Chapter 11: S Corporations

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

S Corporations

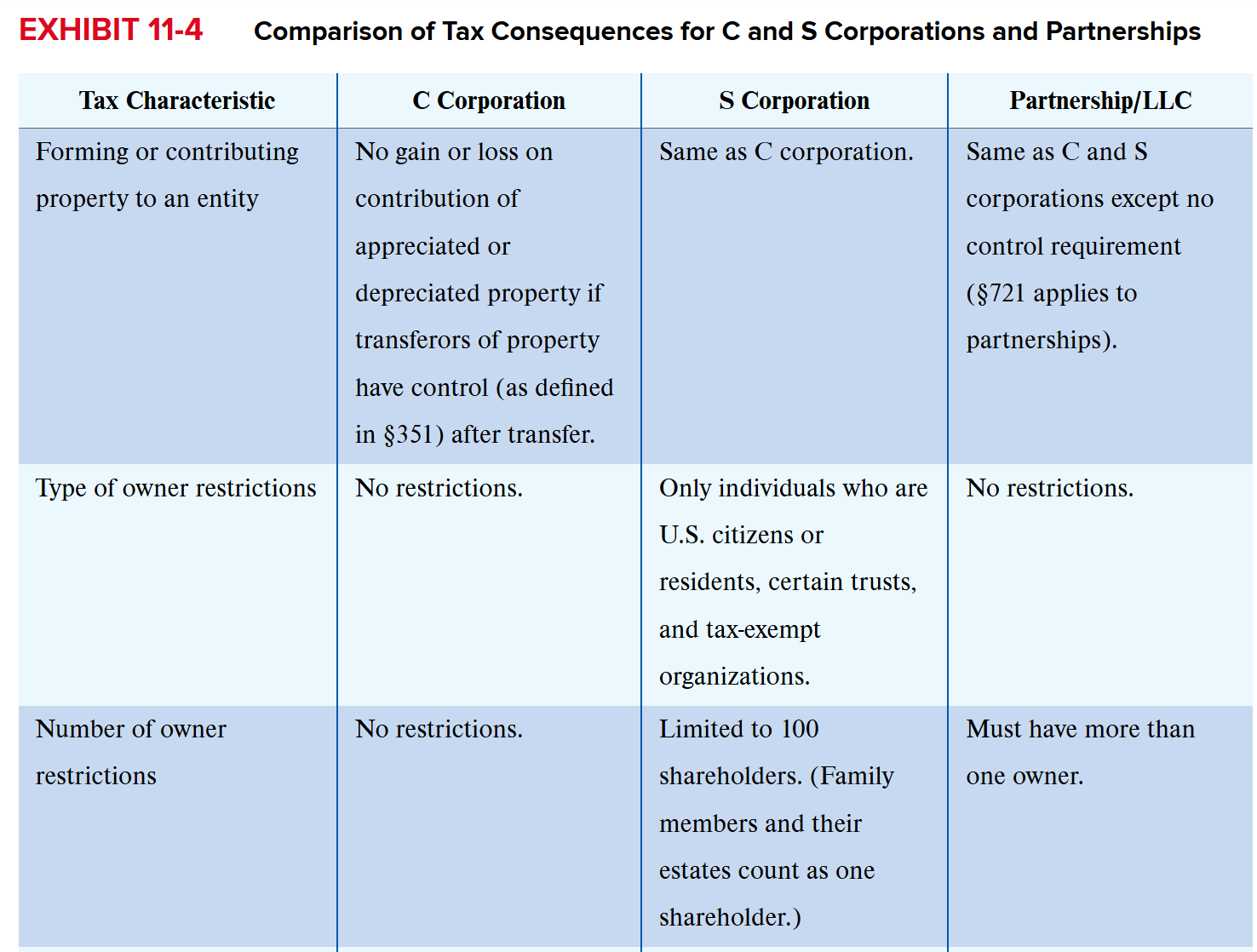

S Corporations are hybrid entities, sharing characteristics with C corporations and partnerships

They are either incorporated under state law, have same legal protections as C corporations and have elected S corporation status or are noncorporate business entities that have elected to be treated as a corporation and then elect S corporation status

S corporations are governed by same corporate tax rules that impact organization, liquidation and reorganization of C corporations

However, they are flow through entities and share many tax similarities with partnerships

Basis calculations are similar, distributions are generally not taxed to the extent of owner basis and income/loss flows through to owners

S Corporation Elections

Formations

Same rules for forming and contributing property like C corporations (§351 transaction)

S Corporation Qualification Requirements

IRC 1361 defines S corporation

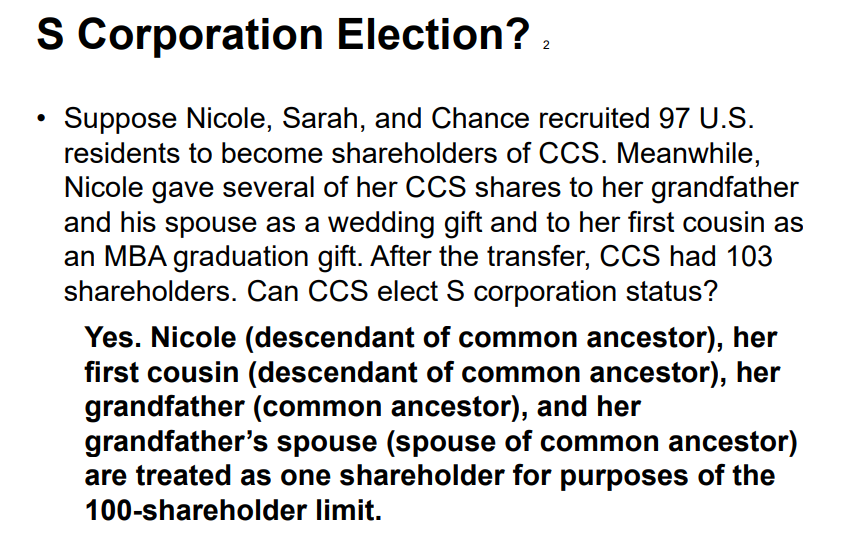

Small business corporation with < 100 shareholders (family members and their estates count as ONE shareholder)

Family members include a common ancestor (not more than six generations removed) and their lineal descendants and their lineal descendants’ spouses (or former spouses)

