chapter 3-5 board

1/52

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

What is the Board of Directors and what do they do?

Shareholder-elected group that oversees management. Duties: hire/fire CEO, set pay, approve strategy, oversee risk/controls, ensure shareholder interests are protected.

What was directorship like in the past?

In 1962, directorships were seen as easy, low-effort perks (“hot bath” jobs: attend a meeting, agree twice, get paid). → Shows how boards used to lack accountability.

Why do boards matter today?

Boards provide visible, values-driven leadership through integrity, communication, and high expectations. Their role influences employees, shareholders, and stakeholders.

What is the role of the board of directors in governance?

Centerpiece of corporate governance.

Elected by shareholders to represent them.

Fiduciary duty = act in corporation’s best interests (honest + competent).

Main job: monitor & guide executives, help solve principal–agent problem.

What are the 2 models of corporate governance?

Shareholder model: Business exists to increase profits (Friedman).

Stakeholder model: Firm serves broader group (employees, customers, suppliers, community, regulators, media).

What does the shareholder model emphasize?

Courts interpret “interest of corporation” as shareholder interest. Boards can consider others only if shareholders aren’t harmed. → U.S. governance is shareholder-centric.

What does the stakeholder model emphasize?

Maximizing value for shareholders and stakeholders (employees, creditors, suppliers, customers, regulators, media).

The company owes a responsibility to a broader group of stakeholders other than just shareholders.

The board has broader responsibilities and should focus on protecting key stakeholders

Shareholders

Employees

Vendors

Customers

Society as a whole

What does CBCA (Canada Business Corporations Act) say about directors’ duty?

Directors must act in the best interest of the corporation as a whole — not just shareholders.

What are the main functions of a board of directors?

Monitor

Monitor & control management.

Hire/fire the CEO.

Approve strategy, major decisions, pay.

Make sure the firm’s activities and financial condition are accurately reported to its stakeholders

Advise

Advise and provide resources.

