3.6 Debt/Equity ratio analysis

1/75

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

76 Terms

Debt and equity ratios (aka efficiency ratios)

Enable a business to calculate the value of their liabilities + debts against their equity

These ratios are a measure of the financial stability of the business

4 efficiency ratios

Stock turnover

Debtor days

Creditor days

Gearing ratio

Stock turnover ratio (inventory turnover)

Measures:

the no. of times a business sells its stocks within a year

OR the avg no. of days it takes for a business to sell all of its inventory.

How can stock turnover ratio be expressed?

No. of times a business sells its stocks within 1 year

Avg no. of days for a business to sell all of its inventory

What does the stock turnover ratio indicate?

The speed at which a business sells + replenishes all its stock

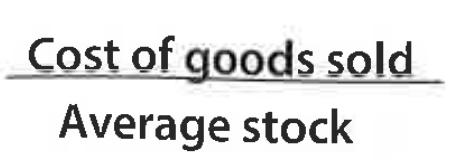

Stock turnover ratio equation

(no. of times)

Cost of sales / average stock

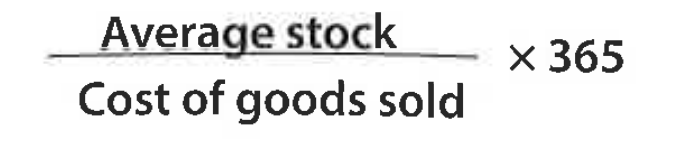

Stock turnover ratio equation

(no. of days)

(Average stock / cost of sales) x 365

For stock turnover ratio, is cost of sales or sales turnover used + why?

Cost of sales (COGS)

Bc stocks are valued at the cost value of the inventory to the business rather than the selling price to the customer

Calculate stock turnover ratio for:

$100,000 cost of sales

$20,000 average stock level

100 000 / 20 000 = 5 times

(20 000 / 100 000) x 365 = 73 days

Benchmark for stock turnover

No. of times = higher the better

No. of days = lower the better

BUT diff businesses = diff ST benchmark figures

So compare similar businesses only

Eg restaurant much higher ST ratio than luxury vehicle seller

Reasons for stock turnover benchmark

Higher the better for no. of times

Lower the better for no. of days

More stock sold → business more efficient in generating profit

Perishable stocks don’t expire / become outdated

General way to improve stock turnover ratio

Reduce organization’s stock level

Strategies to improve stock turnover ratio

Hold lower stock levels → inventories need to be replenished more regularly

Divestment (disposal) of slow selling stock (obsolete / unpopular)

Reduce range of products being stocked → only keep best selling products

Debtor days ratio

An efficiency ratio that measures the average no. of days it takes for a business to collect the money owed from debtors

Debtors

Customers who have purchased items on trade credit → owe money to the business

Is creditor days or debtor days more important?

Debtor days

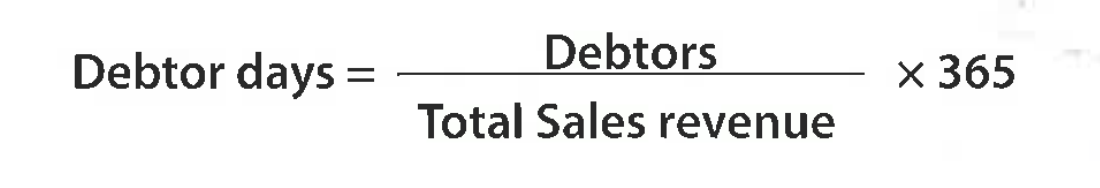

Debtor days ratio equation

(Debtors / total sales revenue) x 365

TSR = approximation of firms total credit sales

Benchmark for debtor days

Lower the better

Lesser time it takes for customers to pay their debts = better

Why is the benchmark for debtor days the lower the better?

Improves cash flow of business

Bc of opportunity cost of holding onto money → business can invest this money in other revenue-generating projects

If a debtor days ratio is too high, why is this problematic?

Too long credit period granted → business faces liquidity problems

If a debtor days ratio is too low, why is this problematic?

