Exchange Rates Multiple Choice

1/67

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

What is the formal representation of the law of one price, if P is domestic price for good X, P* is foreign price for the same good, and E is the exchange rate (units of domestic currency per units of foreign currency)?

P= E$/E x P*

What does PPP imply?

The real exchange rate is equal to 1.

Suppose Russia's inflation rate is 100% over one year but the inflation rate in Switzerland is only 55%. According to relative PPP, over the year the Swiss franc's exchange rate against the Russian ruble (ESFr/R) should

fall by 95%

Large-scale wars typically bring a suspension of international trading and financial activities. Exchange rates lose much of their relevance under these conditions, but once the war is over governments wishing to fix exchange rates face the problem of deciding what the new rates should be. The PPP theory has often been applied to this problem of postwar exchange rate realignment.

If you were the British Chancellor of the Exchequer and World War I had just ended, a good first approximation to identifying the appropriate post-war dollar/pound exchange rate might be obtained by

adjusting the pre-war rate according to the price level changes experienced by the two countries during the war.

If, during the war, the U.S. price level increased by 20% while the U.K. level rose by 8% a best-guess post-war dollar/pound exchange rate would be, compared to the pre-war rate

12% higher

Using the PPP theory in this manner may be a bad idea if

all of the above are reasons why reliance upon PPP theory may be less than satisfactory.

Which of the following correctly represents the formula for absolute PPP? Remember that P stands for the price level and E stands for the level of the exchange rate.

PUS = E$/E x PE

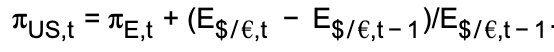

Which of the following correctly represents the formula for relative PPP?

Which of the following theoretical constructions is most likely to be observed in practice?

Relative PPP

Which of the following is a correct prediction based on the PPP model of the exchange rates?

An increase in the U.S. interest rates leads to depreciation of the dollar.

The monetary approach to the exchange rate predicts that the dollar will depreciate in the long run if, ceteris paribus,

US interest rate rises or European Interest rate falls.

Based on purchasing power parity (PPP), which of the following, all else being equal, could lead to a long-run real appreciation of the U.S. dollar?

A rise in the growth rate of the U.S. GDP.

If the prices of identical commodity baskets, after conversion to a single currency, differ marginally across countries, it can be concluded that

absolute PPP holds up quite well.

Which of the following is most plausible as an explanation for relative PPP holding better in the long run than in the short run?

in the short run exchange rate fluctuations may be seen as temporary by trading firms.

prices tend to be less sticky in the long run, thus lessening any deviation from PPP.

it takes time for international trading firms to acquire and/or expand their "presence" in higher price markets.

=> All of the above are plausible.

The Economist magazine has observed that the price of Big Macs is systematically positively related to a country's income level, just as is the general price level.

The figure on the right depicts the relationship between Big Mac dollar prices (from The Economist magazine) and GNI (Gross National Income) per capita for 54 countries (from the World Bank), with each dot representing a different country.

Part 2

According to this graph, the relationship between Big Mac prices and per capita income might be described as

loosely positive.

Which of the following is NOT a valid explanation for the failure of the data to support PPP theory?

Differences in monetary policies across countries.

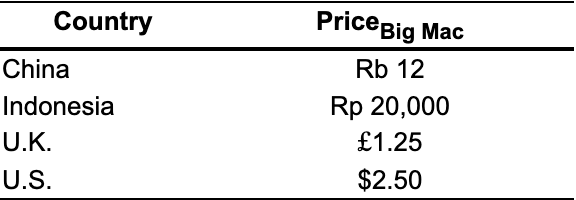

The Economist magazine is famous for its publication of the Big Mac index -- a table of Big Mac prices in different countries around the world. The use of the Big Mac allows for a highly standardized product sold throughout the world.

Part 2

Given the following abbreviated table:

The current (strongly managed / fixed) exchange rate between the U.S. and China is Rb 7.85 = $1.00. If the Chinese monetary authorities allow their currency (the Rembini / Yuan) to float, would you expect the dollar to appreciate or depreciate relative to the Yuan?

Depreciate.

It is often asserted that exporters prosper when their home currencies depreciate in real terms against foreign currencies. This exporter "experience" stems from the fact that, ceteris paribus,

the price of home goods relative to foreign goods falls when the home currency depreciates.

