Microeconomics

1/80

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

81 Terms

(individual) demand

The demand of an individual consumer indicates the various quantities of a good (or service) the consumer is willing and able to buy at different possible prices during a particular time period, ceteris paribus.

Law of Demand

According to the law of demand, there is a negative relationship between the price of a good and its quantity demanded over a particular time period, ceteris paribus.

Market demand

The sum of all individual demands for a good.

Non-Price Determinants for Demand

Income in case of normal good (direct)

Income in case of inferior good (inverse)

Preferences and tastes

Prices of substitute goods (inverse)

Price of complementary goods (direct)

Number of consumers (direct)

Change in price (Demand)

Change in quantity demanded

(Individual) Supply

The supply of an individual firms indicates the various quantities that a firm is willing and able to produce and sell to the market at different possible prices during a particular time period, ceteris paribus.

Law of supply

According to the law of supply, there is a positive relationship between the quantity of a good supplied over a particular time period and its price, ceteris paribus.

Market supply

the sum of all individual firms’ supplies for a good

Non-price determinants (Supply)

Cost of FOP (inverse)

Technology (direct)

Price of related goods: competitive supply

Competitive supply: The production of one or the other by a firm as goods compete for the same resources

Price of related goods: joint supply

joint supply: production of goods that are derived from a single product

Producer (firm) price expectations (inverse)

Taxes (inverse)

Subsidies (direct)

Number of firms (direct)

Shock

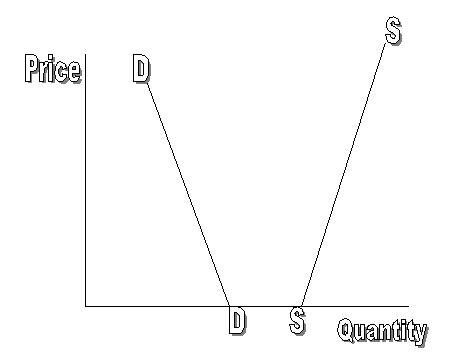

Vertical Supply Curve

As price increases, quantity supplied cannot increase

Fixed quantity of good and no possibility of supplying more of it (ex. Stradivarius violins)

Fixed quantity of good as there is no time to produce more of it (ex. concert tickets)

Competitive market equilibrium

Quantity demanded is equal to the quantity supplied, and ther eis no tendency for price to change.

In market disequilibrium…

There is excess demand (shortage) or excess supply (surplus) and the forces of demand and supply cause the price to change until the market reaches equilibrium.

Free good

A free good is a good for which the quantity supplied is greater than the quantity demanded when the price is zero.

Economic Good

When quantity supplied is smaller than quantity demanded when price is zero.

How do prices and markets achieve the task of resource allocation?

The key to the market’s ability to allocate resources can be found in the signalling and incentive functions of prices in resource allocation. As signals, prices communicate information to decision-makers. As incentives, prices motivate decision makers to respond to the information. (made up examples: strawberries, falling wages)

Price rationing

When the supply of a good is limited, its price increases, which can help to reduce demand and allocate the available quantity to those who are willing and able to pay the higher price

Allocative Efficiency

Allocative efficiency refers to a situation where resources are distributed in a way that maximizes overall societal welfare and utility.

Marginal Benefit

Demand; the highest amount that a consumer would be willing to pay for one additional unit of a good

Since marginal benefit decreases as quantity of a good consumed increases, consumers will be willing to buy an extra unit of the good only if its price falls.

Marginal utility

Supply; Marginal utility is the added satisfaction a consumer gets from having one more unit of a good or service.

Since marginal cost increases as quantity of a good produced increases, producers will. bewilling to produce and sell an extra unit of the good only if its price increases.

Consumer Surplus

The area under the demand curve above the price paid by the consumer, up to the quantity purchased.