Uncompetitive credit period → customers seek other suppliers bc clients prefer better credit terms

Credit control

The ability of a business to collect its debts within a suitable timeframe

Benchmark for debtor days for a healthy business

30-60 days

General way to improve debtor days

Reduce debt collection period

Strategies to improve debtor days

Impose surcharges on late payers

Give debtors incentives to pay earlier

Refuse further business with clients until payments are made

Threaten legal action

For which businesses is it acceptable to have a higher debt collection period + why?

Suppliers of expensive luxury goods

Bc rely more on credit sales

Creditor days ratio

An efficiency ratio that measures the average no. of days it takes for a business to pay its creditors

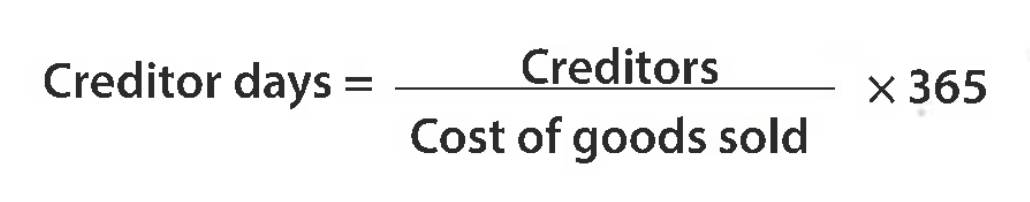

Creditor days equation

(Creditors / cost of goods sold) x 365

Cost of sales = approximation of firm’s total credit purchases

Calculate creditor days:

$225 000 owed to suppliers

$2 000 000 COGS

(225 000 / 2 000 000) x 365 = 41 days

On avg, business takes 41 days to pay its suppliers

CD ratio acceptable, bc most businesses provide 30-60 days credit period to customers

Benchmark for creditor days ratio

Lower the better

Why is a lower creditor days ratio the better?

Business avoids late payment penalties to trade creditors

Pros of high creditor days ratio

Repayments are prolonged → helps free up cash in the business for other use (in ST)

Cons of high creditor days ratio

Business taking too long to pay trade creditors → suppliers impose financial penalities for late payments → harms firms cash flow position

add

add

Strategies to improve creditor days

Improve debtor days → collect enough cash to pay creditors

Negotiate longer TC terms (if struggling bc of too long working capital cycle)

Ideal combination of creditor days ratio + debtor days ratio

High CD

Low DD

Enhance efficiency position of business by…

Improving any of its efficiency ratios

Increase stock turnover

Reduce debtor days

Increase creditor days

General- strategies to improve efficiency position of a business

Develop closer relationships with customers, suppliers, creditors

Introduce JIT production

Improve credit control

General strategies to improve efficiency position of a business

Develop closer relationships with customers, suppliers, creditors

Helps reduce debt collection time + extent credit period

Introduce JIT production

Eliminates need to hold large amounts of stock + improves stock control

Improve credit control

Manage risks regarding amount of credit given to debtors

How does developing closer relationships with customers, suppliers, creditors improve the efficency position of a business?

Helps:

Reduce debt collection time

Extend credit period

How does introducing JIT production improve the efficiency position of a business?

Eliminates need to hold large amounts of stock

Improves stock control

Gearing ratio

Measures the percentage of an organization's capital employed that comes from external sources (NCL)

Eg mortgages

What does the gearing ratio assess?

