ECW1

1/179

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

180 Terms

Economics

The science of human cooperation, focusing on how people and institutions make decisions about the production and consumption of goods and services.

Human cooperation

The way people and institutions make decisions about producing and consuming goods and services and how they face the problem of scarcity.

→ essentially a study of the ways in which humankind provides for its well-being

What is a good model ?

Clear

Predicts accurately

Improves communication (help understand what we agree and disagree about)

Useful → Can be used to improve the economy

GDP (Gross Domestic Product)

A measure of the market value of the output of final goods and services in the economy in a given period, usually expressed in per-capita terms.

Disposable income

Total income - taxes + Government transfers

Industrial Revolution

A wave of technological advances starting in Britain in the 18th century, which transformed an agrarian and craft-based economy into a commercial and industrial economy.

→ gave rise to unprecedented improvements in productivity

Environmental consequences

Global impacts – climate change

Local impacts – pollution in cities, deforestation

Conditions to Malthus’ Law

Diminishing average product of labor

Rising population in response to increases in wages

An absence of improvements in productivity to offset the diminishing average product of labor

Capitalism

An economic system in which private owners of capital hire labor to produce goods for sale on markets with the intent of making a profit.

Firms

One or more individuals own a set of capital goods that are used in production

They pay wages and salaries to employees

They direct the employees (through the managers they also employ) in the production of goods and services

The goods and services are the property of the owners

The owners sell them on markets with the intention of making a profit

Forms of economic organization that coexist with firms in capitalistic systems

Family or individual production (they do not hire others)

Nonprofit organizations (they do not seek to make profit or sell their output on a market)

Cooperatives (labour is not hired, work is done by members)

Government bodies (they do not seek profit; capital goods are not privately owned)

Private Property

The right of individuals to exclude others from using or benefiting from something they own.

Capital goods

The durable and costly non-labour inputs used in production (machinery, buildings) not including some essential inputs, (e.g. air, water, knowledge that are used in production at zero cost to the user.)

Markets

A way that people exchange goods and services by means of directly reciprocated transfers (unlike gifts), voluntarily entered into for mutual benefit (unlike theft, taxation), that is often impersonal (unlike transfers among friends, family).

Why did capitalism led to growth ?

impact on technology: firms competing in markets had strong incentives to adopt and develop new technologies

specialization

Specialization

The process by which individuals focus on a limited range of tasks or production activities to increase efficiency and productivity.

Gains from specialization

• learning by doing

• taking advantage of natural differences in skill and talent

• economies of scale

=> People can only specialize if they have a way to acquire the other. goods they need. In a capitalist society, this is done via markets.

Malthusian Trap

A situation where increases in population outpace increases in resources, leading to subsistence-level living conditions.

Capitalism and democracy

Most countries: Capitalism coexist with democracy

Rule of law - all individuals bounded by the same laws

Civil liberties - Rights of free speech, assembly, press

Inclusive, fair and decisive elections

BUT: capitalism can co-exist with non-democratic systems

Flat World

A term referring to a state of global economic disparity where many regions do not experience growth in standards of living.

Diminishing Average Product of Labour

The principle that as more labor is added to a fixed amount of capital, the additional output from each new worker will eventually decline.

Scarcity

The fundamental economic problem of having seemingly infinite human wants in a world of limited resources.

Market Economy

An economic system based on supply and demand with little or no government control.

Comparative Statics

A method used in economics to compare two different economic outcomes, typically before and after a change in some parameter.

Behavioral Economics

A field of economics that examines the effects of psychological factors on the economic decisions of individuals and institutions.

Economic Systems

The means by which countries and governments distribute resources and trade goods and services.

Coreecon

A term relating to the core concepts of economics outlined in the educational materials or resources used in this course.

Human Progress

The advancement of human society through improvements in living standards, health, and technology over time.

Opportunity Cost

The loss of potential gain from other alternatives when one alternative is chosen = Net benefit of the next best alternative action

→ Homo-economicus: Compare actions to economic costs

Economics

The study of how society manages its scarce resources.

