3. Fiscal Policy

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Fiscal Policy

Fiscal policy refers to the government’s decisions about taxation and spending.

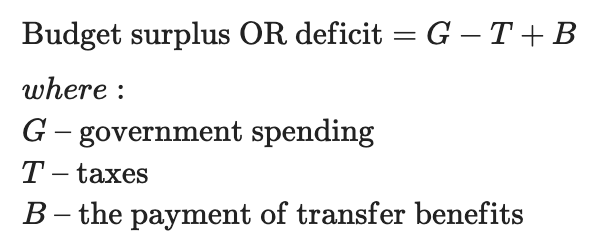

Budget Surplus/Deficit

The budget surplus/deficit – the difference between government revenue and expenditure for a fixed period of time, such as a fiscal or calendar year.

Expansionary Fiscal Policy

Income tax cuts → higher disposable income → ↑ aggregate demand.

Sales tax cuts → lower prices, higher real income → ↑ consumption.

Corporate tax cuts → higher profits → ↑ investment.

Savings tax cuts → higher saver income → ↑ consumption.

Public spending ↑ (infrastructure, social goods) → higher incomes → ↑ aggregate demand.

rise in a deficit

Contractionary Fiscal Policy

Income tax ↑ → lower disposable income → ↓ aggregate demand.

Sales tax ↑ → higher prices, lower real income → ↓ consumption.

Corporate tax ↑ → lower profits → ↓ investment.

Savings tax ↑ → lower saver income → ↓ consumption.

Public spending ↓ (infrastructure, social goods) → lower incomes → ↓ aggregate demand.

increase in a budget surplus

Keynesians

Keynesians – believe fiscal policy strongly affects aggregate demand, output, and employment when spare capacity exists.

Monetarists

Monetarists – believe fiscal policy has only temporary effects, with monetary policy being more effective for controlling inflation and demand.

Automatic stabilizers

Automatic stabilizers – features of fiscal policy that automatically adjust government spending or taxes with the business cycle, without new legislation.

In a slowdown: spending on unemployment benefits rises, supporting demand.

In a boom: tax revenues rise (e.g., from progressive taxes), reducing demand.

"Pay-as-you-go" Rule

A “pay-as-you-go” rule – a neutral policy, which requires that any tax cut or increase in entitlement spending be offset by an increase in other taxes or reduction in other entitlement spending.

Government debt

Government (or national) debt – the accumulation of the government deficits over time.

Ricardian Equivalence

Ricardian Equivalence – if the government borrows money and cuts taxes today (fiscal deficit rises), people expect higher taxes in the future, so they save instead of spend.

No impact on stimulation of the economy!

Crowding Out Effect

Government spending growth → higher interest rates → less private sector investment

Эффект вытеснения (англ. crowding out) — эффект стимулирующей фискальной политики государства. Увеличивая размеры государственных расходов, правительство выходит на денежный рынок, чтобы профинансировать бюджетный дефицит. Рост спроса на деньги на финансовом рынке приводит к росту цены этих денег — то есть к росту процентной ставки, что неизбежно снизит спрос на инвестиции в реальном секторе экономики. Таким образом, увеличение государственных расходов, в том числе государственных инвестиций, приводит к вытеснению частных инвестиций.

Forms of Government Spending

Transfer payments – welfare support (pensions, benefits, tax credits); redistribute income; not part of GDP.

Current spending – regular spending on goods/services (health, education, defense); impacts skills & productivity.

Capital expenditure – infrastructure investment (roads, hospitals, schools); raises capital stock & long-term potential.

Forms of Government Spending Justification

Defense services – benefit all citizens equally.

Infrastructure spending (e.g., roads) – supports economic growth.

Welfare/benefits – ensure minimum income & redistribute wealth.

Aggregate demand management – support low inflation, high employment, growth.

Subsidies – encourage innovation & high-risk markets (e.g., renewable energy).

Forms of Government Revenues

Direct taxes – levied on income, wealth, profits (e.g., income tax, corporate tax, capital gains, inheritance); raise revenue & redistribute wealth.

Indirect taxes – levied on spending (e.g., VAT, excise on fuel, alcohol, tobacco); may exclude health/education; can also deter harmful activities or support environmental goals.

Desirable Attributes of Tax Policy

Simplicity – easy for taxpayers to comply with and authorities to enforce; liability should be clear and hard to manipulate.

Efficiency – minimal interference with market choices; should discourage work and investment as little as possible; may guide “good” behavior (e.g., savings) but risks unintended effects.

Fairness – people in similar situations pay the same (horizontal equity); richer pay more (vertical equity); progressive vs. flat tax debated.

Revenue sufficiency – ensures enough revenue for government spending; may conflict with fairness and efficiency.