Strategic advice

• New product

• New markets and geographies

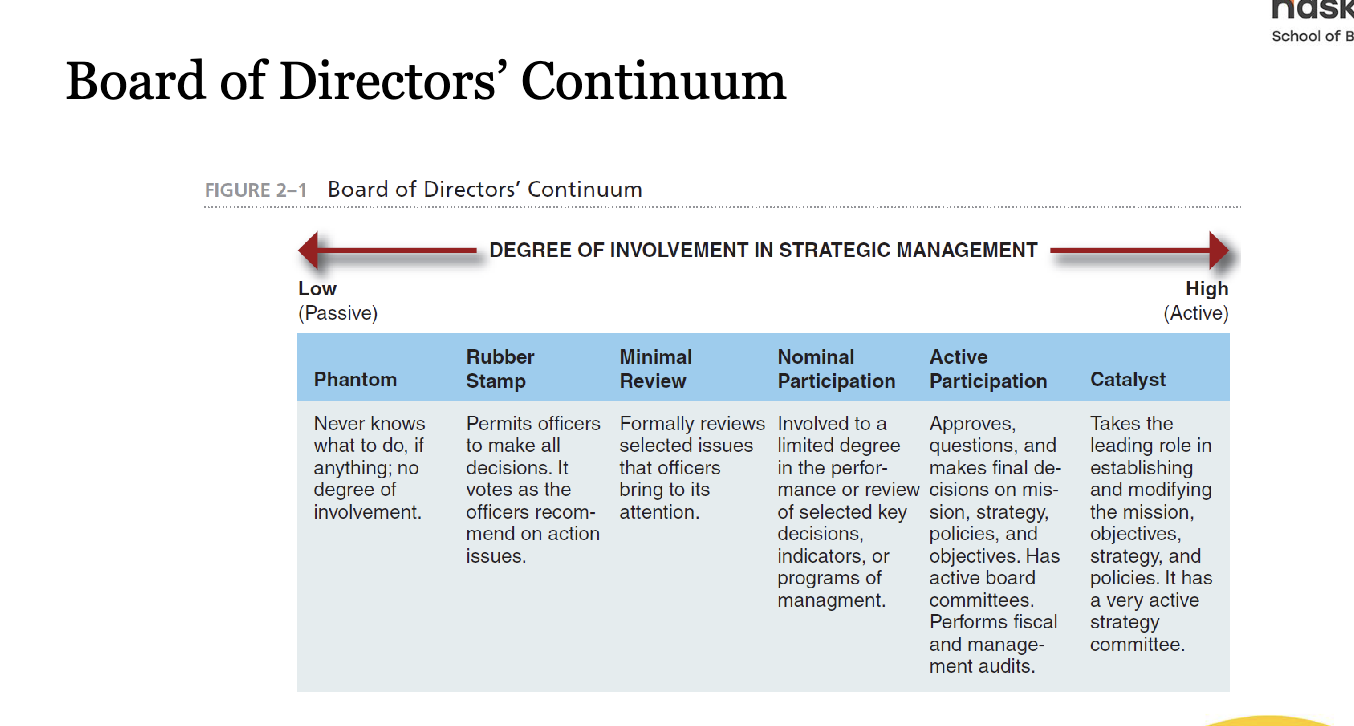

What are the types of boards along the Board of Directors’ Continuum?

Phantom: Clueless, no involvement.

Rubber Stamp: Just approves whatever management says.

Minimal Review: Reviews only what management brings up.

Nominal Participation: Limited input on some key decisions.

Active Participation: Approves, questions, audits; real oversight.

Catalyst: Leads strategy, mission, and objectives; highly active.

What is the fiduciary duty of directors?

A legal obligation for directors and officers to act in the interest of the corporation.

• Duty of care (diligence) - act in in good faith

• Duty of loyalty (interest) - act in the best interest

• Duty of candor (disclosure) - honestly

Please do not skip the “CORPORATION”

What is the business judgment rule?

Courts defer to directors’ decisions if they act in good faith, are informed, and make rational choices in the firm’s best interest.

What is the duty of care for directors?

Directors must act with the care, diligence, and skill that a reasonably prudent person would exercise in similar circumstances.

What is the duty of loyalty? What are common board-level conflicts of interest?

Directors must put the corporation’s interest above their own, avoiding conflicts of interest or self-dealing.

common board-level conflicts of interest:

Related-party transactions.

Excessive perks/compensation.

Using position for personal gain.

Who monitors the board of directors?

Shareholders (via elections & activism), regulators, courts, auditors, media, and proxy advisors.

What’s the key tension between the CEO and the board?

CEO runs the firm daily; board monitors the CEO. But CEOs often have influence over board composition, creating power imbalances.

Board Structure. What “other qualifications” are valued in corporate boards today?

International Experience:

29% of new directors have global work experience.

9% are foreign-born.

Larger firms more likely to have international directors (55% of top 200 S&P firms vs. 47% five years ago).

Diversity:

Sought-after: women + ethnic minorities.

Representation still low (18% women; 9% African-American; 5% Hispanic; 2% Asian).

Adding 1 female director reduces male director attendance problems by 10%.

👉 Memory hook: Global + Inclusive = Stronger Boards.

What is the role of the chairperson of the board?

Leads the board and sets its agenda.

Ensures directors get the information they need.

Facilitates board meetings and decision-making.

Acts as a bridge between board and management.

What is the difference between the CEO and the Chairperson?

CEO: Runs daily operations, implements strategy.

Chairperson: Leads the board, oversees the CEO, ensures accountability.

Separation avoids concentration of power.

Who serves on a corporate board?

Insiders: CEO, CFO, other executives/employees.

Outsiders/independents: Lead independent director (key for oversight).

Stakeholder reps: Investors, suppliers, sometimes employees.

👉 Memory hook: “Mix of Insiders, Independents, and Stakeholders.”

Why are employees on the board (codetermination)?

Codetermination = employees/workers have seats on the board.

US: rare, little likelihood of growth.

Europe: increasingly common; stronger acceptance of worker participation.