Growth

Not distributive → The elephant curve

Production functions

How inputs (e.g. labour) translate into outputs (e.g. goods and services), holding other factors constant(e.g. production environment)

Marginal Product

Change in output per unit change in input (evaluated at a given point, holding other inputs constant)

Average product

Average output per unit of input

Reservation option

Next best alternative

Economic cost

Direct costs incurred by taking an action + opportunity cost

Economic Rent

Net benefit from option taken – opportunity cost

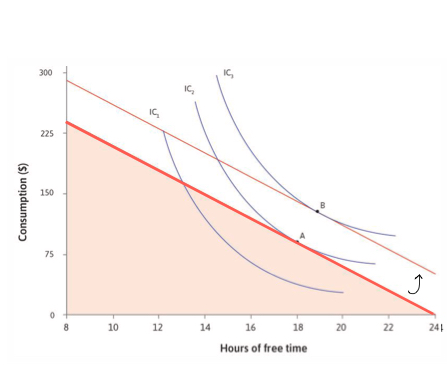

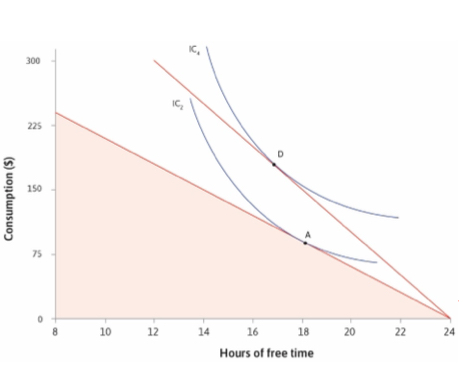

Assumptions of Model of constraint choices

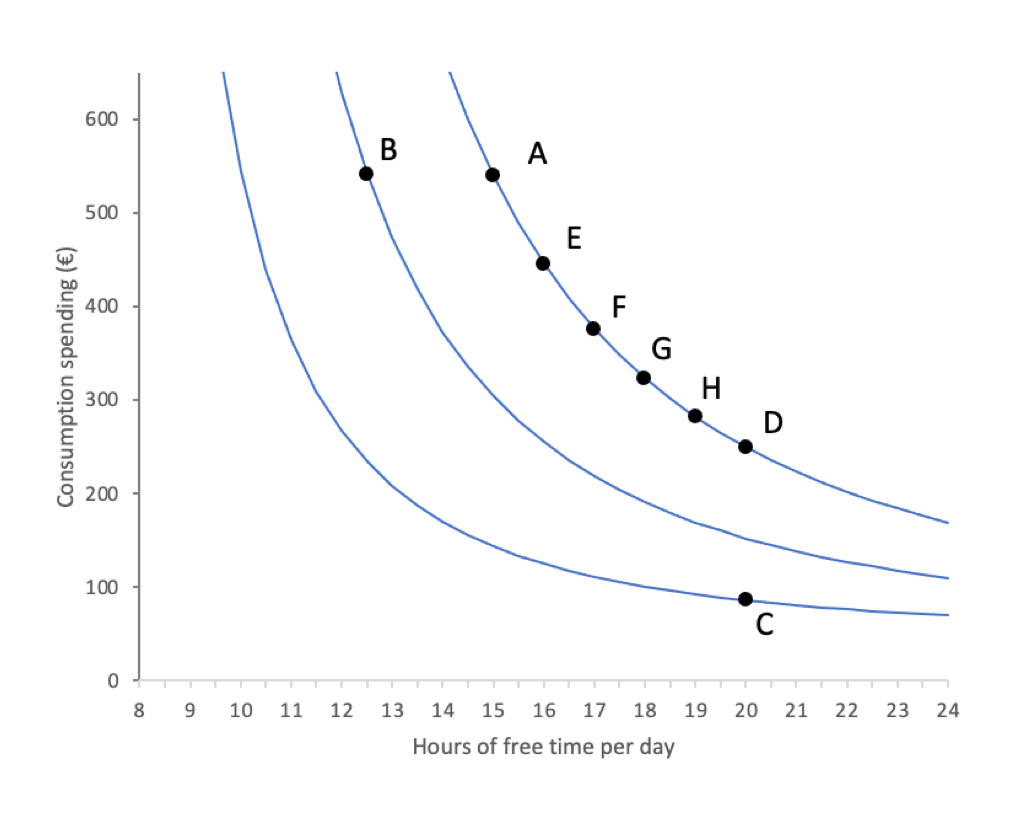

Individuals want to consume as much as possible

They want as much free time as possible

+ No saving or borrowing

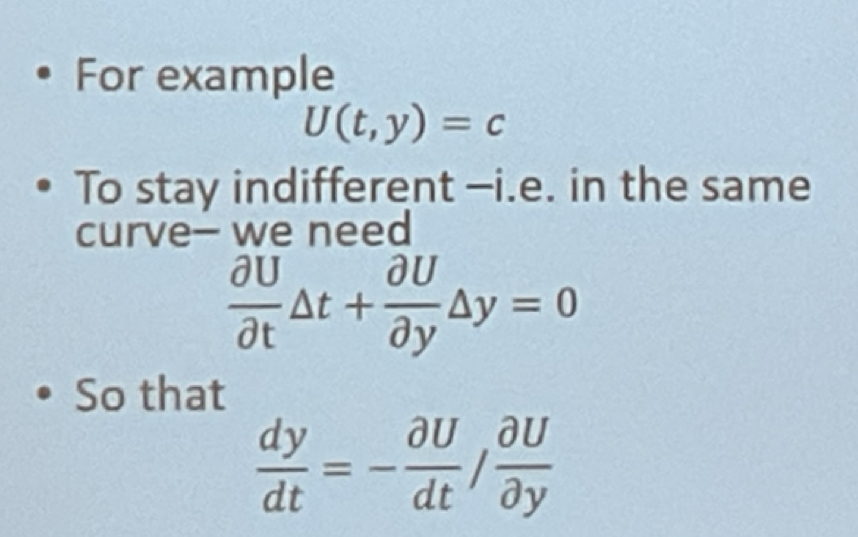

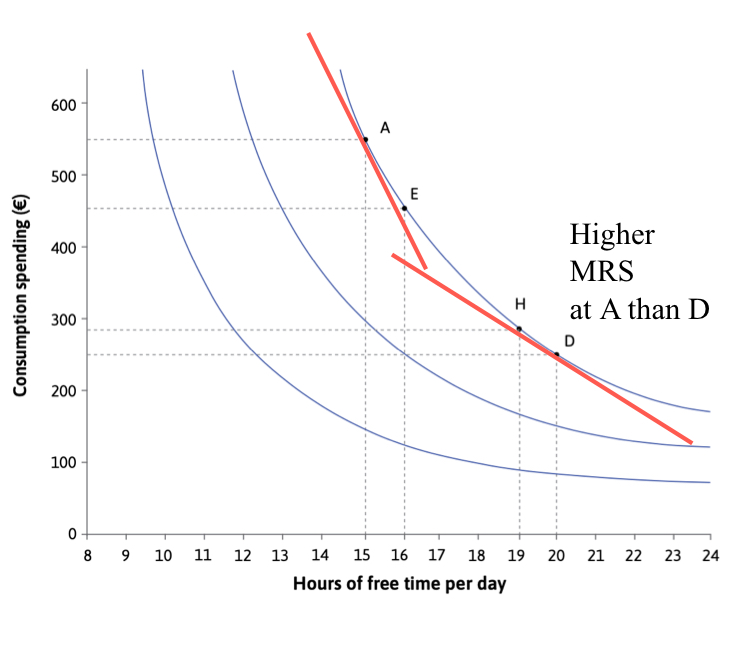

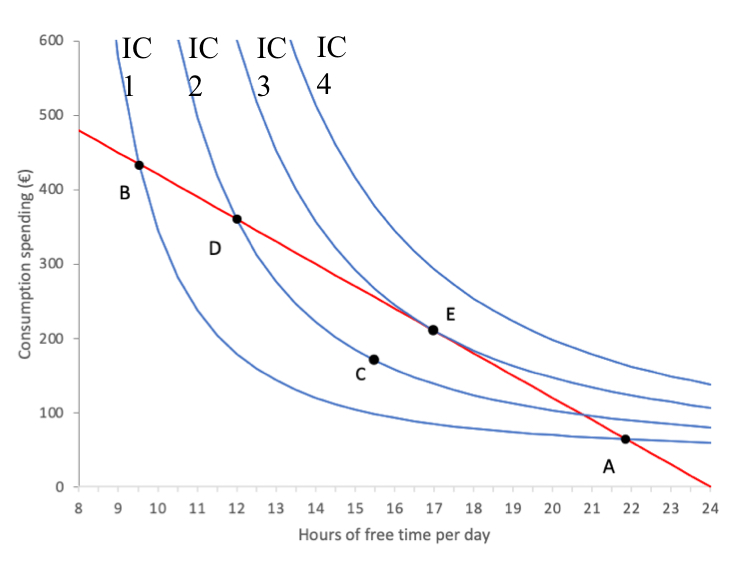

Indifference curve

All the combination of goods that give the same utility (=satisfaction)

