AP Macro Unit 4

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

74 Terms

Money

Is something that used to purchase goods and services, therefore it has intrinsic value that’s set by the number of goods and services

What is considered Money?

1.) Intrinsic value

2.) U.S Dollars as Fiat Money

Unit Account

People commonly accept money as a way to set prices

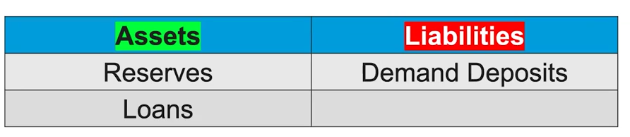

Bank Assets

This is when bank loans out money and earn interests

Bank Liabilities

When the bank owes you money that they have to pay back

Fractional Reserve banking system

when a banking system has a non-zero reserve requirement or anything higher than 0. This is where the rest of demand deposits may be loaned out to individuals or customers.(This doesn’t apply when it’s 0)

The banking system

this is made up by many different banks, including comerical banks and investment

Commercial Banks

they store your money and pay you interest. They also loan out money and earn interest

Reserve requirements

The central bank sets the percentage of customer demand deposits that a bank MUST hold in reserves(not loan out)

How is money created through an economy?

With the Fractional Reserve Banking system, where money is loaned out to customers or businesses

Bank Balance sheets

They show the amounts of bank assets and bank liabilities each individual bank has, and both sides are equal to each other

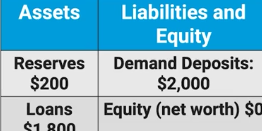

How do Banks keep track of the change in reserves?

changes in demand deposits affect the size of the bank’s required and excess reserves

Required Reserves

the percentage of demand deposits the banks must hold in reserves

Excess Reserves

the percentage of demand deposits banks choose to hold on to. These can be loaned out to individuals and businesses if there’s no excess reserves.

Excess Reserves equation

Total demand deposits - (Required Reserves + Loans)

Required Reserves equation

Demand deposits x required reserves ratio

What happens when there is no excess reserves?

The rest of the money is loaned out

What happens to the excess reserves and loans, when the required reserves goes up?

The excess reserves and loans goes up by the same amount

Maximum increase money supply equation

Excess reserves x money multiplier(1/rrr)

Does buying bonds(securities) expand or contract the economy(money supply)?

Expand

Does selling bonds(securities) expand or contract the economy(Money supply)?

contract

The money multiplier(definition)

used to determine maximum changes to the banking system when deposits or withdrawals from demand deposits. This only happens when the banking system has a non-zero reserve requirement.

Money Multiplier equation

1/rrr

Customer Withdrawals

When customers withdraw money, it’s withdrawn from a bank’s reserves(bank’s assets), and it’s subtracted from a bank’s demand deposits(a bank’s liabilities).

Required Reserve Ratio

the percentage of customer deposits that the bank must hold in reserve and cannot lend out

Assume that the required reserve ratio is 10%

What is the dollar value of new loans that first superior bank can make

0 because they’ve already loaned out their maximum excess reserves

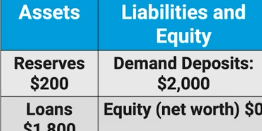

Assume that the Required Reserve Ratio is 10%

Mr. Smith deposits $100 of cash in a demand deposit account at the first superior bank. Calculate the maximum amount of new loans that the first superior bank can now make?

$90 because $10 is the required reserve and there’s $90 left to loan out

Maximum change over time for Loans

The increase in loans x money supply(1/rrr)

Maximum change over time for Demand Deposits

The increase in Loans x Money supply(1/rrr)

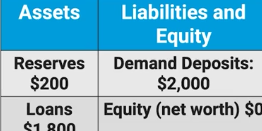

Assume that the Required Reserve Ratio is 10%

As a result of Mr. Smith’s $100 cash deposit, calculate the maximum changes over time for:

1.) Loans

2.) Demand Deposits

1.) $90(excess reserves) x 10= $900

2.) $100 × 10 = $1,000

M1

good being supplied and demanded

Transactions Motives

a term that shows that people want to hold money in hopes of something beneficial

Money demand

People choosing to hold their wealth as money with two components of assets demand for money with interest bearing assets or through cash