Under this broad definition, great-grandparents, grandparents, parents, children, siblings, grandchildren, great-grandchildren, aunts, uncles, cousins, and the respective spouses are family members for this purpose

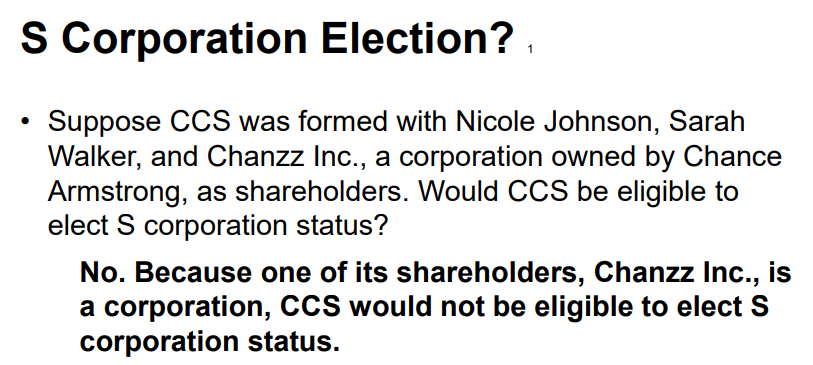

Only US citizens or residents, estates, certain trusts and certain tax-exempt organizations may be shareholders (not non-resident aliens)

S Corporations and C corporations cannot be shareholders

Only ONE class of stock

One class of stock requirement met if shares provide identical distribution, liquidation, and voting

In general, debt instruments do not violate the single-class-of-stock requirement unless they are treated as equity elsewhere under the tax law

An eligible corporation must make an affirmative election to be treated as an S corporation

Eligible corporations must meet type/number of shareholder requirements, be domestic corporations for tax purposes, not be specifically identified as ineligible and have one class of stock

IRC 1362(a) filing: make a formal election before 15th of 3rd month (March 15th), otherwise effective following year (Form 2553)

ALL shareholders must consent to the election

Timing of election may be important for C corporations with NOL

NOL cannot be carried over to the S corporation so timing of election is critical

S Corporation Election [Examples]

S Corporation Terminations

Once the S election becomes effective, the corporation remains an S corporation until the election is terminated

The termination may be voluntary or involuntary

Voluntary Terminations

Elected by shareholders with > 50% of stock (including nonvoting shares)

The corporation files a statement with IRS revoking the election under 1362(a) and stating effective date of revocation and shares outstanding

In general, voluntary revocations made on or before the 15th day of the third month of the year (March 15th) are effective as of the beginning of the year

A revocation after this period is effective the first day of the following tax year

Alternatively, an S corporation may specify the termination date as long as the date specified is on or after the date the revocation is made

Involuntary Terminations

Involuntary terminations can result from (1) failure to meet requirements (by far the most common reason) or (2) from an excess of passive investment income

(1) Failure to Meet Requirements

A corporation’s S election is automatically terminated if the corporation fails to meet the requirements

The termination is effective on the date it fails the S corporation requirements

If the IRS deems the termination inadvertent, it may allow the corporation to continue to be treated as an S corporation if, within a reasonable period after the inadvertent termination, the corporation takes the necessary steps to meet the S corporation requirements

(2) Excess of Passive Investment Income

Only applies to S Corporations which were previously C corporations and had C corporation E&P

If S corporation has E&P from a previous C corporation with passive investment income in excess of 25% of gross receipts for 3 consecutive years, election is terminated

Gross receipts = revenue received, capital gains, sales of stock, not reduced by deductions

Passive investment income = receipts from royalties, rents, dividends, interest and annuities

Net capital gain income is not passive investment income

Termination will be effective on the first day of the year following the third consecutive year with excess passive investment income

Short Tax Years

S corporation election terminations frequently create an S corporation short tax year (a reporting year less than 12 months) and a C corporation short tax year

The corporation must then allocate its income for the full year between the S and the C corporation years, using the number of days in each short year (the daily method)

Or it may use the corporation’s normal accounting rules to allocate income to the actual period in which it was earned (the specific identification method)

Both short tax year returns are due on the corporation’s customary tax return due date (with normal extensions available)

S Corporation Reelections

After terminating or voluntarily revoking S corporation status, the corporation may elect it again, but it generally must wait until the beginning of the 5th tax year after the tax year in which it terminated the election

The IRS may consent to an earlier election under a couple of conditions:

If the corporation is now > 50% owned by shareholders who were not owners at the time of termination, OR

If the termination was not reasonably within the control of the corporation or shareholders with a substantial interest in the corporation and was not part of a planned termination by the corporation or shareholders

Operating Issues: Accounting Methods and Periods

Like partnerships, elections to use accounting periods and methods are made at the entity level and elected with the filing of the tax return

S corporations are generally required to adopt a calendar tax year

May choose a non-calendar year-end if ≥ 25% of the gross receipts for the previous 3 years were recorded in the last 2 months of the year-end requested

S Corporations allocate profits and losses pro rata, based on number of outstanding shares owned by each shareholder on each day of tax year

S Corporations determine each shareholder’s share of ordinary business income (loss) and separately stated items

S corporations do not face restrictions for selecting cash method, unless selling inventory is a material income producing factor (must then use accrual for inventory)

