ACC Econ Final Exam Review

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

When the Federal Reserve conducts open-market operations to increase the money supply, it

redeems Federal Reserve notes.

buys government bonds from the public.

raises the discount rate.

decreases its lending to member banks.

buys government bonds from the public.

Ashley puts money in a savings account at her bank earning 2 percent interest. One year later she takes her money out and notes that prices rose 3 percent. Ashley earned a

real interest rate of -1 percent due to inflation.

real interest rate of 1 percent due to inflation.

nominal interest rate of -1 percent due to inflation.

nominal interest rate of 1 percent due to inflation.

real interest rate of -1 percent due to inflation.

In the long run, which of the following factor is NOT affected by money supply?

the price level

real GDP

nominal interest rates

All of the above are correct.

real GDP

To explain the long-run determinants of the price level and the inflation rate, most economists today rely on the

quantity theory of money.

price-index theory of money.

theory of hyperinflation.

disequilibrium theory of money and inflation.

quantity theory of money.

To decrease the money supply, the Fed could

sell government bonds.

increase the discount rate.

increase the required reserve ratio

All of the above are correct.

All of the above are correct.

According to monetary neutrality and the Fisher effect, an increase in the money supply growth rate eventually increases

inflation and nominal interest rates, but does not change real interest rates.

inflation, nominal interest rates, and real interest rates.

inflation and real interest rates, but does not change nominal interest rates.

nominal interest rates and real interest rates, but does not change inflation.

inflation and nominal interest rates, but does not change real interest rates.

Which of the following affects Money demand?

(Note: The money demand here means the whole money demand curve. Which of the following will shift the whole money demand curve)

the price level and the nominal interest rate.

the price level but not the nominal interest rate.

the nominal interest rate but not the price level.

neither the price level nor the interest rate.

the price level but not the nominal interest rate.

Suppose there are constant returns to scale. Now suppose that over time a country doubles its physical capital but its technology is unchanged. Which of the following would double?

both output and productivity

output, but not productivity

productivity, but not output

neither productivity nor output

neither productivity nor output

Which of the following is not a tool of monetary policy?

open market operations

the required reserve ratio

the discount rate

increasing the government budget deficit

increasing the government budget deficit

Which of the following combinations of nominal interest rates and inflation implies a real interest rate of 7 percent?

a nominal interest rate of 5 percent and an inflation rate of 4 percent.

a nominal interest rate of 4 percent and an inflation rate of 3 percent.

a nominal interest rate of 8 percent and an inflation rate of 1 percent.

a nominal interest rate of 14 percent and an inflation rate of 2 percent.

a nominal interest rate of 8 percent and an inflation rate of 1 percent.

Suppose each good costs $5 per unit and Megan holds $40. What is the real value of the money she holds?

$40. If the price of goods rises, to maintain the real value of her money holdings she needs to hold more dollars.

8 units of goods. If the price of goods rises, to maintain the real value of her money holdings she needs to hold more dollars.

$40. If the price of goods rises, to maintain the real value of her money holdings she needs to hold fewer dollars.

8 units of goods. If the price of goods rises, to maintain the real value of her money holdings she needs to hold fewer dollars.

8 units of goods. If the price of goods rises, to maintain the real value of her money holdings she needs to hold more dollars.

Open-market purchases by the Fed make the money supply

increase, which makes the value of money increase.

increase, which makes the value of money decrease.

decrease, which makes the value of money decrease.

decrease, which makes the value of money increase.

increase, which makes the value of money decrease.

Suppose an economy produces only ice cream cones. If the price level rises, the value of currency

rises, because one unit of currency buys more ice cream cones.

rises, because one unit of currency buys fewer ice cream cones.

falls, because one unit of currency buys more ice cream cones.

falls, because one unit of currency buys fewer ice cream cones.

falls, because one unit of currency buys fewer ice cream cones.

Based on the quantity equation, if M = 100, V = 3, and Y = 150, then P =

1.

1.5.

3.

4.5.

2.