👉 Memory hook: “Codetermination = employees share in decisions; Europe yes, US no.”

What makes a director “independent”? What is the role of a lead independent director?

Not an employee (recent past).

No close family ties to company execs.

Only paid director fees (no extra comp).

No big business ties (e.g., partner in a major supplier).

Lead Independent Director = compromise when CEO is also Board Chair.

👉 Hook: “Independent = No job, no family, no pay (except fee), no business ties.”

role of a lead independent director:

Provides independent leadership when CEO = Chair.

Coordinates input from independent directors.

Acts as a check on CEO power.

Why are outside directors valuable to the board?

Bring independence and objectivity.

Provide broader perspectives and diverse expertise.

Better monitors of management decisions.

What are the risks of relying heavily on outside directors?

Lack of detailed knowledge of day-to-day operations.

Risk of being disengaged or symbolic (“rubber-stamping”).

Why do boards use committees?

To divide complex governance tasks.

Increase efficiency and focus on specialized oversight (audit, pay, nominations).

Committees = focused, powerful, sometimes required.

What are the three core committees every board should have?

Audit Committee – oversees financial reporting & auditors.

Compensation Committee – sets executive pay & incentives.

Nominating/Governance Committee – handles board recruitment & evaluation.

Core 3 = Audit, Pay, People; Others = Money, Community, Governance, Risk.

What is CEO/Chair duality? What are the pros and cons of CEO/Chair duality?

When one person serves as both the Chief Executive Officer (CEO) and Chairperson of the Board → concentrates leadership power.

Pros: Unified leadership, faster decisions, clear authority.

Cons: Weakens oversight, increases CEO dominance, reduces board independence.

How big are corporate boards usually?

Size set by charter & by-laws, but flexible.

Large public firms: ~10 directors.

Small private firms: ~4–5 directors.

👉 Hook: “Big boards ~10, small boards ~5.”

What are the pros and cons of large boards?

Pros: More resources, oversight, advisory capacity, diverse expertise, functional committees.

Cons: Slower decisions, less open debate, diffused responsibility, free-riding, risk-aversion.

Impact: Large boards usually linked to lower firm value — except in very complex firms where size helps.

👉 Hook: “Big board = more brains, but slower trains.”

What are staggered vs. annual board elections?

Staggered (classified) boards: Directors split into ~3 groups, serve 3-year terms; only 1 group up for election each year.

Purpose: Anti-takeover defense (harder to replace board quickly).

Downside: Directors less accountable to shareholders.

Annual elections: All directors elected each year → more accountability.

👉 Hook: “Staggered = slower change, weaker accountability; Annual = full reset, stronger accountability.”

What are the main types of director voting?

Dual Class: Different share classes = different voting power. (~20% of Canadian firms).

Majority: Each director must get >50% “FOR” votes; weak directors often asked to resign.

Cumulative: Votes = shares × directors up for election; shareholders can pool votes to boost chosen candidates.

👉 Hook: “Dual = unequal votes, Majority = >50% wins, Cumulative = pool votes.”

How are directors nominated, and what makes a “good” director?

Nomination: Usually by a nominating committee.

Good director traits:

Willing to challenge management.

Brings special expertise.

Available to advise outside meetings.

Understands key technologies/processes.

Team player, valuable input.

Alert, inquisitive, good judgment.

Prepares well, attends regularly.

👉 Hook: “Good director = expert, engaged, independent, prepared.”

Why might directors leave a board?

Positive reasons: Retirement (personal or mandatory age), board refresh, need for new skills.

Negative reasons: Disagreements with board/management, negligence, poor performance.

Note: True reasons often hidden from shareholders.

👉 Hook: “Leave for age, change, skills… or for fights, failure, neglect.”

How can directors be removed from a board?

Board itself: Can’t directly remove; can only pressure for resignation or wait for annual meeting.

Shareholders:

Special resolution if they prove cause.

Vote for removal under majority voting rules.

Reality: Involuntary removal is rare.