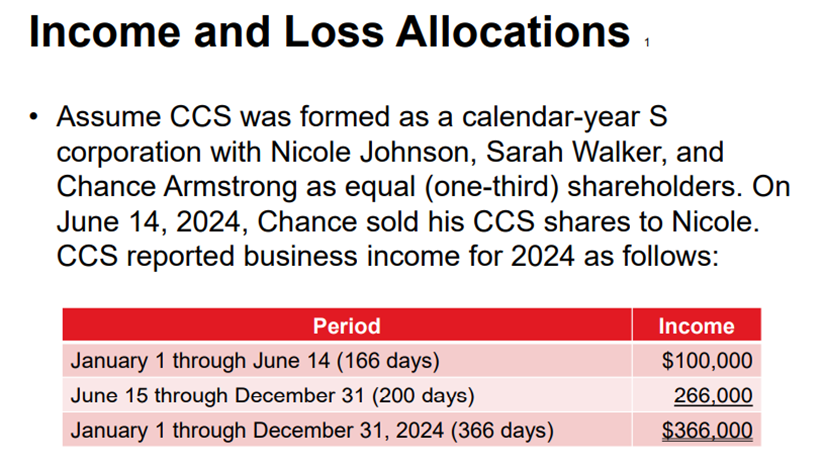

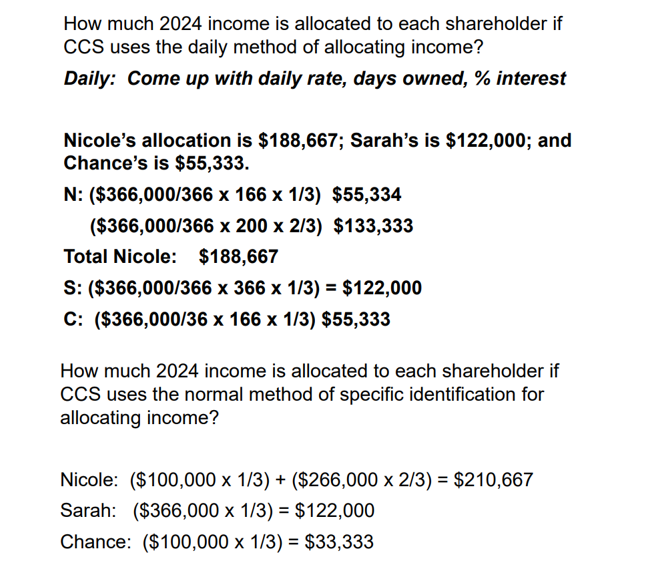

Income and Loss Allocations

Allocate profit and loss pro rata, based on number of outstanding shares each shareholders own on each day of the tax year

An S corporation generally allocates income or loss items to shareholders on the last day of its tax year

If a shareholder sells their shares during the year, they will report their share of S corporation income and loss allocated to the days they owned the stock (including the day of sale) using a pro rata allocation

If all shareholders with changing ownership percentages during the year agree, the S corporation can instead use its normal accounting rules to allocate income and loss (and other separately stated items, discussed below) to the specific periods in which it realized income and losses

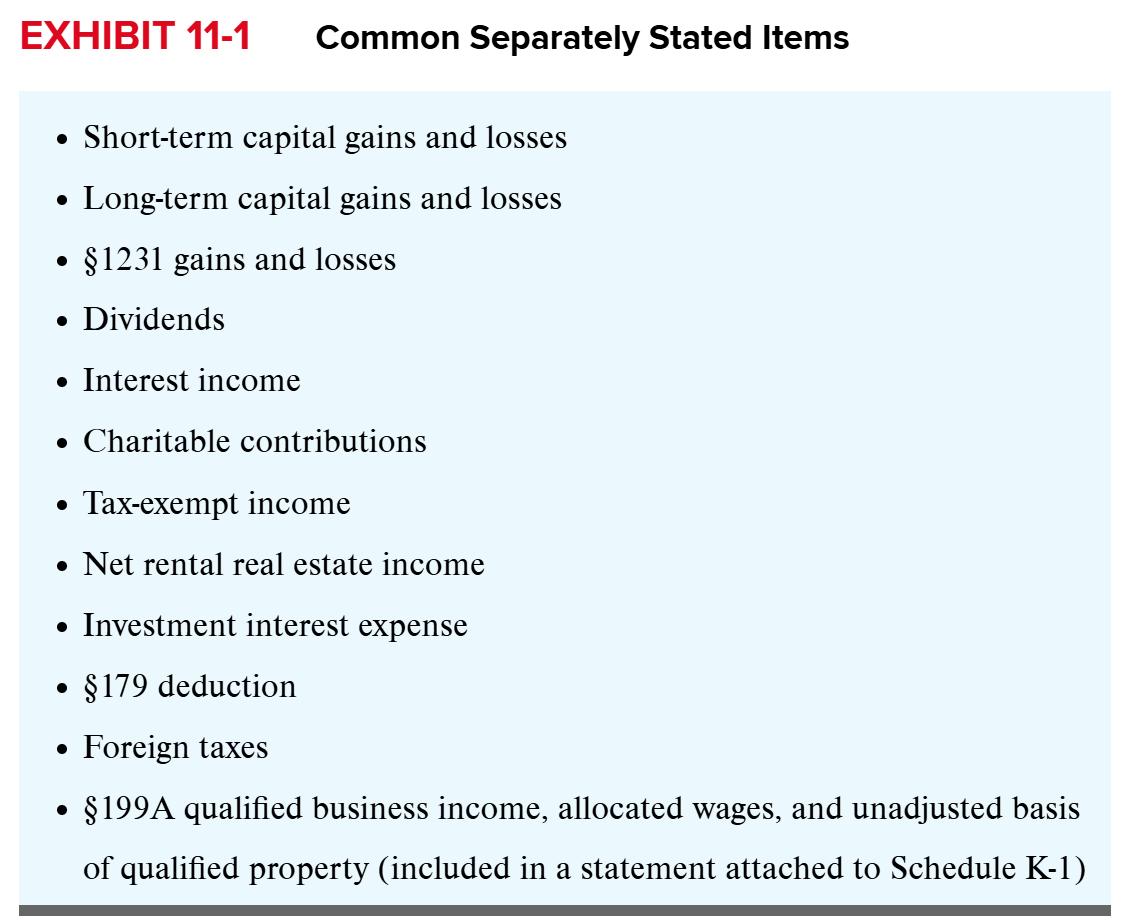

Separately Stated Items

S Corporations are required to file tax return 1120-S annual and Schedule K-1 to shareholders detailing amount and character of income and loss.

