National economic issues

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

why has the car market been incentivised to transition over to electric vehicles?

Cars are a negative consumption externality, where MSB is greater than MPB. It is a market failure in that it creates additional costs for het NHS via chronic health problems such as asthma

who is the biggest global car firm in EV?

Volkswagen will invest 70 billion euros by 2030 in EVs

Honda and Nissan have recently announced a merger to help share the costs of transitioning to making electric vehicles

How is the UK trying to implement electric cars?

Banning all non-electric cars by 2040 - as a result the UK needs to accelerate battery production and help the shift to e-vehicles

what have been the recent production figures in EV?

There were 775,000 cars produced last year in the UK, of which 84% were exported abroad - compared to 1.3 million before COVID-19

Car production in 2023 in the UK was the lowest of 66 years - due to covid and a lack of semi-conductors

what was being produced in Somerset?

A huge gigafactory just off the M5 motorway - costing £4 billion - it should be ready by 2026

Under construction by Agratas, Tata Group's global battery business, between Puriton and Woolavington in Somerset

The purpose is to transport these batteries up the motorway to the midlands and its car factories

What did the EU hit China with?

Big taxes on e-cars in October 2024 - with tariffs increasing from 10 to 45%

why is the EU so significant in regards to EV?

The EU car industry employee 14 million workers and produces 7% of the GDP of EU.

However, overseas demand is falling, and it is facing the risky transition to making e-cars, these problems are made worse by China - it has a 30% cost advantage over eu manufacturers

what is Norway’s successes with EV?

Their aim is to by 2025 end the sale of diesel and petrol cars. It currently offers 25% tax breaks on buying an e-car as well as no car sales tax, free charging, and free parking as well as the use of bus lanes.

In 2019 Norway had 59% of its cars as electric; in contrast UK had 0.9%

what is China’s success with EVs?

In 2023 china overtook Japan as the world’s biggest car exporter (partly because of e-car sales)

BYD passed Tesla as the worlds biggest producer

China has subsidised their EV market; it dominates battery production, and its huge market allows it to make use of economies of scale

Give a description of Tesla?

Tesla was founded in 2003

It has a market value of $900 billion

By 2023 it was making 460,000 a year

With an operating margin of 17%

How has the transition of electric cars been in the UK?

In 2024, the UK became the biggest market in Europe for electric cars - nearly 382,000 were bought in 2024 in the UK

An increase in 21.4% from 2023

what is ZEV? and what is the goal?

Zero Emission Vehicle measure

The long-term goal in 2030 80% all new cars will be zero emission; and 100% by 2035

Immediate targets:

22% 2024

28% 2025

They are big fines for manufactures that don’t meet these targets

why is ZEV complicated?

Annual targets are not black and white.There are mitigations for manufactures if they miss the target - they can role it onto the next year.

Manufacturers say the targets are too high. They argue that in order to hit the targets they either need to cut their prices or sell cars at a loss

The Society of Motor Manufactures say it has cost £6.3 billion in 2024

Why do people not buy electric cars?

Too expensive

Range anxiety - when will the battery run out

Scarce charging points

Price of electricity is increasing

The price difference between petrol and electricity is small

uncertain re-sale value

uncertain battery replacement costs

what is current UK legislation for car manufacturers? what is the issue with the UK?

22% cars must be EV of their total car sales - for every car sold over this figure the car firms must pay a fine of £15,000 per car

The UK does not offer any subsidies to persuade individuals to buy EV’s - unlike places like Norway

What are the reasons why the UK will find the transition to Electric Cars a challenge?