Letting E$/E and q$/E denote, respectively, the nominal and real exchange rates between the U.S. dollar and the U.K. pound, which of the following accurately describes how these rates change when a permanent increase occurs in the U.S. real money demand function?

E$/E decreases and qS/E is unaffected

Chapter 6 addressed the effect of transfers between countries, such as the indemnity imposed on Germany after World War I.

Suppose a transfer occurs involving Poland and the Czech Republic. The equation given below shows the determination of the long-run nominal zloty/koruna exchange rate,

font size increased by 1 Upper E Subscript z divided by kEz/k,

as a function of the real zloty/koruna exchange rate,

q Subscript z divided by kqz/k,

and the nations' long-run price levels.

(Note: the zloty (z) is the currency of Poland (P) and the koruna (k) is the currency of the Czech Republic (C).

Upper P Subscript Upper PPP

and

Upper P Subscript Upper CPC

are, respectively, the price levels in Poland and the Czech Republic.)

font size increased by 1 Upper E Subscript z divided by k Baseline equals q Subscript z divided by k Baseline times left parenthesis Upper P Subscript Upper P Baseline divided by Upper P Subscript Upper C Baseline right parenthesisEz/k=qz/k×PP/PC

Part 2

If a permanent transfer from

PolandPoland

to

the Czech Republicthe Czech Republic

occurs, the nominal zloty/koruna exchange rate,

font size increased by 1 Upper E Subscript z divided by kEz/k

will

appreciate since the transfer will appreciate qz/k.

Suppose Foreign (F) imposes a tariff on imports from Home (H). All else equal, this action will cause the long-run real Home/Foreign exchange rate to ______ and the long-run nominal Home/Foreign exchange rate to ______.

increase; increase

Imagine that two identical countries have restricted imports to identical levels, but one has done so using tariffs and the other has done so using quotas. After these policies are in place, both countries experience identical, balanced expansions of domestic spending. This demand expansion will cause a larger real currency appreciation in

the tariff-using country.

Which of the following would cause a country's nominal interest rate to rise and its currency to appreciate simultaneously, in a world of perfectly flexible prices?

a temporary increase in world relative demand for the country’s output.

Suppose that residents of the U.S. consume relatively more of U.S. export goods than do residents of foreign countries. In other words, U.S. export goods have a higher weight in the U.S. CPI than they do in other countries. Conversely, foreign exports have a lower weight in the U.S. CPI than they do abroad.

What would be the effect on the dollar's real exchange rate of a fall in the U.S. terms of trade (the relative price of U.S. exports in terms of U.S. imports)?

A real depreciation of the dollar occurs.

Suppose a permanent decrease occurs in the expected rate of real appreciation of the dollar against the euro. All else equal, how would the nominal dollar/euro exchange rate be affected?

It too would be expected to appreciate at a slower pace.

Interest rate differences between countries depend exclusively upon differences in expected inflation only when

relative PPP holds.

In the real world where relative PPP fails to hold, suppose that U.S. inflation is expected to exceed European inflation

left parenthesis pi Subscript font size decreased by 1 US Superscript e Baseline minus pi Subscript Upper E Superscript e Baseline right parenthesis(πeUS−πeE) by 4

percent for the foreseeable future. Furthermore, suppose that output demand and supply trends are widely expected to cause the dollar to decline against the euro in real terms at a rate of 2 percent per year. In this case, the international interest rate spread left parenthesis Upper R Subscript $ Baseline minus Upper R Subscript euro Baseline right parenthesis R$−R€ will actually be

6 percent

If the expected real interest rate in the United States is 2 percent per year while that in Europe is 7 percent per year, it can be anticipated that over the next year the real dollar/euro exchange rate will

decrease, resulting in a real appreciation of the dollar against the euro.

Expected real interest rates in all countries will be identical only when

relative PPP is expected to hold.

real exchange rates are not expected to change.

=> A and C but not B

Suppose that output demand and supply trends induce people to expect Home's currency to appreciate in real terms against the currency of Foreign, its key trading partner. This implies that the expected real interest rate should be

higher in Foreign

The current account will increase if

the real exchange rate depreciates or disposable income goes down

the volume effect is

the effect of a change in the real exchange rate on imports and exports.

the value effect is

the effect of a change in real exchange rate on the value of foreign imports in terms of domestic output.