Shareholders must report their share of income and losses on their individual returns

Ordinary business income and separately stated items

S corporations do not report self-employment income and do not have guaranteed payments

S corporations may hold stock in C corporations, and any dividends S corporations receive will flow through to their shareholders

However, S corporations are not entitled to claim the DRD

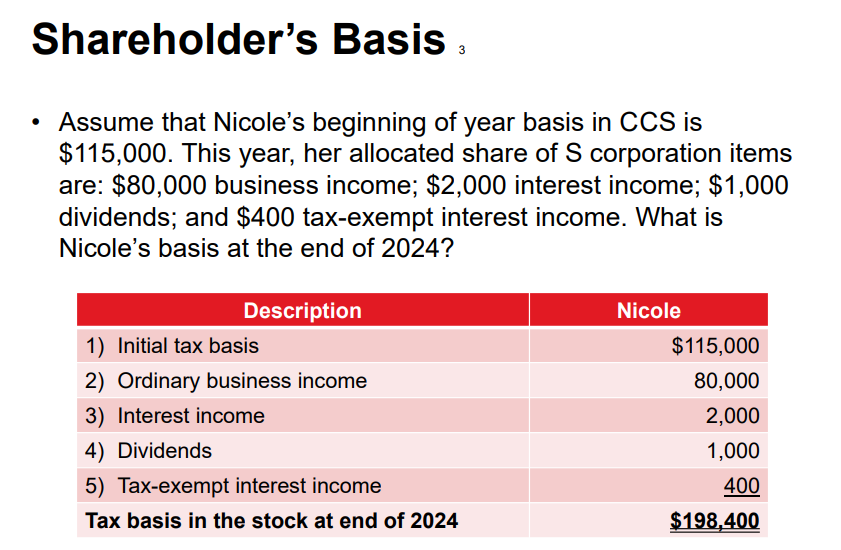

Shareholder’s Basis

Just as partners must determine their bases in their partnership interests, S corporation shareholders must determine their bases in S corporation stock to determine the gain or loss they recognize when they sell the stock, the taxability of distributions, and the deductibility of losses

C corporation rules govern the initial stock basis of S corporation shareholder, while subsequent calculations more closely resemble partnership rules

Initial Basis

Exchange of Stock

Shareholder’s basis in stock received = tax basis of property transferred, less any liabilities assumed by the corporation on the property contributed (substituted basis)

Increased by any gain recognized

Decreased by the FMV of any property received other than stock

Purchase of Stock

Shareholder’s basis in stock purchased = purchase price of the stock

Annual Basis Adjustments

A shareholder will increase the tax basis in their stock for

Capital contributions

Share of ordinary business income

Separately stated income/gain items

Tax-exempt income

A shareholder will decrease the tax basis in their stock for

Cash distributions

Share of nondeductible expenses (fines and penalties)

Share of ordinary business loss

Separately stated expense/loss items

A shareholder’s tax basis may not be < 0

S corporation shareholders are not allowed to include any S corporation debt in their stock basis