The primary reason people hold money is

to keep wealth in a less

liquid form.

to use it as a medium of exchange.

to use it as saving.

to earn interest.

to use it as a medium of exchange.

In the long run, which of the following factor is affected by money supply?

real GDP

unemployment

nominal interest rates

All of the above are correct.

nominal interest rates

A decrease in the money supply might indicate that the Fed had

purchased bonds in an attempt to increase the federal funds rate.

purchased bonds in an attempt to reduce the federal funds rate.

sold bonds in an attempt to increase the federal funds rate.

sold bonds in an attempt to reduce the federal funds rate.

sold bonds in an attempt to increase the federal funds rate.

Your spouse complains that her 6% raise this year will not keep up with the increase in prices. In other words, she is unable to buy the same basket of goods with her 6% raise. Therefore, she believes that her

nominal income and real income increased.

nominal income increased, but their real income decreased.

nominal income and real income decreased.

nominal income decreased, but their real income increased.

nominal income increased, but their real income decreased.

If P = 2 and Y = 1000, then which of the following pairs of values are not possible?

M = $500, V = 4.

M = $250, V = 8.

M = $1,000, V = 2.

M = $300, V = 3.

M = $300, V = 3.

When the Fed sells government bonds,

the money supply increases and the federal funds rate increases.

the money supply increases and the federal funds rate decreases.

the money supply decreases and the federal funds rate increases.

the money supply decreases and the federal funds rate decreases.

the money supply decreases and the federal funds rate increases.

Money demand and money supply determine

the real interest rate.

the nominal interest rate.

the consumption level in the economy

none of the above.

the nominal interest rate.

Based on the quantity equation, if M = 150, V = 4, and Y = 300, then P =

8.

0.5.

2.

3.

2.

Money demand refers to

the total quantity of financial assets that people want to hold.

how much income people want to earn per year.

how much wealth people want to hold in liquid form, i.e. cash.

how much currency the Federal Reserve decides to print.

how much wealth people want to hold in liquid form, i.e. cash.

The supply of money increases when

the price level falls.

the interest rate increases.

the Fed makes open-market purchases.

money demand increases.

the Fed makes open-market purchases.

To increase the money supply, the Fed could

sell government bonds.

increase the discount rate.

decrease the required reserve ratio

None of the above is correct.

decrease the required reserve ratio

Policymakers who control monetary and fiscal policy and want to offset the effects on output of an economic contraction caused by a shift in aggregate supply could use policy to shift

aggregate supply to the right.

aggregate supply to the left.

aggregate demand to the right.

aggregate demand to the left.

aggregate demand to the right.

Which of the following decreases in response to the interest-rate effect from an increase in the price level?

both investment and consumption

consumption but not investment

investment but not consumption

neither investment nor consumption

both investment and consumption

If aggregate demand shifts right then in the short run

firms will increase production. In the long run increased price expectations shift the short-run aggregate supply curve to the right.

firms will increase production. In the long run increased price expectations shift the short-run aggregate supply curve to the left.

firms will decrease production. In the long run increased price expectations shift the short-run aggregate supply curve to the right.

firms will decrease production. In the long run increased price expectations shift the short-run aggregate supply curve to the left.

firms will increase production. In the long run increased price expectations shift the short-run aggregate supply curve to the left.

The price level rises in the short run if

aggregate demand or aggregate supply shifts right.

aggregate demand shifts right or aggregate supply shifts left.

aggregate demand shifts left or aggregate supply shifts right.

aggregate demand or aggregate supply shifts right.

aggregate demand shifts right or aggregate supply shifts left.

During the 1990-91 recession, consumers decided to decrease consumption to repay a larger portion of household debt. What happened?

Short run Aggregate supply shifted to the left, causing equilibrium GDP to decline.

Aggregate demand increased, causing the recessionary GDP gap to diminish.

Short run Aggregate supply and aggregate demand both shifted to the left, causing short run GDP to decline.

Aggregate demand shifted to the right, causing a higher equilibrium real GDP.

Aggregate demand declined, resulting in lower levels of real output and employment.

Aggregate demand declined, resulting in lower levels of real output and employment.

