Managerial Accounting Ch.1

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

Why is Managerial Accounting Important: (management responsibilities) Operational Planning

Focuses on short- term action. dealing with day-today operations (1 year)

Why is Managerial Accounting Important: (management responsibilities) Strategic Planning

Developing long-term strategies to achieve company goals (3 years)

Why is Managerial Accounting Important: (management responsibilities) Directing

Running the day to day operations of a company

Why is Managerial Accounting Important: (management responsibilities) Controlling

Monitoring the day to day operations and keeping the company on track

Why is Managerial Accounting Important: Managerial accounting

Focuses on internal user, managers & employees

Why is Managerial Accounting Important: Purposes of managerial accounting

Give info to management so they can plan better for operations within their company

Why is Managerial Accounting Important: Focus & time dimension of the info of managerial accoutning

Managers need relevant info and focus on the future (proving the business in the future)

Why is Managerial Accounting Important: Rules & restrictions in managerial accounting

Does not need to follow GAAP n=and less restrictions

Why is Managerial Accounting Important: scope of info in managerial acc.

Managers need detailed reports on parts of the company on a daily or weekly basis, broken down into diff departments, territories and products

Why is Managerial Accounting Important: behavioral in managerial accounting

Concern about how reports will affect employee behavior

How are costs classified: Business are classify as a?

Service company, merchandise company or manufacturing company.