Firstly, high upfront costs of EVs such as internal combustion engine (ICE) vehicles remain a significant barrier. Although the total cost of ownership may be lower over time, many consumers are price-sensitive and prioritise short-term affordability. This may reduce consumer demand for EVs, especially in lower-income households, leading to slower market adoption.

insufficient charging infrastructure across much of the UK. While urban areas may have relatively good access, rural regions often lack the charging facilities needed to support widespread EV use. This leads to geographical inequality and could deter uptake, particularly in areas where private car use is essential.

loss of government revenue from fuel duties. Petrol and diesel taxes currently contribute billions to the Treasury. A large-scale switch to EVs would erode this tax base, creating a fiscal gap that the government may need to fill by introducing alternative taxes—potentially on electricity usage or road pricing—causing political and economic friction.

labour market will be disrupted, as EVs require fewer components and less maintenance than ICE vehicles. This threatens jobs in traditional automotive manufacturing and servicing, requiring government intervention in the form of retraining and support for affected workers.

supply-side constraints—such as the limited availability of lithium and other rare materials used in EV batteries—could raise production costs and slow the pace of transition. Global competition for these inputs adds further uncertainty.

suggest and evaluate two ways the UK government can help the transition to EV cars?

subsidies and financial incentives. Such as grants, tax breaks and reduced vehicle excise duty. This will reduced the market price and therefore increase consumer incentive to buy

However, the opportunity costs is significant when providing subsidies and reduces the allocative efficiency and potential market dependency

Investment in the scale of public infrastructure e.g. charging points. This will reduce regional inequality and range anxiety.

However, this can be challenging for economic austerity, as there will be more fiscal restrictions

Further, potential coordination issues with governments and local councils to implement new infrastructure

what is a cashless society?

a society which no longer uses cash, it uses e-money instead e.g. debit and credit cards

how has the UK progressed into a cashless society?

Cash usage in UK in 2022 has increased 19% on all transactions, up from 15% in 2021. This is the first increase since 2013

Cash usage in the UK has unexpectedly risen for the third year in a row despite concerns after the pandemic that it would all but die out.

A 2021 study suggested that the UK could become an entirely cashless society by 2026 if trends of declining usage continued. That same year, the number of payments made with cash plummeted by around 50% as consumers were encouraged to use contactless in the wake of the pandemic.

what is Sweden percentage of cash usage?

only 2% of the value of transactions were in cash, and 20% of all retail transactions were in cash

what are the advantages of a cashless society?

Reduced counterfeiting; less tax evasion

Less theft of cash; less burglary

Reduced costs to businesses to counting cash and processing it

Digital money can be traced

Digital money can be transferred quickly - speed of about 15% transaction - more efficient

There will be better collection of economic data

what are the disadvantages of a cashless society?

Data mining may lead to a loss or personal privacy

It will cause problems for ‘unbanked’ people - in 2011 25% of people in USA earning less than $15,000 did not have a bank account

Digital fraud/Cyber attacks

Some people do not have adequate internet access

Homeless people rely on cash donations

Undemocratic

Sweden - no cash is causing issues with smaller shops, non-profit organisations, and problems for the elderly

what is capital gains tax?

It is a tax on the profits you gain from selling an asset

Such as:

Shares

Real estate

It is a direct tax on income, profits and wealth

what is the aim of capital gains tax?

An approach to raise government revenue from the wealthiest - progressive tactic

who pays capital gain tax?

individuals

self-employees

business partners

company owners

what is the rate of CGT you pay dependent on?

what income tax rate you are in

Recently increased in October budget 2024 - basic rate at 20% you pay 18%

If above 40/45% you pay 24%

what are the advantages of capital gains tax?

raises around £15 billion a year

Helps reduce income inequality

May encourage long-term investment

Progressive tax

Convient to pay = only payed after selling

Disadvantages of capital gains tax?

it is a double tax - taxed on income from asset then again on sale of asset

Not clear how much you will pay - difficult to work out how liable you are

May encourage tac avoidance/evasion

May discourage enterprise and entrepreneurs when selling a business and stunt economic growth

how can capital gains tax be improved?

aligning CGT rates more closely with income tax rates

Discourage investment

Reduce or eliminate tax relief such as Business Asset Disposal Relief

streamlining CGT with Inheritance tax

simplifying the system

using CGT as a tool for green investment

Income tax definition?

is a tax on income and wealth - it is a direct tax and it is progressive (the more you earn the more you are taxed)

what are the characteristics of income tax?

