Chapter 15

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

35 Terms

What is the name given to the macroeconomic equation MV = PQ?

basic quantity equation of money

When the central bank lowers the reserve requirement on deposits:

the money supply increases and interest rates decrease.

A central bank that desires to reduce the quantity of money in the economy can:

raise the reserve requirement.

If the economy is at potential GDP and the Central Bank adopts an expansionary monetary policy that shifts aggregate demand to the right, in the long run, the Central Bank will __________________.

create an inflationary increase in price level.

If nominal GDP is 2700 and the money supply is 900, what is velocity?

3

Atlantic Bank is required to hold 10% of deposits as reserves. If the central bank increases the discount rate, how would Atlantic Bank respond?

by increasing its reserves

Regardless of the outcome in the long run, ______________________ is designed to stimulate the economy in the short run.

expansionary monetary policy

What term is used to describe the interest rate charged by the central bank when it makes loans to commercial banks?

discount rate

_______________ will often cause monetary policy to be considered counterproductive because it makes it hard for the central bank to know when the policy will take effect?

Long and variable time lags

Which of the following terms is used to describe the proportion of deposits that banks are legally required to deposit with the central bank?

reserve requirements

When the Federal Reserve announces that it is implementing a new interest rate policy, it is actually targeting a change in the ____________________.

federal funds rate

If the economy is in recession with high unemployment and output below potential GDP, then __________________ would cause the economy to return to its potential GDP?

a loose monetary policy

If nominal GDP is 1800 and the money supply is 450, then what is velocity?

4

According to the basic quantity equation of money, if price and output fall while velocity increases, then:

the quantity of money will fall.

When the central bank decides to increase the discount rate, the:

interest rates increase.

Which of the following is described as an innovative and nontraditional method used by the Federal Reserve to expand the quantity of money and credit during the Great Recession of 2007-2009?

quantitative easing

When a Central Bank makes a decision that will cause an increase in both the money supply and aggregate demand, it is:

following a loose monetary policy.

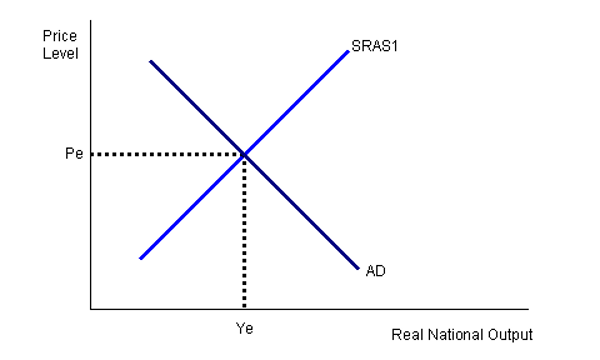

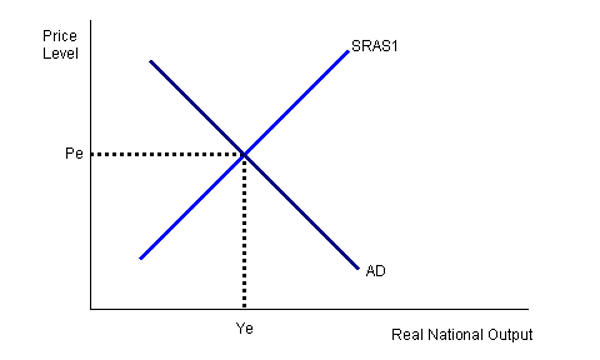

If the economy is at equilibrium as shown in the diagram above, then an expansionary monetary policy will:

reduce unemployment, but increase inflation.

If GDP is 3600 and the money supply is 300, what is the velocity?

12

If a Central Bank decides it needs to decrease both the aggregate demand and the money supply, then it will:

follow tight monetary policy.

When the central bank lowers the reserve requirement on deposits:

the money supply increases and interest rates decrease.

The central bank uses a ____________________ monetary policy to offset business related economic contractions and expansions?

countercyclical

If you were to survey central bankers from around the world and ask them what they believe the primary task of monetary policy should be, what would the most popular answer likely be?

fighting inflation

The quantitative easing policies adopted by the Federal Reserve are usually thought of as:

temporary emergency measures.

When the central bank decides it will sell bonds using open market operations:

the money supply decreases.

When banks hold excess reserves because they don't see good lending opportunities:

it negatively affects expansionary monetary policy.

Regardless of the outcome in the long run, ______________________ is designed to stimulate the economy in the short run.

expansionary monetary policy

Which of the following events would cause interest rates to increase?

a higher discount rate

Which of the following institutions oversees the safety and stability of the U.S. banking system?

The Federal Reserve

The Central Bank has raised its reserve requirements from 10% to 12%. If Southern Bank finds that it is not holding enough in reserves to meet the higher requirements, then it will likely:

borrow for the short term from the central bank.

The central bank requires Southern Bank to hold 10% of deposits as reserves. Southern Bank's policy prohibits it from holding excess reserves. If the central bank sells $25 million in bonds to Southern Bank which of the following will result?

the money supply in the economy decreases

When the central bank decides to increase the discount rate, the:

interest rates increase.

Which of the following is considered to be a relatively weak tool of monetary policy?

altering the discount rate

A central bank that wants to increase the quantity of money in the economy will:

buy bonds in open market operations.

If the economy is at equilibrium as shown in the diagram above, then a contractionary monetary policy will

increase unemployment and decrease inflation.