Questions

1/17

Earn XP

Description and Tags

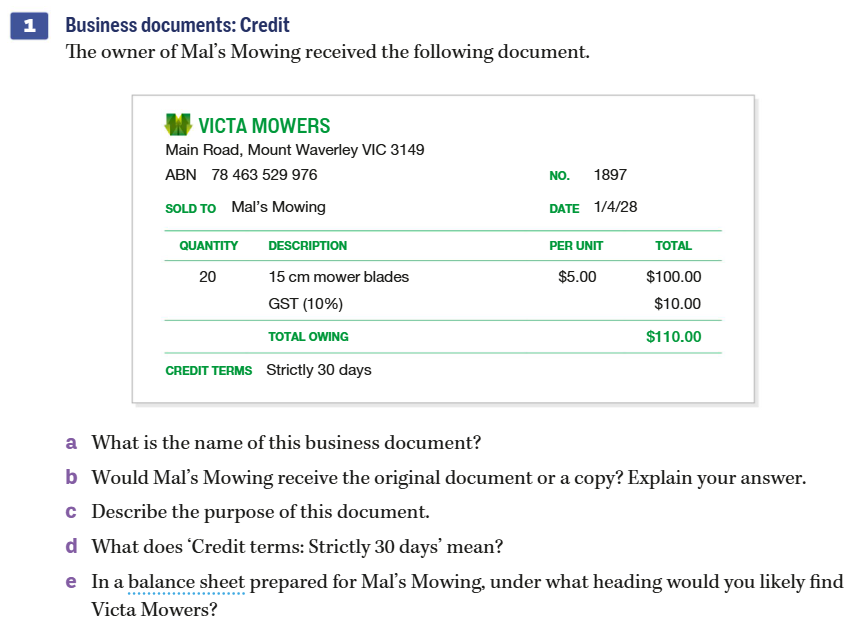

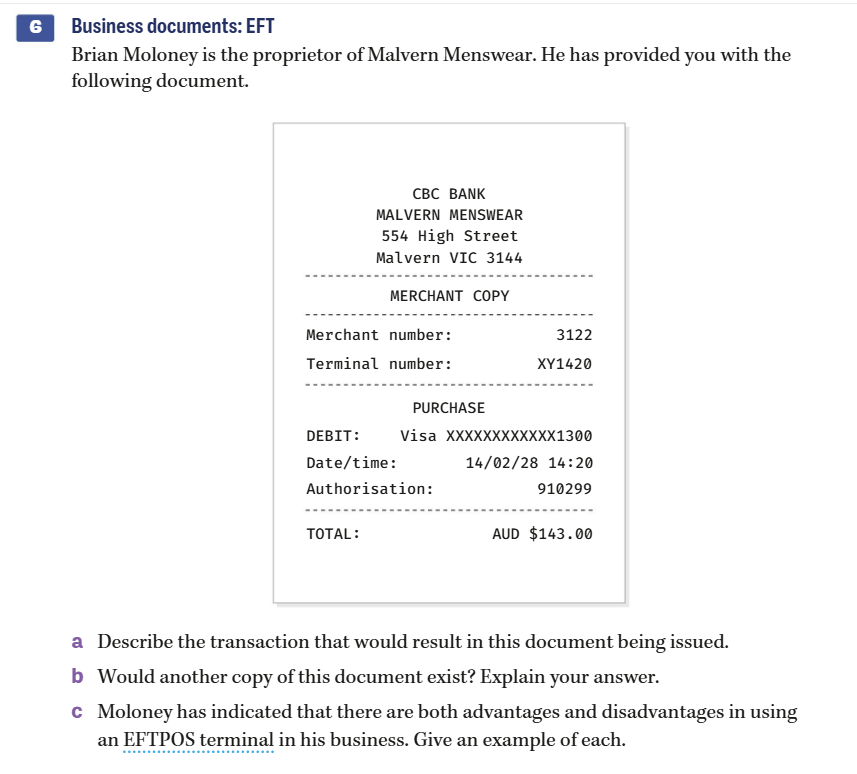

• define single entry accounting [4.1] • explain the role of cash journals in single entry accounting [4.1] • identify source documents used by a small business [4.2] • identify other documents used by a small business [4.3] • describe a basic accounting system for a small business [4.4] • identify the information flows that occur between businesses [4.4] • explain the role of computers in small business accounting [4.4]. [4.1] Many small businesses use single entry accounting. The system consists of two multi-column cash journals that record relevant transactions for a period. The cash receipts journal records money coming in, while the cash payments journal records money going out. [4.2] Source documents provide evidence of financial transactions and are used to create business records. The most common source documents for a small business are EFT payment records, receipts, invoices and credit notes. [4.3] Businesses may also use other types of business documents, such as purchase orders, delivery dockets, statements of account and bank statements. Most of these are not considered source documents, but some may be used to verify transactions. [4.4] The purpose of an accounting system is to track the flow of information and produce financial reports. Some small businesses use manual accounting systems, but many now use simple, affordable software packages and resources.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

What are common source documents?