The real interest rate effect provides a partial explanation for why the aggregate demand curve slopes downward. Which of the following statements best explains the real interest rate effect?

At a lower price level, the purchasing power of accumulated savings is larger; thus, consumers will purchase more goods.

At a lower price level, consumers will buy less because of a reduction in the real money supply.

At a lower price level, domestically produced items are relatively less expensive than foreign goods and therefore are in greater demand.

At a lower price level, the real interest rate tends to be lower; thus, the quantity of investment goods demanded is larger.

At a lower price level, the real interest rate tends to be lower; thus, the quantity of investment goods demanded is larger.

If aggregate supply remains unchanged, a decrease in aggregate demand may

move potential real GDP to the left.

put upward pressure on the price level.

cause a recession.

cause inflation.

cause a recession.

The sticky-wage theory of the short-run aggregate supply curve says that when the price level is lower than expected,

relative to prices wages are higher and employment rise.

relative to prices wages are higher and employment falls.

relative to prices wages are lower and employment rises.

relative to prices wages are lower and employment falls.

relative to prices wages are higher and employment falls.

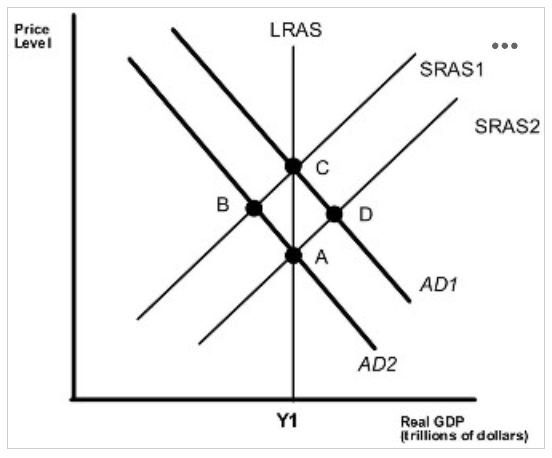

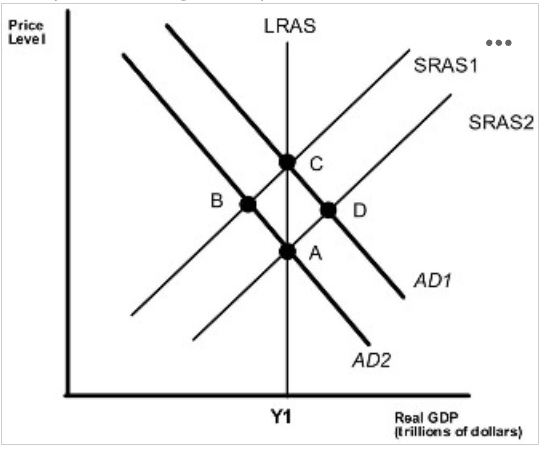

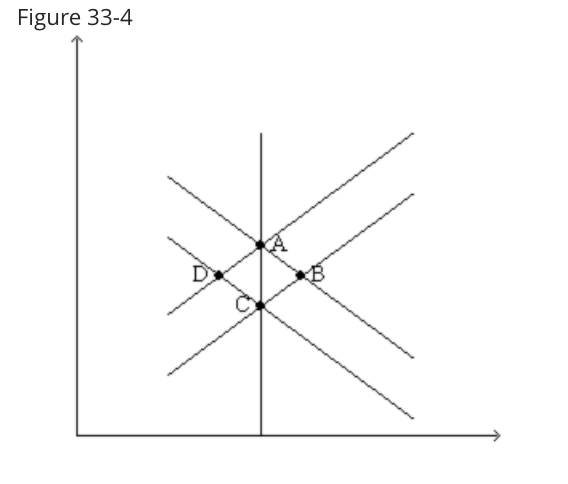

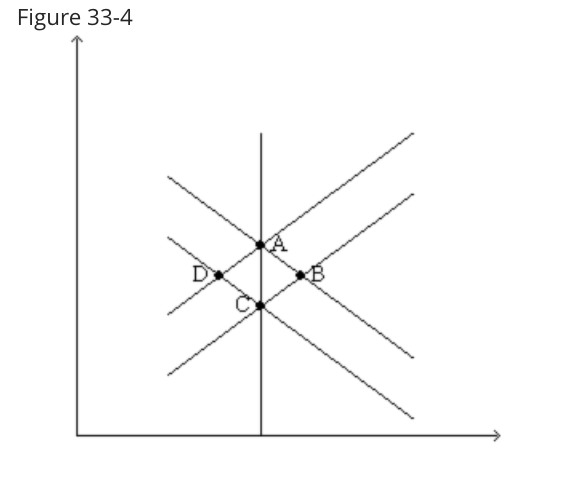

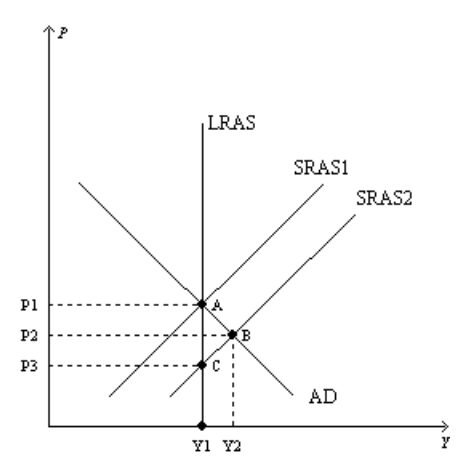

Suppose the economy is at point A. If investment spending increases in the economy, where will the eventual long run equilibrium be?

A

B

C

D

C

Which of the following would cause prices and real GDP to rise in the short run?

short-run aggregate supply shifts right

short-run aggregate supply shifts left

aggregate demand shifts right

aggregate demand shifts left

aggregate demand shifts right

When production costs rise,

the short-run aggregate supply curve shifts to the right.

the short-run aggregate supply curve shifts to the left.

the aggregate demand curve shifts to the right.

the aggregate demand curve shifts to the left.

the short-run aggregate supply curve shifts to the left.

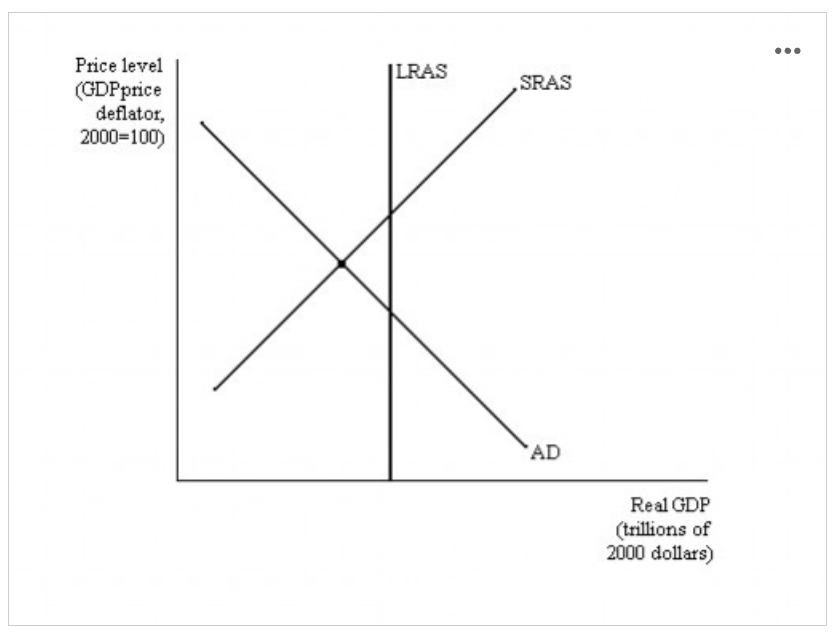

Refer to Figure 33-5. The appearance of the long-run aggregate-supply (LRAS) curve

is consistent with the concept of monetary neutrality.

is consistent with the idea that point A represents a long-run equilibrium and a short-run equilibrium when the relevant short-run aggregate-supply curve is SRAS1.

indicates that Y1 is the natural rate of output.