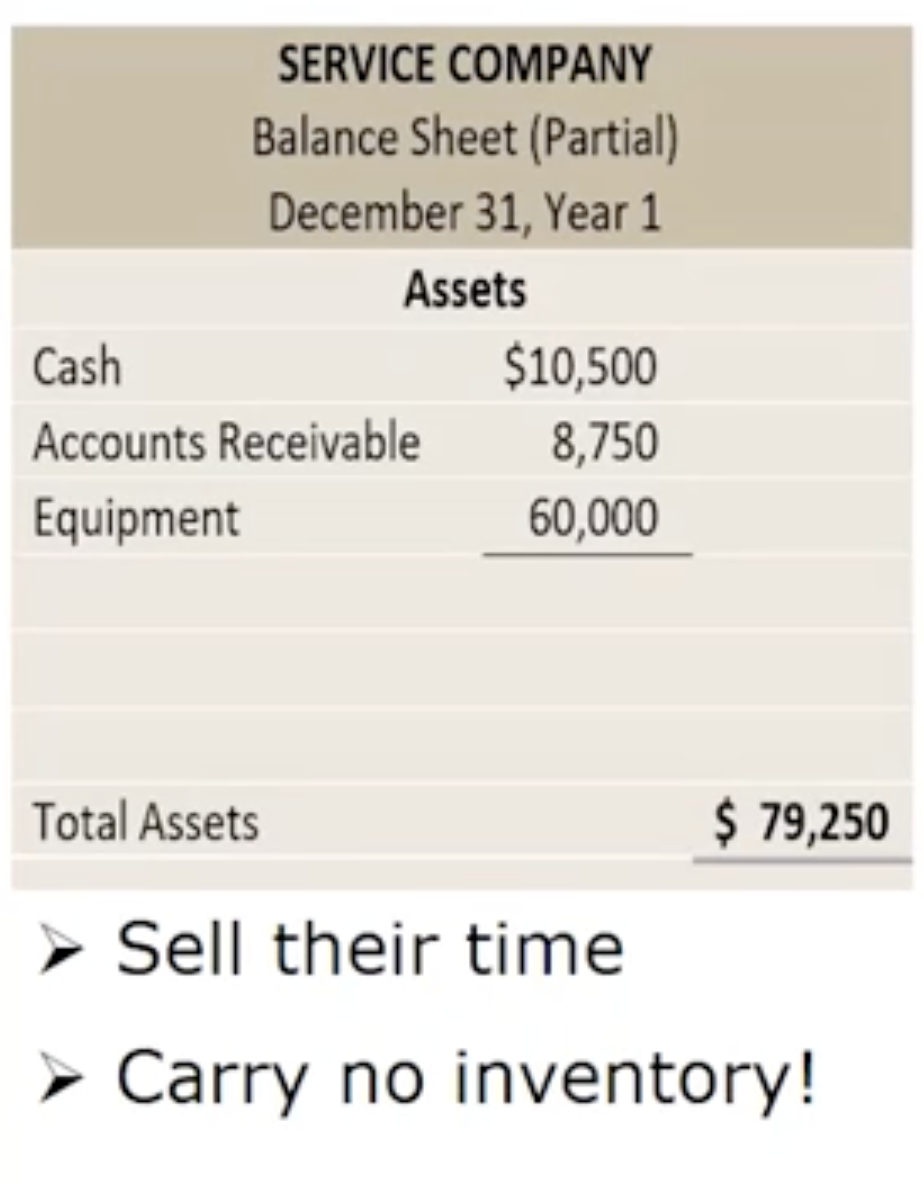

How are costs classified: Service company

They DO NOT carry any inventor7

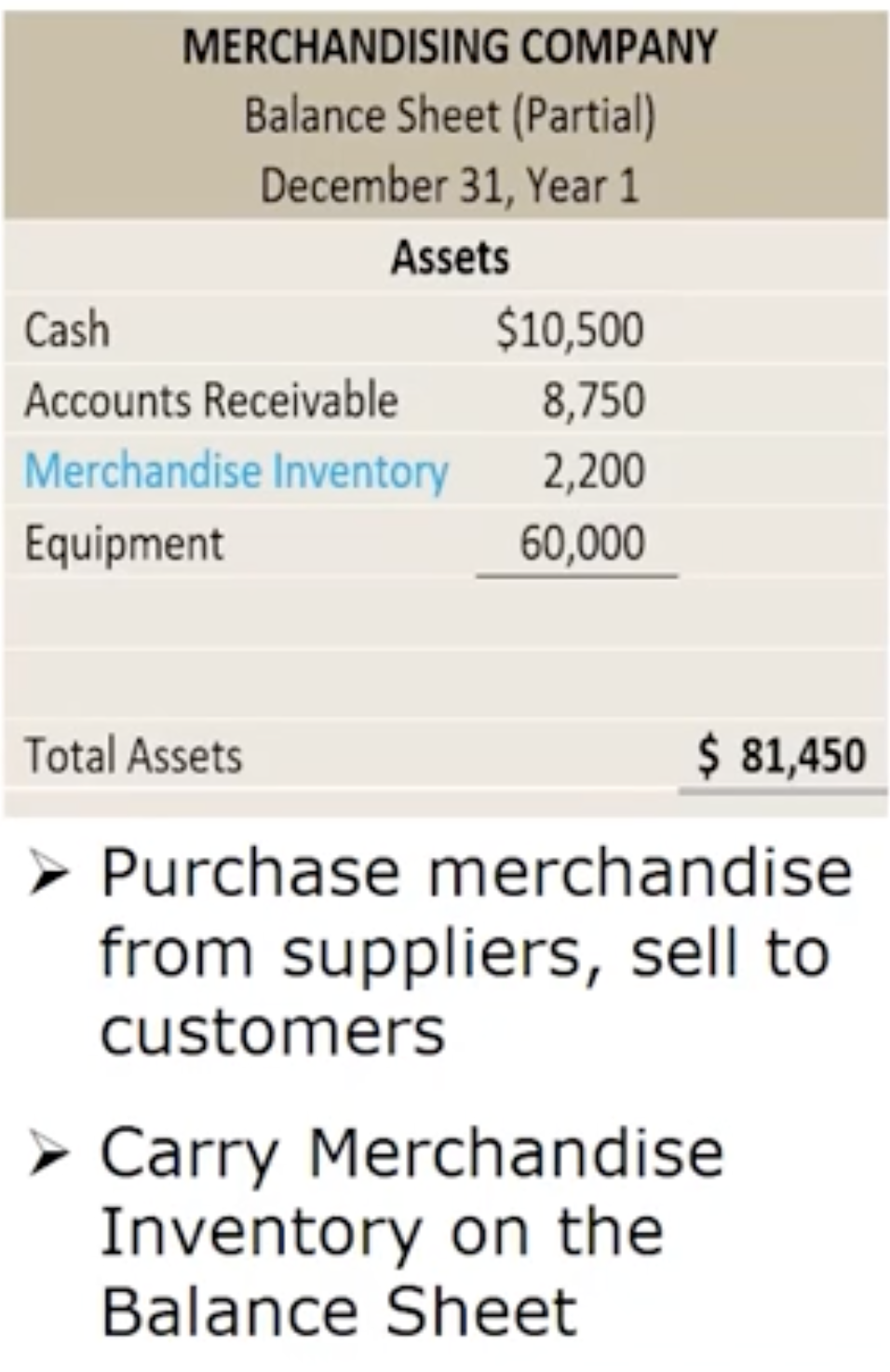

How are costs classified: Merchandising company

They carry inventory which they sell to consumers

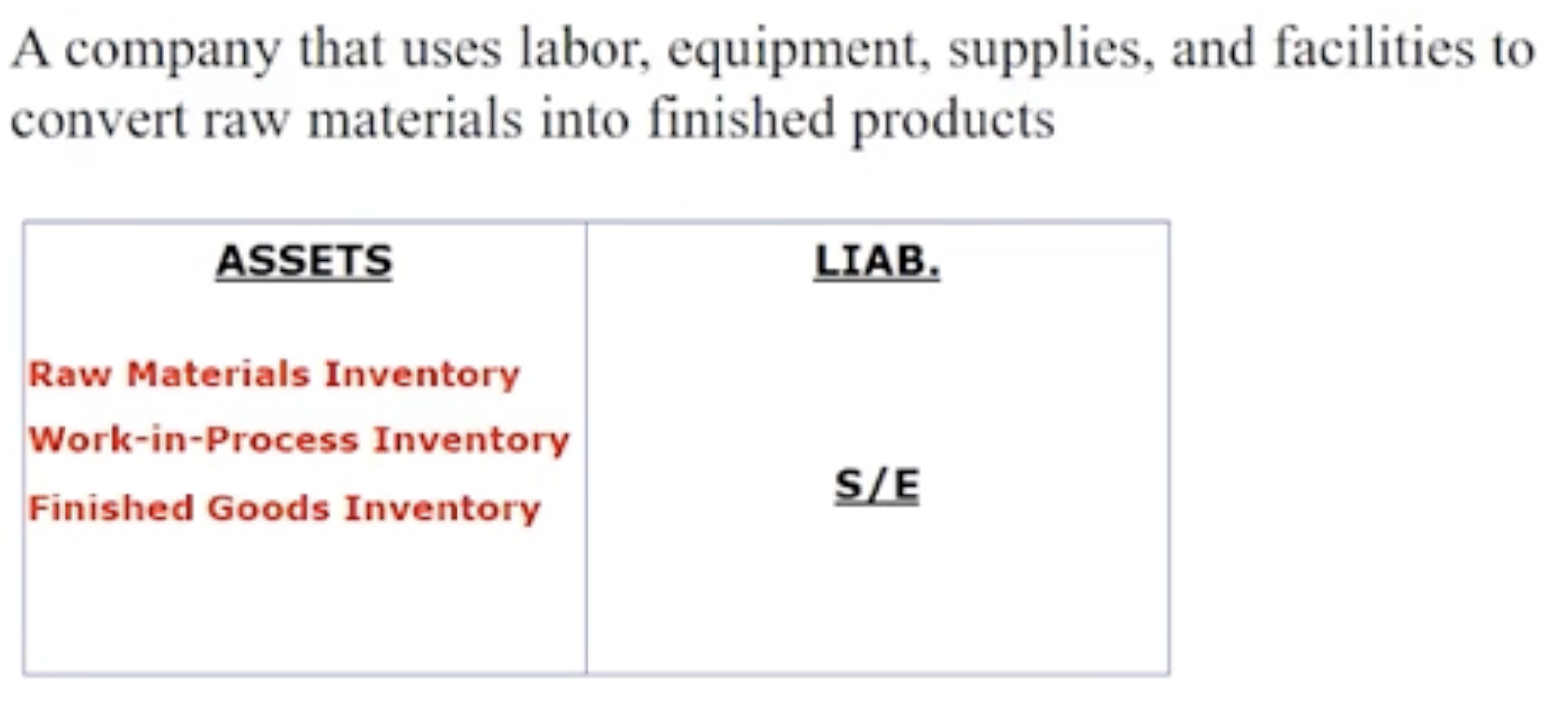

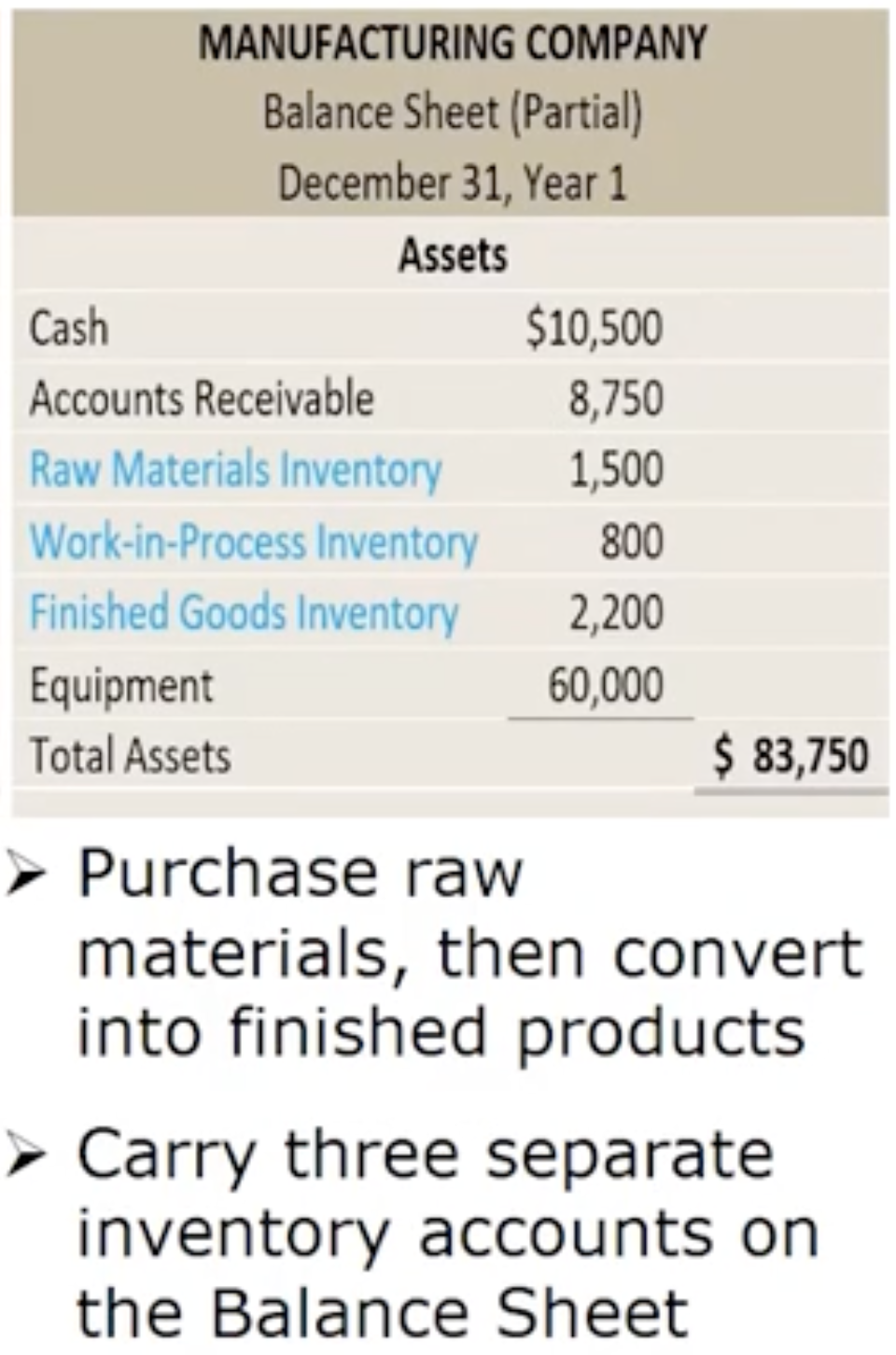

How are costs classified: Manufacturing company

How are costs classified: Manufacturing company— Raw materials inventory

Materials used to manufacture a product

How are costs classified: Manufacturing company— Work- in- process inventory

Goods that have been started in the manufacturing process but not yet complete

How are costs classified: Manufacturing company— Finished goods inventory

completed goods that have not yet been sold

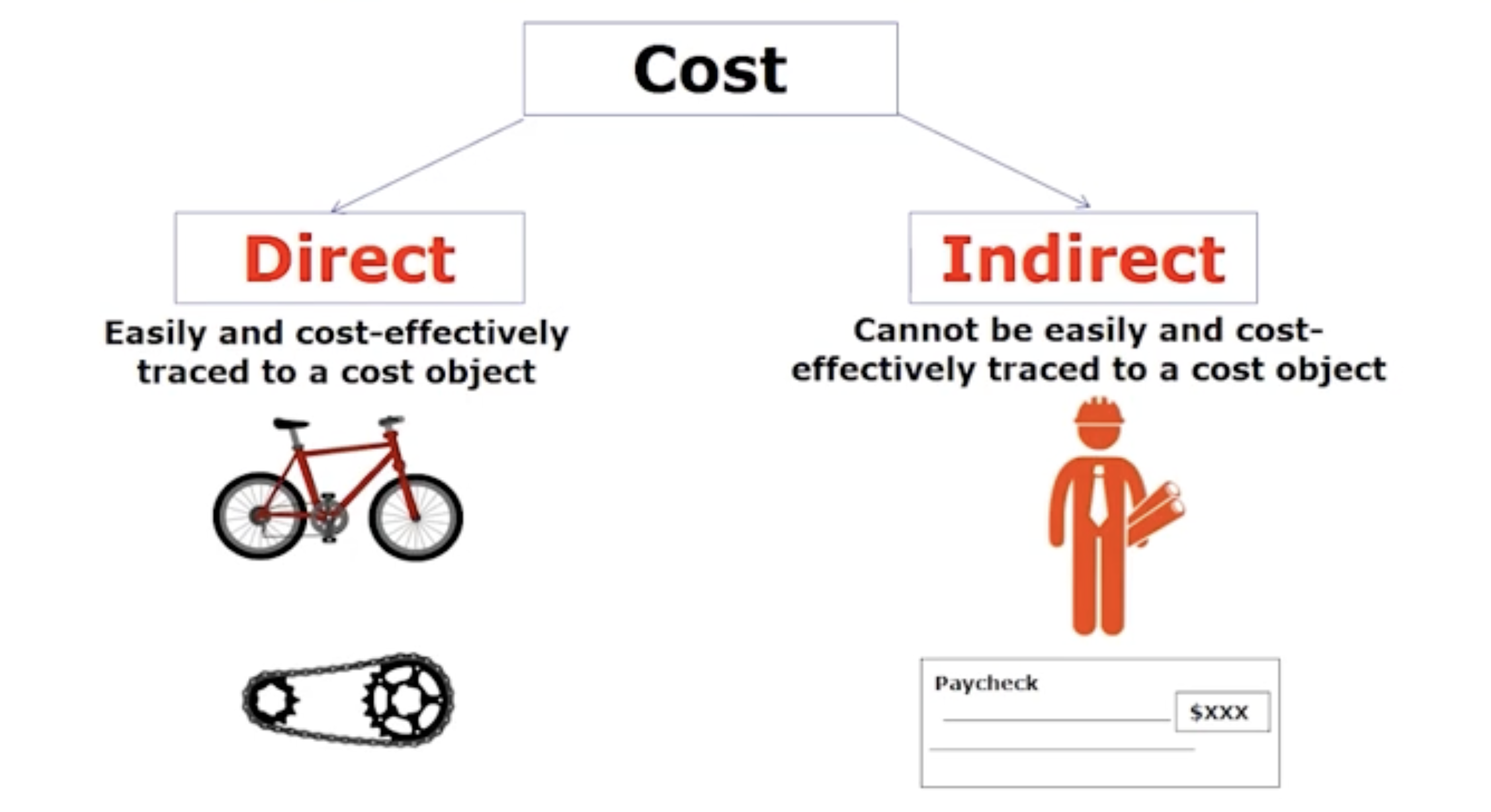

How are costs classified: Direct and indirect costs

A costs is often traced to a costs object: a product, department, sales territory, or activity

