ESP231 - Unit 4: Foreign Direct Investment

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

Foreign Portfolio Investment

The purchase of shares and long-term debt obligations from a foreign entity, where investors do not aim to take control of a corporation.

Foreign Direct Investment (FDI)

The establishment of a plant or distribution network abroad, where investors acquire equity in an existing foreign corporation to control or share control over operations.

Strategic Approach (FDI)

Foreign direct investment decisions based on business strategies, seeking access to raw materials, markets, product efficiency, and "know-how".

Cash Flow

The total amount of cash that remains in a company after it has paid taxes and other cash expenses.

Investment Incentives

Benefits (e.g., cash grants, tax credits, low-interest loans) sponsored by national or local authorities to attract foreign investment.

Exclusive Distributor

An independent sales agent given the sole right, under contract, to sell a foreign manufacturer's products.

Multiple Distributor

A sales agent who represents more than one manufacturer.

Royalty Payments

Payments made by a foreign manufacturer to a company that has licensed the manufacturer to produce its products.

Joint Venture

A subsidiary formed by two or more corporations, often chosen to share capital outlay and "know-how".

Multinational Corporation (MNC)

A corporation controlling production and marketing systems in several countries besides its own.

Acquisition

When one company takes over another and clearly establishes itself as the new owner.

Raid (Takeover)

Buying as many of a company's stocks as possible on the stock market to gain control.

Takeover Bid

A public offer to a company's stockholders to buy their stocks at a certain price during a limited period of time.

Buyout

The purchase of a company's shares in which the acquiring party gains controlling interest of the targeted firm.

Merger

When two firms agree to combine and go forward as a single new company rather than remain separately owned and operated.

Horizontal Merger

A combination of two companies making the same products.

Vertical Merger

A company acquires or merges with another company in an immediately-related stage of production and distribution.

Diversification

A company acquires another company in an entirely different sphere, often to introduce new products/services or enter new markets.

Long-term Commitment (FDI Characteristic)

A characteristic of Foreign Direct Investment, where capital funds are tied up for an extended period.

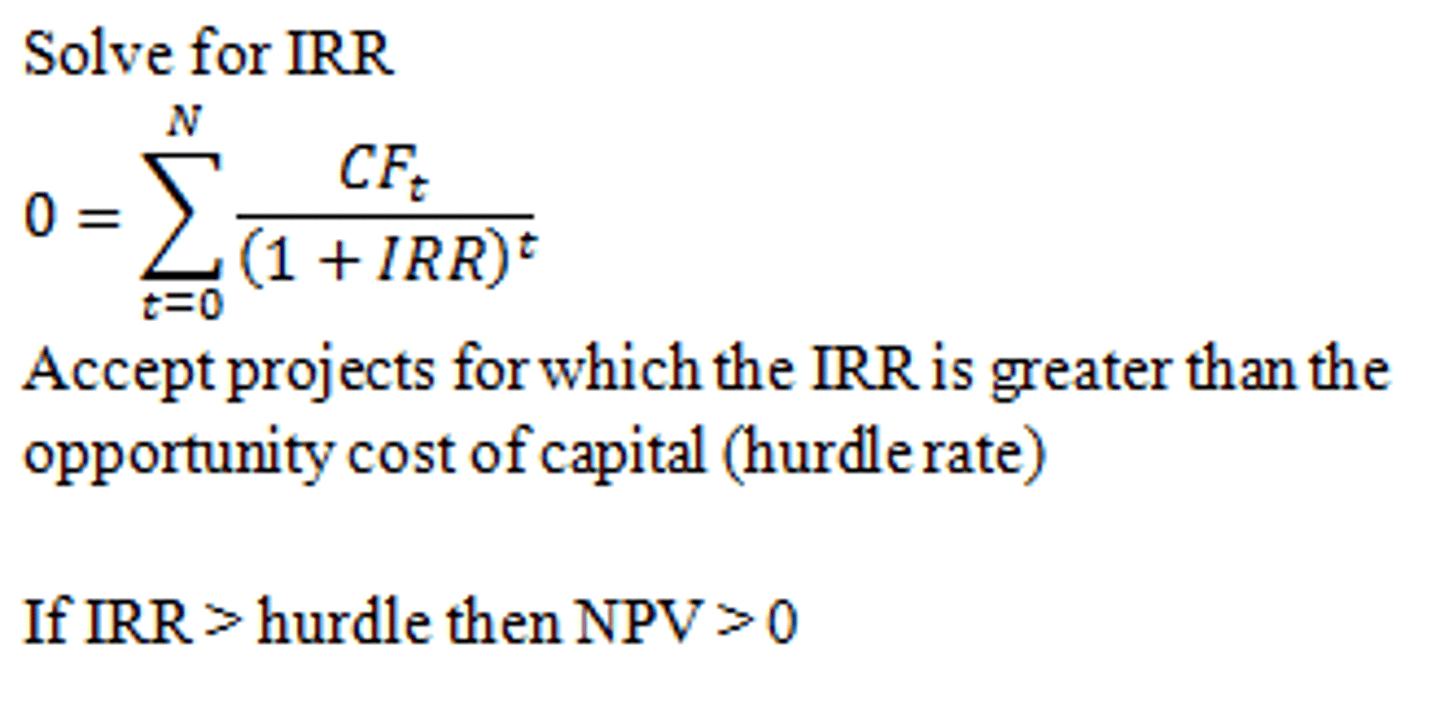

Viable Project (FDI)

A foreign direct investment project for which reliable access to outside financing is available and the expected rate of return is satisfactory.

Non-viable Project (FDI)

A foreign direct investment project where the expected rate of return is likely to be lower than from a comparable investment in the host country.

Know-how

Technical knowledge or expertise, often sought by investors.

Licensing

Authorizing a foreign manufacturer to produce a product under license, using the original manufacturer's brand name, in return for royalty payments.

Synergy

Combined production or productivity that is greater than the sum of the separate parts.

Hostile Takeover

A takeover where the managers of the target company do not want it to be taken over.

Corporate Raider

Individuals or companies that try to buy and sell other companies to make a profit.

Private Equity Companies

Firms that look for undervalued conglomerates to acquire.

Undervalued (Company)

A company whose market capitalization is less than the value of its total assets.

Market Capitalization

The total price of all a company's stocks.

Asset-stripping

Buying a company to sell its most valuable assets at a profit.

Leveraged Buyout (LBO)

A buyout financed predominantly by debt, often involving asset-stripping.

Management Buyout (MBO)

A buyout where the company's own managers buy its stocks.

Rate of Return

Profits realized on assets employed.

Economic Boom

A period when incomes are rising and business is thriving.

Remitted (Profits)

Profits sent back from a subsidiary to the parent company.

Overproduction

A state where production resources are not being fully utilized, leading to excess supply.

Horizontal Foreign Direct Investment (Horizontal FDI)

Multinationals replicate their production processes in foreign facilities located near large customer bases.

Vertical Foreign Direct Investment (Vertical FDI)

Multinationals break up their production chain and perform some parts of that chain in their foreign facilities.