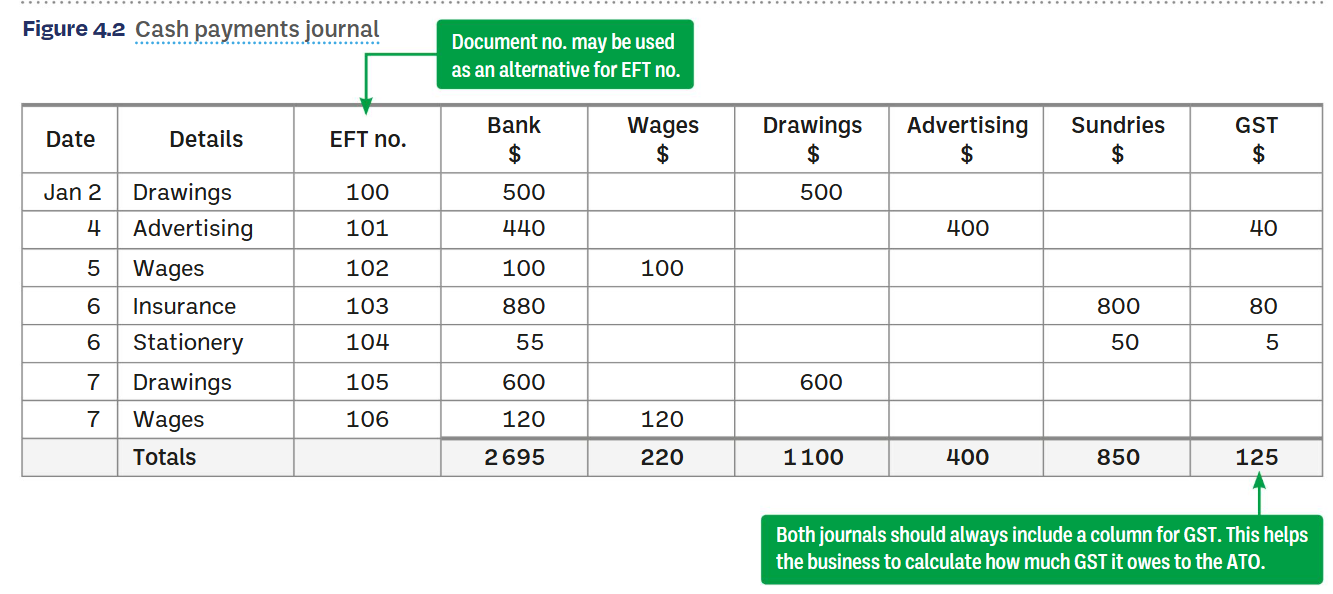

EFT payment records

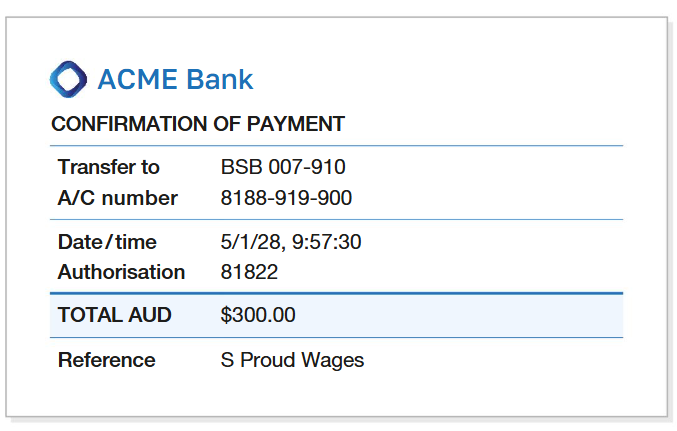

receipts

copies of EFT receipts

invoices

credit notes

What are the 2 record types in single entry accounting?