👉 Hook: “Boards push, shareholders vote — but removals are rare.”

What are direct vs. indirect interlocking directorates?

Direct: Two firms share the same director, or an executive from one firm sits on another’s board.

Indirect: Two firms don’t share a director directly, but their directors both sit on the board of a third firm.

👉 Hook: “Direct = shared seat, Indirect = shared through a third seat.”

Why was Enron’s board considered “captive” to its CEO?

Many directors had conflicts of interest:

Business ties (e.g., Winokur’s National Tank Co. selling to Enron).

Donations (e.g., Cancer Center presidents, charities linked to Walker).

Political ties (e.g., Wendy Gramm’s policies + her senator husband’s donations).

Paid consulting/lobbying (e.g., Walker).

Result: Board loyalty was compromised → weak oversight, enabled fraud.

👉 Hook: “Enron board = conflicted ties → captive to CEO.”

What happened to Enron’s directors after the scandal?

Shareholders filed a class-action lawsuit.

Enron directors paid $168M settlement (with $13M out of their own pockets).

Around the same time, WorldCom directors paid $54M ($18M personally).

Shows shift: courts raising standards; business judgment rule no longer shields weak boards as easily.

👉 Hook: “Enron & WorldCom — directors personally paid; higher accountability.”

Limitations of Boards. What does survey evidence show about board effectiveness?

72%: Leader effective in inviting all directors’ participation.

68%: Effective in including new members.

60%: Lead director asks right questions.

Only 26%: Very effective at giving personal, constructive feedback.

👉 Hook: “Good at inclusion, weak at feedback.”

Why don’t directors always challenge management?

Buffett: Many directors lack knowledge, or choose collegiality over independence → stay silent even against bad deals or excessive pay.

Case – Shirley Young (Bank of America): Asked about CEO’s pay during layoffs → was quietly dropped from the board.

Takeaway: Pressure to conform, fear of removal, and culture of collegiality can silence directors.

👉 Hook: “Silence = safer than challenge.”

Is board independence always good for governance?

not always: Too many outsiders = less knowledge of day-to-day ops.

Can lead to weak assessments → rely on financial controls over strategy.

Side effects: lower R&D, more diversification, higher exec pay.

Evidence: In fast-moving, R&D-heavy industries (e.g., IT), outsiders can hurt performance.

👉 Hook: “Independence ≠ insight — too many outsiders can slow R&D and weaken strategy.”

What happened at Lehman Brothers, and what does it show about independence?

2008: Lehman (4th-largest US investment bank) filed the largest bankruptcy in US history, after huge subprime losses.

Board: 11 directors → 10 outsiders, 1 insider (CEO Fuld).

Problem: Outsiders were older, retired executives (e.g., IBM, Halliburton, Vodafone, Sotheby’s, Red Cross).

Lacked current finance expertise → ineffective oversight.

Lesson: Independence alone ≠ good governance; relevant expertise matters.

👉 Hook: “Lehman: independent but outdated → oversight failed.”

Are active CEOs the best directors? What’s the trend?

Trend: Fewer active CEOs serve on outside boards.

2002: 41% of new S&P 500 directors were active CEOs.

2012: only 25%; average outside boards per CEO fell from 1.2 → 0.6.

Why decline? Companies now discourage or ban their CEOs from joining other boards (time constraints, conflicts).

👉 Hook: “CEOs once common on boards — now rarer, as firms limit outside seats.”

What are professional directors, and what are their pros/cons?

Definition: Board service = primary career.

Pros: Broad experience, more time for board duties, strong networks.

Cons: Risk of being “over-boarded” (too many seats), or treating role as semi-retirement → weak monitoring.

Note: Directors spread effort unevenly → spend more time on prestigious boards (Masulis & Mobbs, 2014).

👉 Hook: “Pros: experience & time; Cons: too many boards or too little effort.”