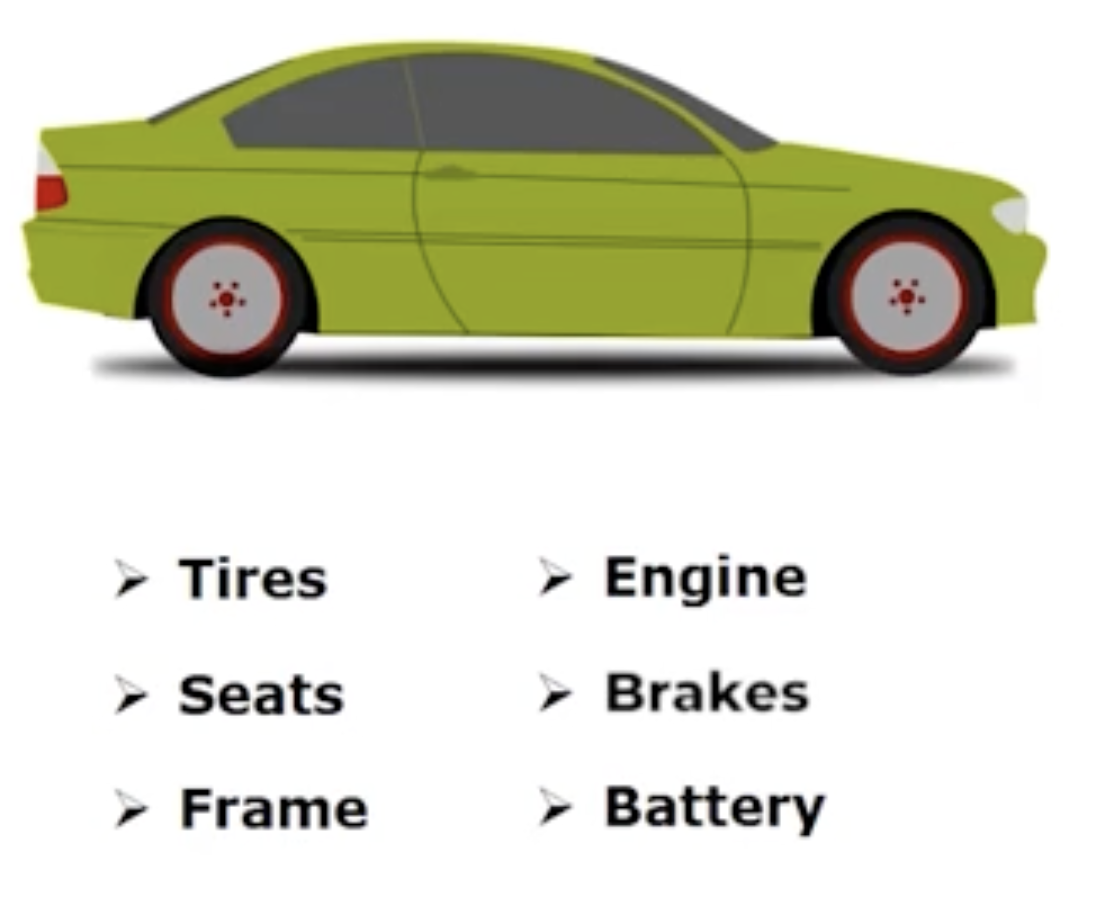

How are costs classified: Manufacturing costs— Direct materials

Materials that become a physical part of a finished product and whose costs are easily traced t the finished product

Ex:

How are costs classified: Manufacturing costs— direct labor

The labor costs of employees who convert raw materials into finished products

Ex: Assembly workers in a car dealership, those who actually work on the assembly line and convert the raw materials into a finished car, are considered direct labor.

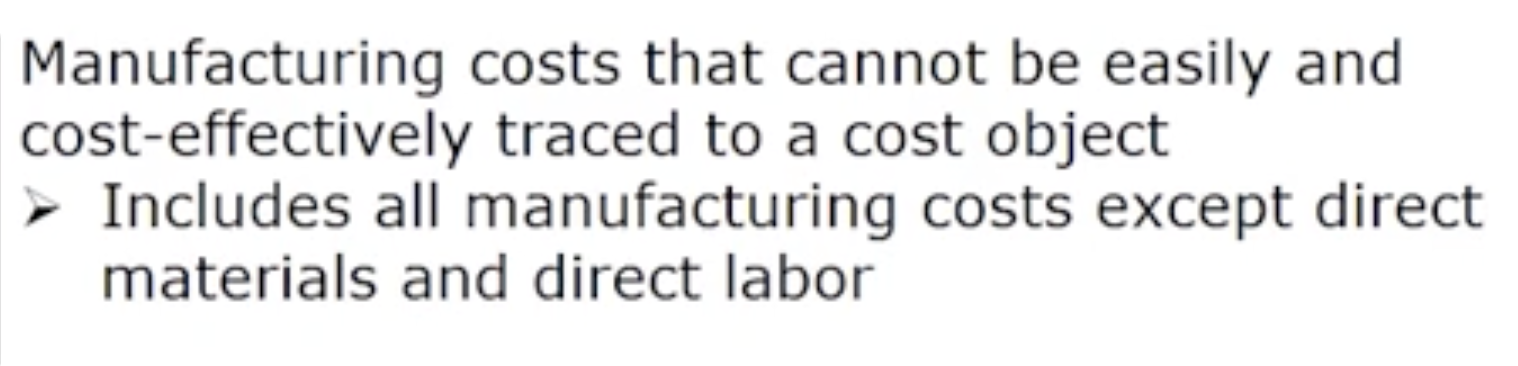

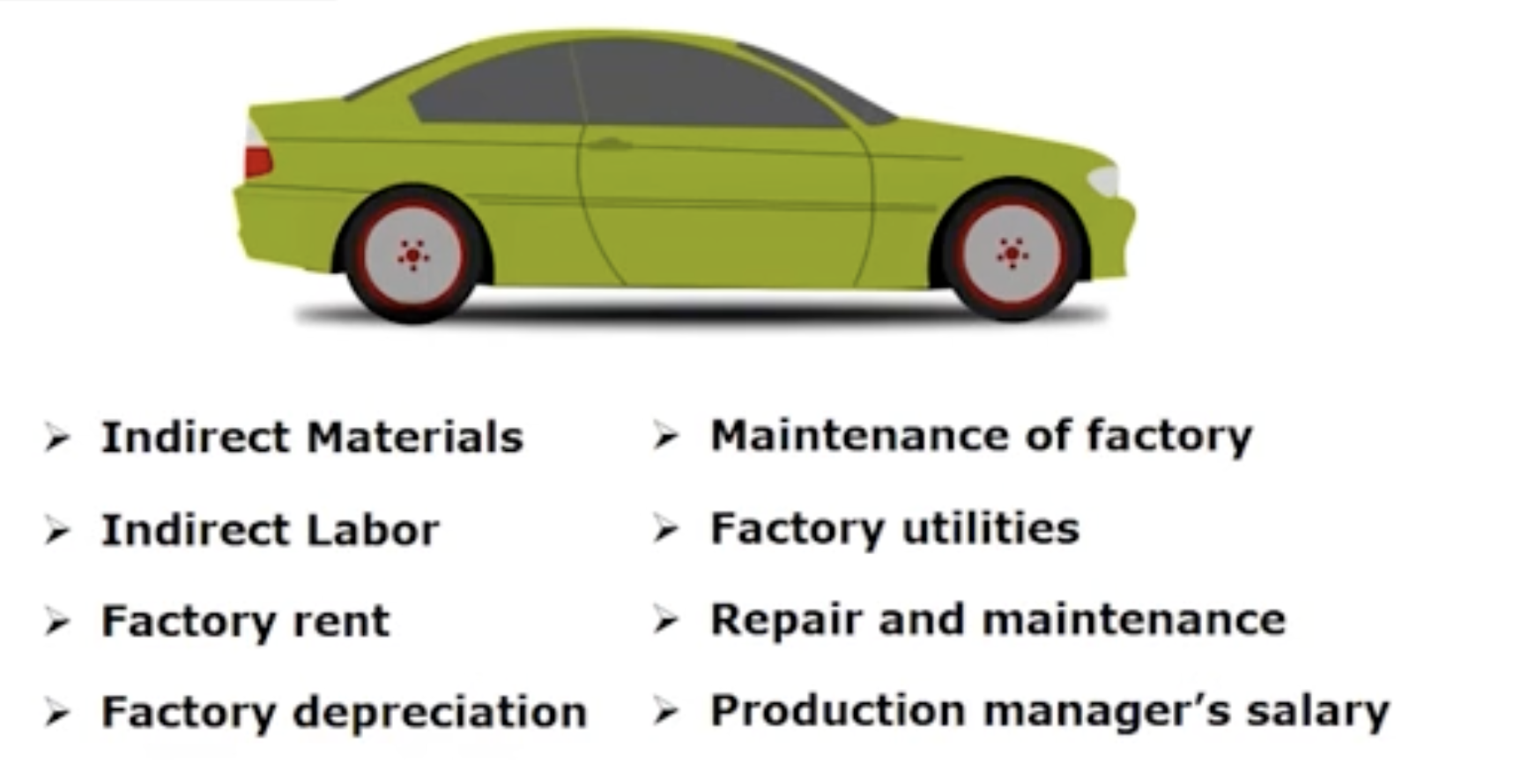

How are costs classified: Manufacturing costs— Manufacturing overhead

How are costs classified:

How are costs classified: Prime costs

Direct Materials plus direct labor

The primary costs in a labor- intensive manufacturing process meaning in the car ex most of the workers are doing the work

So if its labor intensive, management will focus most of their effort on controlling prime costs

How are costs classified: Conversion costs

Direct labor plus manufacturing overhead

Primary costs in a machine-intensive manufacturing process

If its machine intensive managment will focus most of their attention on conversion costs