cash receipts journal

cash payments journal

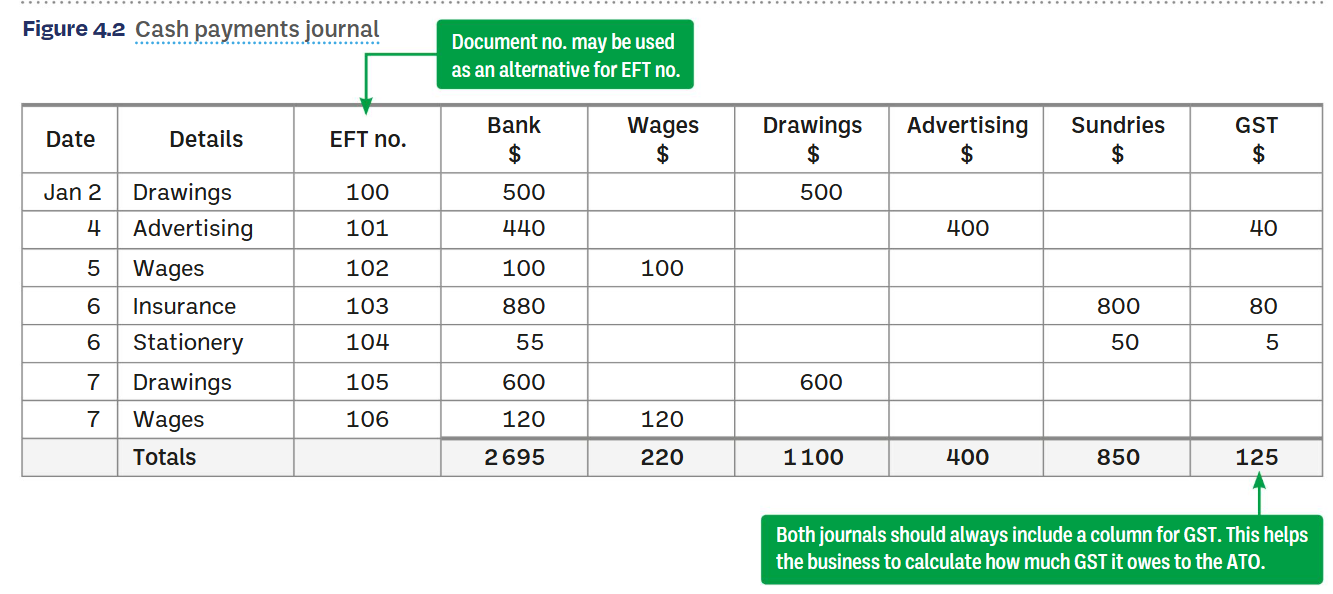

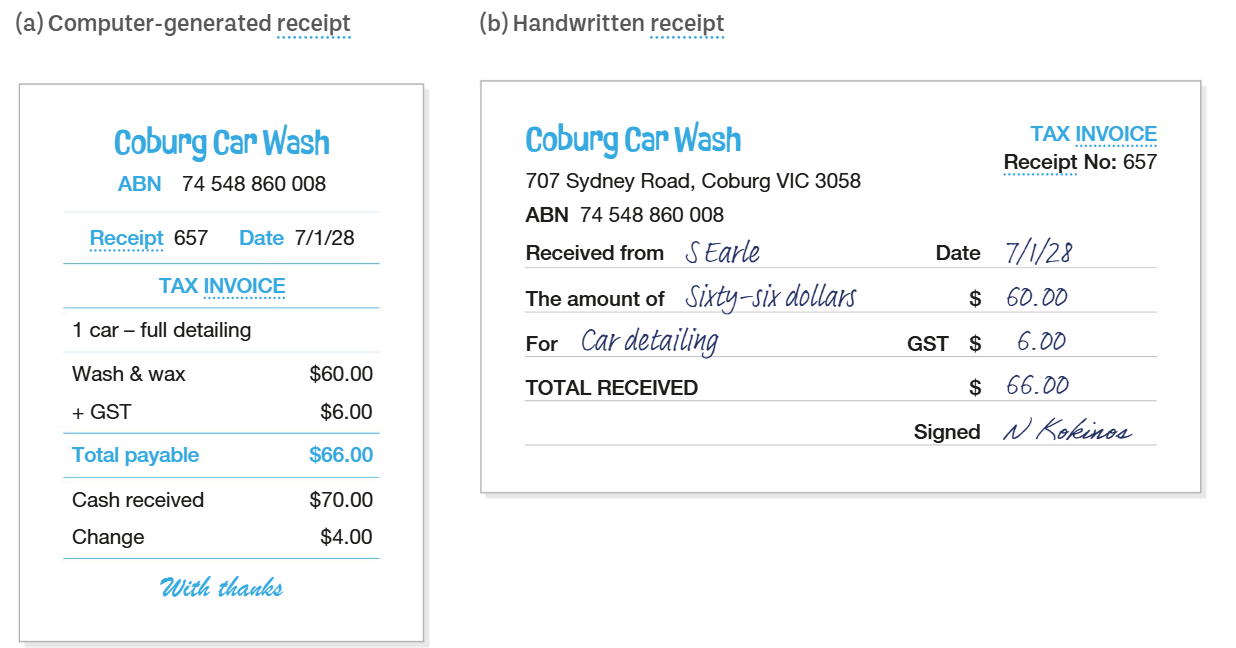

What does a cash payments journal look like?

What does a cash payments journal look like?