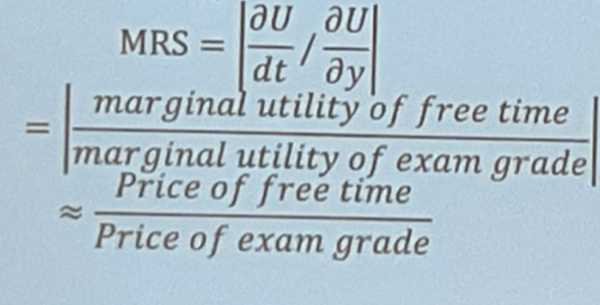

Marginal rate of substitution

Measure of the trade-off someone is willing to make (eg. between consumption and free-time)

Feasible frontier

Maximum output that can be achieved with a given amount of input

Formula for maximum level of consumption

C = w(24-t)

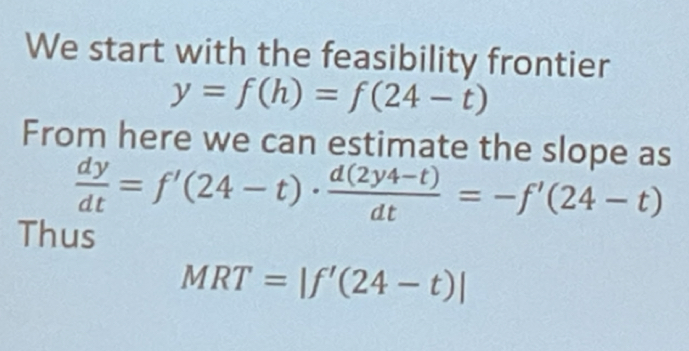

Marginal rate of transformation

Slope of the feasible frontier. Represent the rate at which (for eg.) free time can be transformed into consumption.

