Investment Management Exam #1

1/78

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

79 Terms

Real Assets

Assets used to produce goods and services

What is a limit order?

Execute only if you can meet my specified price (or better)

Financial Assets

Claims on real assets or the income generated by them.

Fixed-income (debt) securities

Pay a specified cash flow over a specific period

Equity

An ownership share in a corporation

Derivative Securities

Securities providing payoffs that depend on the values of other assets

Example of financial assets

Deposits, Pension funds, mutual funds, life insurance.

What are the roles of Financial Markets in the Economy?

Informational Role

Consumption Timing

Risk allocation and diversification

Separation of Ownership and Management

Liquidity

Payment mechanism

Asset Allocation

Allocation of investment portfolio across broad asset classes - % of fund in asset classes.

Top Down Investment Strategies

Security Selection

Choice of particular securities within asset class

Bottom up investment strategies

Security Analysis

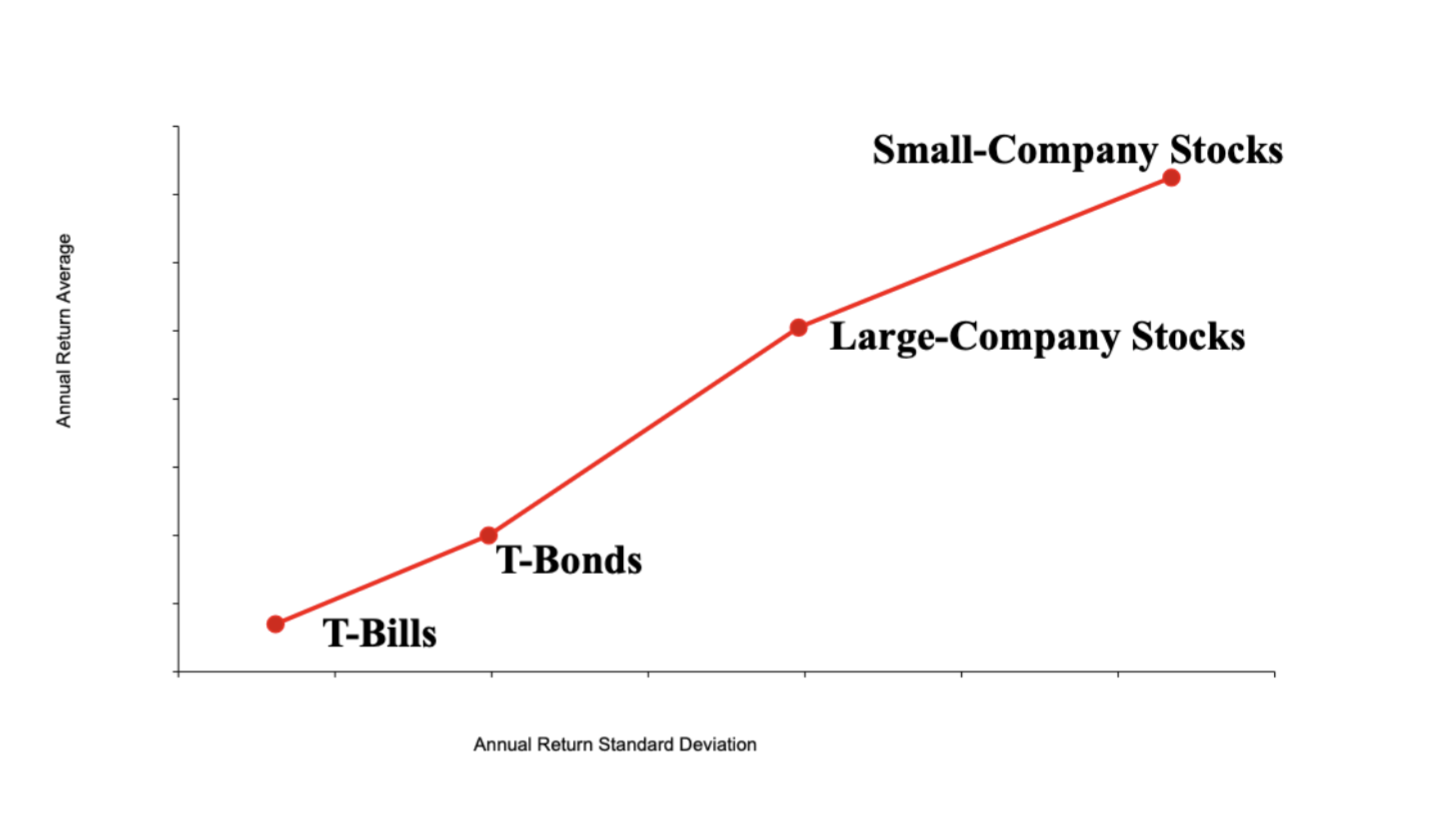

Risk-Return Tradeoff

Higher expected returns means higher risk

Stock portfolios lose money an average of 25%

Bonds (Lower average rates of return(under 6%), Not lost more than 13% of value in any one year)

Market Efficiency

Competitive markets are where investors compete for profits

Competitive markets lead to market efficiency

No overvalued or undervalued securities in an efficient market.