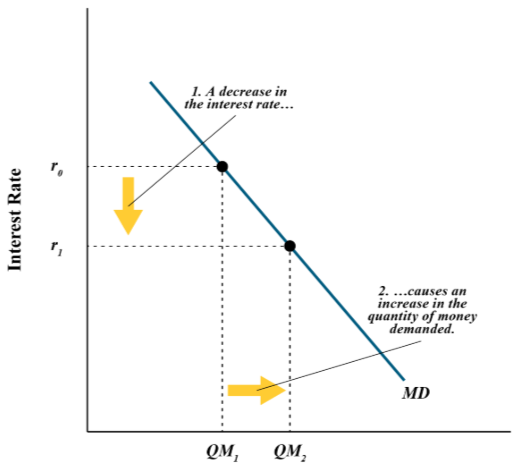

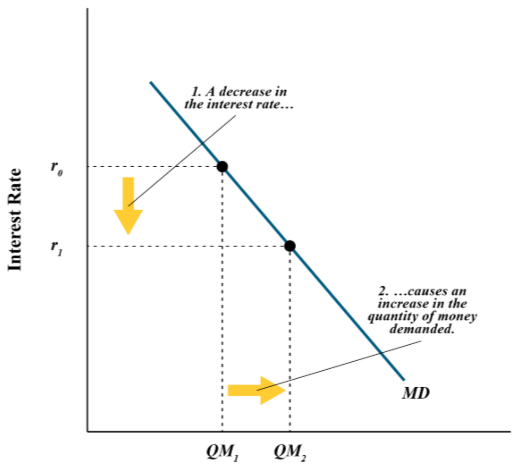

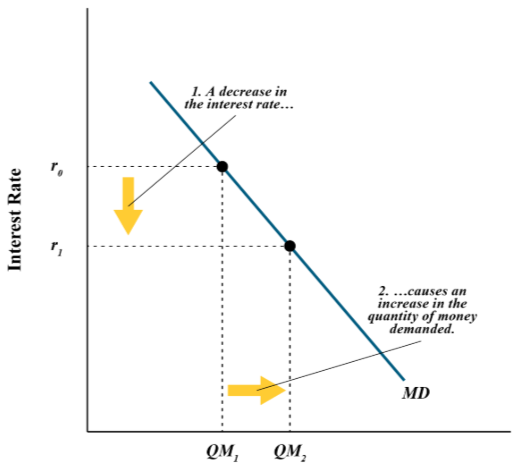

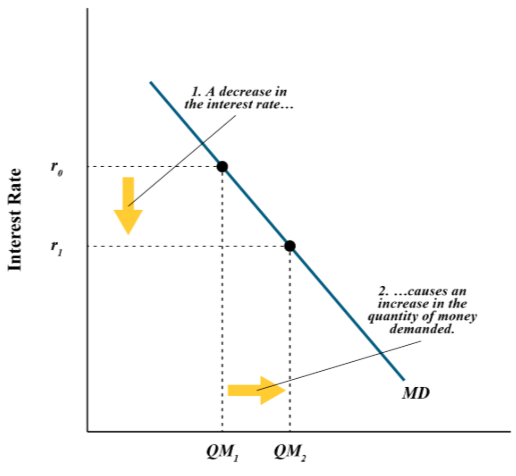

Money demand graph

x-axis: Quantity of money

y-axis: Nominal Interest rate(opportunity costs for holding money)

What happens when you hold your money in cash?

You're not earning the interest you could’ve earned when holding your cash in a certificate of deposit or some other interest bearing assets

When there’s low nominal interest rates the people hold __ money?

More

When there’s high nominal interest rates the people hold __ money?

Less

Transaction demand for money

Money needed to process the transactions in the economy through the Real GDP equation = C + I + G + X(which is Exports - Imports)

What causes an increase in the Money Demand?

An Increase in C + I + G + X

An Increase in Price Level

An Increase in Inflation Expectations

An Increase in Desire to hold wealth as money

What causes an decrease in the Money Demand?

A decrease in C + I + G + X

A decrease in Price Level

A decrease in Inflation Expectations

A decrease in Desire to hold wealth as money

Money Supply

It’s determined by actions of the central Bank when there are scarce reserves and changes in banks lending. It shows how much it has available to loan out

What causes an increase in the Money supply(Rightward shift)?

Increased lending

Expansionary monetary policies

What causes a decrease in the Money Supply(Leftward Shift)?

Decreased Lending

Contraction Monetary policy

Effects of Lower interest

More Gross Investment → More Physical Capital stocks → More Growth

Impacts of Higher interest

Less Gross Investment → Less Physical Capital stocks → Less Growth

The Shifters of Money Demand

1.) Price Level

2.) Incomes

3.) Technology

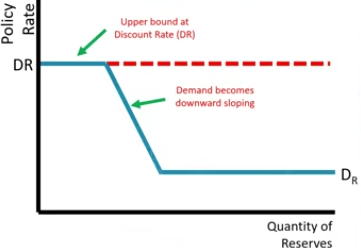

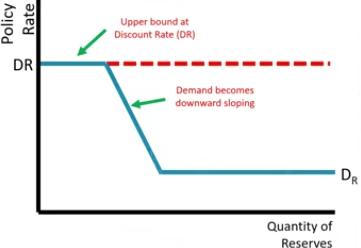

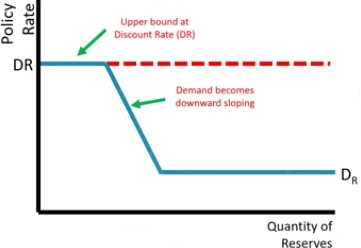

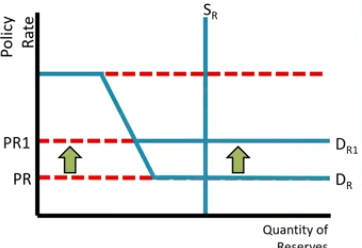

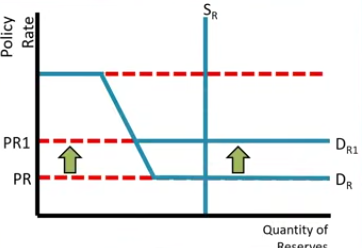

Scarce Reverses

Central banks target their policy rate(the amount banks charge each other, it’s called a federal funds rate in the U.S.) through changes the Money supply.