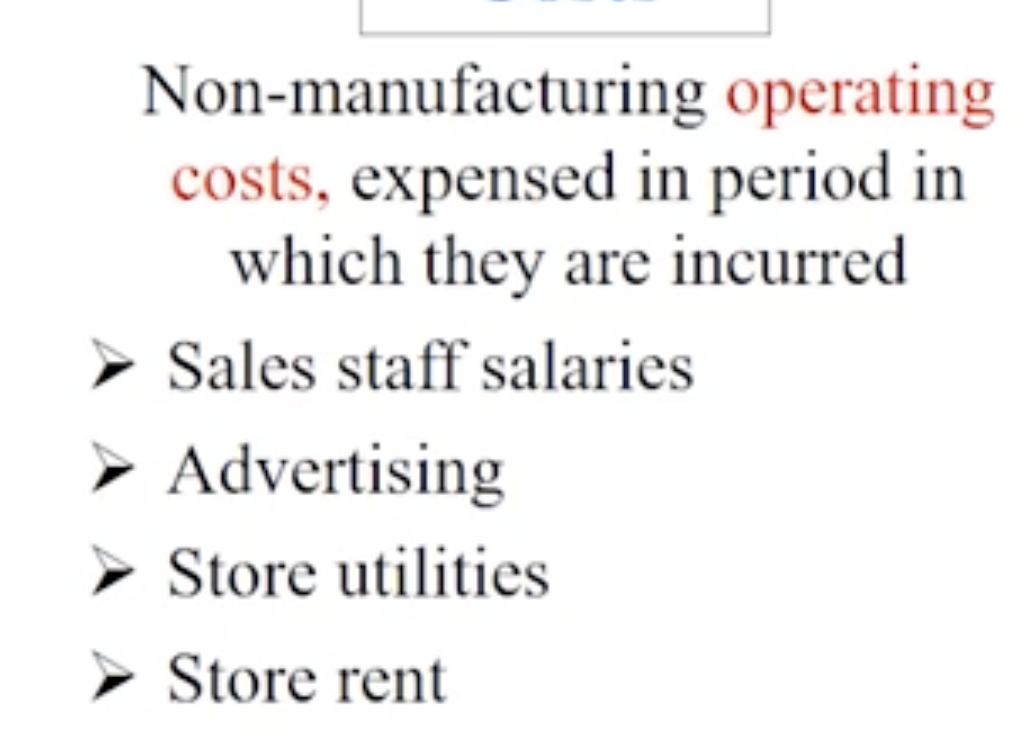

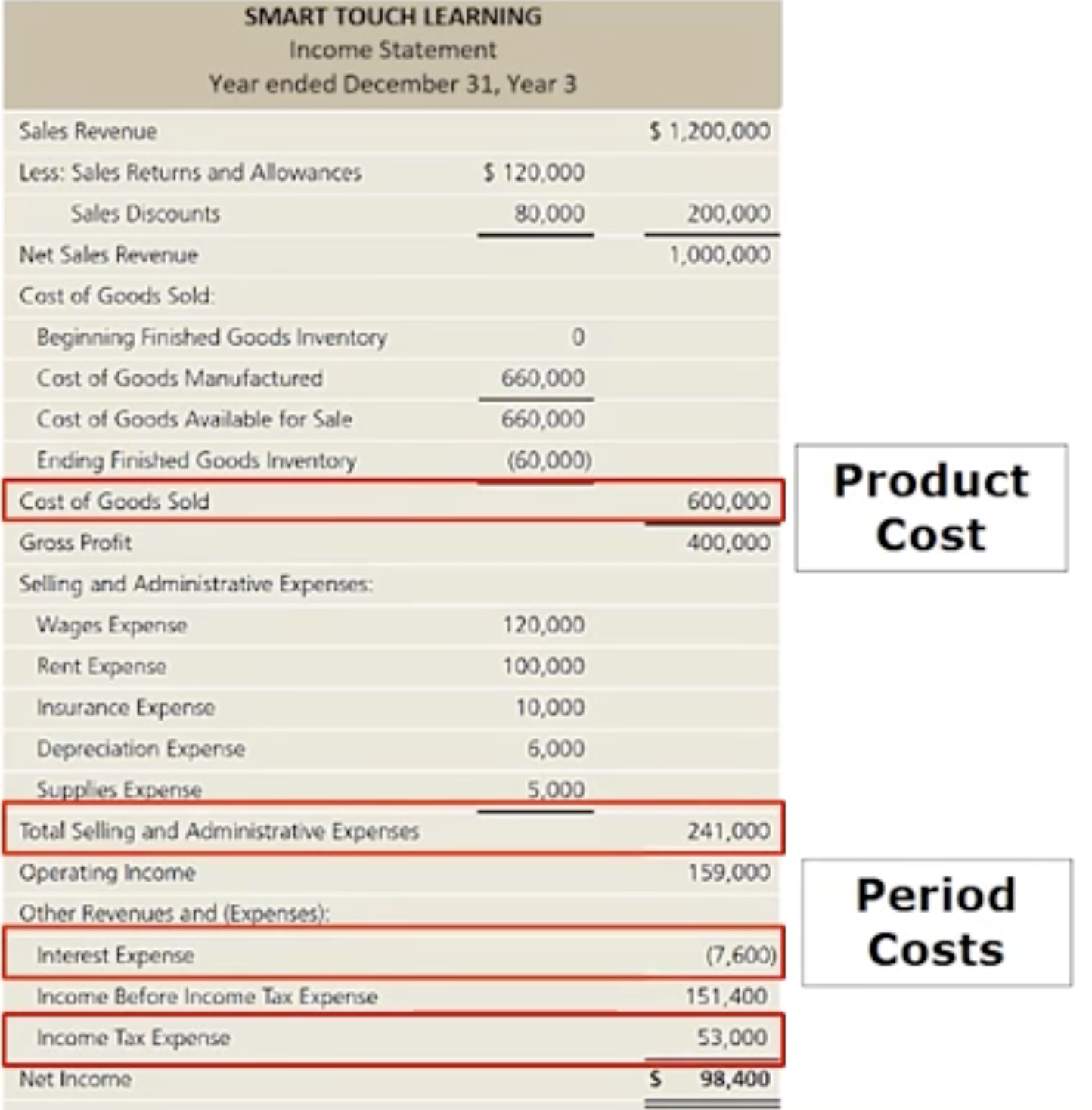

How are costs classified: Period costs

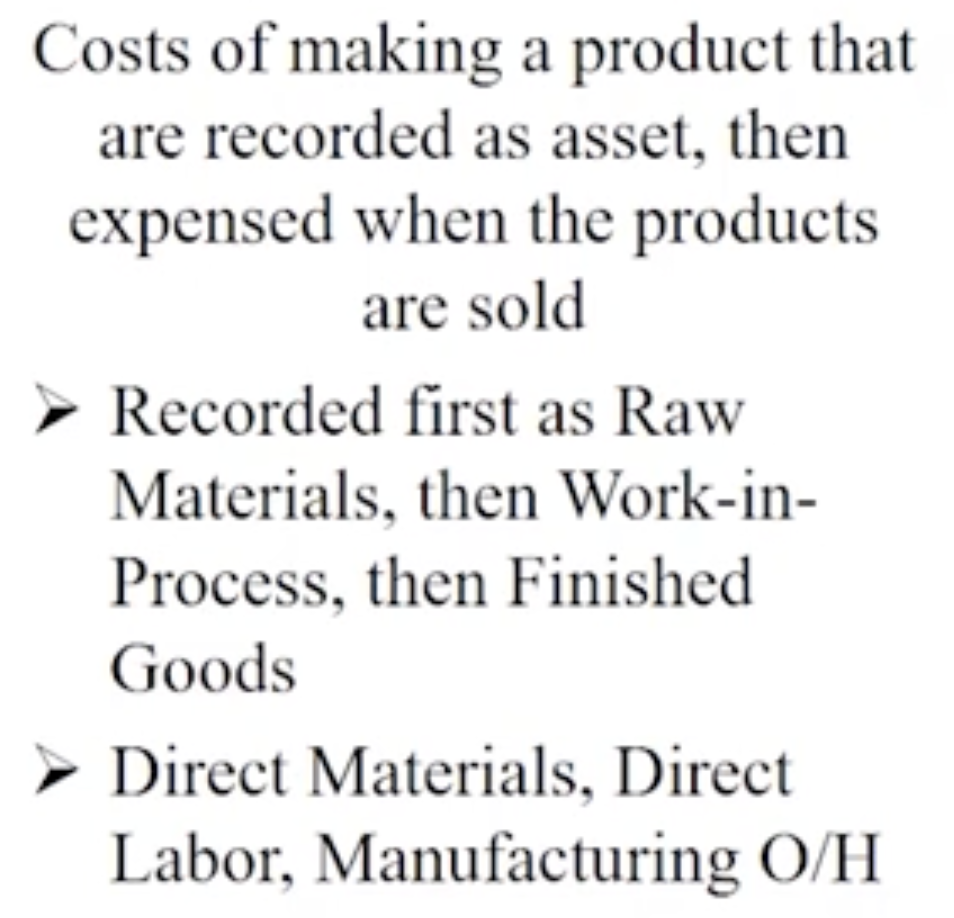

How are costs classified: Product costs

How do manufacturing companies prepare financial statements: Service company

How do manufacturing companies prepare financial statements: Merchandising company

How do manufacturing companies prepare financial statements: Manufacturing company