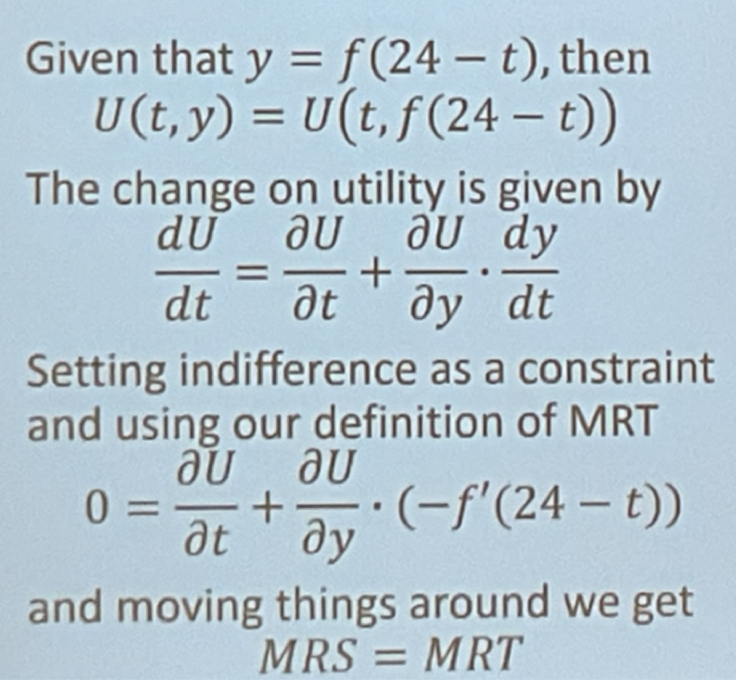

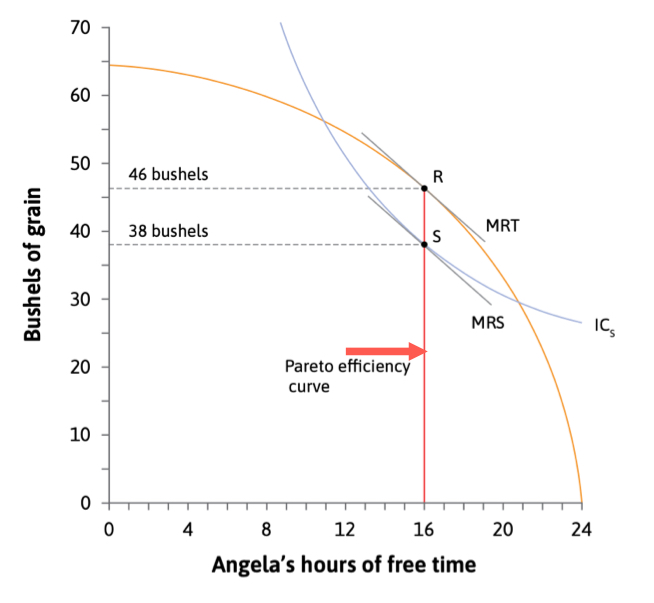

Constrained choices → Utility maximizing choice

MRS = MRT

The amount of one good the individual is willing to trade off for the other good (MRS) equals the actual tradeoff between the two goods (MRT).

Budget constraints

Feasible frontiers for consumption choices

Income effect

Your total earnings increase, holding working hours fixed

Substitution effect

The change in optimal choice when the opportunity cost changes, at the new level of utility

Overall effect on labor choice

Income effect + Substitution effect

Technological progress

Makes it feasible to both consume more and have more free time.

Veblen effect or conspicuous consumption

The more rich people consume, the longer other people will work, so as to try to copy (as best they the can) the standards of the rich.

→ We would expect people to work longer hours in countries in which the rich are especially rich, and people to work less where the rich are only modestly richer than the rest.

Explanations to differences un working hours across countries

Social preferences

Differences in culture

In politics

Social dilemma

A situation in which actions taken independently by self-interested individuals result in a socially suboptimal outcome.

E.g.: traffic jams, climate change

Best response

Strategy that yields the highest payoff, given the other player’s strategy

Dominant strategy

A best response to all possible strategies of the other player (does not always exist!)

Dominant-strategy equilibrium

An outcome of a game in which everyone plays their dominant strategy

Nash equilibrium

All players simultaneously choose a best response + None of the players can improve by deviating unilaterally

• Interpretation 1: the result of players’ independent optimization in the light of others’ presumed rationality

• Interpretation 2: self-enforcing agreements players can reach

Allocation

Outcome of an economic interaction

Way to reach the best equilibrium

Communication between players

BUT If there is more than one Nash equilibrium, the Pareto optimal outcome may not be selected.

→ Society could be ‘stuck’ in a suboptimal outcome since there is no incentive to unilaterally change one’s action.

Aesop’s social dilemma

Mice’s wanting to bell the cat

Prisoners’ Dilemma

Dominant strategy equilibrium, in which playing the dominant strategy yields lower individual and total payoffs compared to other strategies.

Tragedy of the Commons

In 1968, biologist Garrett Hardin coined ‘the tragedy of the commons’

→ A common = common property = common-pool resource = a resource not owned by anyone

• The earth’s atmosphere

• Fish stocks

=> Risk of overexploitation

When is the Pareto optimal outcome achieved in a social dilemma ?

Players only care about their own payoffs

• Solutions: commitment, social preferences

• Nobody can make players pay for the effects of their actions on others

→ Solution: repeated interaction

Altruism

Social dilemmas → when players only care about their own payoffs.

BUT In experiments, many players show altruism by choosing the dominated strategy.

→ Altruistic preferences affect the shape of indifference curves

Inequality aversion

Disliking outcomes in which some individuals receive more than others

Reciprocity

Disliking outcomes in which some individuals receive more than others

Ultimatum Game

Sequential game wherE players choose how to divide up economic rents (cash, chocolates)

→ The proposer’s offer may be motivated by altruism, inequality aversion, social norms, or reciprocity.

Effect of introducing competition ?

Moves outcomes closer to the self-interested outcome → ‘The name of the Game’

Consequences of Repeated games

Social dilemmas can sometime be resolved in repeated interactions due to peer punishment.

→ Behaving selfishly in one period has consequences in future periods, so it may no longer be a dominant strategy.

Name of the Game Liberman

Key Empirical Findings:

Situational Framing Over Individual Reputation:

Participants were significantly more likely to cooperate when the game was called the "Community Game" rather than the "Wall Street Game."

This effect was observed in both American college students and Israeli Air Force trainees.

Reputation-based predictions by peers and instructors failed to predict whether individuals would cooperate or defect.