An increase in the real exchange rate (real depreciation of domestic currency) will result in

an increase in net exports.

An increase in disposable income worsens the current account because

consumers demand more of all goods, including imported goods while exports are not affected.

Which of the following changes does NOT shift the DD schedule in the short run?

An increase in the exchange rate E$/E

Which of the following changes does NOT shift the AA schedule in the short run?

An increase in the exchange rate E$/E

As you move down the AA curve, the interest rate

rises

If a government initially has a balanced budget but then cuts taxes, it is running a deficit that it must somehow finance. Suppose people think the government will finance its deficit by printing the extra money it now needs to cover its expenditures. In this case, the tax cut will

have an ambiguous effect on the exchange rate

A temporary decrease in an economy's money supply produces

no change in the long run expected exchange rate, an appreciation of its currency, and a fall in its output and employment.

A temporary fiscal expansion in an economy produces

no change in the long-run expected exchange rate, an appreciation of its currency, and a rise in its output and employment.

Now let the government use temporary monetary contraction to restore full employment. In this case the policy re-establishes full employment

and restores the currency to its initial value

Because the rise in private aggregate demand is permanent, it will be the case that

output ultimately does not change and no government response is warranted.

If an economy does not start out at full employment, is it still true that a permanent change in fiscal policy has no current effect on output?

No, there is no reason for output to remain constant in this case since its initial value is not equal to its long-run level.

A permanent increase in the money supply (beginning from full employment) will lead to

an increased price level (P).

If a country begins from full employment, a permanent increase in government spending will

cause E$/E to fall.

If the money supply falls permanently and we began at full employment, which will NOT happen?

GDP stays constant in the short run and long run (due to monetary neutrality).

Which statement is NOT true?

No permanent shock moves both AA and DD at the same time; they are separate.

A temporary increase in government spending causes the current account to fall

by a smaller amount than does a permanent increase in government spending because the

latter induces a decrease in the expected future exchange rate.

latter induces an appreciation of the currency's expected future value.

former has no effect on expectations on future exchange rates.

=> All of the above.

If the economy's output is initially above full employment, which of the following policy combinations could restore full employment and keep the exchange rate at the same level?

Contractionary monetary and fiscal policy.

Which of the following temporary policies increases the current account and increases GDP (starting from full employment)?

Monetary Expansion.

XX is flatter than DD because

as GDP increases along DD, domestic demand increases less than supply, so some must be exported.

A temporary fiscal expansion (with full employment) will

increase GDP

Domestic assets

take the form of domestic government bonds and loans to domestic pr

If central banks are not sterilizing and the home country has a balance of payments surplus, any associated

increase in the home central bank’s foreign assets implies and increase

If the central bank purchases assets, it will result in

an increase in the money supply.

A sterilized foreign exchange intervention

always leaves the money supply unchanged.

If the central bank's foreign assets fall, central bank

liabilities can rise or fall depending on the change in central bank domestic assets.

When the central bank buys foreign assets (and makes no other changes),

domestic money supply increases because central bank liabilities rise as well.

To fix an asset price, one needs

money and a supply of the asset

What is the interest parity condition under a fixed exchange rate regime?

R = R*

If there is a decline in output, to keep the exchange rate fixed, the central bank has to

sell foreign assets

How does fiscal contraction affect the current account under a fixed exchange rate?

Current account improves as a result of a fiscal contraction.

Suppose the economy is hit by an adverse aggregate demand shock. In response to this shock, the central bank reacts to maintain a fixed exchange rate. As a result of these changes,

both AA and DD will shift.

What is the effect of an increase in the money supply under fixed exchange rates and perfect asset substitutability in the short run?

None of the above.

What is the effect of an increase in taxes under fixed exchange rates and perfect asset substitutability in the short run?

A decline in output and no change in interest rates.

What is the effect of a currency devaluation under fixed exchange rates in the short run?

An increase in exports.

We will analyze the effect of expansionary monetary policy, which corresponds to an increase in the money supply, under fixed exchange rates.

As a result of this change,

neither AA and DD will shift