All of the above are correct.

All of the above are correct.

Aggregate demand shifts right if

government purchases increase and shifts left if stock prices rise.

government purchases increase and shifts left if stock prices fall.

government purchases decrease and shifts left if stock prices rise.

government purchases decrease and shifts left is stock prices fall.

government purchases increase and shifts left if stock prices fall.

If the economy is initially at long-run equilibrium and aggregate demand declines, then in the long run the price level

and output are higher than in the original long-run equilibrium.

and output are lower than in the original long-run equilibrium.

is lower and output is the same as the original long-run equilibrium.

is the same and output is lower than in the original long-run equilibrium.

is lower and output is the same as the original long-run equilibrium.

The sticky-wage theory of the short-run aggregate supply curve says that when the price level rises more than expected,

production is more profitable and employment rises.

production is more profitable and employment falls.

production is less profitable and employment rises.

production is less profitable and employment falls.

production is more profitable and employment rises.

Which of the points in the below graph are possible long run equilibriums?

A and B

A and C

A and D

B and D

A and C

The real interest rate effect and wealth effect are important because they help to explain

why demand management policy cannot be used effectively when short run aggregate supply shifts to the left.

the downward-sloping nature of the aggregate demand curve.

why the aggregate demand curve may shift inward or outward.

why equilibrium real GDP rarely coincides with potential real GDP.

the downward-sloping nature of the aggregate demand curve.

Which of the following would cause the short-run aggregate supply curve to be upward sloping?

There is no cost to firms of changing the prices of their products.

There is a fixed quantity of inputs.

Firms adjust wages immediately.

Labor contracts make wages sticky.

Labor contracts make wages sticky.

Which of the following would cause prices and real GDP to rise in the short run?

short-run aggregate supply shifts right

short-run aggregate supply shifts left

aggregate demand shifts right

aggregate demand shifts left

aggregate demand shifts right

Suppose the price of crude oil falls substantially. Which of the following is the most likely effect of the decrease in fuel prices on the economy?

A decrease in the equilibrium price level and a decrease in equilibrium real GDP.

An increase in the equilibrium price level and an increase in equilibrium real GDP.

An increase in the equilibrium price level and a decrease in equilibrium real GDP.

A decrease in the equilibrium price level and an increase in equilibrium real GDP.

A decrease in the equilibrium price level and an increase in equilibrium real GDP.

Which of the following helps to explain the downward-sloping nature of the aggregate demand curve?

Falling prices put downward pressure on real interest rates, causing business investment to increase.

Falling prices put downward pressure on nominal interest rates, causing consumption to increase.

Falling prices put upward pressure on real interest rates, causing business investment to increase.

An increase in the price level induces producers to increase the aggregate output they'll offer in the domestic market for goods and services.

Falling prices put downward pressure on real interest rates, causing business investment to increase.