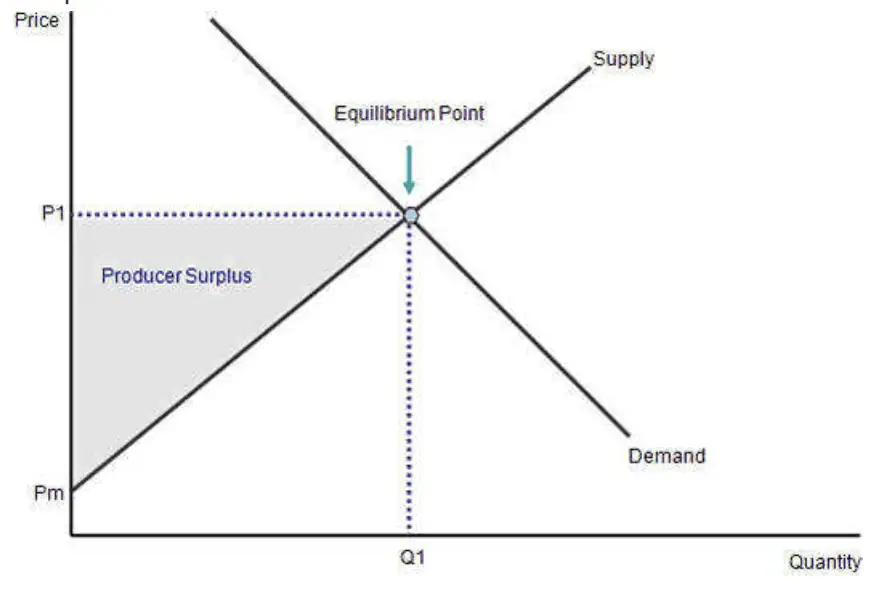

Producer Surplus

The area above the firms’ supply curve and below the price received by the firm up to the quantity produced.

Always refer to the initial supply curve.

Social Surplus

Sum of consumer and producer surplus. When MB = MC, social surplus is maximum.

Welfare Loss

Represents social surplus or welfare benefits that are lost to society because resources are not allocated efficiently.

Price Elasticity for Demand

A measure of the responsiveness of the quantity of a good demanded to changes in it price.

Percentage change in quantity demanded / Percentage change in price

Drop the negative sign!

Range of values for PED

Price Inelastic

PED < 1 (higher slope of demand)

Price Elastic

PED > 1 (lower slope)

Unit Elastic

PED = 1 (Banana)

Perfectly Elastic

PED = 0 (Vertical line)

Perfectly Inelastic

PED = infinity (Horizontal line)

Determinants of Price Elasticity of Demand

Number and closeness of substitutes (more = more elastic)

Necessities vs. Luxuries

Inelastic, Elastic

Longer time period in which consumer makes a pruchasing decision, more elastic

Proportion of income spent on good (Larger the proportion, more elastic)

Total Revenue and PED

TR = P * Q

Elastic Demand - increase in price causes a fall in TR, decrease causes rise

Inelastic Demand - increase in price causes increase

Unit - no change in TR with change in price

Indirect Taxes and PED

Lower the PED of a taxed good, greater the government revenues.

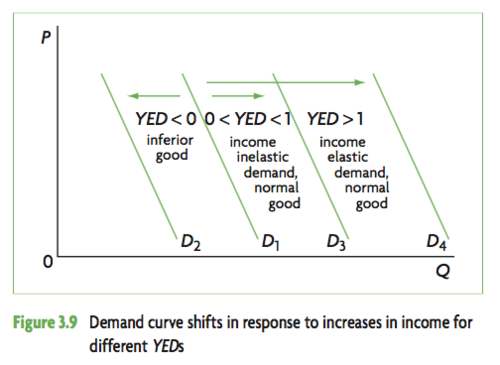

Income Elasticity of Demand (YED)

A measure of the responsiveness of demand of a good to changes in incomes.

Percentage change in quantity demanded of good / Percentage change in income

Categories of Types of Goods with Relation to YED Values

YED > 0

Normal Good

YED < 0

Inferior Good

YED < 1

Necessities (Income inelastic demand)

YED > 1

Luxuries and services (Income elastic demand)