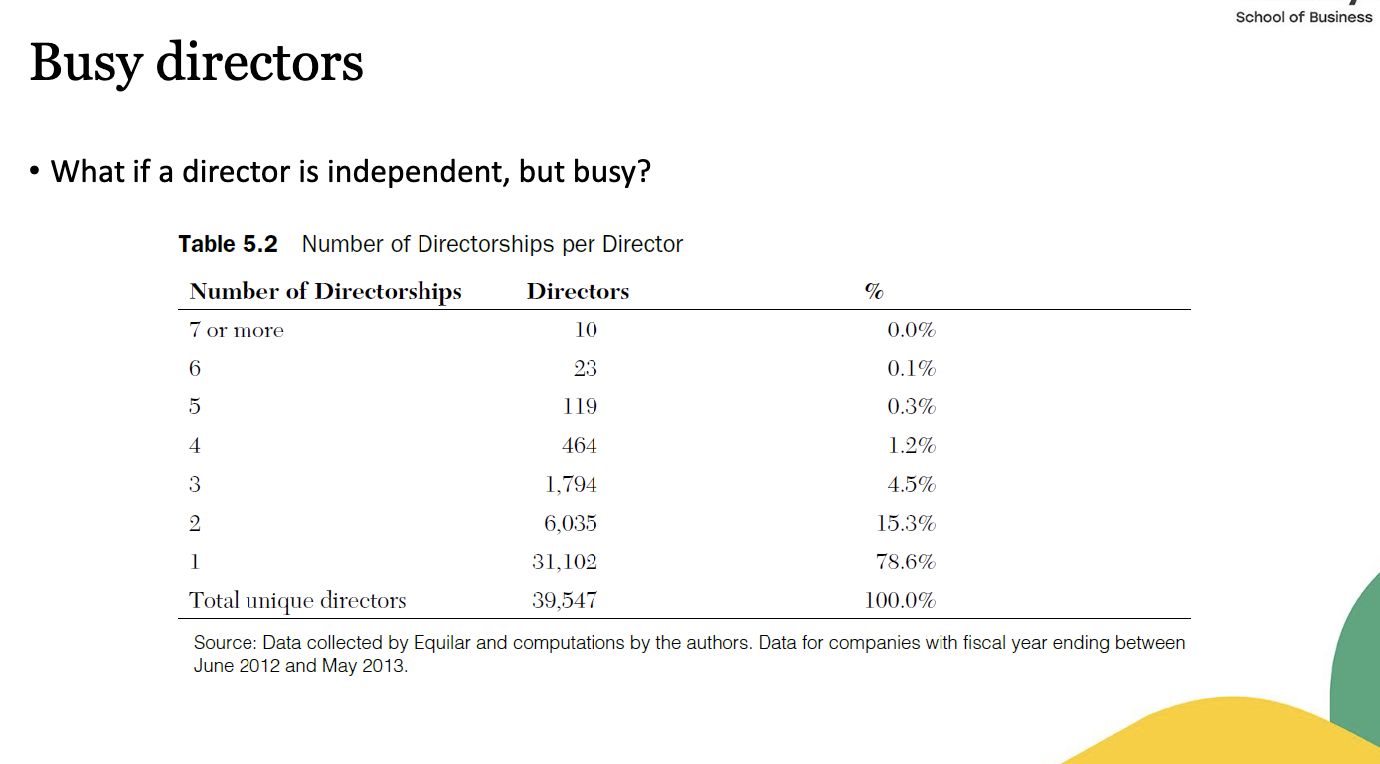

What happens if a director is independent but “busy”?

Data (2012–2013):

79% of directors hold just 1 seat.

15% hold 2 seats.

Very few hold 3+ (only 5.7% total).

Issue: Multiple seats = stretched time, weaker oversight.

Insight: “Over-boarded” directors may prioritize prestigious firms and neglect others.

👉 Hook: “Most directors = 1 board. Too many seats = thin oversight.”

Is being a corporate director still worth it today?

Trend: Directors face more pressure:

Longer hours, higher accountability, more stock ownership, more CEO pushback.

Impact: Many decline roles → 60% of nominees turn down appointments.

But: Still lucrative & prestigious, so positions remain desirable.