It is the biggest tax collected by the UK government - about £300 Billion in England and Wales

Income tax rates were devolved to Scotland fully in 2016 and the rates have diverged from England and Wales

what have been the changes to income tax in the UK?

The personal tax allowance was frozen in the last budget until 2027-28 at £12,570

Income tax band thresholds to rise in line with inflation after 2028, preventing more people being dragged into higher bands as wages rise

In 2010 the top rate of income tax in UK was 50p, however this was reduced to 45 pence shortly afterwards. Scotland is currently 48%

what is fiscal drag?

when individuals are pushed into a higher tax bracket in aim to improve government and reduce aggregate demand so inflation can level out

what happens when you are in highest marginal rate of income tax?

If your income exceeds £100,000, for every £2 earned above this threshold, you lose £1 of your personal allowances

what are the advantages of income tax?

Governments:

Steady and predictable revenue source

Due to tax collection regularly and reliable

Set fiscal targets

Allows for more investment in merit and public goods

Automatic stabiliser

Lowers aggregate demand which allows for inflation pressures to fall

Economic growth

In a downfall/slump individuals will be taxed less which encourages spending

Progressive system

Reduces income/wealth inequality

Re-distribution of income

Consumers:

encourages saving

what are the disadvantages of income tax?

Government:

government revenue is volatile in recessions

as income tax is cyclical it falls during a recession or period of low economic growth

As unemployment rises and income falls - people are taxed less and there is less government revenue which results in budget deficits

high administration and enforcement costs

Try and tax avoid and evade

Less investment incentive - worsening the position of the economy

Reduced labour incentive

higher tax = less incentive too work

Money is not seen as worth while when 50% of it is taken

Creates dead-weight loss and low economic growth

Firms:

loss of skillled workers which lowers efficiency and productivity

De-motivated workers

may have to offer higher salaries

Brain-drain risk - move to other parts of the region that has a lower tax bracket

Consumers:

reduced disposable income

Heavy burden on middle class families

reduces incentive too work

Horizontal inequality

why might total tax revenues fall if the tax rate increases?

Increased rates of tax avoidance - there is a greater incentive to seek out tax relief, make maximum use of tax allowances

stronger incentive to evade taxes - non-declaration of income and wealth by people and businesses

Possible disincentive effects in the labour market - depending on which taxes have been increased (more economically inactive)

Possible 'brain drain’ effects

what is Scottish income tax currently?

18,000 individuals pay the top rate of 48% income tax in Scotland

387,000 individuals pay the higher rate of 42% income tax

40% of adults in Scotland do not pay any income tax

24% of adults in Scotland pay the basic rate of income tax

what were Adams smith 4 principles of a good tax?

equity - the burden should be proportionate to the ability to pay

clarity - people should know what taxes are liable for

economy - the tax should raise more than it collects in

convenience - the tax should be collected when people can afford to pay it e.g. after they have earn the money to pay the tax

what are the UK income/ earnings right now from ONS survey for hours and earnings?

median weekly earnings for full-time employees were £728 In April 2024, a 0.6% increase on the year in nominal terms and a 2.9% increase in real terms.

median gross annual earnings for full-time employees were £37,430 in April 2024, compared with £35,004 in April 2023, an increase of 6.9%

what is FDI definition?

a substantial investment made by the government or a company into a foreign business. It is a key drive of productivity or globalisation

what is FDI valued at?

$1.28 trillion in 2022

where does most FDI go?

it goes towards OCED countries - Organisation for Economic Co-operation and Development - especially in Asia

who are the biggest outflows of FDI?

USA

Japan

China

Germany

UK

who are the biggest inflows of FDI?

USA

China

Brazil

Canada

what does FDI investment involve?

Acquiring a source of materials

Expanding a company’s footprint

Developing a multinational presence

what is FDI a substitute for?

trade

why had FDI increasing over the past few decades?

lower transport costs

Improved technology - lowered capital-intensive start-ups

Increased global trade

Lower tariff costs

advantages of FDI?