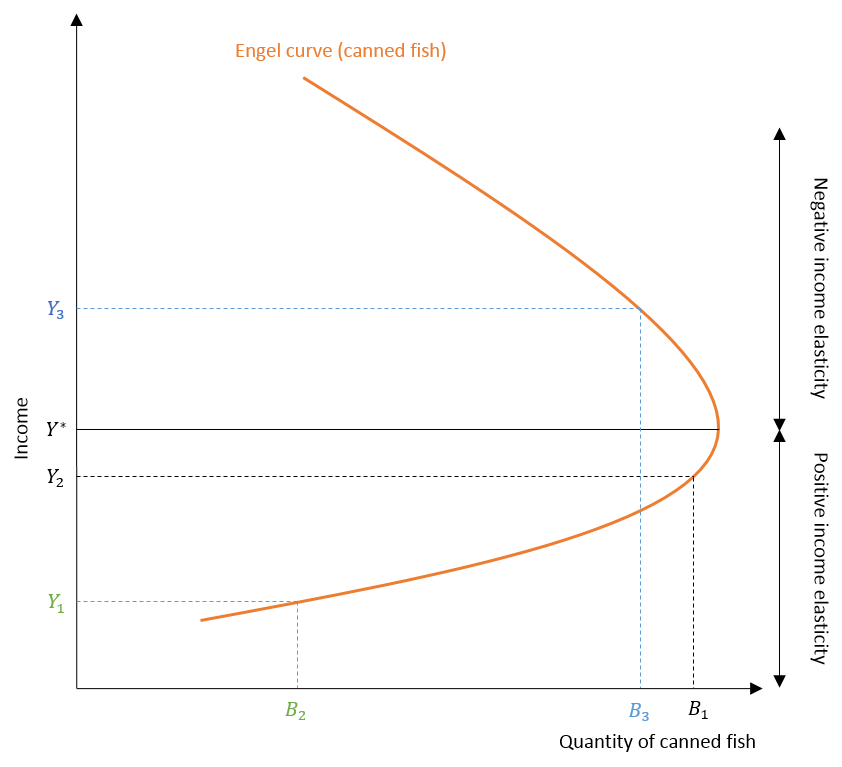

Engel’s Curve

At low income good may be a luxury, as income increases it becomes necessity and then at high income levels it becomes inferior.

Price Elasticity of Supply

A measure of the responsiveness of the quantity of a good supplied to changes in its price.

(same ranges as PED)

Determinants of PES

Length of time

Larger amount of time firms have to adjust their input, larger PES

Mobility of FOP

More easily and quickly FOP can be shifted, higher PES

Spare capacity of firms/Ability to store stocks (direct)

Rate at which costs increase (indirect)

Reasons for Government Intervention

Earn revenue for the government

Provide support to firms

Provide support to households on low income

Influence level of production of firms

Influence level of consumption of households/consumers

Correct market failure

Promote equity

Price controls

The setting of minimum or maximum prices by the government so that prices are unable to adjust to their equilibrium level determinded by demand and supply.

Price ceiling

A maximum price set below the equilibrium price (by the govt.)

Consequences of Price Ceilings - Markets

Shortages

Non-price rationing

Waiting in line/queuing

Distribution of coupons to interested buyers

Favouritism

Underground/Parallel markets

Involves buying a good at the legal price then reselling at a higher price

Underallocation of goods = Allocative inefficiency

Negative welfare impact

Consequences of Price Ceilings - Stakeholders

Consumers

Part gain and loss - those who can buy are able to at a lower price. There are some who have not been able to buy at all.

Producers

Worse off - revenue drop

Workers

Fall in output implying workers are likely to be fired so unemployment

Made-up Examples for Price Ceilings

Rent controls

Housing becomes more affordable

Shortage of housing

Long list of interested tenants

Market for rented units where tenants sublet their apartments above legal maximum (underground market)

Poorly maintained rental housing as unprofitable for landlords to maintain (low revenue)

Food price controls

Price Floor

A minimum price set above the equilibrium price.

