ACC 220 Chapter 4 Homework

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

Activity-based costing (ABC)

A two-stage costing method in which overhead costs are assigned to products on the basis of the activities they require.

ABC differs from traditional cost accounting in three ways

1. Non-manufacturing as well as manufacturing costs may be assigned to products, but only on a cause-and-effect basis

2. Some manufacturing costs may be excluded from product costs.

3. ABC uses more cost pools

Activity

an event that vcauses the consumption of overhead resources

Activity Cost Pool

A “bucket” in which costs are accumulated that relate to a single activity measure in an activity-based costing system.

Activity Measure

An allocation base in an activity-based costing system; ideally, a measure of whatever causes the costs in an activity cost pool.

Two common types of activity measures

Transaction Driver

Duration Driver

Transaction Driver

simple count of the number of times an activity occurs

Duration Driver

a measure of the amount of times needed for an activity

Five Levels of Activity: Unit Level

Activities performed for each unit of production

Five Levels of Activity: Batch Level

Activities performed for each batch of products

Five Levels of Activity: Product Level

Activities performed for and identifiable with an entire product line

ex. changing product (color, model, etc)

Five Levels of Activity: Customer Level

Activities that relate to specific customers

Five Levels of Activity: Organization Sustaining

Activities required to support or sustain an entire production process and not dependent on number of products, batches or units produced

Level of Activity: Various individuals manage the parts inventories

Product Level

Level of Activity: A clerk in the factory issues purchase orders for a job

Batch Level

Level of Activity: The personnel department trains new production workers

Organization Sustaining Level

Level of Activity: The factory's general manager uses her office in the factory building

Organization Sustaining Level

Level of Activity: Direct labor workers assemble products

Unit Level

Level of Activity: Engineers design new products

Product Level

Level of Activity: The materials storekeeper issues raw materials to be used in jobs

Batch Level

Level of Activity: The maintenance department performs periodic preventative maintenance on general-use equipment

Organization Sustaining Level

Designing an ABC System

Step 1 - Define activities, activity cost pools, and activity measures

Step 2 - Assign overhead costs to activity cost pools

Step 3 - Calculate activity rates

Step 4 - Assign overhead costs to cost objects using activity rates and activity measures

Step 5 - Prepare mangement reports

ABC Limitations

-Substantial resources required to implement and maintain

-Resistance to unfamiliar numbers and reports

-Desire to fully allocate all costs to products

-Potential misinterpretation of unfamiliar numbers

-Does not conform to GAAP. Two costing systems may be needed.

Activity rate

An overhead rate in activity-based costing. Each activity cost pool has its own activity rate, which is used to assign overhead to products and services.

Unit Level Measures

Machine Hours, DL Hours, and Units Produced

Batch Level Measures

Purchase Orders Processed, Production Orders Processed, Number of setups, Setup Hours, Pounds of Materials Handled/Moved

Product Level Measures

Hours of Testing Time, Number of Part Types, Hours of Design time

Facility Level Measures

DL Hours

Predetermined Overhead Rate

Estimated Total Manufacturing Overhead/Estimated Total Amount of the Allocation Base

Activity-based management

A management approach that focuses on managing activities as a way of eliminating waste and reducing delays and defects.

Benchmarking

A systematic approach to identifying the activities with the greatest room for improvement. It is based on comparing the performance in an organization with the performance of other, similar organizations known for their outstanding performance.

What are the 3 common approaches to assigning overhead cost to products?

Plantwide overhead rates, departmental overhead rates, and activity-based costing.

Parts administration is an example of

Product Level Activity

Production order processing is an example of a

Batch Level Activity

Purchase Order Processing is an example of a

Batch Level Activity

Which of the following activities would be classified as a batch-level activity?

a)Setting up equipment

b)Designing a new product

c)Training employees

d)Milling a part required for the final product

Setting up Equipment

T/F. Departmental overhead rates applied on the basis of a single activity measure will eliminate any distortions in unit costs due to product diversity

False

T/F. In activity-based costing, departmental overhead rates are used to apply overhead to products.