Capital inflows create higher output and jobs e.g. india $49 billion inflows into cars and textiles - and increased productivity

Capital inflows help finance a current account deficit

LT capital inflows led to a more sustainable investment - higher economic growth e.g. Cambodia 7%

Increase in knowledge and expertise from MNC’s

Higher wages and better working conditions

disadvantages of FDI?

low wage ‘screwdriver jobs’

Environmentally damaging e.g. mining

Profits are repatriated out of the receiving economy

poor working conditions e.g. textiles in Bangladesh

imports of raw materials and technology (domestic products fall in D)

what is an example of an emerging economy that partakes in FDI?

Cambodia

FDI is $4 billion pa (14% from China)

FDI equals to 12% of GDP

Economic growth was 7% of GDP pa

big growth in tourism and garmaent manufacturing

The FDI funded the deficit between the savings ratio 13% and the investment ratio of 23%

Increased jobs and incomes and increased HDI

what are 3 characteristics FDI affects?

FDI is a small % of AMD

Biggest component of AMD is domestic consumption

The impact of FDI affects the local multiplier effects therefore increasing/decreasing domestic consumption

Depends on other factors in the economy

If FDI increasing during a recession, economic growth would be insufficient

As other factors are reducing AMD, and these are powerful

The impact of FDI being dependent on the multiplier effect of our economy

does the investment stimulate the creation of new industries to support the new factory

