Chapter 8 - Interest Rate Risk and Swaps

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

78 Terms

What is LIBOR?

The London Interbank Offered Rate, previously the most widely used reference rate for loans and derivatives.

Why was LIBOR replaced?

It was unreliable and speculative, leading to a transition to more transparent, transaction-based rates.

What are the primary replacements for LIBOR?

SOFR (Secured Overnight Financing Rate) – USD replacement

SONIA (Sterling Overnight Index Average) – GBP replacement

€STR (Euro Short-Term Rate) – Euro replacement

TONA (Tokyo Overnight Average Rate) – JPY replacement

SARON (Swiss Average Rate Overnight) – CHF replacement

CORRA (Canadian Dollar Offered Rate) – Canadian overnight rate

CDOR (Canadian Offered Rate) – Canadian benchmark for bankers’ acceptances

What are the two main categories of credit ratings?

Investment Grade (Prime, High grade, Upper medium grade, Lower medium grade)

Speculative Grade (Speculative, Highly speculative, Substantial risks, Extremely speculative, Default imminent, In default)

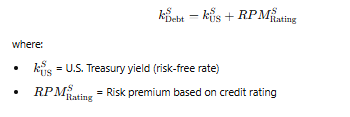

How is the corporate cost of debt calculated?

What is Credit Risk (Roll-over Risk)?

The risk that a borrower’s creditworthiness is reclassified when renewing credit, potentially leading to:

✔ Higher interest rates

✔ Changes in fees

✔ Credit line commitment adjustments

✔ Denial of credit

What is Repricing Risk?

The risk of interest rate changes at the time a financial contract’s rate is reset (e.g., floating rate loans).

✔ Reflects current market conditions

What is sovereign debt?

Debt issued by governments.

Why is sovereign debt historically considered high quality?

✔ Governments can tax their people

✔ Governments can print more money

This gives them the ability to service their own debt when it is denominated in their currency.

What is sovereign credit risk?

The risk that a sovereign borrower may struggle to repay foreign currency-denominated debt.

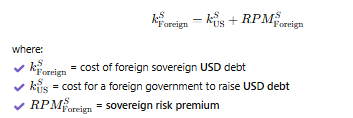

How is the cost of sovereign debt calculated?

What does the sovereign spread represent?

The additional interest rate a country pays above U.S. Treasuries due to credit risk

What is the largest interest rate risk for a nonfinancial firm?

Debt service – the cost of borrowing funds.

Why is multicurrency exposure important?

Multinational enterprises (MNEs) face additional risk due to debt being denominated in multiple currencies.

What is the second most significant source of interest rate risk for MNEs?

Their holdings of interest-sensitive securities, which fluctuate in value as rates change.

What is a day-count convention in international interest rate calculations?

A method used to determine how interest accrues over time for financial instruments such as loans, bonds, and deposits.

What does "International" refer to in financial markets?

Short-term loans in all Eurocurrencies except Eurosterling.

What are the common day-count conventions in the U.S.?

✔ Actual/Actual – U.S. Treasury bonds

✔ 30/360 – Corporate bonds

✔ Actual/360 – Money market instruments

What is a fixed interest rate loan?

A loan where the interest rate remains the same for the entire term, eliminating repricing and credit risk.

What are the main advantages of a fixed-rate loan?

✔ No interest rate risk (no repricing)

✔ No credit risk

✔ Predictable payments

What is a floating interest rate loan?

A loan where the interest rate is reset periodically (e.g., annually), exposing the borrower to repricing risk.

Why does a floating rate loan have repricing risk?

Because the interest rate is reset annually, meaning payments can increase or decrease based on market conditions.

What is a credit premium in a floating rate loan?

An additional fixed percentage (e.g., LIBOR + 2%) added to the base rate to reflect the borrower’s creditworthiness.

Why does a floating rate loan have no credit risk?

The credit premium remains constant over the loan term, so the borrower’s creditworthiness does not impact the rate after the initial agreement.

How does a short-term fixed-rate loan with annual renewal work?

The loan is taken at a fixed rate for one year, then renewed annually at the prevailing interest rate.

What risks are associated with short-term fixed-rate loans?

✔ Repricing risk – The new interest rate at renewal may be higher or lower.

✔ Credit risk – The borrower’s creditworthiness at renewal affects the new rate or loan approval.

Which loan option is the most flexible?

The short-term fixed-rate loan with annual renewal, as it allows the borrower to adjust based on market conditions.

Which loan option is the least flexible?

The fixed-rate loan, as the borrower is locked into the same interest rate for the entire term.

Why are floating-rate loans a major concern for corporate interest rate risk?

They are the most frequently observed type of corporate interest rate exposure because the interest rate fluctuates with market conditions.

What component of a floating-rate loan remains fixed?

The credit spread (e.g., 1.250%), which remains constant throughout the loan term.

Why is the total interest cost of a floating-rate loan uncertain?

Because the LIBOR rate fluctuates, meaning the borrower won’t know the final interest cost until the loan is fully repaid.

What are the four main strategies to manage interest rate risk?

✔ Refinancing – Replacing the existing loan with a new one at better terms.

✔ Forward Rate Agreement (FRA) – Locking in a future interest rate.

✔ Interest Rate Future – Using a futures contract to hedge against rate fluctuations.

✔ Interest Rate Swap – Exchanging a floating-rate payment for a fixed-rate payment.