What does an EFT confirmation of payment look like?

What can a receipt look like?

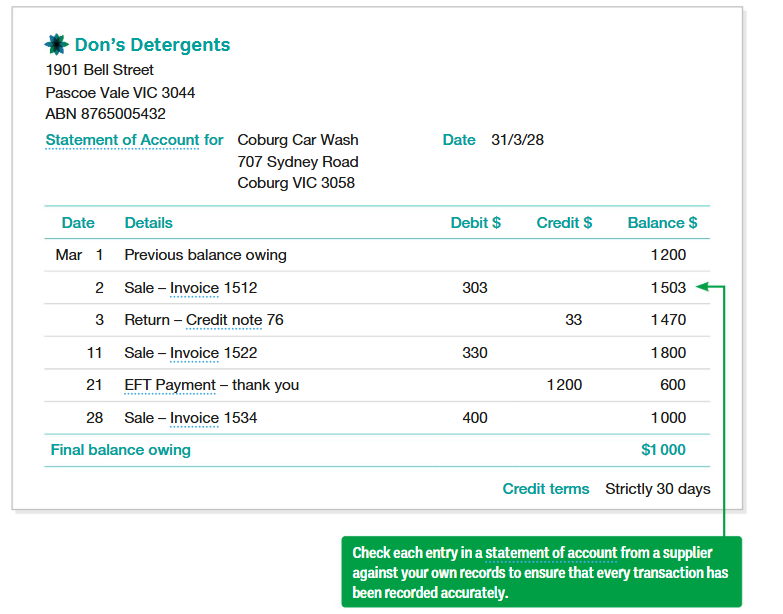

What pieces of data must be recorded from a receipt?