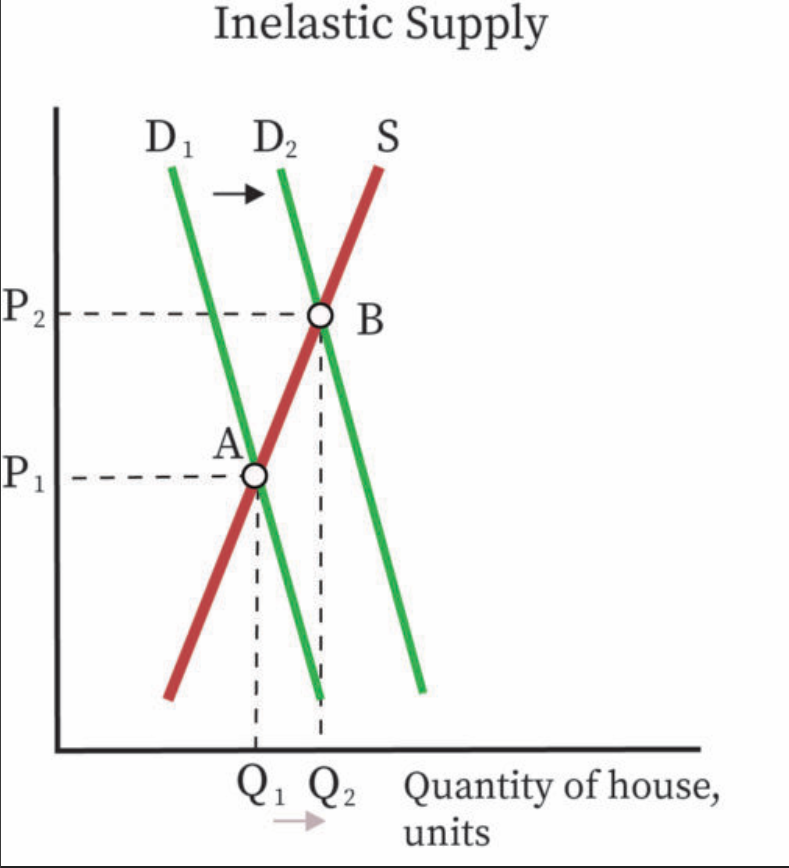

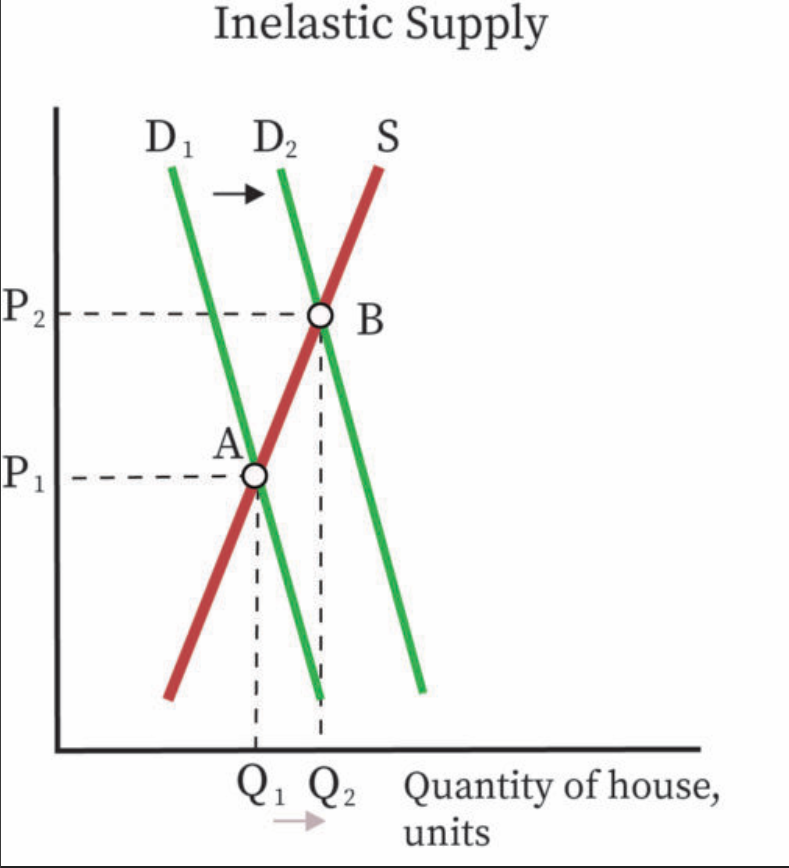

what is the current UK housing prices?

UK house prices have risen significantly since 2012 up to nearly £300,000

The price grew by 3.4% in 2024

Estimated to increase by 2.4% in 2025

how many people are waiting on the local council waiting list for houses?

1.2 million

what has the UK government announced in terms of housing?

1.5 million new homes in the next 5 years before the end of 2029

how much is housing worth of the UK GDP?

6%

what are the key issues with UK housing markets?

high prices and low affordability

Lower mortgage rates recently

Speculation

Help to buy schemes

High cost of rented housing

high land prices

Low level of house building

Lack of social housing

Planning Issues (1947 act) - to control urban sprawl into the countryside and implement a ‘plan-led’ system for the first time

what are the demand factors for the ability to buy on the housing market?

Real incomes

Mortgages Interest Rates

Consumer confidence

Economic growth

Unemployment

Price of substitutes

Longer life expectancy

Smaller household sizes (divorce, single people)

Growing population (inward migration)

what are the supply factors that affect the housing market?

Increasing cost of production - land prices, prices of building materials, exchange rates, employer NIC’s

Shortage of builders (Brexit, ageing population/workforce, shortage of investment in skills and training - too much on university)

Small number of building companies

Land banking by housing firms - they have the land but they are holding onto it to maximise profits

Innovation

Govt tax

Govt spending on social housing

Inelasticity of supply

what are the advantages of the UK Government Building Target?

Increased economic growth - house building stimulates GDP (£20 Billion) possible accelerator effect, as 6% of GDP is housing

Lower unemployment - house building is labour intensive - multiplier effect, positive effect on the public finances

Improves living standards and reduces homelessness

Long-term reduction in rent inflation

Reduces excess demand and shortages/market failure

Boost government revenue - from stamp duty, VAT on construction materials and council tax - will improve budget deficit

what are the disadvantages of the UK Government Building Target?