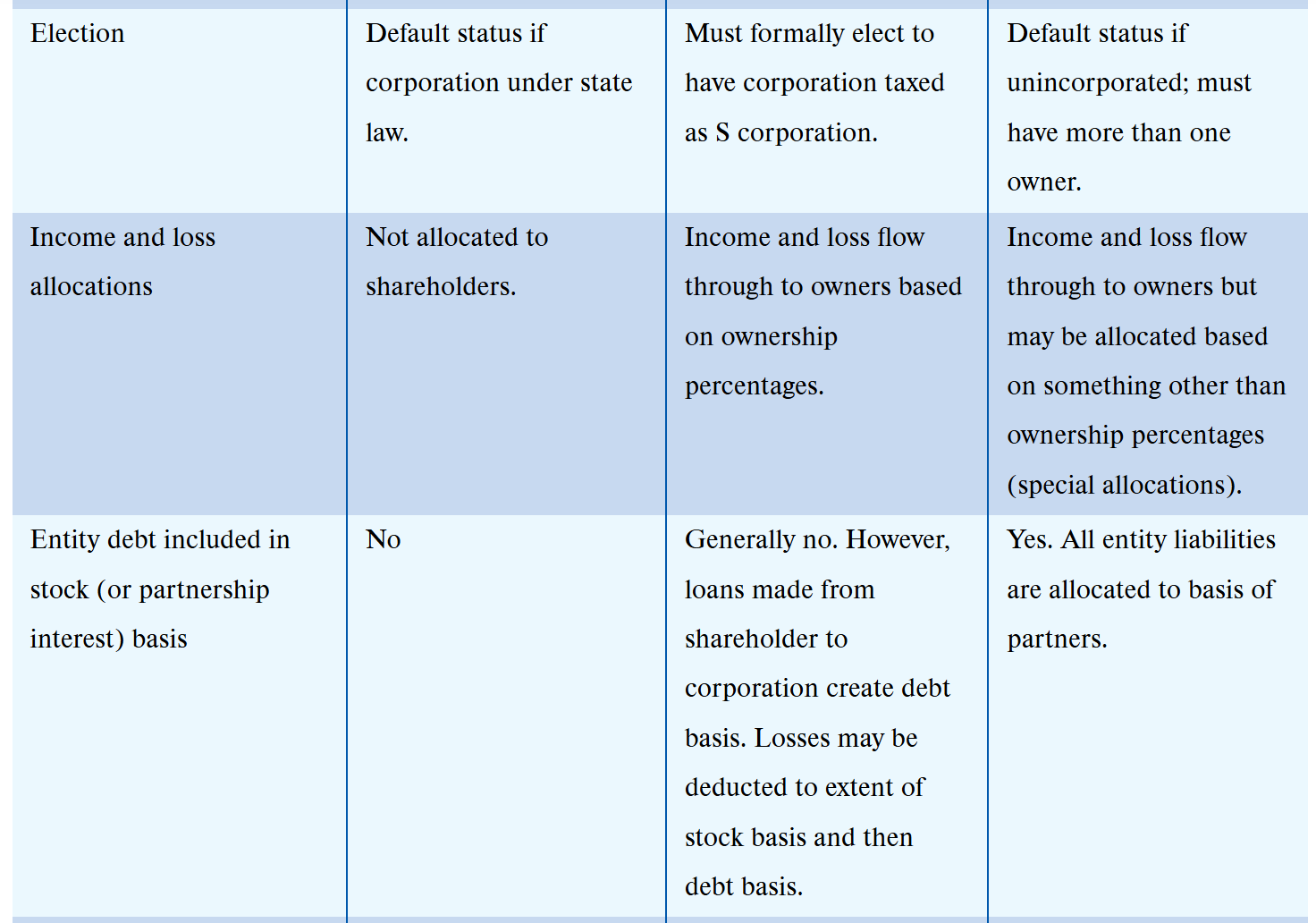

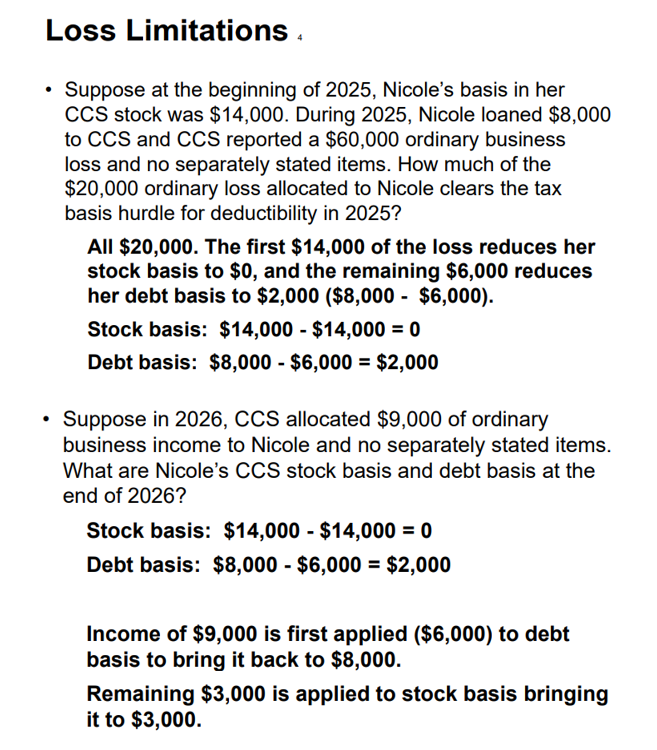

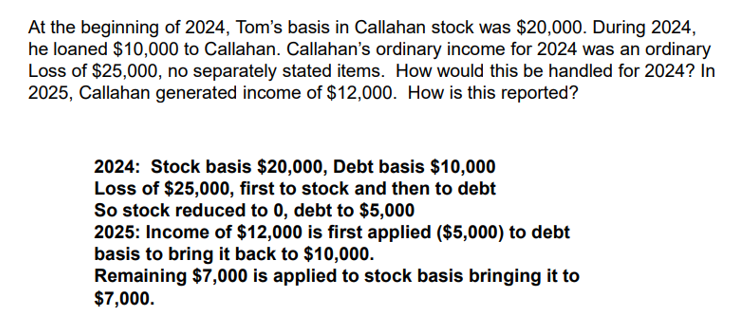

Loss Limitations

Loss limitation rules are similar to partnerships

For S corporation shareholder to deduct a loss, loss must clear (1) tax-basis, (2) at-risk and (3) passive activity hurdles; additionally, shareholder cannot deduct excess business losses

(1) Tax-Basis Limitation

S corporation shareholders cannot deduct losses in excess of stock basis

They cannot include debt in their basis

Losses exceeding basis are suspended until shareholder generates additional basis

A shareholder can mitigate disadvantage of not including S corporation debt in stock basis by loaning money to S corporation, creating debt basis (separate from stock basis)

Losses are first limited by stock basis and then to shareholder’s basis in any direct loans made to the S corporation

We first reduce (1) stock basis, then (2) debt basis

But, not < 0

In subsequent years, any increase in basis restores (2) debt basis first and then (1) stock basis

If S corporation repays debt owed to shareholder before debt basis is restored, a taxable gain is triggered

If the shareholder sells the stock before creating additional basis, the suspended loss disappears unused

(2) At-Risk Limitation

Shareholders may deduct S corporation losses only to the extent of their at-risk amount (§465)

S corporation shareholders are deemed at risk only for direct loans they make to S corporations

At-risk = sum of stock and debt basis

Losses limited under the at-risk rules are carried forward indefinitely until the shareholder generates additional at-risk amounts to utilize them or sells the S corporation stock

Post-Termination Transition Period (PTTP) Loss Limitation

Upon election termination, shareholder may create additional stock basis during post-termination transition period (PTTP) to utilize losses limited by basis or at-risk

PTTP begins on the day after the last day of the corporation’s last taxable year as an S corporation and ends on the later of:

1 year after the last S Corporation day, OR

The due date for filing the return for the last year as an S corporation (including extensions)

This rule allows shareholders to create stock basis (by capital contributions) during PTTP and to utilize suspended losses

Any losses not utilized at the end of the period are lost forever

Loss Limitations [Examples]

(3) Passive Activity Loss Limitation

As in partnerships, the passive activity loss rules limit the ability of S corporation shareholders to deduct losses unless they are involved in actively managing the business

No differences in the application of these rules for S corporations

Passive activity loss rules limit ability of S corporation shareholders to deduct losses of the S corporation unless the shareholders are actively managing the business

Excess Business Loss Limitation

Taxpayers are not allowed to deduct an “excess business loss” for the year

They are carried forward to subsequent years

This applies to losses that are otherwise deductible under tax-basis, at-risk and passive loss limitations

Threshold for 2024 is $610,000 MFJ and $305,000 for others

Self-Employment Income

S corporation shareholder’s allocable share of ordinary business income (loss) is not classified as self-employment income

Shareholder salary as employee is subject to Social Security taxes (SS and Medicare)

Tax-planning incentives

S corporation shareholders may desire to avoid payroll taxes by limiting or even eliminating their salary payments

However, if they work as employees, they are required to pay themselves a reasonable salary for the services they perform

If they pay themselves an unreasonably low salary, the IRS may attempt to reclassify some or all of the S corporation’s ordinary business income as shareholder salary

Net Investment Income Tax

S corporation shareholders are subject to the 3.8% net investment income tax on their share of an S corporation’s net investment income

Common types of investment income include interest, dividends, annuities, royalties, rents, passive income, and gains from disposing of property (other than property held in a trade or business)

Gains on sale of S Corp stock is subject to NIIT to extent it is allocable to assets that have generated a net gain if all S corporation assets were sold at FMV

Fringe Benefits

For shareholder-employees who own ≤ 2% of the S corporation, the S corporation gets a tax deduction AND the benefit is nontaxable to all employees

For shareholder-employees who own ≥ 2% of the S corporation, the S corporation still gets a tax deduction BUT many benefits are taxable to the shareholder-employees