False

In activity-based costing, unit product costs computed for external financial reports includes

Direct Materials, Direct Labor, and MO

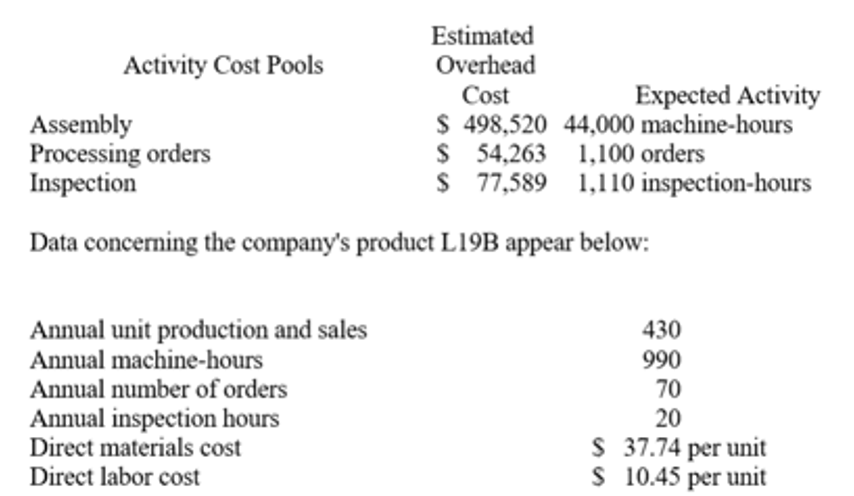

According to the activity-based costing system, the unit product cost of product L19B is closest to: (Round your intermediate calculations to 2 decimal places.)

$85.56 per unit

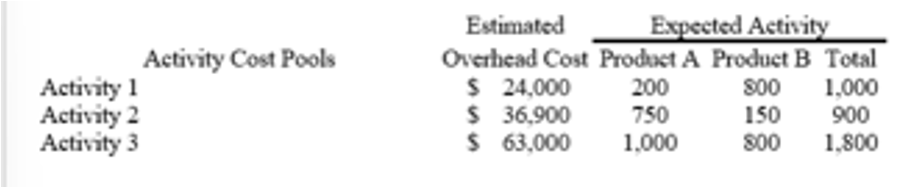

Lindsey Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with estimated total cost and expected activity as follows:

$14.11

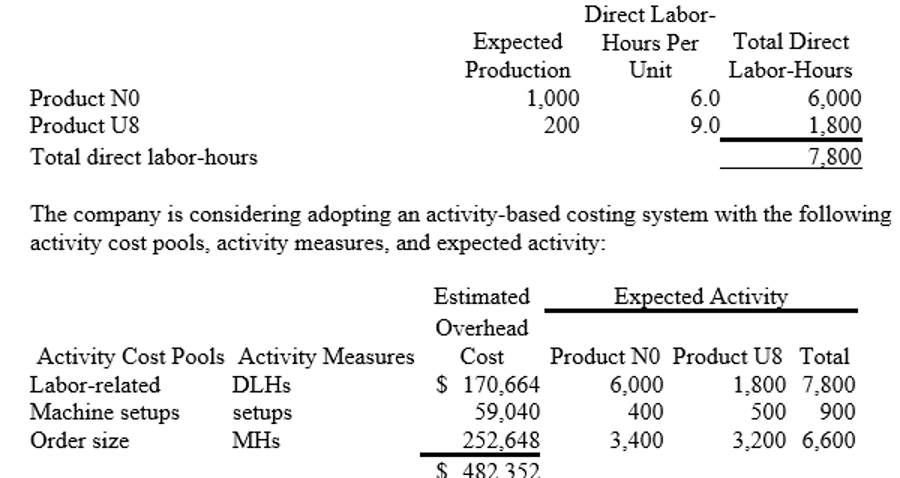

Foisy, Inc., manufactures and sells two products: Product N0 and Product U8. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

The total overhead applied to Product U8 under activity-based costing is closest to: (Round your intermediate calculations to 2 decimal places.)

194,680

Preventive maintenance is performed on general-purpose production equipment.

Facility-level

Products are assembled by hand.

Unit-level

A security guard patrols the company grounds after normal working hours.

Facility-level

Purchase orders are issued for materials to be used in production.

Batch-level

Modifications are made to product designs.

Product-level

New employees are hired by the personnel office.

Facility-level

Machine settings are changed between batches of different products.

Batch-level

Parts inventories are maintained in the storeroom. (Each product requires its own unique parts.)

Product-level

Insurance costs are incurred on the company’s facilities.

Facility-level

Which of the following statements about processing costing is false?

Process costing accumulates costs by department.

Process costing assigns departmental costs uniformly to all identical units that pass through the department during a period.

Process costing systems compute unit costs by department.

Process costing is used when a company produces a continuous flow of units that are distinguishable from one another

Process costing is used when a company produces a continuous flow of units that are distinguishable from one another.

Which of the following statements about companies that use processing costing is false?

A processing department is an organizational unit where work is performed on a product and where materials, labor, or overhead costs are added to the product.

Costs are accumulated by department.

Raw material costs are added only to the first processing department.

A separate Work in Process account is maintained for each processing department.

Raw material costs are added only to the first processing department.