3.7 Cash flow

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Cash flow

The movement of money into and out of a company in a certain period of time

Negative cash flow

When more money is flowing out than is flowing in

Positive cash flow

When more money is flowing in than is flowing out

What is the difference between profit and cash flow?

Profit and cash flow is not the same. Unlike cash, profit does not take into account at which time the payment is made, as this is a very important factor in cash flow. A company only gets the cash when the actual transaction has been made.

What is important in cash flow?

That businesses have more cash inflow than cash outflow. This is called positive net cash flow

What is a liquidity crisis?

When a company lacks enough current assets to convert into cash to pay for current liabilities. It is a short-term cash flow problem

Net current assets

It can also be called working capital. It is current assets - current liabilities

What is the working capital cycle?

It is the time taken between when a firm is paying for the cost of production, and the time in which they receive cash from customers. If the working capital cycle is short that means that the cash flow is good, as there is not a long lag time between the cost and the time of payment

Why is having too much cash bad?

Because then it shows that not enough cash is being reinvested back into the business, and there would always be an opportunity cost of where to spend it.

Are liquid or illiquid goods better for cash flow?

Liquid goods are better for cash flow, as they can easily be converted into cash

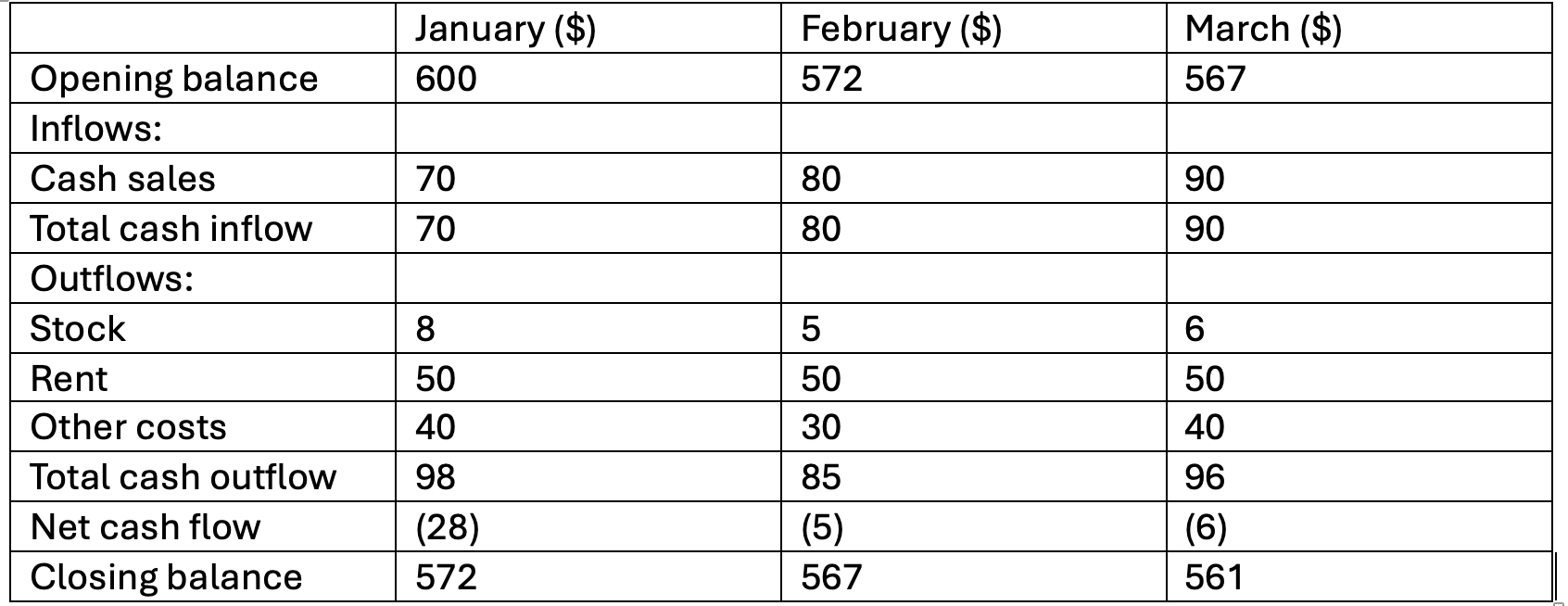

What is a cash flow forecast?

It is a prediction of the amount of cash inflow and cash outflow. It is presented in a table.

Why are cash flow forecasts important for stakeholders?

So that investors know whether the business is worth investing in

So that the bank can know whether the money they loan will be repaid

So that suppliers can see whether you are allowed trade credit or not

So that employees and managers can know whether they will always be paid

In a cash flow forecast, what is opening balance?

It is the amount of cash at the beginning of a trading period

In a cash flow forecast, what is closing balance?

It is the amount of cash at the end of a trading period

What does a cash flow forecast look like?

What are causes of cash flow problems?

Overtrading - when a business expands its sales and operations too quickly, without having enough resources to support the growth

Over-borrowing - when a business loans more money than they have, and the interest rates are too high

Over-stocking - when a business gets more stock than they can sell

Poor credit control - when the business can’t chase up debtor payments

High cash outflows and unnecessary expenses, such as high rent and utility costs

The relationship between investment, profit and cash flow?

If you have good cash flow, then you can make more investments, and then you can get more profits. Then you have better cash flow etc.

What are some ways to improve cash flow?

reduce the debtor time by encouraging debtors to pay earlier

paying back creditors as soon as you have money, so have owe less debts

Sell off excess stock or implement a stock control system

Reduce unneccesary expenses, such as move to a location with cheaper rent or lease instead of buy equipment