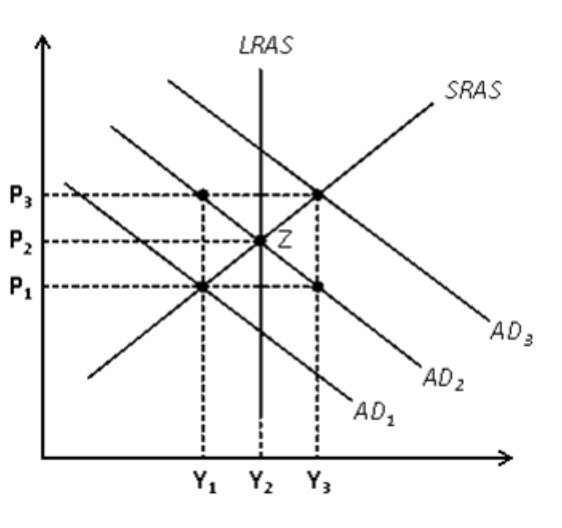

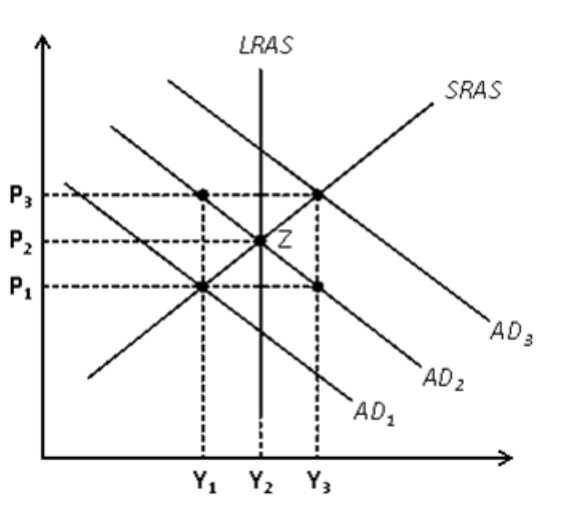

Refer to Figure 33-8. Suppose the economy starts at Z. If changes occur that move the economy to a new short run equilibrium of P1 and Y1 , then it must be the case that

short run aggregate supply has decreased.

short run aggregate supply has increased.

aggregate demand has increased.

aggregate demand has decreased.

aggregate demand has decreased.

Financial Crisis

Suppose that banks are less able to raise funds and so lend less. Consequently, because people and households are less able to borrow, they spend less at any given price level than they would otherwise. The crisis is persistent so lending should remain depressed for some time.

Refer to Financial Crisis. If nominal wages are sticky, which of the following helps explains the change in output?

real wages fall, so firms choose to produce less

real wages fall, so firms choose to produce more

real wages rise, so firms choose to produce less

real wages rise, so firms choose to produce more

real wages rise, so firms choose to produce less

Suppose government spending is cut. Other things being equal, the aggregate demand for national production will

rise.

remain constant.

fall.

All of the above.

fall.

Which of the following would increase output in the short run?

an increase in stock prices makes people feel wealthier

government spending increases

firms chose to purchase more investment goods

All of the above are correct.

All of the above are correct.

Other things the same, an increase in the expected price level shifts

short-run aggregate supply right.

short-run aggregate supply left.

aggregate-demand right.

aggregated-demand left.

short-run aggregate supply left.

An increase in the price of a key input, such as labor, will result in

Decrease in prices.

Increase in national production.

both increase in prices and decrease in national production.

All of the above.

both increase in prices and decrease in national production.

Other things the same, continued increases in technology lead to

continued increases in the price level and real GDP.

continued decreases in the price level and real GDP.

continued increases in real GDP and continued increases in the price level.

continued increases in real GDP and continued decreases in the price level.

continued increases in real GDP and continued decreases in the price level.

Suppose the economy is in long-run equilibrium. If there is a sharp decline in government purchases combined with a significant increase in immigration of skilled workers, then in the short run,

real GDP will rise and the price level might rise, fall, or stay the same. In the long-run, real GDP will rise and the price level might rise, fall, or stay the same.

the price level will fall, and real GDP might rise, fall, or stay the same. In the long-run, real GDP and the price level will be unaffected.

the price level will rise, and real GDP might rise, fall, or stay the same. In the long run, real GDP will rise and the price level will fall.

the price level will fall, and real GDP might rise, fall, or stay the same. In the long run, real GDP will rise and the price level will fall.

the price level will fall, and real GDP might rise, fall, or stay the same. In the long run, real GDP will rise and the price level will fall.

Which of the following will NOT shift a nation's long-run aggregate supply curve to the right?

An increase in the size of the labor force.

A decrease in the nominal wage rate.

An increase in the capital available in the economy.

An improvement in technology.

A decrease in the nominal wage rate.

Optimism

Imagine that the economy is in long-run equilibrium. Then, perhaps because of improved international relations and increased confidence in policy makers, people become more optimistic about the future and stay this way for some time.

Refer to Optimism. Which curve shifts and in which direction?

aggregate demand shifts right

aggregate demand shifts left

aggregate supply shifts right.

aggregate supply shifts left.

aggregate demand shifts right

Factors that influence the long-run aggregate supply curve are

resource availability and technology.

improvements in productivity.

labor, capital, and equipment.