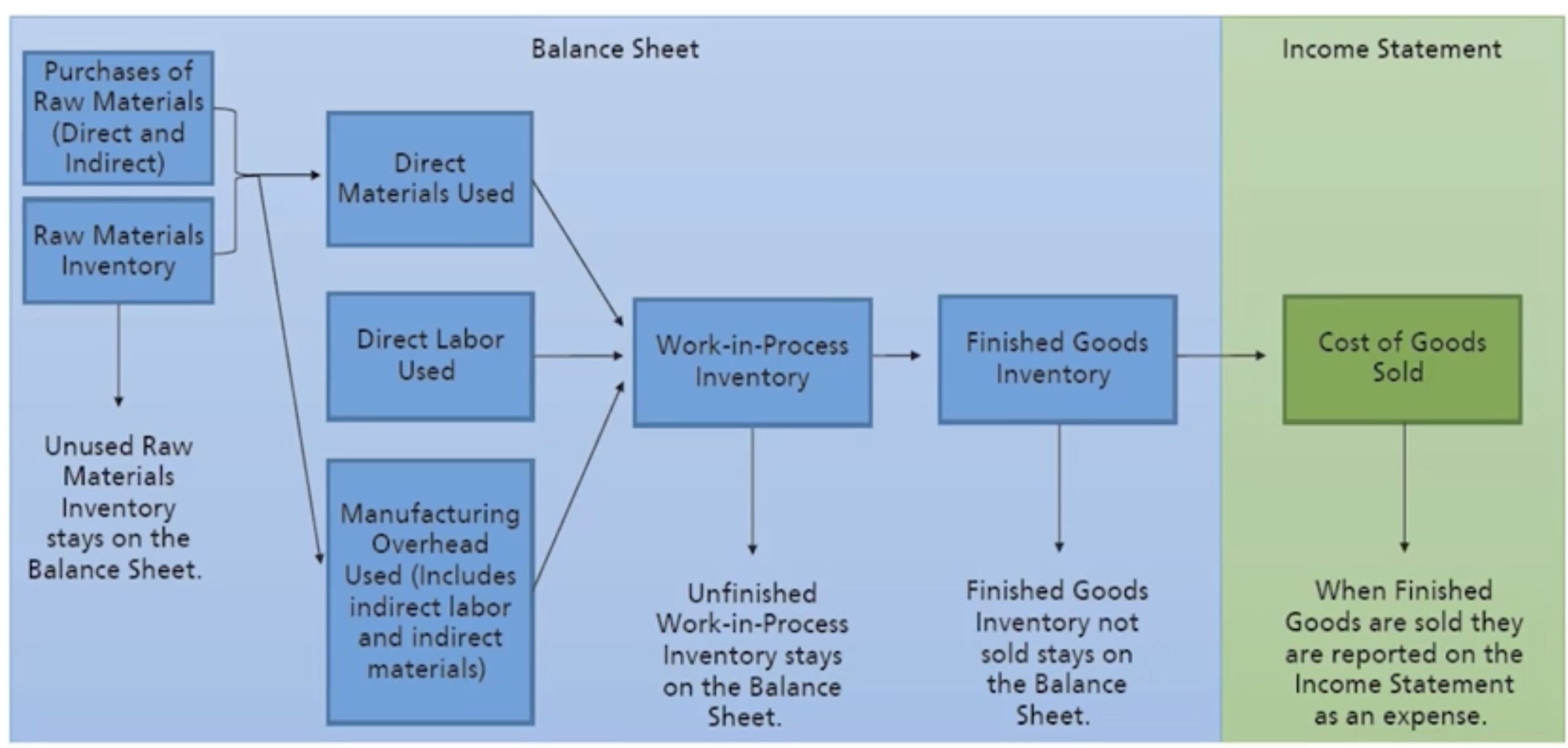

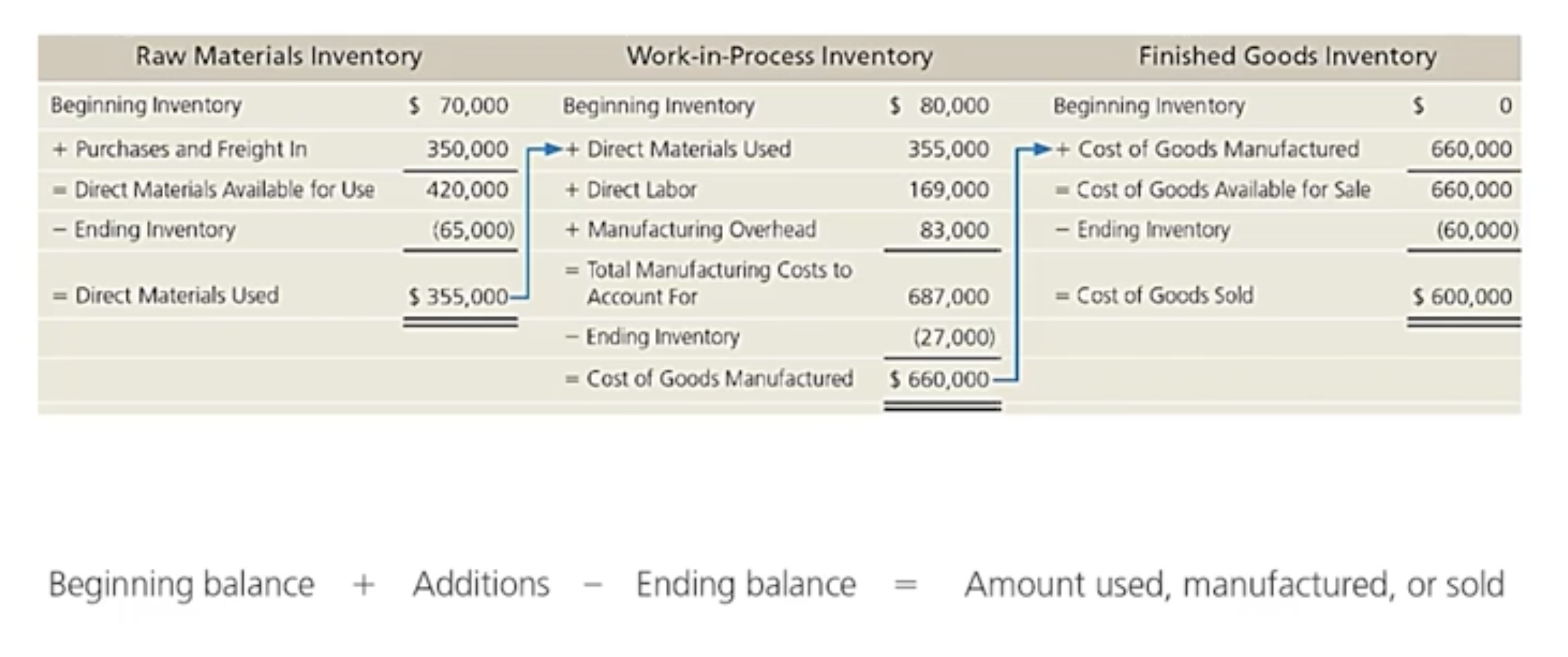

How do manufacturing companies prepare financial statements: Product cost flows- manufacturing

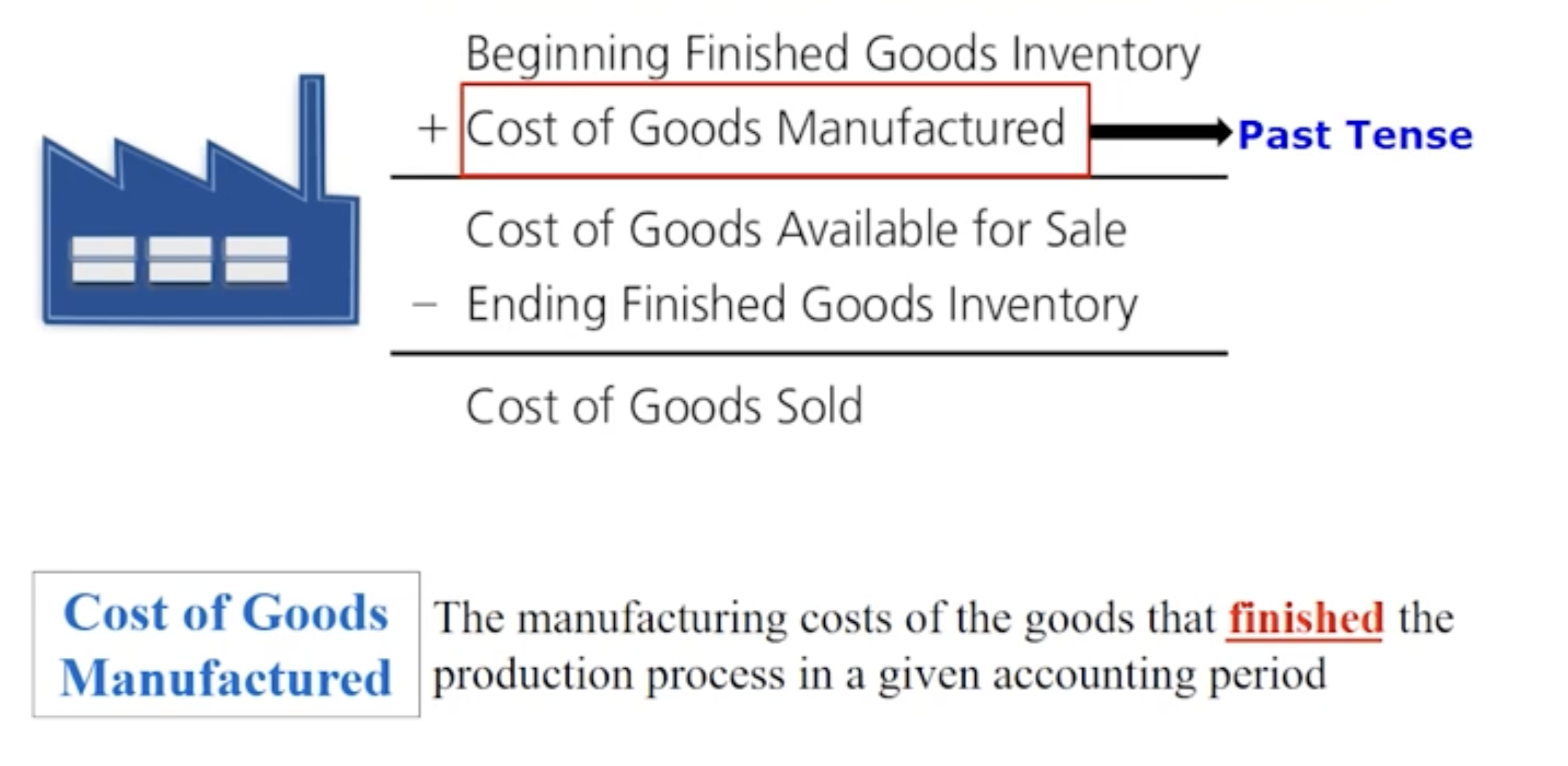

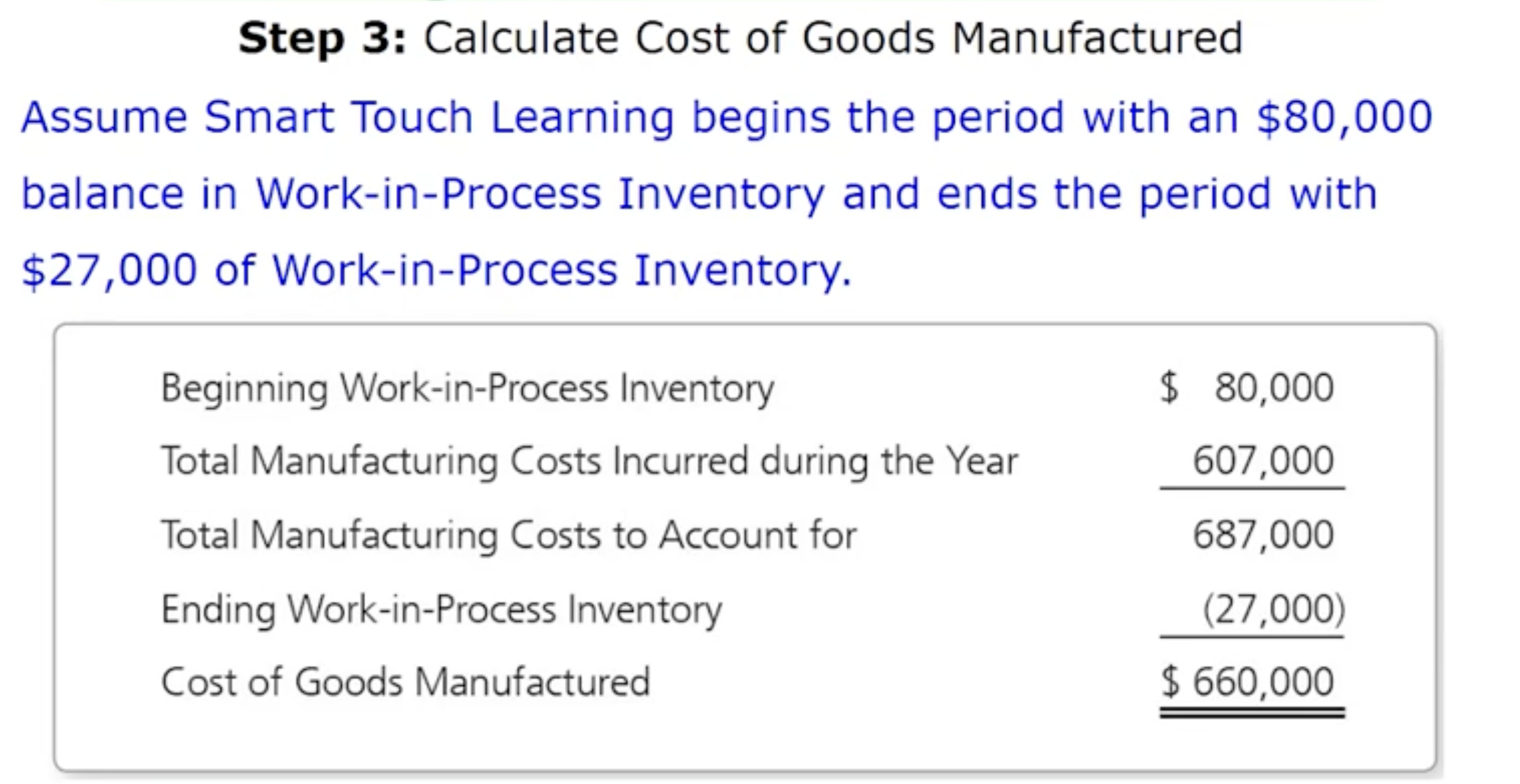

How do manufacturing companies prepare financial statements: Calculating costs of goods manufactured