Examples of benefits that are nontaxable to more-than-2-percent shareholder-employees (and partners in a partnership) include employee achievement awards (§74), qualified group legal services plans (§120), educational assistance programs (§127), dependent care assistance programs (§129), no-additional-cost services (§132), qualified employee discounts (§132), working-condition fringe benefits (§132), de minimis fringe benefits (§132), on-premises athletic facilities (§132), and medical savings accounts (§220)

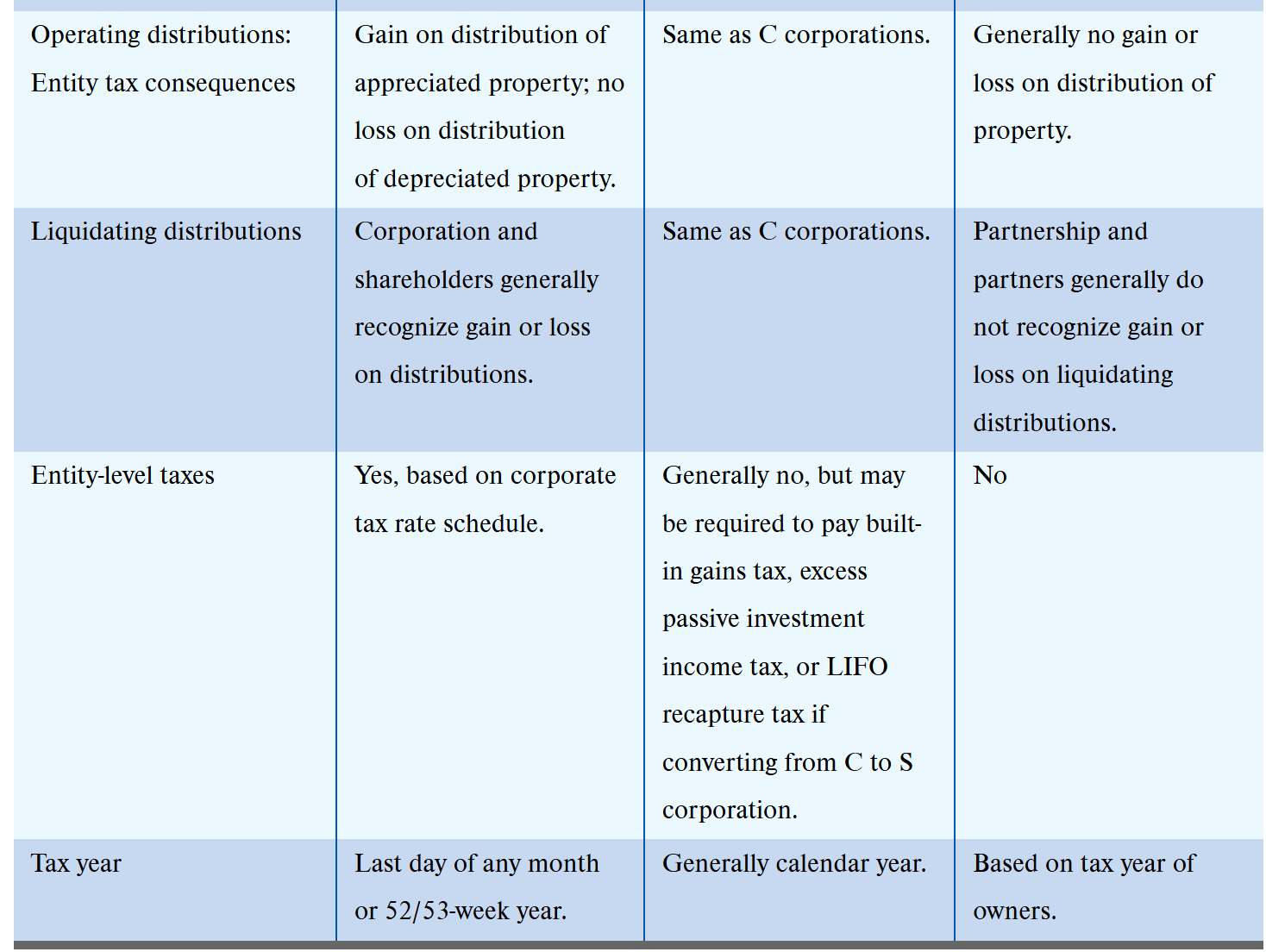

Operating Distributions

The rules for determining the shareholder-level tax consequences of operating distributions depend on the S corporation’s history—specifically whether, at the time of the distribution, it has accumulated earnings and profits from a previous year as a C corporation

