Macroeconomics, starred = key terms [Incomplete]

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

65 Terms

budget deficit

amount by which government spending is greater than government revenue

macroeconomics

study of large economic systems such as those of a whole country or area of the wold

national income

value of income, output, or expenditure over a period of time

Gross domestic product (GDP)

Market value of all final goods and services produced in a period (usually yearly), an internationally recognized measure of national income

boom

The peak of the economic cycle where GDP is growing at its fastest

downturn

period in the economic cycle where GDP grows, but more slowly

depression

bottom of the economic cycle where GDP starts to fall with significant increases in unemployment

recession

period of temporary economic decline during which trade and industrial activity is reduced, generally identified by a fall in GDP in two successive quarters

recovery

a rise in economic activity following a recession or slump

overheat

demand rises too fast, causing prices to and imports to rise, a situation the government may try to correct by raising taxes and interest rates

unsustainable growth

economic growth that is not possible to sustain without causing environmental problems

aggregate demand

total demand in the economy including consumption, investment, government expenditure, and exports minus imports

deflation

period where the level of aggregate demand is falling

inflation

rate at which prices rise, a general and continuing rise in prices

Consumer Price Index (CPI)

measure of the general price level (excluding housing costs)

retail price index (RPI)

measure of the general price level, which includes house prices and tax

demand-pull inflation

inflation cased by too much demand in the economy relative to supply

cost-push inflation

inflation caused by rising business costs

interest rates

price paid to lenders for borrowed money; it is the price of money

monetarists

economists who believe there is a strong link between growth in money supply and inflation

purchasing power of money

amount of goods and services that can be bought with a fixed sum of money

shoe leather costs

costs to firms and consumers of searching for new suppliers when inflation is high (time)

menu costs

cost of firms having to make repeated price changes

hyperinflation

very high levels of inflation; rising prices get out of control

unemployment

when those actively seeking work are unable to find a job

How can unemployment be measured?

Survey

cyclical or demand deficient unemployment

unemployment caused by falling demand as a result of a downturn on the economic cycle

laying off

to stop employing someone beacuse there is no work for them to do

structural unemployment

unemployment caused by changes in the structure of an economy such as a decline in industry

sectorial unemployment (structural)

when people are laid off because of the decline of the industry they work in

technological unemployment (structural)

when people are laid off because technology replaces their jobs

regional unemployment (structural)

when a specific region in a country faces changes in structure of the economy leading to unemployment

seasonal unemployment

unemployment caused when seasonal workers, such as those in the holiday industry, are laid off because the season has ended

frictional unemployment

when workers are unemployed for a short period of time as they move from one job to another

monetary policy

use of interest rate and the money supply to control aggregate demand in the economy

money supply

amount of money circulating the economy

Why might the interest rate vary between banks? (4 points)

Competition, mortgage or not, savers, credit cards

List the role of central banks (4 points)

Implementing monetary policy and regulating the banking system, acting as a lender of last resort to commercial banks, controlling inflation and stablizing currency, setting interest rates

List the 3 things that affect how interest rates affect balance of payments

income elasticity of imports, strength of link between interest rate and exchange rate, PED for exports and imports

quantitative easing

buying of financial assets, such as government bonds from commercial banks, which results in a flow of money from the central bank to commercial banks

List the business activities that damage the environment

mining, power generation, chemical processing, agriculture, construction

List the ways businesses damage the environment

visual, noise, air, water (pollution)

income inequality

differences that exist between the different groups of earners in society, that is, the gap between the rich and poor

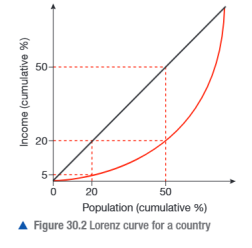

Lorenz curve

graphical representation of the degree of income or wealth inequality in a country

absolute poverty

where people do not have enough resources to meet all of theit basic human needs

relative poverty

poverty that exists relative to existing living standards for the average individual

progressive taxation

where the proportion of income paid in tax rises as the income of the taxpayer rises

regressive taxation

tax system that places the burden of the tax more heavily on the poor

policy instruments

tools governments use to implement their policies, such as interest rate, rates of taxation, levels of government spending

budget

government’s spending and revenue plans for the next year

fiscal policy

decisions about government spending, taxation and levels of borrowing that affect aggregate demand in the economy

direct taxes

taxes levied on the income earned by firms and individuals

indirect taxes

taxes levied on spending, such as VAT

value-added tax (VAT)

tax on some goods and services - businesses pay value-added tax on most goods and services they buy and if they are VAT registered, charge value-added tax on the goods and services they sell

fiscal deficit

amount by which government spending exceeds government revenue

fiscal surplus

amount by which government revenue exceeds government spending

national debt

total amount of money owed by a country

expansionary fiscal policy

fiscal measures designed to stimualate demand in the economy

contractionary fiscal policy

fiscal measures designed to reduce demand in the economy

aggregate supply

total amount of goods and services produced in a country at a given price level in a given time period

supply side policies

government measures designed to increase aggregate supply in the economy

offset

if something such as a cost of sum of money offsets another cost it has the effect of reducing or balancing it, so that the situation remains the same

Two ways supply side policies improve productivity

Improving flexibility, training & education

List the impacts of supply side policies on macroeconomic objectives

Privatization, deregulation, education and training, boosting regions with high unemployment, Infrastructure spending, Lower business taxes to stimulate investment, Lower income taxes to encourage working

austerity

official action taken by the government to reduce the amount of money that it spends or the amount that people spend