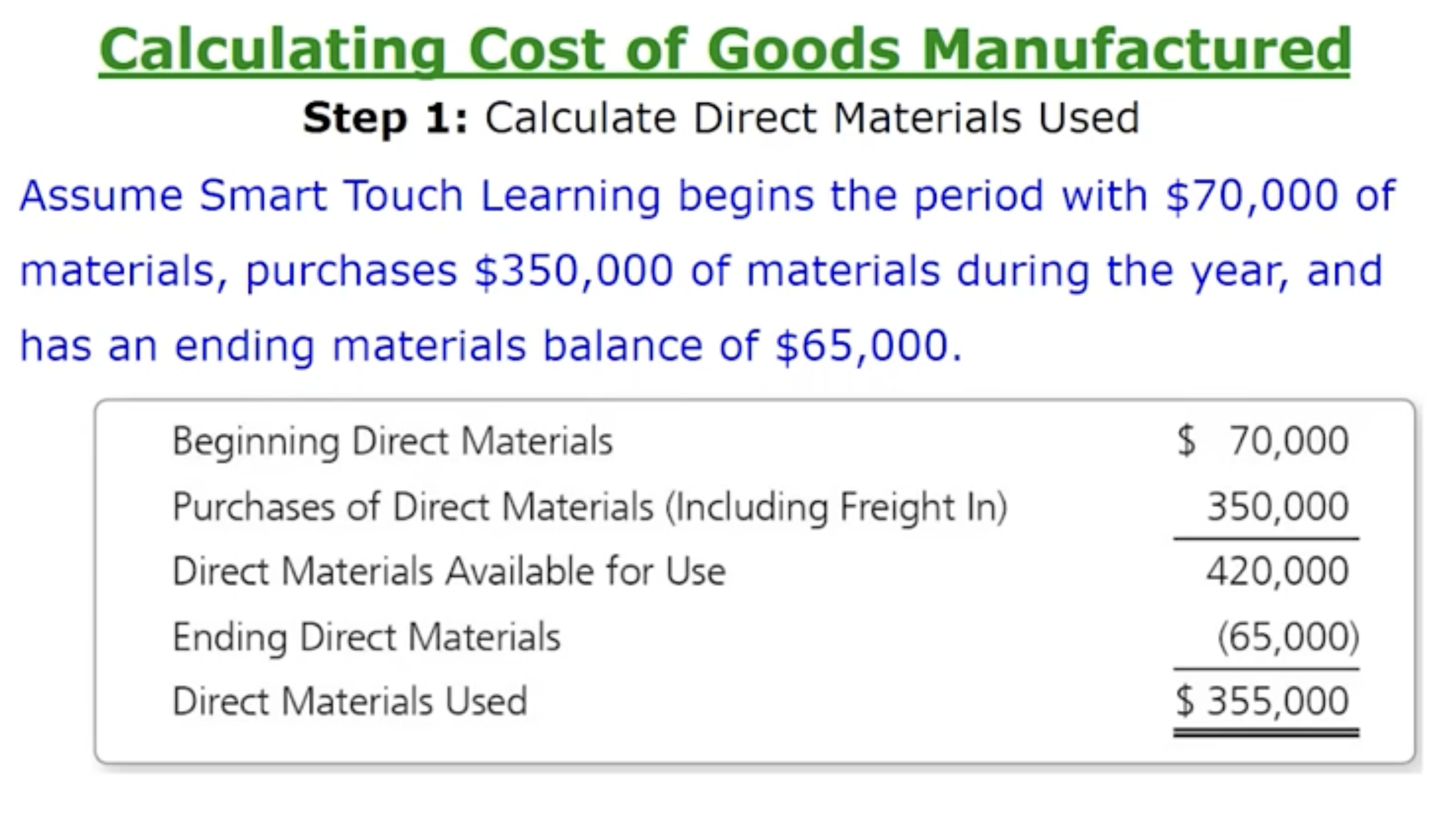

How do manufacturing companies prepare financial statements: Step 1. Breakdown of calculating cost of goods manufactured

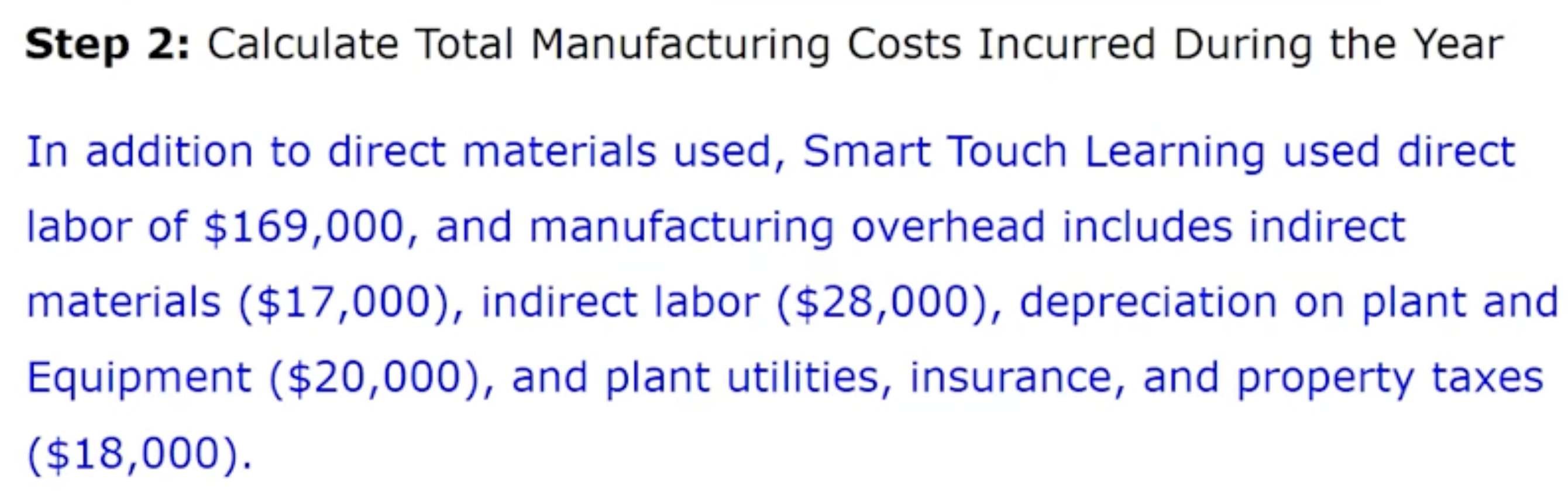

How do manufacturing companies prepare financial statements: Step 2. Breakdown of calculating cost of goods manufactured

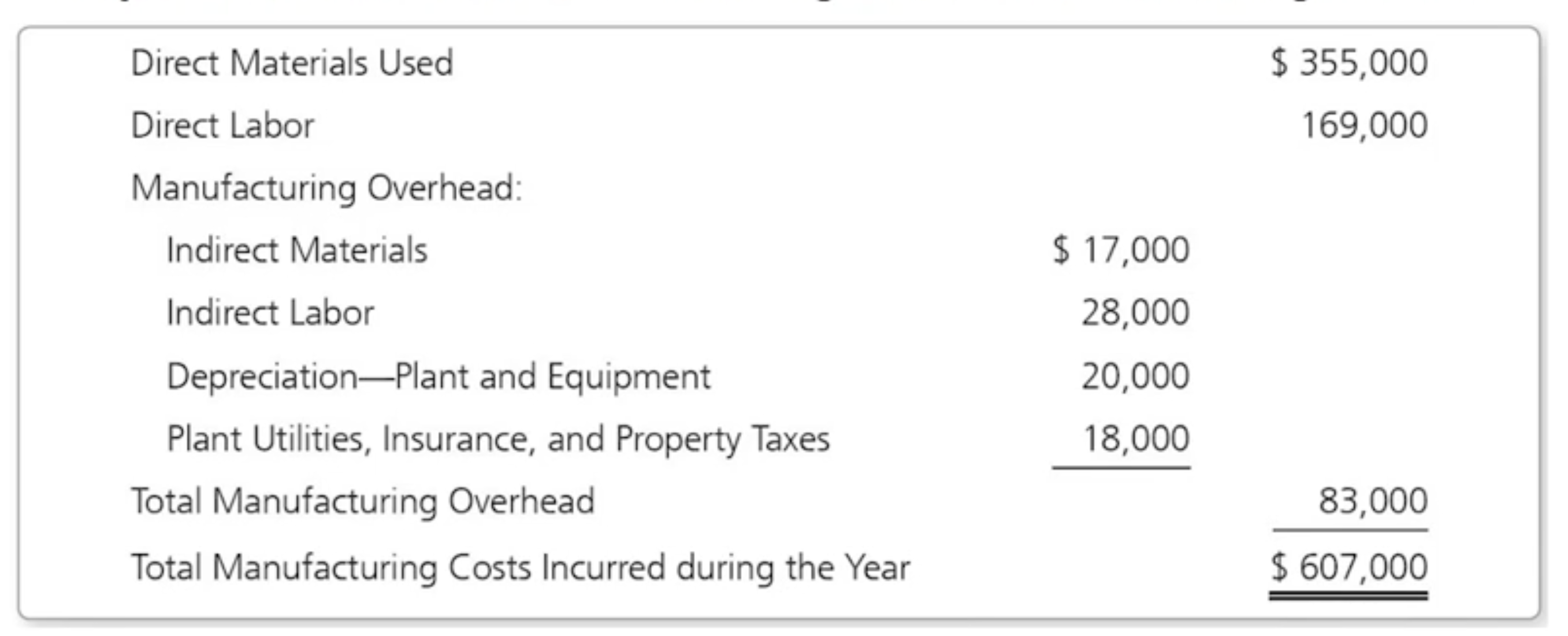

How do manufacturing companies prepare financial statements: Step 3. Breakdown of calculating cost of goods manufactured

How do manufacturing companies prepare financial statements: Final summary of the 3 steps of costs of goods manufacturing