1.) discount rate

2.) Reserve Requirement

3.) Open Market Operations

An increase in the Policy rate, Discount rate, and selling bonds, causes the Money Supply to __?

Decrease

Ample Reserves

The Banks get paid this rate by the central bank on their reserve balances

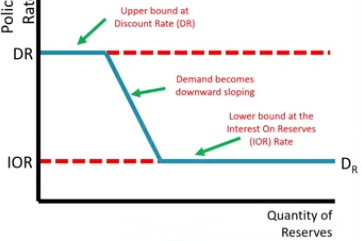

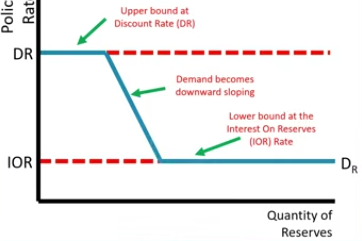

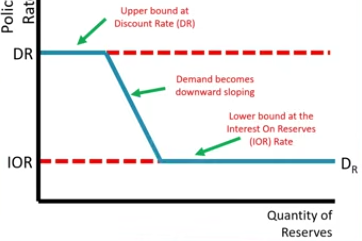

Where can you find the policy rate on the Reserves Market graph?

At the Equilibrium

Where is the Discount rate on the Reserves Market graph?

At the upper bound

Where can you find the demand on the Reserves Market graph?

Downward sloping line

Where can you find the Interest on Reserves Rates?

Lower bound

Supply of Reserves

It’s controlled by the central bank(also called the federal Funds rate in the U.S.), therefore it won’t be impacted by the policy rate which makes it vertical

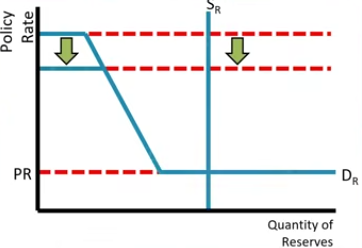

Open Market purchases/buying bonds shift the Supply of Reserves __?

Right

Open Market Sales/selling of bonds shift the Supply of Reserves __?

Left

Where can you find the Scarce Reserves on the Ample Reserve graph?

Downward Slope region

Open Market Operations can only effect the Supply of reserves on the downward sloping region of Ample Reserves graph?

Yes

Decrease in Discount Rate will only move the upper bound on the Ample Reserves graph __?

Down

Changes in the Interest on Reserves Rate will only effect the policy rate or the discount rate?

Policy rate

Increase on the Interest on Reserves only moves the lower bound __?

Up

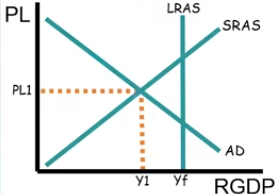

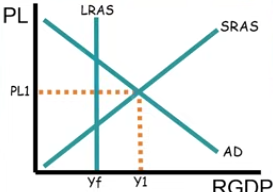

What does this reveal about this economy?

It’s in a recession

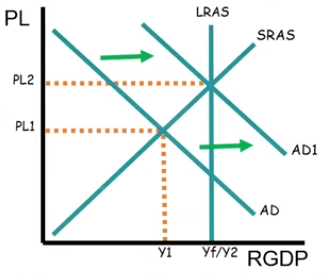

Expansionary Monetary Policy and Contractionary Monetary Policy only Shifts Aggregate Demand, Long-Run Aggregate Supply, or Short-Run Aggregate Supply?

Aggregate Demand

What does this reveal about this economy?

Inflationary period

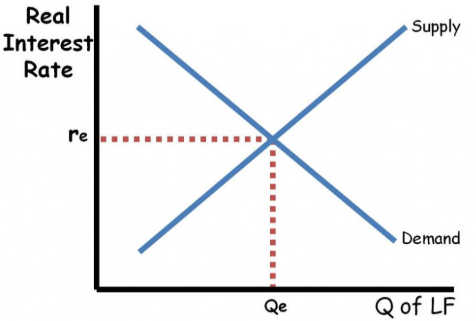

Loan-able Funds Market

The amount of money available to be loaned out in a relationship between the Borrowers(representing the Demand curve) and the Lenders(representing the Supply curve)

If the price of the loan is high, borrowers will borrow __?

Much

Supply to Loan-able funds

Savings that money deposits are available to loan out

When the real interest rate is low, the savings is going to be __ therefore the quantity of loan fund is _?

1.) Small

2.) Small

Holding Cash would __ Supply of Loanable funds

Decrease

What is the Supply to Loanable funds made up of?

Made up of private and public savings

Deficit Spending

When the government does more borrowing than spending?

When the government is borrowing money it will __ the Demand while it _ the supply because there is less money being saved

1.) Increase

2.) Decreases

Crowding Out

when the government deficit spending doesn’t help the economy because it increases Real interest rates and decreases investment/Growth