Behavioral Shift Due to Labels:

The label affected not only first-round decisions but also shaped the cooperation rates over multiple rounds.

In the Community Game, mutual cooperation was significantly higher.

In the Wall Street Game, defection dominated, even among those predicted to be cooperative.

Laypeople’s Incorrect Predictions:

Individuals expected stable cooperation or defection based on personality, but actual behavior was shaped largely by the game's name.

Even when asked to reassess predictions with different labels, forecasters underestimated the impact of framing.

Relation to Classical Economic Theory:

Rational Choice & Self-Interest:

Classical economics assumes that individuals act based on self-interest, choosing strategies that maximize personal gain.

The study contradicts this by showing that simple labeling effects can override stable, rational preferences.

Stable Preferences vs. Context-Dependent Behavior:

Classical economic models assume individuals have stable preferences.

The results indicate that behavior is highly context-dependent, aligning more with behavioral economics and psychology.

Game Theory Predictions:

Standard game theory would predict defection as the dominant strategy in a Prisoner's Dilemma.

However, cooperation rates varied significantly based on labels, suggesting that norms and social expectations influence strategic decision-making.

Nash equilibrium.

Each player's strategy is the best response to the strategies of others.

Who and what are the “Rules of the Game”

Institutions. They provide the constraints (what we can’t do) and the incentives (what you’ll get if you do something).

Power

Ability to do and get the things we want in opposition of the intentions of others.

Structural power

A person’s structural power is the value of their next best alternative. A person’s structural power is limited by the structural power of the other. Eg: Applying for a job while knowing you can get a better salary somewhere else

Bargaining power

A person exercising bargaining power may set the terms of an exchange and/or impose, or threaten to impose, heavy costs. Eg: Being good at convincing

Pareto criterion

An allocation A is better than allocation B if at least one party would be strictly better off with A than B, and nobody would be worse off. (‘better off’ means that they prefer it, not necessarily that they get more money)

Pareto efficiency

An allocation is Pareto efficient if there is no feasible alternative allocation in which at least one person would be better off, and nobody worse off.

Why could allocations be called unfair ?

How unequal the allocations are: In terms of income, for example, or subjective wellbeing. These are called substantive judgements of fairness (e.g. inequality, inequity).

How the allocations came about: For example, by force, or by competition on a level playing field. These are called procedural judgements of fairness.

Ways of evaluating institutions, legitimacy of voluntary exchange

Were the actions resulting in the allocation the result of freely chosen actions by the individuals involved? Or was fraud or force involved?

Ways of evaluating institutions, equal opportunity

Did people have an equal opportunity to acquire a large share of the total to be divided up? Or were they subjected to some kind of discrimination or other disadvantage because of their race, sexual orientation,gender, or who their parents were?

Ways of evaluating institutions, deservingness

Did the rules of the game that determined the allocation take account of the extent to which an individual worked hard, or otherwise upheld social norms?

John Rawl’s three steps for deciding wether an allocation is fair

Justice is impartial, fairness applies to everyone

Imagine a veil of ignorance

From behind the veil of ignorance, we can make a judgment

2 evaluation of the impact of an economic policy

Is this allocation efficient ?

Is the allocation fair ?