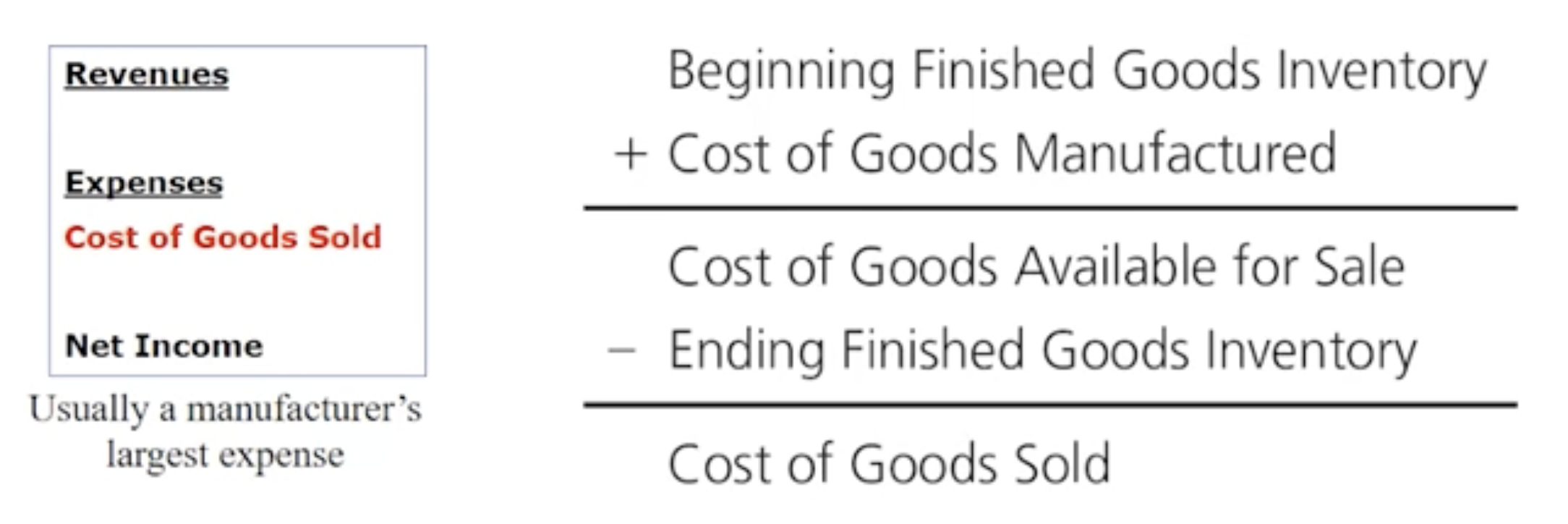

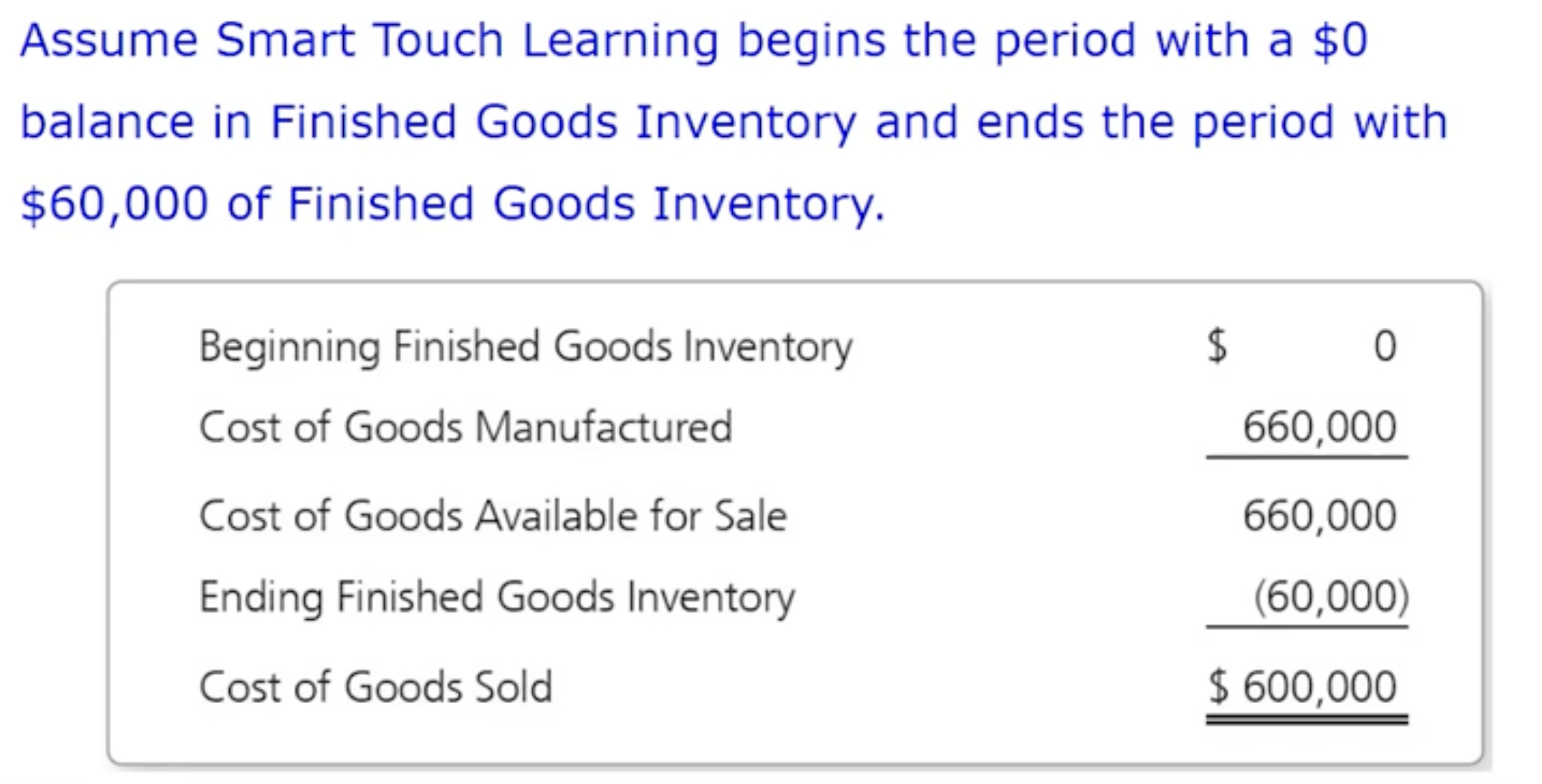

How do manufacturing companies prepare financial statements: Calculating cost of goods sold

How do manufacturing companies prepare financial statements: Calculating cost of goods sold

How do manufacturing companies prepare financial statements: Flow of costs through inventory accounts