Firm's LT liquidity position

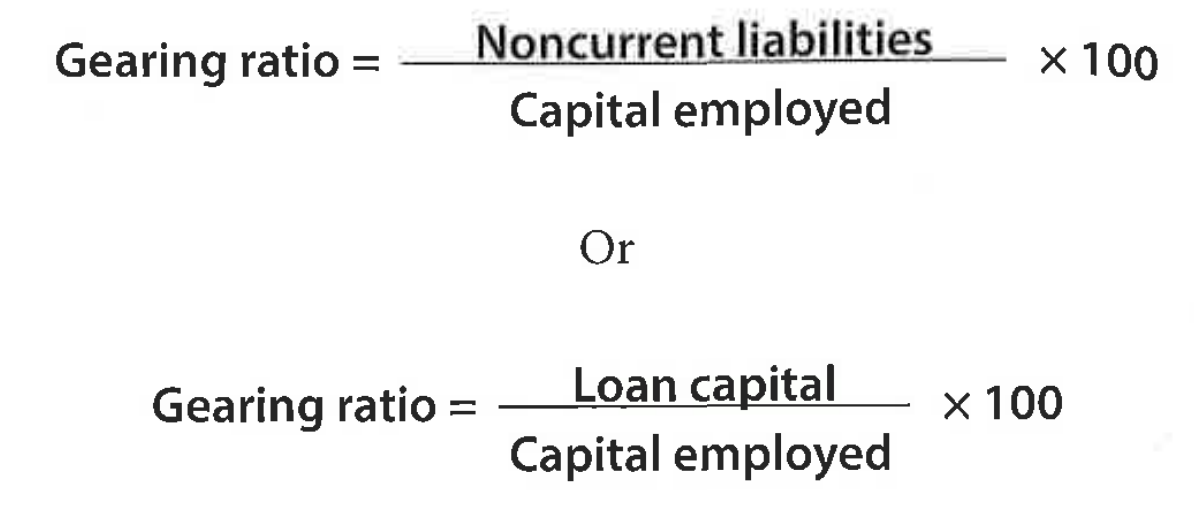

2 equations for gearing ratio

(NCL / capital employed) x 100

(Loan capital / capital employed) x 100

Capital employed equation

Non current liabilities + equity

Equity equation

Share capital + retained earnings

What does it mean the higher a firms gearing ratio is…

The larger the firm’s dependence on LT sources of borrowing

Highly geared firm

Gearing ratio of 50% or above

Cons of high gearing ratio

Business incurs higher costs due to debt financing (interest repayments) → limits profit

Vulnerable to increases in interest rates

Difficult to seek external SoF from other financiers

Downturn in economy / recession → loan repayments remain high but cash inflow from sales fall

If a firm has a high gearing ratio, why is it difficult for them to seek external SoF?

Lenders / financiers concerned about default risks bc of their large loan commitments

Which stakeholders are interested in a firms gearing ratio?

Creditors

Investors + potential investors

Shareholders

Gearing ratio assesses level of?

Riak

Why are shareholders interested in gearing ratio of firms?

Financiers need to be repaid first, with interest

→ reduces amt paid to shareholders + retained profit

But if business has high profitability → high potential returns, even if highly geared

Benchmark for gearing ratio

Why shouldn’t a gearing ratio be too low?

Wasted potential

Need external finance to fund expansion, despite it increasing gearing level

What does the level of gearing acceptable to a business depend on?

Size + status of a business

Greater size + status of firm → more ability to repay LT debts

Level of interest rates

Low IR → business less vulnerable (in ST)

Potential profitability

Business with good profit quality (LT prospects of earning profit) → high gearing less of an issue

Esp for high tech industries that invest in R&D

Need external finance to fund expenditure on R&D, but potential for high returns minimises their exposure to gearing

Insolvency

A financial state where an individual / business entity is unable to pay its debts on time

If insolvency cannot be resolved, this can lead to bankruptcy

2 causes of insolvency

Cash flow insolvency

Balance sheet insolvency

Cash flow insolvency

When an insolvent firm can’t make a payment owed to creditors bc it doesn’t have enough cash

Balance sheet insolvency

When the liabilities (debts) of the firm exceed its assets

Solutions to resolve insolvency

Borrow money

But depends on firm's gearing ratio

Cut costs

Sell NCA

So can raise funds to pay debts

Negotiate a debt payment / settlement plan with creditors

Cons of negotiating a debt payment / settlement plan with creditors

Likely to damage their future credit ratings

Bankruptcy

Formal + legal declaration of a firm’s inability to settle / pay its debts.

Legal process declared by the courts

Business can’t continue trading

Is bankruptcy a first or last resort?

Last resort

Firm owes sm that selling all assets won’t cover debts owed

Business

Order of insolvency + bankruptcy

1st insolvent

2nd bankrupt

Liquidity

How easily an asset can be turned into cash

Highly liquid assets

Can be converted into cash quickly + easily w/o losing their monetary value

Are RM liquid or illiquid CA?

lliquid CA

Inadequate working capital →

Insolvency

Forces business into liquidation

Liquidation

Business sells off its assets to repay as much of the money owed to its creditors

