Chapter 15: The Foreign Exchange Market

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

Nominal exchange rates

The price of the domestic currency in terms of foreign currency (e.g., £/$)

Exchange rates are a price, quoted from 2 perspectives:

£/$, i.e., purchasing power of dollar (U.S. perspective)

$/£, i.e., purchasing power of pound (U.K. perspective)

The two quotes move inversely: If £/$ up, then $/£ down

The $ appreciates: currency rises in value (buys more £)

The £ depreciates: currency falls in value (buys fewer $)

2 nominal foreign exchange rates

Spot transactions: immediate (one or two day) exchange of bank deposits

Forward transactions: the exchange of bank deposits at some specified future date

Why are exchange rates important?

Exchange rates affect the relative price of domestic, foreign goods!

If £/$ up, British imports to U.S. become cheaper

If $/£ down, U.S. exports to U.K. become more expensive

This can have huge implications for standards of living:

Many countries rely on important for food and/or energy

A depreciating currency raises the cost of these imports

May be hard to substitute to domestically produced goods

The law of one price and purchase power parity (PPP)

The law of price is if 2 countries produce an identical good, and transportation costs and trade barriers are very low, the price of the good should be the same throughout the world no matter which country produces it

Intuition: if the exchange rate adjusted price of Japanese steel is less than the price of American steel, the U.S. will import Japanese steel and prices will adjust

Theory of PPP: exchange rates between any 2 currencies will adjust to reflect changes in the price levels of the 2 countries

Intuition: just the law of one price aggregated up to national price levels

The big mac index

Since 1986, The Economist has published a big mac index testing how well PPP holds based on a single identical good produced around the world: a McDonald’s Big Mac

As of July 2024:

Most overvalued: Swiss franc (+42% above PPP-implied dollar exchange rate)

Most undervalued: New Taiwanese dollar (-60% below PPP-implied dollar exchange rate)

Others are close: Canadian dollar (-3%)

Why do you think PPP holds better for Canada?

Real exchange rates

Nominal exchange rate: the price of the domestic currency in terms of foreign currency (e.g., £/$)

Real exchange rate: the rate at which domestic goods can be exchanged for foreign goods

𝜏 = EP/P*

where

𝜏 is the real exchange rate

E is the nominal (spot) exchange rate (e.g., £/$)

P is the domestic price level (e.g., U.S. CPI)

EP is the price of U.S. goods in foreign currency

P* is the foreign price level (e.g., U.K. CPI*)

PPP predicts 𝜏 → 1, i.e., E = P*/P

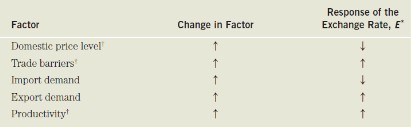

Factors affecting long-run exchange rates

Q: What do you think explains long-run exchange rates?

Relative prices (in line with PPP theory)

Trade barriers: removing barrier → PPP

Preferences between imports, domestically produced goods

Decisions about location of production (e.g., Volkswagen, Nissan producing in TN, GM in China)

Productivity: Produce at lower cost → export demand up

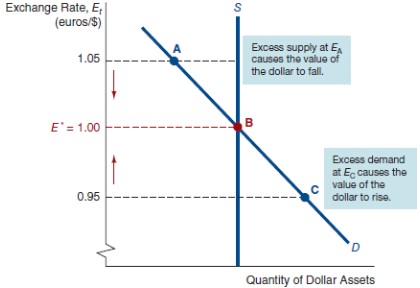

Equilibrium in FX markets

How do other factors change quantity demanded?

An increase in the domestic interest rate, iD, shifts the demand curve for domestic assets, D, to the right and causes the domestic currency to appreciate (E up)

An increase in the foreign interest rate, iF, shifts the demand curve for domestic assets, D, to the left and causes the domestic currency to depreciate (E down)

A rise in the expected future exchange rate, Eet+1, shifts the demand curve to the right and causes an appreciation of the domestic currency (E up)

An increase in expected inflation, pie, decreases demand and causes the domestic currency to depreciate

Change graphics in ppt

Uncovered interest parity and international arbitrage

Uncovered interest parity relation: bonds are priced such that expected returns are equal, adjusting for exchange rate risk

(1+itD) = Et(1+i*t)(1/Eet+1)

(1+itD) = (1+i*t)(Et/Eet+1)

where

(1+itD) is the nominal interest rate on domestic bonds

(1+i*t) is the nominal interest rate on foreign bonds

Eet+1 is the expected exchange rate (or forward rate)

Essentially the law of one price for tradable assets

Note: Assumes no default risk, zero transactions costs…

Rearranging from equation 2:

(1+itD) = (1+i*t)(Et/Eet+1)

(1+itD) = (1+i*t)(1/Eet+1/Et)

(1+itD) = (1+i*t)(1/1+(Eet+1-Et)/Et)

itD ≈ i*t - (Eet+1-Et)/Et

where

(Eet+1-Et)/Et is the expected appreciation of domestic currency

Arbitrage implies the difference between risk-free interest rates across countries is expected appreciation of domestic currency

Case study: Japan revisited

In March 2024, the Bank of Japan raised rates for the first time in 17 years, and they raised rates again in July. The Fed, meanwhile, started cutting interest rates in September 2024. Yet the spread between 10-year Treasuries and 10-year Japanese Government bonds widened from roughly 2.90 ppt to 3.34 ppt over the last 3 months…

Q: Based on our model of exchange rate determination, would we expect the dollar to have appreciated or depreciated against the yen over the last year? Why? Which curves would shift in our model?

Q: Does the uncovered interest parity condition suggest the dollar will appreciate or depreciate against the yen in the future? Explain