Statement of Cash Flows - Topic 4

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

Purpose + usefulness of the Statement of Cashflows

Reports information regarding cash inflows and cash outflows for a particular period of time.

• Prepared on a cash basis, not an accrual basis.

• The statement of cash flows helps ascertain the cash generation from the operating cycle and whether or not the entity is collecting its receipts in a timely manner.

• Cash flows are important for working capital management.

Working Capital

Working capital is the difference between current assets and current liabilities. - It represents the need for entities to be able to fund the purchase of inventory and the use of accounts receivable while waiting for the cash receipt form sales.

Purpose of Cash Flow Statements to Managers

• To be aware of possible future cash shortage - Is there going to be enough cash to pay off current liabilities in this period? - Is there going to be enough cash to pursue profitable investment opportunities?

• To be aware of any possible excess of cash: - What to do with surplus of cash? Investment opportunities? Distribution back to the owners?

Purpose of Cash Flow Statements to Lenders

- Is the business that borrowed from me going to be in the position to make regular interest payment and repay the borrowed amount in due course?

Purpose of Cash Flow Statements to Shareholders + Investors

- How well is the business using cash to generate profit - Is there any default risk from not being able to pay off debts due to a lack of cash? Is my investment in the business at risk?

What is a Statement of Cash Flow

The Statement of Cash Flows reports on one asset only: the inflows and outflows of cash in an accounting period.

Measures ability to: - generate cash - meet short term obligations - continue as a going concern - expand

What are the categories of inflows and outflows of cash

Operating activities: cash flows that relate to the day-to-day operations of an entity. E.g., receipt of cash from customers and payment of expenses.

• Investing activities: Cash flows that relate to the purchase and sale of non-current assets.

• Financing activities: Cash flows that relate to how the entity is funding its operations. E.g., capital contributions from owners, payment of dividends, loan from bank and repayment of loan.

Examples of Operating Activities

The cash inflows and outflows from operations (related to a business’ core trading) that are not Investing or Financing activities including:

- Cash received from customers (inflow)

- Cash paid to suppliers (outflow)

- Cash paid in wages (outflow)

- Cash paid in taxes (outflow)

- Cash paid in interest (outflow)

Examples of Investing Activities

Cash inflows and outflows from acquiring and disposing of non-current assets

- Purchase of new equipment (outflow)

- Purchase of new computers (outflow)

- Purchase of new land and buildings (outflow)

- Sale of any of the non-current assets (inflow)

- Growing businesses usually have investing cash outflows

Examples of Financing Activities

Cash inflows and outflows related to the financing sources of the business

- Borrowing money from the bank (inflow)

- Issuing new shares in the company (inflow)

- Repaying the bank loan (outflow)

- Paying dividends to the shareholders (outflow)

- Business may show either a positive or negative financing cash flow

Accrual Accounting

Accrual accounting focuses on when a transaction takes place and not necessarily the cash flow: has income or revenue been earned or expenses incurred?

Cash Accounting

Cash accounting uses cash flows (receipts and payments): has cash been received or spent?

Difference between Statement of Financial Position and Cashflow Statement

The statement of cash flows gives additional information to assist decision makers in assessing an entity’s ability to:

- generate cash flows

- meet financial commitments as they fall due (i.e. current & non-current liabilities)

- fund changes in scope and/or nature of activities

- obtain external finance

- pursue investment opportunities

- pay dividends to shareholders

Interpreting a Statement of Cash Flow

➢ A healthy business should generate both profit and consistent net cash inflows from operating activities

➢ Consecutive periods of net cash outflows from operating may indicate poor performance or poor cash management

➢ Having negative cash flows is not necessarily bad news

• A business in the growth phase may be expected to have negative net cash flows from investing activities because of the need to acquire non-current assets to expand capacity

• Negative net cash flows from financing activities can occur when repaying the borrowings, which reduces liabilities and may be interpreted as good news because less debt means less risk for shareholders

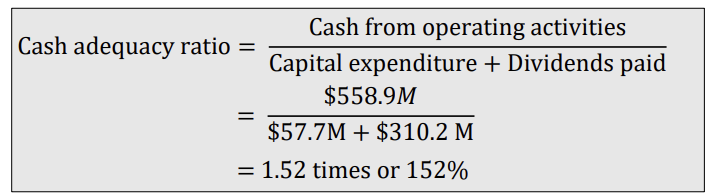

Evaluate an entities cash performance

Free Cash Flow

Managing Cash

Businesses manage cash in relation to the following issues:

• the need to have sufficient cash to meet financial obligations to avoid insolvency.

• the timing of cash flows.

• the cost of cash (i.e. an opportunity cost). The cost of not having enough cash. Managers face a trade-off between risk and return when contemplating how much cash to hold.

What managers do if there is not enough cash available?

- Change collection policies on accounts receivable.

- Limit on how much a customer can put on account.

- Encourage customers to pay early – e.g., provide a discount.

- Carefully consider the amount of inventory that is being held.

- Take advantage of accounts payable when needed.

- Take out a bank loan if there is evidence of future cash flows to meet repayments and interest. - Issue more shares

What managers do if there is too much cash?

Reassess their strategy – expansion

- Invest into additional assets

- Pay off debts