All of the above.

All of the above.

The long-run aggregate supply is vertical because in the long run changes in the price level do NOT:

affect interest rates.

affect the prices of inputs.

affect the number of workers, the capital stock, or technology.

shift aggregate demand.

affect the number of workers, the capital stock, or technology.

Refer to Figure 33-4. If the economy is at A and there is a fall in aggregate demand, in the short run the economy

stays at A.

moves to B.

moves to C.

moves to D.

moves to D

Pessimism

Suppose the economy is in long-run equilibrium. Then because of corporate scandal, international tensions, and loss of confidence in policymakers, people become pessimistic regarding the future and retain that level of pessimism for some time.

Refer to Pessimism. Which curve shifts and in which direction?

aggregate demand shifts right

aggregate demand shifts left

aggregate supply shifts right.

aggregate supply shifts left.

aggregate demand shifts left

When the Fed buys bonds

the supply of money increases and so aggregate demand shifts right.

the supply of money decreases and so aggregate demand shifts left.

the supply of money decreases and so aggregate demand shifts right.

the supply of money increases and so aggregate demand shifts left.

the supply of money increases and so aggregate demand shifts right.

According to the aggregate demand/aggregate supply model, one possible cause of a recession is:

an increase in government spending on education.

a reduction in taxes.

a decrease in demand for investment goods by businesses.

an increase in government spending on military goods.

a decrease in demand for investment goods by businesses.

Refer to Figure 33-8. Suppose the economy starts at Z. Stagflation would be consistent with the move to

P1 and Y1 .

P1 and Y3 .

P3 and Y1 .

P3 and Y3 .

P3 and Y1 .

In the basic aggregate demand and aggregate supply model, which of the following could cause a recession? An increase in:

government purchases.

personal income taxes.

the expectations of households of their future income.

the expectations of firms of the future profitability of their current investment spending.

personal income taxes.

An economic expansion caused by a shift in aggregate demand remedies itself over time as the expected price level

falls, shifting aggregate demand right.

rises, shifting aggregate demand left.

falls, shifting aggregate supply right.

rises, shifting aggregate supply left.

rises, shifting aggregate supply left.

Refer to Figure 33-4. If the economy starts at A, a decrease in the money supply moves the economy

to A in the long run.

to C in the long run.

back to A in the long run.

to D in the long run.

to C in the long run.

As the price level falls

people will want to buy more bonds, so the interest rate rises.

people will want to buy fewer bonds, so the interest rate falls.

people will want to buy more bonds, so the interest rate falls.

people will want to buy fewer bonds, so the interest rate rises.

people will want to buy more bonds, so the interest rate falls.

Which of the following will NOT increase potential real GDP over the long run?

Improvements in technology.

Increases in population.

Increased legal institution.

An increase in demand.

An increase in demand.

Refer to the figure below. The economy's GDP could find itself below potential GDP in short-run macroeconomic equilibrium as a result of:

an increase in oil prices.

a decrease in personal income taxes.

a decrease in business taxes.

an increase in government purchases.

an increase in oil prices.

An increase in the price level will

shift the aggregate demand curve to the left.

shift the aggregate demand curve to the right.

move the economy up along a stationary aggregate demand curve.

move the economy down along a stationary aggregate demand curve.

move the economy up along a stationary aggregate demand curve.

In the mid-1970s the price of oil rose dramatically. This

shifted aggregate supply left, the price level rose, and real GDP fell.

caused U.S. prices to fall, and real GDP rose.

caused an increase in U.S. prices and real GDP.

caused a decrease in U.S. prices and real GDP.

shifted aggregate supply left, the price level rose, and real GDP fell.

Which of the following effects helps to explain the slope of the aggregate-demand curve?

the exchange-rate effect

the wealth effect

the interest-rate effect

All of the above are correct.

All of the above are correct.

Refer to Figure 33-5. In Figure 33-5,

Point B represents a short-run equilibrium and a long-run equilibrium.

