Chapter 7 - Macroeconomic Measures of Performance

0.0(0)Studied by 2 people

Card Sorting

1/64

Last updated 4:56 PM on 4/1/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

65 Terms

1

New cards

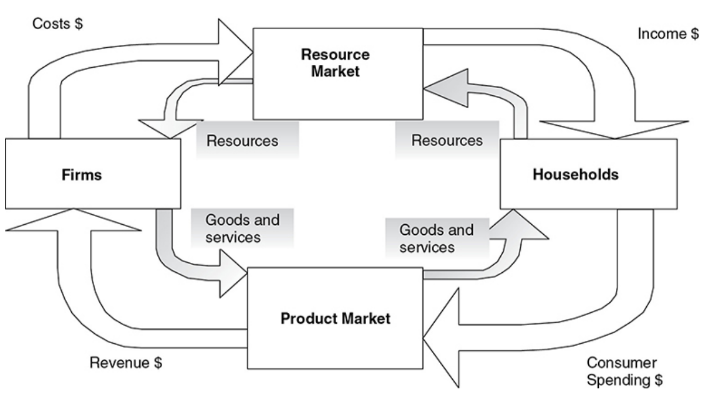

Circular flow of economic activity

A model that shows how households and firms circulate resources, goods, and incomes through the economy

2

New cards

Closed economy

A model that assumes there is no foreign sector (imports and exports)

3

New cards

Aggregation

The process of summing the microeconomic activity of households and firms into a more macroeconomic measure of economic activity

4

New cards

Gross domestic product (GDP)

The market value of the final goods and services produced within a nation in a given period of time

5

New cards

Final goods

Goods that are ready for their final use by consumers and firms, for example, a new Harley-Davidson motorcycle

6

New cards

Intermediate goods

Goods that require further modification before they are ready for final use, e.g., steel used to produce the new Harley

7

New cards

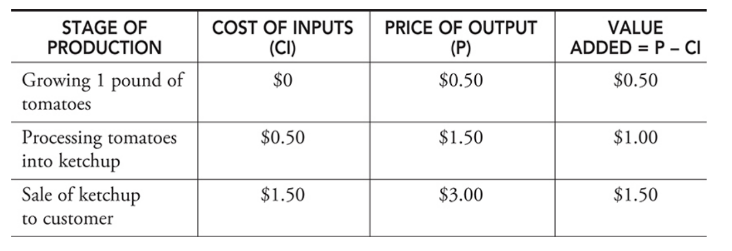

Double counting

The mistake of including the value of intermediate stages of production in GDP on top of the value of the final good

8

New cards

Secondhand sales

Final goods and services that are resold

9

New cards

Nonmarket transactions

Household work or do-it-yourself jobs are missed by GDP accounting

10

New cards

Underground economy

These include unreported illegal activity, bartering, or informal exchange of cash

11

New cards

Aggregate spending (GDP)

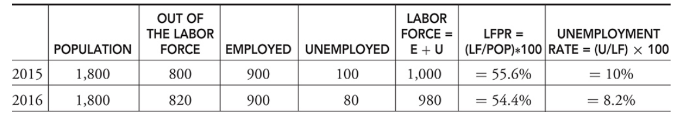

The sum of all spending from four sectors of the economy

12

New cards

GDP formula

GDP = C + I + G + (X – M).

13

New cards

Consumer spending (C)

Spending done by customers

14

New cards

Investment spending (I)

Investment is defined as current spending in order to increase output or productivity later

15

New cards

Three general types of investment included in GDP

* New capital machinery purchased by firms.

* New construction for firms or consumers.

* Market value of the change in unsold inventories.

* New construction for firms or consumers.

* Market value of the change in unsold inventories.

16

New cards

Government spending (G)

Purchases made by the govermnet for final goods and services and investments in infrastructure

17

New cards

Net exports (X-M)

X - exports

M - imports

M - imports

18

New cards

Aggregate income (AI)

The sum of all income earned by suppliers of resources in the economy

**Wages + Rents + Interest + Profit**

**Wages + Rents + Interest + Profit**

19

New cards

Value-added approach

A third approach to calculating GDP that considers all stages of production of a final good and the value that was added to the final good along the way

20

New cards

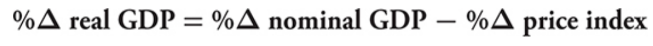

Nominal GDP

The value of current production at the current prices

21

New cards

Real GDP

The value of current production, but using prices from a fixed point in time

22

New cards

Deflating the nominal GDP or adjusting it for inflation

23

New cards

Base year

The year that serves as a reference point for constructing a price index and comparing real values over time

24

New cards

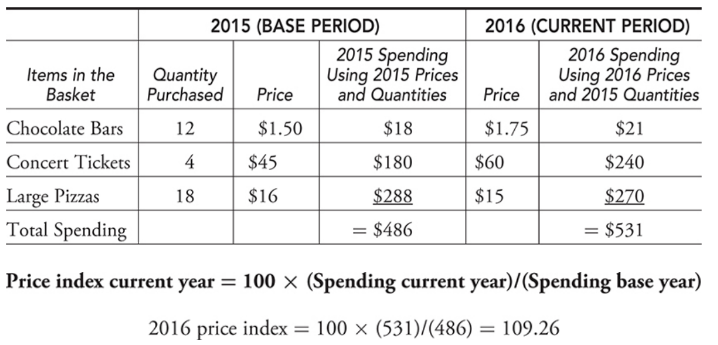

Price index

A measure of the average level of prices in a market basket for a given year, when compared to the prices in a reference (or base) year

25

New cards

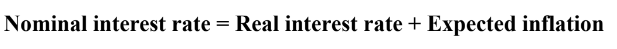

Real rate of interest

The percentage increase in purchasing power that a borrower pays a lender.