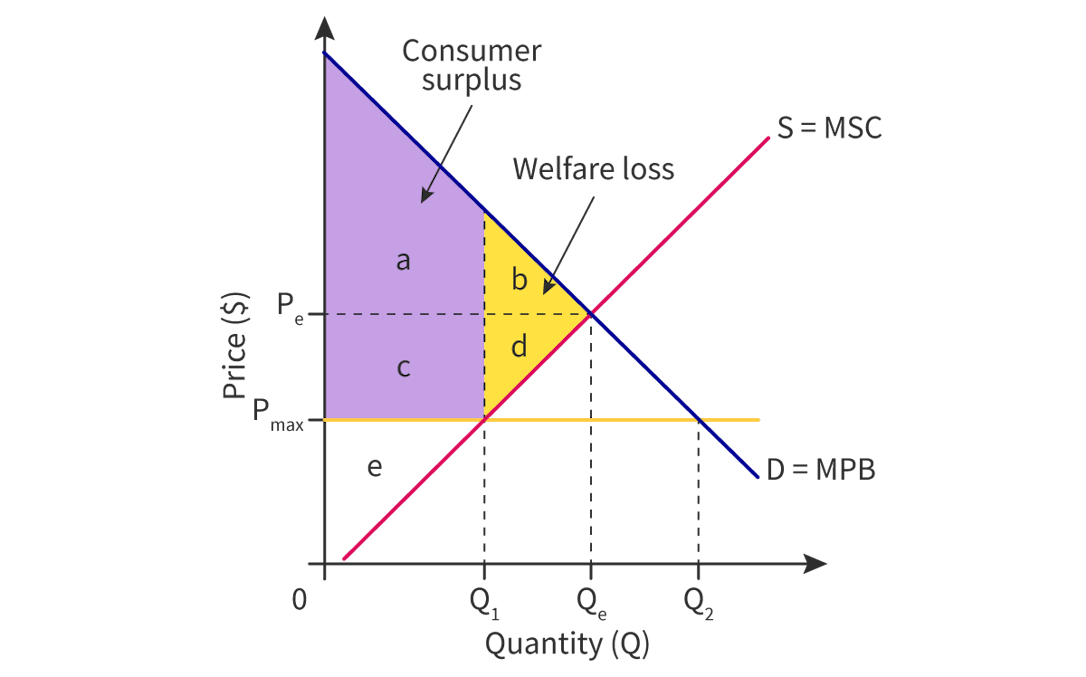

Yellow area is net deadweight loss when government buys it. Otherwise it is c+e

Consequences of Price Floor - Market

Surplus

Government measures to dispose of surplus

Store (additional costs of storage)

Export surplus (sell abroad)

Will require giving subsidy to firms to lower the price as foreign countries would not want to buy at high price

Firm inefficiency - allocative inefficiency - welfare loss

Consequences for Price Floor - Stakeholders

Consumers

Worse off - must pay a higher price for less amount

Producers

Gain - higher price, larger quantity - higher TR

Workers

Gain - employment increase for greater production

Government

Worse off - must see about surplus. Buys yellow area.

Minimum Wages - Price Floor Ex.

Minimum Wage Laws - Determine the minimum price of labour (wage rate) that an employer (a firm) must pay.

Consequences of Minimum Wage - Price Floor Ex.

Labour Surplus and Unemployment

Illegal workers at wages below minimum wage

Illegal immigrants

Misallocation of labour resources

Misallocation in product markets

Firms are worse off (have to pay higher wages)

Workers - mixed (higher wage or unemployment)

Consumers are worse off (an increase in labour costs lead to decrease in supply) - higher product prices

Indirect Taxes

Indirect taxes refer to taxes on expenditure. They are not charged directly on people's incomes or wealth. They are paid indirectly by consumers when they purchase a good, as indirect taxes are included in the price of the good.

![Graph illustrating effects of a tax on supply and demand curves [AI]](https://kognity-prod.imgix.net/media/edusys_2/content_uploads/ibdp.econfe2022.book.2.7.4.aw.14b.58807d31cd24a2a4d5e5.png)

Reasons for imposing indirect tax

Govt. revenue

Discourage consumption of goods that are harmful (demerit goods)

Redistribute income (higher taxes on luxury goods)

Negative externality correction

Consequences of imposing direct tax

Consumers

Worse off - increase in price of good, decrease in quantity bought

Producers

Worse off - Fall in price, fall in quantity of output, decrease in TR

Govt.