Working capital (aka net CA) equation

CA - CL

Profit quality

The ability of a business to earn profit in the foreseeable future

B w good profit quality = can earn profit in the LR

Cons of declaring bankruptcy

Severely damage credit rating of the owners

Hinders ability borrow money for many years ahead

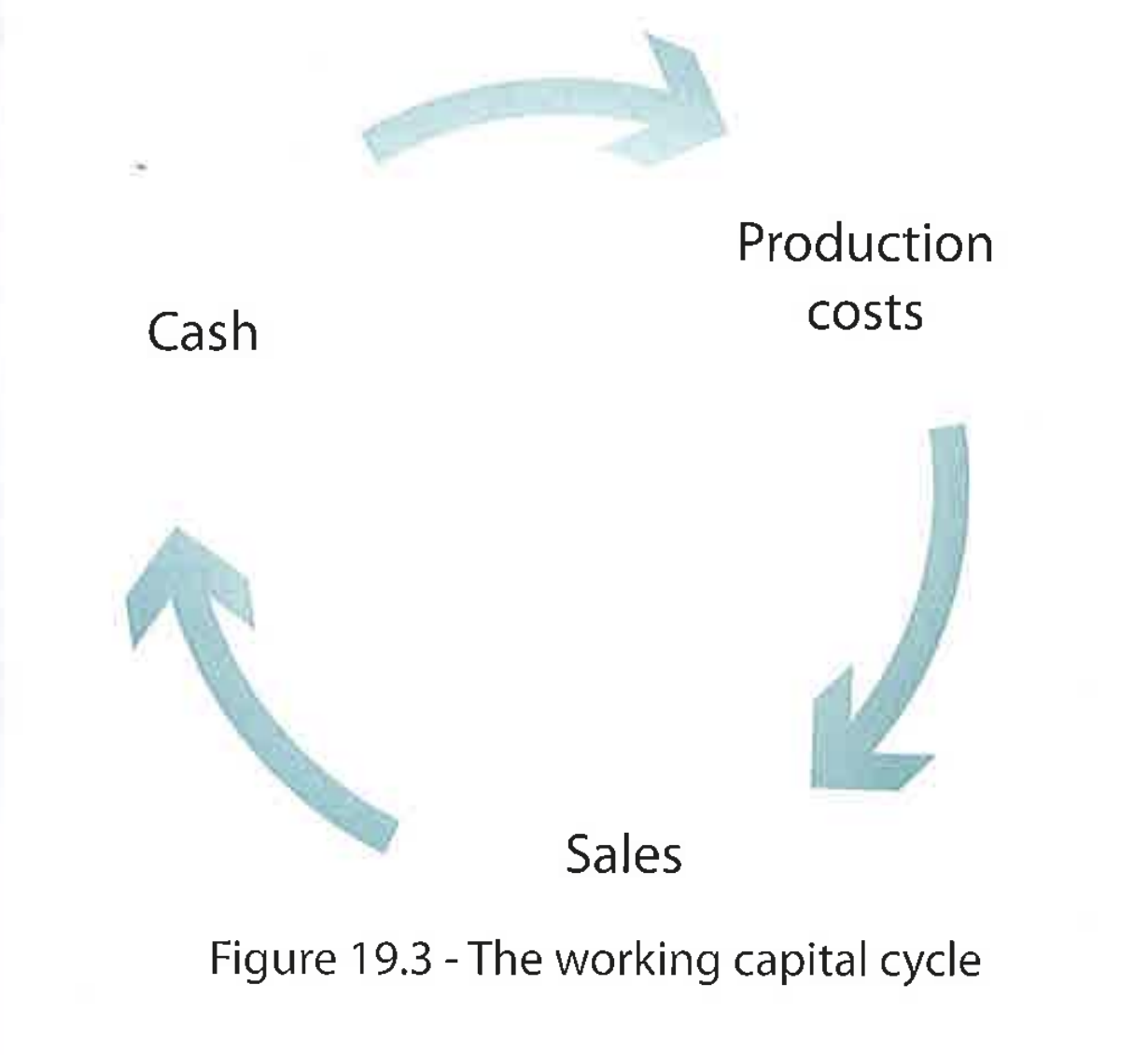

Working capital cycle

The interim period betw cash payments for costs of production and cash receipts from customers

Delay betw paying for CoP + receiving cash from sale of goods → firm needs to manage WC carefully to avoid insolvency

Can a firm recover from insolvency?

Yes

Can a firm recover from bankruptcy?

No