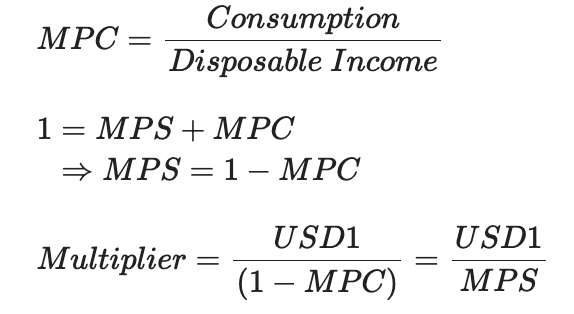

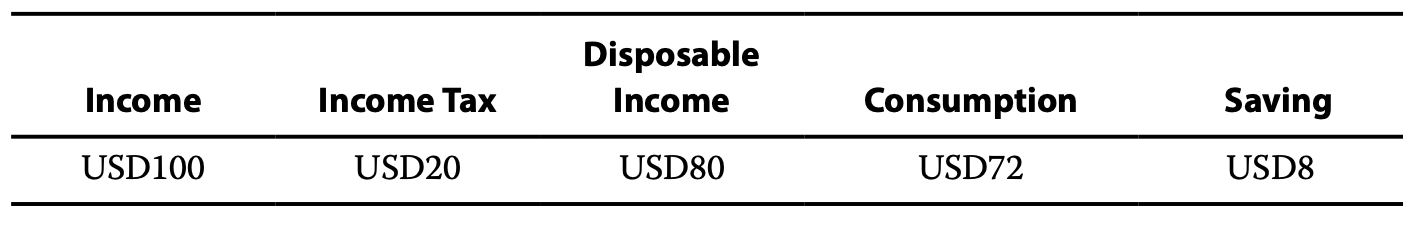

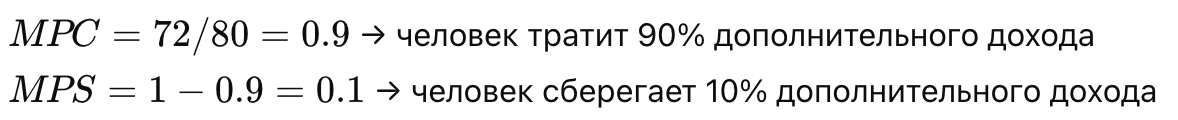

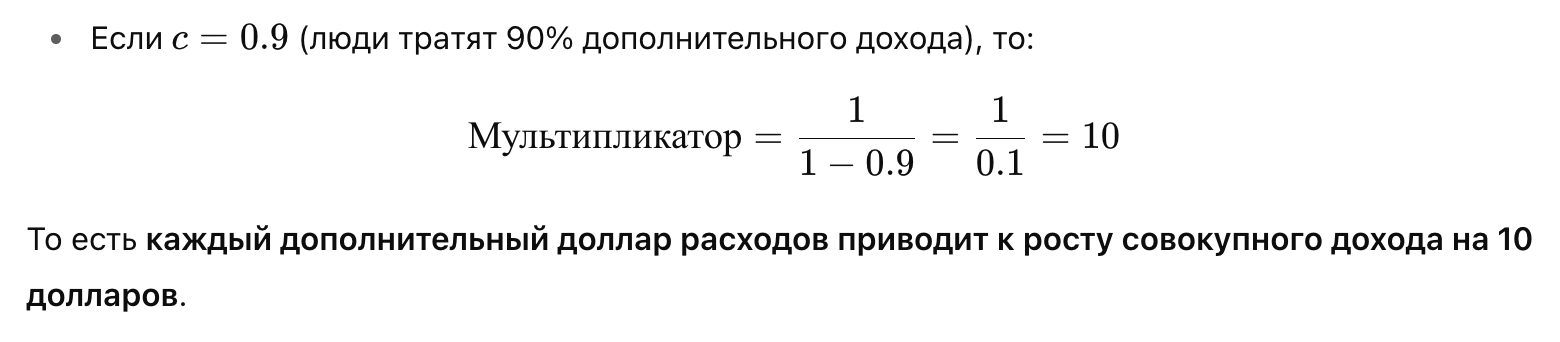

Fiscal Multiplier

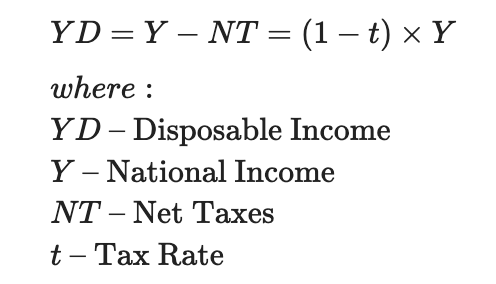

Net Tax Rate

Fiscal Policy Lags

Recognition lag – the time it takes for policymakers to realize the economy has a problem (because data come late and are often revised).

Action lag – the time between realizing the problem and actually putting new policies in place (e.g., passing new spending programs or tax changes).

Impact lag – the time between starting the policy and when the economy finally feels the results (e.g., employment and income changes).