Gain - revenue

Workers

Unemployment, Lesser quantity

Welfare loss

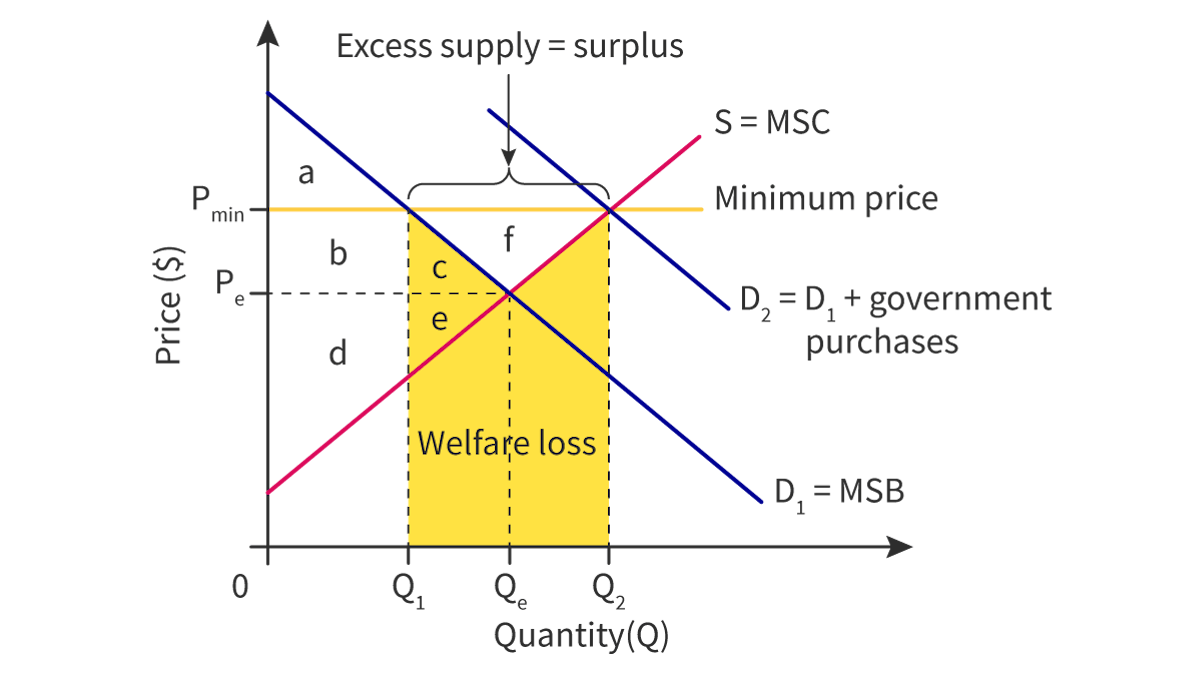

Subsidies

![Supply and demand graph showing effects of subsidy on milk price and quantity. [AI]](https://kognity-prod.imgix.net/media/edusys_2/content_uploads/ibdp.econfe2022.book.2.7.6.aw.17.a5418279fd359663708c.png?w=1344&h=677&fit=&crop=&auto=compress&q=null)

A subsidy is a direct or indirect payment to individuals or firms, usually in the form of a cash payment from the government or a targeted tax cut.

Yellow area is govt. expenditure

Reason for granting subsidies

To increase revenues of producers.

to make basic necessities and merit goods more affordable to low-income consumers.

to encourage the consumption of a good or service that is considered beneficial to consumers.

to support growth of a particular industry.

to encourage exports and protect national industry from foreign competition.

to correct positive externalities, improving the allocation of resources.

Consequences of Subsidies

All benefit except government

Pays for the subsidy. To obtain the revenues for subsidy, the government may have to reduce expenditures elsewhere in economy, or may have to raise taxes, or budget deficit

Welfare loss

Higher price received by producers protects relatively inefficient ones.

Common Pool Resources

Rivalrous: consumption by one person reduces availability for someone else

Excludable: possible to exclude people from the good, usually achieved by charging a price for it

Open Pool Resources

Public Goods

Same as CPR but non-excludable. Free gifts of nature.

Free Rider Problem

Where people enjoy the use of a good without paying for it, typically public goods. This problem arises from non-excludability. Public goods (non-rivalrous, non-excludable) are a type of market failure due to this problem — private firms do not produce these goods, so market fails to allocate resources to their production.

Tragedy of Commons

The tragedy of the commons is an economic problem where the individual consumes a resource at the expense of society. If an individual acts in their best interest, it can result in harmful over-consumption to the detriment of all. This phenomenon may result in under-investment and total depletion of a shared resource.

Private Goods

Rivalrous, Excludable

Quasi-Public Goods

Non-rivalrous, excludable. Often have large positive externalities so may be provided by govt.

Ex. cable TV, uncrowded toll roads, museums

Sustainable Resource Use

Resources are used at a rate that allows them to reproduce themselves so they do not become degraded or depleted

Externality

Occurs when the actions of consumers or producers give rise to negative or positive side-effects on other people who are not part of these actions, and whose interests are not taken into consideration.