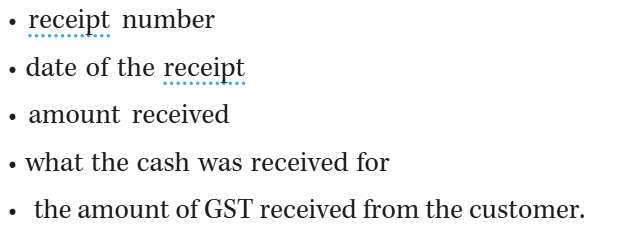

What does an EFTPOS receipt look like?

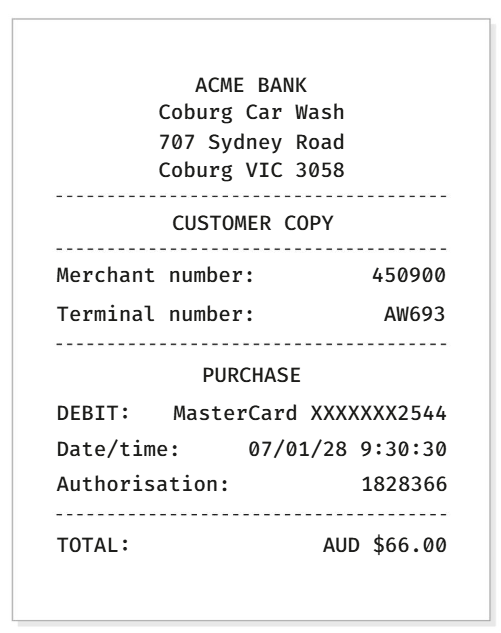

What does an invoice look like?

Which bus. docs aren’t considered source docs and aren’t put on the balance sheet?

Purchase orders

Delivery dockets

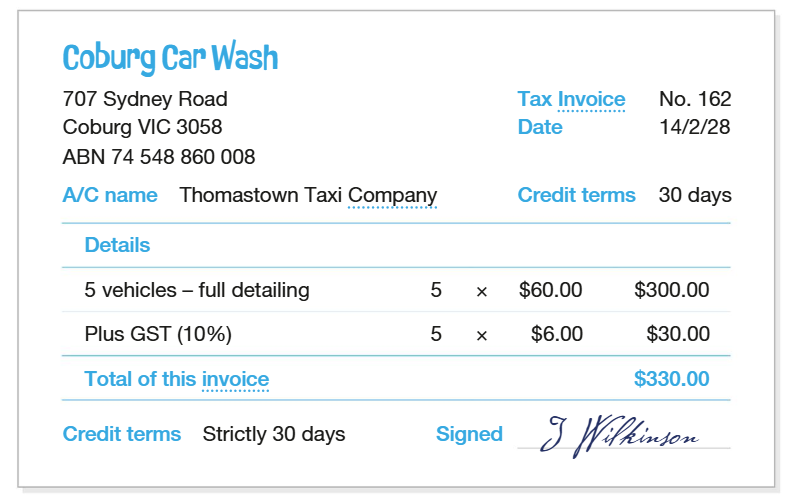

What does a Statement of Accounts look like?

Business documents, such as invoices, receipts, and contracts, provide clear evidence of transactions, ensuring that financial information can be independently verified. These documents help meet the qualitative characteristic of verifiability by offering objective, reliable proof that can be cross-checked by external parties, like auditors or regulators.

What are the headings in the Cash Journals

Top:

Date

Details

Receipt Number/Doc. num/EFT #

Bank

Subtopics (Catagories)

Sundries

GST

Bottom:

Totals

For document number, what must you write?

As this is general document numbers, you must write Rec 190 or Dir DB

In the details column, what must you write?

You must write exactly as the source document states and be specific don’t be general.

Do drawings have GST on them?

No. Actions taken by the owner do not have GST on them. This includes drawings and capital contribution.