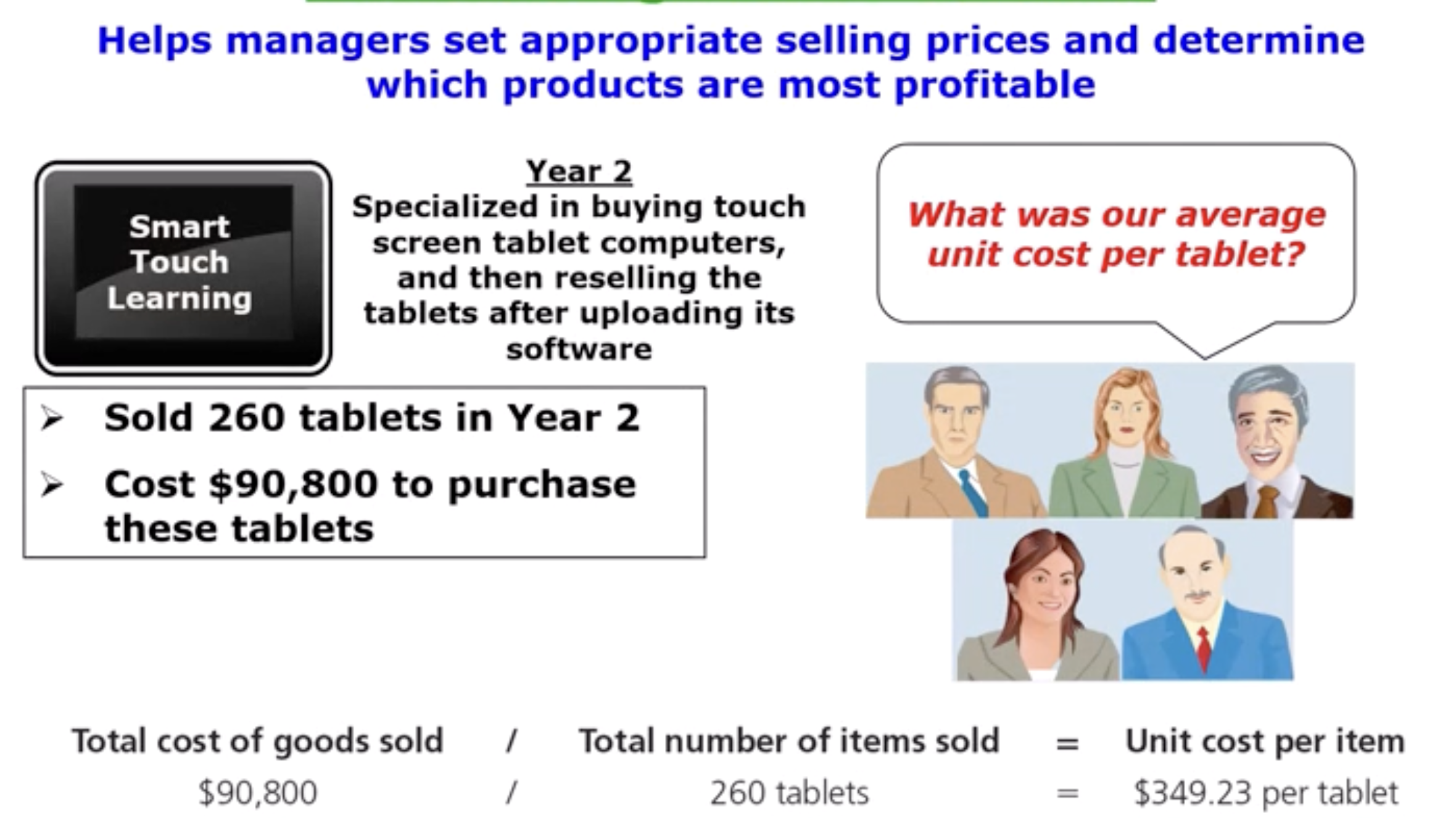

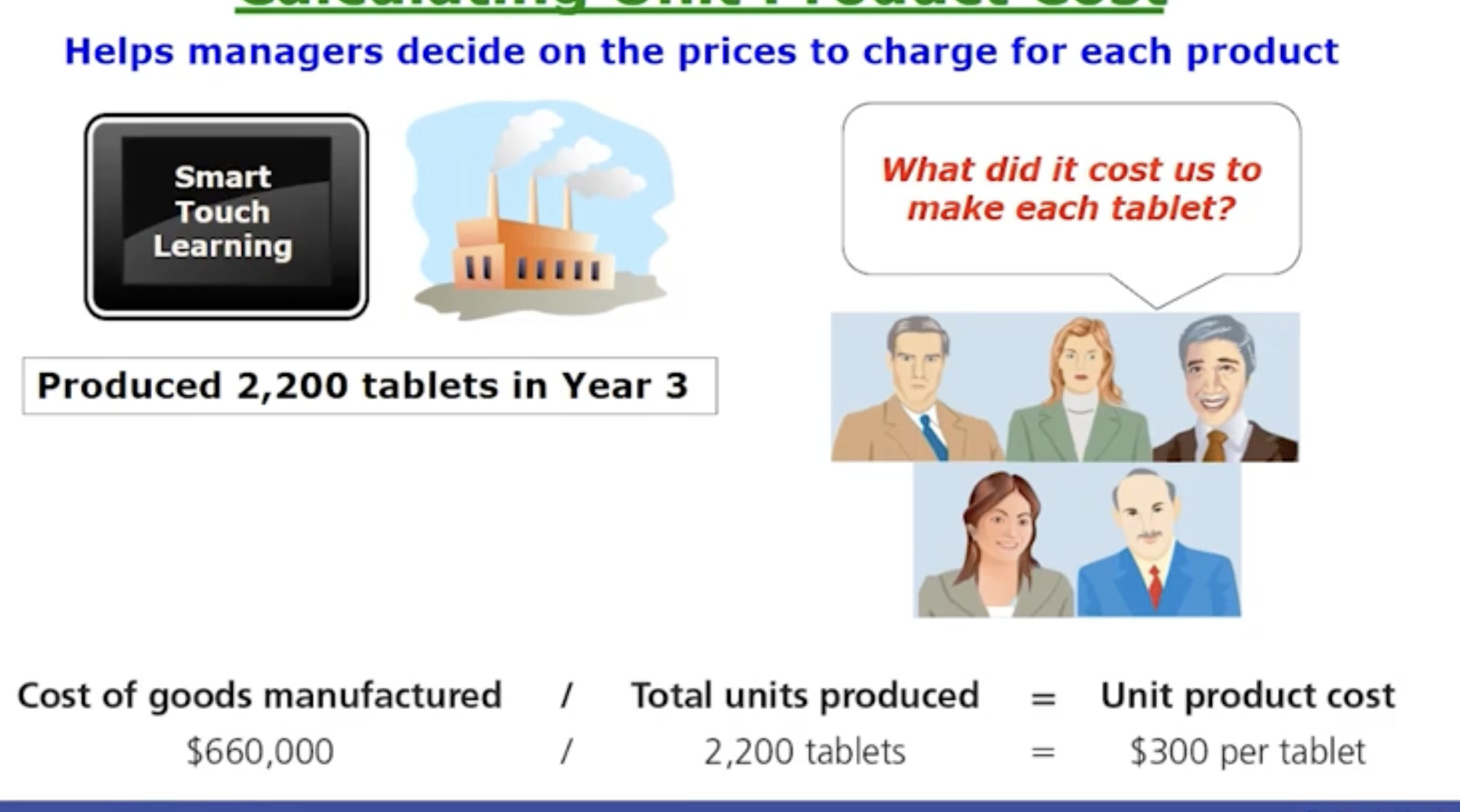

How do manufacturing companies prepare financial statements: Calculating unit product cost example Part 1

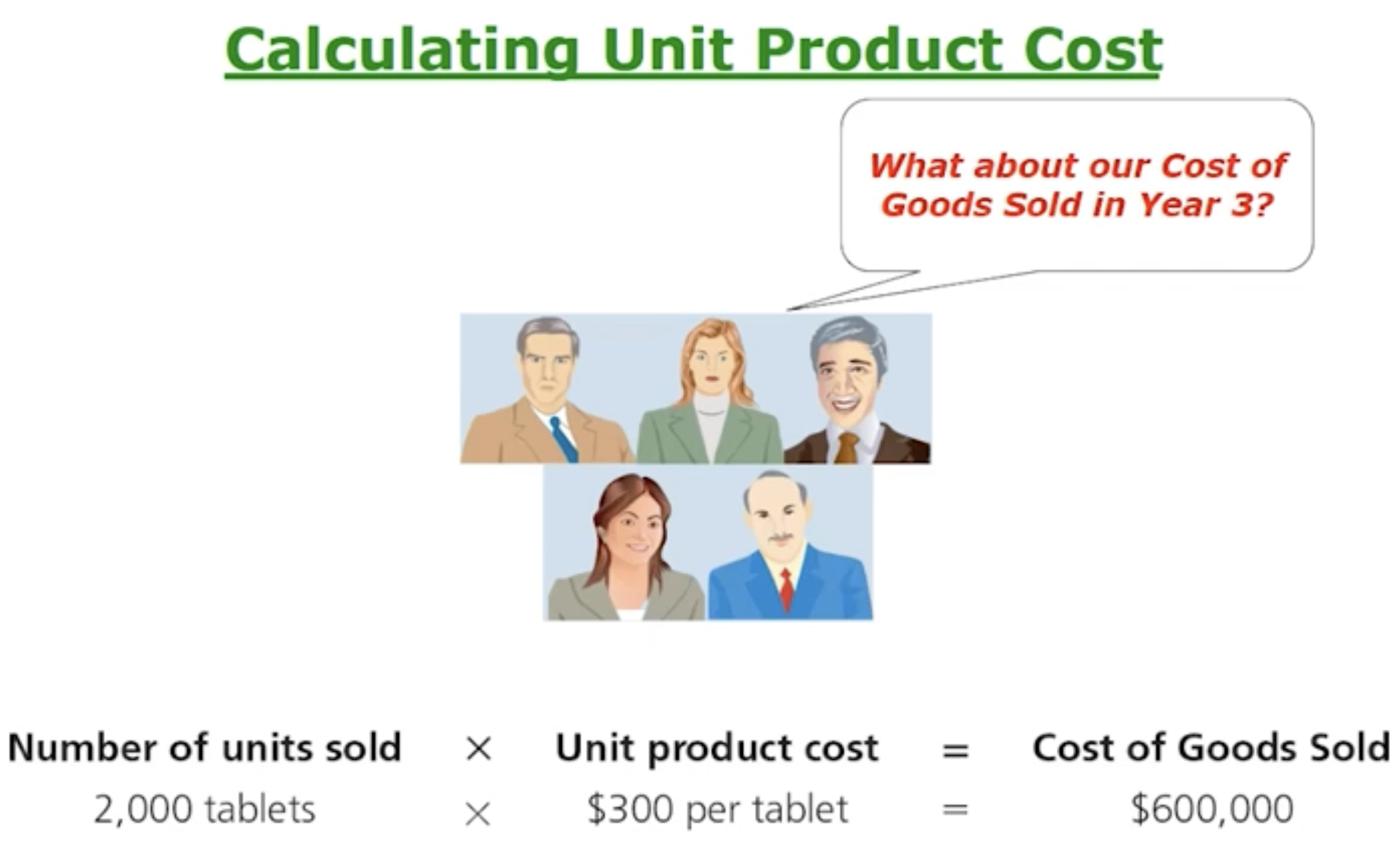

How do manufacturing companies prepare financial statements: Calculating unit product cost example part 2

What business trend are affecting managerial accounting: Enterprise resource planning

A software system that can integrate all of a company’s functions, departments, and data into a single system

E- commerce

What business trend are affecting managerial accounting: Just in time management

Producing products just in time to satisfy needs (limit inventory)

What business trend are affecting managerial accounting: Emerging technologies

Recent advances in technology can equal competitive advantage

What business trend are affecting managerial accounting: Cloud-based services

What business trend are affecting managerial accounting: Total quality management

What business trend are affecting managerial accounting: The triple bottom line

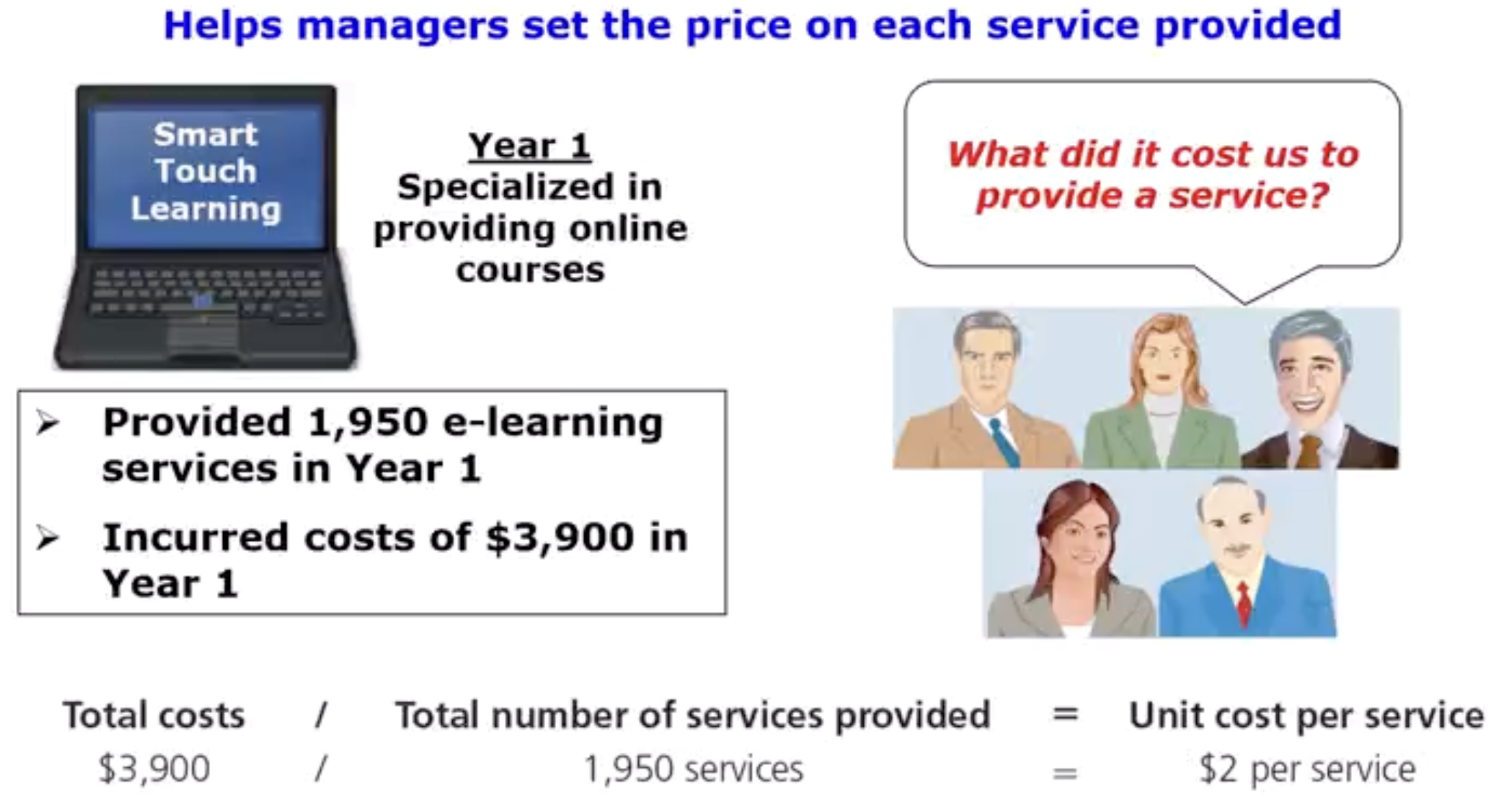

How is managerial accounting used in service and merchandising companies: Calculating cost per service

How is managerial accounting used in service and merchandising companies: Calculating cost per item