MPC, MSC, MPB, MSB

MPC - refer to costs to producers of producing one more unit of good

MSC - refer to costs of society of producing one more unit of good

MPB - refer to benefits to consumers from consuming one more unit of a good

MSB - refer to benefits to society from consuming one more unit of good

MC = MB when there’s no externalities

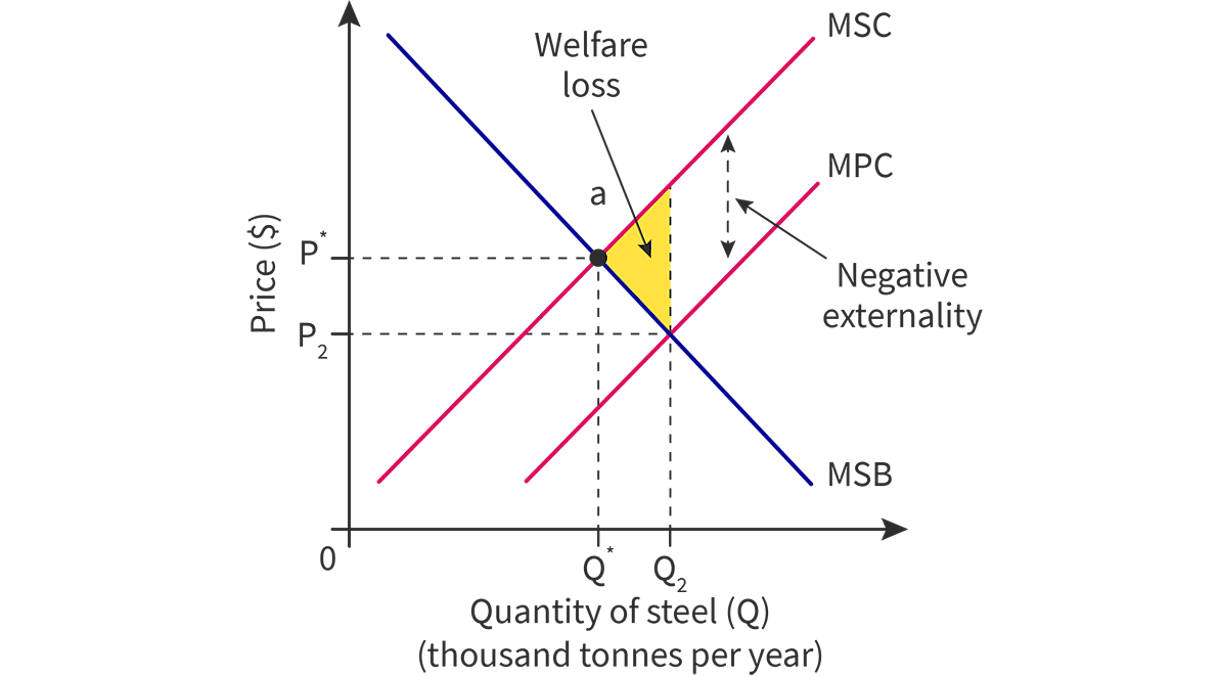

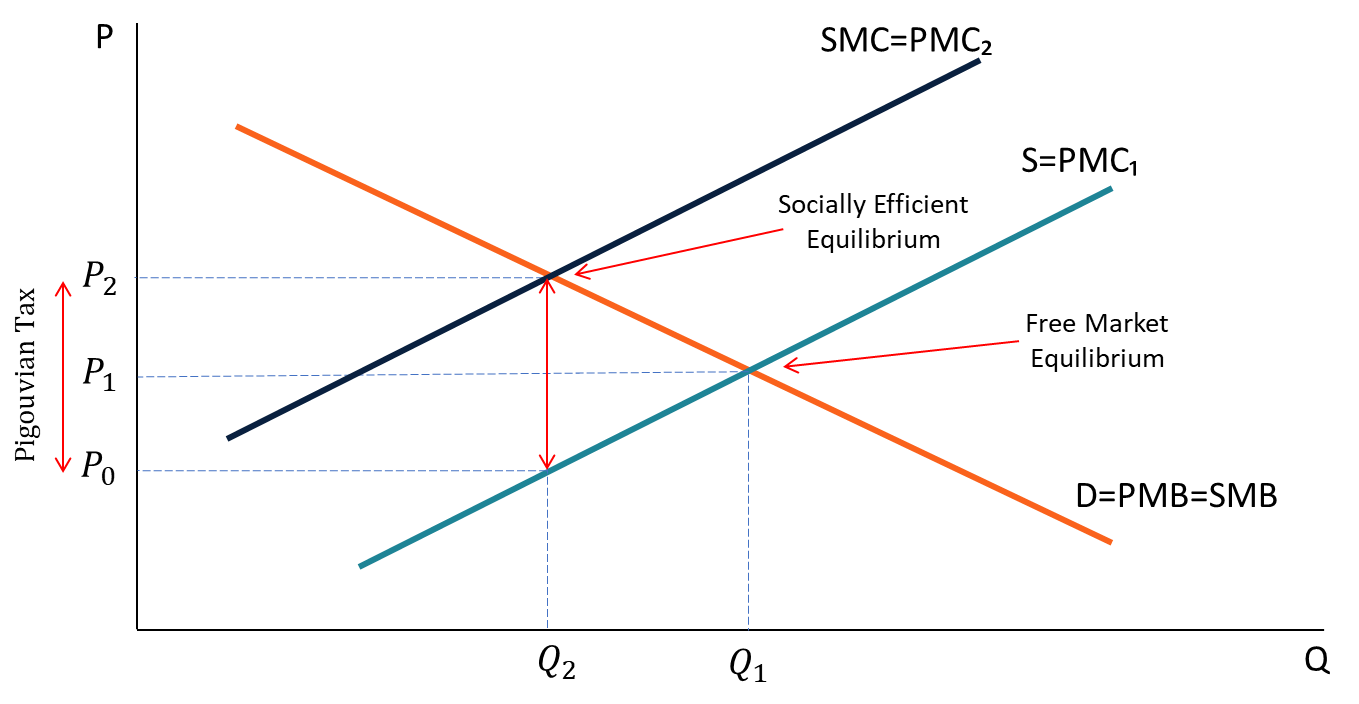

Negative Production Externality

Indirect (pigouvian) Taxes

Refer indirect taxes

Results in lower, optimal quantity of the good produced, and higher optimal price.

Carbon Tax

A tax per unit of carbon emissions of fossil fuels. Creates an incentive for producers to reduce the amount of pollution they create by pruchasing less polluting resources and switching to less polluting technologies. Reduces size of negative externality and increases optimum quantity of the product.

A tax on the output produced does not have this effect; it only corrects overallocation of resources to the good, reducing quantity of output produced.

Benefits of Carbon Tax

Carbon taxes on polluting firms are much easier to apply than other measures, such as tradable emission permits.

Tax revenues from carbon tax will be collected, and can be invested in promoting innovation and new technologies, such as renewable sources of producing energy.

Drawbacks of Carbon Tax

It is often difficult to measure the pollution created and put a value on it to establish the amount of the tax.

It is also difficult to identify which firms are polluting and to what extent each firm is responsible for the pollution.

Taxes make firms pay for the pollution they create but do not actually stop the pollution from taking place.

Tradeable permits / Cap and Trade schemes