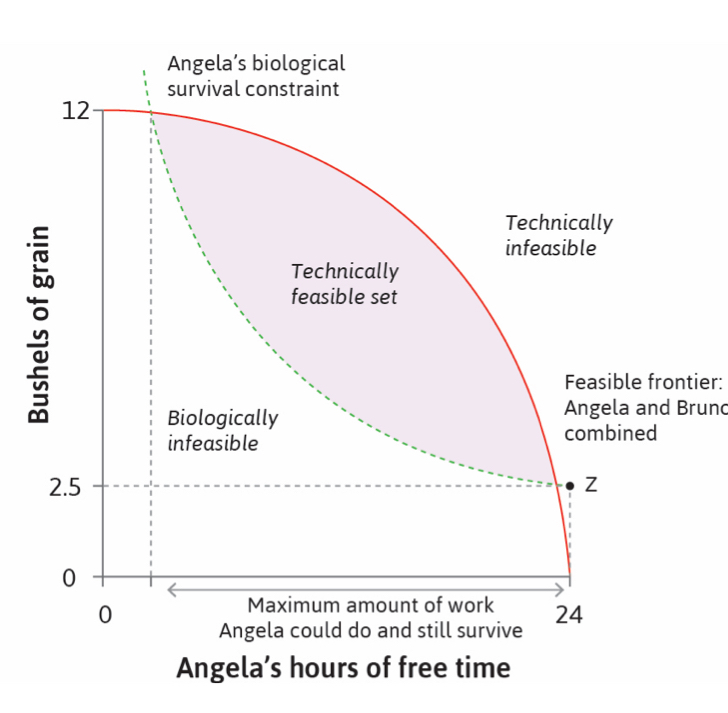

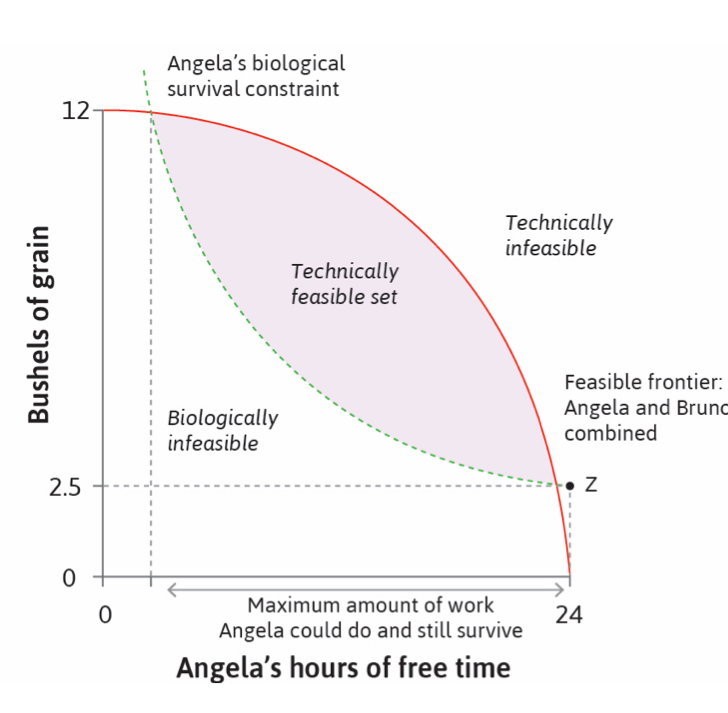

Feasible frontier

All the technically feasible outcomes (limited by technology)

Biological survival constraint

All the biologically feasible outcomes (limited by survival)

What happens under coercion

The allocation chosen is where the slope of the biological constraint equals the slope of the feasible frontier

What happens without coercion ?

Joint surplus is maximized where the slope of the reservation indifference curve equals that of the feasible frontier

2 properties of a Pareto efficient allocation

The MRT on the feasible frontier is equal to the MRS on Angela’s indifference curve

No xxx is wasted

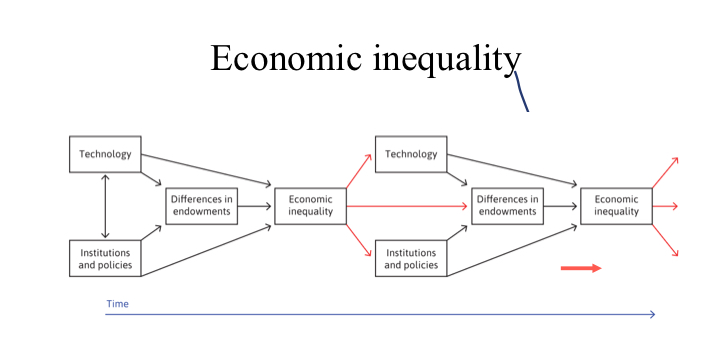

Endowments

Things that allow people to receive income: financial wealth, assets they own, intellectual property, knowledge/skills, race/gender/age, citizenship they have

Economic inequality

Gini coefficient for incomes

One-half times the average difference in income divided by the average income

Lorenz curve

Graphic representation of inequality of some quantity (wealth, income)

→ The extent to which the curve falls below this perfect equality line = measure of inequality

Market vs disposable income

Disposable income= Market income (from wages, salaries, self-employment, business, investment) - direct taxes + cash transfers

Weakest Link Game (paper)

Empirical Findings from the Study

1. Coordination failure was common

- Classical economic theory predicts that rational players should converge toward the Pareto-optimal equilibrium (where everyone chooses the highest number, 7).