Market price is right and no investor can consistently outperform the market

Market efficiency => Active vs. Passive Investment Management

Example of Active and Passive Investment Management

Active: Mutual fund or hedge fund

Passive: ETF

What are the major players in financial markets?

Business firms, households, governments, financial intermediaries(banks, investment companies, insurance companies)

Where can I invest my money?

1. Cryptocurrencies - Risk Level: Very High

2. Commodities - Risk Level: High

3. Emerging Market Equities - Risk Level: High

4. Individual Stocks (Equities) - Risk Level: High

5. High-Yield Bonds (Junk Bonds) - Risk Level: High

6. Real Estate - Risk Level: Moderate to High

7. Corporate Bonds - Risk Level: Moderate

8. Mutual Funds & ETFs - Risk Level: Moderate

9. Government Bonds (Sovereign Debt) - Risk Level: Low to Moderate

10. Investment-Grade Bonds - Risk Level: Low

11. Cash and Cash Equivalents - Risk Level: Very Low

12. Precious Metals - Risk Level: Low to Moderate

13. Certificates of Deposit (CDs) - Risk Level: Very Low

14. Savings Accounts - Risk Level: Very Low

Equity Securities

Common Stock & Preferred Stock

Common stock

Residual Claim & Limited Liability

Preferred Stock

Priority over common, Fixed dividends: limited gains, nonvoting, tax treatment: corporate tax exclusions on 70% of dividends earned.