The government sets the level of 'admitted pollution' per year and splits the 'permission to pollute' into a number of tradable emission permits. These are allocated to individual firms, which now have a quota of emissions that they are allowed to produce. Firms that pollute less can sell their remaining quota to other firms who need to pollute more. This is why they are called 'tradable'.

Benefits of Tradeable permits

It encourages firms to seek lower-cost methods of reducing emissions, such as better energy efficiency, which will lower their overall production costs.

It helps achieve the environmental objective of reduced emissions at lower costs.

The price of permits is determined by the free market, which allows greater flexibility to firms, because in a period of recession the price will fall due to falling output and in periods of economic boom the price will rise. This flexibility will allow firms to benefit from reducing emissions.

It provides a way for international cooperation to tackle the global challenge of emissions.

Drawbacks of Tradeable permits

To start with, it is difficult to set an acceptable level of pollution.-

It is also difficult to measure a firm's pollution production in order to establish the amount of permits per firm.

Firms pay for the pollution they create but it does not lead to a reduction in pollution once the allowed limit has been set.

Govt. Legislation and Regulation

The government could pass laws relating to environmental standards that firms must comply with in the production process, such as using specific types of machinery, air filters, water processes and disposal methods. To meet these standards, a firm's cost of production would increase, shifting the supply curve upwards.