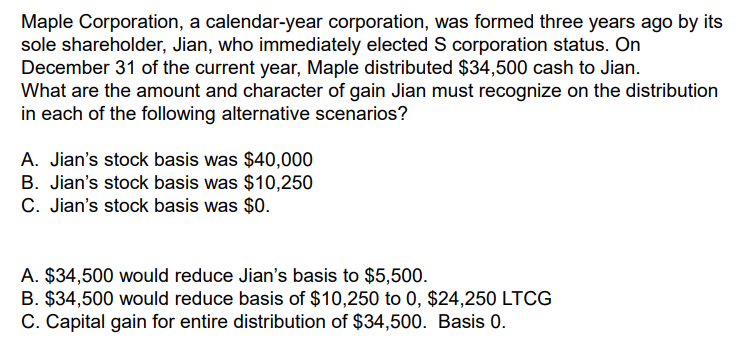

S Corporations Without E&P

Distributions are tax-free to the extent of shareholder’s basis

If distribution exceeds basis, capital gain treatment for the excess

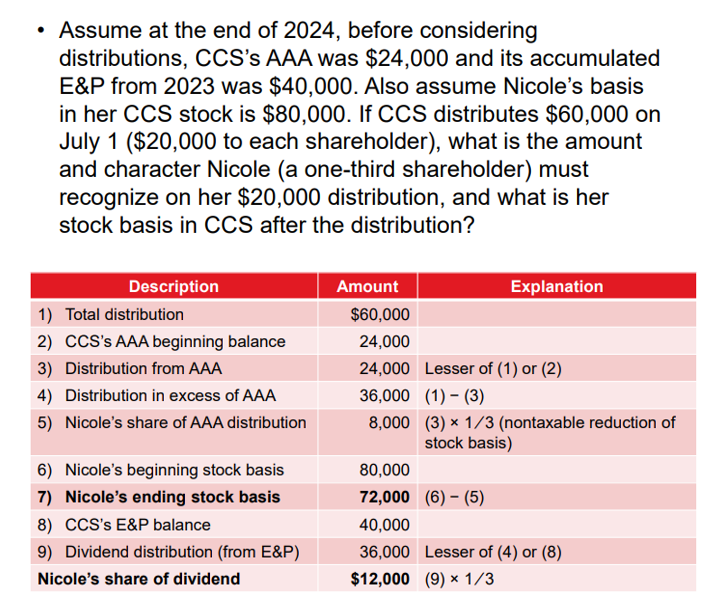

S Corporations With E&P

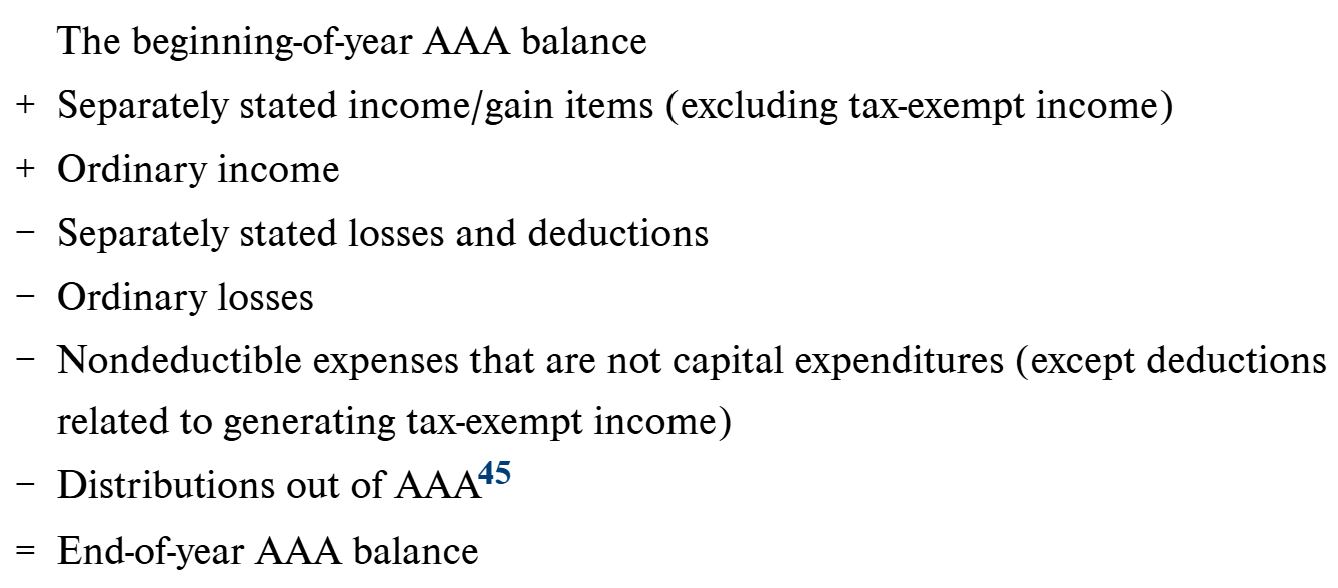

Must determine accumulated adjustments account (AAA), an account that reflects the cumulative income or loss for the time the corporation has been an S corporation

AAA may have a negative balance but distributions may not cause the AAA to go negative or become more negative

Distributions come from (in order)

AAA: nontaxable to extent of shareholder’s basis; any excess is capital gain

E&P: taxed as dividends

Any remaining shareholder stock basis: nontaxable to extent of shareholder’s basis; any excess is capital gain

Operating Distributions [Examples]