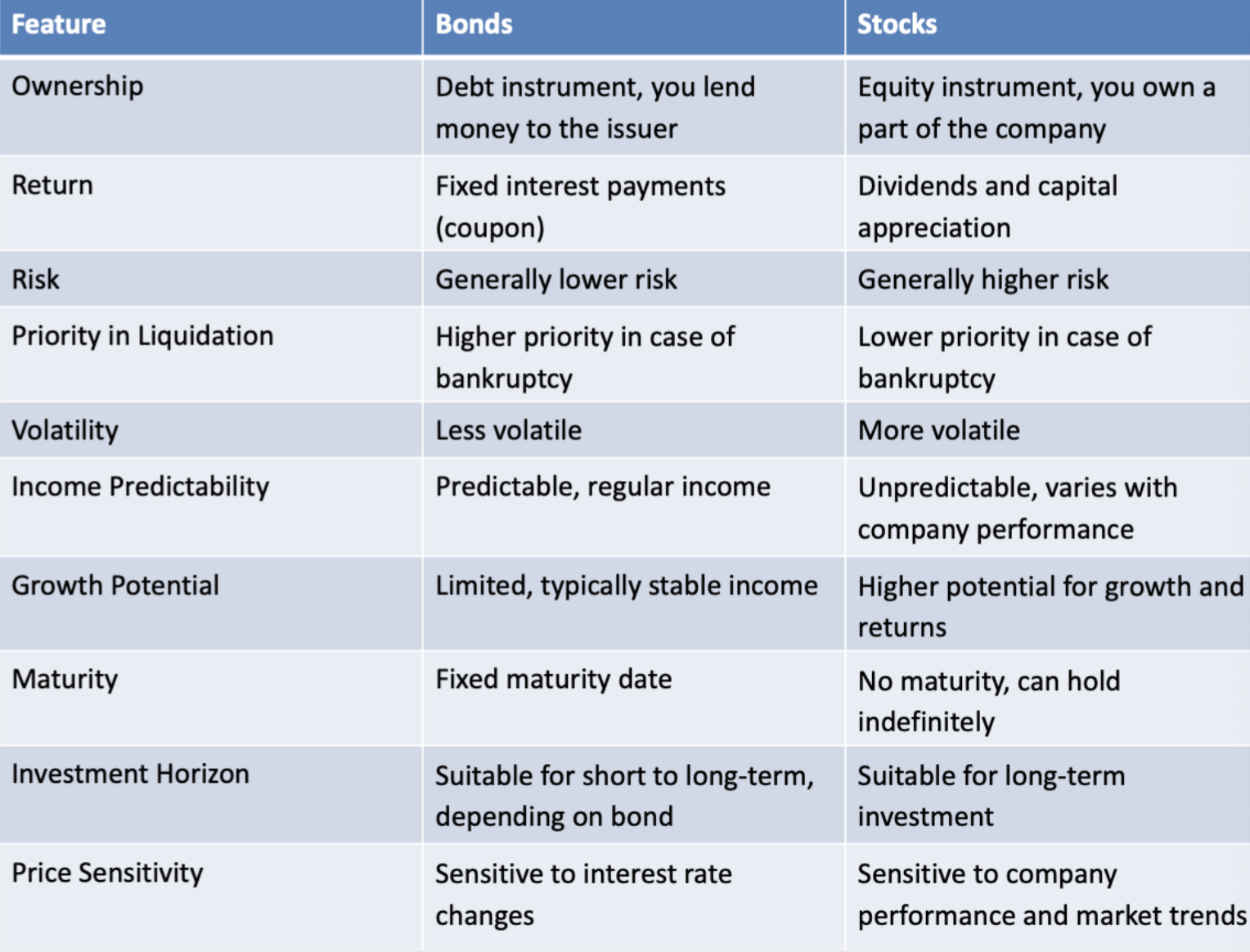

Bonds vs. Stocks

Photo

Money Markets

Subsection of the fixed-income market

Short-term

Highly liquid

Low risk

Often have large denominations

Money Market Securities

T-bills

Certificates of Deposit (CDs)

Commercial Paper or Bill

Repurchase Agreements (Repos)

Bankers' Acceptances

Eurodollar Deposits

Municipal Notes

Federal Funds

London Interbank Offer Rate (LIBOR)

Replaced by Secured Overnight Financing Rate (SOFR)

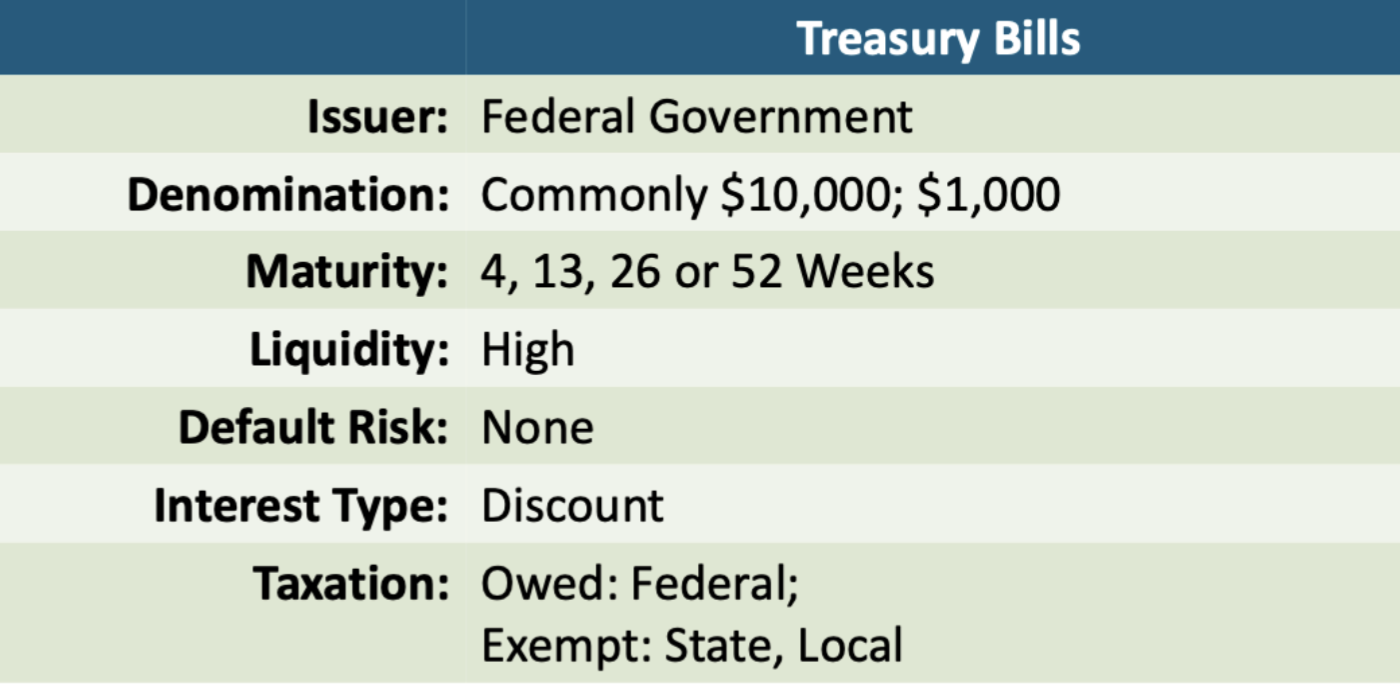

Money Market Securities

Treasury Bills

Look at the photo

Treasury Bonds

Ask prices are always above bid prices

Treasury Bills

Quoted in discount rates(not prices paid)

A high discount rate means a low price paid

Ask discounts are always lower than bid discounts

Bid price

Price paid if I sell

Ask price

Price paid if I buy

Bond Equivalent Yield

Can’t compare T bill directly to bond

360 vs. 365 days

Return is figured in par vs. price paid

Annualize investment gain to make them comparable

Derivative Asset/Contingent Claim

Security with payoff that depends on the price of other securities

Futures Contracts

Purchaser (long) buys specified quantity at contract expiration for set price

Contract seller (short) delivers underlying commodity at contract expiration for agreed-upon price.