Drawbacks of Govt. Legislation

The ban or restriction may lead to unemployment in the corresponding industry, as jobs would be lost if firms are closed or the market reduced.

Banning a firm would create non-consumption of the good that was being produced, which might be a good necessary or desirable to consumers.

The cost of setting and then enforcing the policy standards may be very difficult to implement, and/or have a greater cost than the pollution itself.

Education and Awareness (NPE)

Advantage: firms are very much influenced by opinions of their customers

Disadvantage: is not as effective or widespread of a solution compared to the others.

Negative Consumption Externality

Demerit Goods

Considered undesirable by consumers but overproduced by the market.

Demerit goods are products that have harmful effects on consumers or society when they are consumed, leading to a negative externality

Banning/Regulating good

The government could directly stop the consumption of goods by making them illegal. This would make the externality disappear completely, as the good would no longer exist on the market, unless a black market arose (depending on the nature of the good). Alternatively, the government could regulate the consumption of the product by introducing legislation.

Problems with this solution:

This would have a large effect on the corresponding industry in terms of shareholders and employment.

It might have a big effect on the government's revenue as it would receive fewer or no taxes from this market.

Banning the good might cause a negative reaction from consumers if they perceive the banning of the good as restrictions on their liberties and rights. This could have a negative effect on the government's future election prospects, as consumers are also voters, which makes it unlikely that governments will choose this option.

Regulations will need to be enforced and this may impose an additional cost on the government.

Problems with Indirect Tax (NCE)

When the good is addictive, such as cigarettes, its demand tends to be price inelastic, and an increase in price will not reduce the quantity consumed very much.

If taxes are raised too much, consumers might look for other illegal sources of supply, causing black markets to appear.

Taxes make people pay for the external cost they create but do not stop the negative effect from taking place, as there will still be people using or consuming the good.

Education Awareness / Advertising (NCE)

Problems with this solution:

The costs of these solutions might be high and generate an opportunity cost for the government. However, if these goods were taxed as well, then the revenue generated could be used to fund these measures.

There is always a level of doubt about how effective advertising is at reducing demand, especially in cases such as cigarette consumption within certain age groups. Many studies show that advertising does not have a great effect on teenagers in reducing cigarette consumption.

Positive Production Externalities

![Graph showing positive externality in honey production with MPC, MSC, and MSB curves. [AI]](https://kognity-prod.imgix.net/media/edusys_2/content_uploads/ibdp.econfe2022.book.2.8.3.aw.05.d2b7a5496263c9175d16.png?w=1344&h=677&fit=&crop=&auto=compress&q=null)

Direct Govt. Provision

The effect on the market outcome would be similar to the effect of subsidies: the MPC would shift outwards towards the MSC, reducing the externality, as the government would pay for such investment, reducing firms' costs of production.

Problems with this solution:

The cost for the government might be high and create an opportunity cost, as in the case of subsidies.

The government might lack the expertise found in firms, which are specialised in their area of knowledge.

Private firms might be dissuaded from investing in these areas themselves because of this government policy.

Subsidy

Problems with this solution:

It is very difficult for the government to estimate the level of subsidy deserved by every firm.

Each subsidy uses government funds and therefore they have an opportunity cost; the government would have to cut back on other expenditures that might be important, such as health care.

Positive Consumption Externalities

![Supply and demand graph with positive externality in healthcare. [AI]](https://kognity-prod.imgix.net/media/edusys_2/content_uploads/Screen%20Shot%202023-04-05%20at%2011.52.02%20PM.d77f21b301abdc84ca94.png)

Correction for PCE

Legislation (Govt. Regulations)

This solution is less likely to be successful unless the government provides the goods and services free of charge.

Some people might resent laws of this type if they see them as an infringement of their civil liberties.

There is the additional cost of enforcing the law.

Positive Advertisement

Correction for Public Goods

Direct Govt. Provision

Advantages

Disadvantages

Improves social welfare as consumption is increased.

Has to be financed, which generates an opportunity cost.

Eliminates the free-rider problem.

Government provision may not be economically efficient, as the government is unable to determine the optimal output.

Can be more efficiently provided because the government, as the sole provider, can achieve economies of scale.

Some quasi-public goods, like toll highways, could be provided more efficiently by private firms

Contracting out to Private Sector