26

New cards

Calculating real GDP with percentages

27

New cards

GDP price deflator

The price index that measures the average price level of the goods and services that make up GDP

28

New cards

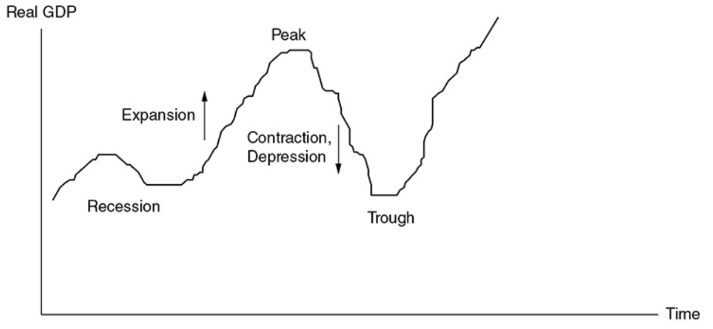

Business cycle

The periodic rise and fall in 4 phases present in economic activity

29

New cards

Expansion

A period where real GDP is growing

30

New cards

Peak

The top of a business cycle where an expansion has ended

31

New cards

Contraction

A period where real GDP is falling

32

New cards

Recession

Unofficially defined as two consecutive quarters of falling real GDP

33

New cards

Depression

A prolonged, deep contraction in the business cycle

34

New cards

Trough

The bottom of the cycle where a contraction has stopped

35

New cards

Consumer price index (CPI)

The price index that measures the average price level of the items in the base year market basket

36

New cards

Main measure of consumer inflation

Consumer price index (CPI)

37

New cards

Market basket

A collection of goods and services used to represent what is consumed in the economy

38

New cards

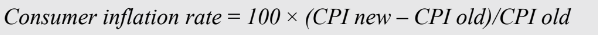

Inflation

The percentage change in the CPI from one period to the next

39

New cards

Annual rate of inflation on goods consumed by the typical consumer

The percentage change in the CPI from one year to the next

40

New cards

CPI

based on a market basket of goods bought by consumers, including products produced abroad

41

New cards

Measure of inflation of only consumer goods

CPI

42

New cards

GDP deflator

includes all items that make up domestic product

43

New cards

broader measure of inflation

GDP deflator

44

New cards

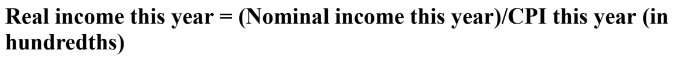

Nominal income

Todays income measured in todays dollars

45

New cards

Real income

Todays income measured in base year dollars

46

New cards

Expected Inflation

When inflation is predictable, people can plan accordingly. The bank adds an inflation factor on the real rate of interest to create a nominal rate of interest that savers receive and borrowers pay.

47

New cards

who does unexpected inflation hurt

Hurts employees if real wages are falling, as well as fixed-income recipients, savers, and lenders.

48

New cards

who does unexpected inflation help

Helps firms if real wages are falling, as well as borrowers. It might also increase the value of some assets like real estate or other properties.

49

New cards

Difficulties with CPI

* Consumer substitute

* Goods evolve

* Quality differences

* Goods evolve

* Quality differences

50

New cards

Consumer substitute

As the price of goods begins to rise, we know that consumers seek substitutes

51

New cards

Goods evolve

The emergence of new products (smartphones) and extinction of others (manual typewriters) is understood by firms and consumers, but the market basket must reflect this or it risks becoming irrelevant

52

New cards

Quality differences

Some price increases are the result of improvements in quality

53

New cards

Employed

A person is employed if they have worked for pay at least one hour per week

54

New cards

Unemployed

A person is unemployed if they are not currently working but are actively seeking work

55

New cards

Labor force

The sum of all individuals 16 years and older who are either currently employed (E) or unemployed (U)

\

* **LF = E + U.**

\

* **LF = E + U.**

56

New cards

Out of the labor force

A person is classified as out of the labor force if they have chosen to not seek employment

57

New cards

Labor force participation

The ratio of the size of the labor force to the size of the population 16 years and older

\

* **LFPR = (LF/Pop)*100.**

\

* **LFPR = (LF/Pop)*100.**

58

New cards

Unemployment rate

The percentage of the labor force that falls into the unemployed category

\

* **UR = 100 × U/LF.**

\

* **UR = 100 × U/LF.**

59

New cards

Discouraged workers

Citizens who have been without work for so long that they become tired of looking for work and drop out of the labor force

60

New cards

Frictional unemployment

A type of unemployment that occurs when someone new enters the labor market or switches jobs

61

New cards

Seasonal unemployment

A type of unemployment that is periodic, is predictable, and follows the calendar

62

New cards

Structural unemployment

A type of unemployment that is the result of fundamental, underlying changes in the economy such that some job skills are no longer in demand

63

New cards

Cyclical unemployment

A type of unemployment that rises and falls with the business cycle

64

New cards

Full employment

Exists when the economy is experiencing no cyclical unemployment

65

New cards

Natural rate of unemployment

The unemployment rate associated with full employment, somewhere between 4 to 6 percent in the United States