Call option

Right to buy an asset at a specified price on or before a specified expiration date

Put option

Right to sell an asset at a specified exercise price on or before a specified expiration date.

Holding-Period Return

Rate of return over given investment period.

Annual Percentage Rate (APR)

Per period rate x Periods per Year

Effective Annual Rate

Actual rate an investment grows

Is there a numerical measure of dispersion to quantify risK?

Variance and standard deviation.

Measuring Risk

In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision.

Investment risk depends on the dispersion or spread of possible outcomes.

Probability distribution

Possible outcomes with probabilities

Expected Return

Mean value

Variance

Expected value of squared deviation from mean

Standard deviation

Square root of variance

Value at risk (VaR)

Measure of downside risk

Worst loss with given probability usually 1 % or 5%

Risk-free rate

Rate of return that can be earned with certainty

Risk Premium

Expected return in excess of that on risk-free securities

Excess return

Rate of return in excess of risk-free rate.

Risk aversion

Reluctance to accept risk. Higher reward to accept higher risk.

Risk vs. Return Trade offs

Look at the image

Sharpe Ratio

A statistic commonly used to rank portfolios in terms of this risk-return tradeoff. A higher ratio indicates a better reward per unit of standard deviation and a more efficient portfolio.

Primary Market

Market for new issues of securities

Secondary Market

Market for already-existing securities

How firms issue securities

Privately held firms

Publicly Traded Companies

Initial Public Offerings (IPO)

What is an Initial Public Offering (IPO)?

Issuer and underwriter put on “road show”

Purpose: Bookbinding and pricing

Underpricing

Post-initial sale returns average 10% or more “winner’s curse”

Easier to market issue => costly to issuing firm

Direct Search Markets

Buyers and sellers locate one another on their own.

Brokered Markets

Third-party assistance in locating buyer or seller

Dealer Markets

Third party acts as intermediate buyer/seller

Auction Markets

Brokers and dealers trade in one location. Trading is more or less continuous.

What are the types of trades that investors execute?

Market Order

Price-contingent Order

What is a market order?

Means to execute immediately at the best available price.

Price-contingent order

Limit order: specifies price at which investor will buy/sell

Stop order: not to be executed until price point hit.

Broker

Buy and sell on behalf of their clients, earns commissions.

Dealers

Buy and sell for their own account, earn profits = bid-ask spread.

Trading Costs

Commission: Fee paid to broker for making transaction. Spread: Cost of trading with dealer. Combination: on some trades both are paid.

Buying on margin

Investors borrows cash from a broker to purchase stocks.

Stocks are used as collateral.

The investor profits from the price difference if the stock price increases.

Short selling

An investor borrows shares from a broker sells them with the hope of buying them back at a lower price (to return to lender)

The investor profits from the price difference if the stock price declines.

Maintenance Margin Requirement (MMR)

Minimum value before additional funds must be added.

Margin Call

Notification from broker that you must put up additional funds or have position liquidated.

If Equity / Stock Value <= MMR

then margin call occurs

Short Sales

Borrow stock from broker, the liability is the borrowed stock. Broker sells stock, and deposits proceeds as Cash. Broker post margin in margin account. Required initial margin and margin call as before. Liable for any cash flows - dividend on stock.

Covering or closing out position

Buy stock; broker returns title to original party.

What are investment companies?

Financial intermediaries that invest the funds of individual investors in securities or other assets. Functions: record keeping and administration, diversification and divisibility, professional management, lower transaction costs.

Net asset value (NAV)

Assets minus liabilities per share.

Open end fund

A fund that issues or redeems its shares at NAV

Closed end fund

Shares are traded at prices that can differ from NAV and may not be redeemed.

Types of Investment Companies

Unit Investment trusts

Managed Investment Companies

Commingled Funds

Real Estate Investment Trusts

Hedge Funds

Costs of Investing in Mutual Funds

Annuaal fees

Loads

Soft Dollars

Annual fees

Paid Each year as a % of funds invested - expense ratios, management fees…. for marketing/distribution costs.

Operating Expenses

Costs in incurred by mutual fund in operating portfolio

Front-end load

Commission or sales charge paid when purchasing shares

Back-end load

“Exit fee incurred when shares

Soft dollars

Value of research services brokerage house provides “free of charge” in exchange for business.