- However, in practice, participants frequently failed to reach the best equilibrium, instead settling at lower, inefficient choices.

2. Path dependence in coordination

- Players' initial choices significantly influenced long-term outcomes.

- Classical theory assumes rational agents will always optimize, but the experiments showed history and expectations shaped decision-making, causing players to get "stuck" in inefficient equilibria.

3. Larger groups performed worse

- Standard economic models suggest that larger groups should not necessarily reduce efficiency if players act rationally.

- However, empirical results showed that as group size increased, efficiency declined because the probability of a low-action choice increased.

- This contradicts classical predictions that more participants should lead to greater overall knowledge and efficiency.

4. Public information improved expectations but did not prevent decline

- Classical theory would predict that revealing others' past decisions should help coordination.

- While public information led some players to attempt higher choices, it was not enough to prevent the lowest-number players from dragging the group down.

5. Aggregation of groups reduced efficiency

- Classical economics assumes that combining two well-functioning groups should maintain or improve performance.

- However, when two groups merged, the new group almost always ended up at the lower equilibrium.

- This suggests behavioral inertia and risk aversion played a larger role than rational optimization.

Relation to Theoretical Predictions from Classical Economics

- Deviation from Nash Equilibrium: Classical game theory suggests that rational players should settle on the highest equilibrium, but experimental results showed persistent failures due to risk aversion and expectation mismatches.

- Social Complexity and Bounded Rationality: Unlike the assumption of perfect rationality in classical models, the findings suggest players rely on heuristics and past experiences, leading to inefficient outcomes.

- Group Dynamics and Coordination Costs: The negative impact of group size contradicts classical predictions that more agents should lead to improved efficiency through information sharing.

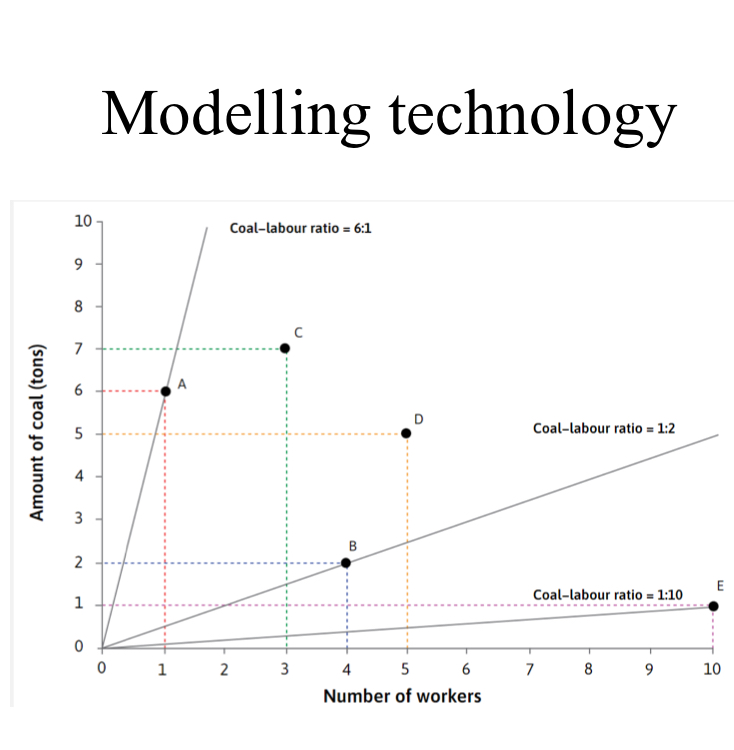

Absolute advantage

The ability to produce a good or service more efficiently than another entity, using the same or fewer resources.

Comparative advantage

The ability to produce a good or service at a lower opportunity cost than another entity. Even if one country has an absolute advantage in producing multiple goods, it should specialize in the one where it has the greatest comparative advantage (i.e., the lowest opportunity cost) and trade for the other goods.

Technology

A process that uses inputs to produce an output

Cost (formula)

= (wage x workers) + (price of a tonne of coal x numbers of tonnes)

= (w x L) + (p x R)

Isocosts lines

Combinations of inputs that give the same cost (slope=relative price of inputs)

Slope of isocost lines = relative price of labor

- w/p

(w = wage/ p = price)

Law of diminishing average product of Labour

If we hold one input (land) fixed, and expand the other input (labour),the average output per worker is going to fall.