Environmental issues - flooding, traffic, congestion, noise pollution, effects on flora and fauna

A skills shortage of house building trades means higher wages, higher housing building production costs which means increased house prices and longer delays

Increase trade deficit - due to more imports of building materials and equipment

Worse regional disparities

Opportunity cost for government spending

Potential inflationary pressures - Large-scale building can cause demand-pull inflation in construction materials and labour, especially if the sector is already at or near full capacity.

what is another proposal the UK Government could take to fix the UK Housing Crisis?

Regulation in the House Building Market

The CMA announced a year-long investigation in February 2024 of unfair competition and collusion in the housing building market.

This could include: High barriers to entry, collusion, information asymmetry and less competition

For example: Barratt and Redrow housing companies announced a merger of worth £2.5 billion

nationalisation definition?

when the government take control of an industry previously owned by private firms

For example, after 1945, the labour government decided to nationalise key industries such as railways, steel and electricity

what did Greenwich university research in terms of nationalisation?

That if the government nationalised all key services such as railways and water services they would save £13 billion p.a.

What are the arguments FOR nationalisation?

Natural monopoly

Due to there being a large amount of efficient firms in the one industry, they work best as a natural monopoly

Due to fixed costs being very high for an individual firm e.g. to put in water pipes. Working as one natural monopoly is far more efficient as there is no sense in having competition

Private monopoly can easily exploit monopoly power and charge high prices to consumers. Government ownership prevents this from happening

All high prices would go towards government revenue - lowering tax rates and potentially lowering fares

Externalities

some industries create positive externalities e.g. public transport which reduces pollution and congestion

Private firms would ignore the positive externalities as the aim to maximise profits. However, government run industries will aim to use these positive externalities to improve on economic infrastructure for a greener way to travel

Welfare Issues

Being government run such as industries that are necessities e.g. gas and water

The government will recognise vulnerable consumers and provide them with necessities through schemes and policies

industrial relations

Labour unions often favour nationalisation because they feel they may be better treated by the government - rather than by a maximising profit monopoly

Government investment

Some industries require long-term investment to improve services over time.

Long term investment may not be profitable in the short-run, therefore require government intervention

And the Government can borrow cheaply to invest for the long-term

Free Market failure

Two train franchise of East Coast Mainline has failed, with the government having to step in.

The third franchise, stagecoach/Virgin has also required help, as they stated they overpaid the franchise.

When the government managed these services they made profits - showing that nationalisation can be profitable

Saving Banking Systems

Two large banks would have gone bankrupt (Lloyds and Royal Bank of Scotland) Without government intervention in 2008

Since then the government have owned shares in these two banks - showing that the government ownership can provide greater stability than free market forces

what are the finances regarding Railways in the UK with link back to nationalisation?

in 2015/16, franchised train companies brought in a combined income of £12.4 BN

Company profits vary, but it can be a lucrative business. Together they made an annual operating profit of £343 m - an average of £20m per company

However, despite the resources of private companies, the rail system has always depended on huge amounts of government investment, mostly via Network Rail

According to the Office of Rail and Road, net government funding of the railways was £3.2bn in 2015/16. It paid £6.7bn in support and received £3.5bn back

Train companies made overall net payments of £0.6bn to the government - also paid Network rail £1.5bn

what are the arguments against nationalisation?

Competition on lines is more important than who owns the railways - allow more operators

Private sector firms are more likely to improve dynamic efficiency and avoid X-inefficiencies

Possible to regulate more fares on services run by private train operating companies

History of state-run railways in the UK (1970s and 1980s) was not always positive

what was the Total Aid in 2023?

$224 billion

who was the 1st and 2nd biggest donor to foreign aid in 2023?

The USA at $66 billion (0.24 GNI)

Norway gave the most 1.09% per GNI

how much aid did the UK provide to Gaza in 2023?

£15.4 billion humanitarian aid

What was the UN target for foreign aid?

0.7% GNI - only a few Scandinavian countries achieved this

what are previous examples of bilateral aid the UK have provided?