Point B represents a short-run equilibrium, and Point A represents a long-run equilibrium.

Correct answer

Point B represents a long-run equilibrium, and Point A represents a short-run equilibrium.

Point B represents a long-run equilibrium, and Point C represents a short-run equilibrium.

Point B represents a short-run equilibrium, and Point A represents a long-run equilibrium.

When looking at a graph of aggregate demand, which of the following is correct?

There are nominal variables on both the vertical and the horizontal axes.

There are real variables on both the vertical and horizontal axes.

The variable on the vertical axis is nominal; the variable on the horizontal axis is real

The variable on the vertical axis is real; the variable on the horizontal axis is nominal

The variable on the vertical axis is nominal; the variable on the horizontal axis is real

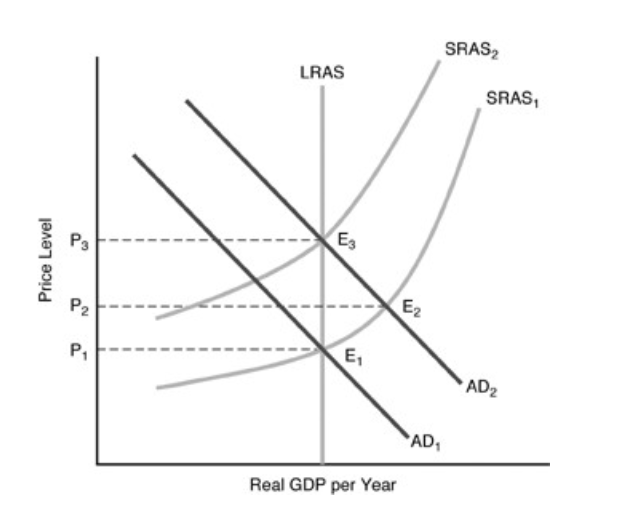

In the above figure, if we start at AD1 and SRAS1, and the money supply increases unexpectedly, what causes the economy to get to the long-run equilibrium?

People's expectations will revise after a short-run gain in output, wages will rise, and SRAS will shift leftward.

People's expectations will revise after a short-run gain in output, wages will rise, and SRAS will shift rightward.

People's expectations will revise after a short-run gain in output, wages will fall, and SRAS will shift leftward.

People's expectations will revise after a short-run loss in output, wages will fall, and SRAS will shift leftward.

People's expectations will revise after a short-run gain in output, wages will rise, and SRAS will shift leftward.

If aggregate supply remains unchanged, a decrease in aggregate demand may

move potential real GDP to the left.

put upward pressure on the price level.

cause a recession.

cause inflation.

cause a recession.

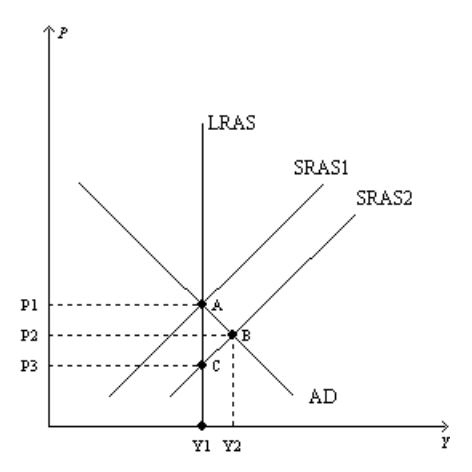

In the above figure, start with the economy in equilibrium at point A. Then an unanticipated reduction in aggregate demand occurs. In the short run, this would cause

the price level to fall by some amount less than P1 but greater than P2, and the rate of unemployment would decrease.

no change in either the price level or real Gross Domestic Product (GDP), but a decrease in unemployment.

the price level to fall from P1 to P2, real Gross Domestic Product (GDP) to fall from y1 to y2, and the rate of unemployment to increase.

the price level to move from P1 to P2, but real Gross Domestic Product (GDP) would stay at y1.

the price level to fall from P1 to P2, real Gross Domestic Product (GDP) to fall from y1 to y2, and the rate of unemployment to increase.