👉 Hook: “Harder job, higher pressure — but still pays in money & prestige.”

How are corporate directors compensated, and why?

Purpose: Pay must attract, retain, and motivate qualified directors.

Covers: board time, flexible scheduling, + risk of scandals/lawsuits.

Forms of pay:

Cash (~36%)

Equity/stock (~54%) → aligns with shareholders.

Committee fees (~10%) for extra duties.

Median pay:

Fortune 500 (2010): ~$212K (54% stock, 46% cash).

Non-exec chair = +$150K.

Larger firms pay more (e.g., Top 200 >$286K vs. micro ~$120K).

👉 Hook: “Directors = paid in cash, stock, and committee fees — stock is the biggest slice.”

How are directors protected from personal liability?

Two main protections:

Indemnification agreements → company promises to cover directors’ legal costs/damages.

D&O insurance (Directors & Officers) → company buys policies that protect directors/managers.

Based on the principle of “sound business judgment” → as long as directors act reasonably, protections apply.

👉 Hook: “Indemnification + Insurance = director shield.”

Good practices and trends. Why are boards often ineffective?

Time limits: Avg 227.5 hrs/year (~4.4 hrs/week); only 24 hrs in meetings. Much time = legal protection, not strategy.

Too many roles: Many directors sit on 3+ boards or are CEOs elsewhere → split loyalties.

CEO dominance: CEOs often pick directors, sit on each other’s boards, and may also be Board Chair.

Weak ownership: Directors usually hold token shares; most of their wealth comes from director fees, not stock.

Consensus culture: Pressure to “be a team player” discourages confrontation.

Agency problem: Misaligned incentives → directors may protect themselves/CEO over shareholders.

👉 Hook: “Busy, CEO-picked, low ownership, and consensus-driven = weak oversight.”

What are the main ways boards get into trouble?

Poor business performance → shareholder anger.

Weak or absent board leadership.

Overstepping (too much management involvement) or underperforming (too little).

Entrenchment: directors staying too long.

Internal politics & personal conflicts.

Ineffective organization & processes.

Worst case: tolerating or enabling legal violations.

👉 Hook: “Bad results, bad leaders, bad structure, bad behavior.”

What makes a “good” board?

Role: Provide oversight & counsel — not just rubber-stamp management.

Structure: Clear roles/authority, lead independent director, balanced mix of execs/non-execs.

Quality: Skilled, high-caliber, diverse directors.

Process: Regular meetings, fair notice, free agenda-setting, active participation.

Compensation: Aligned with best practice (not excessive, links to shareholder interests).

👉 Hook: “Good boards = Clear roles, Skilled people, Active process, Fair pay.”

What six questions should directors ask before making decisions?

Do I have all the information?

Do I have the skills to judge this?

Do I have any conflict of interest?

Is this an objective, rational decision?

Can I explain it transparently?

Is it a responsible discharge of my duties?

What are the main trends in modern board governance?

Investor influence: Institutional investors more active.

Skin in the game: Shareholder pressure for directors & execs to own stock.

Compensation shift: Stock/options now dominant (4% in 1973 → 78% in 1998).

Outsider dominance: Fewer insiders (from 6+ in 1970s → ~2 by late 1990s).

Nominating committees: Grew from 2% (1973) → 75% (1998); CEO less control.

Board size: Smaller, median 9–11 vs. 16–20 in 1970s → more efficient.

Leadership split: Chair and CEO roles increasingly separated.

Diversity: More women/minorities (e.g., 19% in US, 40% in Norway).

Broader role: Balance profitability with societal needs (stakeholder expectations).

👉 Hook: “Boards today = smaller, more independent, stock-paid, diverse, investor-driven.”

Do boards really matter for firms?

Yes — evidence shows real impact:

Sudden director deaths → stock prices move.

Proxy contest losers → struggle to get new board seats (reputation cost).

China: Directors with foreign experience improve firm performance.

👉 Hook: “Boards matter: markets react, reputations stick, experience pays.”