Africa

Asia

Non-region specify or not yet allocated

what is bilateral aid ?

between two countries or organisations

what is Multilateral aid ? and examples the UK have used?

between many countries or organisations

examples:

EU

World Bank

UN

Regional development banks

what are the reasons for giving aid?

Humanitarian - after a natural disaster

Political - to gain allies or ‘countries’ for the future support

Economic - aid is given to developing countries in hope they expand and influence the markets - to contribute more to world economy

To reduce world poverty

what is bilateral aid normally known as?

Tied aid - the aid is only given under certain conditions e.g. the receipts must purchase certain products from the donor country

The donor country can ensure that the aid is being used for appropriate purposes and can also bring benefits for its own economy e.g. more export markets

However the goods bought by the recipient country may not be value for money and can result in political and economic interference

what are different forms of aid?

Gifts - food, can be useful for short-term emergency help. In the longer-term people can become dependent upon it and it can destroy local farming if free food is being given

Grants and loans - a grant is a gift of money which does not have to be repaid. Few grants are now given due to corruption and the money not reaching those who need it the most.

Loans - may be provided at a commercial rate of interest or as ‘soft loans’, loans at a lower rate of interest but which have to be used to buy products from the country providing the loan

Write off debt - the UK government has ‘written off’ money owned to it by a number of LDCs. The money that was spent on debt repayments can now be invested in relieving poverty and infrastructure.

Technical assistance and education - this is extremely useful to LDCs as up to date technology, training and education are vital for a country to develop.

Cheap medicine - this is particularly important in Africa due to HIV/AIDS. A healthier population should enable a country to develop more effectively and at a faster rate.

Provision of capital equipment - capital is vital to development and is especially important for improving productivity. But the donor country must make sure that the LDC can repair the capital or else it will be useless within a few years.

Liberal trade policies - this relates to free trade being allowed between LDCs and developed countries. Some people believe this is the most important form of assistance possible as being able to export their products without trade restrictions.

what are the disadvantages of Aid?

It may not reach the poorest who really need it. This is often a key difference between on LDC and an emerging economy

It can create dependency on rich countries and reduce the incentive to develop

Food aid can destroy local farming by cutting prices where there is a significant increase in supply. This forces local farmers out of business as no one buys good as it is given away instead.

It may be used to buy military equipment or prestige projects when there are far more important projects which could receive the money

Tied aid might force LDCs to buy more expensive and less useful goods that they could have bought if they were allowed to use the money freely.

It may finance capital expenditure but not provide for the running costs. In the longer term this money will have been wasted if the government cannot afford the upkeep of the new capital item.

what are the advantages for oversea aid?

Helps to overcome the saving gap + aid can be key in stabilising post-conflict environments and in disaster recovery e.g. Haiti

Project aid can fast forward investment in critical infrastructure projects - capital deepening effects + higher productivity

Long-term aid for health and education projects - builds human capital and stronger social institutions. Aid projects for enterprise

well targeted aid might add around 0.5% to growth rate of poorest countries - this benefits donor countries too as trade grows

what are the advantages of foreign aid?

Aid can bring economic, human and environmental benefits

Development can take place without aid

Well targeted aid can boost growth but the time lags can take years

what can aid effectiveness be boosted by?

randomised control trials

improve transparency of aid budgets

conditionally linked to improved governance/democracy

Aid that stimulates and supports business enterprises

what are alternatives to direct aid?

debt forgiveness

Lowering trade barriers for the least developed countries

what are the effects of developing economies on the UK?

Gov spending from the UK is used as aid to LDCs (1.4% of gov spending) There are disagreements as to whether this is enough, whether the government should do more to ensure this money is not wasted and if this is too much

Potential new markets for UK firms - Uk can sell their products to LDCs as they develop

source of cheap imports - as LDCs start to develop they may provide a range of cheap products for UK consumers to buy - as their cost of production are likely to be so much lower than the UK their prices are likely to be lower

Jobs could be lost - if LDCs start to develop there will be fewer restrictive regulations in LDCs

Environment globally be damaged - there are fewer environmental laws in LDCs in comparison to the UK