e.g. PLC, can include:

maximise personal salary

maximise departmental budget

improve their status