Accounting equations and key terms

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

accounting equations

assets = liabilities + shareholders equity

expanded accounting equation

a = l + s/c + re + rev - expenses - dd

end common shares

beg c/s + new owners - stock repurchase

end re

beg re + ni - div declared

NI

rev - exp

book value

E

current ratio

current assets/ current liabilities

end a/r (accounts receivable)

beginning a/r + credit sales - cash collection

insurance purchase

prepaid insurance beginning + new purchase + new rent payment - use of insurance - use of rental space

end a/p (accounts payable)

beginning a/p + beg a/p + credit purchase - cash

end inventory

purchases + beg inventory - cogs

market value

#of common share outstanding traded x stock price

t account

title

LS: debit

RS: credit

working capital

= current assets - current liabilities

debt to total assets

total liabilities / total assets

basic EPS (basic earnings per share)

income avail to common shareholders/weighted avg of number of shares

higher is better

PE ratio (price-earnings)

market price per share/basic EPS

higher is better

historical cost

we use the assets and liabilities recorded at original acquisition cost cca

accrual basis accounting

revenue and expense recognition - revenues and expenses are recorded when they are earned or incurred, not when the cash is exchangedevr

rev recognization

when merch is sold and delivered or when service is performed

matching principle

expenses match revenues, they should be reported in the same period

deferred rev

cash received and recorded as liabilities before rev is earned

prepaid expenses

expenses paid in cash & recorded as assets before use

Initially recorded as assets because they provide future benefits

Expire over time or through usage

accrued expenses

incurred for which cash has yet to be paid and that have yet to be recorded through journal entries

accrued revenues

revenues earned for which cash has yet to be received and that have tet to be recorded through journal entries

depreciation

process of allocating cost over estimated useful life

asset * month/year(period)

temporary accounts

revenue accounts

expense accounts

dividends declared

temporary use of accounts to record activity

restarts for the year - not carried over

permanent accounts

all asset accounts

all liability accounts

s/h/e accounts

closing entries

close all rev accounts to income summary (new temp acct set up help w closing process)

close all exp accts to income summary

close all income summary to retained earnings

close div declared to RE

normal debit balance

expense

asset

div declared

normal credit balance

liability

revenue

s/c and RE

gross profit

sales - cogs

income loss before tax

gross profit - operating exp

net income (loss)

income (loss) before tax - income tax expense

inventory purchase

dr) inventory cr) cash, payables

freight costs fob destination

ownership of the goods remains with the seller until it reaches buyer. seller pays the freight costs

freight costs fob shipping point

shipping is on the buyer and the onus is on the buyer when the carrier accepts the goods from the seller

purchase returns

return goods for credit or cash depending on how sale was made

In both cases, a decrease (credit) is made to the inventory account to reflect the decrease in cost of goods purchased (COGS is dr)

purchase allowance

may choose to keep merch if seller grants a reduction

In both cases, a decrease (credit) is made to the inventory account to reflect the decrease in cost of goods purchased (COGS is dr)

goods are sold

dr) cash, a/r, deferred rev cr)sales revenue

sales rev - cogs = gross profit

inc in equity

expense recognition

dr) cogs cr) inventory

inc in net assets

inc in cash/ar or reduction in deferred rev>reduction in inventory

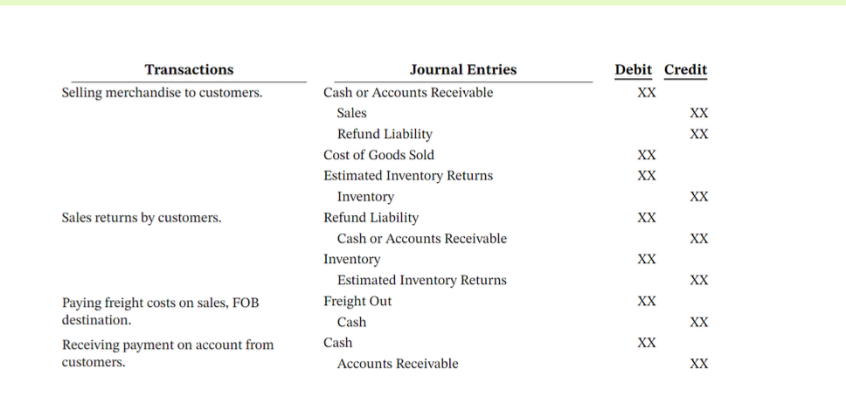

summary of sales transactions

multistep I/s presentation

Shows many steps in determining income before tax

Gross profit = sales – COGS

Income from operations = gross profit – operating expenses

Income before income tax = income from operations + non-operating revenue – non-operating expenses

Net income = income before income tax – income tax expense

nature classification

expenses are reported according to their natural classification

function

expenses are reported according to the activity for which they were incurred

GPM (gross profit margin)

gross profit/sales

generally better to have a higher number

PM (profit margin)

net income/sales

ending inventory

beginning inv + net purchases - COGS

NRV

selling price - cost needed to make goods ready for sale

adjust to the lower amount - cost vs NRV

inventory turnover

cogs/avg inventory

average inventory

(beginning inventory/ending inventory)/2

days in inventory

365 days/inventory turnover