ECON 0200 Monetary and fiscal policy

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

short run non neutrality of money

the idea that the supply of many can influence real variables in the short-run

classical monetary policy

money does not affect long-run real activity

modern monetary policy

money can affect short-run real activity

Remember the Fed’s mandate from Congress is to promote

• Stable prices

• Maximum employment

Prices are a ____, but employment is a ___

nominal variable, real variable

The Fed, whose only tools are monetary, is

required to affect real activity

Since the 1990s, the Fed uses the federal funds rate to

set monetary policy

How does this work? Suppose the Fed raises the FFR

Now it is more expensive for banks to lend to one another overnight

• This increases their incentive to hold onto reserves

• In turn, the supply of loans to consumers falls

• Since loans create money, fewer loans means less money in circulation

• In the short-run, businesses close or shrink, lowering employment and output

The 2008 financial crisis caused a deep recession

• The Fed responded by slashing the FFR to zero

• But financial markets were such a mess that bond rates refused to fall

In this case cutting the FFR

wasn’t sufficient to get market interest rates down

To try and further stimulate the economy, the Fed tried two new policies

• Quantitative easing

• Forward guidance

quantitative easing

the policy tool where the Fed purchases assets other than treasuries in an effort to lower market interest rates

simplified intuition

The Fed may cut the FFR all the way to zero, but market rates are still high

• How can it lower market rates? Step into the market and buy assets

• The Fed can buy so much that its demand alone forces the price down

This was first introduced post-2008 when

the Fed bought mortgage-backed securities (MBS)

forward guidance

when a bank makes announcements about future monetary policy in an attempt to affect current interest rates

recall from homework

If you expected next year’s interest rate to change

• That should affect today’s price of a multi-year bond

• This is precisely forward guidance in action

Since asset prices rely on present value

announcements about future rates should change asset prices today

Fed policy statement

After each FOMC meeting, Fed release the policy statement

• It announces what the FFR will be, as well as what they’re watching in the economy

• Very closely watched document by investors

Every other FOMC meeting, they release

the summary of economic projections

summary of economic projections

• It anonymously conveys each FOMC member’s personal view of the economy

• The most closely watched component is

the “dot plot,” where each member writes down their estimate for “appropriate” future FFR

• Newspapers take this as Fed’s planned rates, but that’s not correct

monetary policy report

Twice a year, the Fed releases a report to Congress on its current stance of monetary policy

• The Fed chair has to testify before House and Senate committees, answer questions on the Fed’s outlook and policy decisions

People enjoy “loose” monetary policy, where

interest rates are low

Mortgages are cheaper, people can more easily buy houses

• Cheaper to start new businesses

The problem: loose monetary policy is

inflationary

When the economy starts to “run too hot,” the Fed has to raise rates

• Very unpopular with households and businesses

Monetary policy is like

medicine for the economy: bitter, but necessary

central bank independence

the concept that central banks should be free from political influence and set monetary policy at their own discretion

Politicians may have

different incentives than the CB

examples

In the run-up to an election, they may want low rates

• This makes people happier, creates short-run boom in the economy

• The problem? This puts upward pressure on inflation

• And harms the CB’s reputation, people expect future low rates too

Central banks need independence to

fight inflation when needed

fiscal policy

the set of policies and tools governments use to both raise funds and allocate how they’re spent

fiscal policy functions

Building public infrastructure

• Paying for social programs and benefits

• Keynesian perspective: breaking out of recessions (next week)

political opinions on this

Inefficient and unnecessary, crowds out better private solutions

• Necessary, solves coordination problems private markets can’t

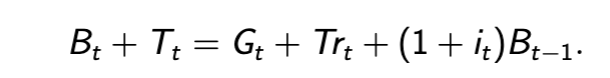

government budget contraint

equates a government’s spending to the revenue it raises

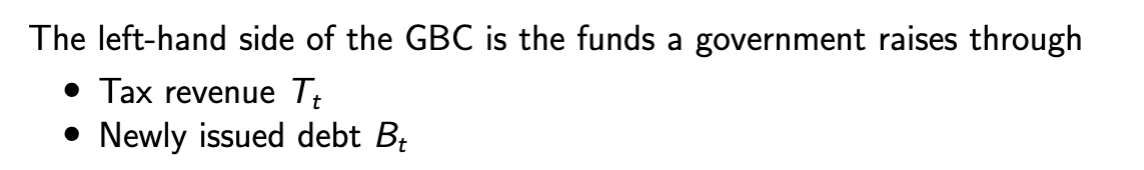

right hand side

funds a government spends through…

left hand side

funds a government raises through…

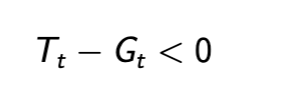

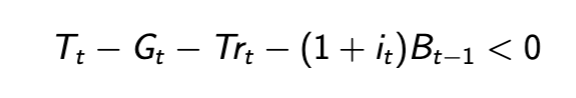

government is running a deficit when

extension

so in this case taxes raised by gov aren’t enough to

what to do in deficit?

issue more debt

paying for fiscal policy in U.S.

Congress votes on any proposed spending in Gt , Trt

• The Treasury is in charge of paying for these policies

• If Congress’s tax policy doesn’t cover the bills, Treasury needs to issue debt

• Weirdly, Congress has to then approve issuing debt to pay for spending they’ve already approved

approving debt

is unique to the U.S.

this is further complicated by

the debt ceiling

We’ve had to raise the debt ceiling many times, each time markets get jittery

broad consensus about debt

Not only is government debt not bad, but

• It’s actually desirable as long as are investors confident they’ll be repaid

no consensus on

How much debt is too much?

• Do persistent deficits matter for the price of debt

Despite being set separately,

monetary and fiscal policy interact

Look at the debt repayment term in the GBC

the central bank raises interest rates, market rates rise as well

• Including the interest paid on government debt

• So, by tightening policy, the CB can make it harder to pay back gov’t debt

If interest rates rise, we say

the government’s fiscal capacity gets smaller

in economic theory this is

a gray area—no consensus on how to handle this