2.5.2 output gaps

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Actual growth rate

Annual percentage increase in real GDP

→ Reflects economy’s short-term performance - influenced by demand + supply shocks, fiscal + monetary policies + other cyclical factors

Calculated by change in GDP

Long-term trend growth rate

The average rate at which an economy can grow over a sustained period without generating inflationary pressures

→ Determined by factors like tech, labour force growth, capital accumulation + productivity improvements - shown by shifts of LRAS

Key differences between actual growth + trend growth

Actual growth rates fluctuate more due to short-term factors, whilst trend growth rates indicate long-term sustainable growth

Actual growth rates can be highly volatile, whereas trend growth rates are relatively stable

Synonyms for actual growth

Short run economic growth

Growth in national income

GDP growth

Synonyms for trend rate growth

Long run economic growth

Potential growth

Long run trend rate growth

When does an output gap occur?

When actual + potential GDP are different

Positive output gap

Occurs when actual GDP > potential GDP

→ Indicates economy is producing above its sustainable capacity, often leading to inflationary pressures

E.g. during economic booms, such as the late 1990s dot-com bubble, the USA experienced a positive output gap

*temporary e.g. time of war

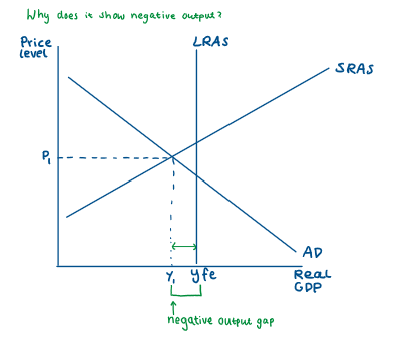

Negative output gap

Occurs when actual GDP < potential GDP

→ Indicates underutilisation of resources, high unemployment, + deflationary pressures

E.g. during the 2008 financial crisis, many economies faced negative output gaps due to reduced demand + high unemployment

Difficulties of measurement

Estimation of potential GDP: not directly observable + must be estimated, leading to potential inaccuracies (hard to quantity the FoP)

Data revisions: economic data is often revised, which can change the assessment of output gaps

Structural changes: changes in the economy’s structure, such as technological advances/demographic shifts can affect potential GDP estimates