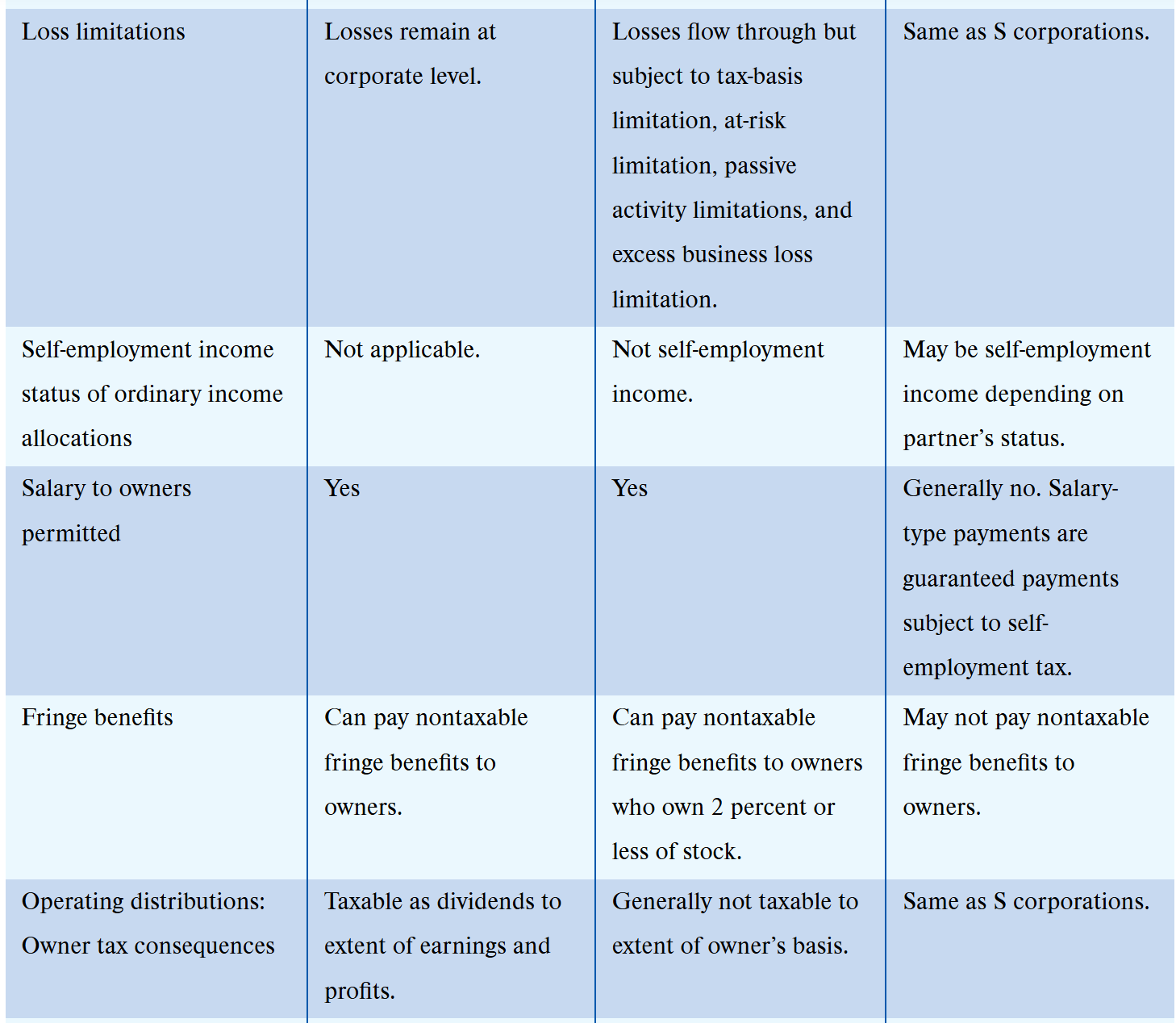

Property Distributions

S Corporation Consequences

Recognizes gain on distribution of appreciated property

Does not recognize loss on distribution of property whose value has declined (depreciated property)

Shareholder Consequences

Recognizes distributive share of the deemed gain and increase stock basis accordingly

The property distribution is the FMV of the property received (minus any liabilities the shareholder assumes on the distribution)

Taxability of distribution is determined based on distribution rules discussed previously (AAA and E&P rules)

Basis in property = FMV of property

Post-Termination Transition Period (PTTP) Distributions

Section 1371(e) provides special treatment of S corporation distribution in cash after S election termination and during post-termination transition

Cash distributions are nontaxable to extent they do not exceed AAA and shareholder basis in stock

The PTTP for post-termination distributions is generally the same as the PTTP for deducting suspended losses

Special rules apply for distributions after the PTTP for eligible terminated S corporations

Liquidating Distributions

S corporation rules follow C corporation tax rules

S corporations generally recognize gain or loss on each asset they distribute in liquidation

These gains and losses are allocated to the S corporation shareholders, increasing or decreasing their stock basis

In general, shareholders recognize gain on the distribution if the value of the property exceeds their stock basis; they recognize loss if their stock basis exceeds the value of the property

S Corporation Taxes and Filing Requirements

Although S corporations are flow-through entities generally not subject to tax, three potential taxes apply to S corporations that previously operated as C corporations: the built-in gains tax, excess net passive income tax, and LIFO recapture tax

Built-in Gains Tax

Congress enacted the built-in gains tax to prevent C corporations from avoiding corporate taxes on sales of appreciated property by electing S corporation status

The built-in gains tax applies only to an S corporation that has a net unrealized built-in gain at the time it converts from a C corporation to the extent the gains are recognized during the built-in gains tax recognition period

The built-in gains tax recognition period is the 5 year period beginning with the first day of the first taxable year the corporation operates as an S corporation after converting from a C corporation

Net unrealized built-in gain is the net gain (if any) an S corporation that was formerly a C corporation would recognize if it sold each asset at its FMV

The corporation’s accounts receivable and accounts payable are also part of the computation: Under the cash method, accounts receivable are gain items and accounts payable are loss items

If the S corporation has a net unrealized gain at conversion, it must compute its net recognized built-in gains for each tax year during the applicable built-in gain recognition period to determine whether it is liable for the built-in gains tax

Recognized built-in gains and losses include gains and losses for any asset sold during the year (limited to unrealized gain/loss for the specific asset at the S conversion date)

Net recognized built-in gain is limited to the least of

Net recognized built in gain less any NOL and net capital loss carryover

Net unrealized build-in gains not yet recognized

Corporation’s taxable income for the year using C corporation tax rule

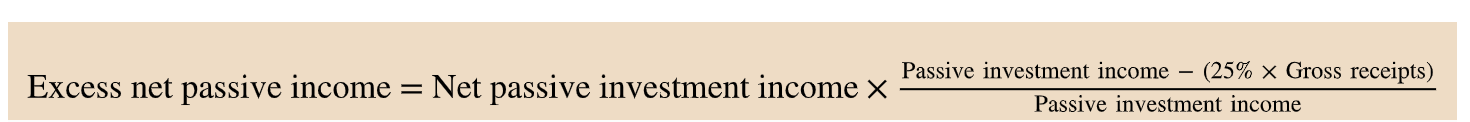

Excess Net Passive Income Tax

Excess net passive income tax is a tax levied on an S corporation that has accumulated earnings and profits from years in which it operated as a C corporation if the corporation reports excess net passive income

Congress created this tax to encourage S corporations to distribute their accumulated earnings and profits from prior C corporation years

It does not apply to S corporations that never operated as a C corporation, or to S corporations without earnings and profits from prior C corporation years

Levied on excess net passive income

Applies when passive investment income exceeds 25% of gross receipts

Passive investment income includes royalties, rents, dividends, interest, annuities

Net passive investment income is passive investment income reduced by expenses connected with producing that income

LIFO Recapture Tax

C corporation must include the LIFO recapture amount (FIFO basis − LIFO basis) in gross income in the last year it operates as a C corporation

Tax paid in four annual installments

The LIFO recapture amount increases the corporation’s adjusted basis in its inventory at the time it converts to an S corporation

Estimated Taxes

Generally follow C corporation rules: S corporations with a federal income tax liability of ≥ $500 due must make quarterly estimated tax payments

Not required to make estimated tax payments for the LIFO recapture tax

Filing Requirements

Form 1120-S due by the 15th day of the third month after the S corporation’s year-end (March 15th)

Automatic 6 month extension by filing Form 7004 (September 15th)

Note the K-1 of the 1120-S is different from the K-1 of the partnership Form 1065

In contrast to the 1065 Schedule K-1, the 1120-S Schedule K-1 does not report self-employment income, does not allocate entity-level debt to shareholders, and does not allow for shareholders to have profit-and-loss-sharing ratios that are different from shareholders’ percentage of stock ownership

Comparing Tax Consequences