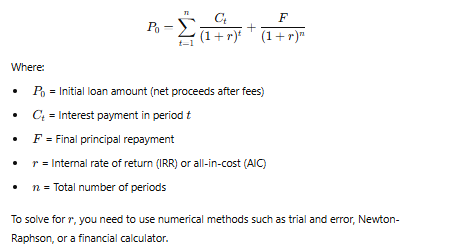

How is the all-in-cost (AIC) or internal rate of return (IRR) calculated for the loan?

What is an interest rate future?

A contract where a buyer and seller agree to the future delivery of an interest-bearing asset.

Why do financial managers use interest rate futures?

✔ High liquidity of interest rate futures markets

✔ Simplicity in use

✔ Standardized interest rate exposures

What are interest rate futures used for?

Hedging and speculation

How is the settlement price of an interest rate futures contract calculated?

Settlement Price = 100−(Implied Interest Rate×100)

How do you calculate the yield of a futures contract?

Yield =100−Settlement Price

What is the notional value of an interest rate futures contract?

The predefined contract size, often $1 million for short-term rate futures.

What is a basis point in interest rate futures, and how much is it worth?

A basis point (0.01%) represents a contract price movement and is often valued at $2,500 per contract.

How do traders use interest rate futures for hedging?

By taking an opposite position to offset risk from changing interest rates.

What happens to futures prices if interest rates rise?

Futures prices fall, benefiting traders who sold (shorted) futures contracts.

What happens to futures prices if interest rates fall?

Futures prices rise, benefiting traders who bought (went long) futures contracts.

How do you calculate profit or loss from a futures position?

Profit/Loss = (Change in Basis Points×Value per Basis Point)×Number of Contracts

How can a trader lock in a fixed interest rate using futures?

By selling (shorting) futures contracts to hedge against rising rates.

What happens if interest rates increase when you are short on a futures contract?

Futures prices fall, and you earn a profit.

If you are earning interest in the future, how do you hedge against falling rates?

Buy (long) a futures contract.

What happens if interest rates decrease when you are long on a futures contract?

Futures prices rise, and you earn a profit.

What is a Forward Rate Agreement (FRA)?

A contract to buy or sell interest rate payments on a notional principal for a future period.

What is the purpose of an FRA?

To hedge against interest rate fluctuations by locking in a future borrowing or lending rate.

Who are the parties involved in an FRA?

✔ Buyer – Locks in a future interest rate (gains if rates rise).

✔ Seller – Agrees to pay the buyer if rates rise (gains if rates fall

What happens if actual interest rates rise above the FRA rate?

The seller pays the buyer the increased interest expense.

What happens if actual interest rates fall below the FRA rate?

The buyer pays the seller the differential interest expense.

Are Forward Rate Agreements settled in cash?

Yes, no principal is exchanged—only the interest differential.

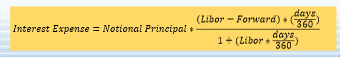

What does the FRA formula calculate?

The interest expense or income based on the difference between LIBOR and the agreed forward rate.

What is an interest rate swap?

A contract where two parties exchange fixed interest payments for floating rate payments or vice versa.

What is a currency swap?

A contract where two parties exchange interest payments in different currencies.

What is a Plain Vanilla Swap?

A basic interest rate swap where parties exchange fixed-rate payments for floating-rate payments in the same currency.

What is a Cross Currency Swap?

A swap where interest payments are exchanged between two different currencies.

How does an FX Swap work?

It involves periodic interest payments and an exchange of principal at the end of the contract.

Does a swap provide new capital?

No, it simply modifies the structure of cash flows related to interest payments.

How do high credit quality companies use swaps?

They raise fixed-rate debt and use swaps to convert some of it into floating-rate debt.

How do low credit quality companies use swaps?

They raise floating-rate debt and use swaps to convert it into fixed-rate debt to manage interest rate risk.

What is the best swap strategy if a company has fixed-rate debt and expects interest rates to fall?

Pay floating, receive fixed (to take advantage of lower rates).

What is the best swap strategy if a company has floating-rate debt and expects interest rates to rise?

Pay fixed, receive floating (to lock in a fixed rate and avoid rising costs).

How are cross-currency swap rates determined?

By the yield curve of each major currency.

Why do firms use cross-currency swaps?

To convert debt payments into a desired currency, reducing currency risk.

What is the desired currency in a cross-currency swap?

The currency in which a firm expects future operating revenues (cash inflows).

Why might a company borrow in a currency where it doesn’t have revenues?

✔ Some currencies have lower borrowing costs.

✔ Companies can swap repayments into a more favorable currency.

How does a cross-currency swap help manage risk?

By matching debt payments to expected revenues, reducing exchange rate exposure.

How is a cross-currency swap different from a plain vanilla interest rate swap?

Notional principal is exchanged at the start and end.

The initial spot exchange rate determines the local currency amount.

What are the two key steps to unwinding a swap?

Discount remaining cash flows using the current interest rate.

Convert the target currency back into the home currency.

What is counterparty risk in a swap?

The risk that the other party in the swap contract fails to make agreed payments.

Why is counterparty risk a major concern in swaps?

Large, well-publicized swap defaults have occurred in the past, highlighting the risk of non-payment.

What are the key steps involved in unwinding a cross-currency swap?

Discount remaining cash flows using current interest rates.

Convert the target currency back to the home currency at the current exchange rate.

What is counterparty risk?

The risk that the other party in a financial contract fails to fulfill its obligations.

What happens if the swap counterparty defaults?

The company is still legally responsible for debt service payments, despite not receiving the swap cash flows.

Why is counterparty risk significant in swap agreements?

Because large, complex derivatives and swaps may involve significant sums, and defaults can have major financial consequences.