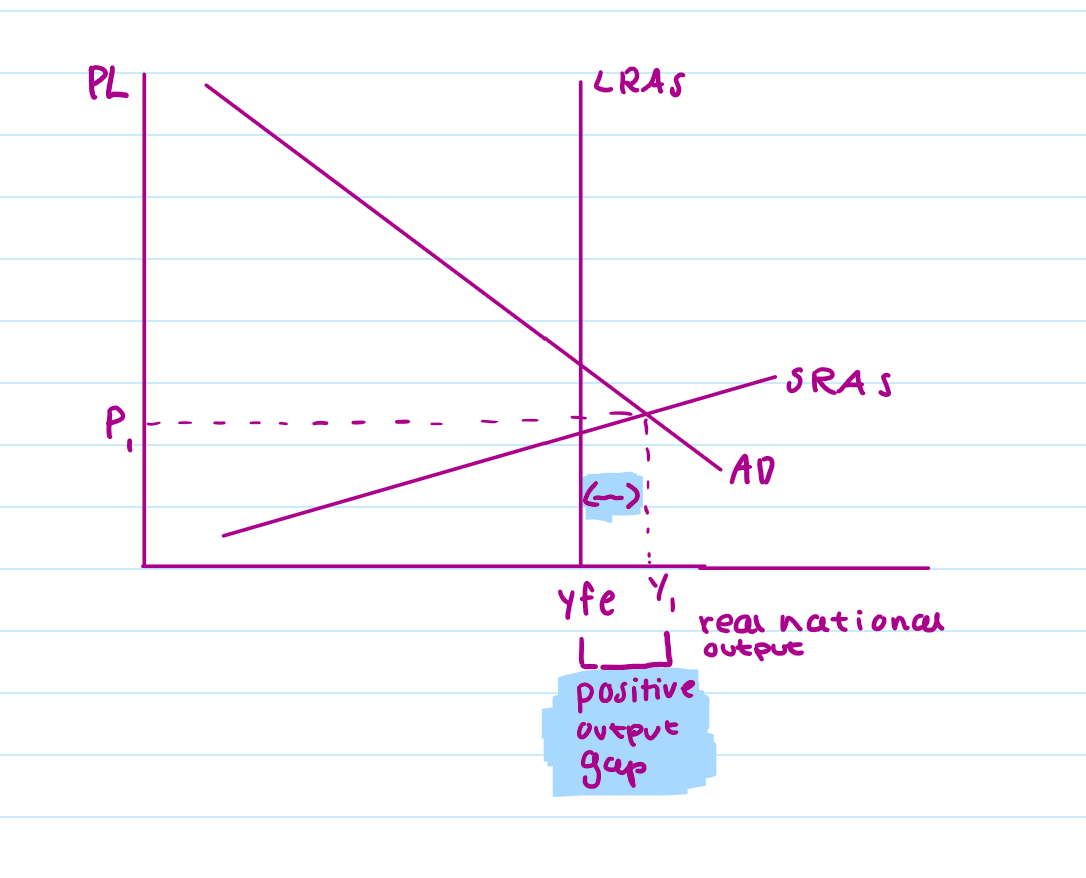

What does a positive output gap look like on a diagram?

Only 1 way

Vertical LRAS: Shows full unemployment output (Yfe) - economy’s productive capacity in long run, vertical line means output cannot increase in long run without effects of inflation

What does a negative output gap look like on a neo-classical diagram?

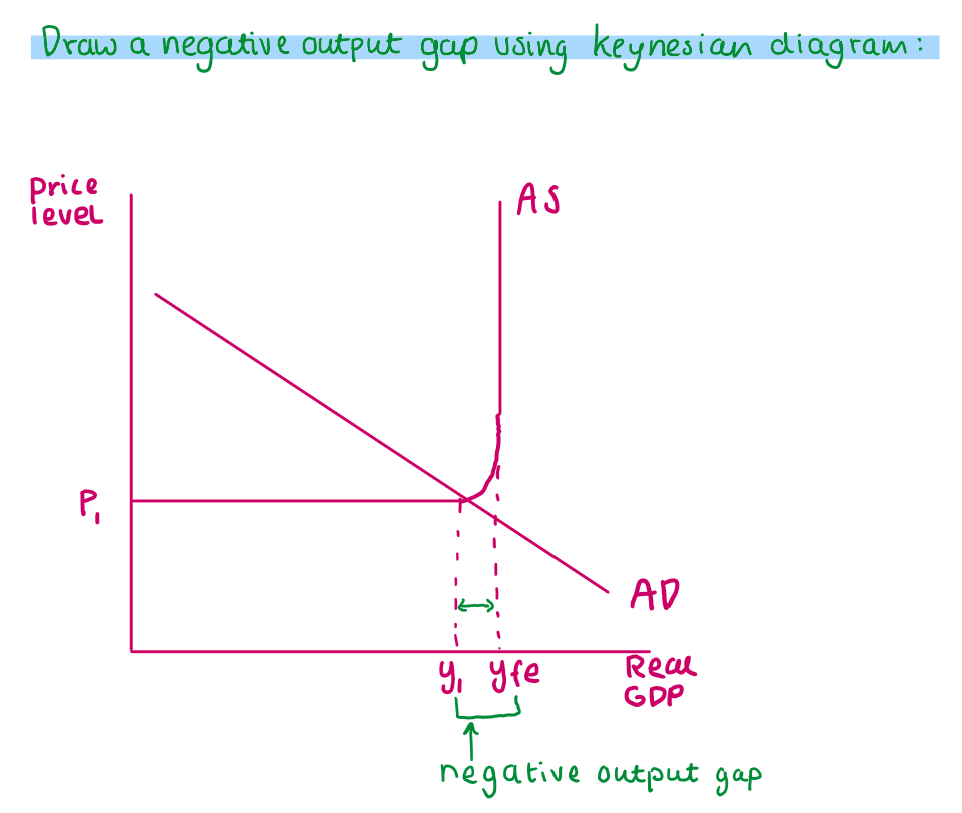

What does a negative output gap look like on a Keynesian diagram?

Real-world example of a negative output gap

During the 2008 financial crisis, the negative output gap was evident as many economies operated below their potential output due to reduced consumer and business spending.

Real-world example of a positive output gap

In the late 1990s, the U.S. economy experienced a positive output gap as high demand and technological optimism drove growth beyond sustainable levels.

What do Neo-Classical economists believe about negative output gaps?

Believe they will correct themselves in the long run

→ As labour + other resources get cheaper, firms will expand production back to LRAS

What do Keynesian economists believe about negative output gaps?

Believe that they might not correct themselves

→ If confidence is very low in economy, it might be that only gov stimulus can help economy

Likely situation during a negative output gap?

Economic growth is relatively low

Unemployment is relatively high (in comparison to maximum possible output)

Inflation is relatively low

Likely situation during a positive output gap?

Economic growth is relatively high/record high

Unemployment is relatively low/zero unemployment

Inflation is relatively high/record high